XM Crude Oil (OIL) Trading

XM Crude Oil (OIL) Trading

XM offers three types of crude oil spot products and five types of futures products . Energy-related products such as crude oil and natural gas are highly volatile and are popular among traders looking to make large profits in a short period of time. Crude oil traded at XM can be traded with fixed leverage of 200x for spot CFDs and 66.7x or 33.3x for futures CFDs . Even with a small amount of money, you can enjoy price movements that differ from those of FX currency pairs.

If you don’t yet have an XM account, you can receive an XM account opening bonus (trading bonus) and trade energy CFDs such as crude oil and natural gas without making a deposit. We are currently running a generous account opening bonus campaign of 15,000 yen for those who open a new account through this website. The usual bonus of 3,000 yen has been increased to 15,000 yen for a limited time . Take this opportunity to open an XM account and experience XM crude oil trading with this great bonus.

When trading crude oil (OIL) on XMTrading, we recommend that you check the product characteristics and price movement characteristics specific to crude oil stocks before trading.

Crude oil is high risk, high return

Crude oil is an essential energy source in our lives, and as a limited resource, its price fluctuates daily due to the relationship between supply and demand. Crude oil prices are also greatly influenced by the global economy, with demand increasing during periods of economic prosperity and consumption decreasing during periods of economic stagnation. For this reason, crude oil prices are widely used as an indicator for analyzing economic conditions .

Crude oil, as a trading instrument, is classified as high-risk, high-return , but its high volatility makes it one of the most popular stocks among traders who prefer exciting trading. Crude oil is a stock with large price fluctuations, but XM offers a trading environment that allows you to pursue profits while minimizing risk. Please enjoy dynamic crude oil trading with XM once you have fully understood the characteristics of crude oil.

XM Crude Oil CFD Trading

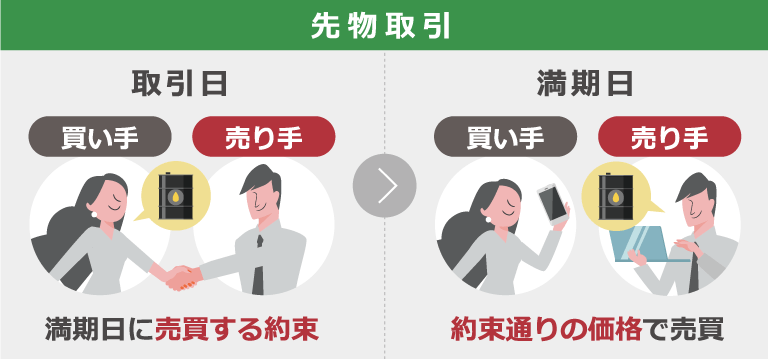

All crude oil traded at XM is CFD trading. CFDs are contract-for-difference transactions in which only the difference between the buy and sell price is settled, without the actual delivery of the product itself. The key features of CFDs are the ability to enter short positions, which is not possible with spot trading, and leveraged trading . XM offers crude oil trading as “spot CFDs” or “futures CFDs.” “Spot CFDs” are spot transactions, where the price is determined at the time of purchase. On the other hand, “futures CFDs” are futures transactions in which you agree to buy or sell on a predetermined date, and the price is determined at the time of purchase, so it’s important to understand that the expiration date (contract month) is fixed.

If crude oil prices go negative

XMTrading’s Crude Oil Futures CFD trading does not support negative prices. In futures trading, prices may become negative depending on the market. The MT4/MT5 and XM app trading platforms do not support negative prices for financial products. When the price of energy futures CFDs, including crude oil, reaches 0 yen, all open positions will be automatically closed based on the last available tradable rate.

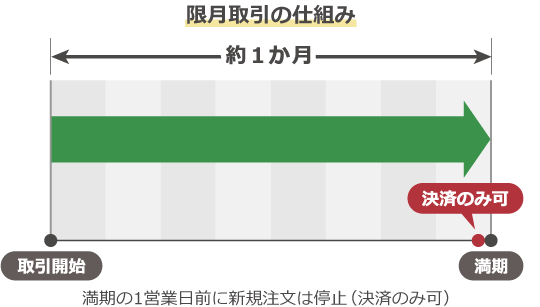

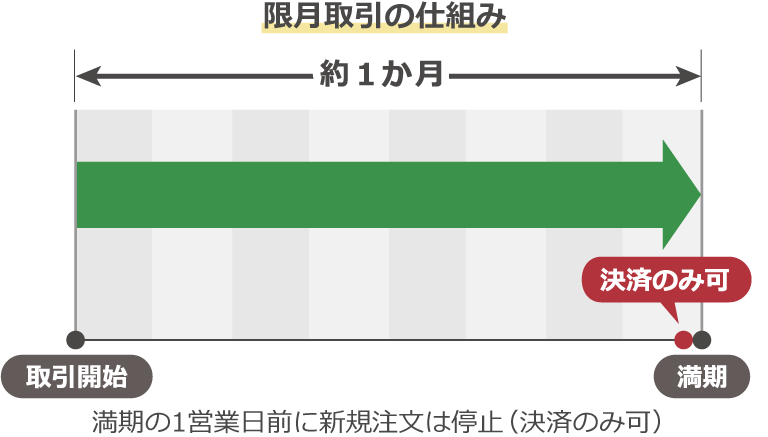

XM Crude Oil Futures CFDs are contract month trading

Among XM’s energy-related products, including crude oil, “futures CFD products” have a predetermined settlement deadline (expiry date) called the “contract month .” The contract month trading period varies depending on the product, but XM’s crude oil is generally approximately one month. When trading XM’s crude oil futures CFDs, the trading period is from the trading start date until two business days before the expiry date. New orders are suspended on the business day before the expiry date, and only settlement orders are possible. If you hold a position until the expiry date, it will be automatically settled, so please be sure to keep an eye on each expiry date (contract month) when trading.

Please note that Crude Oil Futures CFDs are reset to a new product each time they expire. When trading XM Crude Oil Futures CFDs, be sure to check the schedule from the trading start date to the expiration date in advance. Please note that with XM Crude Oil Futures CFD trading, the expiration dates may change as the “settlement only” date or “expiration date” approaches , so please be sure to check the schedule as appropriate.

Click here to check the contract month for XM Crude Oil (OIL) Futures CFDs

XM Crude Oil Price Movement

When trading crude oil (OIL) on XMTrading, we recommend that you check the characteristics of crude oil price movements and trade efficiently, avoiding high-risk times as much as possible. The characteristics of crude oil market price movements are as follows.

The New York market has the highest trading volume

Crude oil trading on XM is most active between 10 PM and 2 AM the following morning (Japan time) when the New York market is open . At XM, you can generally trade crude oil at any time except for Saturdays, Sundays, and weekday mornings between 1 AM and 3 AM Japan time, but targeting these times tends to result in larger price movements. This time of high volatility makes scalping and day trading, which aim to repeatedly make small profits in a short period of time, more effective. After understanding the characteristics of crude oil price movements, you can enjoy strategic and speedy crude oil trading.

