XM Leverage trading up to 1,000x

XM Leverage trading up to 1,000x

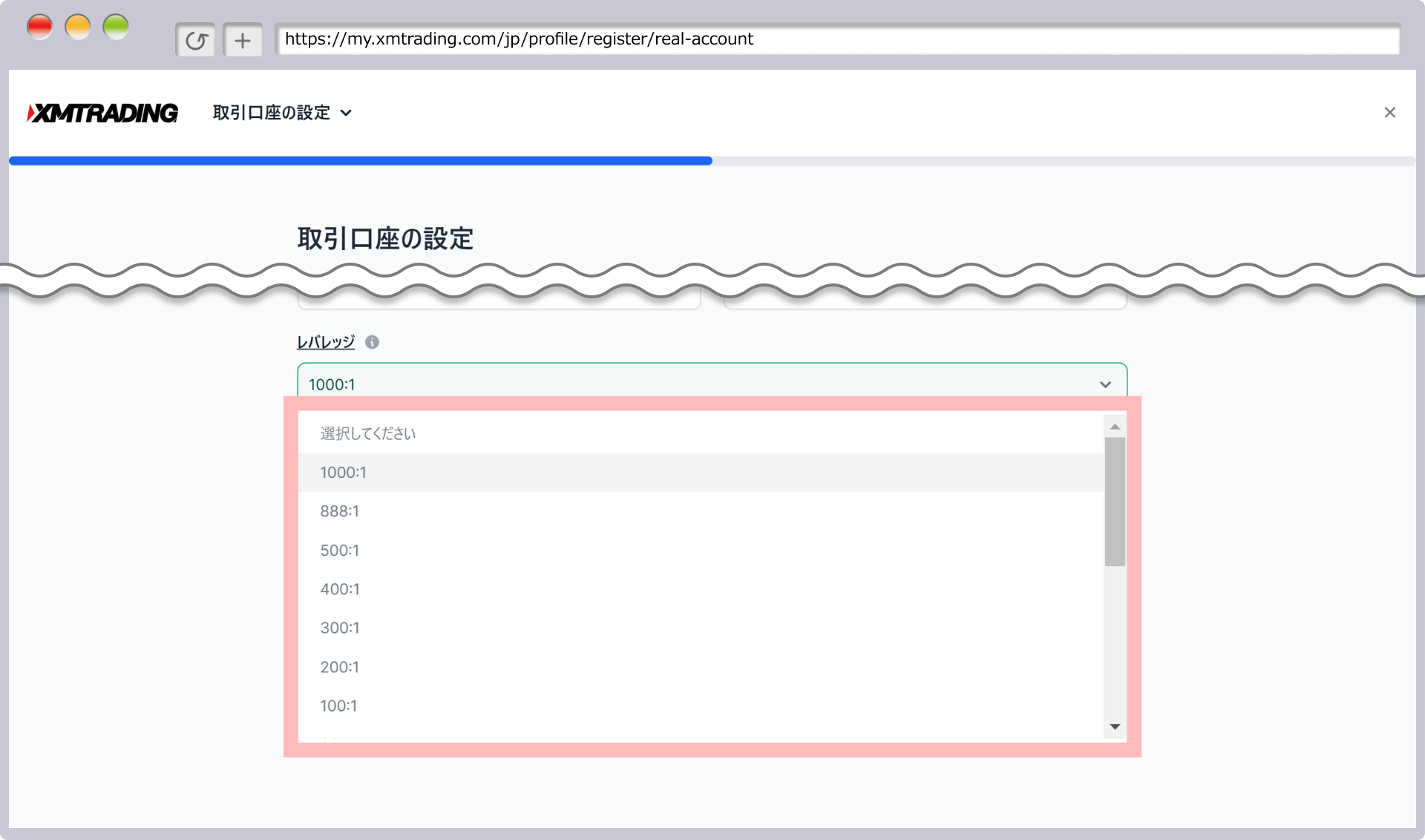

XM provides a maximum recommended leverage of 1,000× for all traders (500× for Zero accounts). Upon registering, a standard MT5 account with the recommended 1,000× leverage is automatically created. You can also open additional real accounts and choose your preferred leverage freely, ranging from 1× to 1,000×. One of the main advantages of FX trading is the ability to control large positions with a small amount of capital. XM offers up to 1,000× leverage on FX currency pairs and popular gold, and up to 500× leverage on cryptocurrency CFDs, including Bitcoin.

At XM, leverage and margin requirements remain stable, even during periods of low liquidity—such as economic data releases, nighttime, or weekends. This allows you to fully enjoy leveraged trading, the true excitement of FX, within XM’s reliable trading environment. Review XM’s leverage rules and learn how to use leverage effectively, then experience the thrill of turning small price movements into potentially significant profits with your XM trading account.

![]()

Once you open a real account, you can select your preferred leverage freely, ranging from 1× to 1,000×.

XM Leverage trading up to 1,000x

XM allows trading with up to 1,000× leverage on Standard, Micro, and KIWAMI accounts (with a maximum of 500× for Zero accounts). The key advantage of leverage is that it enables you to potentially earn significant profits with a relatively small margin. For this reason, XM’s high leverage of up to 1,000× is especially recommended for FX beginners looking to start trading with limited capital.

In Japan, the Financial Services Agency restricts leverage for FX brokers to 25× for individual accounts and 100× for corporate accounts. In contrast, overseas FX brokers—including XM—operate from offshore regions (primarily emerging and developing countries) where leverage regulations are more relaxed, allowing them to offer high-leverage trading to traders worldwide.

Even among overseas FX brokers with relatively relaxed leverage rules, only a few offer leverage as high as 1,000×. By taking advantage of XM’s recommended 1,000× leverage, you can maximize your trading potential. For a limited time, XM is also offering a ¥15,000 account opening bonus, so now is a great opportunity to consider opening a real account.

Start Trading with Minimal Capital at XM

One reason we recommend high-leverage trading with XM (up to 1,000×) is that it allows you to start trading with a small amount of capital. The difference in required margin becomes clear when comparing trading the same lot at XM, which offers up to 1,000× leverage, with a domestic FX broker. For example, when the USD/JPY exchange rate is 100 yen per dollar, the margin required to trade a position of 10,000 units is as follows:

Margin Requirement Comparison: XM vs. Domestic FX Brokers

| Margin Requirements | Approximately 1,000 yen | Approximately 40,000 yen |

| 必要証拠金 | |

| XM レバレッジ 1,000倍 |

約1,000円 |

| 国内FX レバレッジ25倍 |

約40,000円 |

At XM, you can trade 10,000 units of USD/JPY with just 1,000 yen by using a maximum leverage of 1,000×. In contrast, a domestic FX broker with 25× leverage would require over 40,000 yen to trade the same 10,000 units.

At XM, you can trade GOLD (Gold/USD), a popular asset for its high volatility, with a maximum leverage of 1,000×—compared to just 20× for gold CFDs at domestic securities firms. Cryptocurrencies, which often experience even greater price swings than gold, can be traded with major coins like Bitcoin (BTC/USD) and Ethereum (ETH/USD) using up to 500× leverage, whereas domestic crypto exchanges typically offer only 2× leverage. The advantages of high leverage are particularly evident with such volatile assets. By utilizing XM’s high leverage of up to 1,000×, you can trade with a small amount of capital while benefiting from XM’s superior execution speed, extremely tight spreads, and other exceptional trading conditions.

