XM scalping method features and rules

XM scalping method features and rules

XM offers a comfortable scalping environment with an average execution rate of 99.35% . Scalping is a trading method that allows you to trade from entry to settlement in a very short time. Since it is easy to set a tight stop loss, it is also well-suited for trading using XM’s unique high leverage of up to 1,000x.

Furthermore, XM’s KIWAMI account offers extremely low spreads starting from 0.6 pips with no trading fees, allowing you to trade at a cost that is unmatched by other companies. Therefore, of all the account types offered by XM, it is the most suitable for scalping. Please review XM’s scalping rules and scalping techniques for beginners before enjoying scalping in XM’s world-class trading environment.

![]()

With extremely small spreads and excellent execution power, you can scalp in a comfortable trading environment.

XM scalping method features and rules

XM does not prohibit scalping. Some FX brokers prohibit scalping due to concerns about liquidity and high load on trading servers, but XM does not prohibit scalping, so you can scalp without any restrictions.

What is scalping?

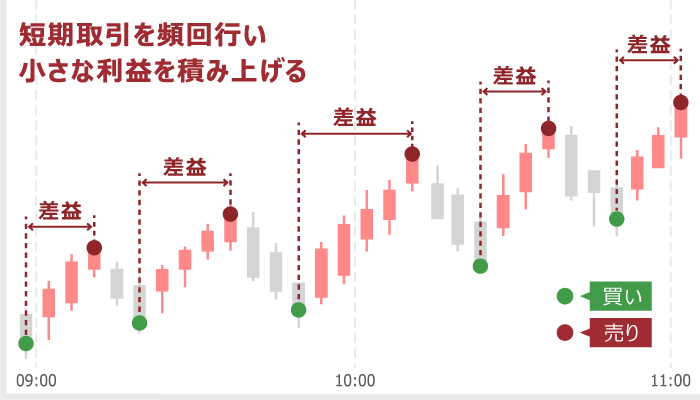

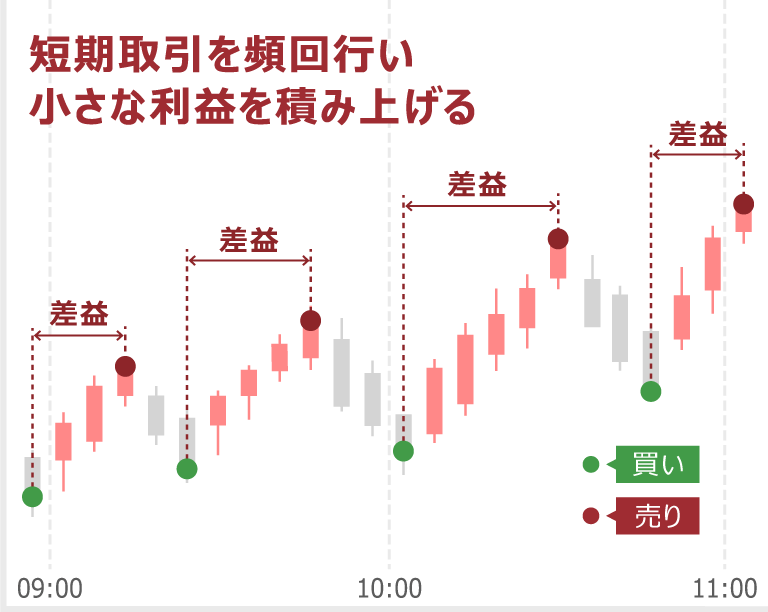

Scalping is a trading method in which trades are repeatedly entered and closed in a very short period of time . Because it is an ultra-short-term trade, the risk of loss due to large price fluctuations is reduced, but the profit per trade is also small. Therefore, when scalping, it is important to keep trading costs, which are the sum of spreads and trading fees, low .

Although scalping requires quick trade decisions, it is a trading method that beginners can use to quickly gain trading experience. Another attractive feature of scalping is that because positions are held for a short period of time, you can make speculative profits by using leverage even with a small amount of capital.

