XM trading symbols

XM trading symbols

XMTrading offers high-leverage trading on a wide range of attractive CFD products, including FX currency pairs popular with Japanese traders, as well as precious metals, stocks (MT5 only), stock indices, energy, commodities, thematic indices, and cryptocurrencies. No special procedures are required—you can trade all instruments through a single account using the same platform (MT4/MT5), making it easy to manage your funds efficiently and explore different trading styles.

![]()

You can trade a wide range of CFD products, including FX, with high leverage.

Total Number of Trading Symbols Available at XM

With XM, you can trade a total of 1,488 products using a single trading account, including FX currency pairs, precious metals, stocks, stock indices, energy, commodities, thematic indices, and cryptocurrency CFDs. Note that thematic indices are not available on Micro accounts, and both thematic indices and cryptocurrencies are unavailable on Zero accounts. All other products can be traded across all XM account types, including Standard, Micro, KIWAMI, and Zero accounts.

Number of trading symbols at XM

| Trading Instruments | Number of stocks | Examples of trading instruments |

|---|---|---|

| FX Currency Pairs | 55 brands | USD/JPY, EUR/USD, GBP/JPY, etc. |

| Precious metal CFD | 7 brands | Gold, silver, palladium, platinum, etc. |

| Share CFDs | 1,313 brands | Apple (AAPL.OQ), Amazon (AMZN.OQ), Microsoft (MSFT.OQ), etc. |

| Stock Index CFDs | 31 brands | Nikkei Average, Dow Jones Industrial Average, S&P 500, DAX, etc. |

| Energy CFD | 8 brands | Crude oil, natural gas, etc. |

| Commodity CFDs | 8 brands | Sugar, soybeans, coffee, wheat, etc. |

| Thematic Index CFDs | 8 brands | AI Index, China Internet, FAANG’s 10, etc. |

| Cryptocurrency CFDs | 58 brands | Bitcoin, Ethereum, Ripple, etc. |

| FX Currency Pairs | |

| Number of stocks | 55 brands |

| Examples of trading instruments | USD/JPY, EUR/USD, GBP/JPY, etc. |

| Precious metal CFD | |

| Number of stocks | 7 brands |

| Examples of trading instruments | Gold, silver, palladium, platinum, etc. |

| Share CFDs | |

| Number of stocks | 1,313 brands |

| Examples of trading instruments | Apple (AAPL.OQ), Amazon (AMZN.OQ), Microsoft (MSFT.OQ), etc. |

| Stock Index CFDs | |

| Number of stocks | 31 brands |

| Examples of trading instruments | Nikkei Average, Dow Jones Industrial Average, S&P 500, DAX, etc. |

| Energy CFD | |

| Number of stocks | 8 brands |

| Examples of trading instruments | Crude oil, natural gas, etc. |

| Commodity CFDs | |

| Number of stocks | 8 brands |

| Examples of trading instruments | Sugar, soybeans, coffee, wheat, etc. |

| Thematic Index CFDs | |

| Number of stocks | 8 brands |

| Examples of trading instruments | AI Index, China Internet, FAANG’s 10, etc. |

| Cryptocurrency CFDs | |

| Number of stocks | 58銘柄 |

| 取引銘柄の例 | ビットコイン イーサリアム リップルなど |

Additionally, to trade all instruments with an XM real account, you must complete the identity verification process.

-

Stock CFDs and Thematic Index CFDs are available exclusively on MT5.

What is CFD?

Among the products offered by XMTrading, precious metals, stocks, stock indices, energy, commodities, and thematic indices are all CFDs (Contracts for Difference). CFDs are a type of trading long popular in Japan as a ‘contract for difference’ transaction. With a small margin deposit, you can trade agricultural products, industrial materials, precious metals, stocks, energy, stock indices, and more using leverage. Settlement is based on the price difference between the opening and closing of a position—no physical goods (such as grains or crude oil) are exchanged.

You can trade both FX and CFDs using the same trading account and trading platform.

At XM, you can trade a wide range of CFDs—including precious metals, stocks, stock indices, energy, commodities, thematic indices, and cryptocurrencies—using the same account you use for FX trading. This eliminates the need to open a separate account or transfer funds between accounts. All products can be traded with the same platforms (MT4, MT5, and Web Trader), making it easy to explore a variety of trading opportunities. Please note, however, that Stock CFDs and Thematic Index CFDs are only available on MT5 accounts.

Leverage Options for XM Trading Instruments

XMTrading offers a wide range of trading instruments with high leverage of up to 1,000x. Notably, stock index CFDs have a maximum leverage of 500x—higher than many other FX brokers—allowing you to trade with a relatively low margin.

Maximum leverage for XM trading instruments

| Trading Instruments | Maximum Leverage |

| FX currency pairs, gold, silver |

1,000 times |

| Palladium, Platinum |

Approximately 22.2 times |

| Share CFDs | 20 times |

| Stock Index CFDs | 500 times |

| Energy CFD | 200 times |

| Commodity CFDs | 50 times |

| Thematic Index CFDs | 50 times |

| Cryptocurrency CFDs | 500 times |

Please note that there are two types of trading products at XM : those to which the leverage set in the trading account is applied, and those to which individually set leverage is applied. For FX currency pairs and spot metals (gold and silver), the leverage set in each account type, which ranges from 1x to 1,000x, is applied. (For silver, the maximum leverage is limited to 400x, regardless of account type.) For other CFD products, the required margin rate (leverage) for each product is applied, regardless of the leverage set in the trading account or the maximum leverage for each account type.

Leverage Settings for XM Trading Instruments

| Trading Instruments | Leverage |

| FX currency pairs, gold, silver |

Trading account setting leverage: 1x to 1,000x (zero account: 1x to 500x) |

| Other CFD products (*) | Fixed leverage is applied to each stock. |

| FX通貨ペア、ゴールド、シルバー |

取引口座の設定レバレッジ 1倍~1,000倍

(ゼロ口座は1倍~500倍) |

|---|---|

| その他CFD商品(*) |

各銘柄ごとに固定レバレッジが適用される

|

Palladium, Platinum, Stocks, Stock Indices, Energy, Commodities, Thematic Indices, Cryptocurrencies

Click here for details on leverage for each stock

-

For XMTrading’s FX currency pairs, gold, and silver, the maximum leverage decreases as your account balance grows: it is limited to 500× if your margin balance exceeds $40,000 (or equivalent), 200× if it exceeds $80,000 (or equivalent), and 100× if it exceeds $200,000 (or equivalent).