XM Enables You to Earn Significant Profits in a Short Time

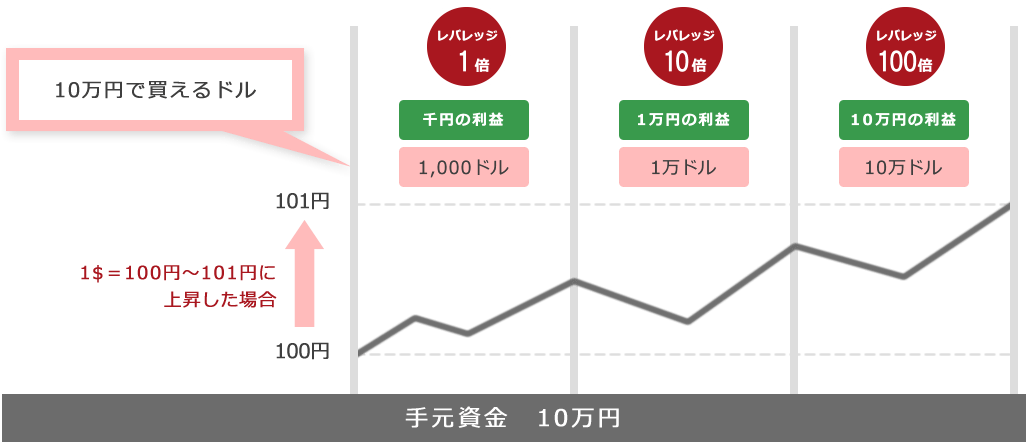

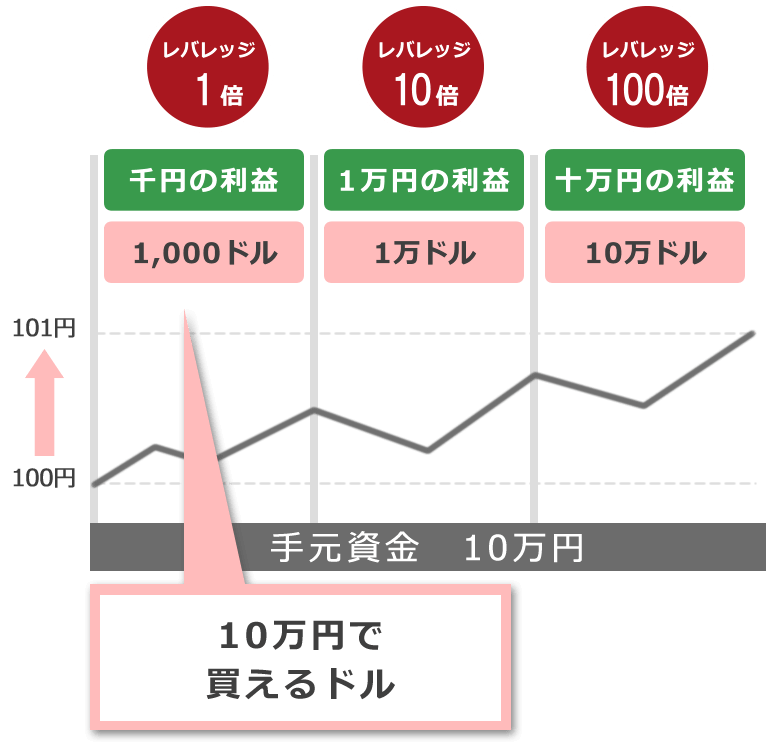

One of the advantages of trading with up to 1,000× leverage on XMTrading is the potential to earn significant profits in a short period. In leveraged trading, both trading volume and profits or losses fluctuate with leverage—the higher the leverage, the greater the potential profit.

For example, with 100,000 yen and no leverage, you could trade $1,000. If you buy $1,000 when the USD/JPY rate is 100 and it rises to 101, your profit would be $10. However, by using XM’s maximum leverage of 1,000×, you could control $1 million with the same capital. In this case, a 1-yen increase in the rate could generate a potential profit of 1 million yen. With high leverage, even small price movements can lead to substantial gains, making XM’s up to 1,000× leverage particularly suitable for traders seeking to grow their capital efficiently in a short period.

XM’s High Leverage Can Be a Powerful Tool When Used Wisely

Trading with high leverage can boost potential profits, but it also comes with higher risks. For first-time overseas FX traders, the perception that “high leverage equals high risk” is common, which often prevents them from fully benefiting from its advantages.

However, by mastering the fundamentals of money management and practicing gradually, high leverage can become a powerful tool rather than a danger. Starting with a small amount of capital and gaining experience while controlling risk is the first step toward achieving consistent long-term success.

How Leverage Amplifies Profit from Price Fluctuations

With XM, You Can Never Lose More Than Your Deposited Amount

Trading with XM using up to 1,000× leverage can increase potential profits, but it also proportionally raises the risk of loss. While high-leverage trading offers many advantages, it’s crucial to always be aware of the associated risks. Fortunately, XM employs a zero-cut system, which means that even if losses exceed your account balance and result in a negative balance, you will not be required to deposit additional funds. In other words, you cannot lose more than your deposited amount, allowing you to trade with peace of mind.

XM offers a wide range of flexible leverage settings of up to 1,000×, making it suitable for all traders—from beginners to experienced FX professionals. Standard, Micro, and KIWAMI accounts provide 17 different leverage options, while the Zero account, known for its ultra-tight spreads, offers 15. When opening a real account with XM, you can select your preferred leverage from 1× up to 1,000× (500× for Zero accounts), depending on your risk management strategy. Furthermore, you can adjust your leverage at any time after account opening through the XM Member Area.

Click here for instructions on how to change the leverage

At XM, a stop-out is automatically triggered if your margin level falls below 20%. While leveraged trading can generate significant profits, it can also result in substantial losses if the market moves against you. To protect traders, XM provides a zero-cut guarantee, ensuring that even in the rare event a stop-out does not function as expected, you will never lose more than the funds you have deposited.

Learn more about XM’s stop loss and margin call levels here

What is leverage?

Leverage is based on the principle that a small force can move a much larger one. In FX trading, this concept—known as the “leverage effect”—allows traders to control large amounts of capital with only a small margin. For example, “XM 1,000× leverage” means you can trade 10 million yen worth of funds with just 10,000 yen in margin.

The relationship between XM’s leverage and margin

Margin refers to the minimum amount of funds required to open and maintain a trading position, serving as collateral against potential losses. In leveraged trading, the higher the leverage, the lower the margin requirement—and conversely, the lower the leverage, the higher the required margin. Refer to the calculation method and margin list below to see how required margins are determined for XM’s available leverage levels.

How to calculate margin requirements

The required margin is calculated using the following formula:

Margin calculation formula

“Trading volume” x “Current price”

÷ “Leverage” = “Required margin”

For example, if you have an XM account with maximum leverage of 1,000× and open a long position of 1 lot (100,000 units) when the USD/JPY exchange rate is 130 yen, the required margin can be calculated using the following formula:

Required Margin Formula for 1 Lot of USD/JPY (1,000× Leverage)

100,000 (trading volume) x 130 (current price)

÷ 1,000 (leverage)

= 13,000 yen (required margin)

Click here for details on XM USD/JPY trading

The required margin for trading 1 lot of the BTC/USD (Bitcoin/US Dollar) cryptocurrency CFD with a maximum leverage of 500×—when the BTC price is $50,000 and the USD/JPY exchange rate is 130 yen—can be calculated using the following formula:

1 (trading volume) x 50,000 (current price)

x 130 (USD/JPY rate)

÷ 500 (leverage)

= 13,000 yen (required margin)

Learn more about XM Bitcoin here

Additionally, XM provides the “XMTrading Margin Calculator,” a convenient tool for calculating required margin. By simply entering key information such as leverage and trade size, the calculator quickly determines your margin, making it an easy and recommended way to avoid manual calculations.

XM Leverage and Margin Requirements

On XMTrading, when USD/JPY is 114 JPY, EUR/JPY is 130 JPY, and GBP/JPY is 154 JPY, the relationship between leverage and the required margin for trading 10,000 units (0.1 lot) of each currency pair is as follows:

XM Major Currency Pairs Margin Requirements

| Leverage | USD/JPY (US dollar/yen) |

EUR/JPY (Euro/Yen) |

GPB/JPY (British Pound) |

| 1,000 times | Approximately 1,140 yen | Approximately 1,300 yen | Approximately 1,540 yen |

| 888 times | Approximately 1,284 yen | Approximately 1,464 yen | Approximately 1,734 yen |

| 500 times | Approximately 2,280 yen | Approximately 2,600 yen | Approximately 3,080 yen |

| 1,000倍 | |

| USD/JPY | 約1,140円 |

| EUR/JPY | 約1,300円 |

| GPB/JPY | 約1,540円 |

| 888倍 | |

| USD/JPY | 約1,284円 |

| EUR/JPY | 約1,464円 |

| GPB/JPY | 約1,734円 |

| 500倍 | |

| USD/JPY | 約2,280円 |

| EUR/JPY | 約2,600円 |

| GPB/JPY | 約3,080円 |

In domestic FX, where maximum leverage is limited to 25×, trading 0.1 lot of USD/JPY requires a margin of approximately 45,600 yen. In contrast, with XM’s maximum leverage of 1,000×, the same trade requires only about 1,140 yen, making it ideal for traders with limited capital. Additionally, XM’s high leverage keeps the required margin low, allowing even beginners to start trading confidently with a small investment.