XM allows scalping without limits

XM officially permits scalping , and although there are some restrictions, there are no restrictions on trading instruments or lot sizes for scalping. Therefore, XM allows scalping of cryptocurrency CFDs, which have the highest volatility, without any restrictions. Regarding lot size, the same minimum and maximum lot sizes are allowed for all trading methods, including day trading, swing trading, and scalping. With a standard account, you can place orders from a minimum of 0.01 lots (1,000 units) to a maximum of 100 lots (10 million units) at a time.

Click here for details on XM’s minimum and maximum lot size (lot calculation method)

XM not only offers the KIWAMI Kiwami Account, which allows you to trade at the lowest possible cost, but also provides a trading environment that allows for comfortable scalping, with industry-leading execution power, up to 1,000x leverage, and a wide variety of trading instruments.

Scalping using automated trading (EA) is also not prohibited.

XM allows unlimited scalping through discretionary trading as well as automated trading using MT4/MT5 EAs (Expert Advisors). By utilizing automated trading (EA), you can easily perform high-frequency scalping that would be difficult to achieve manually. XM has no particular restrictions on EA logic, and has excellent execution power that is sufficient to handle everything from scalping in minutes to ultra-high-frequency scalping. However, please be aware that depending on the EA logic, you may unintentionally engage in hedging across multiple accounts, which could result in prohibited transactions.

Is scalping a difficult trading method?

Scalping is said to be a difficult trading method for beginner traders, but by using it effectively, you can earn profits while minimizing the risk of loss. Scalping requires a very short time from entry to exit, and many traders focus on 1-minute to 15-minute candlestick charts. Therefore, scalping requires speed in trading decisions and analysis. On the other hand, day trading and swing trading take longer to complete a trade than scalping, making them easier for beginners to make calm decisions and analyze. Because scalping requires quick decision-making and analytical skills, it can be a difficult method for beginner traders. Therefore, we recommend using an automated trading system (EA) that can automate all trading.

Detailed instructions for running EA (Expert Advisor) are provided in the XM MT4/MT5 User Guide, with easy-to-understand illustrations.

With XM MT4/MT5, you can not only perform settlement and order operations, but also check trading conditions, manage your account, set indicators, etc. For detailed instructions on how to use XM MT4/MT5, please refer to the “XM MT4/MT5 User Guide.”

XM officially permits scalping, but prohibits scalping that violates certain terms of use. Please be aware that if scalping that falls under prohibited transactions is deemed malicious, you may be subject to penalties such as account freezing or refusal to withdraw fraudulently obtained profits. Prohibited transactions related to scalping at XM are as follows:

XM scalping-related prohibited transactions

-

Hedging between multiple accounts

-

Trading using rate errors and connection delays

-

Transactions aimed at fraudulently obtaining bonuses

-

Trading only targeting gaps

Hedging between multiple accounts

XMTrading prohibits scalping involving hedging between multiple accounts. Hedging between multiple accounts also includes the following transactions:

-

Hedging between additional XM accounts

-

Hedging between XM and other company accounts

-

Hedging between groups including XM accounts

-

Hedging using multiple XM accounts

At XM, hedging is only possible within the same account, so scalping using hedging between multiple accounts is prohibited. Hedging between accounts with other companies other than XM is also prohibited, and hedging between accounts with other companies may be discovered during the process of orders flowing to liquidity providers (LPs), so please be careful if you also have accounts with other companies.

-

Arbitrage trading, which aims to take advantage of price differences in rates or swap points between accounts, is likely to be considered a hedging arrangement between multiple accounts. For this reason, XM prohibits scalping for the purpose of arbitrage trading.

-

Please note that if you are running EA (automated trading), you may be unintentionally conducting prohibited transactions such as hedging between multiple accounts.

Trading using rate errors and connection delays

XMTrading prohibits scalping that targets only the moment when a rate error accompanied by a connection delay occurs. Rate errors accompanied by connection delays, such as shock market conditions that cause sudden market fluctuations, can occur with any FX broker. Please note that intentionally targeting such timing for trading is prohibited.