-

For certain FX currency pairs, the maximum leverage is fixed between 50× and 400×, regardless of your account balance.

-

The maximum leverage for silver is capped at 400×.

XM Trading Instruments: Swap and Settlement Dates

XMTrading’s trading products are categorized into two types based on swaps and settlement dates. Futures CFDs do not accrue swaps but have settlement dates, whereas all other products have swaps but no settlement dates. .

Swap and settlement date for XM trading products

| Trading Instruments | swap | Payment due date |

| Futures CFD products (Note: 1) | none | can be |

| Other products (Note: 2) | can be | none |

| 先物CFD商品(注:1) | |

| スワップ | なし |

| 決済期日 | あり |

| その他の商品(注:2) | |

| スワップ | あり |

| 決済期日 | なし |

-

Precious Metals CFD Futures, Energy CFD Futures, Stock Index CFD Futures, Commodity CFD

-

Forex, Spot Metals, Stocks, Spot Stock Index CFDs, Spot Energy CFDs, Thematic Index CFDs, Cryptocurrency CFDs

For futures CFDs, any positions still open at the settlement date will be forcibly closed. Please note that these positions will not be automatically rolled over to the next contract month.

Zero-Cut System Minimizes Risk

All trading instruments on XMTrading are covered by a zero-cut system with no margin calls, ensuring the protection of customer funds. This means that even during unexpected market fluctuations, traders cannot lose more than their account balance, allowing for peace of mind while trading. Margin calls are triggered when the margin maintenance level falls below 50%, and stop-outs occur when it falls below 20%.

In addition, XM offers a 15,000 JPY account opening bonus (trading bonus) to new account holders. This bonus allows you to trade XM’s wide range of instruments without any risk and without making a deposit. To open a real account with XM, please apply here.

XMTrading offers a total of 1,433 CFD products, including 55 FX currency pairs, precious metals, stocks, stock indices, energies, commodities, thematic indices, and cryptocurrencies. Each product has its own trading conditions, so please review the details carefully before trading. Trading hours also vary by product; for more information, please refer to the link below.

XMTrading offers 55 currency pairs, including those most popular among FX traders. These pairs are classified into three categories based on liquidity and trading volume: major, minor, and exotic.

For major, minor, and exotic currency pairs, certain pairs are subject to restrictions on maximum leverage and trading hours. In addition, trading conditions such as the minimum and maximum trade sizes for each account type apply to all FX transactions, and swaps specific to each currency pair are charged on positions held overnight.

-

XMTrading’s maximum leverage is capped at 400× for currency pairs involving the CHF (Swiss Franc), 100× for pairs involving the TRY (Turkish Lira), and 50× for pairs involving the DKK (Danish Krone), HKD (Hong Kong Dollar), and CNH (Chinese Yuan). These limits apply to all account types.

-

In a Micro Account, 1 lot is equal to 1/100 of the standard contract size.

Major Currency Pairs

At XM, major currency pairs are those composed of the most widely traded currencies in the global foreign exchange market. These include six major currencies: the US dollar, euro, Japanese yen, British pound, Swiss franc, and Canadian dollar. Major pairs also cover key cross-yen combinations such as USD/JPY, EUR/JPY, and GBP/JPY.

XM Major Currency Pairs – Maximum Leverage by Instrument

| Currency Pairs | Standard/Micro/ KIWAMI Account |

Zero Account |

| CADCHF (Canadian dollar/Swiss franc) |

400 times | 400 times |

| CADJPY (Canadian dollar/Japanese yen) |

1,000 times | 500 times |

| CHFJPY (Swiss Franc/Japanese Yen) |

400 times | 400 times |

| CADCHF | |

| スタンダード マイクロ口座 KIWAMI極口座 |

400倍 |

| ゼロ口座 | 400倍 |

| CADJPY | |

| スタンダード マイクロ口座 KIWAMI極口座 |

1,000倍 |

| ゼロ口座 | 500倍 |

| CHFJPY | |

| スタンダード マイクロ口座 KIWAMI極口座 |

400倍 |

| ゼロ口座 | 400倍 |

Symbols vary by account type

At XMTrading, the symbol notation for each instrument varies by account type. In Micro accounts, “micro” is added after the symbol; in KIWAMI accounts, a “#” is added; and in Zero accounts, a “.” (dot) is added. For example, the USD/JPY symbol appears as USDJPY for Standard accounts, USDJPYmicro for Micro accounts, USDJPY# for KIWAMI accounts, and USDJPY. for Zero accounts.

Minor currency pairs

XM’s minor currency pairs consist of the Australian dollar (AUD) and New Zealand dollar (NZD) paired with major currencies. Popular cross-yen pairs among domestic traders, such as AUD/JPY and NZD/JPY, are also included in this category.

XM Minor Currency Pairs – Maximum Leverage by Product

| Currency Pairs | Standard/Micro/ KIWAMI Account |

Zero Account |

| AUDCAD (Australian dollar/Canadian dollar) |

1,000 times | 500 times |

| AUDCHF (Australian dollar/Swiss franc) |

400 times | 400 times |

| AUDJPY (Australian dollar/Japanese yen) |

1,000 times | 500 times |

| AUDCAD | |

| スタンダード マイクロ口座 KIWAMI極口座 |

1,000倍 |

| ゼロ口座 | 500倍 |

| AUDCHF | |

| スタンダード マイクロ口座 KIWAMI極口座 |

400倍 |

| ゼロ口座 | 400倍 |

| AUDJPY | |

| スタンダード マイクロ口座 KIWAMI極口座 |

1,000倍 |

| ゼロ口座 | 500倍 |

Exotic Currency Pairs

XM’s exotic currency pairs consist of a major currency paired with a currency that has low trading volume in the market. These pairs typically have low liquidity and limited price movement, but they can experience sudden and significant volatility during unexpected market events.

XM Exotic Currency Pairs – Maximum Leverage by Instrument

| Currency Pairs | Standard/Micro/ KIWAMI Account |

Zero Account |

| CHFSGD (Swiss franc/Singapore dollar) |

400 times | 400 times |

| EURDKK (Euro/Danish Krone) |

50 times | 50 times |

| EURHKD (European Euro/Hong Kong Dollar) |

50 times | 50 times |

| CHFSGD | |

| スタンダード マイクロ口座 KIWAMI極口座 |

400倍 |

| ゼロ口座 | 400倍 |

| EURDKK | |

| スタンダード マイクロ口座 KIWAMI極口座 |

50倍 |

| ゼロ口座 | 50倍 |

| EURHKD | |

| スタンダード マイクロ口座 KIWAMI極口座 |

50倍 |

| ゼロ口座 | 50倍 |

XM FX currency pair trading hours

XM offers seven precious metals CFDs, available in two types: spot trading and futures trading. Gold (GOLD), silver (SILVER), and gold/euro (XAUEUR), popular among Japanese traders, are classified as “spot metals” and can be traded as spot products. Palladium (XPDUSD) and platinum (XPTUSD), previously listed as futures products, are now also available for spot trading at XM. Palladium (PALL) and platinum (PLAT), categorized as “precious metals futures CFDs,” continue to be traded as futures products. Please note that different trading rules apply to spot and futures trading.