XM (XM Trading) applies leverage restrictions based on account type and available margin to help minimize unexpected losses and ensure a comfortable trading experience. As a result, these limits may prevent you from using the full 1,000× leverage, one of XM’s key features. Additionally, leverage limits for cryptocurrency CFDs are determined by the trading amount. When trading with XM, it is recommended to review all applicable leverage restrictions in advance.

XM’s Leverage Limits Based on Account Equity

XMTrading applies leverage restrictions based on the available margin for trading FX currency pairs and spot metals (gold and silver). If the available margin in an XM real account (including bonuses and unrealized profits and losses) exceeds $40,000 (approximately 4 million yen*), the maximum leverage is reduced from 1,000× to 500×. If it exceeds $80,000 (approximately 8 million yen*), the maximum leverage is lowered to 200×, and if it exceeds $200,000 (approximately 20 million yen*), the maximum leverage is limited to 100×.

Calculated at 1 dollar = 100 yen. Exchange rates are subject to change.

XM’s Equity-Based Leverage Limits

| Equity Balance | Maximum Leverage | |

| Standard/Micro/KIWAMI Extreme | zero | |

| $5 to $40,000 | 1,000 times | 500 times |

| $40,001 to $80,000 | 500 times | |

| $80,001 to $200,000 | 200 times | 200 times |

| Over $200,001 | 100 times | 100 times |

| $5~$40,000の 最大レバレッジ |

|

| スタンダード マイクロ KIWAMI極 |

1,000倍 |

| ゼロ | 500倍 |

| $40,001~$80,000の 最大レバレッジ |

|

| スタンダード マイクロ KIWAMI極 |

500倍 |

| ゼロ | 500倍 |

| $80,001~$200,000の 最大レバレッジ |

|

| スタンダード マイクロ KIWAMI極 |

200倍 |

| ゼロ | 200倍 |

| $200,001以上の 最大レバレッジ |

|

| スタンダード マイクロ KIWAMI極 |

100倍 |

| ゼロ | 100倍 |

XM’s leverage restrictions based on available margin apply not to the margin of a single account, but to the total balance across all accounts under the same user. Please note that available margin also includes bonuses and unrealized profits and losses on open positions. The calculation method for available margin is as follows:

Equity Calculation Formula

“Account Balance” + “Bonus”

+ “Unrealized Profit and Loss” = “Available Margin”

Additionally, if your margin increases or you make an additional deposit during trading, the maximum leverage will adjust according to the above “Leverage Restrictions Based on XM’s Effective Margin.” When placing orders, be careful to avoid triggering a stop-out due to insufficient margin.

When Leverage Restrictions Come Into Effect

At XMTrading, if the combined equity across all trading accounts held by a customer exceeds a threshold amount (e.g., $40,000), leverage restrictions will be applied, and the maximum available leverage will be adjusted accordingly.

When leverage restrictions are activated, XM’s Support Desk will typically notify you in advance via email or other means, so you should check your account balance and open positions. However, please note that in urgent situations, leverage restrictions may be applied before any prior notification.

How to remove leverage restrictions (limits)

At XM, if leverage restrictions are applied, they will not be automatically removed even if your effective margin falls below the threshold due to withdrawals or a decrease in unrealized profits. To have the restrictions lifted, you must reduce your effective margin below the limit and contact the XM Support Desk via email to request the removal. Please note that if you do not contact support, the leverage restrictions will remain in place.

Leverage Limits by XM Account Type

XM applies different leverage restrictions depending on the account type. Standard, Micro, and Kiwami accounts allow a maximum leverage of 1,000×, while Zero accounts are limited to a maximum of 500×.

Leverage restrictions (limits) by XM account type

| Account Type | Maximum Leverage |

| Standard Account | 1,000 times |

| Micro Account | |

| KIWAMI polar account | |

| Zero Account | 500 times |

Although the Zero Account has a lower maximum leverage compared to other account types, it offers the tightest spreads among all XM accounts. The Micro Account allows trading from as little as 0.01 micro lots (10 units), and with XM’s unique maximum leverage of 1,000×, you can open a position with a minimum required margin of just 1 yen.

-

Click here for details on XM’s minimum and maximum lot size (lot calculation method)

-

Click Here for Details on How to Choose Your Recommended XM Account Type

-

The minimum order size for an XM Micro account is 0.01 lots (10 units) on MT4, while on MT5 it is 0.1 lots (100 units).

How to remove leverage restrictions (limits)

With an XMTrading Zero Account, the maximum leverage is fixed at 500×, and leverage restrictions cannot be removed. To trade with up to 1,000× leverage—the hallmark of XM—without being subject to these restrictions, choose a Standard, Micro, or KIWAMI Kyoku Account. If you want to benefit from account bonuses, the Standard or Micro Account is recommended, while the KIWAMI Kyoku Account is ideal for trading with ultra-tight spreads.

XM Cryptocurrency Leverage Limits

XM’s cryptocurrency CFDs for BTC/USD and ETH/USD can be traded with a maximum leverage of 500×. However, cryptocurrency trading at XM is subject to a “tiered margin rate,” meaning leverage is restricted based on the trade size of each order.

XM Cryptocurrency Leverage Limits by Trade Size (BTC/USD)

| Transaction amount | Margin Rate | Leverage |

| $0-$1,000,000 | 0.2% | 500 times |

| $1,000,001 to $3,000,000 | 0.4% | 250 times |

| $3,000,001 to $5,000,000 | 2% | 50 times |

| Over $5,000,001 | 100% | 1x |

XM’s “tiered margin” system for cryptocurrencies reduces maximum leverage based on trade size. For BTC/USD, leverage drops from 500× to 250× when trading $1,000,000 or more, to 50× for trades of $3,000,000 or more, and to 1× for trades of $5,000,000 or more. As trade size increases, leverage becomes unavailable, which is one of XM’s key features. Additionally, the tiered margin system applies different margin rates for each cryptocurrency product.

Click here for details on XM cryptocurrency CFD tiered margin rates

How to remove cryptocurrency leverage restrictions

Leverage restrictions imposed by XMTrading on cryptocurrency CFDs cannot be removed. To trade without being subject to these limits, you must reduce the total trading amount for each product. If you wish to trade with maximum leverage, you will need to split your positions across multiple trades.

-

If your account’s leverage is lower than the leverage set for a cryptocurrency CFD, the CFD’s leverage will automatically be reduced to match your account leverage.

Due to market liquidity and volatility, XM imposes maximum leverage limits on certain FX currency pairs and CFD products. Some products cannot be traded with XM’s signature high leverage of up to 1,000×, so please refer to the list of leverage limits for each product offered by XM.

XM FX Currency Pair Leverage Limits

For XMTrading’s major FX currency pairs, the leverage set for your account will apply, allowing you to trade with XM’s recommended maximum of 1,000× (or 500× for Zero accounts). However, please note that leverage limits are also determined by your margin balance, so exercise caution when trading.

XM FX Currency Pair Leverage Table

Most of XMTrading’s FX currency pairs can be traded with a maximum leverage of 1,000× (with some exceptions), making them ideal for traders seeking high-leverage opportunities.

-

Standard/Micro/KIWAMI Extreme

-

zero

-

Product $5 to

$40,000$40,001 to

$80,000$80,001 to

$200,000

Over $200,001FX Currency Pairs 1,000 times 500 times 200 times 100 times 商品ごとの証拠金残高/最大レバレッジ

FX通貨ペア $5~$40,000 1,000倍 $40,001~$80,000 500倍 $80,001~$200,000 200倍 $200,001以上 100倍

-

Even if your available margin drops below the equivalent of $5, you can still trade with a maximum leverage of 1,000× (or 500× for Zero accounts).

XM FX Currency Pairs Subject to Leverage Restrictions

For certain XMTrading FX currency pairs, leverage restrictions override the leverage set in your account. Swiss franc (CHF) pairs have a maximum leverage of 400×, Turkish lira (TRY) pairs 100×, and Danish krone (DKK), Chinese renminbi (CNH), and Hong Kong dollar (HKD) pairs 50×. Some products also have leverage limits based on margin balances, so please exercise caution when trading the pairs listed below.

