XM Swap Points

XM Swap Points

With XMTrading, you can earn steady profits through “swap points” generated by interest rate differences between currencies. Unlike exchange rate gains, swap points are earned automatically just by holding a position, making them a key factor to consider when choosing an FX broker.

XM offers trading in high-yield currencies such as the Turkish lira, Mexican peso, and South African rand. This allows you to leverage one of XM’s key advantages—high leverage—and aim for long-term gains through swap points. Even in the rare case of significant price fluctuations, XM’s zero-cut system ensures that your losses will never exceed your deposited amount.

![]()

XM allows you to trade minor currency pairs with high swap points, making it suitable for long-term swap strategies.

What exactly are swap points?

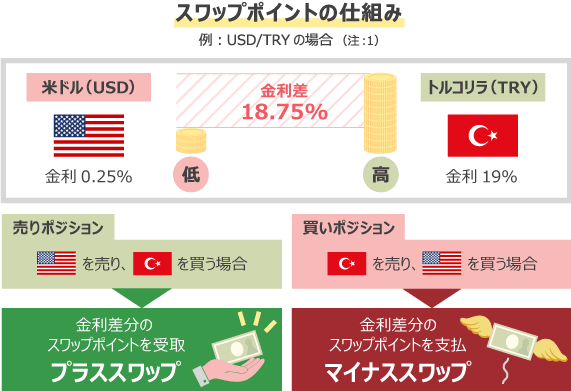

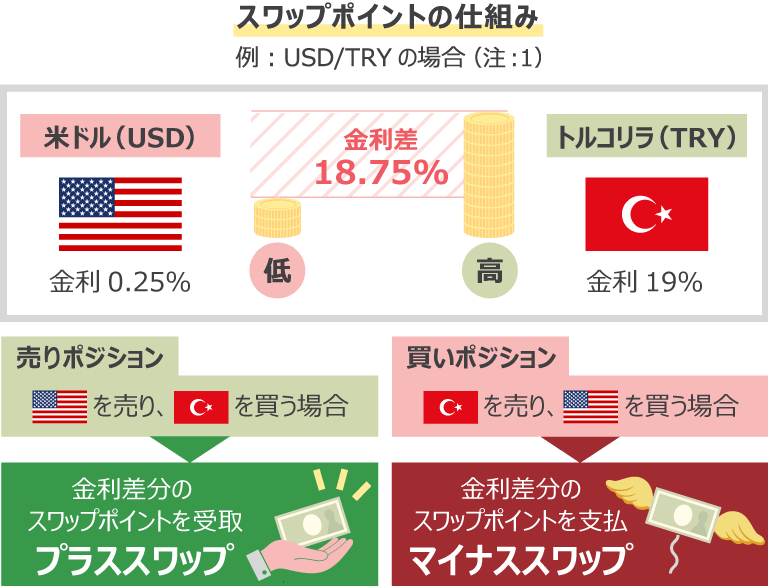

Swap points represent the adjusted profits or losses resulting from the interest rate differences between the currencies of different countries. In FX trading, where two currencies with varying policy interest rates are exchanged, swap points are credited or debited daily until the position is closed, reflecting the interest rate differential between the two nations.

If you buy a currency with a higher interest rate and sell one with a lower interest rate, you will earn swap points. Conversely, if you buy a currency with a lower interest rate and sell one with a higher interest rate, you will have to pay swap points. Keep in mind that swap points can fluctuate daily due to changes in exchange rates and market interest rates, so the amount you receive or pay may vary or even reverse.

Generally, highly creditworthy developed country currencies—such as the Japanese yen and the US dollar—have low policy interest rates. For example, the Japanese yen’s policy rate is set at 0.50%, maintaining an ultra-low interest rate environment. In contrast, emerging market currencies like the Turkish lira and Mexican peso tend to have much higher policy rates. The Turkish lira, known as a high-interest currency, currently has a policy rate of 43.00% (*). (*)

Make sure to check the most recent data prior to executing a transaction.

Policy Interest Rates for Major Currencies (As of August 2025)

| currency | Policy Benefits |

| JPY (Japanese Yen) | 0.50 % |

| USD (US Dollar) | 4.50 % |

| EUR (European Euro) | 2.15 % |

| GBP (British Pound) | 4.00 % |

| AUD (Australian Dollar) | 3.60 % |

| CAD (Canadian dollar) | 2.75 % |

| CHF (Swiss Franc) | 0.00 % |

| MXN (Mexican peso) | 8.00 % |

| ZAR (South African Rand) | 7.25 % |

| TRY (Turkish Lira) | 43.00 % |

What is the policy interest rate?