Pay close attention to “oil inventory statistics”

XMTrading’s crude oil (OIL) prices can fluctuate significantly depending on the results of the ” US Weekly Oil Inventory Statistics, ” which is released every Wednesday at 11:30 PM (midnight in winter). The US Weekly Oil Inventory Statistics is a report on domestic oil inventories in the United States published by the Energy Information Administration (EIA). The figures for each type of oil, including crude oil, gasoline, distillates, light oil, diesel, and kerosene, are released every Wednesday, with figures as of the previous Friday. Among the weekly oil inventory statistics, the one that receives the most attention is the crude oil inventory in Cushing, Oklahoma, the delivery point for the New York crude oil futures market. This is an important indicator for considering comprehensive trading strategies, not just based on simple inventory fluctuations, but also on other fundamental factors and price trends. Because crude oil stocks are affected by oil inventory levels, we recommend refraining from trading before and after the release of the oil inventory statistics to avoid risk .

Long trends are likely to occur

Crude oil stocks tend to maintain strong trends . When a trend is strong, short-term fluctuations occur repeatedly, but rates tend to move in one direction over the long term. This allows for short-term trading while aiming for medium- to long-term profits. However, when trading XMTrading’s crude oil futures CFDs, caution is required for long-term trades. Crude oil futures CFDs are traded on contract months with settlement dates of approximately one month. Since they are automatically settled on the expiration date, please be sure to check the contract month (expiry date) if holding a position that spans multiple days. If you want to target long-term crude oil price increases, choosing spot CFDs allows you to trade without worrying about expiration dates.

Check out the expert analysis on TradingCentral

When day trading crude oil on XM, it’s important to understand long-term market trends, not just short-term price trends (5- or 15-minute periods), but also at least daily charts. This allows you to develop a trading strategy to avoid significant losses. XM also offers advanced technical analysis via MT4/MT5 and the XM app (XM smartphone app), but you can also easily access the latest analytical data from experts. The analytical data provided by XM is the latest data collected and analyzed by experts at TradingCentral . TradingCentral’s data is highly specialized and widely used by financial institutions around the world. XM provides this advanced, up-to-date analytical data free of charge to all users. TradingCentral analytical data can also be easily accessed from the XM smartphone app, so please feel free to use it.

Currently, the iOS version of the XMTrading app cannot be installed.

XMTrading’s crude oil (OIL) trading conditions are significantly different from those of FX currency pairs. XM’s crude oil products are classified as energy CFDs and consist of a total of eight products: three spot CFD products, including natural gas, and five futures CFD products . Different conditions apply to spot and futures products, so please check the trading hours, leverage, spreads, etc. of each product before starting crude oil trading.

XM Crude Oil (OIL) Trading Stock

XM offers a total of eight energy CFD products, including crude oil (OIL) and natural gas, including three spot CFDs and five futures CFDs . While crude oil comes in a variety of varieties depending on its origin, XM offers the three major crude oil price indicators: OIL (WTI New York Crude Oil Futures) and BRENT (London Crude Oil Futures) . Additionally, you can trade OIL Mn (New York Crude Oil Futures Mini), which allows you to trade small amounts of OIL (WTI New York Crude Oil Futures), GSOIL (London Gas Oil Futures), which is refined crude oil, and NGAS (Liquefied Natural Gas Futures), which uses natural gas, primarily from Russia, as its underlying asset. Please note that when trading crude oil futures CFDs with XM, there is a limited trading period known as a “contract month contract,” so please be sure to review the trading terms before beginning trading.

XM Crude Oil (OIL) Spot CFD Trading Products

| Brand name | Actual product name |

| BRENTCash (BRENTCash) |

London Crude Oil |

| NGASCash (Natural Gas Cash) |

liquefied natural gas |

| OILCash (WTI Oil Cash) |

WTI New York Crude Oil |

| BRENTCash | |

| 現物商品名 | ロンドン原油 |

| NGASCash | |

| 現物商品名 | 液化天然ガス |

| OILCash | |

| 現物商品名 | WTI ニューヨーク原油 |

XM’s Crude Oil Spot CFDs are only available for trading on MT5.

XM Crude Oil (OIL) Futures CFD Trading Products

| Brand name | Futures Product Name |

| OIL (WTI OIL) |

WTI New York Crude Oil Futures |

| BRENT (Brent Crude Oil) |

London Crude Oil Futures |

| OIL Mn (WTI OIL Mini) |

WTI New York Crude Oil Futures Mini |

| GSOIL (London Gas OIL) |

London Gas Oil Futures |

| NGAS (Natural Gas) |

Liquefied Natural Gas Futures |

| OIL | |

| 現物商品名 | WTI ニューヨーク 原油先物 |

| BRENT | |

| 現物商品名 | ロンドン原油先物 |

| OIL Mn | |

| 現物商品名 | WTI ニューヨーク 原油先物ミニ |

| GSOIL | |

| 現物商品名 | ロンドン軽油先物 |

| NGAS | |

| 現物商品名 | 液化天然ガス先物 |

Click here for details on XM Crude Oil and Natural Gas (Energy CFD Products)

XM Crude Oil (OIL) Trading Hours

XMTrading’s crude oil (OIL) trading hours are as follows. However, crude oil futures CFDs have a set settlement deadline (contract month), and new orders are accepted from the trading start date until two business days before maturity. New orders are suspended on the business day before maturity, and only settlement transactions are possible. Please note that if you hold a crude oil futures CFD position on the maturity date, it will be automatically settled.

XM Crude Oil (OIL) Spot CFD Trading Hours (Japan Time)

| Brand name | Daylight Saving Time | Winter time |

| OILCash (WTI Oil Cash) |

7:05 to 5:55 the next day (closes at 5:10 the next day on Fridays only) |

8:05 to 6:55 the next day (closes at 6:10 the next day on Fridays only) |

| BRENTCash (BRENTCash) |

9:05 to 6:55 the next day (closes at 5:10 the next day on Fridays only) |

10:05 to 7:55 the next day (closes at 6:10 the next day on Fridays only) |

| NGASCash (Natural Gas Cash) |

7:05 to 5:55 the next day (closes at 5:10 the next day on Fridays only) |

8:05 to 6:55 the next day (closes at 6:10 the next day on Fridays only) |

| OILCash | |

| 夏時間 | 7:05~翌 5:55 (金曜日のみ翌 5:10閉場) |

| 冬時間 | 8:05~翌 6:55 (金曜日のみ翌 6:10閉場) |

| BRENTCash | |

| 夏時間 | 9:05~翌 6:55 (金曜日のみ翌 5:10閉場) |

| 冬時間 | 10:05~翌 7:55 (金曜日のみ翌 6:10閉場) |

| NGASCash | |

| 夏時間 | 7:05~翌 5:55 (金曜日のみ翌 5:10閉場) |

| 冬時間 | 8:05~翌 6:55 (金曜日のみ翌 6:10閉場) |

XM’s Crude Oil Spot CFDs are only available for trading on MT5.

