XM Zero Account

XM Zero Account

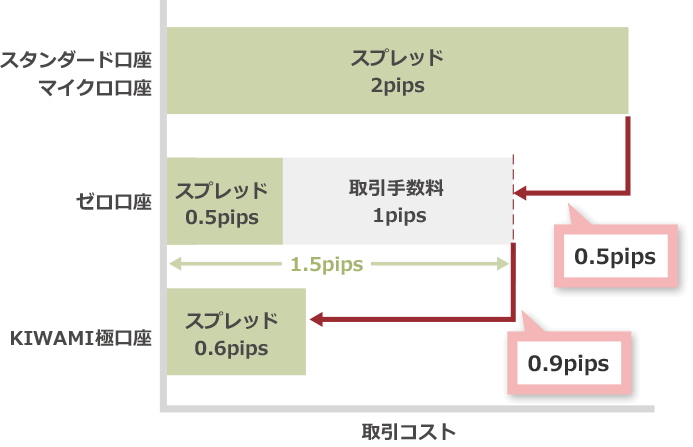

XM’s Zero Account, which features the tightest spreads starting from 0 pips , is recommended for professional traders who require tight spreads and traders who engage in high-speed trading such as scalping. XM’s Zero Account, which offers industry-leading execution power while minimizing spreads, incurs a one-way transaction fee of 5 currencies/lot, but offers the second lowest cost of trading after the KIWAMI Account.

XMTrading offers four types of accounts to accommodate various trading styles of customers: Standard Account, Micro Account, KIWAMI Account, and Zero Account.

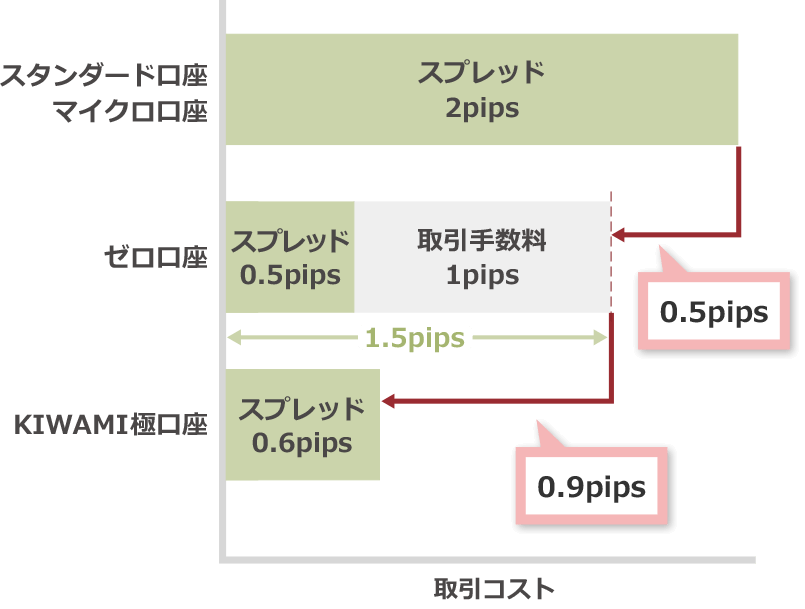

XMTrading’s Zero account is an account type that offers narrow spreads starting from a minimum of 0 pips . Since Zero accounts incur trading fees, the spreads including fees are narrower for KIWAMI accounts. However, because the spreads are narrower, it is possible to keep total trading costs lower than for Standard and Micro accounts.

XM Zero Account Trading Conditions (Features)

| Trading Platform | MetaTrader 4 (MT4) and MetaTrader 5 (MT5) |

|---|---|

| How to Order | No dealing desk OTC system |

| Margin Currency | Japanese Yen, US Dollar, Euro |

| Maximum Leverage | 500 times |

| Average spread (USDJPY) | 0.1 pips |

| Transaction fee (Note 1) | One way $5/lot |

| Minimum deposit amount | $5 worth |

| 1 lot trade size | 100,000 currency |

| Minimum Order Quantity | 0.01 lot (1,000 currency units) |

| Maximum order quantity (total maximum order quantity) | 50 lots (10,000 lots) |

| Product (brand) |

[FX currency pairs]: 55 brands

[Precious metals CFD]: 7 brands [Stock CFD]: 1,313 types (Note: 2) [Stock index CFD]: 31 brands [Commodity CFD]: 8 brands [Energy CFD]: 8 brands |

| Total: 1,422 stocks | |

| Stop loss level | 20% |

| Zero cut method | Applies |

| Bonus (Note 3) | can be |

-

This is the one-way fee amount based on a USD/JPY transaction.Please seehere for the trading fees for each product.