The policy interest rate is the rate set by each country’s central bank—such as the Bank of Japan—as part of its monetary policy. This rate serves as the basis for determining deposit and lending rates at commercial financial institutions. Typically, when the economy is strong, the policy interest rate is raised to control inflation, while during economic slowdowns, it is lowered to encourage growth. Swap points also fluctuate in response to changes in the policy interest rate.

When are XM swap points applied?

XMTrading swap points are applied during rollovers on weekdays, from Monday to Friday. Specifically, swap points are charged or credited for any open positions held past 6:00 AM Japan time (7:00 AM during winter), which corresponds to the New York market close. If you’re aiming to earn positive swap points, be aware that closing your position before this time means you won’t receive swap points for that day. Conversely, to avoid paying negative swap points, you must close your position before the rollover occurs.

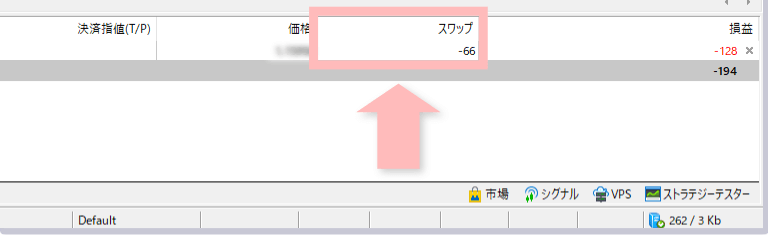

You can view the swap points you’ve earned in the “Terminal” tab of MT4/MT5.

Swap points are tripled on Wednesdays

At XM, swap points are tripled during the rollover from Wednesday to Thursday. In the foreign exchange market, the settlement date is typically two business days later, meaning trades executed on Thursday settle on Monday, and trades on Friday settle on Tuesday. As a result, on Wednesday, swap points for three days—including the weekend (Saturday and Sunday)—are combined and applied, since no rollovers occur over the weekend when trading is suspended. Both positive and negative swap points will be tripled, so please exercise caution when holding positions overnight on Wednesday.

XM Swap Point Calendar

| day of week | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday | Sunday |

| Swap Points |

1 day’s worth | 1 day’s worth | 3 days worth | 1 day’s worth | 1 day’s worth | Closed | Closed |

| day of week | Swap Points |

| moon | One day’s worth |

| fire | One day’s worth |

| water | 3 days worth |

| tree | One day’s worth |

| gold | One day’s worth |

| soil | Closed |

| day | Closed |

-

When trading selected swap-freeproducts (major and minor FX currencies, gold, and silver) withthe KIWAMI Kiwami account, no swap points will be charged.

-

Cryptocurrency CFD swap points are applied Monday through Friday, with triple swap points charged on Fridays.

XM automatically calculates swap points based on trading conditions and other factors. If you want to convert swap points into Japanese yen or another currency, you’ll need to perform the calculation for each currency pair. To simplify this, XM offers a “Swap Calculator” that automatically converts swap points into your account’s base currency, allowing you to easily check your profits and losses without manual calculations.

Here’s how to calculate swap points and use the XM Swap Calculator:

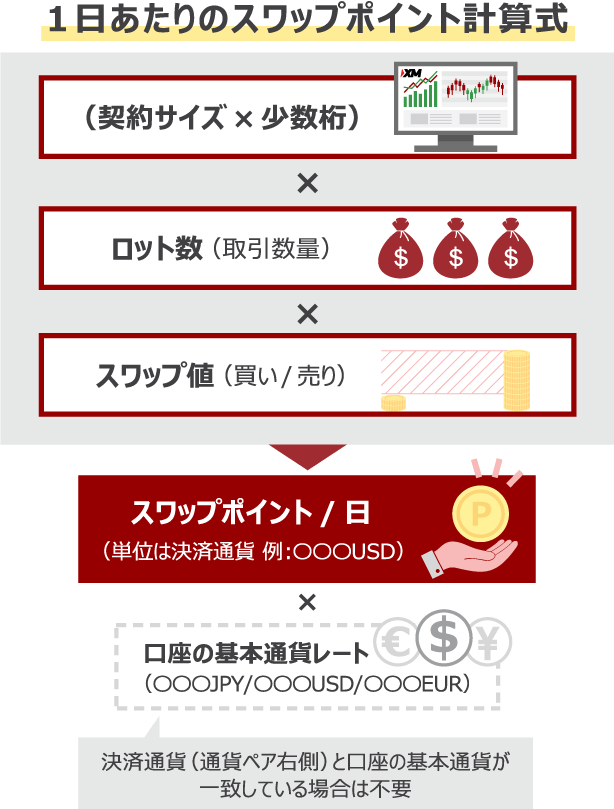

Formula for Calculating XM Swap Points

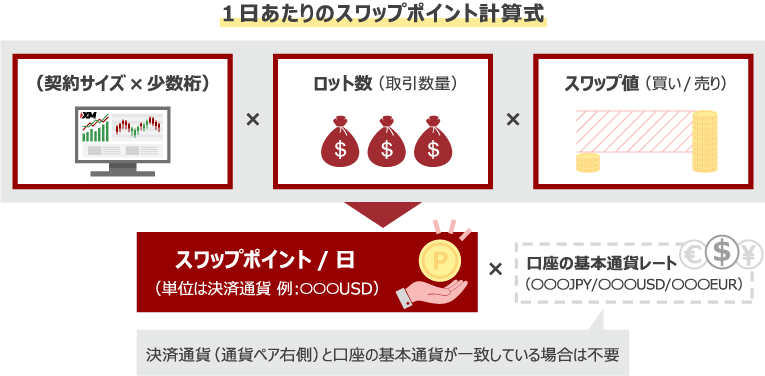

XMTrading’s swap points can be calculated using factors such as contract size (the value of 1 lot), the number of decimal places (3 digits = 0.001 / 5 digits = 0.00001), trading volume (number of lots), and the swap value (buy or sell). The formula for calculating daily swap points is as follows:

Swap points are calculated in the settlement currency, which is the currency on the right side of the currency pair. Therefore, when converting swap points to Japanese yen, you need to convert the calculated amount using the current yen exchange rate. If the currency pair is “USDJPY” and Japanese yen is the settlement currency, no conversion to yen is required. Please note that for micro accounts, the lot size is smaller, so swap points will be one hundredth (1/100) of the amount calculated for standard accounts.

Example 1: In a yen-denominated account, you sell 1 lot of USDJPY (contract size 100,000, with 3 decimal places), and the sell swap rate is -3.8.

(100,000 × 0.001) × 1Lot × -3.8

= -380JPY/day

Example 2: In a yen-denominated account, if you buy 1 lot of EURUSD (contract size 100,000, with 5 decimal places) and the buy swap rate is -5.42.

(100,000 × 0.00001) x 1Lot

× -5.42 = -5.42 USD/day

-5.42USD x (USDJPY: 110)

= -596.2JPY/day

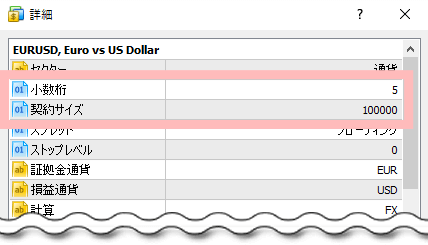

Contract size and decimal places can be viewed on MT4/MT5.

You can check the contract size and decimal places for each XMTrading symbol in MT4/MT5 (MetaTrader). Simply right-click on the desired currency pair in the “Quotes” window, then select “Specifications” to view the trading conditions, including contract size and decimal places. Note that decimal places are shown as “0.001” for three digits and “0.00001” for five digits.