Transactions aimed at fraudulently obtaining bonuses

XM prohibits trading with the purpose of fraudulently obtaining bonuses. For example, trading methods such as hedging multiple accounts with bonus credits, zero-cutting one account, and securing unrealized profits in the remaining accounts fall under this category.

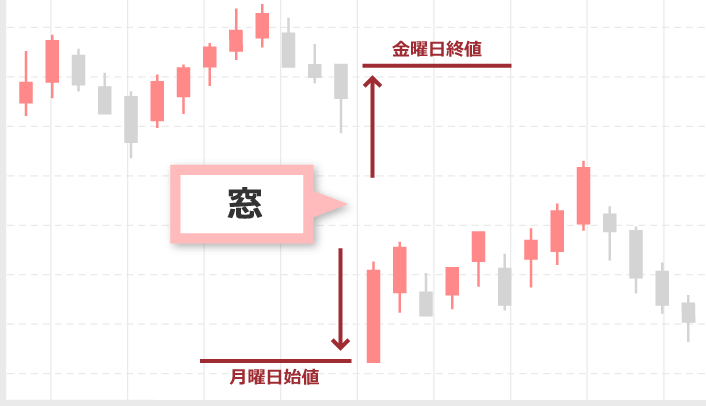

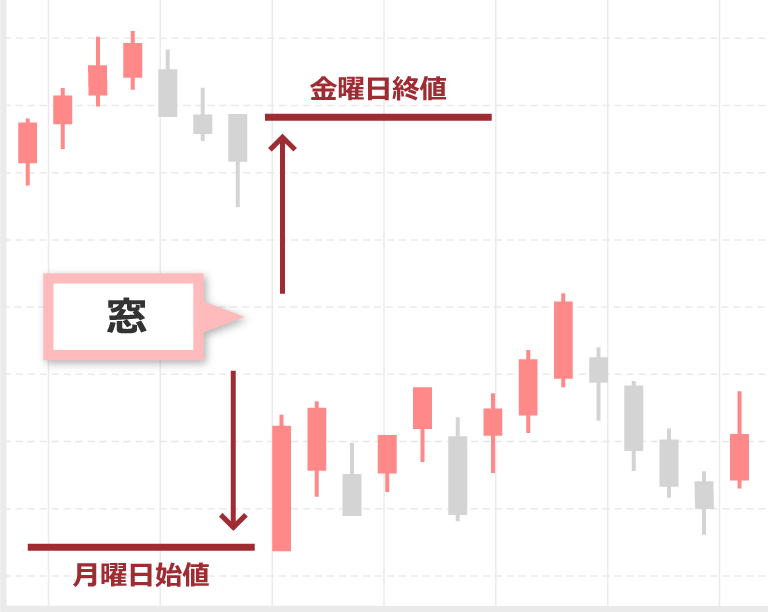

Trading aimed only at opening windows

The phenomenon of large rate movements over the weekend causing a large divergence between the closing price on Friday and the opening price early on Monday morning when the main market begins to move is called a “gaps.” XMTrading prohibits trading that targets only the timing of gaps, and scalping limited to these timings is also prohibited, so please be aware of this.

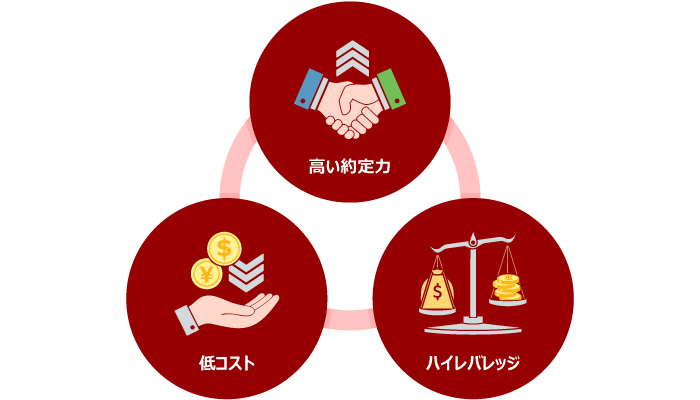

Scalping is a trading method that aims for small price fluctuations by repeating short-term buying and selling, so by its nature it requires three essential conditions: low cost, high execution power, and high leverage. XMTrading provides a trading environment that is well-balanced in terms of these three conditions, making it ideal for beginners as well as advanced traders who combine small amounts of capital with high leverage to get started with scalping.