商品ごとの証拠金残高/最大レバレッジ

| Trading Instruments | $5 to $80,000 |

$80,001 to $200,000 |

Over $200,001 |

| AUDCHF (Australian dollar/Swiss franc) |

400 times | 200 times | 100 times |

| CADCHF (Canadian dollar/Swiss franc) |

400 times | 200 times | 100 times |

| CHFJPY (Swiss Franc/Japanese Yen) |

400 times | 200 times | 100 times |

| AUDCHF | |

| $5~$80,000 | 400倍 |

| $80,001~$200,000 | 200倍 |

| $200,001以上 | 100倍 |

| CADCHF | |

| $5~$80,000 | 400倍 |

| $80,001~$200,000 | 200倍 |

| $200,001以上 | 100倍 |

| CHFJPY | |

| $5~$80,000 | 400倍 |

| $80,001~$200,000 | 200倍 |

| $200,001以上 | 100倍 |

XM CFD Leverage Limits

When trading CFDs with XMTrading, the leverage set in your account does not apply. For CFD products other than gold and silver, leverage restrictions based on account type or equity are not enforced; instead, each product has a fixed leverage. BTC/USD and ETH/USD can be traded with a maximum leverage of 500×, other major cryptocurrencies like Ripple and Litecoin with up to 250×, and other altcoins with a maximum leverage of 50×.

XM Precious Metals CFD Leverage Table

XMTrading’s precious metals CFDs allow trading gold with a maximum leverage of 1,000× and silver with a maximum of 400×. Palladium and platinum are not subject to leverage restrictions based on account type or equity, with a fixed effective leverage of 22.2×. Gold is the only CFD product that can be traded at XM’s recommended maximum leverage of 1,000×.

-

Standard/Micro/KIWAMI Extreme

-

zero

-

Product $5 to

$40,000$40,001 to

$80,000$80,001 to

$200,000

Over $200,001GOLD 1,000 times 500 times 200 times 100 times SILVER 400 times 200 times 100 times XAUEUR (Gold/Euro) 1,000 times 500 times 200 times 100 times PALL (Palladium) 22.2 times PLAT (Platinum) 22.2 times 商品ごとの証拠金残高/最大レバレッジ

GOLD $5~$40,000 1,000倍 $40,001~$80,000 500倍 $80,001~$200,000 200倍 $200,001以上 100倍 SILVER $5~$40,000 400倍 $40,001~$80,000 $80,001~$200,000 200倍 $200,001以上 100倍 XAUEUR $5~$40,000 1,000倍 $40,001~$80,000 500倍 $80,001~$200,000 200倍 $200,001以上 100倍 PALL $5~$40,000 22.2倍 $40,001~$80,000 $80,001~$200,000 $200,001以上 PLAT $5~$40,000 22.2倍 $40,001~$80,000 $80,001~$200,000 $200,001以上

XM Stock CFD Leverage Table

XM’s stock CFDs allow trading of shares from 1,313 of the world’s leading companies. From iconic U.S. names like Apple, Microsoft, Amazon, and Google, familiar to many in Japan, to well-known firms from Europe, Asia, and South America, you can trade with up to 20× leverage across a wide range of stocks. Leverage restrictions based on account type or equity do not apply to stock CFDs. Please note that stock CFDs are only available on MT5 accounts. The leverage for representative stocks from XM’s 1,313-stock CFD offering is as follows:

| Product (brand) | Leverage (fixed) |

| Alibaba | 20 times |

| Amazon | 20 times |

| Apple | 20 times |

XM Stock Index (Spot) CFD Leverage Table

XMTrading’s stock index CFDs allow trading in both spot and futures products. Leverage restrictions based on account type or available margin do not apply, and the leverage is the same for both spot and futures of the same index. For example, the Nikkei 225, popular among Japanese traders, can be traded with up to 500× leverage.

| Product (brand) | Leverage (fixed) |

| AUS200Cash (ASX 200) |

100 times |

| CA60Cash (Canada 60 Index Cash) |

250 times |

| ChinaHCash (Hong Kong China H-shares Index Cash) |

250 times |

XM Stock Index (Futures) CFD Leverage Table

| Product (brand) | Leverage (fixed) |

| EU50 (EURO STOXX 50) | 100 times |

| FRA40 (CAC 40) | 100 times |

| GER40 (DAX) | 500 times |

XM Energy (Spot) CFD Leverage Table

XMTrading’s energy CFDs allow trading in both spot and futures products. Leverage restrictions based on account type or equity do not apply to either, but spot trading offers a fixed leverage of 200×, which is higher than futures. For energy futures, crude oil and natural gas can be traded with leverage of 66.7× and 33.3×, respectively. Crude oil prices often fluctuate significantly in short periods, making it ideal for traders looking to use leverage to pursue large profits.

| Product (brand) | Leverage (fixed) |

| BRENTCash | 200 times |

| NGASCash | 200 times |

| OILCash | 200 times |

XM Energy (Futures) CFD Leverage Table

| Product (brand) | Leverage (fixed) |

| BRENT (Brent Crude Oil) | 66.7 times |

| GSOIL (London Gas Oil) | 33.3 times |

| NGAS (Natural Gas) | 33.3 times |

| OIL (WTI Oil) | 66.7 times |

| OILMn (WTI Oil Mini) | 66.7 times |

Click here for details on XM Crude Oil

XM Thematic Index CFD Leverage Table

XMTrading’s Thematic Index CFDs cover a variety of sectors, including emerging technology, renewable energy, e-commerce, cybersecurity, and blockchain. You can trade up to 50× leverage on eight different thematic indices, focusing on future-oriented industries. Leverage restrictions based on account type or equity do not apply to Thematic Index CFDs. Please note that Thematic Index CFDs are available only on MT5 Standard and Kiwami accounts.

| Product (brand) | Leverage (fixed) |

| AI_INDX | 50 times |

| ChinaInternet | 50 times |

| Crypto_10 | 50 times |

Learn more about XM’s Thematic Index CFDs

XM Cryptocurrency CFD Leverage Table

XMTrading’s cryptocurrency CFDs have varying maximum leverage depending on the product. BTC/USD, BTG/USD, ETH/BTC, and ETH/USD can be traded with up to 500× leverage; other Bitcoin and Ethereum pairs, Ripple, and Litecoin can be traded with up to 250×; and other altcoins can be traded with up to 50× leverage. Please note that some cryptocurrency products are available only on MT5 accounts.

| Brand | Margin Rate (Note 1) | Maximum Leverage | Trading Platform |

| 1INCHUSD (1INCH Network/USD) |

2% | 50 times | MT5 |

| AAVEUSD (Aave/USD) |

2% | 50 times | MT4/MT5 |

| ADAUSD (Cardano/USD) |

2% | 50 times | MT4/MT5 |

| 1INCHUSD | |

| 証拠金率(注:1) | 2% |

| 最大レバレッジ | 50倍 |

| 取引 プラットフォーム |

MT5 |

| AAVEUSD | |

| 証拠金率(注:1) | 2% |

| 最大レバレッジ | 50倍 |

| 取引 プラットフォーム |

MT4/MT5 |

| ADAUSD | |

| 証拠金率(注:1) | 2% |

| 最大レバレッジ | 50倍 |

| 取引 プラットフォーム |

MT4/MT5 |

-

The thresholds for fluctuating margin rates vary for each stock.

-

Please note that “tiered margin rates” apply to cryptocurrency CFDs, meaning leverage is restricted based on the transaction amount.

When opening a real account with XMTrading, you can choose your preferred leverage anywhere from 1x to 1,000x. The leverage you select can be easily checked or adjusted at any time via the XM Members Area on your PC or smartphone. XM places no limit on how many times you can change your leverage after opening an account. While it is possible to change your leverage even with open positions, please note that doing so may lower your margin level, so timing is important.

-

When you register, an XM-recommended MT5 Standard Account (1,000x leverage, base currency in Japanese Yen) will be opened automatically. However, you can later open an additional real account with your preferred settings.

-

You can also change the leverage of the trading account that is automatically opened upon registration through My Page or the XM smartphone app.

-

You cannot change the account type, platform (MT4/MT5), or base currency of an account once it has been opened. If you would like to trade with a different account type, platform, or base currency, please open an additional account.

