XM Bitcoin Trading

XM Bitcoin Trading

XM offers five Bitcoin-related instruments: BTC/USD, BTC/EUR, BTC/GBP, BTC/JPY, and ETH/BTC. XM offers a trading environment with a maximum leverage of 500x and no fees , making it possible to trade these Bitcoin-related instruments with small amounts at low cost. XM allows you to trade Bitcoin-related instruments 24 hours a day, 365 days a year, so you can enjoy exciting Bitcoin trading on weekends, holidays, and other days when the FX market is closed.

If you wish to trade Bitcoin with XM, please choose the account type that best suits your trading style from Standard Account, Micro Account, or KIWAMI Account (Zero Accounts do not handle cryptocurrency-related products). We are currently running a limited-time account opening bonus (trading bonus) campaign of 15,000 yen (usually 3,000 yen) for those who open a new XM account through this website. Take advantage of this great bonus and enjoy dynamic Bitcoin trading without making a deposit.

BTC/JPY and ETH/BTC can only be traded with MT5 Standard Account, Micro Account, and KIWAMI Account.

At XMTrading, you can trade Bitcoin (BTC) as a CFD 24 hours a day, 365 days a year (including weekends and holidays). Learn about the characteristics of Bitcoin and experience its dynamic price movements that are different from other stocks.

What is Bitcoin?

Bitcoin (BTC) is the world’s first cryptocurrency, inspired by a paper published by a person calling himself Satoshi Nakamoto. Since Bitcoin trading began in 2009, various cryptocurrencies have emerged, but Bitcoin’s popularity has not waned and it is actively traded around the world. While the cryptocurrency market tends to be highly volatile overall, Bitcoin has a high trading volume and is characterized by its relatively stable price compared to other cryptocurrencies. XM provides a safe and comfortable Bitcoin trading environment 24 hours a day, 365 days a year (including weekends and holidays).