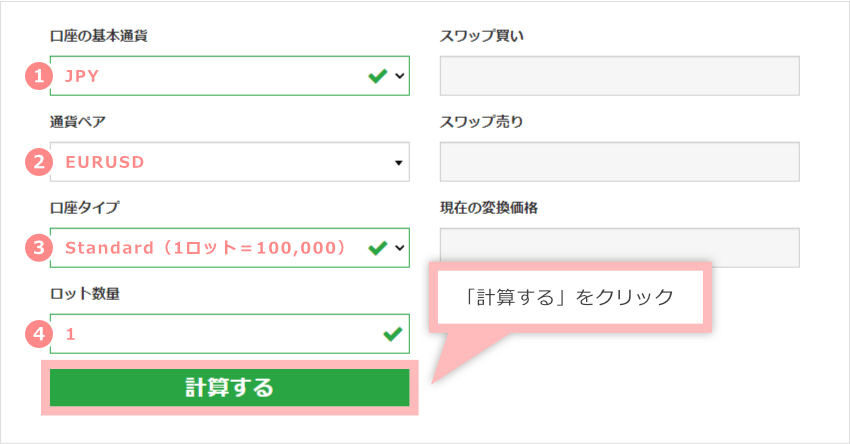

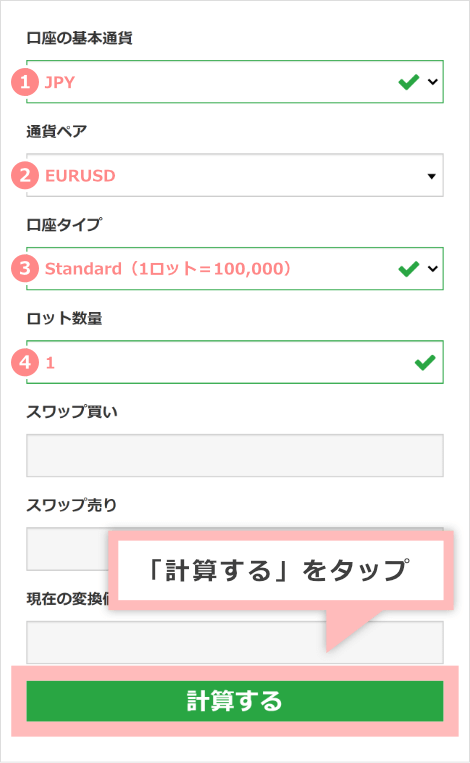

How to use the XM Swap Calculator

XM offers the “XM Swap Calculator” to easily calculate swap points. There is no need to log in to your member page or go through any complicated procedures, and you can easily calculate the latest swap points at any time. Please use the XM Swap Calculator to check the actual swap points before trading. Here’s how to use the XM Swap Calculator.

Enter the required information

①Select the base currency of your account and the ②currency pair for which you want to calculate swap points . Next, select the ③account type and ④lot size you want to trade , and click “Calculate.”

①Select the base currency of your account and the ②currency pair for which you want to calculate swap points . Next, select the ③account type and ④lot size you want to trade , and tap “Calculate.”