There are six benefits to scalping with XM. XM not only offers narrow spreads and high execution power, which are important for scalping, but also high leverage and generous bonuses that can increase capital efficiency.

Advantages of scalping with XM

-

Industry-leading execution power

-

Up to 1,000x leverage

-

Trading at the lowest possible cost

-

Increase your funds with various bonuses

-

Stop Level Zero

-

A wide range of brands available

Advantage 1. Industry-leading execution power

XM has an industry-leading execution rate of 99.35% on average . With no contract rejections or requotes, you can comfortably trade scalping with this execution rate that ensures you don’t miss any market opportunities.

Advantage 2. Trading with a maximum leverage of 1,000 times is possible even with small amounts

XMTrading’s Standard, Micro, and KIWAMI accounts allow you to trade FX currency pairs and some precious metals with up to 1,000x leverage. Scalping and high leverage go hand in hand, and even with a small amount of capital, you can make big profits through speculation.

The table below shows the required margin for major currency pairs when set to a maximum leverage of 1,000x. For most major currency pairs, it is possible to hold a position with a margin of around 10,000 yen per lot. When trading with the minimum lot (1,000 units), it is possible to start scalping with a margin of just around 100 yen.

XM’s required margin for major currency pairs (for 1,000x leverage)

| Currency Pair/Margin Required | 1 lot | 0.1 lot | 0.01 lot |

| USD/JPY (US dollar/Japanese yen) |

14,820 yen | 1,482 yen | 148 yen |

| EUR/GBP (Euro/Pound) |

17,271 yen | 1,727 yen | 173 yen |

| EUR/USD (Euro/US Dollar) |

17,271 yen | 1,727 yen | 173 yen |

| GBP/USD (Pound Sterling/US Dollar) |

19,904 yen | 1,990 yen | 199 yen |

| AUD/USD (Australian Dollar/US Dollar) |

9,669 yen | 967 yen | 97 yen |

| USD/CAD (US Dollar/Canadian Dollar) |

14,820 yen | 1,482 yen | 148 yen |

| USD/JPY | |

| 1 lot | 14,820 yen |

| 0.1 lot | 1,482 yen |

| 0.01 lot | 148 yen |

The required margin fluctuates depending on the exchange rate level, so please check the latest figures when trading.

XM adopts a zero cut system

In FX trading, high leverage can lead to large profits, but it also increases the risk of loss. However, XM employs a zero-cut system, so even if a negative balance occurs, it will be reset to zero. Normally, in domestic FX, if losses exceed the margin, you must pay margin calls (additional margin). However, with XM, you do not need to pay margin calls, and losses that exceed the amount deposited will not occur, so you can trade with peace of mind.

Advantage 3. You can trade at the lowest possible cost

XMTrading’s KIWAMI Goku Account is commission-free and offers extremely small spreads starting from 0.6 pips , allowing you to trade at the lowest possible cost. Scalping involves repeated short-term trades, which limits the profits you can make from each trade. Therefore, by keeping the costs incurred with each trade low, you can earn profits efficiently. The Zero Account features extremely narrow spreads starting from 0 pips, but incurs a trading fee of $5 (equivalent) per one-way trade per lot. Considering the total cost of fees and spreads, the KIWAMI Goku Account is a more suitable account type for scalping.

Click here for details on the extremely low costs of XM’s KIWAMI Extreme Account

Comparison of average spreads between KIWAMI Kyoku Account and Zero Account (including trading fees)

| Currency Pairs | KIWAMI polar account | Zero Account |

| USDJPY (US Dollar/Japanese Yen) |

1.2 pips | 0.2 pips |

| EURUSD (European Euro/US Dollar) |

1.0 pips | 0.2 pips |

| GBPUSD (British Pound / US Dollar) |

1.2 pips | 0.9 pips |

| USDCHF (US Dollar/Swiss Franc) |

1.5 pips | 1.2 pips |

| USDCAD (US Dollar/Canadian Dollar) |

2.2 pips | 1.3 pips |

| AUDUSD (Australian Dollar/US Dollar) |

1.3 pips | 0.8 pips |

| USDJPY | |

| KIWAMI極口座 | 1.2 pips |

| ゼロ口座 | 0.2 pips |

Spreads fluctuate daily, so please check the latest figures when trading.