XM Bitcoin CFD trading

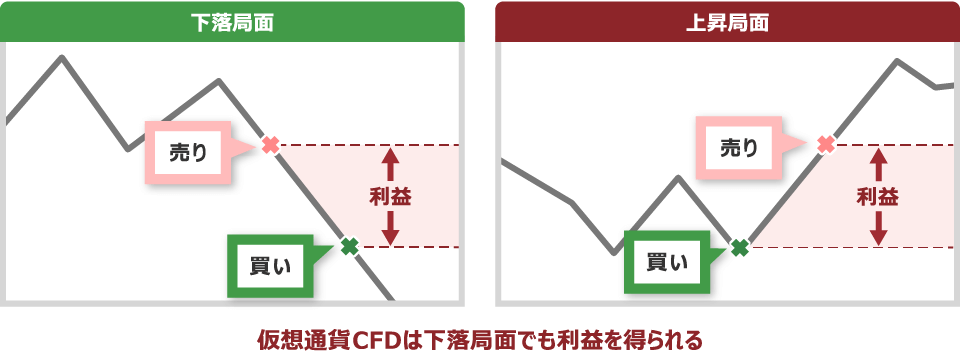

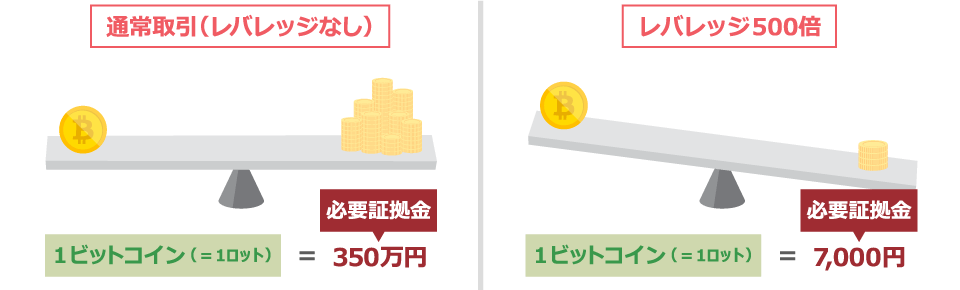

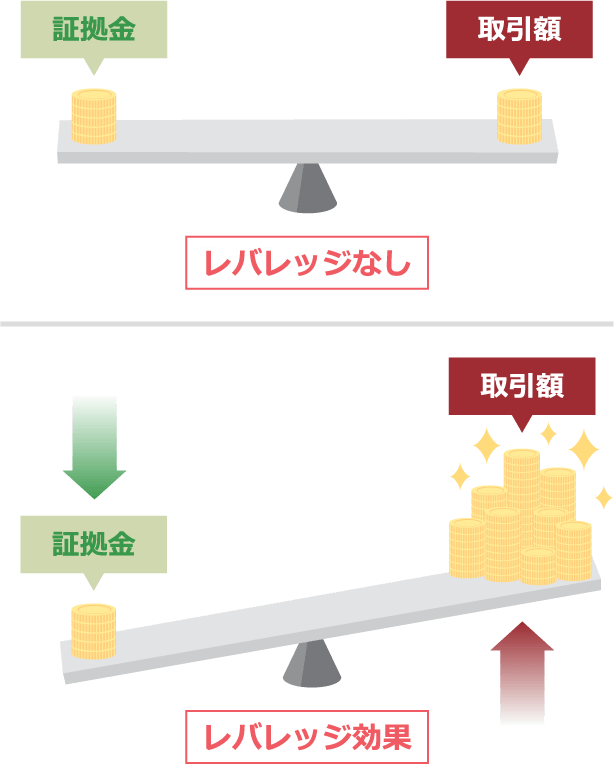

XMTrading’s Bitcoin (BTC) product is available as a CFD (contract for difference) with five currency pairs: USD (US Dollar), EUR (European Euro), GBP (British Pound), JPY (Japanese Yen), and ETH (Ethereum). The greatest appeal of trading Bitcoin with CFDs is its abundant entry opportunities and high leverage of up to 500x . Direct trading of Bitcoin is limited to one-way transactions: placing an order at a low price and capitalizing on a rise. Furthermore, purchasing Bitcoin requires hundreds of thousands of yen, making it a challenging investment. However, CFD trading, where settlement is based solely on the difference between the buying and selling prices, allows entry from a short position, providing trading opportunities even during downtrends. Additionally, tight spreads and leverage allow you to experience dynamic trading with minimal capital, aiming for large profits while minimizing trading costs.

Learn more about XM Bitcoin Leverage Trading

Bitcoin can be traded 24 hours a day, 365 days a year

The cryptocurrency market where Bitcoin (BTC) is traded is open 24 hours a day, 365 days a year, allowing you to trade at any time, even on weekends and during global holidays like Christmas and New Year’s. Forex currency pairs and other instruments, rates fluctuate significantly on weekends, and to avoid significant losses during the “gaps” at the start of the week, many traders tend to close their positions before the markets close on Friday. However, Bitcoin does not have a “closing” period, meaning there is no need to settle positions for the weekend (Saturday and Sunday) . Bitcoin and other cryptocurrencies are the only FX instruments that can be traded on weekends and holidays, making it easier to carry over positions over the weekend, something that is often avoided with other instruments. However, during times of reduced liquidity, spreads may widen, so traders should be cautious when timing their trades.

Aim for big profits with Bitcoin trading on weekends and holidays

Bitcoin, which can be traded 24 hours a day, 365 days a year, including weekends and holidays, is an easy currency to trade even for office workers who are busy with work during the day and don’t have time to trade FX or stocks. Bitcoin, in particular, can exhibit active price movements depending on the time of day, allowing for large price swings even in short-term trades. At XM, you can trade cryptocurrency CFDs with your regular FX trading account (excluding Zero accounts), so there’s no need to open a separate cryptocurrency account or wallet. By focusing on FX trading during the week and trading cryptocurrencies on weekends when FX and stock markets are closed, you can aim for greater profits.

XM also allows instant deposits on weekends and holidays (deposits made by bank transfer outside of business hours will be reflected on the next business day). If you deposit using a credit/debit card or online wallet, your account balance will be adjusted in real time even on weekends according to fluctuations in the margin maintenance rate, so you can rest assured.

XM Bitcoin price movement

When trading Bitcoin (BTC) with XM, understanding the characteristics of price movements in advance will help you develop an effective trading strategy and maximize performance. Furthermore, unlike other markets, the cryptocurrency market, including Bitcoin, is the only one that is open 24 hours a day, 365 days a year (including weekends and holidays). Please also be sure to understand the characteristics of the cryptocurrency market as a whole, and enjoy Bitcoin trading with XM while minimizing risk.

Bitcoin tends to be more active during New York time

Bitcoin trading tends to be most active during New York time (from 10 PM to 2 AM Japan time) . This is because New York time is the time when more people participate in various markets, including not only the cryptocurrency market but also the foreign exchange market and stock market.

However, because Bitcoin can be traded 24 hours a day, worldwide, trading is active even outside of New York time . For example, after the domestic stock market opens at 9:00 AM Japan time, Bitcoin is sometimes bought and sold based on stock market movements, which can increase Bitcoin trading volume and cause large price movements. Bitcoin trading tends to be particularly active during New York time, but there are also entry opportunities at other times. However, please note that trading volume is at its lowest during the day from 4:00 AM to 8:00 AM Japan time, which coincides with the end of New York time, and spreads tend to widen.

Keep an eye on Bitcoin-related news

To understand Bitcoin (BTC) price movements, pay close attention to Bitcoin-related news . Bitcoin’s market capitalization is determined by multiplying the market price (current value) of Bitcoin by the number of units issued. Therefore, as demand increases, the market capitalization increases. Therefore, news about Bitcoin demand has a significant impact on Bitcoin’s price movements. For example, be sure to check for news about large companies entering the Bitcoin market or statements about Bitcoin by world-renowned investors, as these may affect the increase or decrease in demand for Bitcoin.

Additionally, the United States and China are strengthening regulations on the trading volume of virtual currencies, including Bitcoin, with the aim of stabilizing their financial systems and guarding against the outflow of funds overseas and money laundering. Other countries are also considering restricting Bitcoin trading, so it’s important to keep a close eye on the situation. Keeping up with the latest news can give you the chance to make big profits from Bitcoin trading or avoid major losses due to a price crash.

Easily check professional analysis data with the XM app

XM’s official app, the “XM Trading Smartphone App (XM Smartphone App),” allows you to easily check professional Bitcoin analysis data with just one smartphone. XM provides analytical data from Trading Central, a company highly regarded by financial institutions around the world, free of charge to those who open an account with XM. Use professional market analysis data using various indicators and future forecast scenarios as a reference for your Bitcoin trading. Bitcoin analytical data can be viewed from the Bitcoin trading screen of the XM Smartphone App. After logging in to the XM Smartphone App, open the trading screen for a Bitcoin-related stock and tap “View the latest trade ideas based on Trading Central analytical data” at the bottom of the chart. After checking the analytical data, close the window to return to the trading screen and proceed with trading.

