XM USD/JPY trading

XM USD/JPY trading

XMTrading offers excellent trading conditions for the US Dollar/Japanese Yen (USDJPY), including maximum leverage of 1,000x and extremely low spreads of as little as 0 pips. The USD/JPY is the second most traded FX currency pair in the world. Its relatively stable price movements, coupled with moderate volatility, make it a recommended FX currency pair for all traders, from beginners to advanced traders .

XM offers four account types (Standard Account, Micro Account, KIWAMI Account, and Zero Account), so please choose the account type that best suits your trading style. If you do not yet have an XM account, open a new account through this website and receive a 15,000 yen account opening bonus (trading bonus). The usual bonus is 3,000 yen, but we have increased it to 15,000 yen exclusively for this website. Take advantage of this great limited-time bonus and enjoy USD/JPY trading in XM’s excellent trading environment.

To maximize your performance when trading USD/JPY on XM, it’s important to understand the characteristics of the USD/JPY market. XM offers a high-spec trading environment, including an incredibly fast execution system that executes 99.35% of all orders within one second, narrow spreads, and high leverage. However, no matter how excellent the trading environment, significant losses can occur depending on the time of day and market conditions. To pursue profits in USD/JPY trading, we recommend understanding the characteristics of the USD/JPY market before beginning trading.

XM USD/JPY Trading Conditions (Features)

| Supported account types |

Standard account, Micro account , KIWAMI account, Zero account |

|---|---|

| Trading Platform |

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) |

| Trading Hours | [Summer time]: Monday 06:05 – Saturday 05:50 [Winter time]: Monday 07:05 – Saturday 06:50 |

| Transaction fees | [Standard Account, Micro Account, KIWAMI Goku Account] Free [Zero Account] One-way $5/1 lot |

| Maximum Leverage | [Standard Account, Micro Account, KIWAMI Goku Account] 1,000 times [Zero Account] 500 times |

| Minimum Spread |

0.0 pips

|

| Minimum Order Quantity |

0.01 lot

|

| Maximum order quantity |

10,000 lots

|

Click here for details on XM USD/JPY trading conditions

USD/JPY trading volume

The USD/JPY, comprised of the US Dollar (USD) and the Japanese Yen (JPY), is the second most traded FX currency pair after the EUR/USD. The highly liquid USD/JPY has relatively stable price movements and spreads, making it an easy pair to trade even for FX beginners , and it is one of the most popular pairs among Japanese traders . The USD/JPY also has the advantage of being easily accessible for information on news and events that affect the exchange rate. This allows you to avoid times when risk is likely to be high and focus your trades on opportunity periods where you can expect large profits.

Economic indicators highly related to the dollar/yen

One of the factors that affect the dollar-yen (USDJPY) exchange rate is the impact of economic indicators and statements by important figures in the United States and Japan. The exchange rate is more likely to rise or fall sharply around the time of the release of important economic indicators and statements by important figures that indicate the economic situation and outlook of both countries, which attracts a lot of market attention.

When trading USD/JPY, we recommend checking the schedule of economic indicators and important statements in advance. The economic indicators that are highly related to USD/JPY are as follows:

US economic indicators closely related to the dollar/yen

-

US employment statistics

-

ADP Employment Statistics

-

FOMC Statement/Minutes

-

Philadelphia Funds Rate

-

Gross Domestic Product (GDP)

-

ISM Manufacturing Business Index

-

trade balance

-

Consumer Price Index (CPI)

-

retail sales

-

personal consumption expenditure (PCE)

-

Consumer Confidence Index

-

Industrial Production Index

-

Number of housing starts

-

Number of used homes sold

Japanese economic indicators highly related to the dollar/yen

-

National Consumer Price Index

-

Domestic Corporate Goods Price Index

-

Gross Domestic Product (GDP)

-

Business Enterprise Statistics Survey

-

Economic activity index

-

Bank of Japan Tankan

-

Lending Trends

-

current account balance

-

The dollar-yen exchange rate may fluctuate significantly due to social, military, and geopolitical factors not only in the United States and Japan but also in other countries.

-

In addition to scheduled economic indicators and statements by important people, the market may fluctuate significantly due to unexpected events.