-

Stock CFDs are only available on MT5 accounts.

-

The only bonus available for Zero accounts is the “Account Opening Bonus (Trading Bonus).”

The Zero Account has the narrowest spreads among XM’s account types

XM’s Zero account is an account type that features narrow spreads starting from as little as 0 pips . For major currency pairs with high market volume, such as the Euro/US Dollar (EURUSD) and the US Dollar/Japanese Yen (USDJPY), the average spread is 0.1 pips. XM operates a variable spread system, which means spreads are constantly fluctuating depending on market conditions. Therefore, spreads may widen during periods of low liquidity or when the market moves significantly, such as when important economic indicators are released or important figures make statements. However, XM strives to offer consistently low spreads.

Click here to compare spreads with Standard/Micro/KIWAMI accounts

Zero accounts incur trading fees

XMTrading’s Zero account is an account type in which a trading fee is charged in addition to the spread . Trading fees are only charged for FX currency pairs and gold/silver, while other precious metals, stocks, stock indexes, energy, and commodity CFDs can be traded with only the spread as a cost. With XM’s Zero account, a one-way fee of 5 currencies (10 currencies round trip) is charged for each lot (= 100,000 currencies) traded, so when trading with a Zero account, you should be aware that the trading cost will be the “spread + trading fee.”

Please note that trading fees are calculated based on the base currency of the currency pair you are trading (the currency shown on the left). For example, if you purchase 1 lot of US Dollar/Japanese Yen (USD/JPY), you will incur a trading fee of $5 one way ($10 round trip), and if you purchase 1 lot of Euro/US Dollar (EUD/USD), you will incur a trading fee of €5 one way (€10 round trip).

Click here for an explanation of how Zero Account trading costs work

XMTrading’s Zero account keeps spreads as low as possible and is structured so that external trading fees are incurred. Therefore, the trading cost incurred when trading with a Zero account is the sum of the “spread” and the “trading fee. “

For Standard Accounts, Micro Accounts, and KIWAMI Accounts, which have no transaction fees, the only transaction cost that traders pay to FX brokers when making a transaction is the spread. For Zero Accounts, transaction costs must be calculated by adding the transaction fee to the spread.

When trading fees are required in addition to spreads, it may seem like overall trading costs are high, but XM’s Zero Account keeps spreads to an absolute minimum, making its total trading costs the second lowest of the four account types, after the KIWAMI Account .

What is the spread unit, pips?

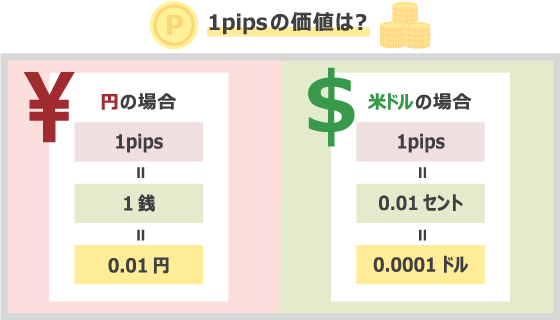

The spread refers to the difference between the bid and ask prices of a trading currency pair. The narrower this spread is, the lower the transaction costs, creating a more favorable trading environment for customers. Spreads are usually expressed in units called “pips.” Pips represent the minimum price movement, and by using pips, it is possible to express the trading conditions of each instrument using the same unit even for currency pairs that use different units.

For example, the rate units vary depending on the currency pair, such as yen, sen, dollars, or cents, such as “the spread between the US dollar and yen is 1 sen” and “the spread between the euro and US dollar is 0.02 cents.” However, by using pips, these different currencies can be expressed in a uniform unit, such as “the spread between the US dollar and yen is 1 pip” and “the spread between the euro and US dollar is 2 pips.”

How much is 1 pip?