Currently, the iOS version of the XMTrading app cannot be installed.

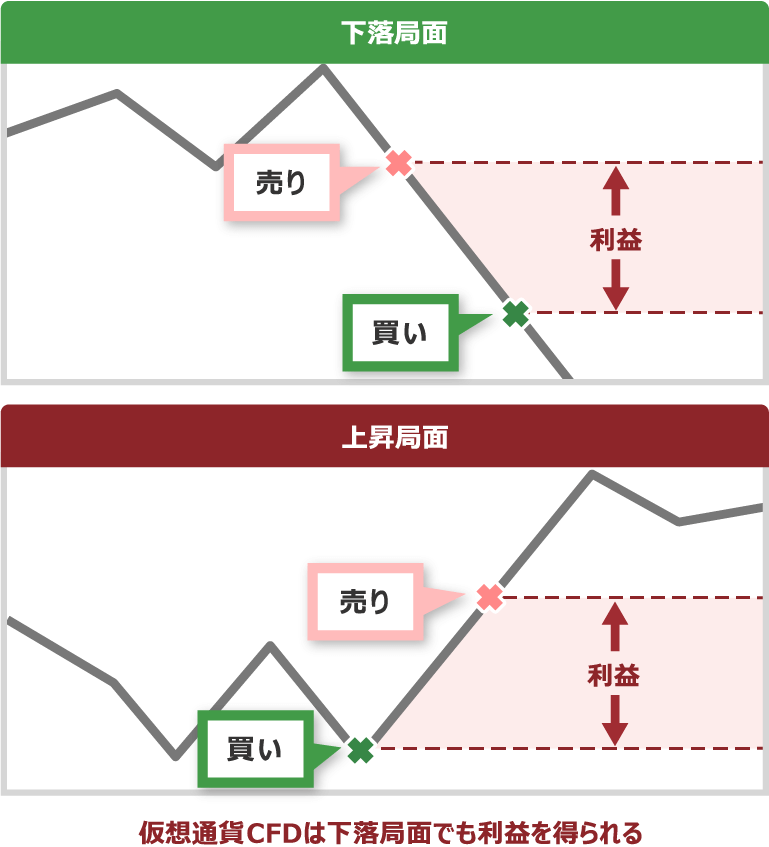

Bitcoin has a halving

If the amount of Bitcoin (BTC) in circulation increases too much, its value will decrease, so the amount issued is adjusted to stabilize the price. Since Bitcoin does not have a central bank of any country that issues or manages the currency, miners issue Bitcoin and are rewarded for doing so. However, if Bitcoin continues to be issued infinitely, the market will be flooded with Bitcoin and its value will decrease, so a “halving” is set up to gradually reduce mining rewards and limit the amount issued.

Since the first halving in 2012 (50 BTC → 25 BTC), mining rewards have been halved approximately every four years, with further reductions in rewards occurring in 2016 (25 BTC → 12.5 BTC), 2020 (12.5 BTC → 6.25 BTC), and 2024 (6.25 BTC → 3.125 BTC). The next halving is predicted for 2028 (mining rewards are expected to eventually reach zero around 2140). While halvings are intended to stabilize Bitcoin prices, historically, the price has tended to rise leading up to the halving, followed by increased selling and a subsequent decline. After hitting bottom, buying has again increased, forming a long-term upward trend. XM’s Bitcoin is traded as a CFD, allowing you to profit from short positions not only during uptrends but also during downtrends. Although it is not possible to pinpoint the date of the next halving, please enjoy trading Bitcoin with XM, keeping in mind that Bitcoin has a halving and that entry opportunities tend to increase around the time of the halving.

XM’s Bitcoin (BTC) can also be traded via the “XM smartphone app”

XM’s Bitcoin (BTC) related products can be traded on MT4/MT5 as well as the “XM Smartphone App.” XM offers the official “XMTrading Smartphone App (XM Smartphone App),” which combines the XM membership page and MT4/MT5 trading functions. By downloading the XM Smartphone App to your smartphone or tablet, you can easily access XM’s MT4/MT5 for trading and account management. Bitcoin is in constant motion 24 hours a day, 365 days a year (including weekends and holidays), allowing you to trade anytime, anywhere, allowing you to quickly respond to sudden market fluctuations and entry opportunities.

Currently, the iOS version of the XMTrading app cannot be installed.

XM’s Bitcoin is classified as a cryptocurrency CFD, and five different products are available for trading: BTCUSD (Bitcoin/US Dollar), BTCEUR (Bitcoin/European Euro), BTCGBP (Bitcoin/British Pound), BTCJPY (Bitcoin/Japanese Yen), and ETHBTC (Ethereum/Bitcoin) . Bitcoin, a representative cryptocurrency, is also traded by many FX brokers and is often paired with the US dollar. However, XM also allows you to trade Bitcoin in currency pairs with the heavily traded European Euro, British Pound, Japanese Yen, and the major cryptocurrency Ethereum.