| 1Account base currency | Example: JPY |

|---|---|

| 2Currency Pairs | Example: EURUSD |

| 3Account Type | Example: Standard (1 lot = 100,000) |

| 4Lot Quantity | Example: 1 |

Displaying the Results of Calculations

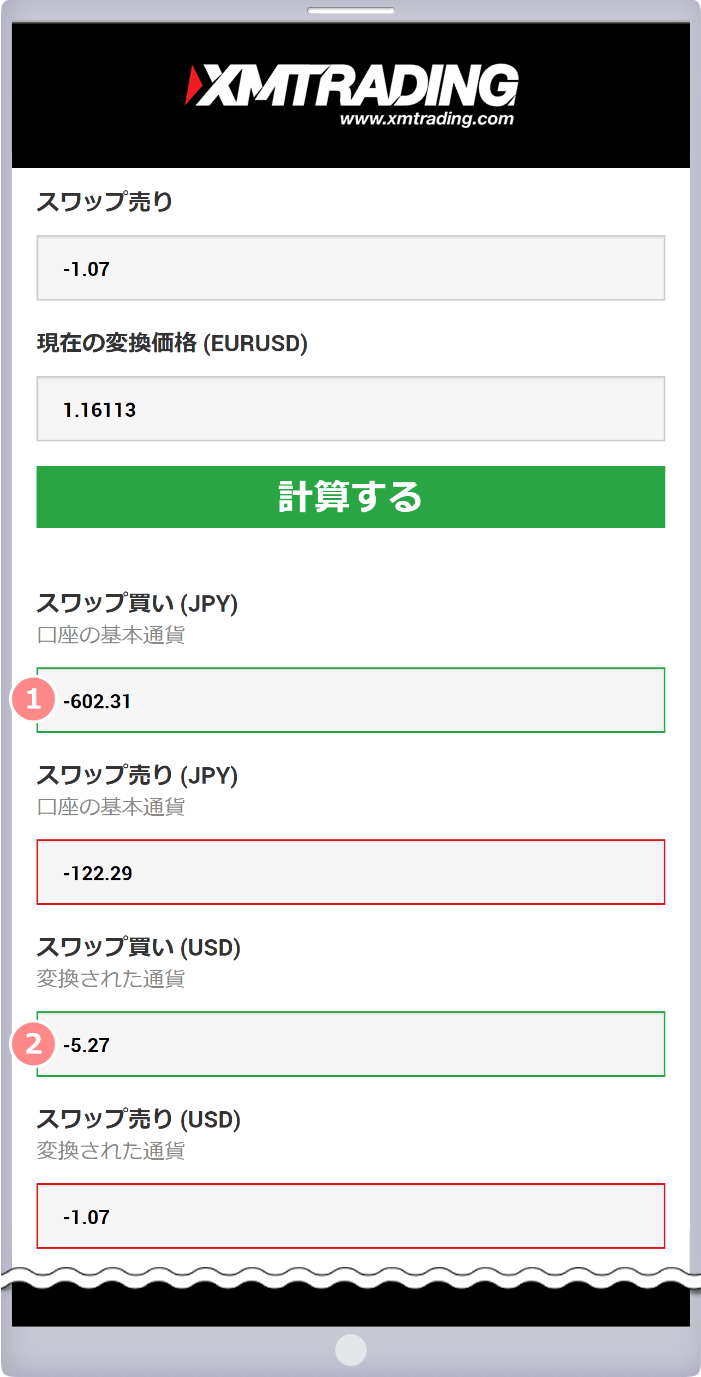

Once the swap point calculation is complete, the daily swap points converted into your account’s base currency will be displayed as ① Swap Buy (JPY) and ② Swap Sell (JPY).

-

Swap point calculation results constantly fluctuate based on factors such as currency pair rates. Please note that the figures shown by the XM swap calculator may differ from the actual swap points incurred during live trading.

Withdrawal of swap points alone is not allowed.

At XMTrading, profits and losses from swap points are settled and reflected in your account balance only when the position is closed. Therefore, you cannot withdraw unrealized profits from swap points. To have swap point profits available for withdrawal, please close the open position.

Positive swaps pose no issues, but in the case of negative swaps, the accumulated negative amount will be deducted upon settlement. Additionally, swap points for open positions are included in the calculation of your available margin, just like unrealized profits and losses. They also impact the margin maintenance rate, which determines stop-loss (forced liquidation) levels. Therefore, please monitor your account balance carefully to avoid unexpected losses caused by automatic stop-loss triggers.

There are no swap points applied to futures CFDs.

XM does not offer futures CFDs with swap points. All commodities are traded as futures contracts, and no swap points are provided for any of them. Please note that some precious metals and stock indexes are also offered as futures CFDs. The following futures CFDs at XM do not include swap points:

| Commodities | COCOA, COFFEE, CORN, COTTON, HGCOP, SOYBEAN, SUGAR, WHEAT |

|---|---|

| Precious Metals Futures |

PALL、PLAT

PALL、PLAT

|

| Energy Futures |

BRENT, GSOIL, NGAS, OIL, OILMn

BRENT, GSOIL, NGAS, OIL, OILMn

|

| Futures Stock Index | EU50、FRA40、GER30、JP225、SW120、UK100、US100、US30、US500、 USDX、VIX |

Please note that swap points are charged as usual for spot stock indexes and energy instruments. .

Dividends are paid on spot stock indexes (except GER40)

At XMTrading, spot stock indexes—except for GER40—are subject to dividend adjustments. Dividends vary based on the positions held at the rollover time on the dividend date: long position holders receive dividends, while short position holders are charged. The dividend schedule for each stock is updated every Monday. Please note that futures stock indexes are not eligible for dividend adjustments.

Holding a long position to earn swap points may result in a loss.

At XMTrading, even when one side of the swap—either buy or sell—is positive, the negative swap is set to be larger. As a result, when executing a hedged trade, the net swap points will always be negative. Please note that whether you hedge with the intention of earning swap points or hold a long-term hedged position, you will consistently incur daily unrealized losses equal to the negative swap.

-

XMTrading strictly prohibits hedging between different accounts or with other brokers. Please be aware that engaging in such activities may result in your account being frozen or other administrative actions being taken.

At XM, swap points are applied not only to FX currency pairs (major and minor), but also to precious metals (such as gold and silver), individual stocks, spot stock indexes, and thematic index CFDs. As of August 2025, the swap points for XM’s tradable instruments are as follows. Since swap points fluctuate daily, be sure to check the most up-to-date figures before trading.

Swap points for FX currency pairs

The swap points for FX currency pairs offered by XMTrading are listed below. Please note that swap points fluctuate daily, so be sure to check the latest rates before trading.

Swap points for FX currency pairs (major currencies)

| Product (brand) |

Long (Buy) Swap Points |

Short (selling) swap points |

| USDJPY (US Dollar/Japanese Yen) |

4.08 | -28.92 |

| EURUSD (European Euro/US Dollar) |

-10.92 | 4.38 |

| GBPUSD (British Pound / US Dollar) |

-4.08 | -3.48 |

Swap points for FX currency pairs (minor and exotic currencies)

| Product (brand) |

Long (Buy) Swap Points |

Short (selling) swap points |

| AUDCAD (Australian dollar/Canadian dollar) |

-0.97 | -6.66 |

| AUDCHF (Australian dollar/Swiss franc) |

3.16 | -8.44 |

| AUDJPY (Australian dollar/Japanese yen) |

3.29 | -14.81 |

Swap Points for Precious Metals, Stocks, Indices, Thematic Indices, and Cryptocurrencies

The swap points for precious metals, individual stocks, stock indexes, thematic indexes, and cryptocurrencies offered by XMTrading are listed below. Please note that swap points fluctuate daily, so be sure to check the latest rates before trading.

