XM Cryptocurrency CFD Trading

XM Cryptocurrency CFD Trading

At XMTrading, you can trade cryptocurrency CFDs 24 hours a day, 365 days a year—including weekends and holidays. A wide range of options is available, from major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) to lesser-known niche coins, all accessible through Standard, Micro, and KIWAMI accounts. On MT5 Standard, Micro, and KIWAMI accounts, you can trade 58 cryptocurrency CFDs, while MT4 accounts of the same types offer 28.

Cryptocurrency CFDs are highly volatile, meaning they can generate significant profits but also substantial losses within a short time. To protect traders, XM uses a “zero-cut system” with no margin calls, allowing you to trade with confidence. With XM’s exclusive maximum leverage of up to 500x, you can reduce the required investment amount while benefiting from a superior trading environment, featuring an average execution rate of 99.98%.

![]()

Enjoy trading cryptocurrency CFDs in a secure and user-friendly trading environment.

XMTrading offers CFD trading on a wide variety of cryptocurrencies. Since CFD trading provides advantages not available with spot trading, we recommend reviewing the basics of cryptocurrencies and the key features of cryptocurrency CFD trading beforehand.

What is virtual currency?

Virtual currencies, also known as “crypto assets” or “cryptocurrencies,” are digital currencies used exclusively online. Unlike physical money such as coins or banknotes, virtual currencies exist only in digital form. They vary widely, ranging from currencies that can be used only on specific websites or in games to those that can be used in everyday transactions, including shopping and domestic or international remittances.

Unlike fiat currencies, virtual currencies often operate without a central administrator. To ensure the secure management of transaction history even in the absence of an administrator, virtual currencies use a technology called “blockchain,” which makes data tampering or destruction extremely difficult. Supported by this enhanced security, the virtual currency market is rapidly expanding, as major companies adopt virtual currencies for payments and more businesses and countries enter the space. Today, over 10,000 types of virtual currencies exist worldwide, and further growth is expected in the future.

Trading Conditions for XM Cryptocurrency CFDs

XM cryptocurrency CFDs are derivative products, not spot trades.

The cryptocurrencies traded on XMTrading are CFDs (Contracts for Difference), which allow you to trade solely on the profits and losses resulting from price changes between the opening and closing of a position. In CFD trading, only the profit is added to your margin if a trade is successful, and only the loss is deducted if a trade incurs a loss. Since there is no actual delivery of cryptocurrencies, you can not only “buy” to profit from price increases but also “sell” to profit from price declines. One key advantage of cryptocurrency CFD trading is that it provides more trading opportunities compared to spot trading.

However, because cryptocurrency CFDs do not involve owning the actual coins, you cannot earn rewards from staking or lending. Staking allows you to earn rewards simply by holding a cryptocurrency on its blockchain network, while lending lets you earn interest by loaning your cryptocurrency to an exchange.

At XM, you can trade cryptocurrency CFDs 365 days a year, including weekends and holidays, using Standard, Micro, and KIWAMI accounts (Zero accounts do not support cryptocurrency CFDs). Trading conditions vary across the 58 cryptocurrency CFDs offered, so be sure to review the conditions for each product before trading. All 58 products are available on MT5 Standard, Micro, and KIWAMI accounts, while MT4 Standard, Micro, and KIWAMI accounts support 28 of these products.

All XM Cryptocurrency CFDs

The complete list of cryptocurrency CFDs available on XMTrading is shown below. On both MT4 and MT5 platforms, all products can be traded with any account type and trading tools, except for the Zero account. On the MT5 platform, trading is available through Standard, Micro, and KIWAMI accounts. Cryptocurrency CFDs use a “tiered margin rate,” meaning leverage varies according to the current market price.

XM Cryptocurrency CFD List

| Brand | Margin Rate (Note 1) | Maximum Leverage | Trading Platform |

| 1INCHUSD (1INCH Network/USD) |

2% | 50 times | MT5 |

| AAVEUSD (Aave/USD) |

2% | 50 times | MT4/MT5 |

| ADAUSD (Cardano/USD) |

2% | 50 times | MT4/MT5 |

| 1INCHUSD | |

| 証拠金率(注:1) | 2% |

| 最大レバレッジ | 50倍 |

| 取引プラット フォーム |

MT5 |

| AAVEUSD | |

| 証拠金率(注:1) | 2% |

| 最大レバレッジ | 50倍 |

| 取引プラット フォーム |

MT4/MT5 |

| ADAUSD | |

| 証拠金率(注:1) | 2% |

| 最大レバレッジ | 50倍 |

| 取引プラット フォーム |

MT4/MT5 |

The criteria for tiered margin rates, based on position size, vary for each asset.