XM Bitcoin Trading Hours

XM’s Bitcoin ( BTC ) trading hours are 24 hours a day, 365 days a year (including weekends and holidays). Even during global holidays such as Christmas and New Year’s, when foreign exchange and other markets are closed, you can still trade Bitcoin in the constantly fluctuating cryptocurrency market all year round. However, XM will be performing maintenance for 30 minutes from 4:05 PM to 4:35 PM on Saturdays (winter time: 5:05 PM to 5:35 PM) and trading will be unavailable.

XM Bitcoin trading hours (Japan time)

| Brand name | Daylight Saving Time | Winter time |

All Bitcoin brands |

Trading available 24 hours a day, 7 days a week (Saturdays only, closing time: 16:05-16:35) |

Trading available 24 hours a day, 7 days a week (Saturdays only, closing from 17:05 to 17:35) |

| ビットコイン全銘柄 | |

| 夏時間 | 週7日24時間取引可能 (土曜日のみ16:05〜 16:35閉場) |

| 冬時間 | 週7日24時間取引可能 (土曜日のみ17:05〜 17:35閉場) |

-

The cryptocurrency market operates 24 hours a day, 365 days a year, but please note that trading hours may change depending on market conditions.

XM Bitcoin trading volume and minimum/maximum trade size

XM’s Bitcoin (BTC) trading volume per lot is 1 Bitcoin (1 lot = 100,000 tokens for ETHBTC). Since XM’s FX currency pair trading volume is 1 lot = 100,000 units, Bitcoin trading volume may seem small when viewed solely from the perspective of trading volume alone. However, even with a small trading volume, it’s important to note that the price per Bitcoin is significantly different from that of FX currency pairs. Before starting Bitcoin trading with XM, please check the trading volume and transaction size (minimum/maximum) and avoid increasing the lot size too much. Additionally, when the settlement currency (the currency displayed to the right of the currency pair) is EUR (European Euro) or GBP (British Pound), the maximum transaction size for XM’s Bitcoin is smaller than that for USD (US Dollar). The trading volume per lot and minimum/maximum transaction size for XM’s Bitcoin are as follows:

XM Bitcoin trading volume and minimum/maximum trade size

| Brand name | Trading volume of 1 lot | Min/Max Trade Size |

| BTCUSD (Bitcoin/US Dollar) |

1 Bitcoin | 0.01 lot/80 lots |

| BTCEUR (Bitcoin/European Euro) |

1 Bitcoin | 0.01 lot/30 lots |

| BTCGBP (Bitcoin/British Pound) |

1 Bitcoin | 0.01 lot/30 lots |

| BTCJPY (Bitcoin/Japanese Yen) |

1 Bitcoin | 0.01 lot/20 lots |

| ETHBTC (Ethereum/Bitcoin) |

100,000 tokens | 0.01 lot/43 lots |

| BTCUSD | |

| 1ロットの 取引量 |

1 Bitcoin |

| 最小/最大 取引サイズ |

0.01ロット/80ロット |

| BTCEUR | |

| 1ロットの 取引量 |

1 Bitcoin |

| 最小/最大 取引サイズ |

0.01ロット/30ロット |

| BTCGBP | |

| 1ロットの 取引量 |

1 Bitcoin |

| 最小/最大 取引サイズ |

0.01ロット/30ロット |

| BTCJPY | |

| 1ロットの 取引量 |

1 Bitcoin |

| 最小/最大 取引サイズ |

0.01ロット/20ロット |

| ETHBTC | |

| 1ロットの 取引量 |

100,000 tokens |

| 最小/最大 取引サイズ |

0.01ロット/43ロット |

Click here for details on XM’s minimum and maximum lot size (lot calculation method)

XM Bitcoin Tiered Margin Rate (Leverage)

XMTrading’s Bitcoin (BTC) uses a “tiered margin rate” where leverage changes gradually depending on the trading amount. Please note that as the trading amount (trading rate x trading lot) increases, the required margin rate also increases (leverage decreases) based on the variable leverage value set for each product. Furthermore, BTCUSD (Bitcoin/US Dollar) and ETHBTC (Ethereum/Bitcoin) have a maximum leverage of 500x, while BTCEUR (Bitcoin/European Euro), BTCGBP (Bitcoin/British Pound), and BTCJPY (Bitcoin/Japanese Yen) have a maximum leverage of 250x. The applicable leverage is gradually limited depending on the lot size as shown below.

XM BTCUSD Tiered Leverage

| Transaction amount | Margin Rate | Leverage |

| $0-$1,000,000 | 0.2% | 500 times |

| $1,000,001 to $3,000,000 | 0.4% | 250 times |

| $3,000,001 to $5,000,000 | 2% | 50 times |

| Over $5,000,001 | 100% | 1x |

XM BTCEUR, BTCGBP, and BTCJPY tiered leverage

| Transaction amount | Margin Rate | Leverage |

| $0-$300,000 | 0.4% | 250 times |

| $300,001 to $600,000 | 2% | 50 times |

| Over $600,001 | 100% | 1x |

XM ETHBTC Tiered Leverage

| Transaction amount | Margin Rate | Leverage |

| $0-$300,000 | 0.2% | 500 times |

| $300,001 to $600,000 | 0.4% | 250 times |

| $600,001 to $1,000,000 | 2% | 50 times |

| Over $1,000,001 | 100% | 1x |

When trading Bitcoin with XM, please check the “transaction amount per order” including any new positions you may be placing and calculate the required margin. The applied leverage is not affected by your current positions or the effective margin amount (account balance) of your trading account.

