XM’s minimum and maximum lot size (lot calculation method)

XM’s minimum and maximum lot size (lot calculation method)

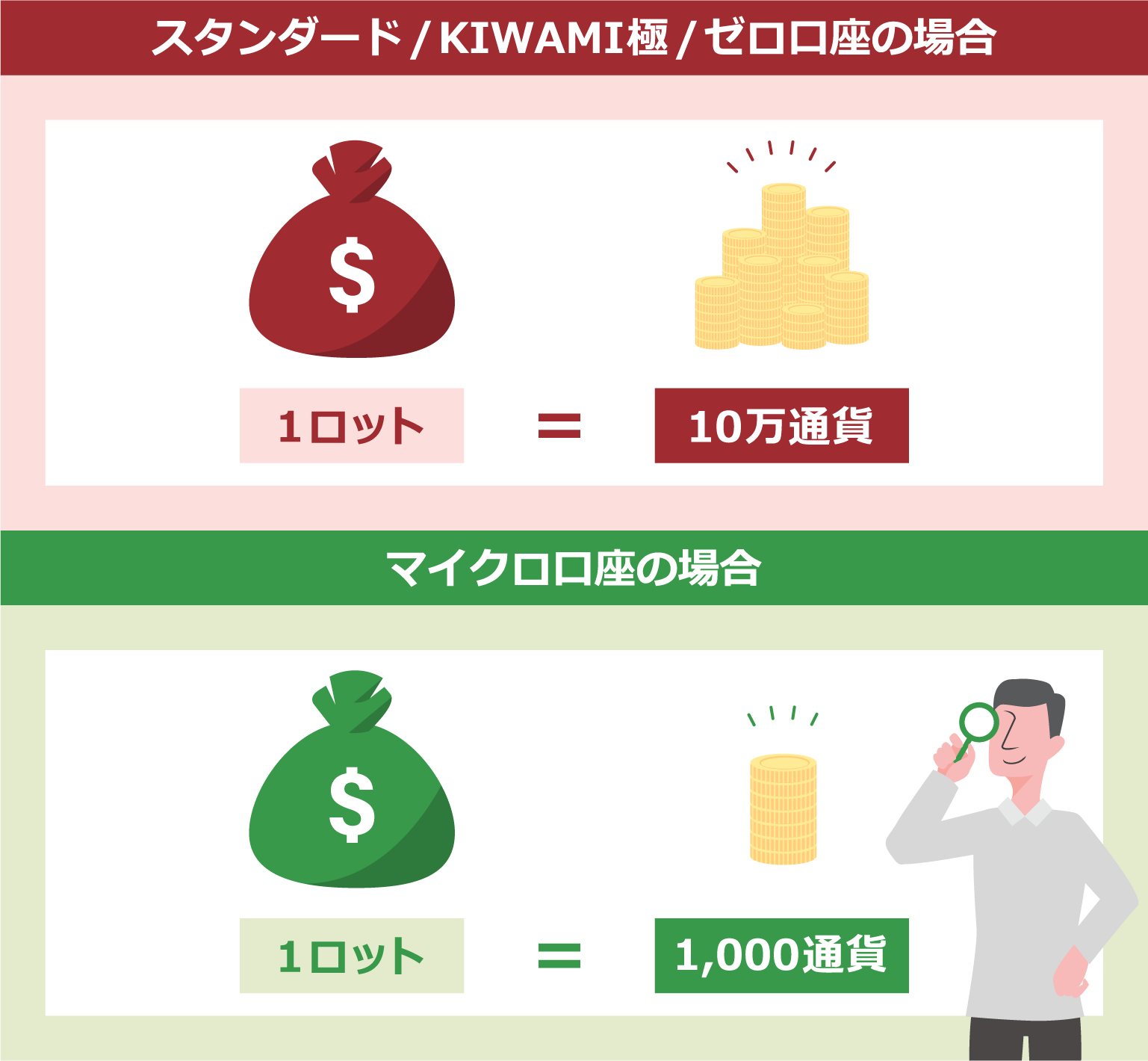

At XM, orders are placed in units of currency amounts called “lots.” XM’s Standard Account, KIWAMI Account, and Zero Account allow trading at 1 lot = 100,000 currency units, while Micro Accounts allow trading at 1/100th the size, at 1,000 currency units. Please note that the value per lot and the minimum and maximum lot sizes vary depending on the stock, so please check before trading. Furthermore, trading lot size affects margin, so it is important to adjust it to your own risk tolerance.

