XM Hedging Trading Rules

XM Hedging Trading Guidelines

XM permits hedge trading within the same account. By using hedge trading strategically, you can not only protect yourself from risks during sudden price fluctuations, but also avoid forced stop losses caused by insufficient margin, maximize potential profits, and access various other advantages. However, if you engage in hedge trading that violates XM’s terms and conditions, you may face severe consequences, such as profit cancellation or account suspension. It’s important to familiarize yourself with the fundamental rules and restrictions related to hedge trading. While hedge trading can offer significant benefits, it also carries the risk of amplifying losses and triggering stop losses due to unexpected market changes. When participating in hedge trading with XM, always stay vigilant and monitor market trends, even during periods of relative stability.

![]()

You can effectively use hedging within the same account to manage risk, avoid forced stop-outs, and more.

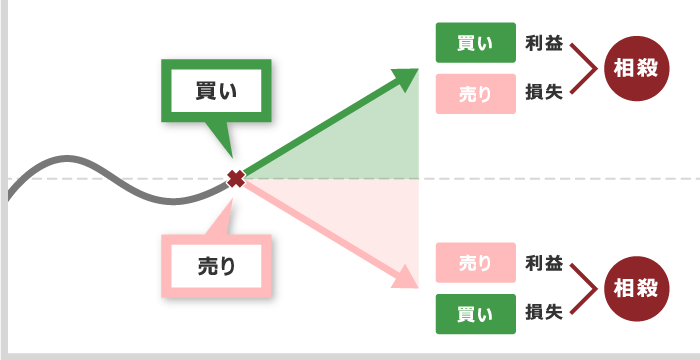

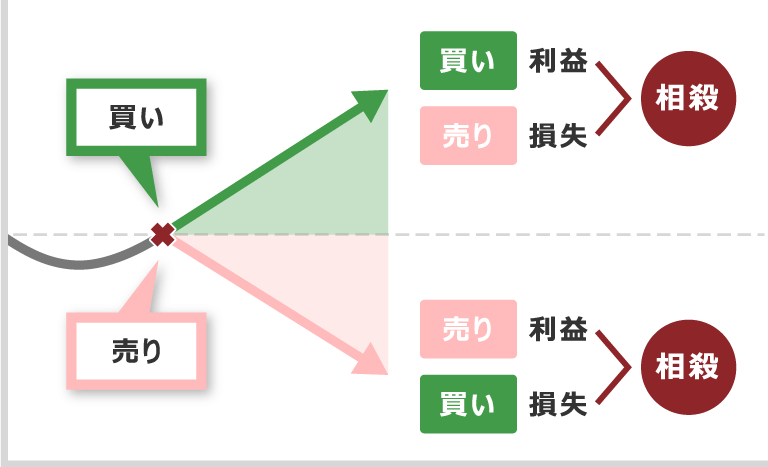

What Is a Hedging Transaction in Forex?

Hedging is a trading strategy where you simultaneously hold both buy and sell positions for the same currency pair. By holding positions of equal size in both directions, unrealized gains and losses offset each other, providing a risk hedge against sudden price fluctuations.

In addition, by effectively using hedging, you can not only avoid forced stop-outs in unfavorable market conditions but also minimize losses and enhance potential profits.

Hedging during market fluctuations carries risks, so it’s important to carefully consider the timing of your hedging transactions.

XM permits hedging only within the same account

XM permits hedging only within the same account. As a general rule, hedging across multiple accounts or with different brokers is prohibited, and unintentional violations may result in penalties such as account freezing or profit cancellation. Beginners in FX should be particularly cautious, as they might unknowingly engage in prohibited transactions. To avoid accidentally violating XM’s terms and conditions, always review the rules regarding prohibited hedging activities before trading.