Stocks correlated with the dollar/yen

The US Dollar/Japanese Yen (USDJPY) can be traded by taking advantage of its correlation with gold. The US Dollar is said to have an inverse correlation with gold . Gold, a physical asset, is one of the financial products that is often purchased in risk-averse markets as a safe asset that does not lose its value. Also known as “emergency gold,” when financial risk increases, funds sold from foreign currencies and stocks tend to flow into gold. Therefore, an inverse correlation is often observed , where gold rises in prices when the US Dollar is easily sold, and falls in prices when the US Dollar is easily bought . XM also offers gold CFDs. You can analyze gold price movements as an indicator when trading the US Dollar/Japanese Yen (USDJPY) and trade gold depending on the market environment.

Be careful when trading USD/JPY and gold at the same time

Please note that holding XMTrading’s USDJPY and gold (XAUUSD) simultaneously across multiple accounts may constitute prohibited conduct by XM. XM only permits hedging (a trading method in which both short and long positions of the same security are held simultaneously) within the same account, but prohibits hedging across multiple accounts, including those with other companies, or across multiple names. Although USDJPY and gold (XAUUSD) are not the same security, they are inversely correlated currencies, and therefore constitute prohibited conduct as “hedging across multiple accounts with the aim of avoiding the risk of a specific currency.” If you hold USDJPY and gold simultaneously, please be careful not to unintentionally engage in prohibited trading.

XMTrading offers excellent trading conditions to help you achieve the best performance in FX trading of the US Dollar/Japanese Yen (USDJPY), one of the most popular symbols among Japanese traders. Trading conditions vary depending on the account type you use, so please choose a trading account that suits your trading style.

XM USD/JPY trading hours

At XM, you can trade FX currency pairs, including the US Dollar/Japanese Yen (USDJPY), 24 hours a day, weekdays (from early Monday morning to early Saturday morning) . XM’s trading hours are divided into two time zones: “summer time” and “winter time.” Daylight saving time is a system in which standard time is advanced by one hour during the summer season when the daylight hours are long. XM switches between summer time and winter time on the last Sunday of March and October, and accordingly, the trading hours for the US Dollar/Japanese Yen will change as follows:

XM USDJPY trading hours (Japan time)

| Daylight Saving Time : Last Sunday in March to Last Sunday in October |

Winter time: Last Sunday in October to last Sunday in March |

|

Monday 06:05 – Saturday 05:50

|

Monday 07:05 – Saturday 06:50

|

| XM Daylight Saving Time |

|

From the last Sunday in March to the last Sunday in October

Monday 06:05 – Saturday 05:50

|

| XM winter time |

|

From the last Sunday in October to the last Sunday in March

Monday 07:05 – Saturday 06:50

|

At XM, you can enjoy USD/JPY trading even on Japanese national holidays, including long weekends like Golden Week and Obon. However, please note that trading hours are shortened or unavailable on international holidays such as Christmas and New Year’s. Information about summer/winter time changes, changes in trading hours, and closing days will be sent in advance to the email address registered with XM. Information will also be provided via ” Site Announcements ,” so please check as appropriate.

MT4/MT5 server time and Japan time

The time displayed on MT4/MT5 is the standard time in Cyprus, where XM’s headquarters are located. Cyprus’ GMT (Greenwich Mean Time: the global standard time) is GMT+3 (GMT+2 during winter time), which is 3 or 2 hours ahead of GMT. Japan is GMT+9, which is 9 hours ahead of GMT, so you can convert to Japan time by adding the 6-hour time difference between Japan and Cyprus (7 hours during winter time) to the time displayed on MT4/MT5.