The value of pips varies depending on the currency pair. For currency pairs where the settlement currency is the yen, such as the US dollar/yen (USD/JPY) or the euro/yen (EUR/JPY), 1 pip is equivalent to 0.01 yen, and for currency pairs where the settlement currency is the US dollar, such as the euro/US dollar (EUR/USD), 1 pip is equivalent to 0.01 cents (0.0001 dollars).

The above is the value of 1 pip per currency. For example, if you trade 1 lot of US Dollar/Japanese Yen (USD/JPY) with a spread of 1 pip, a 1 pip spread is worth 1 pip (0.01 yen) x 100,000 currency = 1,000 JPY.

To calculate trading costs like this, you need to calculate the pip value of the spread. By using XMTrading’s pips calculator, you can automatically calculate the pip value without having to do any complicated calculations.

XMTrading’s Zero account incurs a trading fee of 5 currencies one way (10 currencies round trip) for each lot traded. Therefore, the KIWAMI account, which offers zero commission and extremely small spreads starting from 0.6 pips, can reduce total costs. However, by offering narrow spreads as low as 0 pips, this account type offers lower overall trading costs than the Standard and Micro accounts, even when taking into account trading fees.

Average spread for Zero accounts

XM’s Zero account offers lower spreads for FX currency pairs, gold, and silver than the Standard account, Micro account, and KIWAMI account. To allow a fair comparison of the industry-leading, ultra-thin spreads of XM’s Zero account, XM publishes average spread values. Please note that spread values fluctuate daily, so please check the latest figures when trading .

XM Average Spreads by Account Type ( as of September 2025 )

| Product (brand) | Standard/ Micro Account |

KIWAMI polar account | Zero Account |

| AUDCAD (Australian dollar/Canadian dollar) |

3.9 pips | 3.1 pips | 1.8 pips |

| AUDCHF (Australian dollar/Swiss franc) |

3.6 pips | 2.0 pips | 1.3 pips |

| AUDJPY (Australian dollar/Japanese yen) |

3.6 pips | 2.5 pips | 1.5 pips |

| AUDCAD | |

| スタンダード/ マイクロ口座 |

3.9 pips |

| KIWAMI極口座 | 3.1 pips |

| ゼロ口座 | 1.8 pips |

| AUDCHF | |

| スタンダード/ マイクロ口座 |

3.6 pips |

| KIWAMI極口座 | 2.0 pips |

| ゼロ口座 | 1.3 pips |

| AUDJPY | |

| スタンダード/ マイクロ口座 |

3.6 pips |

| KIWAMI極口座 | 2.5 pips |

| ゼロ口座 | 1.5 pips |

-

55XM’s Zero Account offers low spreads onFX currency pairs , as well as gold and silver. Please note that for other products, the same spreads as the Standard/Micro/KIWAMI Accounts will be applied.

Zero Account Trading Fees

With XMTrading’s Zero account, a trading fee of 5 currencies per one way (10 currencies round trip) will be charged for each lot traded for the 55 FX currency pairs and 5 CFD products of gold and silver that can be traded with the Zero account. For CFD products other than gold and silver, the trading conditions are the same for all account types, and no trading fees will be charged even if you trade with a Zero account.

Please note that XM’s Zero Account trading fees are calculated in units of the base currency of the currency pair you are trading (the currency shown on the left). For example, if you trade USD/JPY, you will incur a trading fee of $5 per lot ($10 round trip).

The timing of when you pay trading fees depends on the trading platform of your trading account.

Timing of transaction fee payment

XM Zero Account Trading Fees by Instrument

| Product (brand) | Trading fee for 1 lot (one way) |

| AUDCAD (Australian dollar/Canadian dollar) |

5 AUD |

| AUDCHF (Australian dollar/Swiss franc) |

5 AUD |

| AUDJPY (Australian dollar/Japanese yen) |

5 AUD |

Zero Account Total Transaction Costs

The total trading costs for an XMTrading Zero account can be calculated by adding up the spread and trading fees. Below is a table listing the trading costs incurred when trading 1 lot (100,000 units) of each stock with a Zero account. The trading costs in the trading cost table are calculated by adding up the average spread value and trading fees (round trip), converted to yen (JPY). Please note that trading costs fluctuate daily as the average spread fluctuates. Please check the latest figures when trading .