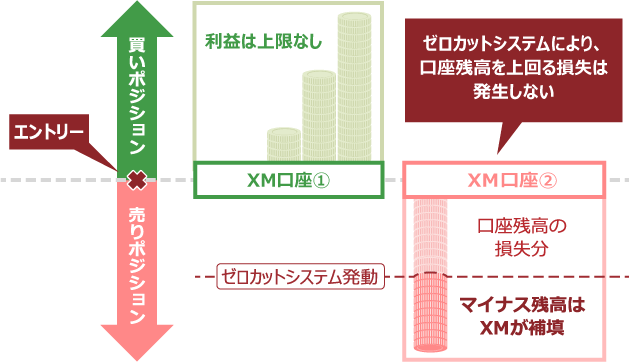

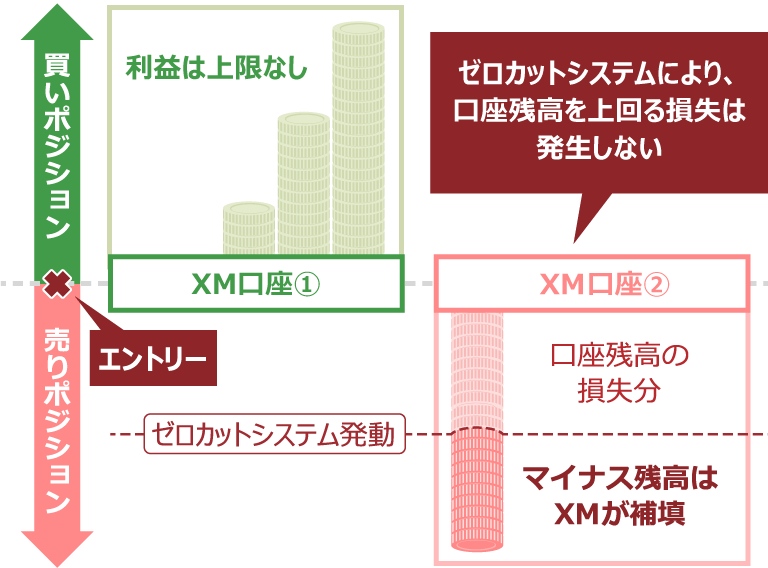

To prevent exploitation of the zero‑cut system through hedging transactions

The reason many overseas FX brokers, including XMTrading, prohibit hedging is to prevent abuse of the zero‑cut system. The zero‑cut system is a service that protects traders: if a sudden price fluctuation causes losses exceeding the account balance, the broker covers the negative amount and resets the account balance to zero.

For example, if a trader holds both buy and sell positions for the same currency pair across two XM accounts and a sudden price fluctuation occurs, one account could make a large profit while the other account only loses up to its account balance. XM’s zero‑cut system would cover the negative balance, allowing the trader to potentially earn the difference between the two accounts with no risk.

To prevent the risk of such one-sided advantages, XM prohibits hedging across multiple accounts or with different FX brokers.

Hedging Across Multiple Accounts at XM

XM prohibits hedging across multiple accounts within the platform. While each person can hold up to eight accounts, using these accounts to hedge individual buy and sell positions violates XM’s terms of service. Be aware that managing numerous positions across multiple accounts or using an EA (automated trading) could unintentionally result in prohibited hedging activity.

Hedging between XM and other FX brokers

XMTrading prohibits hedging between an XM account and any account with another broker. This restriction applies to all brokers, whether domestic or overseas. If you trade with multiple brokers, be careful not to unintentionally hedge positions across accounts.

Is it possible to monitor hedging transactions across other brokers?

When using a shared trading platform, such as MT4 or MT5, which XM also uses, FX brokers can access each other’s trading history and customer information. This means that if a hedging transaction occurs between an XM account and an account with another broker, XM can easily track the trade history. Be aware that attempting prohibited transactions across brokers, thinking they won’t be detected, can still result in penalties.

Coordinated Hedging Transactions by Multiple Traders

XM prohibits coordinated hedging by multiple people. For example, if one person intentionally holds a long position in one account and a short position in another, this creates hedging across multiple accounts, which could be used to exploit the zero‑cut system. Accidentally holding opposite positions to a friend is not an issue; however, if XM determines that the activity is organized hedging by multiple people—such as when clearly unnatural profits are being generated—it will be considered a prohibited transaction, and penalties like profit cancellation or account freezing may be applied.