What are spot trading and futures trading?

In financial markets, transactions settled within two business days from the trade date are called “spot transactions,” while those settled three business days or more after the trade date are referred to as “futures transactions.”

Spot Metal

Leverage and trading rules specific to each account type apply to spot metals such as gold (GOLD), silver (SILVER), gold/euro (XAUEUR), XPDUSD (palladium), and XPTUSD (platinum). The maximum leverage for silver is capped at 400×. Currently, for held positions in spot metal products, long positions incur negative swaps while short positions earn positive swaps. (KIWAMI accounts are swap-free for both long and short positions.)

XM Spot Metals List

| Currency Pairs | Maximum Leverage | Trading volume of 1 lot | Min/Max Trade Size | ||

| Standard Micro KIWAMI pole |

zero | Standard KIWAMI Extreme Zero |

Micro | ||

| GOLD | 1,000 times | 500 times | 100 oz | 1 oz | 0.01/50 |

| SILVER | 400 times | 400 times | 5,000 oz | 50 oz | 0.01/50 |

| XAUEUR (Gold/Euro) |

1,000 times | 500 times | 100 oz | 1 oz | 0.01/50 |

| XPDUSD (Palladium/US Dollar) |

100 times | 100 times | 10 oz | 1 oz | 0.1/30 |

| XPTUSD (Platinum/US Dollar) |

200 times | 200 times | 10 oz | 1 oz | 0.1/30 |

GOLD

| 最大レバレッジ | |

| スタンダード KIWAMI極 ゼロ |

1,000倍 |

| ゼロ | 500倍 |

| 1ロットの取引量 | |

| スタンダード KIWAMI極 ゼロ |

100 oz |

| マイクロ | 1 oz |

| 最小/最大取引サイズ | |

| 0.01/50 | |

SILVER

| 最大レバレッジ | |

| スタンダード KIWAMI極 ゼロ |

400倍 |

| ゼロ | 400倍 |

| 1ロットの取引量 | |

| スタンダード KIWAMI極 ゼロ |

5,000o z |

| マイクロ | 50 oz |

| 最小/最大取引サイズ | |

| 0.01/50 | |

XAUEUR

| 最大レバレッジ | |

| スタンダード KIWAMI極 ゼロ |

1,000倍 |

| ゼロ | 500倍 |

| 1ロットの取引量 | |

| スタンダード KIWAMI極 ゼロ |

100 oz |

| マイクロ | 1 oz |

| 最小/最大取引サイズ | |

| 0.01/50 | |

XPDUSD

| 最大レバレッジ | |

| スタンダード KIWAMI極 ゼロ |

100倍 |

| ゼロ | 100倍 |

| 1ロットの取引量 | |

| スタンダード KIWAMI極 ゼロ |

10 oz |

| マイクロ | 1 oz |

| 最小/最大取引サイズ | |

| 0.1/30 | |

XPTUSD

| 最大レバレッジ | |

| スタンダード KIWAMI極 ゼロ |

200倍 |

| ゼロ | 200倍 |

| 1ロットの取引量 | |

| スタンダード KIWAMI極 ゼロ |

10 oz |

| マイクロ | 1 oz |

| 最小/最大取引サイズ | |

| 0.1/30 | |

What is a troy ounce (oz)?

The price of precious metals is quoted in US dollars per troy ounce (oz). A troy ounce is a unit of weight used for precious metals, equivalent to approximately 31.1 grams. For example, if the price of gold is 1,800 USD per oz and the exchange rate is 110 JPY per USD, then 1 oz of gold equals 1,800 USD, or 198,000 JPY. The price per gram of gold would therefore be 198,000 JPY ÷ 31.1, which is approximately 6,367 JPY.

Precious Metals CFDs (Futures)

The same trading rules apply to precious metals futures CFDs on palladium (PALL) and platinum (PLAT), regardless of account type or leverage setting. Since futures CFD trading does not incur swaps, positions can be held without concern for overnight carry costs. However, positions are forcibly closed on the settlement date for each product, so trading should account for the rollover to the next contract month. The effective leverage for precious metals futures CFDs (palladium and platinum) is approximately 22.2×, based on a required margin rate of 4.5%.

XM Precious Metals CFD (Futures) List

| Brand | Required margin rate (effective leverage) |

Trading volume of 1 lot | Min/Max Trade Size |

| PALL (Palladium) | 4.5% (approximately 22.2 times) |

10 oz | 1/45 |

| PLAT (Platinum) | 4.5% (approximately 22.2 times) |

10 oz | 1/100 |

| PALL(パラジウム) | |

| 必要証拠金率 (実質レバレッジ) |

4.5% (約22.2倍) |

| 1ロットの取引量 | 10 oz |

| 最小/最大取引サイズ | 1/45 |

| PLAT(プラチナ) | |

| 必要証拠金率 (実質レバレッジ) |

4.5% (約22.2倍) |

| 1ロットの取引量 | 10 oz |

| 最小/最大取引サイズ | 1/100 |

XM’s palladium and platinum have relatively high daily price movements, averaging 3.5% of the current price. Although the effective leverage is modest at around 22.2×, these metals are popular among traders seeking significant short-term gains. Since holding positions does not incur negative swaps, they are also suitable for medium- to long-term trading, provided settlement dates are taken into account.

Palladium and Platinum

Palladium and platinum are rare metals belonging to the platinum group. In Japan, platinum is known as “shirogane” and is widely used in decorative items alongside gold and silver. Both metals are also in high demand in the automotive industry. As global exhaust gas regulations tighten, palladium is essential for catalysts in gasoline vehicles, while platinum is crucial for catalysts in diesel vehicles. Additionally, demand for these metals in fuel cell vehicle catalysts is expected to rise, which may lead to significant price movements driven by real-world demand.