Click here to calculate the required margin for XM Cryptocurrency CFDs

-

When trading Bitcoin with XM, the leverage set in your trading account will not be applied. Please note that the tiered leverage set for each stock will be applied.

-

The transaction amount to which tiered margin rates apply varies by product.

XM adopts a zero cut system

XM employs a zero-cut system for all account types . The zero-cut system is a system in which if a sudden market fluctuation prevents a stop loss and a loss that exceeds the account balance occurs, XM will compensate for the negative balance and reset it to zero. Since losses will never exceed the amount deposited, you can minimize risk and pursue unlimited profits even in high-leverage trading of the highly volatile Bitcoin (BTC).

XM Bitcoin Spreads

XMTrading allows you to trade Bitcoin (BTC) with tight spreads. Spreads for CFDs on Bitcoin and other cryptocurrencies vary depending on the account type, but the KIWAMI Kiwami account, which features ultra-low spreads and no trading fees, offers the lowest spreads. However, please note that spreads tend to widen during periods of low liquidity. Bitcoin spreads are expressed as the spread in the settlement currency.

XM Bitcoin Lowest Spreads

| Brand name | Standard Account Micro Account |

KIWAMI polar account |

| BTCUSD (Bitcoin/US Dollar) |

60.00 | 30.00 |

| BTCEUR (Bitcoin/European Euro) |

165.00 | 115.00 |

| BTCGBP (Bitcoin/British Pound) |

210.00 | 170.00 |

| BTCJPY (Bitcoin/Japanese Yen) |

13,000.00 | 9,000 |

| ETHBTC (Ethereum/Bitcoin) |

0.00 | 0.00009 |

| BTCUSD | |

| スタンダード口座 マイクロ口座 |

60.00 |

| KIWAMI極口座 | 30.00 |

| BTCEUR | |

| スタンダード口座 マイクロ口座 |

165.00 |

| KIWAMI極口座 | 115.00 |

| BTCGBP | |

| スタンダード口座 マイクロ口座 |

210.00 |

| KIWAMI極口座 | 170.00 |

| BTCJPY | |

| スタンダード口座 マイクロ口座 |

13,000.00 |

| KIWAMI極口座 | 9,000 |

| ETHBTC | |

| スタンダード口座 マイクロ口座 |

0.00 |

| KIWAMI極口座 | 0.00009 |

-

Cryptocurrency CFDs are not available for Zero Accounts. BTCJPY and ETHBTC are only available for MT5 Standard Accounts, Micro Accounts, and KIWAMI Accounts.

-

Spreads fluctuate daily, so please check the latest figures when trading.

XM’s Bitcoin spreads tend to be wider than those of FX currency pairs and other CFDs. However, XM offers a loyalty program that allows you to earn various bonuses and XM points, which can help you reduce your overall trading costs. These services are also available for Bitcoin trading, so please make use of them.

XM Bitcoin Swap Points

XMTrading’s Bitcoin (BTC) exchange incurs swap points. Swap points are incurred Monday through Friday each time a position is carried over to the next day, with three days’ worth of swap points incurred on Fridays. Bitcoin’s high volatility makes it suitable for short-term trading such as scalping and day trading. However, because spreads are somewhat wider than those of major currency pairs, holding long-term positions and aiming for large profits can also be an effective strategy in markets experiencing strong trends.

One trading condition to keep an eye on when trading long-term is the “swap point,” an interest rate adjustment that occurs when a position is carried over to the next day . If the swap point is negative, losses will accumulate daily on open positions, so when trading Bitcoin long-term, losses from negative swaps can be a bottleneck. Swap points fluctuate daily, so be sure to check the latest figures when trading .

XM Bitcoin Swap Points

| Product (brand) | Long (Buy) Swap Points |

Short (selling) swap points |

| BTCUSD (Bitcoin/US Dollar) |

-7,552.71 | -7,552.71 |

| BTCEUR (Bitcoin/European Euro) |

-7,751.48 | -7,751.48 |

| BTCGBP (Bitcoin/British Pound) |

-6,707.03 | -6,707.03 |

| BTCJPY (Bitcoin/Japanese Yen) |

-11,106.3 | -11,106.30 |

| ETHBTC (Ethereum/Bitcoin) |

-3.34 | -3.34 |

| BTCUSD | |

| ロング(買) スワップポイント |

|

| ショート(売) スワップポイント |

|

| BTCEUR | |

| ロング(買) スワップポイント |

|

| ショート(売) スワップポイント |

|

| BTCGBP | |

| ロング(買) スワップポイント |

|

| ショート(売) スワップポイント |

|

| BTCJPY | |

| ロング(買) スワップポイント |

|

| ショート(売) スワップポイント |

|

| ETHBTC | |

| ロング(買) スワップポイント |

|

| ショート(売) スワップポイント |

|

XM provides the optimal trading environment for Bitcoin (BTC) . Bitcoin, which boasts the largest market share in the cryptocurrency market, is traded by many exchanges and FX brokers, but XM allows traders to pursue large profits from Bitcoin, which is expected to grow further, while reducing risk and costs. In addition, XM has narrowed the spreads between BTCUSD and ETHUSD, providing more favorable trading conditions for traders.