Hedging Across Multiple Accounts to Mitigate Risk in Specific Currencies

XM prohibits hedging across multiple accounts to manage the risk of a specific currency. For example, if you hold a long EUR/USD position and intentionally open a short EUR/JPY position in another account to hedge against a potential Euro decline, this could be considered a prohibited hedging transaction. Like other forms of cross-account hedging, this may also result in an unintentional violation of XM’s terms of service.

Exercise caution when using an EA (Expert Advisor)!

If you have multiple XM accounts and are using an EA (automated trading) on one of them, exercise caution. The EA might unintentionally open positions that hedge the risk of a specific currency or mirror positions held in another manual account, which could constitute prohibited hedging. Please note that even if these positions are opened automatically and unintentionally by the EA, they will still be considered violations of XM’s terms of service.

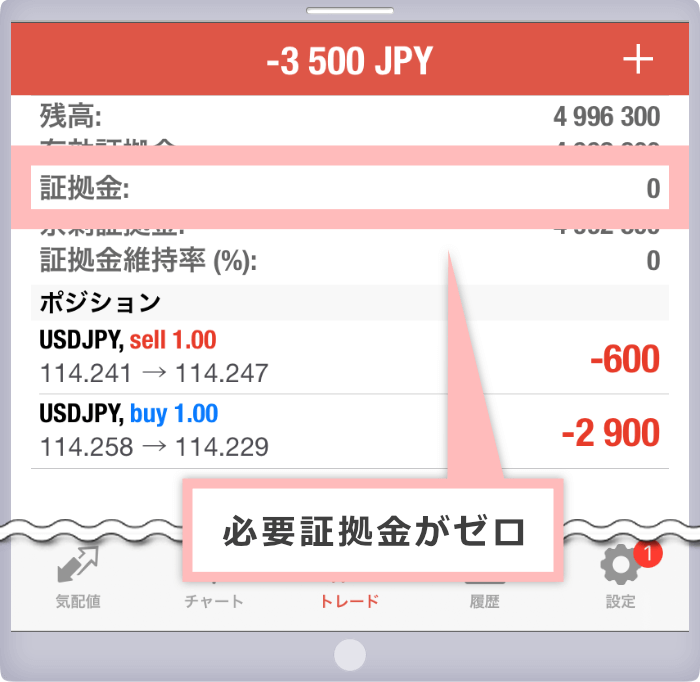

XM’s required margin is “0” (zero)

At XM, when you place hedging trades of the same lot size for FX currency pairs, gold, or silver within the same account, the required margin for these positions is “0” (zero). Unlike other FX brokers that may require margin for hedging trades, XM does not, creating a margin surplus. This allows you to maintain positions even in unfavorable conditions, helping to avoid forced stop-outs and enabling you to close positions at the optimal time. However, XM only waives the margin requirement for hedging trades of the **same lot size**; hedging trades with different lot sizes will still incur a required margin.

-

For XM’s FX currency pairs and products other than gold and silver, if you hold a long position of the same lot size, the required margin will not be zero. Please note that margin is required for only one side of the position—either the buy or the sell order.

-

Sudden market fluctuations can increase losses and trigger stop-outs, so always monitor market conditions closely when trading.

You can maintain your position and observe how the market evolves.