XM Precious Metals CFD trading hours

XM Stock CFDs

XMTrading’s stock CFDs give you access to shares from 1,313 of the world’s most reputable companies. You can trade a wide range of stocks, from iconic US names like Apple, Microsoft, Amazon, and Google—well known to Japanese investors—to prominent companies from Europe, Asia, and South America, with leverage of up to 20×. Please note that stock CFDs are only available on MT5 accounts.

There are no leverage restrictions based on account type or account equity for stock CFDs traded on XM. Among the 1,313 stock CFDs offered, the leverage for the most popular stocks is as follows:

XM Stock CFD List

| Brand | Lowest spreads | Required margin rate (effective leverage) |

Min/Max Trade Size |

| Alibaba | 0.9 pips | 2% (50 times) |

0.08/54 |

| Amazon | 1.58 pips | 2% (50 times) |

0.06/75 |

| Apple | 1.77 pips | 2% (50 times) |

0.04/52 |

| Alibaba | |

| 最低スプレッド | 0.9 pips |

| 必要証拠金率 (実質レバレッジ) |

5% (20倍) |

| 最小/最大取引サイズ | 0.08/54 |

| Amazon | |

| 最低スプレッド | 1.58 pips |

| 必要証拠金率 (実質レバレッジ) |

5% (20倍) |

| 最小/最大取引サイズ | 0.06/75 |

| Apple | |

| 最低スプレッド | 1.77 pips |

| 必要証拠金率 (実質レバレッジ) |

5% (20倍) |

| 最小/最大取引サイズ | 0.04/52 |

XMTrading offers two types of stock index CFDs: spot and futures. There are 20 spot stock indexes and 11 futures stock indexes available. Stock indexes are composed of the stock prices of major companies listed on each country’s exchange, or representative stocks from specific industries, and serve as indicators of a country’s economic trends.

Stock index CFDs traded on XM are subject to the same trading rules across all products, regardless of account type or leverage setting. The required margin rate, trade size, and stock symbol for each product are consistent across all four account types. However, spot and futures stock index CFDs differ in terms of swaps, settlement dates, and spread widths, as outlined below:

The difference between XM Stock Index CFD Spot and Futures

| Stock Index CFDs (spot) | can be | none | narrow |

| Stock Index CFDs (Futures) | none | can be | Wide |

| 株価指数CFD(現物) | |

| スワップ | あり |

| 決済期日 | なし |

| スプレッド | 狭い |

| 株価指数CFD(先物) | |

| スワップ | なし |

| 決済期日 | あり |

| スプレッド | 広め |

Please note that the stock symbols for spot and futures stock indexes differ. For spot stock indexes (Cash), the expiration month is indicated at the end of the symbol, while for futures stock indexes, the expiration month is shown in the format (e.g., DEC21).

-

Stock index (spot)

-

Stock index (futures)

Stock Index CFDs (spot)

XM offers spot stock index CFDs for 20 indices. Spot trading of these CFDs has no settlement date and features relatively tight spreads, but swaps are applied to positions held overnight. Currently, swaps for futures stock index CFDs are negative for both long and short positions, so for medium- to long-term trades, it is recommended to account for carryover costs.

XM Stock Index CFD (Spot) Stock List

| Brand | Lowest spreads | Required margin rate (effective leverage) |

Min/Max Trade Size MT4 |

Min/Max Trade Size MT5 |

| AUS200Cash (ASX 200) |

1.90 pips | 1% (100 times) |

0.1/12500 | 0.1/220 |

| CA60Cash (Canada 60 Index Cash) |

0.85 pips | 0.4% (250 times) |

– | 0.1/1080 |

| ChinaHCash (Hong Kong China H-shares Index Cash) |

3.90 pips | 0.4% (250 times) |

– | 0.1/550 |

| AUS200Cash | |

| 最低スプレッド | 1.90 pips |

| 必要証拠金率 (実質レバレッジ) |

1% (100倍) |

| 最小/最大取引サイズ MT4 |

0.1/12500 |

| 最小/最大取引サイズ MT5 |

0.1/220 |

| CA60Cash | |

| 最低スプレッド | 0.85 pips |

| 必要証拠金率 (実質レバレッジ) |

0.4% (250倍) |

| 最小/最大取引サイズ MT4 |

– |

| 最小/最大取引サイズ MT5 |

0.1/1080 |

| ChinaHCash | |

| 最低スプレッド | 3.90 pips |

| 必要証拠金率 (実質レバレッジ) |

0.4% (250倍) |

| 最小/最大取引サイズ MT4 |

– |

| 最小/最大取引サイズ MT5 |

0.1/550 |

Spreads are subject to fluctuations, so please check the latest figures before trading.

Stock Index CFDs (Futures)

XM offers futures CFDs on 11 major stock indexes. All stock index futures have a designated settlement date, with holding periods ranging from 1 to 3 months. Please note that positions held until the settlement date will be forcibly closed and will not be automatically rolled over to the next contract month.

Stock index CFD futures trading features wider spreads compared to spot trading. However, because no swaps are charged on held positions, it is suitable for traders aiming for medium-term swing profits while monitoring the settlement date.

XM Stock Index CFD (Futures) List

| Brand | Lowest spreads | Required margin rate (effective leverage) |

Min/Max Trade Size MT4 |

Min/Max Trade Size MT5 |

| EU50 (EURO STOXX 50) |

3.00 pips | 1% (100 times) |

1/12500 | 0.1/280 |

| FRA40 (CAC 40) |

3.50 pips | 1% (100 times) |

1/12500 | 0.1/280 |

| GER40 (DAX) |

3.75 pips | 0.2% (500 times) |

1/12500 | 0.1/230 |

| EU50 | |

| 最低スプレッド | 3.00 pips |

| 必要証拠金率 (実質レバレッジ) |

1% (100倍) |

| 最小/最大取引サイズ MT4 |

1/12500 |

| 最小/最大取引サイズ MT5 |

0.1/280 |

| FRA40 | |

| 最低スプレッド | 3.50 pips |

| 必要証拠金率 (実質レバレッジ) |

1% (100倍) |

| 最小/最大取引サイズ MT4 |

1/12500 |

| 最小/最大取引サイズ MT5 |

0.1/280 |

| GER40 | |

| 最低スプレッド | 3.75 pips |

| 必要証拠金率 (実質レバレッジ) |

0.2% (500倍) |

| 最小/最大取引サイズ MT4 |

1/12500 |

| 最小/最大取引サイズ MT5 |

0.1/230 |

Spreads can fluctuate, so please verify the latest figures before trading.

What is the Dollar Index?