Small trades are possible with “Zero Cut x Maximum 500x Leverage”

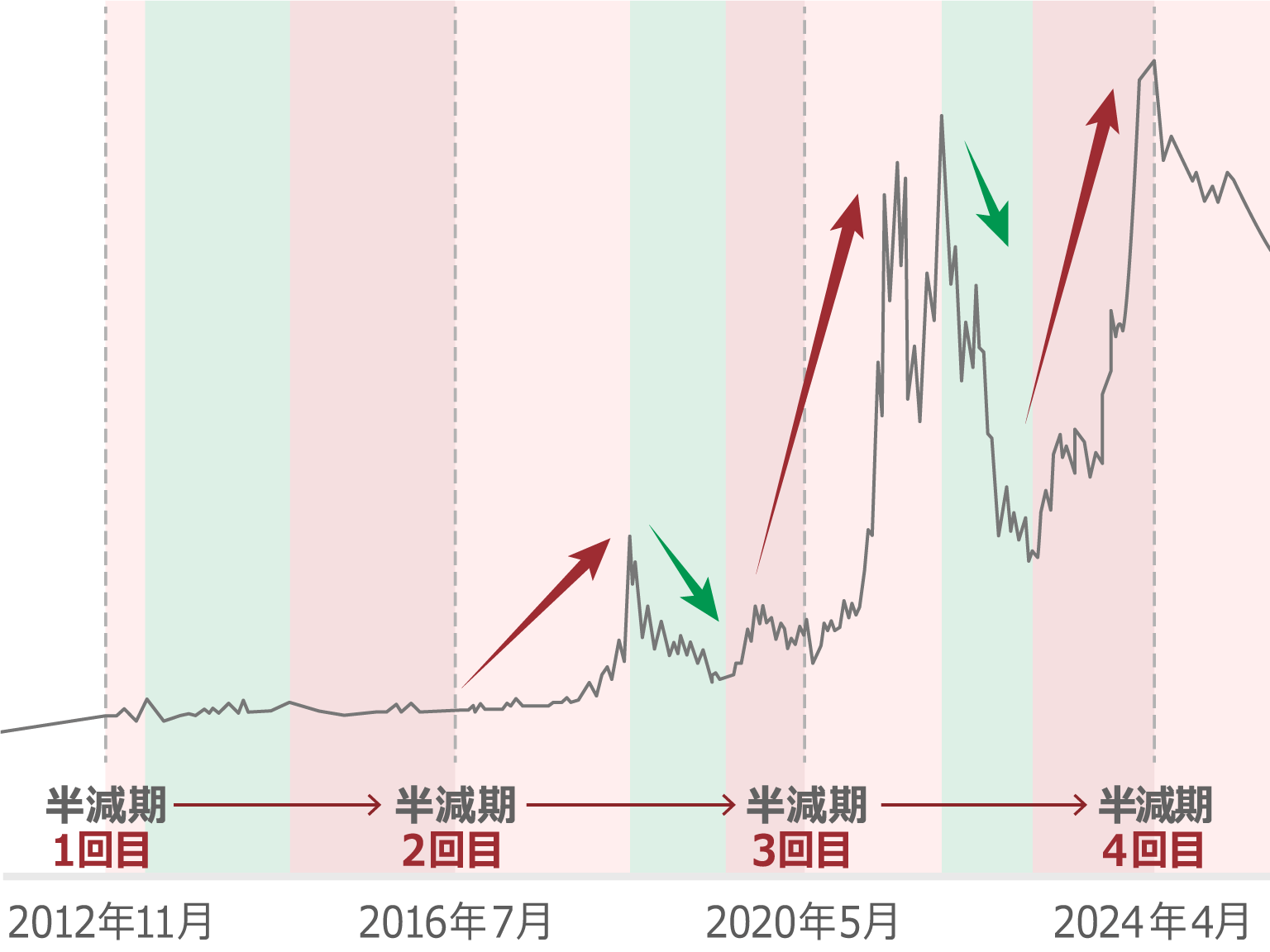

XM allows you to trade Bitcoin (BTC) with “zero cut x high leverage of up to 500x .” Bitcoin’s appeal lies in its high volatility, but on the other hand, it is a “high-risk, high-return” product with a high risk of large losses in a short period of time. While purchasing Bitcoin normally requires a large capital investment, XM allows you to trade CFDs with leverage of up to 500x, so you can start trading with a small amount.

For example, if you trade Bitcoin directly, you need approximately ¥3.5 million (as of the time of writing) to purchase one Bitcoin. On the other hand, with XM’s Bitcoin CFD, if the BTCUSD (Bitcoin/US Dollar) exchange rate is $26,000 (= ¥3.5 million) (calculated at ¥135/US Dollar), the margin required to hold one lot (= one Bitcoin) with 500x leverage is only ¥7,000. Furthermore, XM allows you to trade Bitcoin with a minimum lot size of 0.01, meaning that under the same conditions, you can trade Bitcoin with a minimum margin of ¥70 . While Bitcoin typically requires a large investment, XM’s Bitcoin CFD allows you to utilize high leverage with a small amount of capital and aim for large profits. Therefore, with Bitcoin expected to continue growing, you can pursue unlimited profits while limiting losses to your margin.

“Commission-free” trading allows you to keep costs down

XM allows you to trade Bitcoin (BTC) with no trading fees. Trading costs consist of spreads and swaps. However, with the KIWAMI account, you can trade Bitcoin with no trading fees and even tighter spreads than other account types, further reducing trading costs . Bitcoin is available for trading 24 hours a day, 365 days a year, including weekends and holidays, and can exhibit active price movements at certain times of the day. While high volatility is attractive, it can also result in large losses in a short period of time. However, with XM’s leverage of up to 500x and a zero-cut system, you can minimize risk and costs while pursuing unlimited profits.