Swap points for precious metals CFD products

| Product (brand) |

Long (Buy) Swap Points |

Short (selling) swap points |

| GOLD | -53.86 | 19 |

| SILVER | -6.65 | 0.18 |

| XAUEUR (*) |

-29.97 | 5.31 |

XAUEUR is only available for trading on MT5 accounts.

-

With the XMTrading KIWAMI account, you can trade gold (GOLD), silver (SILVER), and gold/euro (XAUEUR) without incurring swap charges. However, please note that restrictions may apply if the terms of use are violated. Additionally, at XMTrading, palladium (PALL) and platinum (PLAT) are not subject to swap points.

Swap points for stock CFDs

| Product (brand) |

Long (Buy) Swap Points |

Short (selling) swap points |

| Alibaba | -9.86 | -0.14 |

| Amazon | -9.86 | -0.14 |

| Apple | -9.86 | -0.14 |

-

Swap points for stock CFDs are calculated daily by prorating the interest rate (%) based on your held position’s value (trading price × trading volume).

Swap points for stock index (spot) CFD products

| Product (brand) | Long (Buy) Swap Points |

Short (selling) swap points |

| AUS200Cash | -1.65 | 0.20 |

| ₹60Cash | -0.26 | -0.01 |

| ChinaHCash | -1.00 | -0.53 |

-

Futures stock indexes at XMTrading do not incur swap points.

Swap points for thematic index CFD products

| Product (brand) | Long (Buy) Swap Points |

Short (selling) swap points |

| AI_INDX | -1.38 | -0.74 |

| Crypto_10 | -16.62 | -16.62 |

| ElectricVehicles | -0.27 | -0.10 |

Thematic index CFDs are only available on MT5 for Standard and KIWAMI accounts.

List of swap points for cryptocurrency CFD products

| Product (brand) | Long (Buy) Swap Points |

Short (selling) swap points |

| 1INCHUSD | -0.20 | -0.20 |

| AAVEUSD | -21.15 | -21.15 |

| ADAUSD | -59.04 | -59.04 |

-

Cryptocurrency CFD swap points are applied from Monday to Friday, with triple swap points charged on Fridays to cover the weekend.

Currency pairs with high swap rates also carry a high risk of volatility.

Emerging market currency pairs with high swap rates—such as the Turkish lira, South African rand, and Mexican peso—are prone to sudden price swings due to domestic political instability or geopolitical risks. These sharp movements can trigger stop-outs, potentially resulting in losses that outweigh the swap profits earned up to that point. While one of the main appeals of swap trading is that positions can often be held for extended periods with minimal intervention, we strongly recommend regularly monitoring your required margin as long as you maintain an open position.

Among the many currency pairs available on XM, we’ll highlight several that offer high swap points and are well-suited for long-term swap trading. Below is a list of daily swap points per 1-lot trade, converted into Japanese yen. Please note that swap points are subject to change, so be sure to check the latest rates before placing any trades.

FX Currency Pairs with High Swap Points (as of August 2025)

| Product (brand) | position | Swap points (yen equivalent) |

| EURTRY | short | Approximately 6,101 yen |

| USDTRY | short | Approximately 4,443 yen |

| GOLD | short | Approximately 2,729 yen |

| GBPCHF | long | Approximately 1,248 yen |

| EURTRY | |

| ポジション | ショート |

| スワップポイント (円換算) |

約6,101円 |

| USDTRY | |

| ポジション | ショート |

| スワップポイント (円換算) |

約4,443円 |

| GOLD | |

| ポジション | ショート |

| スワップポイント (円換算) |

約2,729円 |

| GBPCHF | |

| ポジション | ロング |

| スワップポイント (円換算) |

約1,248円 |

Negative swap points are treated as trading costs

In the case of a positive swap, the amount will be added to your account balance at settlement, so there’s no issue. However, with negative swaps, charges are applied daily, increasing your overall transaction costs. Therefore, it’s important to pay close attention when holding such positions.

Even if your goal isn’t to earn swap points, holding positions overnight—as in swing trading, long-term trading, or algorithmic/system trading—can still expose you to the impact of swaps. Depending on market conditions and the monetary policies of individual countries, positive swap points can even turn negative. When trading, be sure to use XM’s Swap Calculator to check real-time swap rates.

