XM’s Zero Cut System

XM’s Zero Cut System

XMTrading uses a ‘zero cut’ (negative balance protection) system, which means clients are not required to make additional margin payments even if sudden market fluctuations cause losses that exceed the funds in their trading account. This ensures that clients can trade with confidence, knowing they will never lose more than their deposited amount.

Since the zero cut system is not offered by FX brokers in Japan, it is one of the key advantages of trading with XM as an overseas broker.

![]()

At XM, our no-margin-call ‘zero cut system’ protects clients from the risk of losing more than their deposited funds

XM’s ‘Zero Cut System’ ensures that if a loss cut (forced settlement) cannot be executed in time due to sudden market fluctuations, and the loss exceeds the available margin in the account, XM will cover the loss and reset the negative balance to zero.

Margin call and stop loss

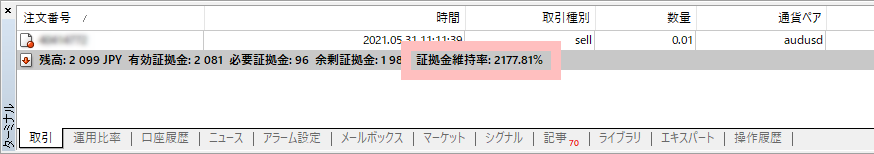

XM actively monitors your trading and provides early warnings to help manage customer risk. Typically, a ‘margin call’ is issued when your account’s margin maintenance ratio falls below 50%, alerting you to a decrease in available margin. If the ratio drops below 20%, a ‘loss cut’ (forced liquidation) is triggered to minimize losses and prevent them from exceeding your deposited funds. In rare cases of sudden market fluctuations, a loss cut may not occur in time, potentially resulting in losses that exceed your deposit. To protect clients in such situations, XM’s Zero Cut System automatically resets any negative balance to zero, ensuring you can trade with confidence.

| Margin Call | Stop loss |

| Triggered when margin maintenance rate falls below 50% | Triggered when margin maintenance rate falls below 20% |

| Margin Call |

| Triggered when margin maintenance rate falls below 50% |

| Stop loss |

| Triggered when margin maintenance rate falls below 20% |

What are margin calls and stop-loss orders?

At XM, margin calls and stop-losses (forced liquidations) are triggered based on the margin maintenance rate—the ratio of your net assets to the required position margin. A margin call occurs when this rate falls below 50%, alerting you that your available margin is decreasing. A stop-loss is triggered when the rate drops below 20%, forcing liquidation to prevent losses from exceeding your deposited funds. XM sends notification emails to your registered email address to inform you of both events.

After a margin call is triggered, you can avoid a stop-loss by depositing additional funds to increase your margin maintenance ratio. However, in rapidly moving markets, the time between a margin call and a stop-loss may be very short. To reduce the risk of triggering a margin call or stop-loss, it is recommended to maintain a high margin maintenance ratio.

You can view your margin maintenance rate in the ‘Trading’ tab of the terminal window (or the Toolbox window in MT5) on your MetaTrader 4 (MT4) or MetaTrader 5 (MT5) trading platform.

Why does XM use the Zero Cut System?

If the foreign exchange market experiences larger-than-expected fluctuations due to global economic trends or various domestic and international news, a stop-loss (forced liquidation) may not be executed in time, potentially resulting in a negative account balance.

At domestic FX brokers in Japan, where negative balance protection (zero cut) is not allowed by law, customers with a negative account balance are required to pay margin calls—meaning they must deposit additional funds if their account falls below zero—exposing them to the risk of significant, unexpected debt. In contrast, many overseas FX brokers, including XMTrading, have adopted a Zero Cut System to protect clients from such losses. Under this system, the broker covers any negative balance, so customers are never required to pay margin calls, limiting their potential loss to the amount they originally deposited.

XM employs a Zero Cut System to ensure that traders cannot lose more than their deposited funds, offering a safe and secure trading environment. Take advantage of XM’s high leverage of up to 1,000x to trade boldly and confidently.