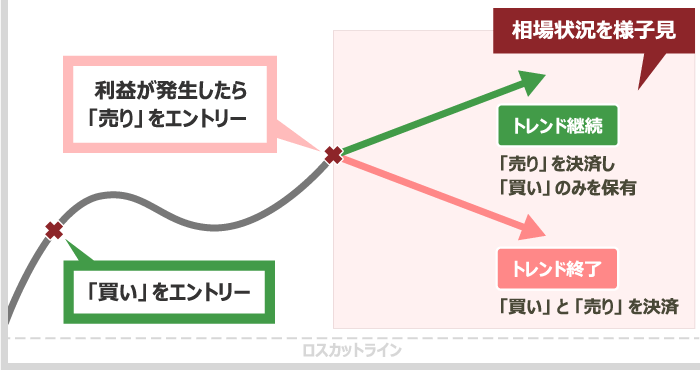

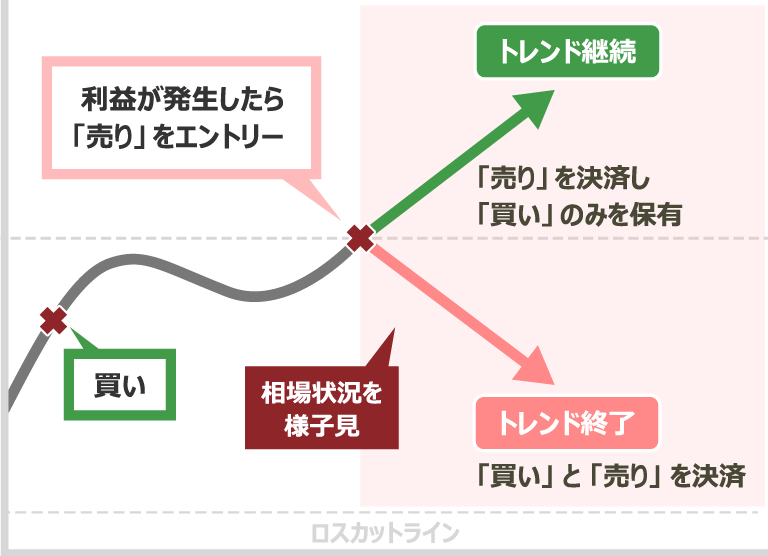

By trading hedges within the same XMTrading account, you can hold your positions and observe how market trends develop without closing them. For example, if a position is currently profitable, you can open an opposite position, enabling you to monitor the market risk-free and secure profits at the optimal time. Specifically, if the trend appears likely to continue, you may close only one position; if the trend seems to be ending, you can close both positions. This approach helps prevent forced stop-outs, minimizes losses, and allows you to maximize profits.

Hedging during market fluctuations carries risks, so it’s important to carefully consider the timing of your hedging trades.

You can employ different trading strategies simultaneously, depending on the market trend.

With XM, you can hold both long-term and short-term positions according to market trends, using hedging to trade positions with different holding periods simultaneously. By combining strategies such as swing trading, day trading, and scalping, you can increase your opportunities for greater profits.

Earn XM Points (XMP) for Complete Round-Trip Trades

XM Trading offers the “XM Loyalty Program,” allowing you to earn XM Points (XMP) with every trade, which can be redeemed for trading bonuses or cash. When using an XM Standard or Micro account, you can earn XM Points on both sides of a hedge. However, intentionally hedging solely to accumulate XM Points is considered a violation of the terms of use.

Watch Out for Swap Points When Holding Long-Term Positions

When you hold a position on XMTrading overnight, “swap points” are applied daily to account for the interest rate differential between currencies. Be aware that some FX currency pairs offered by XM have larger negative swaps than positive ones. Holding such positions for an extended period can result in losses equal to the accumulated swap points.

Exercise Caution When Hedging During Market Fluctuations

With hedging, you hold both a buy and a sell position, so if the hedge does not perform as expected, your losses can be twice as large as usual. Markets are especially prone to sudden fluctuations during major economic announcements, which can cause hedging positions to incur large losses or trigger stop-outs. While hedging offers many benefits in stable market conditions, it carries significant risk during volatile periods. When hedging with XM, it is recommended to closely monitor market conditions, even when the market appears relatively stable.

Timing for Closing Hedged Positions

When executing hedging trades with XM, hedged positions must be closed simultaneously (unhedged). Settling long and short positions separately can create timing risks, potentially increasing unrealized losses and reducing unrealized gains. XM’s MT4 (MetaTrader 4) and MT5 (MetaTrader 5) platforms include a built-in “unhedge” function, allowing you to close hedged positions easily and efficiently.

Exercise Caution When Closing Only One Position

When hedging, if you close only the buy or sell position, be aware that your margin maintenance rate may drop. At XM, hedging transactions of the same lot size require zero margin, but once one side of the hedge is closed, the hedge is canceled and the required margin increases according to the trading volume. If you are hedging to prevent a forced stop-out, closing only one position could cause your margin maintenance rate to fall sharply, potentially dropping below the stop-out threshold.