How to apply and set XM leverage

Setting leverage with XM is straightforward. After opening a real XM account, you can adjust your leverage on the **“Trading Account Details”** screen. For **Standard, Micro, and KIWAMI accounts**, you may choose from 17 leverage options ranging from 1x up to 1,000x. For **Zero accounts**, you can select from 15 leverage options ranging from 1x up to 500x before completing your real account setup. In addition, once you verify your email address during registration, an **XM MT5 Standard account** (base currency: Japanese Yen, leverage: 1,000x) will automatically be opened for you.

Procedure for Checking or Changing XM Leverage (PC/Smartphone)

If you want to change the leverage on your XMTrading real account after it has been opened, follow the steps below to adjust it via your XM My Page. This guide covers how to check and change leverage on both PC and smartphone.

-

PC version

-

Smartphone version

-

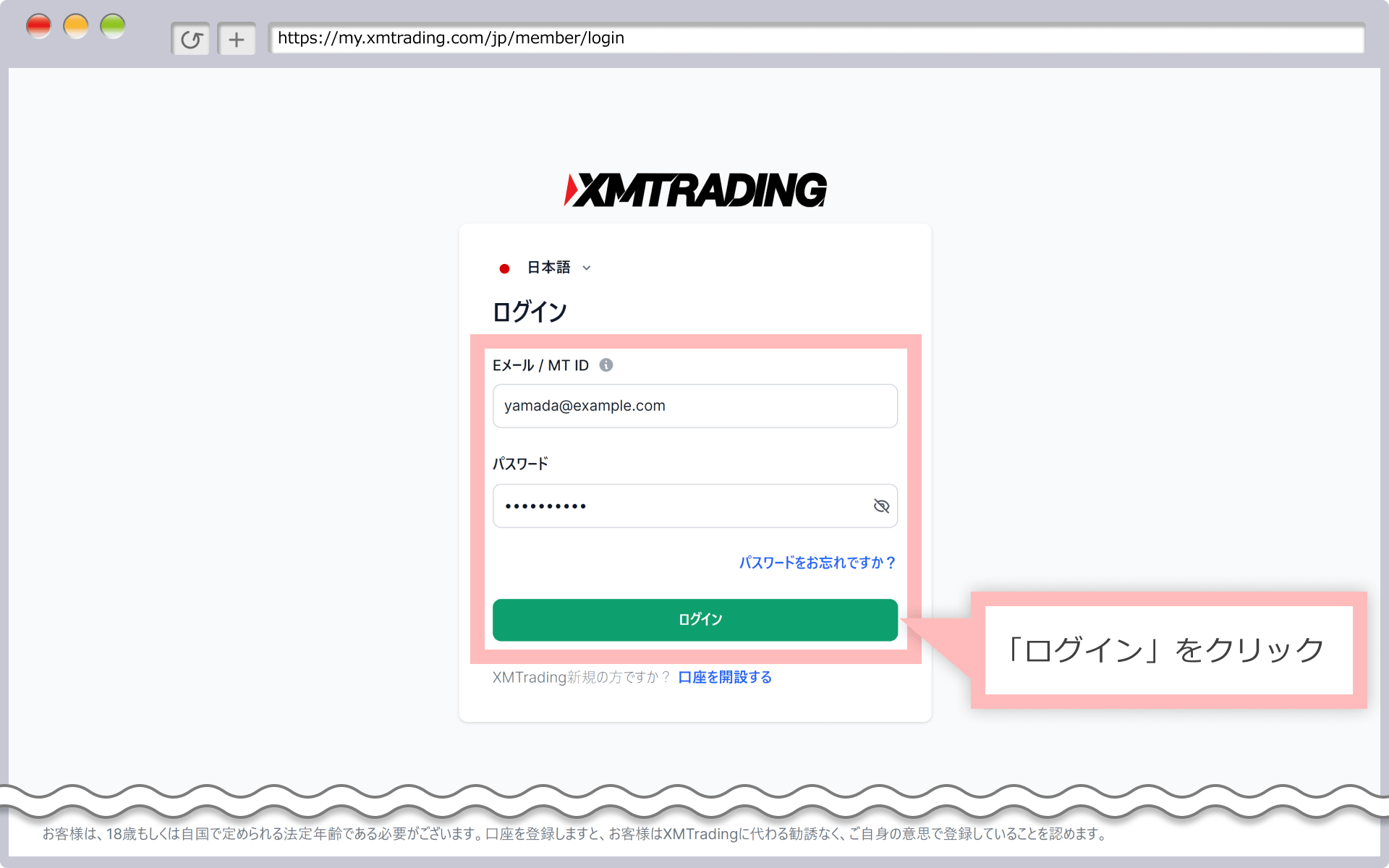

Here’s how to check and change your XMTrading account leverage settings on your PC.

-

Steps: 1

Log in to My Page

Please log in to your XMTrading “Member Page” using your registered email address and password .

-

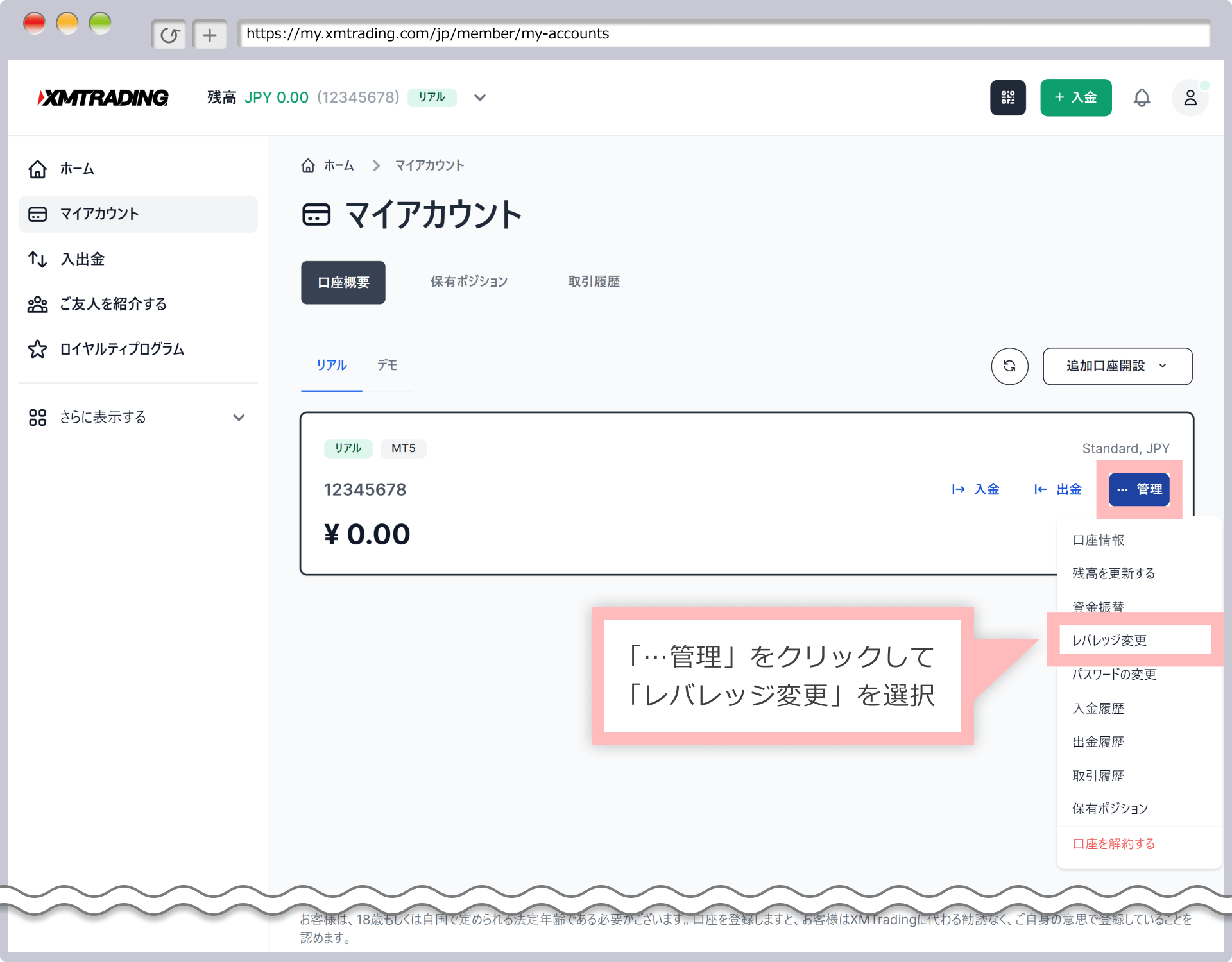

Steps: 2

Click “My Account”

After logging in to the XM “Member Page”, click “My Account” on the left menu.