Trading Hours for XM Cryptocurrency CFDs

XM’s cryptocurrency CFDs can generally be traded 24 hours a day, 365 days a year, including weekends and holidays. This means you can trade cryptocurrency CFDs year-round, even during weekends and New Year holidays, when other products such as FX currency pairs are typically closed. However, trading hours may occasionally change depending on market conditions. Please note that, while weekend trading is available, the system undergoes maintenance for 30 minutes every Saturday—4:05 PM to 4:35 PM (winter time: 5:05 PM to 5:35 PM)—during which trading is unavailable.

XM Cryptocurrency CFD Trading Hours (Japan Time)

| Daylight Saving Time |

Trading available 24 hours a day, 7 days a week

(Saturdays only: 16:05-16:35 closing) |

|---|---|

| Winter time |

Trading available 24 hours a day, 7 days a week

(Saturdays only, closing from 17:05 to 17:35) |

-

For details on XM’s weekend trading and deposit/withdrawal rules, click here

-

Click here for instructions on depositing cryptocurrency (crypto assets) into your XM account.

-

At XM, cryptocurrency CFDs can be traded on weekends; however, trading is unavailable for 30 minutes every Saturday from 16:05 to 16:35 (winter time: 17:05 to 17:35) due to system maintenance.

Leverage for XM Cryptocurrency CFDs

XM allows cryptocurrency CFDs to be traded with leverage of up to 500x. In addition, XM uses a “tiered margin” system specifically for cryptocurrency CFDs, meaning leverage varies depending on the current market price for each order. The applied leverage (margin rate) also depends on the trading size of each product: four tiers for products with a maximum leverage of 500x, three tiers for products with a maximum leverage of 250x, and two tiers for products with a maximum leverage of 50x. As the trading size increases, the margin rate rises (i.e., leverage decreases), so it’s important to consider the appropriate margin rate (leverage) when opening a new position.

Tiered Margin Rates for XM Cryptocurrency CFDs (BTCUSD, ETHUSD)

| Transaction amount | Margin Rate | Leverage |

| $0-$1,000,000 | 0.2% | 500 times |

| $1,000,001 to $3,000,000 | 0.4% | 250 times |

| $3,000,001 to $5,000,000 | 2% | 50 times |

| Over $5,000,001 | 100% | 1x |

Target stocks

Tiered Margin Rates for XM Cryptocurrency CFDs (BTGUSD, ETHBTC)

| Transaction amount | Margin Rate | Leverage |

| $0-$300,000 | 0.2% | 500 times |

| $300,001 to $600,000 | 0.4% | 250 times |

| $600,001 to $1,000,000 | 2% | 50 times |

| Over $1,000,001 | 100% | 1x |

Target stocks

Three-Tier Margin Rates for XM Cryptocurrency CFDs

| Transaction amount | Margin Rate | Leverage |

| $0-$300,000 | 0.4% | 250 times |

| $300,001 to $600,000 | 2% | 50 times |

| Over $600,001 | 100% | 1x |

Target stocks

Two-Tier Margin Rates for XM Cryptocurrency CFDs

| Transaction amount | Margin Rate | Leverage |

| $0-$300,000 | 2% | 50 times |

| Over $300,001 | 100% | 1x |

Target stocks

1INCHUSD, AAVEUSD, ADAUSD, ALGOUSD, APEUSD, APTUSD, ARBUSD, ATOMUSD, AVAXUSD, AXSUSD, BATUSD, CHZUSD, COMPUSD, CRVUSD, DASHUSD, DOGEUSD, DOTUSD, EGLDUSD, ENJUSD, VAULTAUSD, ETCUSD, FILUSD, FLOWU SD, GRTUSD, ICPUSD, IMXUSD, LDOUSD, LINKUSD, LRCUSD, MANAUSD, MATICUUSD, NEARUSD, OPUSD, SANDUSD, SHIBUSD, SNXUSD, SOLUSD, STORJUSD, STXUSD, SUSHIUSD, UMAUSD, UNIUSD, XLMUSD, XTZUSD, ZECUSD, ZRXUSD

もっと見る閉じる

Spreads for XM Cryptocurrency CFDs

XM offers cryptocurrency CFDs with exceptionally tight spreads. While cryptocurrency CFDs are available through three account types, the KIWAMI account—featuring extremely low spreads and no trading fees—provides the lowest possible spreads. Please note, however, that spreads may widen during periods of low liquidity. For an estimate of the spreads on XM’s cryptocurrency CFDs, see “Minimum Spreads for XM Cryptocurrency CFDs.”