The US Dollar Index measures the value of the US dollar against a basket of major currencies, including the euro, Japanese yen, British pound, Canadian dollar, and Swiss franc. It is calculated by multiple organizations, including the Federal Reserve Board (FRB), major financial institutions, and rating agencies, and serves as an indicator of the overall strength of the US dollar.

In the foreign exchange market, the term “dollar index” usually refers to the ICE Futures US Dollar Index, a futures product listed on ICE Futures US, a derivatives exchange under the Intercontinental Exchange (ICE). The ICE Dollar Index is composed of 57.6% euro, 13.6% Japanese yen, 11.9% British pound, 9.1% Canadian dollar, 4.2% Swedish krona, and 3.6% Swiss franc, and serves as an indicator of the US dollar’s strength in the FX market. At XMTrading, the dollar index can be traded as a stock index CFD futures product under the symbol “USDX.”

XM offers two types of energy CFDs: spot and futures. There are three spot energy products and five futures energy products available. Crude oil trading, in particular, is known for its large price swings over short periods in response to market news, making it popular among traders seeking significant profits through leveraged trading.

Please note that energy futures products have a designated settlement date. Any positions held until the settlement date will be forcibly closed, and they are not automatically rolled over to the next contract month.

The difference between XM Energy CFD Spot and Futures

| Energy CFD (spot) | 200 times | can be | none | narrow |

| Energy CFDs (Futures) | Approximately 66.7 times | none | can be | Wide |

| エネルギーCFD(現物) | |

| 最大レバレッジ | 200倍 |

| スワップ | あり |

| 決済期日 | なし |

| スプレッド | 狭い |

| エネルギーCFD(先物) | |

| 最大レバレッジ | 約66.7倍 |

| スワップ | なし |

| 決済期日 | あり |

| スプレッド | 広め |

Please note that spot and futures energy products use different naming conventions. Spot energy products indicate the expiration month at the end of the name (e.g., “Cash”), while futures energy products include the expiration month in the format (e.g., “JUN23”).

-

Energy (spot)

-

Energy (futures)

Energy CFD (spot)

XM offers spot energy CFDs on three commodities. Spot energy trading has no settlement date and features relatively tight spreads, but swaps are applied to positions held overnight. Trading is available with leverage of up to 200×, providing higher leverage compared to futures energy CFDs.

XM Energy CFD (spot) stock list

| Brand | Required margin rate (effective leverage) |

Trading volume of 1 lot | Min/Max Trade Size |

| BRENTCash | 0.5% (200 times) |

100 Barrels | 0.01/270 |

| NGASCash | 0.5% (200 times) |

1,000 MMBtu | 0.01/370 |

| OILCash | 0.5% (200 times) |

100 Barrels | 0.01/330 |

| BRENTCash | |

| 必要証拠金率 (実質レバレッジ) |

0.5% (200倍) |

| 1ロットの取引量 | 100 Barrels |

| 最小/最大取引サイズ | 0.01/270 |

| NGASCash | |

| 必要証拠金率 (実質レバレッジ) |

0.5% (200倍) |

| 1ロットの取引量 | 1,000 MMBtu |

| 最小/最大取引サイズ | 0.01/370 |

| OILCash | |

| 必要証拠金率 (実質レバレッジ) |

0.5% (200倍) |

| 1ロットの取引量 | 100 Barrels |

| 最小/最大取引サイズ | 0.01/330 |

Energy CFDs (Futures)

XM offers five energy futures CFDs for trading. WTI (West Texas Intermediate) Crude Oil (OIL), traded on the North American market, and North Sea Brent Crude Oil (BRENT), traded on the European market, can both be traded with a required margin rate of 1.5%, providing an effective leverage of approximately 66.7×. WTI Crude Oil Futures Mini (OILMn) has a minimum trade size of 1/10 that of standard WTI Crude Oil, allowing traders to start with smaller capital.

XM Energy CFD (Futures) List

| Brand | Required margin rate (effective leverage) |

Trading volume of 1 lot | Min/Max Trade Size |

| BRENT (Brent Crude Oil) |

1.5% (approximately 66.7 times) |

100 Barrels | 1/280 |

| OIL (WTI Oil) |

1.5% (approximately 66.7 times) |

100 Barrels | 1/280 |

| OILMn (WTI Oil Mini) |

1.5% (approximately 66.7 times) |

10 Barrels | 1/2,800 |

| BRENT | |

| 必要証拠金率 (実質レバレッジ) |

1.5% (約66.7倍) |

| 1ロットの取引量 | 100 Barrels |

| 最小/最大取引サイズ | 1/280 |

| OIL | |

| 必要証拠金率 (実質レバレッジ) |

1.5% (約66.7倍) |

| 1ロットの取引量 | 100 Barrels |

| 最小/最大取引サイズ | 1/280 |

| OILMn | |

| 必要証拠金率 (実質レバレッジ) |

1.5% (約66.7倍) |

| 1ロットの取引量 | 10 Barrels |

| 最小/最大取引サイズ | 1/2,800 |

XMTrading allows you to trade eight major commodity CFDs within the same account used for regular FX trading. Commodity trading is a form of futures trading that involves grains and metals and has long been known in Japan as “commodity futures trading.” Exchanges for commodity futures exist not only in Japan but around the world, where a wide range of agricultural products and industrial materials are actively traded.

The commodity CFDs offered by XM consist of seven agricultural products and one industrial material, all traded on US commodity futures exchanges, with prices quoted in US dollars. XM’s commodity CFDs require a margin rate of 2% (effective leverage of 50×) across all four account types, and no swaps are applied. Each commodity CFD has a designated settlement date, and any open positions held until that date will be forcibly closed. There is no automatic rollover to the next contract month, so traders should pay close attention to the settlement date for each product.

XM Commodity CFD List

| Brand | Required margin rate (effective leverage) |

Value per lot | Min/Max Trade Size |

| COCOA (US Cocoa) |

2% (50 times) |

1 Metric Ton | 1/500 |

| COFFE (US coffee) |

2% (50 times) |

10,000 LBS | 1/40 |

| CORN (US corn) |

2% (50 times) |

400 Bushels | 1/400 |

| COCOA | |

| 必要証拠金率 (実質レバレッジ) |

2% (50倍) |

| 1ロット当たりの 価値 |

1 Metric Ton |

| 最小/最大取引サイズ | 1/500 |

| COFFE | |

| 必要証拠金率 (実質レバレッジ) |

2% (50倍) |

| 1ロット当たりの 価値 |

10,000 LBS |

| 最小/最大取引サイズ | 1/40 |

| CORN | |

| 必要証拠金率 (実質レバレッジ) |

2% (50倍) |

| 1ロット当たりの 価値 |

400 Bushels |

| 最小/最大取引サイズ | 1/400 |

XM Commodity CFD trading hours

XMTrading’s Thematic Index CFDs track the performance of forward-looking industries or specific market themes, with eight products available for trading. These indexes cover a wide range of sectors, including emerging technologies, renewable energy, e-commerce, cybersecurity, and blockchain, providing instant access to some of today’s most popular market trends. Please note that Thematic Index CFDs are only available on MT5 Standard and Kiwami accounts.