-

Steps: 3

Select “Change Leverage”

Click “Manage…” and select “Change Leverage.”

-

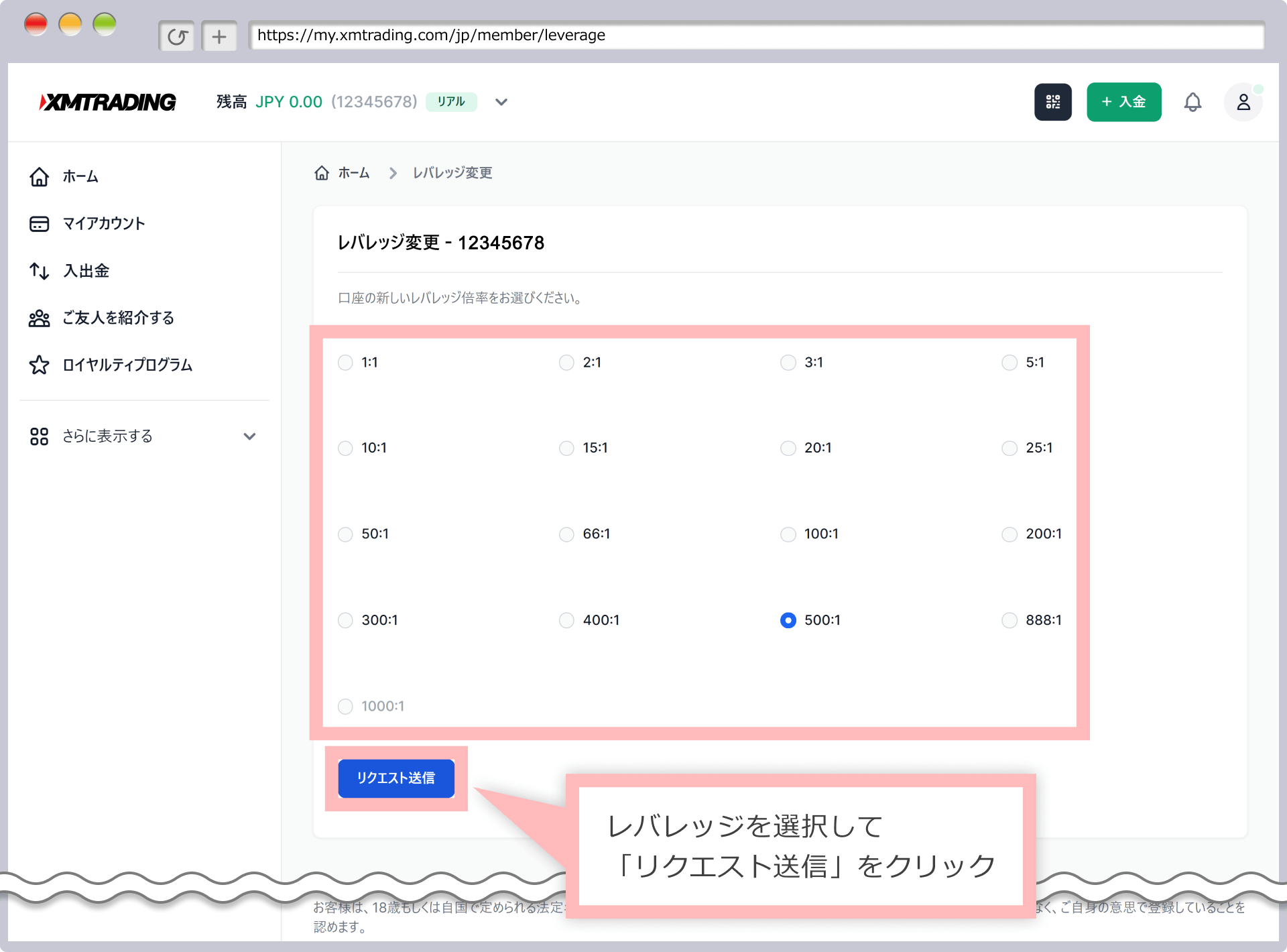

Steps: 4

Change Leverage

On the Leverage Change screen, select your desired leverage and click “Submit Request.” A blue mark will appear next to the chosen leverage to indicate your selection.

-

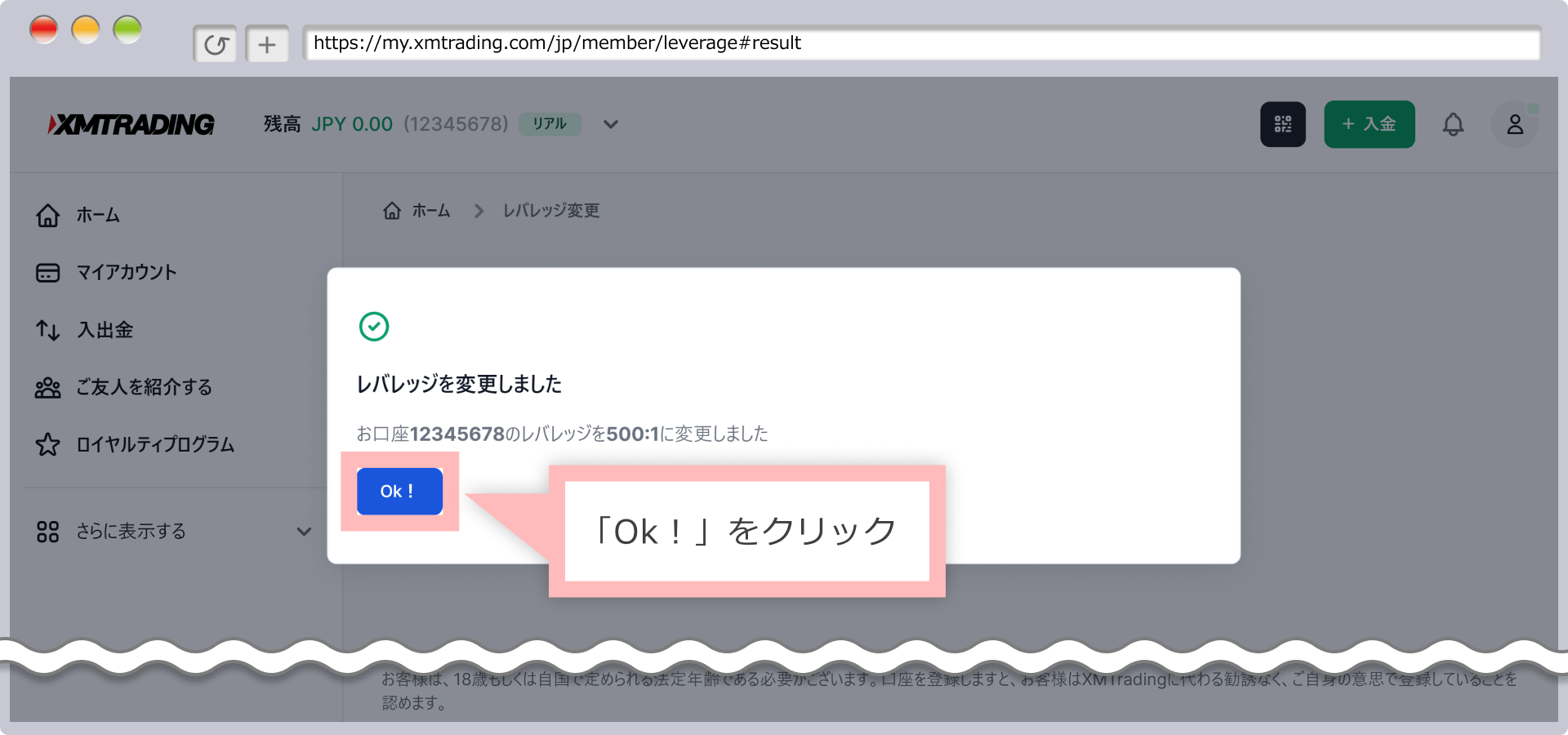

Steps: 5

Leverage change procedure completed

If the request is successful, a message saying “Leverage has been changed” will appear, and an email with the subject “Leverage Change Request Acceptance Notification” will be sent to your registered email address. Click “Ok!” to return to the home screen.