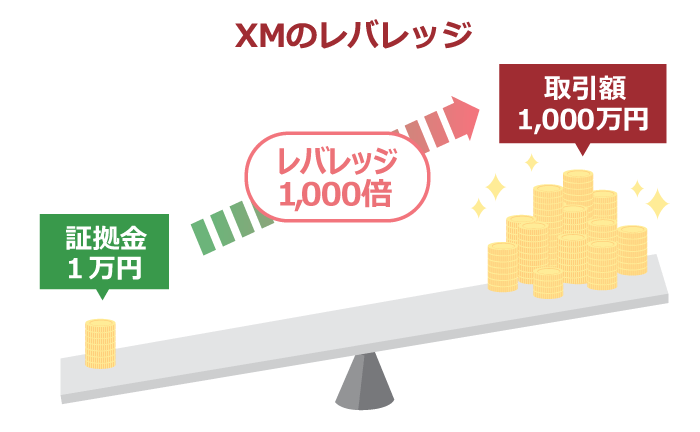

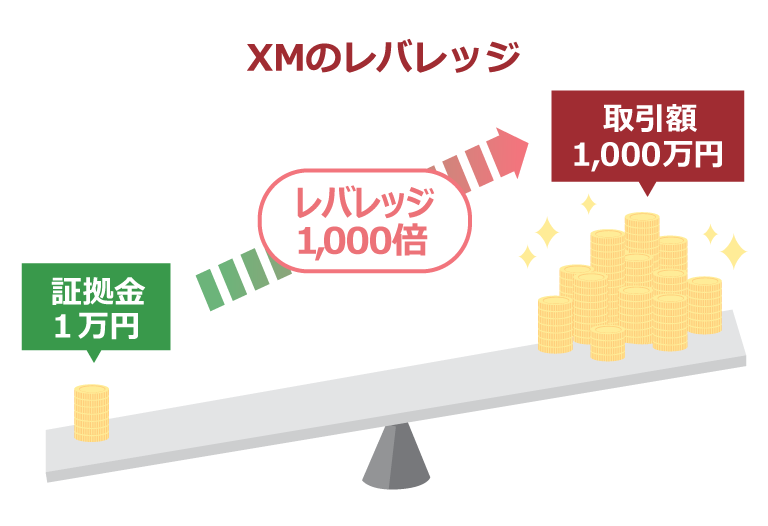

XM USD/JPY Maximum Leverage

At XMTrading, you can trade the US Dollar/Japanese Yen (USDJPY) with high leverage of up to 1,000x . While domestic FX brokers are limited to a maximum leverage of 25x due to regulations, overseas FX brokers allow you to trade with even higher leverage. XM, in particular, offers the highest leverage in the industry at 1,000x, allowing you to trade with a small amount of capital.

XM’s maximum USD/JPY leverage varies by account type as follows. Please note that for Zero accounts only, the maximum USD/JPY leverage is 500x.

XM USD/JPY Maximum Leverage (by account type)

| Account Type | Maximum Leverage |

| Standard Account | 1,000 times |

| Micro Account | |

| KIWAMI polar account | |

| Zero Account | 500 times |

High leverage trading allows you to aim for large profits with a small margin, but you should understand that there is also a risk of incurring large losses in a short period of time if the market moves in an unexpected direction. XM employs a “zero cut system,” meaning that even if you incur losses that exceed your margin, you will not be required to deposit additional margin (margin call). You will not incur losses that exceed the amount of your deposit, so you can enjoy high leverage trading of the USD/JPY with peace of mind in a comfortable and secure trading environment.

What is the zero cut system?

The ” zero-cut system ” is a system that resets a negative balance to “zero” if losses exceed the margin. At XM, if the margin maintenance rate falls below 20%, a loss cut (forced liquidation) is automatically executed to prevent losses from expanding. However, there are cases where a sudden market fluctuation prevents the loss cut and the account balance becomes negative. When the zero-cut system is not applied, such as in domestic FX, a margin call (additional margin) must be deposited, but XM does not charge a margin call. If you have a bonus in your account, we will use the bonus to cover losses, and then fully cover the negative balance when you make an additional deposit. The account balance will be reset to zero and the deposit amount will be reflected, so the negative balance will not be covered by your own funds.