XM’s minimum and maximum lot size (lot calculation method)

At XMTrading, the unit of currency volume is “lot.” Please check the explanation of lot and enjoy trading with the appropriate trading volume.

What is a lot?

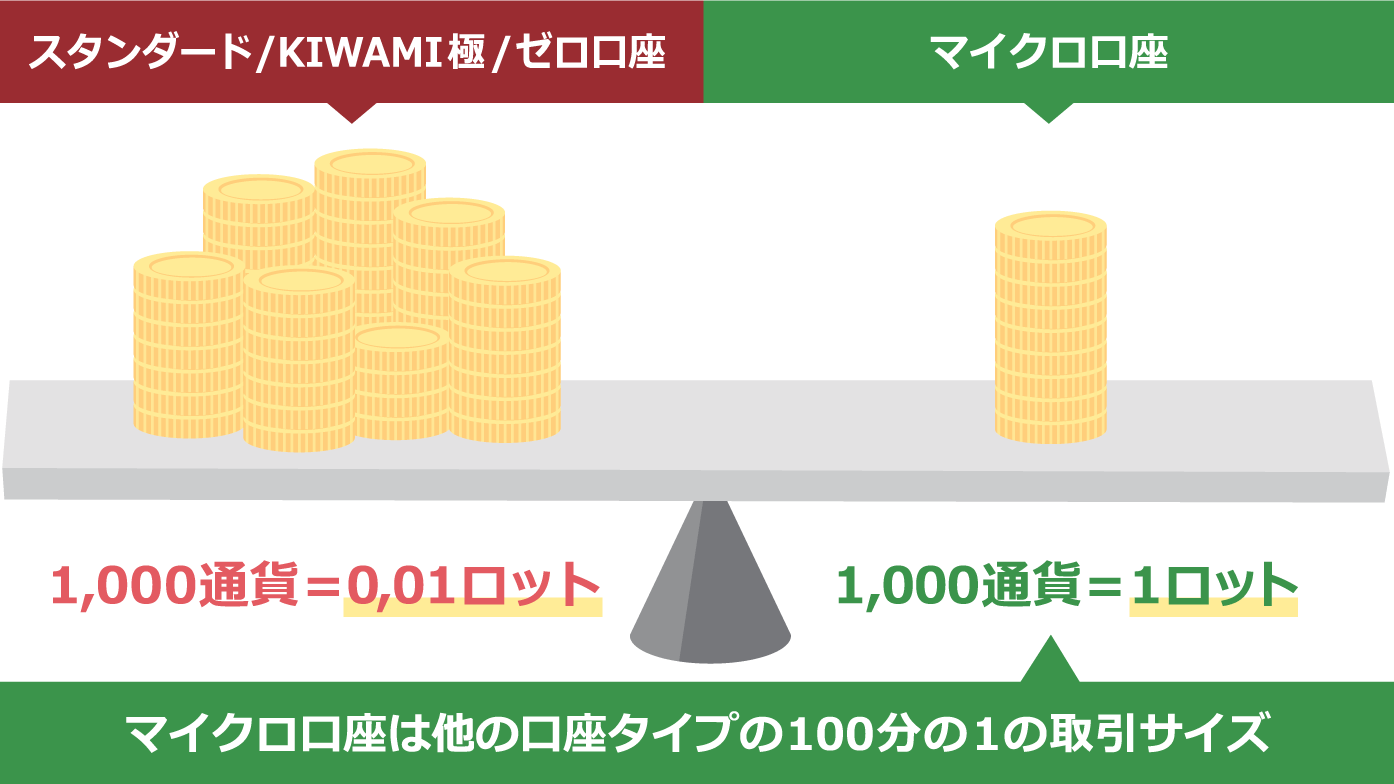

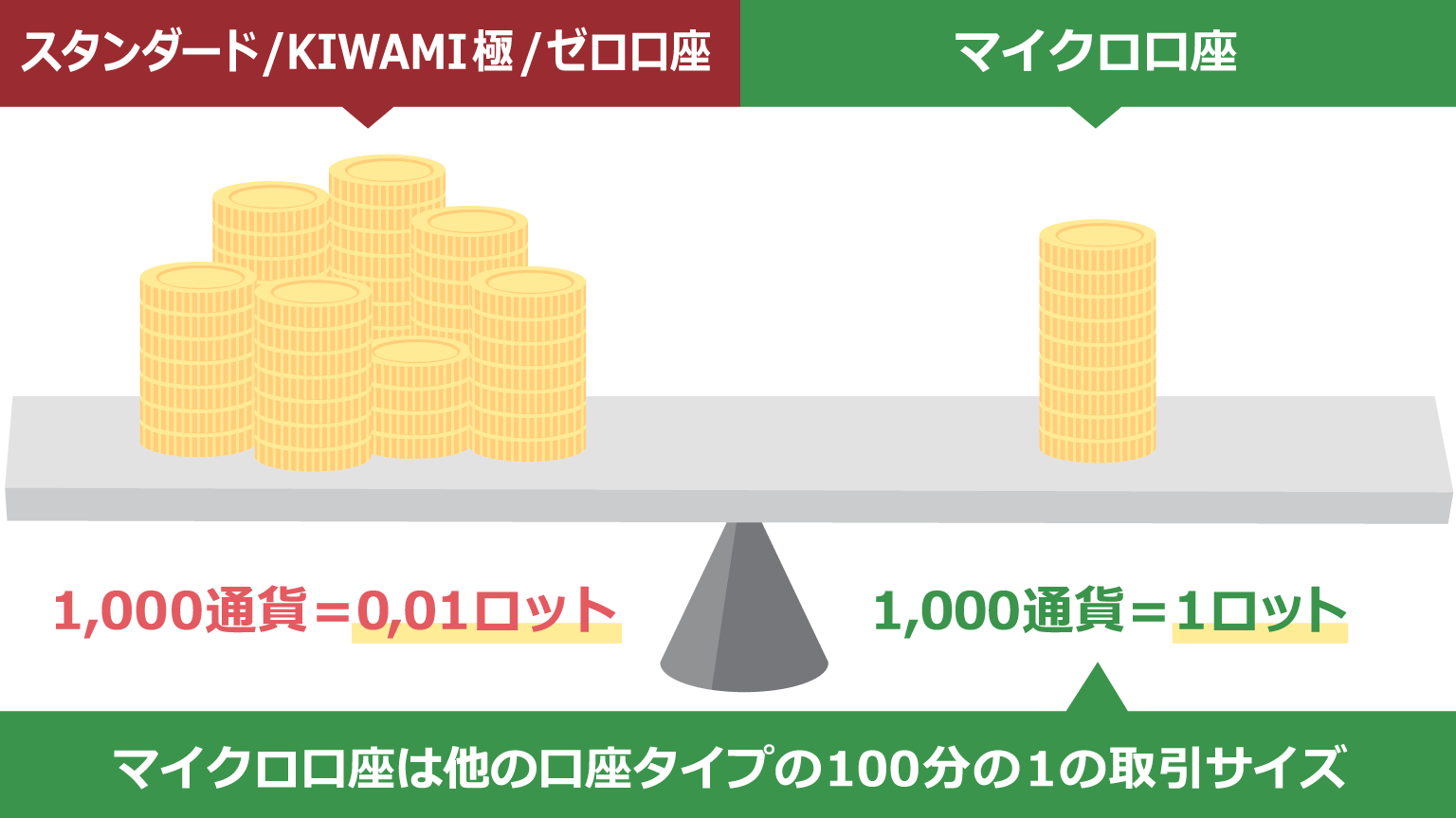

A “lot” refers to the unit of currency volume used in FX trading. Orders are placed in “lots,” not units such as 10,000 units. XM’s Standard, KIWAMI, and Zero accounts are set at 1 lot = 100,000 units , and many FX brokers also set this amount. For example, trading 1 lot of USD/JPY is equivalent to trading $100,000. XM’s Micro account is set at 1 lot = 1,000 units, allowing you to trade at 1/100th the size of other account types . Smaller lot sizes allow for lower risk with less margin, while larger lot sizes allow for higher risk and higher returns.

Relationship between XM lot size and margin

At XMTrading, there is a close relationship between lot size and margin; if the lot size is small, the margin decreases, and if the lot size is large, the margin increases . For example, if you need a margin of $100,000 to trade one lot, trading two lots will require a margin of $200,000. As such, as the lot size increases, the margin also increases accordingly, so the trading lot size is very important in capital management.

Furthermore, the required margin is also related to leverage; the higher the leverage, the larger the trades you can make with a smaller amount of capital. XM offers a maximum recommended leverage of 1,000x for all traders. Enjoy trading by adjusting the number of lots and leverage to suit your own capital and risk tolerance. When trading USDJPY (US Dollar/Japanese Yen) with 1,000x leverage using an XM Standard account, the margin required for each lot size is as follows:

Margin required for each lot (USD/JPY = 156 yen, leverage 1,000x)

| Trading volume | amount of currency | Margin Requirements |

| 0.01 lot | 1,000 currencies | 156 yen |

| 0.1 lot | 10,000 currency | 1,560 yen |

| 1 lot | 100,000 currency | 15,600 yen |

| 10 lots | 1 million currency | 1,560,000 yen |

This is the required margin when 1 lot = 100,000 units.