Changes to your XM trading account’s leverage take effect immediately, so please verify your new leverage on My Page. For MT4 accounts, the updated leverage will be applied after you log in again.

-

Step-by-step instructions for changing your leverage are available in the XM Member Page User Guide, which includes clear, easy-to-follow illustrations.

On the XM Members Page, you can not only open an account and make deposits or withdrawals, but also change your leverage and access the copy trading page. For detailed instructions on using the XM Members Page, please refer to the “XM Members Page User Guide.”

You can also adjust your leverage directly through the XM smartphone app!

The XM smartphone app is an exclusive mobile application available to anyone with an XM account. It allows you to trade, make deposits and withdrawals, manage your account, and access the member page—all within a single app—making it ideal for those who want to trade efficiently on the go. You can also adjust your account leverage directly through the member page in the app. If you haven’t yet opened an XM account, you can complete the entire process—including registration, account activation (identity verification), and submission of identification documents—entirely through the XM smartphone app.

At the moment, the XMTrading app is not available for installation on iOS devices.

If you cannot change XM’s leverage

If you are unable to change your leverage on XMTrading, the issue may be due to one of the following reasons. Please review each solution carefully.

Your margin balance is over \$40,000 (around 4 million yen)

At XMTrading, if your account balance exceeds $40,000 (approximately 4 million yen*), leverage restrictions based on your available margin will apply. As a result, you may not be able to set your account leverage to your desired level. If you wish to adjust your leverage, please check your margin balance—including bonuses and unsettled profits and losses—and withdraw funds to bring it below $40,000.

Based on an exchange rate of 1 USD = 100 JPY. Rates are subject to change.

You did not log in to MT4 again after requesting a leverage change.

At XMTrading, when you request a change to your account leverage, the adjustment is applied to your trading account immediately. However, please note that the updated leverage may not appear instantly in MetaTrader 4 (MT4). If your MT4 leverage does not update after a change, try logging out and back into MT4 or restarting the platform, then check the leverage again. In MetaTrader 5 (MT5), leverage changes are reflected in real time, even while the app is running.

The leverage change procedure is being processed through MT4/MT5.

Please note that the leverage of your XMTrading account cannot be changed directly from the trading platforms (MT4/MT5). To adjust your leverage, you must do so through the XM Member Page. Log in to the XM Member Page and follow the instructions to change your leverage. You can also update your leverage settings via the XMTrading mobile app.

I am currently in the process of adjusting the leverage on my demo account.

Please note that the leverage selected when opening a XMTrading demo account cannot be changed. If you wish to use a different leverage, you will need to open a new demo account.

Even minor price fluctuations can result in a loss of capital.

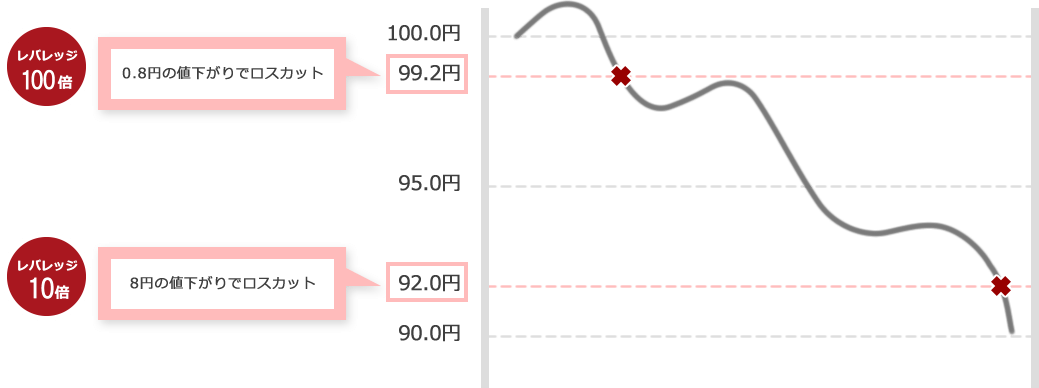

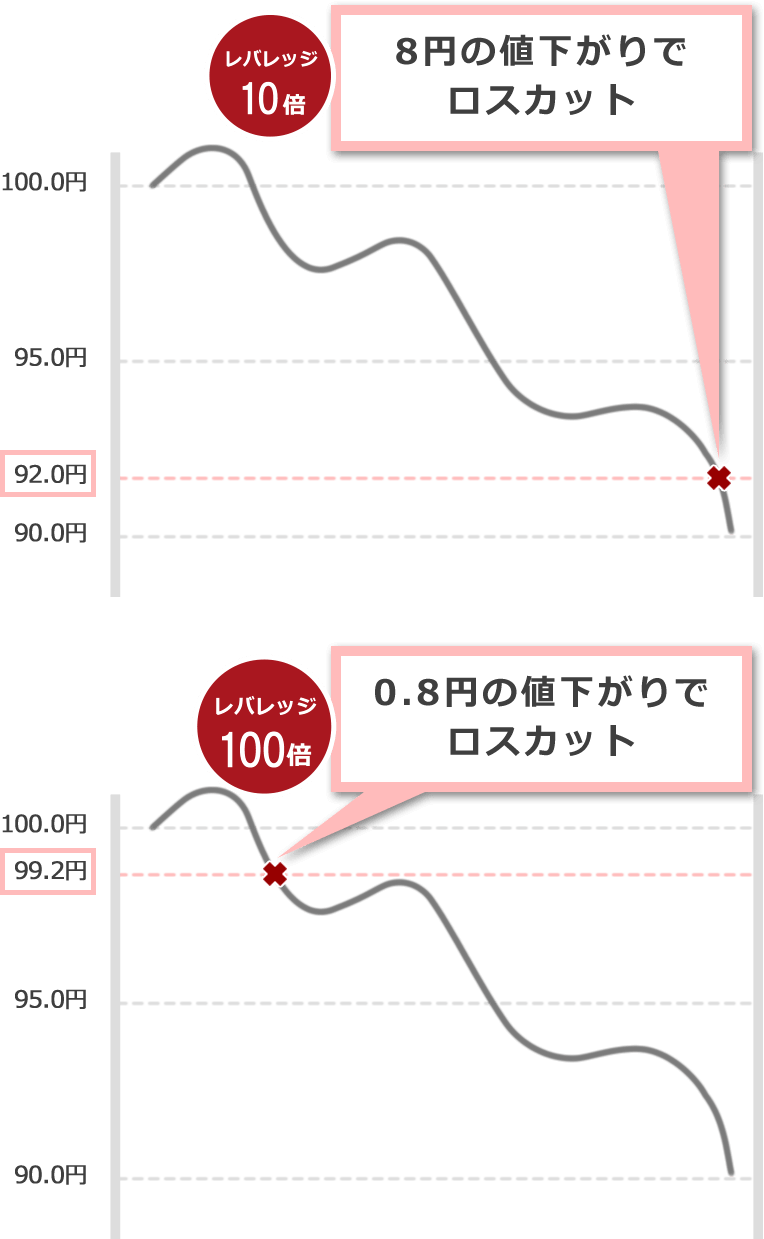

Trading with high leverage—up to 1,000x—can be very attractive, but higher leverage also increases the risk of losing your margin. With lower leverage, even if the market moves slightly against your position, you have a larger margin buffer, so the risk of losing funds is lower. As leverage increases, the risk grows, and with high-leverage trading, even small price movements can result in significant losses.

Difference in Stop-Loss Levels Between Low and High Leverage

High-leverage trading is often described as having high potential returns but also high risk. However, even with low leverage, unrealized losses can occur if the market moves against your position. A higher margin maintenance rate means you remain exposed to that risk for longer, so it is not accurate to assume that “low leverage equals low risk.”

So, what is the difference between low- and high-leverage trading? It largely depends on the investor’s trading style. The leverage you use will vary based on whether you aim to capture long-term FX trends and make modest profits over the medium to long term, seek large short-term gains, or focus on earning swap interest. Therefore, we recommend first understanding the advantages and risks of high-leverage trading, and then selecting the leverage approach that best suits your trading style.