XM Crude Oil (OIL) Futures CFD Trading Hours (Japan Time)

| Brand name | Daylight Saving Time | Winter time |

| OIL (WTI OIL) |

7:05 to 5:55 the next day (closes at 5:10 the next day on Fridays only) |

8:05 to 6:55 the next day (closes at 6:10 the next day on Fridays only) |

| BRENT (Brent Crude Oil) |

9:05 to 6:55 the next day (closes at 5:10 the next day on Fridays only) |

10:05 to 7:55 the next day (closes at 6:10 the next day on Fridays only) |

| OIL Mn (WTI OIL Mini) |

7:05 to 5:55 the next day (closes at 5:10 the next day on Fridays only) |

8:05 to 6:55 the next day (closes at 6:10 the next day on Fridays only) |

| GSOIL (London Gas OIL) |

9:05am – 5:55am (closes at 5:10am on Fridays only) |

10:05 to 6:55 the next day (closes at 6:10 the next day on Fridays only) |

| NGAS (Natural Gas) |

7:05 to 5:55 the next day (closes at 5:10 the next day on Fridays only) |

8:05 to 6:55 the next day (closes at 6:10 the next day on Fridays only) |

| OIL | |

| 夏時間 | 7:05~翌 5:55 (金曜日のみ翌 5:10閉場) |

| 冬時間 | 8:05~翌 6:55 (金曜日のみ翌 6:10閉場) |

| BRENT | |

| 夏時間 | 9:05~翌 6:55 (金曜日のみ翌 5:10閉場) |

| 冬時間 | 10:05~翌 7:55 (金曜日のみ翌 6:10閉場) |

| OIL Mn | |

| 夏時間 | 7:05~翌 5:55 (金曜日のみ翌 5:10閉場) |

| 冬時間 | 8:05~翌 6:55 (金曜日のみ翌 6:10閉場) |

| GSOIL | |

| 夏時間 | 9:05~翌 5:55 (金曜日のみ翌 5:10閉場) |

| 冬時間 | 10:05~翌 6:55 (金曜日のみ翌 6:10閉場) |

| NGAS | |

| 夏時間 | 7:05~翌 5:55 (金曜日のみ翌 5:10閉場) |

| 冬時間 | 8:05~翌 6:55 (金曜日のみ翌 6:10閉場) |

-

Please note that XM’s Crude Oil Futures CFDs are contract month trades, so new orders will be suspended on the business day before expiration.

-

XM’s Crude Oil Futures CFDs may have the suspension date for new orders brought forward due to market closures in crude oil-related markets, so please be sure to check the market closure schedule.

Click here to check the contract month for XM Crude Oil (OIL) Futures CFDs

XM Crude Oil (OIL) Trading Volume and Minimum/Maximum Trading Size

The trading volume per lot and minimum/maximum trading size for crude oil (OIL) on XMTrading varies depending on the stock as follows:

XM Crude Oil (OIL) Spot CFD Trading Volume and Minimum/Maximum Trading Size

| Brand name | Trading volume of 1 lot | Min/Max Trade Size |

| OILCash (WTI Oil Cash) |

100 Barrels | 0.01 lot/330 lots |

| BRENTCash (BRENTCash) |

100 Barrels | 0.01 lot/270 lots |

| NGASCash (Natural Gas Cash) |

1,000 MMBtu | 0.01 lot/370 lots |

| OILCash | |

| 1ロットの 取引量 |

100 Barrels |

| 最小/最大 取引サイズ |

0.01ロット/330ロット |

| BRENTCash | |

| 1ロットの 取引量 |

100 Barrels |

| 最小/最大 取引サイズ |

0.01ロット/270ロット |

| NGASCash | |

| 1ロットの 取引量 |

1,000 MMBtu |

| 最小/最大 取引サイズ |

0.01ロット/370ロット |

XM’s Crude Oil Spot CFDs are only available for trading on MT5.

XM Crude Oil (OIL) Futures CFD Trading Volume and Minimum/Maximum Trading Size

| Brand name | Trading volume of 1 lot | Min/Max Trade Size |

| OIL (WTI OIL) |

100 Barrels | 1 lot/280 lots |

| BRENT (Brent Crude Oil) |

100 Barrels | 1 lot/280 lots |

| OIL Mn (WTI OIL Mini) |

10 Barrels | 1 lot/2,800 lots |

| GSOIL (London Gas OIL) |

4 Tonnes | 1 lot/200 lots |

| NGAS (Natural Gas) |

1,000 MMBtu | 1 lot/180 lots |

| OIL | |

| 1ロットの 取引量 |

100 Barrels |

| 最小/最大 取引サイズ |

1ロット/280ロット |

| BRENT | |

| 1ロットの 取引量 |

100 Barrels |

| 最小/最大 取引サイズ |

1ロット/280ロット |

| OIL Mn | |

| 1ロットの 取引量 |

10 Barrels |

| 最小/最大 取引サイズ |

1ロット/2,800ロット |

| GSOIL | |

| 1ロットの 取引量 |

4 Tonnes |

| 最小/最大 取引サイズ |

1ロット/200ロット |

| NGAS | |

| 1ロットの 取引量 |

1,000 MMBtu |

| 最小/最大 取引サイズ |

1ロット/180ロット |

Units of crude oil and natural gas

For those without experience trading energy-related products such as crude oil and natural gas, the units used for crude oil and natural gas may be unfamiliar. While there are various units, the units used for crude oil and natural gas traded at XM are barrels, tons, and million British thermal units (MMBtu). For all FX currency pairs, the trading volume per lot is 100,000 units (1,000 units for micro accounts only), but the trading volume and units per lot for crude oil and natural gas vary by product.

XM Crude Oil (OIL) Leverage

The leverage applied to XMTrading’s crude oil (OIL) varies depending on the product. XM’s crude oil does not have leverage restrictions based on account type or equity. All account types can use fixed leverage of 200x for crude oil spot CFDs and 33.3x or 66.7x for crude oil futures CFDs.

XM Crude Oil (OIL) Spot CFD Maximum Leverage

| Brand name | Leverage (fixed) |

| OILCash (WTI Oil Cash) |

200 times |

| BRENTCash (BRENTCash) |

|

| NGASCash (Natural Gas Cash) |

XM’s Crude Oil Spot CFDs are only available for trading on MT5.

XM Crude Oil (OIL) Futures CFD Maximum Leverage

| Brand name | Leverage (fixed) |

| OIL (WTI OIL) |

66.7 times |

| BRENT (Brent Crude Oil) |

|

| OIL Mn (WTI OIL Mini) |

|

| GSOIL (London Gas OIL) |

33.3 times |

| NGAS (Natural Gas) |

-

Please note that when trading XM Crude Oil CFDs, the leverage set in your trading account will not be applied. The leverage set for each product will be automatically applied.