How XM’s Zero Cut System Operates

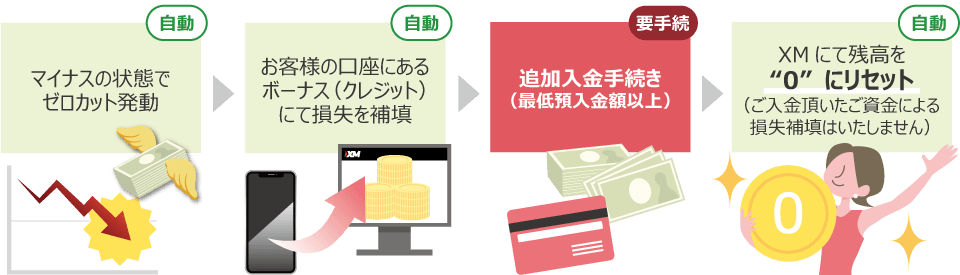

XM’s Zero Cut System resets your account balance to zero if your equity becomes negative due to a forced liquidation, even if an additional deposit has been made. If your account includes a bonus (credit) balance, XM will apply the Zero Cut System to cover any remaining losses after the bonus has been used, ensuring your balance never falls below zero.

Applicable to all account types: Standard Account, Micro Account, KIWAMI Goku Account, and Zero Account.

XM’s Zero Cut System is available for all account types: Standard Account, Micro Account, KIWAMI Goku Account, and Zero Account. Customers are never required to make margin calls, whether trading with high leverage of up to 1,000x on the Standard, Micro, or KIWAMI Goku Accounts, or taking advantage of the tight spreads offered by the Zero Account. This system allows you to trade while effectively managing risk across all account types.

Supports all FX currency pairs, precious metals, stocks, stock indices, commodities, energy products, and virtual currencies.

XM’s Zero Cut System applies to all seven trading products offered by XM: FX (55 pairs), precious metals (7), stocks (1,313), stock indices (31), commodities (8), energy (8), and cryptocurrencies (58). With XM, you can trade safely—not only FX currency pairs but also CFDs—without the risk of margin calls.

No prior registration or application is necessary.

At XM, if the conditions for the Zero Cut System are met, any negative balance will be automatically reset to zero when additional funds are deposited into your trading account. There is no need to pre-register or apply for Zero Cut execution after a stop-loss has been triggered. XM will automatically apply the Zero Cut upon your deposit, so please wait for your negative balance to be reset.

XM’s Zero Cut System is subject to certain rules. Please review these rules before trading to ensure you understand how the system works.

The Zero Cut System does not apply if your available margin is positive.

XMTrading’s Zero Cut System, which resets a negative balance to zero, does not apply if your account balance is negative but your available margin remains positive. Available margin includes your account balance, any bonuses (credits), and unrealized gains or losses on open positions. If your available margin is positive, you can continue trading, so the conditions for Zero Cut execution are not met.

Equity = Balance + Bonus (Credit) ± Unrealized P&L (Open Positions)

When equity is positive due to bonuses (credits)

XM’s Zero Cut System is triggered only when equity is negative. Therefore, if your equity is positive due to a bonus (credit), the Zero Cut will not be applied.

For example, if your account balance is -50,000 yen but you have a bonus (credit) balance of 100,000 yen, your available margin would be 50,000 yen. Since your available margin is zero or positive and you can continue trading, the Zero Cut System would not be applied.

If you hold a position with unrealized gains

Even if your account balance is negative, if you have unrealized profits from other open positions in the same account and your available margin is positive, those profits would be sufficient to cover the negative balance if you were to close your positions immediately. In this case, the Zero Cut System would not be applied.

For example, if your account balance is -50,000 yen, but the total value of your open positions A and B is 100,000 yen (A: 120,000 yen, B: -20,000 yen), your available margin would be 50,000 yen. Since your available margin is zero or positive, allowing you to continue trading, the Zero Cut System would not be applied.