XM USD/JPY Margin Requirements

The margin requirement for XMTrading’s US Dollar/Japanese Yen (USDJPY) varies depending on the trading volume, applied leverage, and the exchange rate at the time of the transaction. Margin requirement refers to the minimum amount of funds required to trade. The higher the leverage, the lower the margin requirement, allowing you to start trading with less capital. The method for calculating margin requirement is as follows:

Margin calculation formula

“Trading volume” x “Current price”

÷ “Leverage” = “Required margin”

For example, if the trading volume is 1 lot (= 100,000 units), the current price is 135 yen/dollar, and the leverage is 1,000 times, the margin required for USD/JPY trading is calculated as follows:

100,000 × 135 ÷ 1,000 = 13,500 yen

Furthermore, by reducing your trading volume, you can trade USD/JPY with less capital. XM allows trading from a minimum of 0.01 lot (= 1,000 units), and for Micro accounts (MT4), you can trade from 0.01 lot (= 10 units), so you can adjust your trading volume according to your needs.

The required margin can be calculated using XM’s margin calculator. Simply enter some basic information and the calculation will be performed automatically, so please make use of it.

XM USD/JPY Spread

XM’s USDJPY spreads can be traded with one of the lowest spreads in the industry, starting from 0 pips. XM uses a variable spread system that allows spreads to shrink or expand depending on market conditions, and spreads are constantly fluctuating. XM’s USDJPY spreads vary depending on account type as follows:

XM USD/JPY spreads (by account type)

| Account Type | Standard Account Micro Account |

KIWAMI polar account | Zero Account |

| Minimum Spread | 1.8 pips | 0.7 pips | 0.0 pips |

| Average Spread | 2.5 pips | 1.2 pips | 0.2 pips |

| Transaction fees | free | free | One way $5/lot |

| Standard Account Micro Account |

|

| Minimum Spread | 1.8 pips |

| Average Spread | 2.5 pips |

| Transaction fees | free |

| KIWAMI polar account | |

| Minimum Spread | 0.7 pips |

| Average Spread | 1.2 pips |

| Transaction fees | free |

| Zero Account | |

| Minimum Spread | 0.0 pips |

| Average Spread | 0.2 pips |

| Transaction fees | One way $5/lot |

-

Spreads fluctuate daily, so please check the latest figures when trading.

The Zero Account offers a minimum spread of 0 pips for USD/JPY, but there is a one-way transaction fee of $5 per lot, so when comparing total costs, the KIWAMI Kyoku Account offers the lowest cost trading. Additionally, while the Standard Account/Micro Account has slightly wider spreads than the KIWAMI Kyoku Account/Zero Account, you can effectively reduce the spread by taking advantage of deposit bonuses and XM Points (XMP) . You can also use multiple account types to suit your trading style, so make the most of XM’s services.

XM USD/JPY Swap Points

XM’s USDJPY swap points are applied to all three account types: Micro, Standard, and Zero. Due to the interest rate differential between Japan and the US, long positions in USDJPY currently result in a positive swap, while short positions result in a negative swap. Please note that if you trade USDJPY hedges with XM, your total swap points will be negative.

XM USD/JPY Swap Points

| Long (Buy) Swap Points |

3.52 | 3.52 | 0 | 3.52 |

| Short (selling) swap points |

-28.58 | -28.58 | 0 | -28.58 |

| Standard Account | |

| Long (Buy) | 3.52 |

| Short (sell) | -28.58 |

| Micro Account | |

| Long (Buy) | 3.52 |

| Short (sell) | -28.58 |

| KIWAMI polar account | |

| Long (Buy) | 0 |

| Short (sell) | 0 |

| Zero Account | |

| Long (Buy) | 3.52 |

| Short (sell) | -28.58 |

Swap points fluctuate, so please check the latest figures when trading.

XM’s USD/JPY swap points fluctuate depending on US/Japanese interest rates and market trends. If you are trading with a strategy that is affected by swap points, please be sure to check the swap points before opening a position and make sure there are no fluctuations while you are holding the position.

Click here for the latest swap points for XM USD/JPY

-

With the KIWAMI Kiwami Account, you can trade USD/JPY swap-free. However, restrictions may be applied if you violate the terms of use.

XM USD/JPY 1 lot currency amount

The currency amount of 1 lot of USDJPY at XMTrading is 100,000 units. Only micro accounts, which are characterized by small-volume trading, have a currency amount of 1,000 units per lot. At XM, all account types allow you to trade from small lots with a minimum of 0.01 lots (0.1 lots only for MT5 micro accounts).