Learn more about XM Bitcoin Leverage Trading

Deposits and withdrawals can be made using Bitcoin

XM (XM) supports deposits and withdrawals via Bitcoin (BTC) . If you have activated a real account with XM, you can choose to deposit virtual currency (crypto assets). As with other XM deposit and withdrawal methods, there are no deposit or withdrawal fees. Furthermore, if you deposit with Bitcoin, it will automatically be converted to your account’s base currency (JPY (Japanese Yen), USD (US Dollar), or EUR (European Euro)) and reflected in your trading account within one hour. Amounts deposited with Bitcoin can be withdrawn in Bitcoin, and profits can be withdrawn via domestic bank transfer.

Before you start trading Bitcoin (BTC) on XMTrading, please read the following points of caution.

Bitcoin cannot be traded with a zero account

Please note that you cannot trade Bitcoin (BTC) with an XM Zero account . XM’s cryptocurrency CFDs, including Bitcoin, can only be traded with three account types: Standard, Micro, and KIWAMI Kyoku accounts (BTCJPY and ETHBTC are only available with MT5 Standard, Micro, and KIWAMI Kyoku accounts). If you only have a Zero account, you can open a different account type with an additional account. XM allows one person to hold up to eight accounts, so you can use multiple accounts to suit your trading instruments and trading style.

Bitcoin is highly volatile

When trading Bitcoin (BTC) on XMTrading, please be aware that it is a highly volatile currency . Since the birth of Bitcoin, the cryptocurrency market has grown year by year and is expected to become even larger in size in the future. However, compared to the foreign exchange and stock markets, the cryptocurrency market is immature and characterized by high volatility. Bitcoin, with its large market capitalization, has relatively stable price movements among cryptocurrencies, but it is important to be aware that it is prone to sudden price fluctuations compared to other markets. While high volatility is one of the attractions of Bitcoin trading, please be aware that it also involves risks before enjoying Bitcoin trading.

No physical Bitcoin ownership

XM’s Bitcoin (BTC) is traded as a CFD, where only the difference between buying and selling is settled. Please note that you cannot hold physical Bitcoin . If you hold physical Bitcoin, you can receive rewards through staking and lending in addition to trading. However, since the Bitcoin traded on XM is traded as a CFD and you do not hold the actual Bitcoin, you cannot participate in staking or lending.

Furthermore, XM offers a trading environment not found in spot Bitcoin trading, such as leverage of up to 500x and trading utilizing the various generous bonuses offered by XM . Furthermore, by using the Standard Account or KIWAMI Account, which have reduced spreads, you can aim for big profits with a small amount while keeping costs down, even with the highly volatile Bitcoin.

Staking and Lending

“Staking” is a system in which you hold virtual currencies such as Bitcoin and participate in a blockchain network, thereby receiving a fixed interest rate as a reward. On the other hand, “lending” is a system in which you lend your virtual currencies such as Bitcoin that you hold to a virtual currency exchange and receive loan interest as a reward. While both staking and lending allow you to earn rewards in addition to the trading profits you make, staking carries the risk of being unable to respond to sudden market fluctuations as restrictions may be placed on virtual currency withdrawals for a certain period of time. With lending, there is a risk that the lent virtual currency may not be returned.

Leverage up to 500x for BTCUSD and ETHBTC only

XM allows you to trade Bitcoin (BTC) against not only the US dollar (USD), but also five other currency pairs, including the euro (EUR), British pound (GBP), Japanese yen (JPY), and Ethereum (ETH). However, please note that only BTCUSD (Bitcoin/US dollar) and ETHBTC (Ethereum/Bitcoin) offer a maximum leverage of 500x , while BTCEUR, BTCGBP, and BTCJPY offer half the maximum, at 250x. The required margin also varies depending on the leverage. For example, if you mistakenly select BTCEUR, BTCGBP, or BTCJPY, which offer 250x leverage, instead of trading BTCUSD, which offers 500x leverage, your margin maintenance rate may drop significantly when you open a position. When starting Bitcoin trading with XM, be careful not to select the wrong symbol name.