XM adopts a zero cut system

XM employs a ” zero cut system ,” allowing you to trade leveraged crude oil (OIL) with peace of mind. The zero cut system is a system in which, if a sudden market fluctuation prevents a stop loss and you incur losses that exceed your account balance, XM will compensate for your negative balance and reset it to zero. Since you will not incur losses that exceed the amount you deposited, the mental burden is reduced, allowing you to focus on trading crude oil.

XM Crude Oil (OIL) Margin Requirements

The margin required when trading crude oil (OIL) on XMTrading varies depending on the price of the trading instrument, the required margin rate, and the number of trading lots. Also, if the base currency of your trading account is not the dollar (USD), a currency conversion is required. The margin required for XM crude oil can be calculated using the following formula.

XM Crude Oil (OIL) Margin Calculation Method

Number of lots x contract size

x opening price ÷ leverage

For example, the required margin for trading 1 lot of XM’s OIL (Crude Oil Futures CFD) when the price is $70/barrel is as follows:

“1 lot” x “100 barrels”

x “70 dollars/barrel” ÷ “66.7 times”

= 105 dollars

If the base currency of your trading account is Japanese Yen (JPY), multiply by the current price of the US Dollar/JPY (USD/JPY). If the US Dollar/JPY rate is 130 yen/dollar, the required margin will be 105 dollars x 130 yen/dollar = 13,650 yen.

Without XM’s 66.7x leverage, the margin required to trade 100 barrels of crude oil under the same trading conditions would be approximately 910,000 yen. By utilizing leverage, you can trade crude oil, which has high volatility and the potential for large profits, with a small margin.

XM Crude Oil (OIL) Spreads

XMTrading’s crude oil (OIL) spreads are the same for all account types. Please note that during times of low liquidity, prices become unstable and spreads tend to widen. For your reference, the minimum spreads for XM crude oil are as follows. Please note that spreads fluctuate daily, so please check the latest figures when trading.

XM Crude Oil (OIL) Futures CFD Lowest Spreads

| Brand name | Lowest spreads |

| OILCash (WTI Oil Cash) |

0.03 pips |

| BRENTCash (BRENTCash) |

0.03 pips |

| NGASCash (Natural Gas Cash) |

0.012 pips |

XM’s Crude Oil Spot CFDs are only available for trading on MT5.

XM Crude Oil (OIL) Futures CFD Lowest Spreads

| Brand name | Lowest spreads |

| OIL (WTI OIL) |

0.03 pips |

| BRENT (Brent Crude Oil) |

0.03 pips |

| OIL Mn (WTI OIL Mini) |

0.03 pips |

| GSOIL (London Gas OIL) |

1.35 pips |

| NGAS (Natural Gas) |

0.033 pips |

When trading crude oil with XM, a spread will be incurred as a trading cost. However, by taking advantage of XM’s attractive service, the loyalty program , which allows you to earn various bonuses and XM points (XMP) , you can reduce your overall trading costs.

XM Crude Oil (OIL) Swap Points

XMTrading’s crude oil (OIL) spot CFDs incur swap points only . Crude oil futures CFDs are swap-free , so no swap points, positive or negative, are incurred. Swap points in CFDs refer to the interest rate or price adjustments incurred on CFD positions. Typically, when an open position is rolled over, swap points are applied to each type of position (buy/sell) for each product. If swap points are positive, you will make a profit, so some trading strategies aim to earn swap points in addition to foreign exchange gains. Conversely, if swap points are negative, simply carrying over a position to the next day will result in a loss, so they must be considered as a trading cost.

XM uses swap-free trading for crude oil futures CFDs, so you can trade without worrying about losses due to negative swaps. The swap points incurred when trading XM crude oil spot CFDs are as follows. Please note that swap points fluctuate daily, so please check the latest figures when trading.

XM Crude Oil (OIL) Spot CFD Swap Points ( as of September 2025 )

| Brand name | Long (Buy) Swap Points |

Short (selling) swap points |

| OILCash (WTI Oil Cash) |

1.00 | -5.12 |

| BRENTCash (BRENTCash) |

1.00 | -3.92 |

| NGASCash (Natural Gas Cash) |

-2.26 | 1.43 |

-

Swap points fluctuate.

-

XM’s Crude Oil Spot CFDs are only available for trading on MT5.

XM Swap-Free Eligible Stocks

XM offers swap-free trading on other products in addition to crude oil (OIL) futures CFDs. At XM, you can trade cryptocurrency CFDs and futures CFDs (commodities, energy, stock indexes, and precious metals (platinum and palladium)) swap-free (not subject to swap points) with all account types. Swap points will be charged for trading FX currency pairs, spot CFDs (stocks, stock indexes, energy), and spot metals (gold and silver). Furthermore, with the KIWAMI account, you can trade major and minor FX currency pairs, gold, and silver swap-free.

Stocks that are not eligible for swap points are listed here

You can check XM crude oil (OIL) contract months on the “XM Energy” page, on XM’s trading platform ” MT4 (MetaTrader 4) / MT5 (MetaTrader 5) ,” and on XM’s official app, the “XM Energy” app (XM smartphone app). On the “XM Energy” page, you can check the “trading start date, settlement only, and expiration date,” as well as the general expiration dates for each contract month. On MT4/MT5 and the XM app, you can check the trading start date and trading end date (= the date and time of automatic settlement due to expiration) by opening the “Specifications” or “Product Details” screen for each crude oil product.