Margin Requirements for XM Cryptocurrency CFDs

The margin required for trading cryptocurrency CFDs on XMTrading (XM) can be calculated using the following formula:

Lots x Contract Size x Opening Price

x Required Margin Rate = Required Margin

In addition, XM’s cryptocurrency CFDs use a “tiered margin rate (leverage),” which decreases leverage as the trading amount increases. For BTCUSD (Bitcoin/US Dollar), the maximum leverage drops from 500x to 250x if the trading amount exceeds $1,000,000, and from 250x to 50x if it exceeds $3,000,000. Tiered margin rates are applied based on the size of each individual order.

Tiered Margin Rates at XM (e.g., BTCUSD)

| Transaction amount | Margin Rate | Leverage |

| $0-$1,000,000 | 0.20% | 500 times |

| $1,000,001 to $3,000,000 | 0.4% | 250 times |

| $3,000,001 to $5,000,000 | 2% | 50 times |

| Over $5,000,001 | 100% | 1x |

Assuming 1 BTC = $100,000 and 1 USD = 150 JPY, for a trading account denominated in Japanese Yen, the required margin for BTCUSD (Bitcoin/US Dollar) varies according to the number of trading lots as follows:

Margin required for trading 1 lot of BTCUSD

| Transaction amount | Tiered Margin Rates | Margin Requirements |

|---|---|---|

| $100,000 | 0.20% | 100,000 × 0.2% = 200 USD 200 USD × 150 yen = 30,000 yen |

| 取引額 | 100,000ドル |

| 段階式 証拠金率 |

0.20% |

| 必要証拠金 | 100,000 × 0.2% = 200USD 200USD × 150円 = 30,000円 |

Margin required for trading 20 lots of BTCUSD

| Transaction amount | Tiered Margin Rates | Margin Requirements |

|---|---|---|

| $2,000,000 | 0.40% | 2,000,000 × 0.4% = 8,000 USD 8,000 USD × 150 yen = 1,200,000 yen |

| 取引額 | 2,000,000ドル |

| 段階式 証拠金率 |

0.40% |

| 必要証拠金 | 2,000,000 × 0.4% =8,000USD 8,000USD × 150円 = 1,200,000円 |

Margin required for trading 40 lots of BTCUSD

| Transaction amount | Tiered Margin Rates | Margin Requirements |

|---|---|---|

| $4,000,000 | 2% | 4,000,000 × 2% = 80,000 USD 80,000 USD × 150 yen = 12,000,000 yen |

| 取引額 | 4,000,000ドル |

| 段階式 証拠金率 |

2% |

| 必要証拠金 | 4,000,000 × 2% = 80,000USD 80,000USD × 150円 = 12,000,000円 |

Unlike other products, XM’s cryptocurrency CFDs use a gradually reduced leverage based on the trading amount, so be careful when calculating the required margin. In addition, XM’s tiered margin rates differ for each trading product.

-

If your account currency differs from the settlement currency (the currency listed to the right of the stock symbol), you can calculate the required margin in your account currency by multiplying the required margin by the settlement currency-to-account currency exchange rate.

Swap Points for XM Cryptocurrency CFDs

Trading cryptocurrency CFDs at XM incurs swap points. Swap points are applied from Monday through Friday whenever a position is carried overnight, with three days’ worth of swap points charged on Fridays. Swap points vary by product and fluctuate according to market conditions. Many cryptocurrency CFDs carry negative swap points for both long and short positions. XM cryptocurrency CFD swap points are as follows:

List of swap points for cryptocurrency CFD products

| Product/Brand | Long (Buy) Swap Points | Short (selling) swap points |

| 1INCHUSD | -0.20 | -0.20 |

| AAVEUSD | -21.15 | -21.15 |

| ADAUSD | -59.04 | -59.04 |

| 1INCHUSD | |

| ロング(買) スワップポイント |

-0.20 |

| ショート(売) スワップポイント |

-0.20 |

| AAVEUSD | |

| ロング(買) スワップポイント |

-21.15 |

| ショート(売) スワップポイント |

-21.15 |

| ADAUSD | |

| ロング(買) スワップポイント |

-59.04 |

| ショート(売) スワップポイント |

-59.04 |

Swap points fluctuate daily, so be sure to check the latest rates before trading.

What are swap points?

Swap points are the adjusted profits or losses resulting from the interest rate difference between the two currencies being traded. If you buy a currency with a higher interest rate and sell a currency with a lower interest rate, you will receive swap points; conversely, if you do the opposite, you will incur swap points. Swap points are applied daily until the position is closed, and their value may fluctuate depending on market conditions.