Thematic Index CFDs available at XM are not subject to leverage restrictions based on account type or available margin. Trading is conducted with a required margin rate of 2%, providing an effective leverage of 50×.

XM Thematic Index CFDs

| Brand | Lowest spreads | Required margin rate (effective leverage) |

Min/Max Trade Size |

| AI_INDX | 11.60 pips | 2% (50 times) |

0.01/170 |

| ChinaInternet | 14.20 pips | 2% (50 times) |

0.05/220 |

| Crypto_10 | 200.80 pips | 2% (50 times) |

0.01/20 |

| AI_INDX | |

| 最低スプレッド | 11.60 pips |

| 必要証拠金率 (実質レバレッジ) |

2% (50倍) |

| 最小/最大取引サイズ | 0.01/170 |

| ChinaInternet | |

| 最低スプレッド | 14.20 pips |

| 必要証拠金率 (実質レバレッジ) |

2% (50倍) |

| 最小/最大取引サイズ | 0.05/220 |

| Crypto_10 | |

| 最低スプレッド | 200.80 pips |

| 必要証拠金率 (実質レバレッジ) |

2% (50倍) |

| 最小/最大取引サイズ | 0.01/20 |

Click here for XM Thematic Index CFD trading hours

XMTrading offers 58 cryptocurrency CFDs, including well-known coins like Bitcoin, Ethereum, Ripple, and Litecoin, as well as various lesser-known altcoins. MT5 Standard, Micro, and KIWAMI accounts provide access to all 58 cryptocurrencies, while MT4 Standard, Micro, and KIWAMI accounts offer 28 cryptocurrencies, primarily the major ones. Leverage varies by cryptocurrency: BTCUSD, BTGUSD, ETHBTC, and ETHUSD can be traded with a maximum leverage of 500×, while other Bitcoin-Ethereum pairs, Ripple, Litecoin, and other altcoins have a maximum leverage of 250×. Cryptocurrency CFDs are not available in Zero accounts.

Cryptocurrency CFDs incur swaps, but they do not have a settlement date. Swap points are applied Monday through Friday for positions carried overnight, with three days’ worth of swaps charged on Fridays. Additionally, cryptocurrencies can be traded actively 24 hours a day, seven days a week, including weekends.

In addition, cryptocurrency CFDs are subject to a “tiered margin rate,” where the required margin varies depending on the size of the transaction.

XM Cryptocurrency List

| Brand | Tiered margin rate (effective leverage) |

Trading volume of 1 lot | Min/Max Trade Size |

| 1INCHUSD (1INCH Network/USD) |

2% (50 times) |

10,000 tokens | 0.01/100 |

| AAVEUSD (Aave/USD) |

2% (50 times) |

10 Aave | 0.01/1,000 |

| ADAUSD (Cardano/USD) |

2% (50 times) |

1,000 Cardano | 0.01/3,000 |

| 1INCHUSD | |

| 段階式証拠金率 (実質レバレッジ) |

2% (50倍) |

| 1ロットの取引量 | 10,000 tokens |

| 最小/最大取引サイズ | 0.01/100 |

| AAVEUSD | |

| 段階式証拠金率 (実質レバレッジ) |

2% (50倍) |

| 1ロットの取引量 | 10 Aave |

| 最小/最大取引サイズ | 0.01/1,000 |

| ADAUSD | |

| 段階式証拠金率 (実質レバレッジ) |

2% (50倍) |

| 1ロットの取引量 | 1,000 Cardano |

| 最小/最大取引サイズ | 0.01/3,000 |

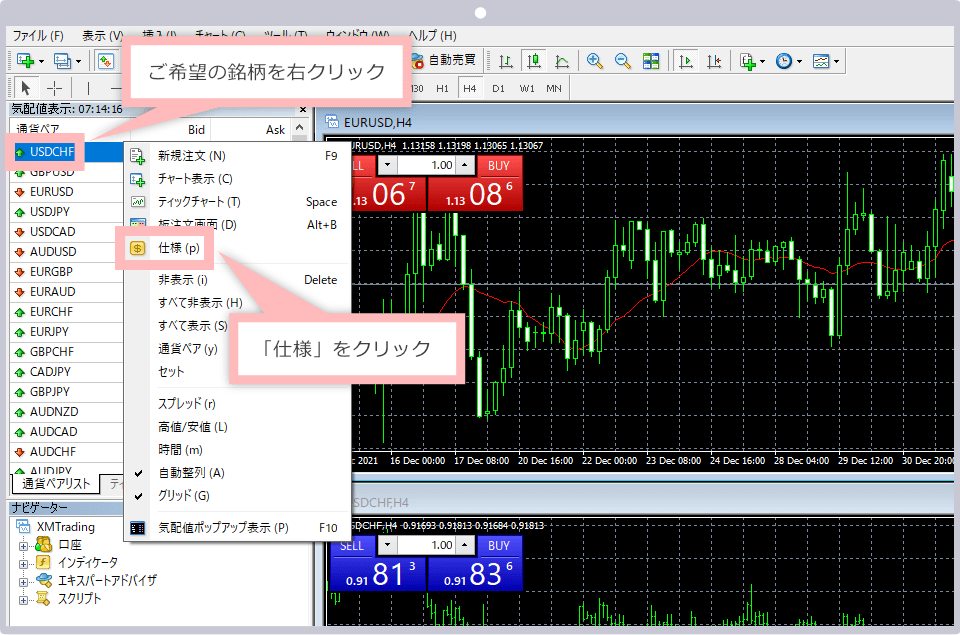

At XMTrading, you can view detailed trading conditions for each stock using XM’s dedicated MT4 (MetaTrader 4), MT5 (MetaTrader 5), or the official XM app (XMTrading smartphone app). Here’s how to check trading conditions on MT4/MT5.