Click here for details on the required margin for each leverage at XM

Furthermore, we provide a “Margin Calculator” for XM’s FX currency pairs. By using XM’s margin calculator, manual calculations are no longer necessary, and anyone can easily calculate the required margin.

How to use XM’s margin calculator

The difference between XM’s maximum lot size and maximum position size

XMTrading imposes limits on the number of lots, which represent the amount of currency, and the number of positions, which represent the number of orders (including reserved orders). The minimum and maximum lot sizes vary depending on the account type, but the maximum number of positions that can be held is 200 for all account types. For example, if you place a buy order for 10 lots of USD/JPY (US Dollar/Yen), this will be counted as “10 lots” and “1 position.” The maximum lot size is counted for each position, but the maximum position size is the total number of positions in the account, so please be careful when trading with multiple accounts.

At XMTrading, the amount of currency per lot and the minimum and maximum lot sizes vary depending on the account type. The required margin and the amount of profit you can earn will vary depending on the trading volume per lot, so please check the minimum and maximum lot sizes for each account type in advance.

Transaction size for Standard Account, KIWAMI Account, and Zero Account

The currency amount per lot for XMTrading’s Standard Account, KIWAMI Account, and Zero Account is set at 100,000 units. The minimum lot size per position for these three account types is set at 0.01 lots (1,000 units) , so you can reduce your trading volume to 1/100th of the original amount when you want to reduce risk. The maximum lot size is set at 50 lots per position, so there is no need to worry about incurring losses due to setting an excessive lot size.

Please note that the maximum lot number is counted per position, but the maximum number of positions per account is limited to 200, so please be careful if you hold multiple positions.The Standard Account, KIWAMI Goku Account, and Zero Account, which allow trading with a minimum of 0.01 lots and a maximum of 50 lots, are very user-friendly account types, allowing you to trade dynamically from small amounts.

Transaction size for Standard/KIWAMI/Zero accounts

Trading volume per lot |

100,000 currency

|

|---|---|

| Minimum lot size |

0.01 lot

|

| Maximum lot size |

50 lots

|

-

Please note that the Zero Account has a maximum leverage of 500x, unlike the Standard/Micro/KIWAMI Accounts, which have a maximum leverage of 1,000x.

Micro accounts can trade as few as 10 currencies

XMTrading’s Micro account is the only account type with a currency amount set at 1,000 units per lot. The minimum lot size per position for a Micro account varies depending on the trading platform, with 0.01 lots (10 units) for MT4 and 0.1 lots (100 units) for MT5 . MT4 Micro accounts allow for very small trade sizes, 1/100th of those for other account types, making it possible to trade with small amounts of capital. Forex beginners who want to try trading with an XM real account should choose the Micro account.

Furthermore, like other accounts, Micro accounts can hold up to 200 positions. The maximum lot size for Micro accounts is set at 100 lots, so in terms of lot size alone, you can order larger lots than Standard accounts, KIWAMI accounts, and Zero accounts.

Micro Account Trade Size

| Trading volume per lot |

1,000 currencies

|

|---|---|

| Minimum lot size |

MT4: 0.01 lot

|

| Maximum lot size |

100 lots

|

Learn more about XM Micro Accounts

XMTrading’s FX currency pairs are set at 100,000 units per lot (1,000 units for micro accounts), but the currency units and amounts for other CFD products vary by product. If you are trading CFD products, please check the currency units and amounts per lot for each product in advance.

XM FX currency pair 1 lot trading volume

At XMTrading, you can trade popular FX currency pairs at 100,000 units per lot (1,000 units for micro accounts). Since the left side of the FX currency pair notation is the base currency, the trading volume unit also depends on the left side of the currency pair. For example, the trading volume of one lot of the US Dollar/Japanese Yen (USD/JPY) is $100,000.

XM FX currency pair list

| Brand | Trading volume of 1 lot |

| FX Currency Pairs | 100,000 currency |

Click here for details on XM FX currency pair products

XM Precious Metals CFD 1 Lot Trading Volume

XMTrading offers both spot and futures trading of precious metals CFDs. Precious metals CFDs are measured in troy ounces (oz), and the trading volume of one lot varies depending on the product, so please check before trading.