Be cautious of stop losses caused by insufficient margin

By taking advantage of the high leverage offered exclusively by XMTrading, you can trade swaps with a relatively small margin. However, if your margin is too low, even minor exchange rate fluctuations could trigger a forced stop loss. Therefore, when engaging in long-term swap trading, it’s crucial to maintain a sufficient margin to withstand sudden market movements.

Emerging market currencies, known for their particularly high interest rates, are also highly volatile. If losses occur and your account balance falls below the required margin, a stop loss will be triggered, potentially causing losses that exceed the swap points you’ve earned. Even if you accumulate substantial swap points, unrealized losses can outweigh those gains. For this reason, we recommend maintaining a generous margin to manage risk effectively.

You can check XMTrading swap points using MT4 (MetaTrader 4), MT5 (MetaTrader 5), or XM’s “Swap Calculator.”

Check swap points from XM MT4/MT5

At XMTrading, you can check the swap points for each product using XM’s dedicated MT4 or MT5 platforms. Here’s how to check swap points on MT4/MT5:

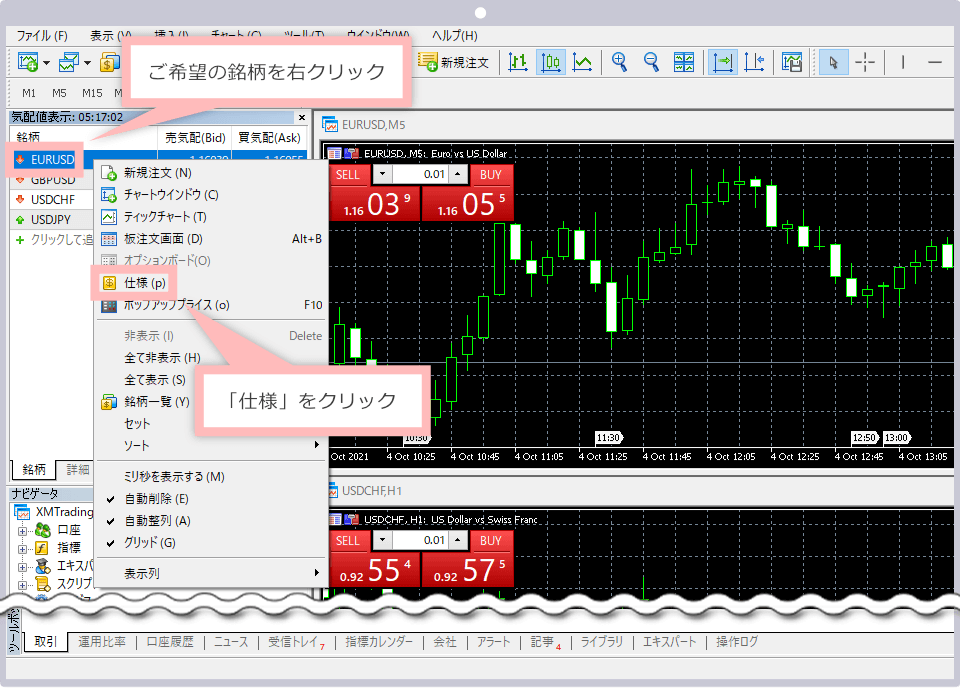

-

Steps: 1

MT4/MT5 (Profit/Loss Display Screen)

Launch XMTrading’s MT4/MT5 platform and open the “Market Watch” window. Right-click on the currency pair you want to check, then select “Specifications.” If the “Market Watch” window isn’t visible, go to the MT4/MT5 menu, click “View,” and enable “Market Watch.”