XM adopts “fractional pip pricing”

XM uses “fractional pip pricing” and can offer extremely small spreads of less than 1 pip. XM’s spreads are variable and may temporarily widen depending on market conditions, but by trading with tighter spreads, you can make profits even with small price fluctuations.

Benefit 4. Increase your funds with various bonuses

XMTrading is running a generous bonus campaign offering bonuses (credits) worth over 1 million yen in total . In addition to the “account opening bonus (trading bonus)” available to all account types, standard and micro accounts can receive “deposit bonuses” and trading bonuses through the “loyalty program.” By taking advantage of the bonus campaign, you can secure additional trading funds in addition to your deposit amount. The more trading funds you can secure, not just for scalping but for any trading method, the more you can broaden the scope of your trading strategies, giving you an advantage in trading.

-

Only the “Account Opening Bonus (Trading Bonus)” is available for XM Zero Account and KIWAMI Goku Account. Other limited-time campaigns may also apply, soplease check ”XM’s Current Bonus Campaigns ” for details.

Advantage 5. Zero stop level

XM uses a “zero stop level .” A stop level is the minimum price difference that must exist between the limit or stop order price and the real-time market price. With FX brokers that have wide stop levels, even if you want to narrow your stop loss, you will need to set an order price that exceeds the stop level price difference. XM uses a zero stop level, so you can set stop-loss orders with any price range, even if you want to narrow your stop loss when scalping. The lack of stop levels maximizes the freedom in order prices, allowing for more flexible trading.

Advantage 6. Wide range of brands available

XM offers a wide range of scalping options , from FX currency pairs to stock indices, precious metals, and cryptocurrency CFDs . To efficiently profit from scalping, it’s recommended to ride market trends and achieve large profit margins in a short period of time, rather than maintaining a high win rate and accumulating small profits. XM offers 1,488 stocks, allowing you to choose the most volatile trading stock at the time of your trade for efficient scalping. Please note that 1,313 stock CFDs are only available on MT5 accounts. Eight thematic index CFDs are also only available on MT5 Standard and Kiwami accounts.

List of XM trading stocks

| Trading Instruments | Number of trading stocks |

| FX Currency Pairs | 55 types |

| Precious metal CFD | 7 types |

| Share CFDs | 1,313 types |

| Stock Index CFDs | 31 types |

| Commodity CFD | 8 types |

| Energy CFD | 8 types |

| Thematic Index CFDs | 8 types |

| Cryptocurrency CFDs | 58 types ( 28 stocks for MT4 ) |

Here we will introduce two recommended account types for scalping with XMTrading, divided by trading style. The account types recommended for scalping with XM are as follows:

“Standard Account” for scalping beginners

We recommend the “Standard Account” for scalping beginners who want to gain experience in scalping trading or who want to use leverage with a small amount of capital. The Standard Account allows scalping with a small amount of capital with a maximum leverage of 1,000 times.

In addition, with a Standard Account, you can take advantage of not only the account opening bonus (trading bonus), but also deposit bonuses and loyalty programs, so you can increase your trading capital by taking advantage of all of XM’s bonuses. XM’s loyalty program allows you to earn XM Points, which can be exchanged for credits equivalent to approximately $6 per lot trade. XM Points are awarded regardless of whether the trade is successful or unsuccessful, so even beginner traders can benefit from the bonuses and scalp with reduced effective spreads. Furthermore, while the spreads on the Standard Account are wider than those on the Zero Account, there are no trading fees for the Standard Account.