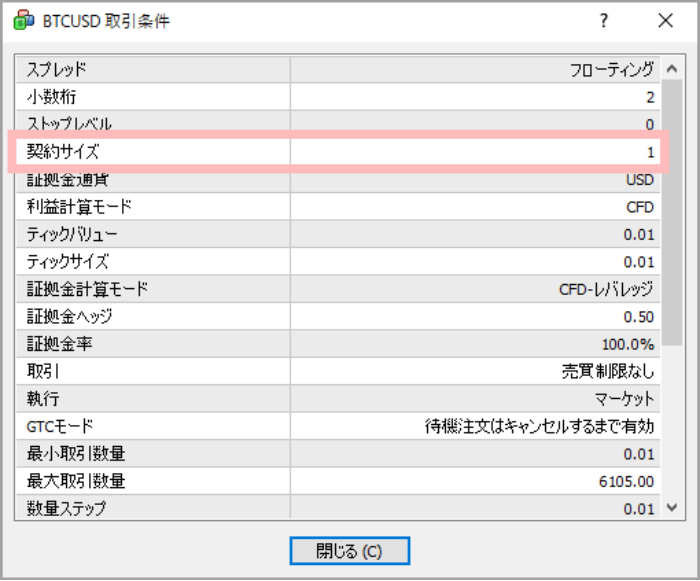

Contract Sizes and Trading Limits for XM Cryptocurrency CFDs

At XMTrading, all cryptocurrency CFDs can be traded from a minimum of 0.01 lots. Maximum trade sizes and contract sizes (the amount of currency per lot) vary by product. For example, 1 lot of BTCUSD (Bitcoin/US Dollar) equals 1 BTC, while 1 lot of XRPUSD (Ripple/US Dollar) equals 1,000 Ripple. Contract sizes are designed for ease of trading based on the market value of each currency. When trading cryptocurrency CFDs, be sure to pay attention to the contract size for each currency.

Trade Sizes for XM Cryptocurrency CFDs

| Brand | Contract size (amount of currency in 1 lot) |

Min/Max Trade Size | Trading Platform |

| 1INCHUSD (1INCH Network/USD) |

10,000 tokens | 0.01/100 | MT5 |

| AAVEUSD (Aave/USD) |

10 Aave | 0.01/1,000 | MT4/MT5 |

| ADAUSD (Cardano/USD) |

1,000 Cardano | 0.01/3,000 | MT4/MT5 |

| 1INCHUSD | |

| 契約サイズ | 10,000 tokens |

| 最小/最大 取引サイズ |

0.01/100 |

| 取引プラット フォーム |

MT5 |

| AAVEUSD | |

| 契約サイズ | 10 Aave |

| 最小/最大 取引サイズ |

0.01/1,000 |

| 取引プラット フォーム |

MT4/MT5 |

| ADAUSD | |

| 契約サイズ | 1,000 Cardano |

| 最小/最大 取引サイズ |

0.01/3,000 |

| 取引プラット フォーム |

MT4/MT5 |

契約サイズは1ロットの通貨量です。

Click here for details on XM’s minimum and maximum lot size (lot calculation method)

-

Please note that in XM cryptocurrency CFD trading, the margin used to open positions is limited to $1,000,000 per person.

How to Verify the Currency Amount per Lot for Cryptocurrency CFDs

The amount of currency per lot is also referred to as the “contract size” or “trading unit.” To check the contract size for each cryptocurrency CFD offered by XMTrading, right-click on the product in the “Quotes” window on MT4/MT5, select “Specifications,” and then review the “Trading Conditions.”

XM offers a trading environment that allows you to maximize your performance in the highly volatile cryptocurrency CFD market, while ensuring you never lose more than your initial deposit. The key benefits of trading cryptocurrency CFDs with XM include:

XM’s cryptocurrency CFDs come with no cutoff level and no margin calls.

XMTrading uses a zero-cut system with no margin calls (additional margin) across all products, including cryptocurrency CFDs, to provide traders with a safe and secure trading environment. Under the zero-cut system, if sudden market fluctuations prevent a stop-out from being triggered in time and losses exceed the available margin, any negative balance is automatically reset to zero.

Cryptocurrencies are far more volatile than most other financial instruments, with daily price swings of over 10% not uncommon. Such large fluctuations can create significant profit opportunities, but they also carry the risk of substantial losses if the market moves against your position. With brokers that do not use a zero-cut system, traders are responsible for covering negative balances. At XM, however, the zero-cut system ensures that while you can pursue unlimited profit potential in volatile cryptocurrency CFDs, your losses are limited to the funds in your margin balance.