XM Precious Metals CFD List

| Brand | Trading volume of 1 lot |

| GOLD | 1 oz |

| SILVER | 50 oz |

| XAUEUR (Gold/Euro) | 1 oz |

What is a troy ounce (oz)?

The troy ounce (oz) is a unit used to measure the weight of precious metals, with one troy ounce equaling approximately 31.1 grams. It can be used in precious metal transactions and calculations, and is traded based on the price per troy ounce (oz) in US dollars.

XM Stock CFD 1 lot trading volume

For XMTrading stock CFDs, the trading volume for many stocks is set at 1 lot = 10 shares. However, the trading volume for 1 lot of the following stocks is set at 100 shares, so please check before trading.

Aviva, BAESystems, BP, BTGroup, Barclays, Barratt, Burberry, Easyjet, GSK, HSBC, LSE, Legal&Gen, Lloyds, ManGroup, Marks&Spe n, 3iGroup, NatWest, Next, Prudential, Rolls-Royce, Sainsbury, StdCharter, Tesco, Unilever, Vodafone, Flutter Entertainment

もっと見る閉じる

XM Stock Index CFD 1 Lot Trading Volume

At XMTrading, the trading volume for stock index CFDs is set at 1 lot = 1 Index Unit, regardless of whether it is spot or futures. For example, the contract size for the Nikkei 225 (JP225) is 1 Japan 225 index, and for the US100 it is 1 US 100 index. However, please note that for USDX (Dollar Index), 1 lot = 10 US Dollar Index Units.

XM Stock Index CFD List

| Brand | Trading volume of 1 lot |

| Stock index CFDs (spot/futures) |

1 Index Unit |

| USDX (US Dollar Index) |

10 Index Units |

XM Energy CFD 1 lot trading volume

With XMTrading’s Energy CFDs, the trading volume for one lot varies for each product. Energy CFDs are available in both spot and futures, and the trading volume for one lot of the same product is set to the same size regardless of whether it is spot or futures. Please check the trading volume for each product before trading.

XM Energy CFDs List

| Brand | Trading volume of 1 lot |

| BRENTCASH (Brent Oil Spot) | 100 Barrels |

| NGASCASH (spot natural gas) | 1,000 MMBtu |

| OILCASH (WTI crude oil spot) | 100 Barrels |

XM Commodity CFD 1 Lot Trading Volume

For XMTrading commodity CFDs, the trading volume for 1 lot varies for each product. Please check the trading volume for each product before trading.

XM Commodity CFD List

| Brand | Trading volume of 1 lot |

| COCOA (US Cocoa) | 1 Metric Ton |

| COFFE (US coffee) | 10,000 LBS |

| CORN (US corn) | 400 Bushels |

Learn more about XM Commodity CFDs

XM Thematic Index CFD 1 Lot Trading Volume

At XMTrading, the trading volume for all Thematic Index CFDs is set at 1 lot = 1 Index Unit. The base currency for all Thematic Index CFDs is USD, and the trading volume for 1 lot is 1 US index.

XM Thematic Index CFDs

| Brand | Trading volume of 1 lot |

| Thematic Index CFDs | 1 Index Unit |

Learn more about XM’s Thematic Index CFDs

XM Cryptocurrency CFD 1 lot trading volume

With XMTrading’s cryptocurrency CFDs, the trading volume per lot varies depending on the product. Specifically, the trading volume per lot for popular cryptocurrency CFDs such as Bitcoin (BTC) and Ethereum (ETH) is one currency, and cryptocurrency CFDs with lower circulation tend to have higher trading volumes. Even for the same 1 lot, the trading volume varies depending on the product, so please check before trading.

XM Cryptocurrency CFD List

| Brand | Trading volume of 1 lot |

| 1INCHUSD (1INCH Network/USD) | 10,000 tokens |

| AAVEUSD (Aave/USD) | 10 Aave |

| ADAUSD (Cardano/USD) | 1,000 Cardano |

At XMTrading, the currency amount per lot is 100,000 units, and you can use the lot to calculate the required margin and profit/loss per 1 pip. For detailed calculation methods, please refer to the formula below.

XM Margin calculation formula per lot (FX currency pair)

XMTrading allows you to calculate the required margin based on the currency amount and the exchange rate of the trading instrument. The calculation method for the required margin for FX currency pairs is as follows:

Required margin

= Trading volume ÷ Leverage × Current rate (*)

Prices are constantly changing.