Total trading cost calculation for Zero Account (when trading 1 lot of USD/JPY)

Average Spread

0.1 pips

100 JPY

Transaction fees

10USD

1,300JPY

Transaction costs

1,400 JPY

平均スプレッド

0.1pips

100JPYJPY

取引手数料

10USD

1,300JPY

取引コスト

1,400JPY

XM Zero account trading costs per lot

| Product (brand) | Total trading cost calculation formula (average spread + trading fee) |

Transaction costs |

| AUDCAD (Australian dollar/Canadian dollar) |

1.8 pips + 10 AUD | 2,800 JPY |

| AUDCHF (Australian dollar/Swiss franc) |

1.3 pips + 10 AUD | 3,095 JPY |

| AUDJPY (Australian dollar/Japanese yen) |

1.5 pips + 10 AUD | 2,426 JPY |

| AUDCAD | |

| 総取引コスト 計算式(注:1) |

1.8 pips + 10 AUD |

| 取引コスト | 2,800JPY |

| AUDCHF | |

| 総取引コスト 計算式(注:1) |

1.3 pips + 10 AUD |

| 取引コスト | 3,095JPY |

| AUDJPY | |

| 総取引コスト 計算式(注:1) |

1.5 pips + 10 AUD |

| 取引コスト | 2,426JPY |

-

Exchange rates are constantly changing.

-

Gold is calculated as 1 lot = 100oz (troy ounces), and silver as 1 lot = 5,000oz.

-

Total trading costs = average spread + trading fees

Gold and silver trading fees vary

One lot of gold or silver is measured in troy ounces (oz), and since the value of one lot (in US dollars) fluctuates, the transaction fee also fluctuates. For example, if one lot of gold is worth 100 oz, and the current rate of XAUUSD (gold) is 1,750 USD/oz, the transaction would be “1,750 USD x 100 oz = 175,000 USD.”

The transaction fee for a transaction of $175,000/1 lot is $10 round trip, which can be calculated using the following formula:

$175,000 x 10 currencies ÷ 100,000 currencies = $17.5

Please note that since the units and currency amounts per lot for gold and silver are different from those for FX currency pairs, trading fees will fluctuate depending on the current price.

XM’s Zero Account is an account type that allows you to trade with narrow spreads starting from 0 pips . Due to external transaction fees, the Zero Account has higher total trading costs compared to the KIWAMI Account, which also has a low spread. However, for some currency pairs, the Zero Account offers lower trading costs even when transaction fees are taken into account. The Zero Account also allows you to trade with swap points while minimizing costs . The Zero Account is the only account type offered by XM that differs in maximum leverage and fee structure, so compare it with the Standard/Micro/KIWAMI Accounts to enjoy trading with XM under the best trading conditions.

Those who want to trade Oceanian currency pairs at low cost

The Zero account is recommended for those who want to trade some of XMTrading’s Oceania currency pairs with minimal trading costs. For major currency pairs such as the Euro/US Dollar (EURUSD) and the US Dollar/Yen (USDJPY), the KIWAMI account offers lower trading costs than the Zero account. However, for some Oceania currency pairs, the Zero account offers the lowest trading costs, even when taking into account the round-trip trading fee of 10 currencies per lot.

Comparison of average spreads including trading fees for XM’s Oceania currency pairs

| Product | KIWAMI polar account | Zero Account |

| AUDUSD (Australian Dollar/US Dollar) |

1.3 pips | 1.4 pips |

| NZDUSD (New Zealand Dollar/US Dollar) |

2.0 pips | 1.8 pips |

| AUDNZD (Australian dollar/New Zealand dollar) |

3.2 pips | 3.1 pips |

| AUDUSD | |

| KIWAMI極口座 | 1.3pips |

| ゼロ口座 | 1.4pips |

| NZDUSD | |

| KIWAMI極口座 | 2.0pips |

| ゼロ口座 | 1.8pips |

| AUDNZD | |

| KIWAMI極口座 | 3.2pips |

| ゼロ口座 | 3.1pips |

Spreads are constantly changing, so please check the latest information.