XM’s currency amount per lot and minimum order quantity (by account type)

| Micro Account | 1,000 currencies | MT4: 0.01 lot (10 currencies) MT5: 0.1 lot (100 currencies) |

| Standard Account | 100,000 currency | 0.01 lot (1,000 units) |

| KIWAMI polar account | ||

| Zero Account |

| Amount of currency per lot | |

| Micro | 1,000 currencies |

| Standard | 100,000 currency |

| KIWAMI pole | |

| zero | |

| Minimum Order Quantity | |

| Micro | MT4: 0.01 lot (10 currencies) MT5: 0.1 lot (100 currencies) |

| Standard | 0.01 lot (1,000 units) |

| KIWAMI pole | |

| zero | |

For Standard/KIWAMI Goku/Zero accounts, 1 lot = 100,000 units, so the minimum order size is 0.01 lot = 1,000 units. If you apply 1,000x leverage when the USD/JPY exchange rate is 130 yen, you can trade USD/JPY with margin of approximately 130 yen. For Micro accounts, the minimum order size is even smaller, at 0.01 lot = 10 units for MT4 and 0.1 lot = 100 units for MT5. If you apply 1,000x leverage when the USD/JPY exchange rate is 130 yen, with 0.01 lot = 10 units, you can trade USD/JPY with XM with a small amount of approximately 1.3 yen.

If you want to maximize your performance in USD/JPY trading with XMTrading , we recommend the KIWAMI Kiwami Account . The highly liquid USD/JPY has relatively stable price movements, but tends to form strong trends during periods of active trading, making it a currency pair that allows you to target profits using a variety of trading strategies. You can enjoy USD/JPY trading using a variety of trading methods, such as swing trading in long-term trending markets, and scalping and day trading in short-term trending markets or range-bound markets.

XM offers four different account types with different features to accommodate a variety of trading styles, and all account types allow you to trade USD/JPY. While it is possible to use multiple accounts for different trading strategies, the KIWAMI Kiwami Account allows you to accommodate a variety of trading styles while thoroughly reducing costs with a single account offering low spreads, no trading fees, and no swaps .

KIWAMI Goku Account allows you to trade USD/JPY at the lowest cost

XMTrading’s KIWAMI Kyoku Account offers ultra-small spreads, no trading fees, and no swaps, cutting trading costs to the limit. The spreads charged for each trade are reduced to an average of 0.7 pips, and no trading fees are charged, minimizing costs. The KIWAMI Kyoku Account is especially recommended for scalping traders who make multiple trades in a short period of time to accumulate small profits.

XM USD/JPY Actual Costs (by Account Type)

| Account Type | KIWAMI polar account | Zero Account | Micro Account Standard Account |

| Minimum spread (Note: 1) | 0.7 pips | 0.0 pips | 1.8 pips |

| Average spread (Note: 1) | 1.2 pips | 0.2 pips | 2.5 pips |

| Transaction fees | free | Round trip: $10/lot | free |

| Real average cost | 1.2 pips | pips | 2.5 pips |

| Swap Points | None (swap-free) (Note: 2) |

can be | can be |

| KIWAMI polar account | |

| Minimum spread (Note: 1) | 0.7 pips |

| Average spread (Note: 1) | 1.2 pips |

| Transaction fees | free |

| Real average cost | 1.2 pips |

| Swap Points | None (swap-free) (Note: 2) |

| Zero Account | |

| Minimum spread (Note: 1) | 0.0 pips |

| Average spread (Note: 1) | pips |

| Transaction fees | Round trip: $10/lot |

| Real average cost | 3.52 pips |

| Swap Points | can be |

| Micro Account Standard Account |

|

| Minimum spread (Note: 1) | 1.8 pips |

| Average spread (Note: 1) | 2.5 pips |

| Transaction fees | free |

| Real average cost | 2.5 pips |

| Swap Points | can be |

-

Spreads fluctuate, so please check the latest figures when trading.

-

Restrictions may be applied if you violate the terms of use.

XMTrading offers an environment where traders can trade the popular US Dollar/Japanese Yen (USDJPY) under favorable conditions. Please note the following points in advance to ensure you achieve the best performance in the optimal environment for USD/JPY trading.