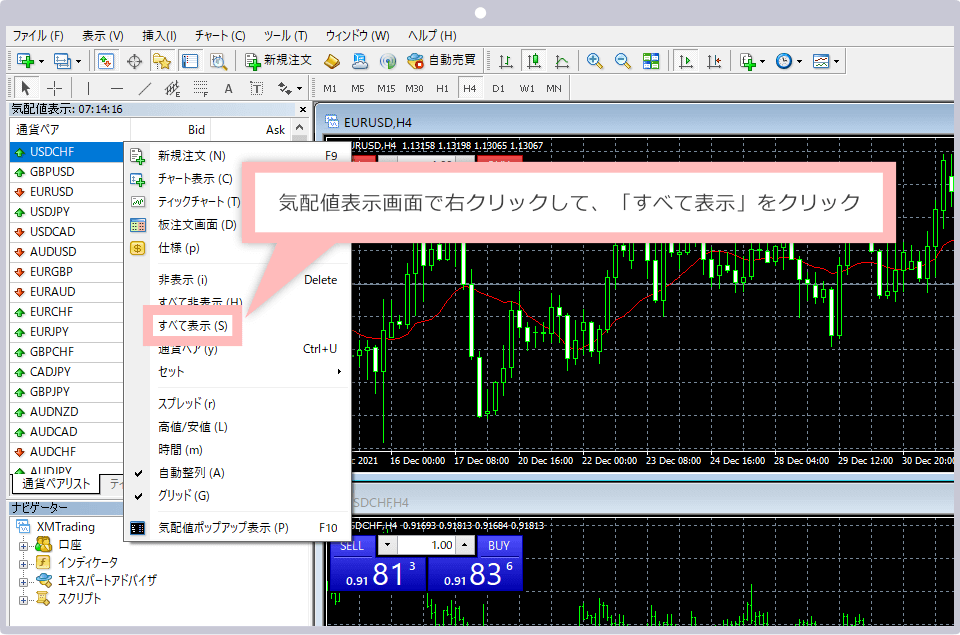

How to Display Bitcoin on MT4/MT5

By default, the quote list on XMTrading’s trading platform, MT4/MT5, only displays certain symbols. To display Bitcoin in the quote list, log in to MT4/MT5, right-click on the quote list screen, and click “Show All.” All symbols will be displayed on the quote list screen. However, since Bitcoin is not handled in Zero accounts, Bitcoin will not be displayed on the quote list screen. If Bitcoin does not appear on MT4/MT5 using the method above, please check that your login account is not a Zero account.

Here are some points to note about XM’s cryptocurrency CFD trading

-

What is XM’s “tiered margin” for Bitcoin?

Tiered margin is a system in which the margin rate (leverage) varies depending on the trading amount. For BTCUSD (Bitcoin/US Dollar), the maximum leverage is 500x, but if the trading amount per order exceeds $1 million, it is limited to 250x. The leverage gradually decreases to 50x for orders over $3 million and 1x for orders over $5 million.

read more

2024.06.05

-

Can I use my XM bonus as margin to trade Bitcoin?

Yes, XM bonuses can be used as margin for Bitcoin trading. XM offers a wide range of bonuses, and by utilizing these bonuses you can increase your capital efficiency and enjoy Bitcoin trading. You can also try Bitcoin trading risk-free by using only the account opening bonus, which you can receive without making a deposit.

read more

2024.06.05

-

Do I need to open a new account to trade Bitcoin with XM?

No, at XM, you can trade all cryptocurrency CFDs, including Bitcoin, using the same account as your FX trading. There is no need to switch accounts depending on the product you are trading, and you can trade Bitcoin using the same margin as your FX trading. Fund management is very easy, so even beginners can easily start trading Bitcoin.

read more

2024.06.05

-

Can I trade Bitcoin on weekends at XM?

Yes, XM allows you to trade all cryptocurrency CFDs, including Bitcoin, on weekends (including holidays). XM’s Bitcoin CFDs are available for trading 24 hours a day, 365 days a year, but are closed for 30 minutes on Saturdays from 16:05 to 16:35 (17:05 to 17:35 during winter hours) due to maintenance. Please be aware of this when trading Bitcoin CFDs with XM.

read more

2024.06.05

-

Does XM offer spot trading of Bitcoin?

No, XM does not offer spot trading of Bitcoin. XM only offers CFD trading (contract for difference) of Bitcoin, which can be traded in both “buying” and “selling” directions. Since you can trade Bitcoin even when it is falling, one of the features of XM’s Bitcoin CFD trading is that it offers more trading opportunities compared to spot trading.

read more

2024.06.05

-

What are the spreads for XM’s Bitcoin trading products?

XM’s Bitcoin spreads vary depending on the account type. With the KIWAMI account, you can trade BTCUSD (Bitcoin/US Dollar) at a minimum of 190 pips, BTCEUR (Bitcoin/European Euro) at 350 pips, and BTCGBP (Bitcoin/British Pound) at 200 pips.

read more

2023.05.17

-

What are the benefits of trading Bitcoin with XM?

XM Bitcoin can be traded 24 hours a day, 365 days a year with a maximum leverage of 500x. This has the advantage of making it easy to hold positions for the long term with a small amount of capital. In addition, XM employs a zero-cut system, allowing you to trade while minimizing risk.

read more

2023.05.17

-

Bitcoin is not showing up on XM’s MT4/MT5.

To display Bitcoin on XM’s MetaTrader4 (MT4) / MetaTrader5 (MT5), log in to MT4/MT5, right-click on the market price display screen, and click “Show all.” Note that Bitcoin is not displayed on Zero accounts, as it is not handled in these accounts.

read more

2023.05.17

-

Are there any leverage limits when trading Bitcoin with XM?

Yes, XM’s Bitcoin trading has leverage limits based on the number of lots held. BTCUSD (Bitcoin/US Dollar) has a maximum leverage of 500x, while BTCEUR (Bitcoin/European Euro), BTCGBP (Bitcoin/British Pound), and BTCJPY (Bitcoin/Japanese Yen) have a maximum leverage limit of 250x, with leverage limits gradually increasing depending on the number of lots held.

read more

2023.05.17

-

What Bitcoin trading instruments does XM support?

XM’s Bitcoin products are BTCUSD (Bitcoin/US Dollar), BTCEUR (Bitcoin/Euro), BTCGBP (Bitcoin/British Pound), BTCJPY (Bitcoin/Japanese Yen), and ETHBTC (Ethereum/Bitcoin). By combining major fiat currencies with popular cryptocurrencies, you can trade with high market liquidity.

read more

2023.05.17