For example, if you trade 1 lot (100,000 units) with 1,000x leverage when USDJPY (US Dollar/Japanese Yen) is 156 yen in an XM standard account, you can calculate the required margin using the following formula.

100,000 units x 156 yen ÷ 1,000 times

= 15,600 yen

XM Margin calculation formula per lot (CFD products)

Please note that the trading volume of 1 lot of XMTrading CFD products varies depending on the product, so please be careful when calculating the required margin. The calculation method for the required margin for CFD products is as follows.

Required margin

= number of lots x trading volume x opening price (*) ÷ leverage

Prices are constantly changing.

Furthermore, for XM’s FX currency pairs, gold, and silver, you can easily calculate the required margin by using the “XM Margin Calculator.”

How to calculate profit and loss for 1 pip at XM

XMTrading’s spreads are expressed in units called “pips,” which represent the smallest unit of price movement. The value of a pip varies depending on the settlement currency displayed to the right of the FX currency pair; if the settlement currency is the yen, the spread is equivalent to 0.01 yen, and if the settlement currency is the US dollar, the spread is equivalent to 0.01 cents. The profit and loss calculation for 1 pip is as follows:

Price of 1 pips

= Trading volume × Minimum unit of currency pair

For example, if you trade 1 lot (100,000 units) of USDJPY (US Dollar/Japanese Yen) with an XM Standard account, you can calculate the price of 1 pip using the following formula.

100,000 units x 0.01 yen

= 1,000 yen

In other words, a 1 pip movement will result in a profit or loss of 1,000 yen. The smaller the lot size, the smaller the price per pip, and conversely, the larger the lot size, the larger the price per pip, allowing you to enjoy high-risk, high-return trading. Please adjust the lot size wisely and enjoy trading within your reasonable limits.

In addition, XM provides a pips calculator that can automatically calculate the value of the spread, so please feel free to use it.

At XM, adjusting the lot size is extremely important for asset management. The size of the lot size affects the margin, and the size of the lot also affects the size of the trade risk. Learn how to adjust the appropriate lot size so that you can trade while minimizing trading losses.