No upper limit on the Zero Cut amount

XM’s Zero Cut System does not impose any limits on the amount covered. If the conditions for Zero Cut execution are met, XM will cover the entire negative balance, regardless of the loss amount. This allows you to trade with confidence, even when using high leverage of up to 1,000x.

No limit on the number of Zero Cut executions

XMTrading does not limit the number of times the Zero Cut System can be applied. Even if multiple loss cuts occur, as long as your available margin is negative and the conditions for Zero Cut execution are met, the system will be applied. You can trade with confidence knowing this protection is always in place.

Zero Cut is applied on a per-account basis.

XM’s Zero Cut System is triggered when an account’s balance becomes negative and is executed on accounts with negative equity. Even if you have multiple accounts with positive equity under the same name, XM will not transfer funds between accounts to cover losses. Zero Cut protection is applied on an individual account basis, not across multiple accounts.

If the account is involved in any prohibited activities, the Zero Cut System will not apply.

XMTrading’s Zero Cut System is designed to provide a safe trading environment for customers. However, if it is determined that you are abusing the system—such as by engaging in cross-account hedging or hedging between XM and another broker—the Zero Cut will not apply, even if losses exceed your deposited funds. Additionally, the Zero Cut will not be applied in cases of prohibited activities or violations of the Terms of Service, including arbitrage trading or fraudulent acquisition of XMP or bonuses.

XMTrading’s Zero Cut System can immediately reset your account’s negative equity when an additional deposit above the minimum deposit amount is made, XMP (XM Points) are exchanged for cash (USD), or funds are transferred between accounts. Please note that XMP bonus exchanges to Zero Cut–eligible accounts do not count as additional deposits. If you exchange XMP for a bonus into a Zero Cut–eligible account with no open positions, the bonus will first offset the negative balance. Any remaining negative balance not covered by the bonus can then be addressed with an additional deposit using one of the methods above, at which point the Zero Cut will be applied immediately.

| Zero cut execution conditions | Timing of zero cut execution |

| Adding more money to your account | Immediate reflection |

| Exchange XM Points (XMP) for cash | |

| Transferring funds from other XM accounts |

Zero cut execution conditions and execution timing

| Execution conditions | timing |

| Adding more money to your account | Immediate reflection |

| Exchange XM points for cash | |

| Transferring funds from other XM accounts |

-

In principle, XM’s Zero Cut System is triggered when you make an additional deposit. However, if you do not hold any open positions, the XM system may automatically reset your negative balance to zero even without a deposit. Please note that the timing of this automatic execution is irregular. To ensure the Zero Cut is applied immediately, it is recommended to make an additional deposit.

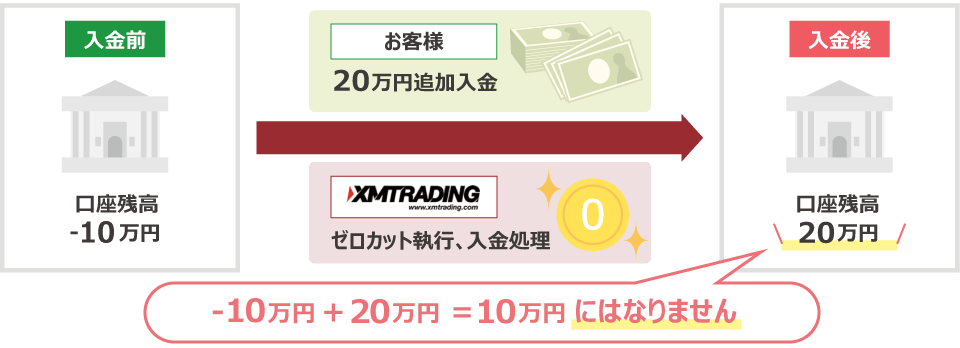

When you make an additional deposit into an account eligible for the Zero Cut System, the deposit will not be used to cover existing losses. Once the deposit is made, XM will verify that the account qualifies for Zero Cut and execute the reset. After your negative balance is reset to zero, the additional deposit will be processed, and the full amount will be reflected in your account balance.