XM Margin Call and Stop Out Levels

At XM, we use “margin calls” and “loss cuts” to minimize losses and protect customer funds when the margin maintenance ratio falls below a certain level. If the market moves against your position and losses increase, a “margin call” will be issued to notify you of a decrease in margin. When the equity in your trading account falls below a certain required margin, a “loss cut” (forced liquidation of your position) will be executed. XM’s margin call and loss cut levels are as follows:

XM Margin Call and Stop Out Levels

| Margin Call |

If the margin maintenance rate falls below 50%

|

|---|---|

| Stop Loss Level |

If the margin maintenance rate falls below 20%

|

In this way, XM detects risks early and alerts customers. If the situation does not improve, XM monitors their trades to prevent losses exceeding deposited funds. In the unlikely event that a stop-loss is not executed properly due to sudden market movements, XM does not charge for negative balances. All negative balances are reset to zero (zero cut) at the time of the next deposit, allowing even FX beginners to trade with confidence.

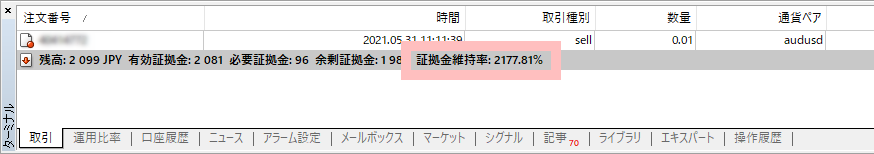

Method for Calculating the Margin Maintenance Rate

The margin maintenance rate is the ratio of the required margin for your open positions to your account balance, including unrealized profits and losses. It serves as the basis for XM’s margin calls and stop-losses and can be calculated using the following formula:

Formula for Calculating the Margin Maintenance Rate

“Margin Maintenance Rate (%)” = “Available Margin” ÷ “Required Margin” × 100

Furthermore, you don’t need to calculate the margin maintenance rate for every trade. You can also check it directly from the “Trading” tab in XM’s MT4/MT5 terminal window.

The formulas for “Available Margin” and “Required Margin,” which are needed to calculate the margin maintenance rate, are as follows:

“Available Margin” = “Account Balance” + “Bonus” + “Unrealized Profit and Loss”

“Required Margin” = “Trading Amount” x “Current Rate” ÷ “Leverage”

「有効証拠金」

= 「口座残高」 + 「ボーナス」 + 「未実現損益」

「必要証拠金」

= 「取引数量」 × 「現在のレート」 ÷ 「レバレッジ」

XM offers a maximum leverage of 1,000x, but the recommended leverage varies depending on the trading instrument and your trading style. With leverage options ranging from 1x to 1,000x, you can select the level that best suits your approach when opening an account. XM’s recommended leverage settings for different trading styles are as follows:

Recommended Leverage for Traders Using Small Positions

For traders looking to start with a small amount of capital, we recommend using the maximum leverage of 1,000x. Higher leverage reduces the required margin, allowing you to control a larger position with a relatively small amount of capital.

Additionally, XM is running a limited-time campaign offering a 15,000 yen account opening bonus for first-time account holders. By combining this bonus with high leverage, you can potentially achieve significant profits in a short period, making it ideal for those with limited funds. For those who are cautious about using high leverage, you can trade using only the account opening bonus without making a deposit, allowing you to experience XM’s high-leverage trading risk-free. Enjoy dynamic trading with XM’s recommended maximum leverage of 1,000x.

Recommended leverage for cryptocurrency traders

The maximum leverage for cryptocurrency CFDs on XMTrading varies by product, but we recommend trading with the highest available leverage. BTCUSD, BTGUSD, ETHBTC, and ETHUSD can be traded with up to 500x leverage; other Bitcoin and Ethereum pairs, as well as Ripple and Litecoin, allow up to 250x; and other altcoins can be traded with a maximum leverage of 50x.

Cryptocurrency CFDs are highly volatile and can generate significant profits, but they can also result in substantial losses in a short period. To help manage this risk, XM uses a ‘tiered margin rate’ that automatically adjusts leverage based on the trading amount, effectively limiting exposure. Because risk management is handled automatically and you don’t need to adjust leverage manually, this approach is ideal for traders who want to control potential losses effectively.

Additionally, XM’s zero-cut system with no margin calls lets you trade even highly volatile cryptocurrency CFDs while limiting your losses to your margin balance. Since well-established and in-demand cryptocurrencies have high market capitalizations, we recommend trading them in small amounts using leverage of up to 500x.

Recommended leverage for traders seeking to avoid leverage restrictions

At XM, leverage restrictions are applied based on your available margin. If you want to avoid these restrictions, we recommend setting your leverage to a maximum of 100x from the beginning. These restrictions are calculated on the total balance (available margin) across all accounts under the same account holder, so be sure to choose a leverage setting that matches your trading capital. For cryptocurrencies, a ‘tiered margin rate’ applies, meaning the leverage automatically adjusts depending on the transaction size of each order.

-

I can’t change the leverage on XM, why?

There are several reasons why you may be unable to change your leverage on XM. Please check whether your equity exceeds $40,000 (4 million yen), which would subject you to leverage restrictions, or whether you attempted to change your leverage directly from MT4/MT5. Changes made through MT4/MT5 will not be applied.

read more

2022.12.29

-

Can I change XM’s leverage using my smartphone?

Yes, you can change your XM leverage from your smartphone. After logging in to the XM Members Page, tap the account number you want to update. The current leverage will be displayed—simply tap the pen icon next to it, choose your preferred leverage, and then tap Send Request.

read more

2022.12.29

-

How can I remove XM’s leverage restrictions?

At XM, leverage restrictions cannot be removed by customers themselves. If you wish to lift these restrictions, you will need to reduce your equity below the specified threshold and then contact XM’s support desk to request their removal. Please note that leverage restrictions are not lifted automatically.

read more

2022.12.29

-

How do I use leverage at XM?

XM’s leverage settings can be easily configured when opening an account. You can choose from 17 leverage options ranging from 1x to a maximum of 1,000x. Simply select the leverage that best matches your trading style—we recommend choosing the option that suits your trading strategy and risk tolerance.

read more

2022.12.29

-

Where can I check the leverage I selected when opening my XM account?

You can check the leverage you selected when opening your XM account via the XM Members Page. After logging in, click on My Account Overview, and the leverage setting will be displayed in your account details. You can also view this information on your smartphone through the mobile Members Page.

read more

2022.12.29

-

What is the maximum leverage available at XM?

The maximum leverage at XM varies by account type. Standard, Micro, and KIWAMI Accounts offer up to 1,000x leverage, while Zero Accounts allow up to 500x. Please choose your preferred leverage when opening your account.

read more

2020.06.23

-

Does XM impose leverage restrictions based on the number of positions held?

XM does not limit leverage based on the number of positions held. However, if your equity exceeds $40,000 (4 million yen), your maximum leverage will be capped at 500x. Leverage restrictions may also be applied during significant political or economic events or depending on the specific instrument you are trading.

read more

2020.06.23

-

How do I change the leverage at XM?

You can change the leverage of your XM trading account through the XM Members Page. After logging in, locate the account you want to modify, click Select an option on the right side, and choose Change Leverage from the drop-down menu to proceed.

read more

2020.06.23

-

What leverage options are available at XM?

XM’s Standard, Micro, and KIWAMI accounts offer 17 leverage options: 1x, 2x, 3x, 5x, 10x, 15x, 20x, 25x, 50x, 66x, 100x, 200x, 300x, 400x, 500x, 888x, and 1,000x. Zero Accounts offer 15 options, excluding 888x and 1,000x.

read more

2020.06.23

-

Does XM have leverage restrictions?

Unlike domestic FX brokers, XM does not have a 25x maximum leverage limit and instead offers up to 1,000x leverage. However, leverage may be restricted if your equity exceeds a certain threshold, when trading minor currency pairs, or during significant political or economic events.

read more

2020.06.23

-

Why has the leverage on my XM account suddenly changed?

XM uses a ‘floating leverage system,’ where leverage adjusts based on your account equity. If equity exceeds $40,000 (4 million yen), the maximum leverage is reduced to 500x; if it exceeds $80,000 (8 million yen), it drops to 200x; and if it exceeds $200,000 (20 million yen), it is limited to 100x.

read more

2020.06.23

-

Does XM offer 1000x leverage on any currency pair?

No, XM does not offer 1,000x leverage on certain currency pairs. The maximum leverage is 400x for CHF-related pairs, 100x for TRY-related pairs, and 50x for HKD-, CNH-, and DKK-related pairs.

read more

2020.06.23