As mentioned above, there are some currency pairs where the Zero Account is more cost-effective. If you wish to trade FX currency pairs, please compare the total trading costs, including trading fees, between the Zero Account and the KIWAMI Kyoku Account before trading. However, as there are differences in maximum leverage and swap points between the Zero Account and the KIWAMI Kyoku Account, please make a comprehensive decision, including trading conditions other than trading costs.

Comparison of specifications between XM Zero Account and KIWAMI Goku Account

| item | Zero Account | KIWAMI polar account |

| Maximum Leverage | 500 times | 1,000 times |

| Minimum Spread | 0.0 pips~ | 0.6 pips and up |

| Transaction fees | One way $5/lot | free |

| Swap Points | occurs | Does not occur (only select brands) |

| 最大レバレッジ | |

| ゼロ口座 | 500倍 |

| KIWAMI極口座 | 1,000倍 |

| 最小スプレッド | |

| ゼロ口座 | 0.0pips~ |

| KIWAMI極口座 | 0.6pips~ |

| 取引手数料 | |

| ゼロ口座 | 片道5ドル/1ロット |

| KIWAMI極口座 | 無料 |

| スワップポイント | |

| ゼロ口座 | 発生する |

| KIWAMI極口座 | 発生しない (厳選銘柄のみ) |

Those who want to aim for swap points while keeping costs down

The Zero account is recommended for those who wish to hold positions in major stocks long-term and accumulate swap points. While swap points are accrued in all account types offered by XMTrading, the KIWAMI account offers a swap-free policy that does not accrue swap points for select stocks, including major currency pairs and gold and silver. Therefore, if you wish to earn swap points on stocks eligible for the swap-free policy in the KIWAMI account, you will need to trade in either a Standard, Micro, or Zero account. The Zero account, in particular, offers narrower spreads starting from 0 pips compared to the Standard/Micro account, allowing for lower trading costs. Therefore, it is recommended for those who wish to pursue swap point profits while keeping costs down . However, please note that the maximum leverage for the Zero account is 500x, which requires higher margin than the Standard/Micro account.

What are swap points?

Swap points are adjustments made due to the interest rate differential between the two currencies traded in FX. Swap points, which arise due to differences in each country’s policy interest rates, are accrued every day while you hold a position. Since swap points are an “interest rate differential,” if you buy a low-interest currency and sell a high-interest currency, you will have a negative swap and will need to pay swap points. On the other hand, if you buy a high-interest currency and sell a low-interest currency, you will receive swap points, so one trading method is to hold a position long-term and steadily accumulate swap points every day.

-

Swap points fluctuate daily depending on exchange rates and market interest rates, so please be sure to check them regularly not only before opening a position but also while you are holding it.

-

Currency pairs with high swap points have a high risk of price fluctuations and spreads are likely to widen, so please pay attention to the margin maintenance rate while holding a position.

When using the XMTrading Zero Account, please note the following points.

Zero account has 500x leverage

XMTrading’s Zero account allows for a maximum leverage of 500x, unlike the Standard/Micro/KIWAMI accounts, which have a maximum leverage of 1,000x . The higher the leverage, the less margin you can trade with, and conversely, the lower the leverage, the greater the required margin.

Example of margin requirements (per lot) for XM leverage

| Product | Leverage 1,000x Standard/KIWAMI Extreme Account |

Leverage 500x Zero Account |

| EURUSD (European Euro/US Dollar) |

17,271 JPY | 34,543 JPY |

| USDJPY (US Dollar/Japanese Yen) |

14,820 JPY | 29,639 JPY |

| EURJPY (European Euro/Japanese Yen) |

17,271 JPY | 34,543 JPY |

| GBPUSD (British Pound / US Dollar) |

19,904 JPY | 39,808 JPY |

| スタンダード/KIWAMI極口座 レバレッジ1,000倍 |

|

| EURUSD | 17,271 JPY |

| USDJPY | 14,820 JPY |

| EURJPY | 17,271 JPY |

| GBPUSD | 19,904 JPY |

| ゼロ口座 レバレッジ500倍 |

|

| EURUSD | 34,543 JPY |

| USDJPY | 29,639 JPY |

| EURJPY | 34,543 JPY |

| GBPUSD | 39,808 JPY |

-

The required margin fluctuates depending on the exchange rate level, so please check the latest figures when trading.

-

For micro accounts, 1 lot = 1,000 units, so the required margin is 1/100 of the above.