XMTrading’s Zero Cut System prioritizes covering losses using any available bonus balance in an account eligible for Zero Cut.

If your bonus balance is exhausted and your losses are still not fully covered, the Zero Cut will be executed. However, if your account balance reaches zero due to the bonus covering the loss, the Zero Cut will not be applied. If no bonus balance is available at the time of Zero Cut execution, XM will cover the entire negative equity amount.

Example of Zero Cut Execution with a Bonus (Credit) Balance

If a loss of -100,000 yen occurs due to a loss cut and you have a bonus (credit) balance of 50,000 yen, your effective margin will be -50,000 yen. When the Zero Cut is executed, the bonus will first be applied to cover part of the loss, and the remaining -50,000 yen will be reset to zero.

-

Negative balance occurs

-

-100,000 yenAccount balance:

-

50,000 yenBonus (credit):

-

-50,000 yenEffective margin:

-

-

Negative balance will be deducted from your bonus (credit)

Bonus offset

-

-50,000 yenAccount balance:

-

0 yenBonus (credit):

-

-50,000 yenEffective margin:

-

-

If a negative balance remains after the bonus is offset, “zero cut” will be applied.

Applying zero cutoff

-

0 yenAccount balance:

-

0 yenBonus (credit):

-

0 yenEligible margin:

-

Example of Zero Cut Execution Without a Bonus (Credit) Balance

If a loss of -100,000 yen occurs due to a loss cut and there is no bonus (credit) balance in the account, the effective margin will be -100,000 yen. When the Zero Cut is executed, the entire negative balance of -100,000 yen will be reset to zero.

-

Negative balance occurs

-

-100,000 yenAccount balance:

-

0 yenBonus (credit):

-

-100,000 yenEffective margin:

-

-

If there is no bonus balance,

the entire negative balance will be “zero cut”Applying zero cutoff

-

0 yenAccount balance:

-

0 yenBonus (credit):

-

0 yenEligible margin:

-

-

Can I make a deposit before XM’s Zero Cut is applied?

Yes, XM allows you to deposit funds before the Zero Cut process is applied. If you make an additional deposit while your account balance is negative, the Zero Cut System will be executed first, resetting your balance to zero, and then your deposited funds will be reflected in your account. This ensures that your deposit will not be used to cover the negative balance, allowing you to add funds with peace of mind.

read more

2021.05.21

-

When is XM’s Zero Cut applied to my account?

At XM, as a general rule, if the conditions for the Zero Cut System are met, your negative balance will be reset to zero when you make an additional deposit, transfer funds between accounts, or exchange XM Points (XMP) for cash (USD). Please note, however, that if you exchange XMP for a bonus, the bonus will first be used to offset the negative balance.

read more

2021.05.21

-

Does XM’s Zero Cut System apply to all account types?

Yes, XM’s Zero Cut System applies to all account types: Standard Account, Micro Account, KIWAMI Goku Account, and Zero Account. There is no need to set up the system manually—it is automatically applied to any account that meets the conditions when an additional deposit is made. There is also no limit to the number of times the Zero Cut can be applied, allowing you to trade with peace of mind.

read more

2021.05.21

-

What happens to my bonus if my XM account undergoes a Zero Cut?

XM’s Zero Cut System first uses your bonus to offset any negative balance in your account, then resets any remaining losses to zero. If your bonus exceeds the negative balance, the remaining bonus will stay in your account as credit. Please note that the Zero Cut System is not applied if your equity is positive.

read more

2021.05.21

-

Even though my XM account balance is negative, the Zero Cut has not been applied.

At XM, even if your account balance is negative, the Zero Cut System will not be applied if your equity is positive. Your account will only be reset to zero when losses exceed your equity and your equity becomes negative. The Zero Cut System is executed automatically when you make an additional deposit.”

read more

2021.05.21