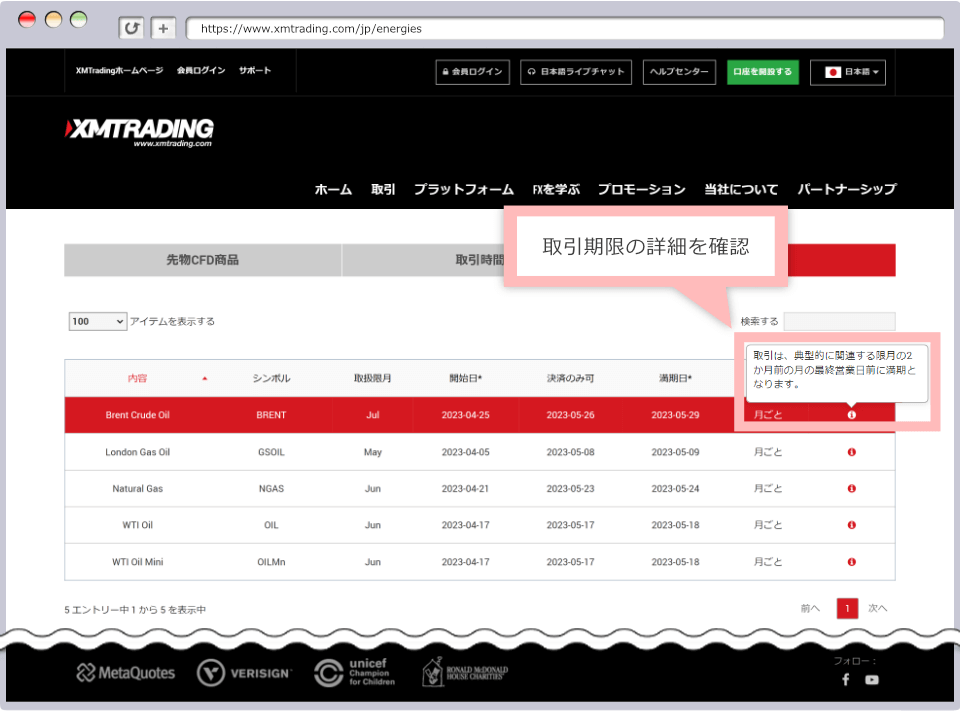

How to check the contract month on the “XM Energy” page

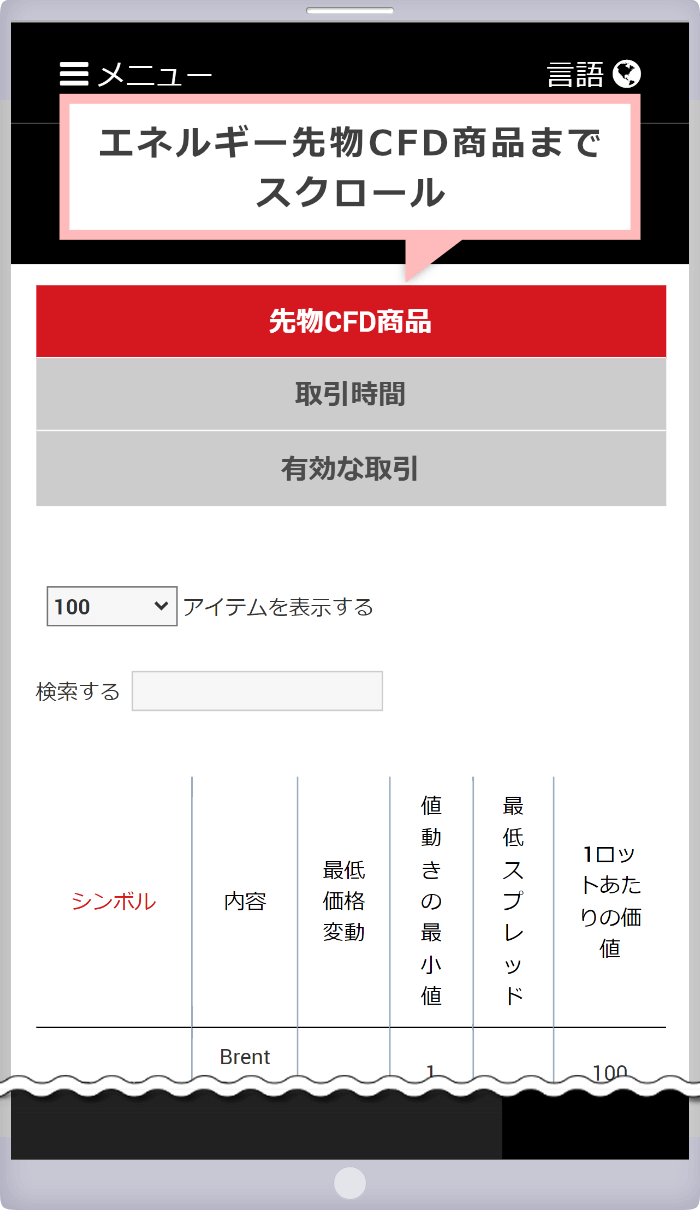

At XMTrading, you can check the contract month for crude oil (OIL) by accessing “XM Energy” and going to the “Available Trades” tab.

-

Steps: 1

Access the “XM Energy” page

Go to ” XM Energy ” and scroll down to the list of Energy Futures CFDs.