To trade with an XM Zero Account, you will need a margin that is approximately 1.8 times that of a Standard/KIWAMI Account, but with narrow spreads starting from 0 pips, you can trade at low cost. Please choose the account type that best suits your trading conditions and trading style.

What is leverage?

Leverage means the “principle of leverage,” and in FX it refers to trading large amounts with a small margin. For example, with a margin of 10,000 yen, a leverage of 500x means you can trade 5 million yen, and with a leverage of 1,000x you can trade 10 million yen.

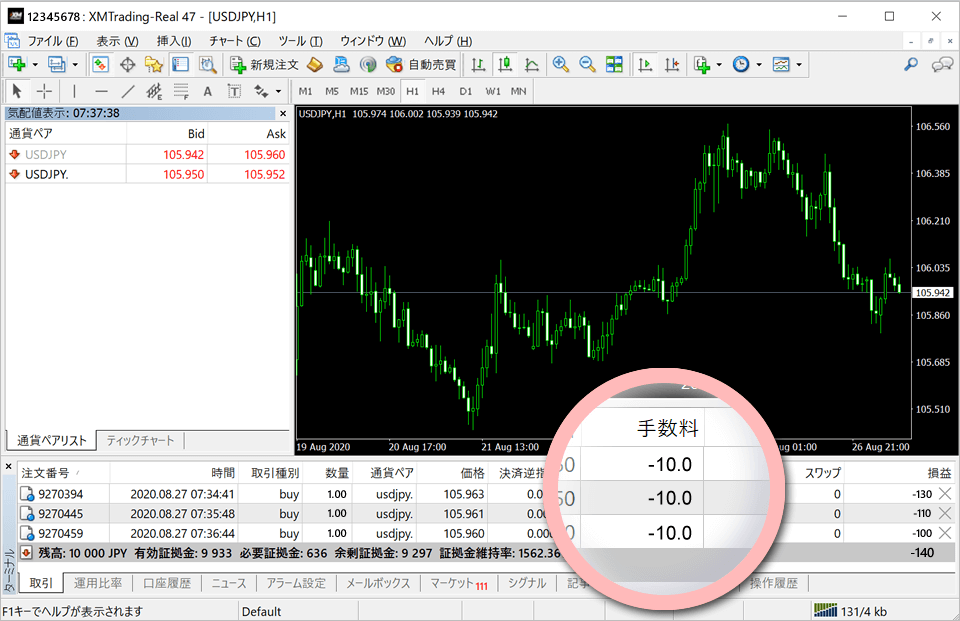

Trading fees incurred in an XMTrading Zero account are paid at different times depending on the trading platform you use: MT4 (MetaTrader 4) or MT5 (MetaTrader 5). For MT4, a 10-currency round-trip fee is deducted from your trading account balance when you open a position. For MT5, a 5-currency one-way trading fee is deducted from your balance when you open a position, and the remaining 5-currency one-way trading fee is deducted from your balance when you close the position. When trading with MT5, please note that the account currency conversion rate for the trading fee differs for each round-trip.

XM Zero Account trading fees can be viewed in the “Trade” tab of your MT4/MT5 terminal.

Zero accounts are only eligible for new account opening bonuses (trading bonuses).

Please note that the only bonus eligible for XMTrading’s Zero account is the “account opening bonus (trading bonus).” XM offers three types of bonuses to all customers who open a new real account: an ” account opening bonus ” worth 15,000 yen that can be used as trading funds; a two-tiered ” deposit bonus ” that can be received up to the equivalent of $10,500 depending on the amount deposited; and a ” loyalty program (trading points) ” that allows you to accumulate points based on the amount of trading . However, only the “account opening bonus” is eligible for the Zero account.

In addition to the three bonuses mentioned above, XMTrading also holds irregular campaigns. There are also campaigns for zero accounts, so please take advantage of them.

Regarding stocks that cannot be traded with a zero account

Zero accounts do not offer cryptocurrency CFD trading. Cryptocurrency CFDs are only available for trading on Standard, Micro and Kiwami accounts.