With XM, you can trade cryptocurrency CFDs with leverage of up to 500:1.

XM’s cryptocurrency CFDs can be traded with leverage of up to 500:1. This means you can gain exposure to cryptocurrencies through CFD trading with just 1/500 of the required capital. While newly issued cryptocurrencies may be purchased for only a few yen, highly credible and in-demand cryptocurrencies often have high market capitalizations and can cost tens of thousands to hundreds of thousands of yen to buy outright. With XM, however, you can trade these cryptocurrencies via CFDs with leverage of up to 500:1, keeping your initial investment low. Please note that the available leverage for XM’s cryptocurrency CFDs varies depending on the product.

Learn more about XM Bitcoin Leverage Trading

Maximum Leverage for XM Cryptocurrency CFDs

| Maximum Leverage | Target cryptocurrency CFDs |

|---|---|

| 500 times |

BTCUSDBTGUSDETHBTCETHUSD

|

| 250 times |

BCHUSDBTCEURBTCGBPBTCJPYETHEURETHGBPLTCUSDXRPUSD

|

| 50 times |

1INCHUSDAAVEUSDADAUSDALGOUSDAPEUSDAPTUSDARBUSDATOMUSDAVAXUSDAXSUSDBATUSDCHZUSDCOMPUSDCRVUSDDASHUSDDOGEUSDDOTUSDEGLDUSDENJUSDVAULTAUSDETCUSDFILUSDFLOWUSDGRTUSDICPUSDIMXUSDLDOUSDLINKUSDLRCUSDMANAUSDMATICUSDNEARUSDOPUSDSANDUSDSHIBUSDSNXUSDSOLUSDSTORJUSDSTXUSDSUSHIUSDUMAUSDUNIUSDXLMUSDXTZUSDZECUSDZRXUSD |

| 最大 レバレッジ |

対象の 仮想通貨CFD銘柄 |

| 500倍 |

BTCUSDBTGUSDETHBTCETHUSD

|

| 250倍 |

BCHUSDBTCEURBTCGBPETHEURETHGBPLTCUSDXRPUSD

|

| 50倍 |

1INCHUSDAAVEUSDADAUSDALGOUSDAPEUSDAPTUSDARBUSDATOMUSDAVAXUSDAXSUSDBATUSDCHZUSDCOMPUSDCRVUSDDASHUSDDOGEUSDDOTUSDEGLDUSDENJUSDVAULTAUSDETCUSDFILUSDFLOWUSDGRTUSDICPUSDIMXUSDLDOUSDLINKUSDLRCUSDMANAUSDMATICUSDNEARUSDOPUSDSANDUSDSHIBUSDSNXUSDSOLUSDSTORJUSDSTXUSDSUSHIUSDUMAUSDUNIUSDXLMUSDXTZUSDZECUSDZRXUSD もっと見る |

XM’s cryptocurrency CFDs are subject to tiered margin rates.

XMTrading’s cryptocurrency CFDs use a ‘tiered margin rate,’ meaning that leverage adjusts gradually based on the trading volume. Unlike some brokers, XM does not impose a leverage limit based on your account balance (effective margin), so your leverage remains unrestricted regardless of how much your account balance grows.

In general, larger trading volumes carry a higher risk of significant losses in the event of sudden market fluctuations. With XM’s tiered leverage system, however, leverage is automatically adjusted based on the trading amount and the limits set for each product. This eliminates the need to manually adjust leverage to match your trade size. Because trading volumes and leverage vary by product, please review the specific details before trading cryptocurrency CFDs.

For example, when trading BTCUSD (Bitcoin/US Dollar), XM’s most popular cryptocurrency CFD, the leverage and margin rate adjust in tiers based on the trading volume, as shown below.

XM’s tiered margin rates for cryptocurrency CFDs (e.g. BTCUSD)

| Transaction amount | Margin Rate | Leverage |

| $0-$1,000,000 | 0.20% | 500 times |

| $1,000,001 to $3,000,000 | 0.4% | 250 times |

| $3,000,001 to $5,000,000 | 2% | 50 times |

| Over $5,000,001 | 100% | 1x |

Click here for details on tiered margin rates for each XM cryptocurrency CFD product.

You can trade other stocks using the same account.

XM’s cryptocurrency CFDs can be traded using the same margin as FX currency pairs and other CFD products within a single account, without the need to open a separate wallet at a cryptocurrency exchange. At XM, you can trade a wide range of cryptocurrencies—from major ones like Bitcoin (BTC) and Ethereum (ETH) to smaller-cap cryptocurrencies—paired with the US Dollar (USD), Euro (EUR), or British Pound (GBP).