-

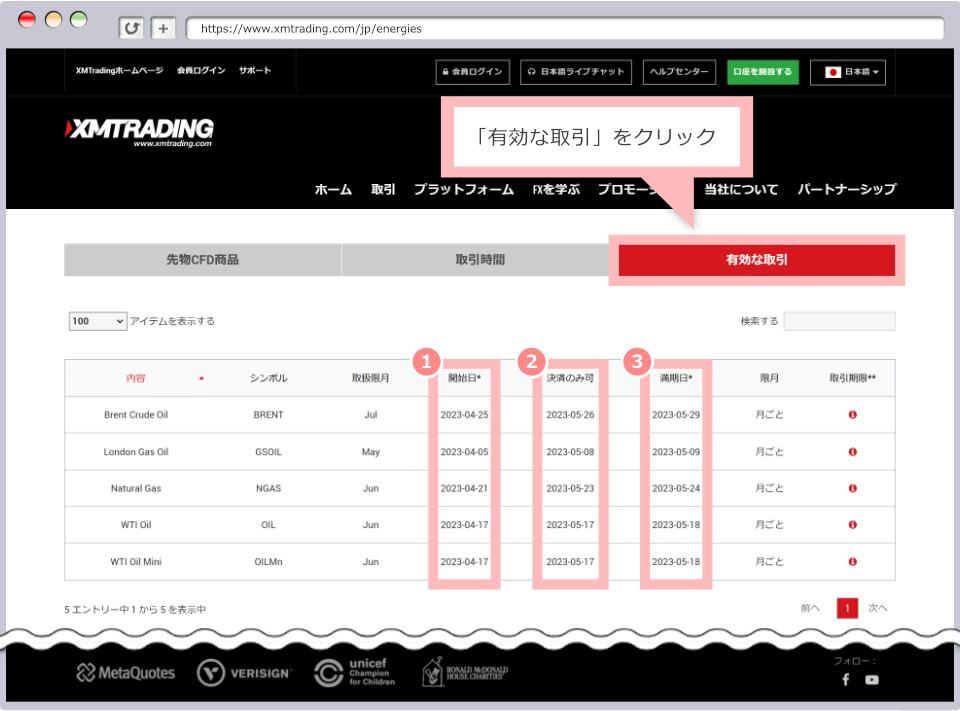

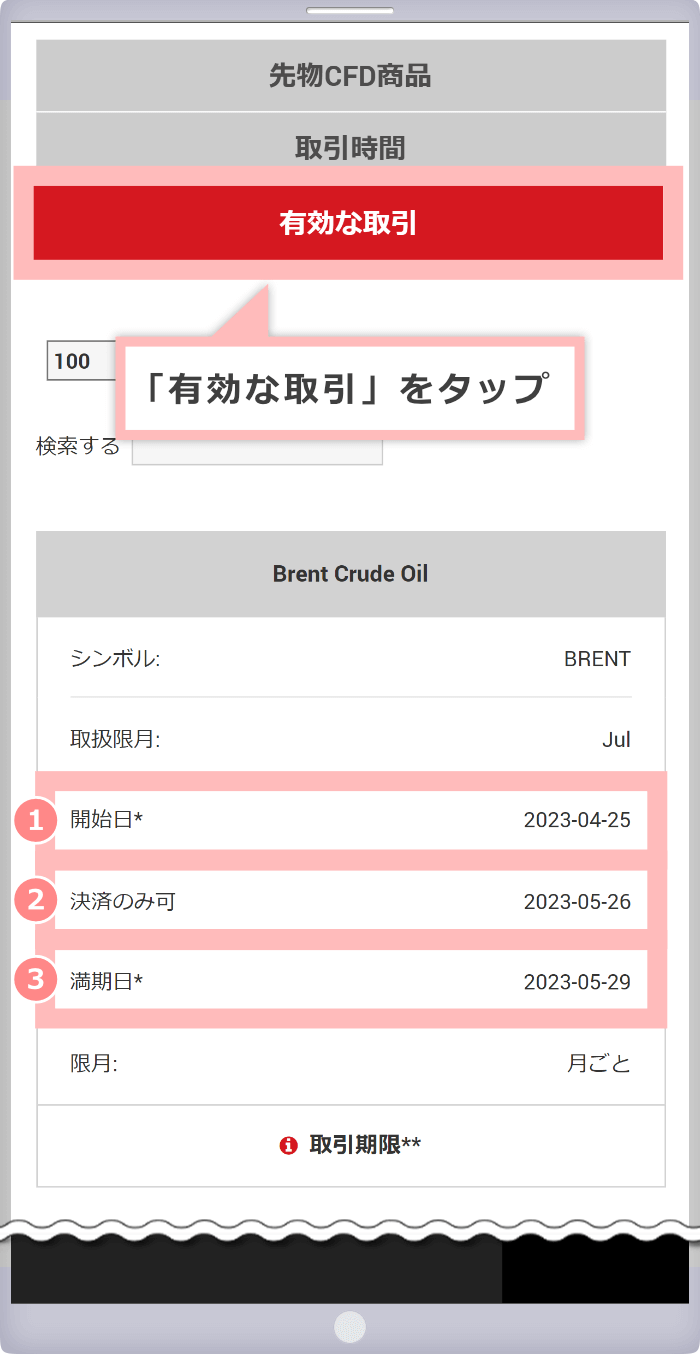

Steps: 2

Click on “Valid Transactions”

「有効な取引」をタップ

Clicking on the “Available Trades” tab will display the information you need to trade currently available crude oil contracts.

「有効な取引」タブをタップして頂くと、現時点で有効な原油銘柄の限月取引に必要な情報が表示されます。

The information about the contract month required for trading XM’s crude oil stocks is ① “Start date”, ② “Settlement only available”, and ③ “Expiration date”.

1start date Trading start date 2Payment only Only payment orders are possible 3Maturity Date Open positions will be automatically settled upon maturity. New orders are not accepted

-

Steps: 3

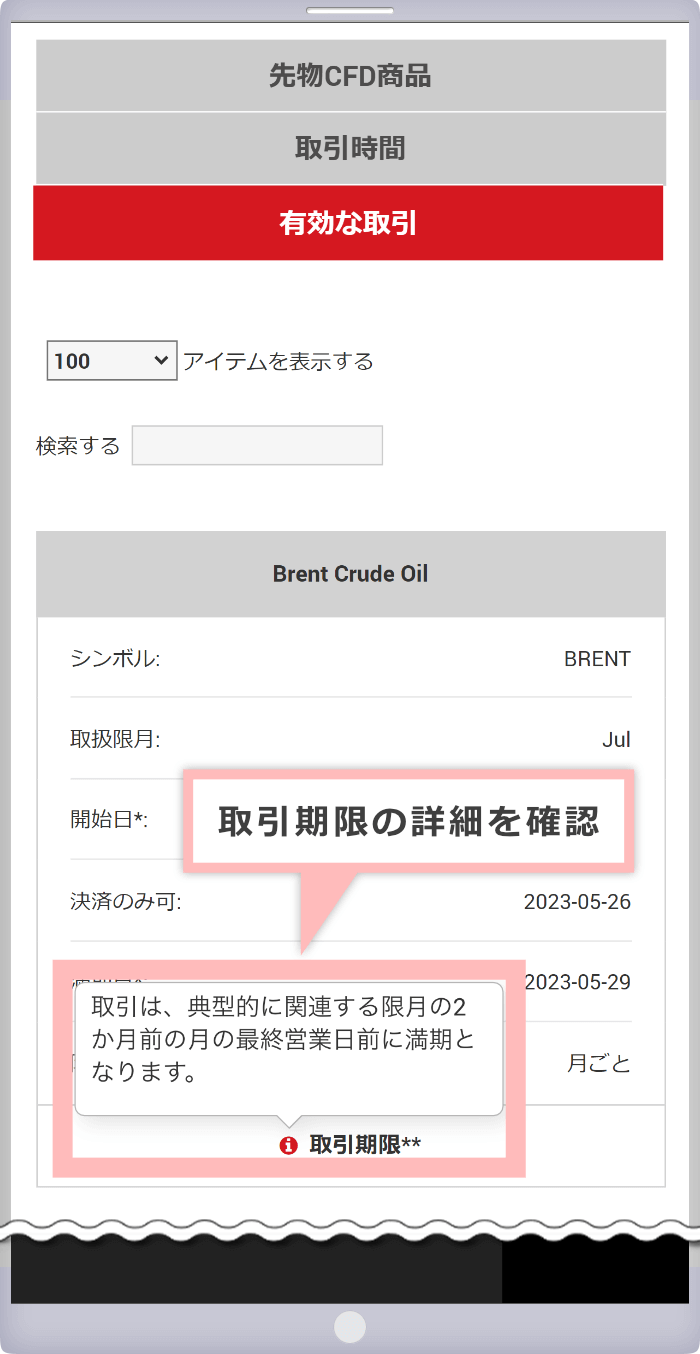

Place the cursor on the “i” in “Expiration date**”

Hover your cursor over the “i” in “Delivery Date**” to view details of the trading deadline for each stock.

The information about contract month transactions that can be checked using the above methods is updated as needed. Also, as the expiry date approaches, the “settlement only” date and “maturity date” may be brought forward , so please be sure to check the latest expiration dates before trading or when carrying over a position.

Please check the link below for the latest crude oil contract months available for trading at XM.