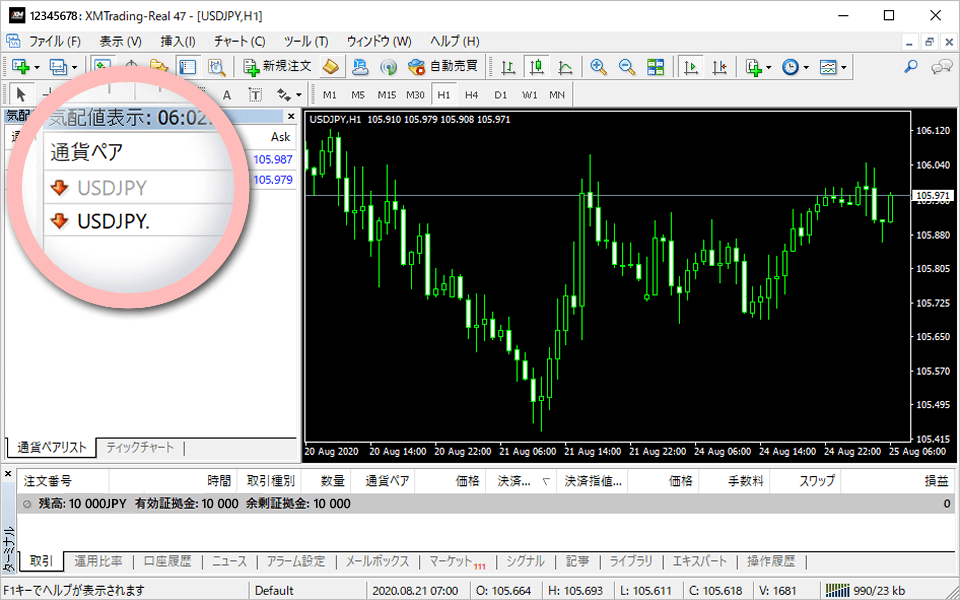

For FX with a zero account, select the stock name with a period.

At XMTrading, the names of instruments that can be traded vary depending on the account type . For FX with a Zero account, you can trade instruments with a “.” (period) suffix after the currency pair (e.g., USDJPY. ). Instrument names without a suffix after the currency pair are FX instruments available with a Standard account. If you use a Zero account, the Standard account instrument (USDJPY) will appear grayed out in the quote window, but you will not be able to trade it. However, you can trade precious metal CFDs other than gold and silver, stock index CFDs, commodity CFDs, and energy CFDs with the same instrument names and trading conditions (spreads, leverage, no commissions) as with a Standard account.

If you are using an EA that specifies the currency pair to trade, please note that it may not work with currency pairs with suffixes.

-

What are the trading fees for XM Zero accounts?

XM’s trading fees vary by product. The trading fee for a Zero Account is 5 units per way (10 units round trip), and is based on the base currency of the currency pair you are trading (the currency shown on the left). For USD/JPY, a trading fee of $5 per lot per way ($10 round trip) will be charged.

read more

2020.08.27

-

What is the maximum order number for an XM Zero account?

With an XM Zero Account, you can order up to 50 lots per trade. You can also hold up to 200 positions simultaneously within the same account, for a total of up to 10,000 lots. The minimum order size for a Zero Account is 0.01 lots.

read more

2020.08.26

-

What are the disadvantages of XM’s Zero account?

The disadvantage of the Zero Account is that it is not eligible for deposit bonuses or the XM Points Program (although new account opening bonuses (trading bonuses) are available). Also, the maximum leverage for the Zero Account is 500x, so if you wish to use 1,000x leverage and all the bonuses offered by XM, we recommend the Standard Account.

read more

2020.08.26

-

What are the benefits of the XM Zero account?

The advantage of XM’s Zero Account is the narrowest spread, with a minimum of 0 pips. The Zero Account has the narrowest spread of the four account types. The average spread for major currencies such as the USD/JPY is around 0.1 pips, making it a recommended account type for scalping and short-term trading.

read more

2020.08.26

-

How much tighter are the spreads on XM Zero accounts compared to standard accounts?

XM’s average spreads for USD/JPY are 1.6 pips for Standard Accounts and 0.1 pips for Zero Accounts. For EUR/USD, the spreads are 1.7 pips for Standard Accounts and 0.1 pips for Zero Accounts, with Zero Accounts offering the narrowest spreads.

read more

2020.03.25