Trading is available even on weekends.

XM’s cryptocurrency CFDs can be traded 365 days a year—including weekends, holidays, and New Year’s holidays—making them ideal for office workers who may not have time for FX or stock trading during the week. Since XM’s cryptocurrency CFDs do not involve holding the actual assets, you can open positions both to profit from rising prices (buying) and falling prices (selling). This flexibility provides more trading opportunities than spot trading, even during the limited time available on weekends, offering ample potential for profits.

XM also accepts deposits on weekends and holidays, with funds typically reflected in your account immediately. However, if you make a bank transfer outside business hours, the funds will be credited on the next business day. For immediate deposits on weekends, we recommend using a credit/debit card or an online wallet. XM also supports deposits and withdrawals using cryptocurrencies, with funds usually reflected in your account within a few minutes to an hour.

XM’s cryptocurrency CFDs can be traded using bonuses and XM Points.

XM’s cryptocurrency CFDs can be traded using bonuses and XM Points. XM offers three types of bonuses: a ¥15,000 ‘New Account Opening Bonus (Trading Bonus)’ (available for a limited time) for all new real account holders; a two-tier ‘Deposit Bonus’ that can be received up to $10,500 depending on the deposit amount; and a ‘Loyalty Program’ that allows you to accumulate points based on your trading volume. All of these bonuses can be applied as part of your margin for cryptocurrency CFD trading. Take advantage of these unique XM bonuses to enhance your capital efficiency while enjoying cryptocurrency CFD trading.

-

The XM KIWAMI Goku Account and Zero Account are eligible only for the New Account Opening Bonus (Trading Bonus).

-

Please note that cryptocurrency CFDs cannot be traded with an XM Zero Account.

-

You can convert XM Points (XMP) into bonuses to trade cryptocurrency CFDs; however, please note that trading cryptocurrency CFDs does not earn XMP.

The following are possible reasons why cryptocurrency CFDs may not appear or be available for trading on XMTrading’s MT4 (MetaTrader 4) or MT5 (MetaTrader 5).

Trading with zero accounts

Cryptocurrency CFDs cannot be traded with an XM Zero Account. Therefore, if you are logged in to XM’s MT4/MT5 using a Zero Account, cryptocurrency CFDs will not be displayed. To trade cryptocurrency CFDs with XM, please ensure your account is a Standard, Micro, or KIWAMI Goku Account. If you only have a Zero Account, log in to the member page and open an additional Standard, Micro, or KIWAMI Goku Account.

All 58 cryptocurrency CFDs are available for trading on MT5 Standard, Micro, and KIWAMI Goku accounts. On MT4, Standard, Micro, and KIWAMI Goku accounts can trade 28 cryptocurrency CFDs.

The server used is called ‘XMTrading-MT5’.

If your XM account is connected to the ‘XMTrading-MT5’ server, you will not be able to trade cryptocurrency CFDs. XM’s MT5 accounts are hosted on two servers: ‘XMTrading-MT5’ and ‘XMTrading-MT5 3.’ Accounts opened on the ‘XMTrading-MT5’ server cannot trade cryptocurrency CFDs. The server assignment is automatic when you open an account, so you cannot choose your preferred server. If you are assigned the ‘XMTrading-MT5’ server, please open an additional account on the ‘XMTrading-MT5 3’ server to trade cryptocurrency CFDs. If you still cannot trade cryptocurrency CFDs after opening an additional account, please contact XM’s support desk at support@xmtrading.com .

-

With an XM MT5 account, you can trade cryptocurrency CFDs if your account is connected to the ‘XMTrading-MT5 3’ server.

-

For XM MT4 accounts, cryptocurrency CFDs can be traded regardless of the server you are connected to.