How to Close a Hedged Position on XM MT4/MT5

At XMTrading, you can easily close hedged positions simultaneously using the “hedge release” function built into XM’s MT4/MT5 platforms. The steps to perform a hedge release on MT4/MT5 are as follows.

-

Steps: 1

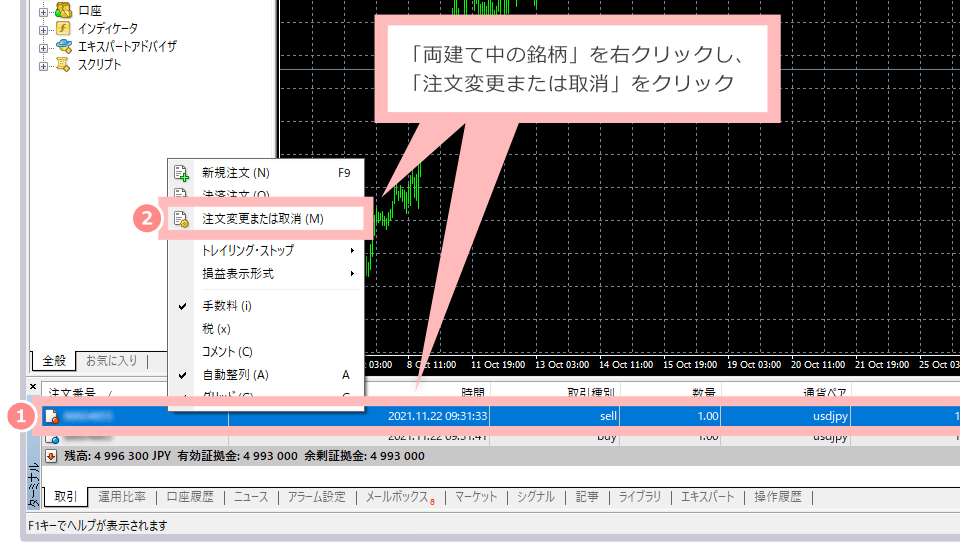

Modifying an Order for a Hedged Position

In the MT4/MT5 terminal, ① right-click on the currency pair you are trading in a hedged position, and then ② select “Change or Cancel Order.”

-

Steps: 2

Select “Cancel hedging”

From “Order Type”, select “Cancel Hedging: Specify Currency Pair”.

-

Steps: 3

“Hedging Cancellation” Completed

A yellow button labeled “Cancel Hedging” will appear. Make sure it corresponds to the correct currency pair, and if everything is correct, click it to complete the hedging cancellation process.

-

What are the benefits of XM’s hedging trading?

Hedging with XM offers several benefits, including a required margin of “0” (zero) for positions, the ability to employ multiple trading strategies simultaneously, and the accumulation of XM Points (XMP). However, intentionally hedging solely to earn XM Points is a violation of the terms of use, so be sure to review prohibited activities before trading.

read more

2021.11.10

-

Is it possible to close only one side of a long/short position at XM?

Yes, you can close only one side of a long or short position at XM. However, doing so will cancel the corresponding long or short position, and a margin requirement will be applied based on the remaining trading volume.

read more

2021.11.10

-

Please tell me how to cancel a hedged position at XM.

To close (unhedge) a hedged position simultaneously at XM, right-click on the currency pair you are hedging in MetaTrader 4 (MT4) or MetaTrader 5 (MT5), select ”Modify or Cancel Order,” and then choose “Unlock Hedged Position” under “Order Type.”

read more

2021.11.10

-

What is the required margin when trading long and short positions with XM?

At XM, when you hedge positions of the same lot size within a single account, the required margin for these positions is “0” (zero). This allows you to maintain sufficient margin and helps prevent forced stop-outs during hedging trades. However, if you hedge positions of different lot sizes, a required margin will apply.

read more

2021.11.10

-

Does XM Prohibit Scalping, EAs, or Hedging?

No, XM does not impose restrictions on scalping, using EAs, or hedging within the same account. However, hedging across multiple XM accounts or with accounts at other brokers is strictly prohibited.

read more

2020.06.16