Click here for the latest contract month for XM’s crude oil products

How to check the contract month on MT4/MT5

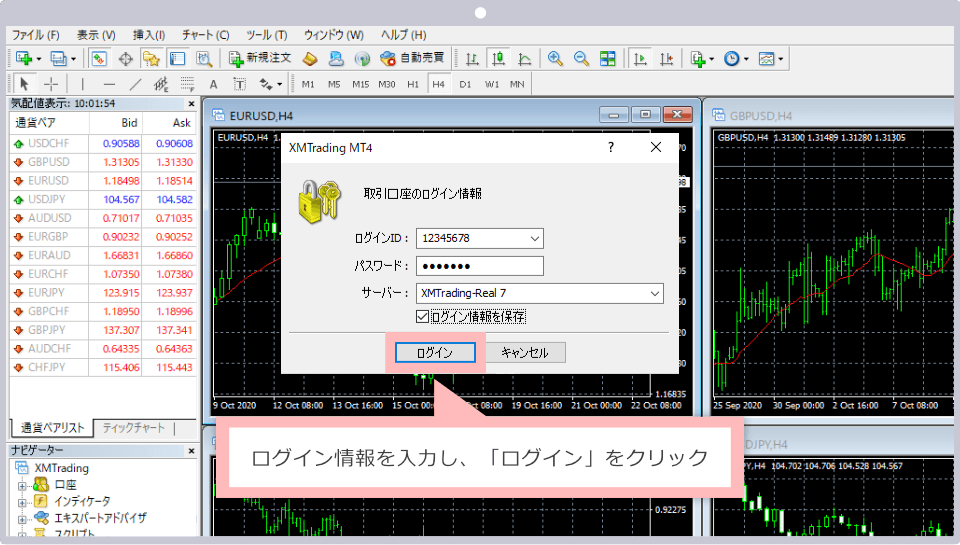

At XMTrading, you can check the crude oil (OIL) contract month by logging in to MT4/MT5 and going to “Specifications.”

-

Steps: 1

Log in to XM MT4/MT5

Enter your MT4/MT5 login information (login ID and password), select the login server for your trading account, and click “Login.”

-

Steps: 2

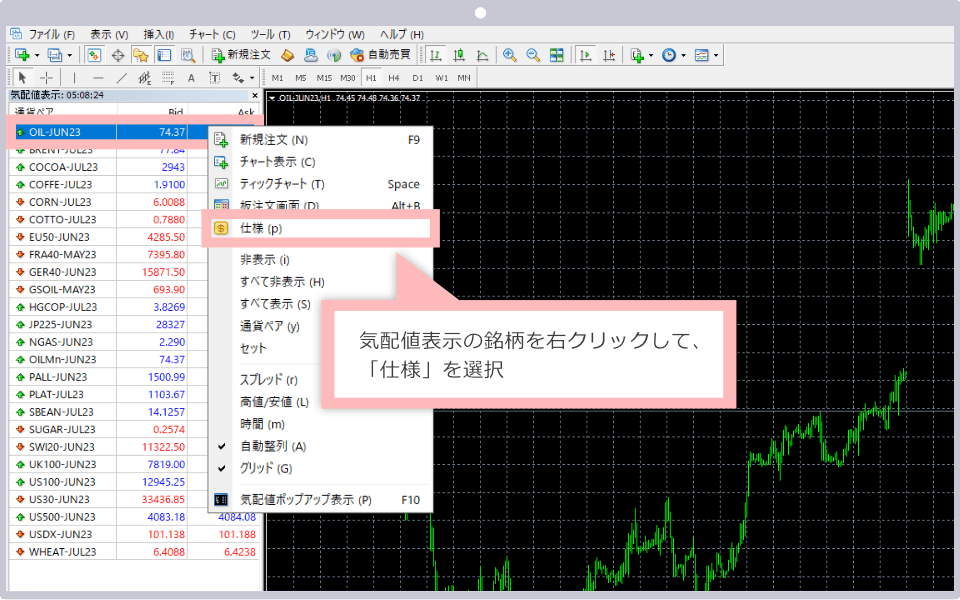

Select the “Specifications” of the crude oil brand

In the “Market Watch” window, right-click on the crude oil product you want to view details for and select “Specifications.”

-

Steps: 3

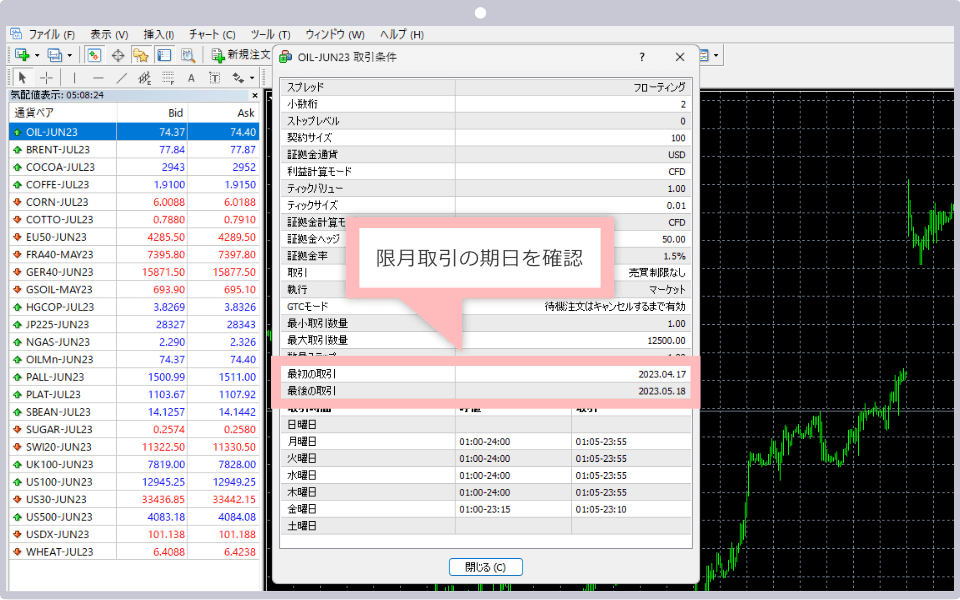

Check the contract month

The trading conditions for the crude oil brand you want will be displayed, so please check the trading start date and time under “First Transaction” and the maturity date and time under “Last Transaction.”

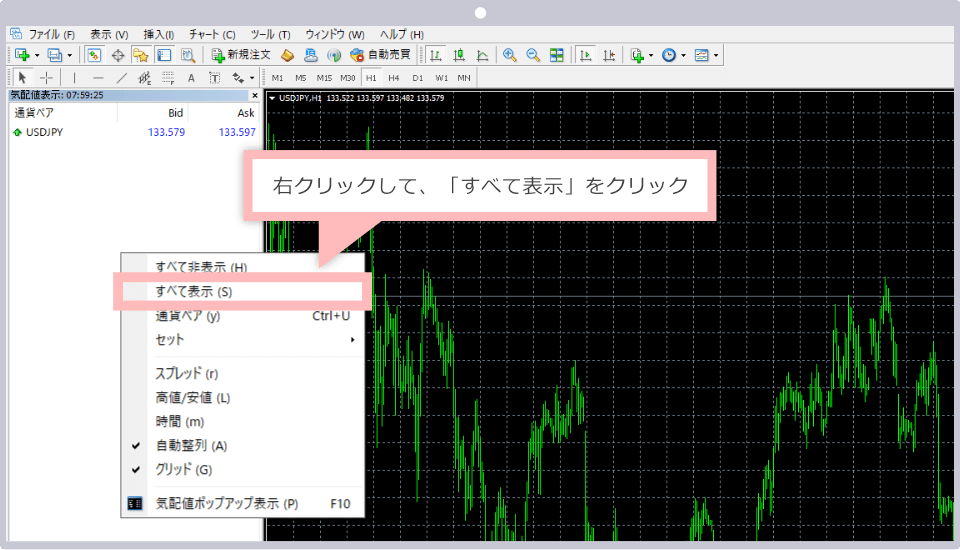

If crude oil stocks are not displayed in the MT4/MT5 “Quotes”

If Crude Oil (Energy) products are not displayed in XM’s MT4/MT5 “Market Watch,” right-click within the “Market Watch” window and select “Show All.” All products traded in your trading account will be displayed. Please note that Crude Oil Spot CFDs are only available on MT5.