Click here to open an additional XM account

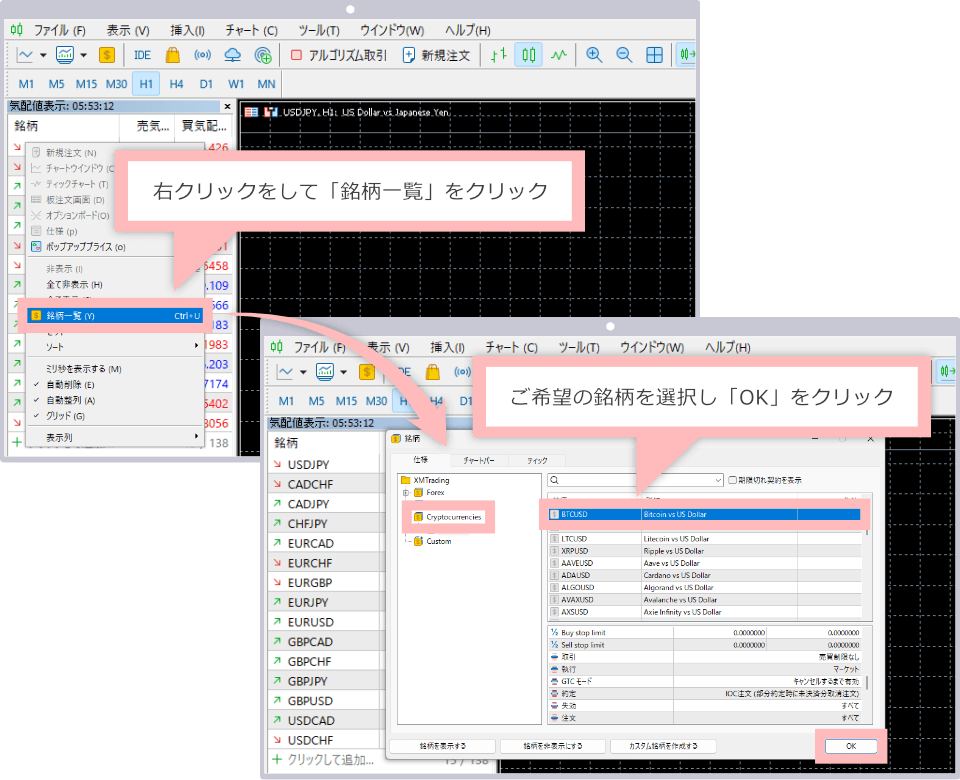

Hidden in the Market Watch window

Even when you launch XMTrading’s MT4/MT5, cryptocurrency CFDs may not appear in the quote list. If the desired symbol is missing, right-click on the ‘Quote List’ window and select ‘Symbols.’ The categories for all symbols will be displayed—click ‘Cryptocurrencies,’ select the desired cryptocurrency CFD, and then click ‘OK.’ The symbol will then appear in the quote list.

Maintenance in Progress

XMTrading (XM) regularly performs system maintenance. Cryptocurrency CFDs on XM are generally available for trading 24 hours a day, 365 days a year, including weekends and holidays; however, trading is temporarily unavailable during maintenance periods. Regular maintenance takes place every Saturday for 30 minutes—from 16:05 to 16:35 during summer time and from 17:05 to 17:35 during winter time. In addition to regular maintenance, XM may occasionally carry out irregular maintenance. In such cases, notifications will be sent in advance via email and posted in the ‘XM Latest News’ section, so please check for updates as needed.

Please note the following important points when trading cryptocurrency CFDs with XMTrading.

Cryptocurrency CFDs cannot be traded with an XM Zero Account.

XM cryptocurrency CFDs cannot be traded with a Zero Account. To trade these CFDs, please use a Standard Account, Micro Account, or KIWAMI Account. XM allows each person to hold up to eight accounts, which can be used for different trading instruments, strategies, or to diversify risk. To open an additional account, log in to your member page and click the ‘Open an Additional Account’ button.

Detailed instructions for opening an additional account are provided in the XM Member Page User Guide, complete with easy-to-follow illustrations.

On the XM Members Page, you can open accounts, deposit and withdraw funds, adjust your leverage, and access the copy trading page. For detailed instructions on using the XM Members Page, please refer to the ‘XM Members Page User Guide.’

Cryptocurrency CFD availability depends on your account type and trading tool.

The number of cryptocurrency CFDs available for trading at XM depends on the account type and trading platform (MT4/MT5). All 58 XM cryptocurrency CFDs can be traded on MT5 Standard, Micro, and KIWAMI Accounts. On MT4, Standard, Micro, and KIWAMI Accounts support trading of 28 cryptocurrencies, primarily major ones such as Bitcoin, Ethereum, Litecoin, and Ripple.