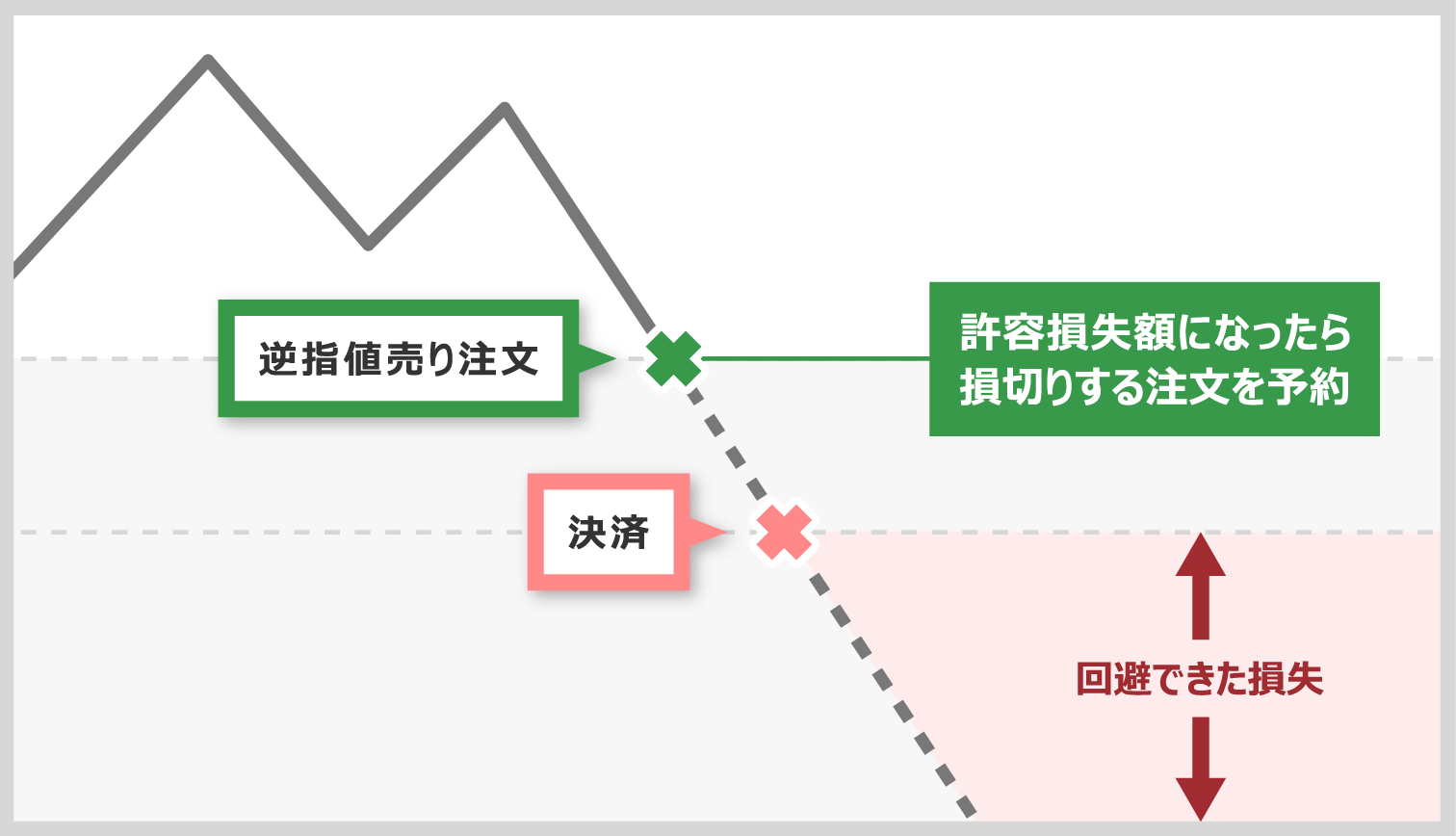

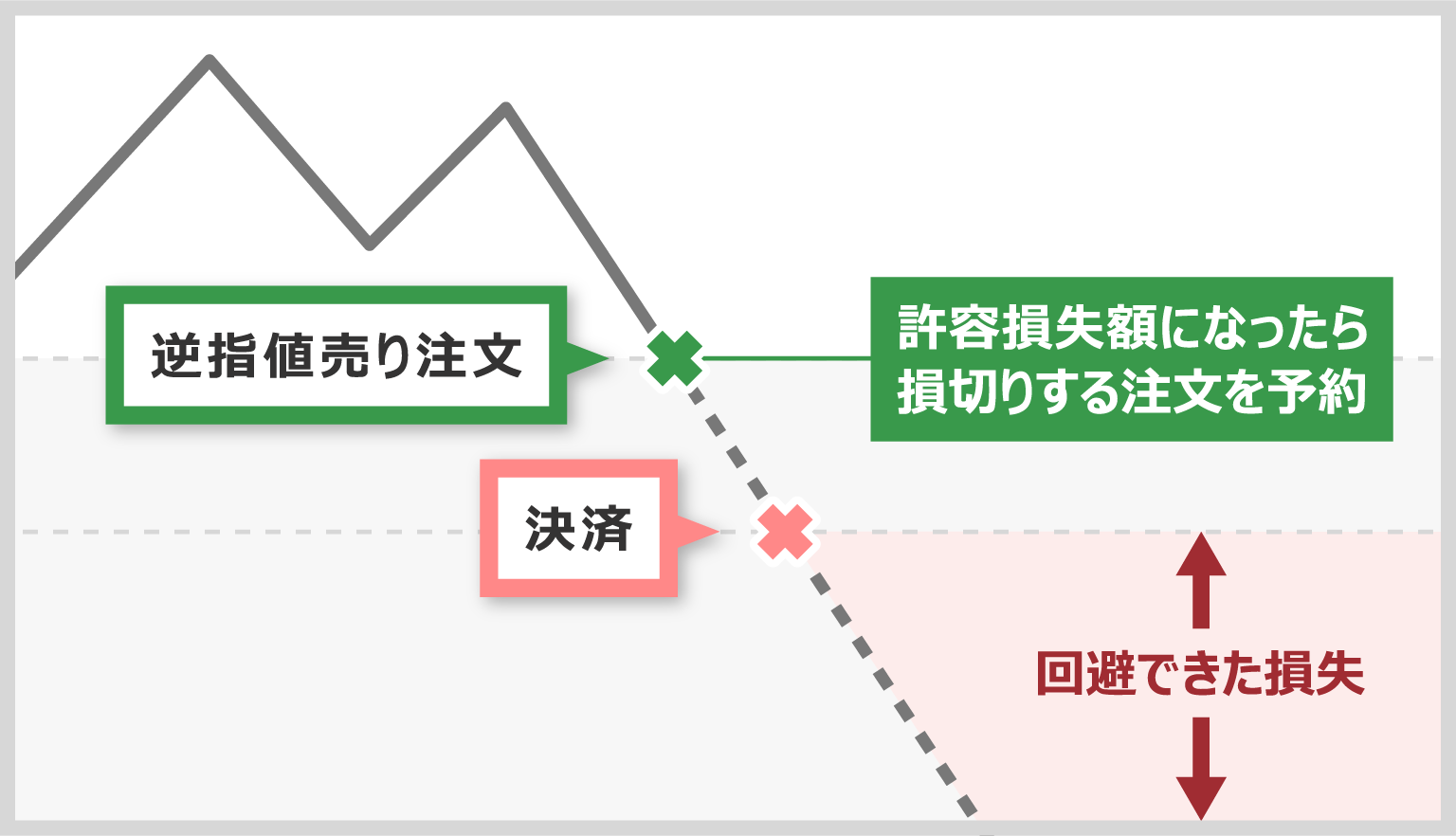

Lot number calculated backward from allowable loss amount

With XMTrading, you can minimize risk by determining your acceptable loss amount before trading and placing a stop-loss order at a point that will not exceed that loss amount. By placing a stop-loss order, settlement will be carried out automatically even in the unlikely event of a sudden market fluctuation, allowing you to calmly manage risk without being swayed by emotions.

Generally, it is said that the acceptable loss amount is approximately 2% of your capital. For example, if you have 100,000 yen in hand, it is important to limit your trading losses to 2,000 yen. In other words, by placing a stop-loss order in advance at a price where your loss will be 2,000 yen, you can trade without exceeding your acceptable loss amount. However, the price range at which you place a stop-loss order will vary depending on your trading style and strategy, so please determine the number of lots that suits your trading strategy and enjoy trading within a reasonable range.

Lot size taking into account the volatility of the stock

XMTrading offers a wide range of stocks, but because trading environments such as volatility vary depending on the stock, it is not recommended to trade all with the same lot size. Typically, for stocks with high volatility, you can minimize risk by trading with a smaller lot size. Conversely, for stocks with low volatility, you can expect to make large profits even with small price movements by trading with an increased lot size. Please determine the volatility of the stock you are trading and enjoy trading with an appropriate lot size.

Lot size to suit your trading style

At XMTrading, target profit margins and price ranges up to stop-loss differ depending on your trading style, so it’s important to set an appropriate lot size when trading. For example, scalping, which involves repeated short-term trades, and swing trading, which involves long-term trades, have different trading objectives, so trading with the same lot size could result in large losses. We recommend that you check the target profit margins and stop-loss ranges that suit your respective trading style before setting your lot size.