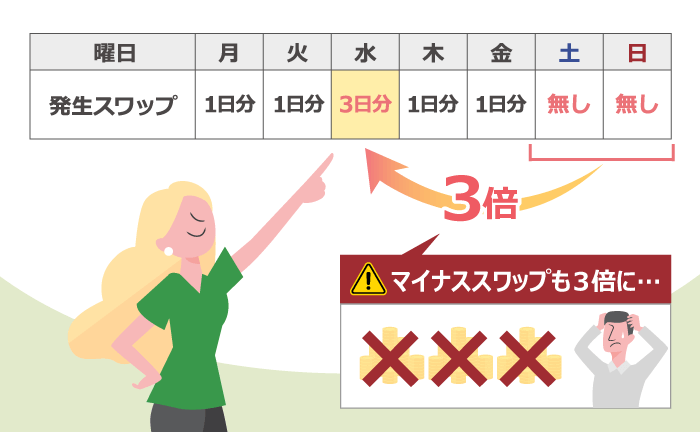

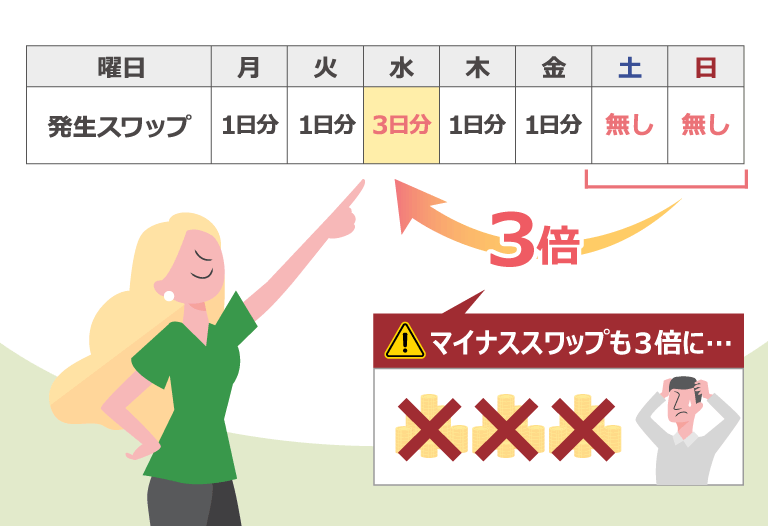

Swap points are tripled on Wednesdays

Please note that XMTrading triples swap points only on Wednesdays . This is because the swap points that occur on Saturdays and Sundays, when trading hours are closed, are added to the swap points on Wednesdays. If you hold a position at the time of the rollover on Wednesday, you will receive swap points for three days.

When entering a short (selling) position for USD/JPY, the swap tends to be negative. Also, if you hold a position in both directions through a hedged trade, the total swap points will be negative. Please note that in this case, the loss due to swap points will also be tripled.

Click here for the timing when XM swap points are awarded.

Leverage Limits by Equity Balance

Please note that XM has a leverage limit based on the account’s equity balance . XM allows you to trade USDJPY with a maximum leverage of 1,000x (500x for zero accounts). However, please note that if your account’s equity balance (margin + bonus + open position profit/loss) exceeds a certain value, the maximum leverage will be limited to 500x, 200x, or 100x as follows:

XM Leverage Limits by Equity Balance

| Equity Balance | Maximum Leverage | |

| Standard/Micro/KIWAMI Extreme | zero | |

| $5 to $40,000 | 1,000 times | 500 times |

| $40,001 to $80,000 | 500 times | |

| $80,001 to $200,000 | 200 times | 200 times |

| Over $200,001 | 100 times | 100 times |

Maximum leverage from $5 to $40,000 |

|

| Standard Micro KIWAMI pole |

1,000 times |

| zero | 500 times |

Maximum leverage from $40,001 to $80,000 |

|

| Standard Micro KIWAMI pole |

500 times |

| zero | 500 times |

Maximum leverage from $80,001 to $200,000 |

|

| Standard Micro KIWAMI pole |

200 times |

| zero | 200 times |

Maximum leverage of $200,001 or more |

|

| Standard Micro KIWAMI pole |

100 times |

| zero | 100 times |

For more information on XM’s equity leverage limits, click here

Hedging multiple accounts is prohibited

Please note that XM prohibits hedging across multiple accounts . While XM allows up to eight accounts per account, cross-account hedging is prohibited. For example, accidentally holding a short position and a long position in USD/JPY in different accounts is also prohibited. Due to its correlation with popular currencies such as EUR/USD, GBP/USD, and gold, USD/JPY is a currency pair that is often subject to hedging aimed at avoiding the risk of a specific currency. Therefore, please exercise caution when trading multiple accounts simultaneously. XM only permits hedging within the same account, so if you wish to use USD/JPY hedging as a trading method, please do so within the same XM account.

For details on prohibited items in XM’s hedging transactions, click here

USD/JPY trading is possible using EA (automated trading)

XM allows you to trade USDJPY using EAs (automated trading). EAs are software with built-in buy/sell timing logic that you install on MT4/MT5. The EA constantly monitors the market and automatically trades. All account types at XM allow you to trade using EAs. USDJPY is a currency with trading opportunities throughout the day. EAs can also be used in conjunction with discretionary trading, allowing you to use them according to your trading style.

-

If you use separate accounts for EA and discretionary trading, or if you run EAs with different logic on multiple accounts, please be careful not to engage in hedging between multiple accounts, which is a prohibited act.

Time periods when the dollar-yen spread tends to widen

At XMTrading, we strive to provide our customers with stable, low spreads on the USD/JPY. However, there are times when spreads tend to widen , such as early morning Japan time when liquidity is low, and around the time of the release of important economic indicators, when the market is likely to move significantly . In unstable markets where spreads tend to widen, there is a risk of incurring large unrealized losses at the time of entry, depending on the timing. By avoiding times when USD/JPY spreads tend to widen and trading in a stable spread environment, you can minimize the risk of a stop loss. The main times when USD/JPY spreads tend to widen are as follows:

XM USD/JPY spreads tend to widen during these times

-

Around 4am to 8am Japan time

-

Friday after 26:00

-

Before and after the release of important economic indicators and statements by important figures

-

When a sudden event occurs

-

What is XM’s average spread for USDJPY (dollar-yen)?

XM’s average spreads for the US Dollar/Japanese Yen (USD/JPY) are 1.6 pips for Standard Micro accounts, 0.7 pips for KIWAMI Kyoku accounts, and 0.1 pips for Zero accounts. However, Zero accounts incur trading fees, making the effective spread 1.1 pips, so KIWAMI Kyoku accounts offer the lowest spreads.

read more

2023.04.10

-

What is the amount of currency per lot of USDJPY (US Dollar/Japanese Yen) at XM?

The currency amount for 1 lot of XM’s USDJPY (dollar yen) is 100,000 units. However, only for Micro accounts, the currency amount for 1 lot is set as small as 1,000 units. Furthermore, Standard, KIWAMI, and Zero accounts can also order from a minimum of 0.01 lots (1,000 units).

read more

2023.04.10

-

How much margin is required per lot of USDJPY (US Dollar/Japanese Yen) at XM?

The required margin per XM USDJPY (US Dollar/Japanese Yen) lot can be calculated by “1 lot (number of lots) x opening price / leverage”. The higher the leverage and the smaller the trading volume (number of lots), the lower the required margin will be, allowing you to trade with less capital.

read more

2023.04.10

-

What are XM’s USDJPY (dollar-yen) trading hours?

XM’s USDJPY (dollar-yen) trading hours are Monday 6:05 AM to Saturday 5:50 AM Japan time during summer time, and Monday 7:05 AM to Saturday 6:50 AM during winter time. USDJPY is a popular FX currency pair with high trading volume, making it recommended for all traders, from FX beginners to advanced traders.

read more

2023.04.10

-

Please tell me about swap points for XM USDJPY (dollar-yen) trading.

XM’s swap points for USDJPY (dollar yen) are positive for long positions and negative for short positions. However, please note that in the case of long and short trades, the total swap will be negative. Swap points can be confirmed in the “Specifications” of MT4/MT5 or in the “XM FX Calculator.”

read more

2023.04.10