-

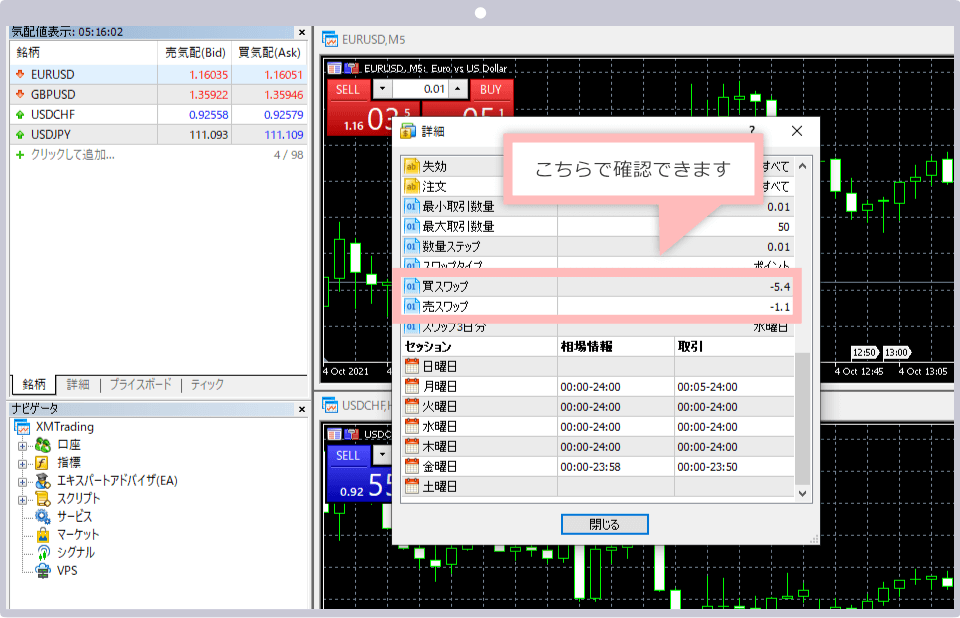

Steps: 2

MT4/MT5 (trading conditions screen)

Once the trading conditions screen appears, scroll down to the bottom to view the “Buy Swap” and “Sell Swap” rates for the currency pair.

Check the swap points accumulated while the position is still open.

Swap points incurred on open positions can be viewed in the “Trade” tab within the “Terminal” of XMTrading’s MT4 (MetaTrader 4) or MT5 (MetaTrader 5) platforms. When swap points are credited or debited, they are reflected in the equity calculation as unrealized gains or losses, similar to exchange rate fluctuations.

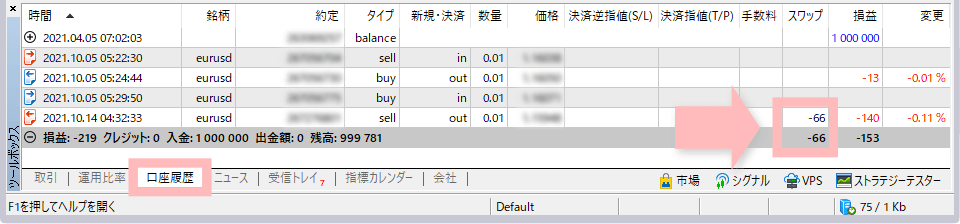

Check the swap points credited after closing the position.

After closing a position, you can view the swap points awarded in the “Account History” tab within the “Terminal” of XM’s MT4/MT5 platforms. While holding a position, swap points are recorded as unrealized profit or loss, but once the position is closed, these profits or losses are finalized and reflected in your account balance.

You can view details of XM’s trading products on the XM app.

XMTrading’s official mobile app, the “XMTrading app,” lets you access detailed information on trading instruments, including charts, trading hours, minimum and maximum lot sizes, contract sizes, and swap points.

Currently, the iOS version of the XMTrading app is not available for installation.

-

Where can I view the swap points earned on XM?

Swap points generated from XM trading can be viewed in the “Terminal” of MetaTrader 4 (MT4) or MetaTrader 5 (MT5). For open positions, check the “Trade” tab, and for closed positions, refer to the “Account History” tab.

read more

2021.10.22

-

Why does XM generate swap points for three days at once?

In the foreign exchange market, the settlement date is typically two business days later. Therefore, if you hold a position at XM from Wednesday to Thursday, swap points for three days will be charged to cover the weekend (Saturday and Sunday). Please note that both positive and negative swaps will be tripled during this period, so losses from negative swaps may be three times the usual amount.

read more

2021.10.22

-

Please provide information about CFD swap points offered by XM.

At XM, swap points are charged on spot CFDs such as stock indexes, precious metals, and cryptocurrencies. However, swap points are not applied to futures CFDs on commodities, energy, and similar products. Please note that some futures CFDs also fall under the categories of precious metals and stock indexes.

read more

2021.10.22

-

Are swap points applied to long positions at XM?

Yes, XM applies swap points even when you engage in hedging trades. However, please note that the total swap points for hedging positions are designed to be negative, so using hedging solely to earn swap points may lead to unrealized losses.

read more

2021.10.22

-

How are swap points calculated at XM?

XM’s swap points are calculated using the formula: (Contract size × decimal places) × number of lots (trading volume) × swap value (buy/sell). Since swap points are calculated in the settlement currency, you will need to convert them to Japanese yen using the appropriate exchange rate.

read more

2020.06.16