-

What is an XM lot?

An XM lot refers to the unit of currency amount used in FX trading. Normally, in overseas FX, 1 lot is set at 100,000 units. For example, trading 1 lot of USD/JPY is equivalent to trading $100,000. In addition, for micro accounts, which can be started with a small amount of capital, 1 lot is set at 1,000 units.

read more

2025.02.13

-

How do I calculate the margin required per lot for XM?

At XM, you can calculate the required margin from the currency amount (trading volume) of the trading product, the trading price (rate), and the leverage set for your trading account (or target product).In addition, you can easily calculate the required margin for XM’s FX currency pairs, gold, and silver by using the “XM Margin Calculator.”

read more

2025.02.13

-

Do XM’s lots differ depending on the stock?

Yes, XM’s lot size varies depending on the product. XM’s FX currency pairs are set at 100,000 units per lot (1,000 units for micro accounts). The currency units and amounts for other CFD products vary by product. If you are trading CFD products, please check the currency units and amounts per lot for each product in advance.

read more

2025.02.13

-

Please tell me the minimum and maximum lot sizes for XM.

At XM, the amount of currency per lot and the minimum and maximum lot sizes vary depending on the account type. For Standard Accounts, KIWAMI Accounts, and Zero Accounts, where 1 lot = 100,000 currency units, the minimum lot size is 0.01 lots (1,000 currency units). The maximum lot size is 50 lots per position.

read more

2025.02.13

-

Does XM have different lot sizes depending on the account type?

Yes, at XM, the amount of currency per lot and the minimum and maximum lot sizes vary depending on the account type. For Standard Accounts, KIWAMI Accounts, and Zero Accounts, 1 lot = 100,000 currency, while for Micro Accounts, 1 lot = 1,000 currency. The required margin and the amount of profit you can earn also change depending on the trading volume per lot.

read more

2025.02.13