How to check with the XM smartphone app

At XMTrading, you can check the contract month for crude oil (OIL) by logging in to the official app, the XMTrading app (XM smartphone app), and going to “Product Details.”

Currently, the iOS version of the XMTrading app cannot be installed.

-

Steps: 1

Log in to the XM smartphone app

Launch the XM smartphone app, enter your login information (email address and password), and tap “Login.”

-

With the introduction of XM’s new account management feature, XMTrading Profile, the login ID for the XM smartphone app has been changed from MT4/MT5 ID to email address. If you have converted to a profile or registered a profile, you will not be able to log in with your MT4/MT5 ID, so please be sure to log in to the XM smartphone app using your registered email address.

-

-

Steps: 2

Select the stock you want to display

From the “Quotes” menu at the bottom of the XM smartphone app, tap the crude oil stock you want to check details for.

-

Steps: 3

Brand details

Tap “Symbol Details” at the bottom of the chart screen .

-

Steps: 4

Check the contract month

The trading conditions for the crude oil brand you want will be displayed, so please check the trading start date and time under “First Transaction” and the maturity date and time under “Last Transaction.”

XM crude oil can also be traded via the “XM smartphone app”

XM crude oil (energy) products can be traded using MT4/MT5 as well as the “XM Smartphone App” (spot products are only available through MT5). XM offers the official “XMTrading Smartphone App (XM Smartphone App),” which combines the XM membership page and MT4/MT5 trading functions. You can use the app to deposit and withdraw funds to your trading account, change various settings, and trade all XM stocks. The XM Smartphone App also provides advanced analysis and market news from Trading Central, which you can use as a reference for your crude oil trading. The XM Smartphone App allows you to access XM’s MT4/MT5 anytime, anywhere. With easy on-the-go trading, you can respond to sudden buying and selling without missing entry opportunities or profit-taking opportunities, even in the highly volatile world of crude oil trading.

Before you start trading crude oil (OIL) on XMTrading, please read the following points of caution.

The settlement date for crude oil futures CFDs may change

XMTrading’s crude oil (OIL) futures CFDs are contract month trades, so there is a settlement date, and if you hold a position while it reaches the maturity date, it will be automatically settled. Please note that the “settlement only” date and “maturity date” may change as they approach the actual date . Please be sure to check each date before crude oil trading begins or if you roll over a position.

Click here to check the contract month for XM Crude Oil (OIL) Futures CFDs

Crude Oil Spot CFD and Futures CFD Symbol Names

The symbol names (product names) for XMTrading’s crude oil (OIL) spot CFDs and futures CFDs are different, as shown below. Crude oil spot CFDs have “Cash” added to the end of the symbol name. Crude oil futures CFDs have the “expiration month (month/year)” added to the end of the symbol name, such as “JUN23 .” Futures CFDs are contract month transactions, and have different trading periods than spot CFDs, which have no contract month, so please be careful not to make a mistake when selecting a product.

-

Crude Oil CFD Product (Spot)

-

Crude Oil CFDs (Futures)

Crude oil spot CFDs can only be traded on MT5

XMTrading’s crude oil (OIL) products can be traded on all platforms: the installed version of MT4/MT5, the XMTrading app, and XM WebTrader. However, please note that crude oil spot CFD products are only available on MT5 and cannot be traded on MT4. Crude oil futures CFD products can be traded on all platforms, both MT4 and MT5.

When hedging, the required margin is 50%

Please note that the required margin for hedging with XMTrading’s crude oil (OIL) products is 50%. At XM, the required margin for hedging positions is zero for FX currency pairs, gold, and silver, so you can open an opposite position even if your margin maintenance rate is less than 100%. However, for CFD products other than gold and silver, including crude oil, the required margin for hedging is 50%. When opening an opposite position, please make sure that your available margin is equal to or greater than the required margin.

XM Hedging

XMTrading only allows hedging within the same XM account. However, please note that hedging across multiple accounts, including accounts with other companies, is prohibited. Hedging refers to holding both a buy and a sell position in the same stock at the same time. This is a trading method that is used for long-term trades aimed at swap points, or when you want to limit losses while aiming to take advantage of price gains when a major trend occurs.

Crude oil is subject to fixed leverage

Please note that XM crude oil (OIL) is subject to fixed leverage. XM allows you to use a maximum leverage of 1,000x, but for crude oil products, a fixed leverage set for each product is applied. The leverage for crude oil spot CFDs is 200x for all three products, while the leverage for crude oil futures CFDs is 66.7x or 33.3x, with different leverage settings depending on the product. In addition, XM crude oil products are not subject to leverage restrictions based on the equity balance. Therefore, you can trade at the fixed leverage set for each product without worrying about fluctuations in margin.

-

What is the margin requirement for long-end trading of XM Energy CFD (Crude Oil)?

When trading XM’s energy CFDs, including crude oil (OIL), margin is required for only one of the buy or sell orders. Please note that the required margin cannot be zero for CFD products other than gold and silver, including crude oil (OIL).

read more

2023.04.26

-

Where can I check the contract months for XM Energy Futures CFDs (Crude Oil)?

The contract months for XM’s energy futures CFDs, including crude oil (OIL), can be found on the XM official website or in the MT4/MT5 specifications. On the XM official website, you can check details about contract month trading, such as the trading start date, settlement only, and expiration date, in the “Available Trades” tab under “XM Energy.”

read more

2023.04.26

-

Are there any contract months for XM Energy CFDs (Crude Oil) trading?

Yes, XM’s energy futures CFDs, including crude oil (OIL), have expiration dates. The contract month trading period for crude oil (OIL) is generally approximately one month. If you hold a position until the expiration date, it will be automatically settled, so please check the schedule up to the expiration date in advance when trading.

read more

2023.04.26

-

What is the margin required per lot for XM Energy CFDs (Crude Oil)?

The required margin per lot for crude oil (OIL), which is classified as an XM Energy CFD, can be calculated as “1 lot (number of lots) x contract size x opening price / leverage.” Please note that contract size and minimum/maximum trading size differ depending on the product, so please check the “Specifications” for MT4/MT5.

read more

2023.04.26

-

What are XM’s Energy CFD (Crude Oil) trading hours?

Crude oil (OIL), which is classified as an energy CFD at XM, is available for trading 24 hours a day, excluding weekends and maintenance times. However, please note that energy (crude oil) futures CFDs have contract months, and new orders are accepted from the trading start date until two business days before the expiration date.

read more

2023.04.26