How to check trading conditions on MT4/MT5

-

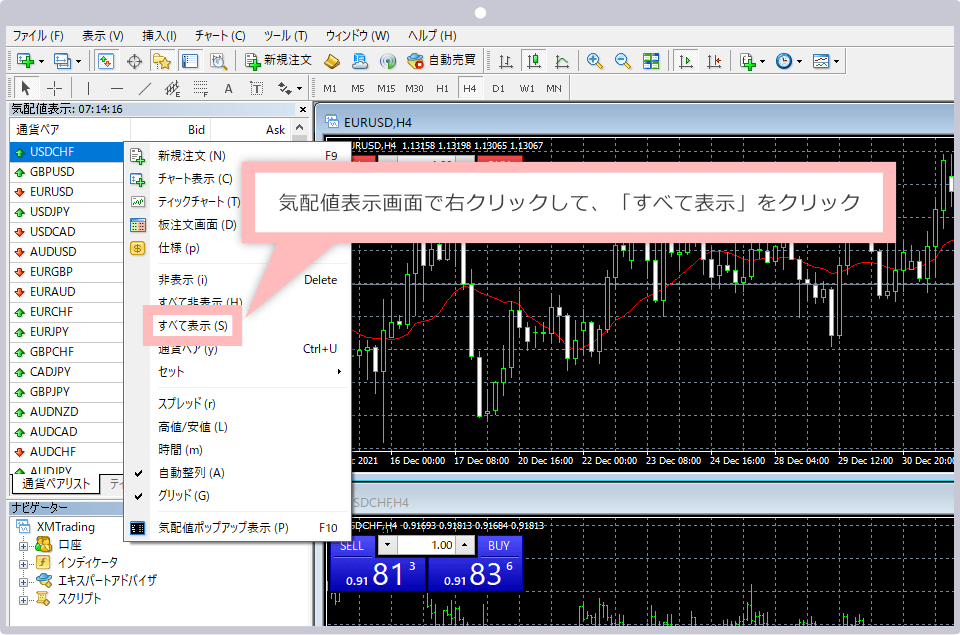

Steps: 1

MT4/MT5 (Quote display screen)

Launch XMTrading’s MT4 or MT5, right-click the desired currency pair on the “Market Watch” screen, and select “Specifications.” If the Market Watch screen is not visible, go to the “Display” menu in MT4/MT5 and enable “Market Watch.”