28 cryptocurrency CFDs available for trading on all account types (except Zero Accounts)

AAVEUSD, ADAUSD, ALGOUSD, AVAXUSD, AXSUSD, BATUSD, BCHUSD, BTCEUR, BTCGBP, BTCUSD, COMPUSD, ENJUSD, ETHEUR, ETHGBP, ETHUSD, GRTUSD, LINKUSD, LTCUSD, MATICUUSD, SNXUSD, SOLUSD, STORJUSD, SUSHIUSD, UMAUSD, UNIUSD, XLMUSD, XRPUSD, ZRXUSD

もっと見る閉じる

30 cryptocurrency CFDs available for trading with MT5 Standard, Micro and KIWAMI accounts

1INCHUSD, APEUSD, APTUSD, ARBUSD, ATOMUSD, BTCJPY, BTGUSD, CHZUSD, CRVUSD, DASHUSD, DOGEUSD, DOTUSD, EGLDUSD, VAULTAUSD, ETCU SD, ETHBTC, FILUSD, FLOWUSD, ICPUSD, IMXUSD, LDOUSD, LRCUSD, MANAUSD, NEARUSD, OPUSD, SANDUSD, SHIBUSD, STXUSD, XTZUSD, ZECUSD

もっと見る閉じる

Cryptocurrency CFD trading does not earn XM Points (XMP).

XM Trading offers a loyalty program that lets you earn XM Points (XMP), which can be exchanged for cash or bonuses, based on your trading volume. XMP can only be earned by holding positions in non-cryptocurrency instruments for at least 10 minutes with a Standard or Micro Account. Please note that trading cryptocurrency CFDs does not qualify for XMP. However, you can convert your XMP into a bonus and use it as margin for trading cryptocurrency CFDs. Take advantage of XM’s unique bonuses to trade cryptocurrency CFDs more efficiently and enhance your profit potential.

Cryptocurrency CFD long position

XM allows hedging only within the same account. Please note that the required margin for hedging cryptocurrency CFDs is 50%, which differs from FX currency pairs. For XM’s FX currency pairs, gold, and silver, the required margin is offset to zero when you open a hedging position for the same product and lot. However, for other CFDs, including cryptocurrency CFDs, the required margin is not offset, and a one-way margin (buy or sell) is required. You can open a hedging position in cryptocurrency CFDs only if your XM trading account has sufficient equity margin.

What is a hedged transaction?

Hedging is a trading strategy in which you simultaneously hold both ‘buy’ and ‘sell’ positions on the same asset. Hedging locks in unrealized gains and losses, helping to reduce the risk of losses increasing due to sudden price fluctuations.

The tax treatment of virtual currency CFDs is the same as that of other securities.

Profits from cryptocurrency CFD trading with XM are subject to taxation. Like profits from FX currency pairs, they are classified as ‘miscellaneous income (comprehensive taxation),’ which requires you to file a tax return and pay taxes. Additionally, profits and losses from FX currency pairs and cryptocurrency CFDs fall under the same tax category, allowing you to offset them against each other. By offsetting gains and losses, you can reduce your taxable income and, consequently, the amount of tax owed. For more details on filing tax returns and taxation of profits with XM, please refer to ‘About XM’s Tax Return Method and Taxes.’

-

Can I trade XM cryptocurrency CFDs on all account types?

No, XM’s cryptocurrency CFDs cannot be traded with Zero Accounts. MT5 Standard, Micro, and KIWAMI Goku Accounts allow trading of all 58 cryptocurrency CFDs, while MT4 Standard, Micro, and KIWAMI Goku Accounts support trading of 29 cryptocurrency CFDs.

read more

2022.06.23

-

What types of cryptocurrency CFDs can be traded at XM?

XM’s cryptocurrency CFDs allow trading in a total of 58 cryptocurrencies, ranging from popular ones like Bitcoin (BTC) to lesser-known options. MT4 Standard, Micro, and KIWAMI Accounts support trading of only 28 cryptocurrencies. Cryptocurrency CFDs are not available on Zero Accounts.

read more

2022.06.23

-

Can I trade XM’s cryptocurrency CFDs in a hedged position?

Yes, XM’s cryptocurrency CFDs can be traded in both directions, but only within the same account. However, when opening positions in both directions, the required margin is 50%. Unlike FX currency pairs, the margin is not offset for cryptocurrency CFDs, so a one-way margin (for either buy or sell) is required. Please keep this in mind when trading.

read more

2022.06.23

-

Are there any leverage limits when trading cryptocurrency CFDs with XM?

Yes, XM’s cryptocurrency CFDs use a tiered leverage system, where leverage adjusts based on the trading amount. While cryptocurrency CFDs can be traded with up to 500:1 leverage, please note that as the trading volume per order increases, the applicable leverage decreases and a higher margin is required.

read more

2022.06.23

-

What are XM’s cryptocurrency CFD trading hours?

XM cryptocurrency CFDs are available for trading 24 hours a day, 365 days a year. However, please note that due to server maintenance on Saturdays, trading will be unavailable for 30 minutes—from 4:05 PM to 4:35 PM Japan time during summer, and from 5:05 PM to 5:35 PM Japan time during winter.

read more

2022.06.23