-

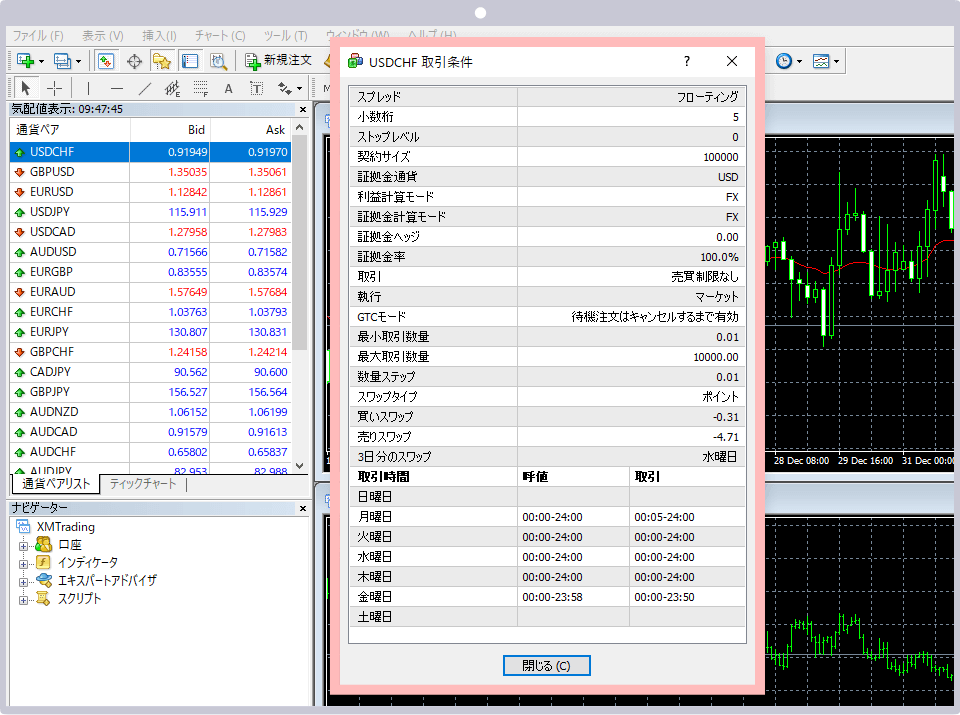

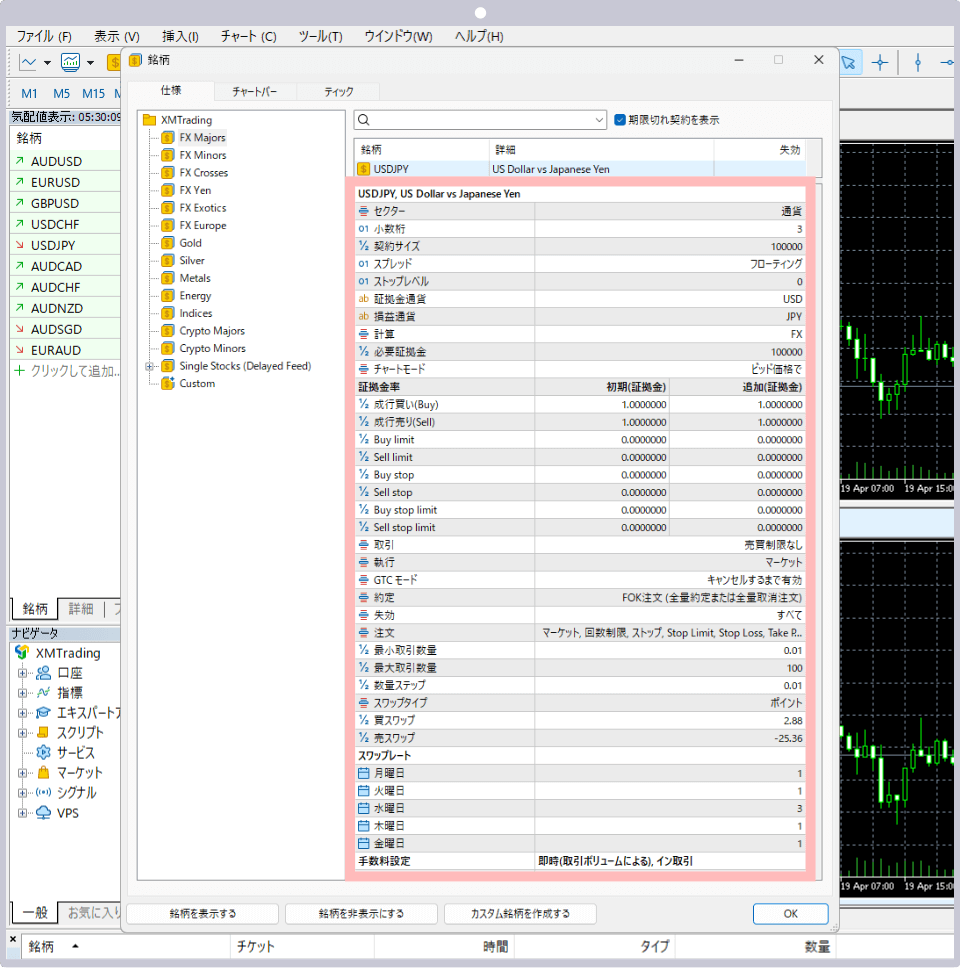

Steps: 2

MT4/MT5 (trading conditions screen)

The trading conditions screen will appear, allowing you to view the margin rate, swaps, trading hours, and other details for each stock.

-

Steps: 3

MT4/MT5 (display all symbols)

If the trading symbol you wish to trade is not displayed, right-click on the Market Watch screen and select “Show All” to display all symbols offered by XMTrading.

How to check trading conditions on MT5

-

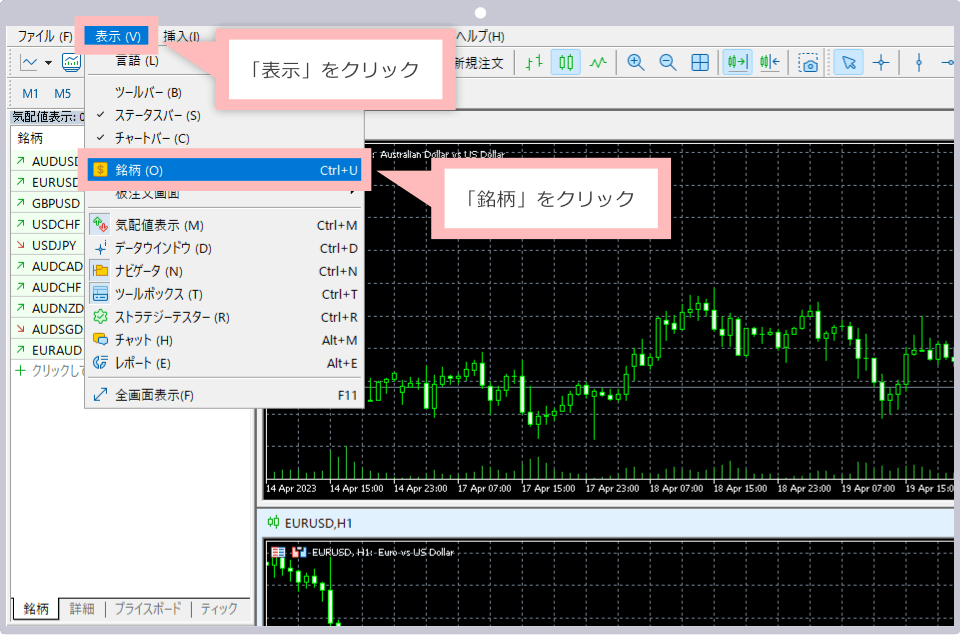

Steps: 1

MT5 (View Menu)

If you are using MT5, you can also check by clicking “View” and then selecting “Products.”

-

Steps: 2

MT5 (Stock screen)

Once the stocks screen is displayed, click on the stock you wish to trade to view its trading conditions.

Detailed instructions for checking the trading conditions of each stock are provided in the XM MT4/MT5 User Guide, which includes clear, easy-to-follow illustrations.

With XM MT4/MT5, you can not only execute trades and manage orders, but also check trading conditions, manage your account, set indicators, and more. For detailed instructions on using XM MT4/MT5, please refer to the “XM MT4/MT5 User Guide.”

How to check trading conditions on the XM app

XMTrading’s official mobile app, the “XMTrading App,” lets you view detailed trading conditions for each stock, including chart screens, trading hours, minimum and maximum lot sizes, and contract sizes.

Currently, the XMTrading app is not available for installation on iOS devices.

With an XM demo account, you can trade all available symbols using virtual funds. Demo accounts allow you to experience almost the same conditions as real accounts, including chart movements and trading hours. We recommend using the demo account to familiarize yourself with the price behavior of each symbol and to practice the settings and functions of MT4/MT5 in advance.

XM demo accounts are available in three account types: Standard Account, KIWAMI Goku Account, and Zero Account. However, the KIWAMI Goku demo account is only available on MT4 and cannot be used with MT5. Micro accounts are not offered as demo accounts. To open an XM demo account, please apply here.

-

How can I check the trading conditions for XM’s trading symbols?

You can view the trading conditions for XM’s symbols in MetaTrader 4 (MT4) or MetaTrader 5 (MT5). Simply right-click the desired currency pair in the Quotes window and select “Specifications” to check the details.

read more

2022.01.04

-

Does XM provide different leverage levels for different trading instruments?

Yes, at XM, maximum leverage depends on the trading instrument. For FX currency pairs, gold, and silver, you can choose leverage between 1× and 1,000×. For other CFD products, the leverage is determined by the required margin rate for each specific product.

read more

2022.01.04

-

What stocks does XM offers?

XM offers a total of 1,433 trading products, including 55 FX currency pairs and 1,378 CFDs covering precious metals, stocks, stock indices, energy, commodities, and cryptocurrencies. All trading products are protected by XM’s zero-cut system, allowing you to trade with peace of mind. Please note that the number of available trading products may vary depending on your account type and trading platform.

read more

2022.01.04

-

Is a separate CFD account required to trade with XM?

No, a separate CFD account is not required with XM. You can trade all CFD products—including FX currency pairs, precious metals, stock indices, energy, commodities, and cryptocurrencies—using the same account. These products are available for trading with the Standard Account, Micro Account, and KIWAMI Account.

read more

2022.01.04

-

How can I select stocks that are available for trading on XM’s MT4 or MT5 platforms?

At XM, the symbols displayed on MetaTrader 4 (MT4) and MetaTrader 5 (MT5) vary depending on your account type, so you need to select the symbol that corresponds to your account. For Standard Accounts, choose the six-character standard symbol format, such as “EURUSD.”

read more

2020.07.14