“KIWAMI Goku Account” for scalping traders

We recommend the “KIWAMI Kyoku Account” for intermediate and advanced traders with a trading style centered around scalping. The KIWAMI Kyoku Account is commission-free and offers extremely low spreads starting from 0.6 pips , making it the lowest-cost account type offered by XMTrading. The Zero Account offers low spreads starting from 0 pips, but with a one-way trading fee of $5 per lot, trading costs are higher.

Scalping is a trading method that involves frequent short-term trades, so the lower the costs incurred with each trade, the greater the profit you can make per trade. Scalping also involves repeatedly targeting small price fluctuations, but XM’s KIWAMI Goku account offers leverage of up to 1,000x, making it possible to maximize profits with a small margin. The KIWAMI Goku account provides a satisfactory trading environment for scalping, even for intermediate traders who can consistently secure a certain level of win rate and profit margin.

We will introduce three scalping methods that are easy to understand even for beginners and are tailored to the trading conditions of XMTrading.

Range trading using channel lines

Range trading using channel lines is one of the simplest scalping methods. In channel scalping, a trend line is drawn based on high-high or low-low prices, and a channel line is drawn by duplicating the line at the same angle.

With XMTrading’s MT4/MT5, you can easily duplicate trend lines of the same angle by holding down the Ctrl key while dragging and dropping. After drawing a channel line, you can enter and exit positions based on the upper and lower limits of the channel line. Position direction is short if the channel line is sloping downwards, and long if it is sloping upwards, which is trend-following. Scalping techniques using channel lines offer many entry opportunities, so it’s important to focus on accumulating profits by maintaining a high win rate with tight stop losses rather than making a big profit in one go.

Hourly trend following

Hourly trend following is a scalping technique that involves checking the trend on the hourly chart and making trend-following trades on a minute-by-minute basis (1 to 15 minutes).

If a clear trend can be seen on the 1-hour to 4-hour charts, buy on dips if the trend is up and sell on rallies if the trend is down. Conversely, if the trend is unclear on the hourly chart, it’s important to avoid forcing trades to stabilize your win rate and reduce unnecessary losses. We recommend establishing simple criteria for entry points for buying on dips and selling on rallies, such as the classic Dow Theory or displaying a moving average and entering when it overlaps with the rate. Additionally, if you’re using XMTrading’s MT5 trading platform, you can display a mini chart by going to “Insert” → “Objects” → “Graphics” → “Charts” in the top menu. Using the mini chart allows you to view the minute chart while checking the trend direction on the hourly chart.

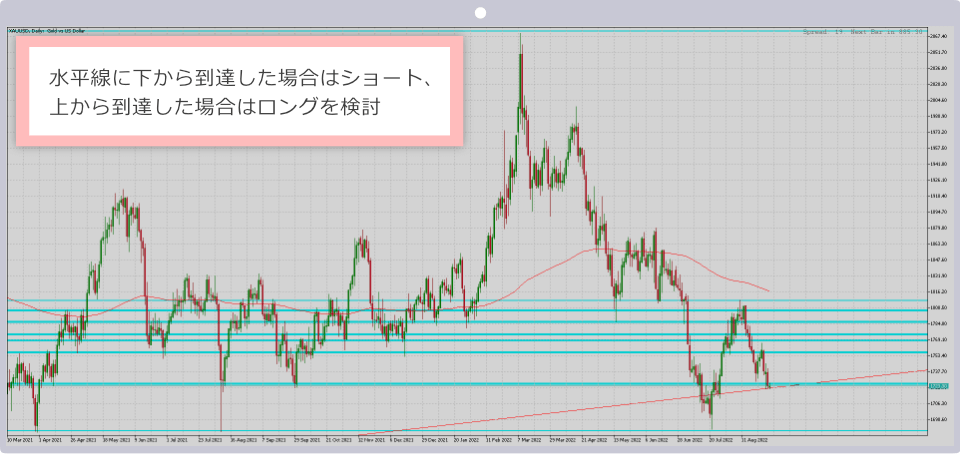

Contrarian trading using horizontal lines

Contrarian trading using horizontal lines is a scalping technique similar to day trading. You draw a horizontal line that is clearly visible at the daily chart level, and enter a long or short position when the rate reaches the horizontal line.

Regardless of the trend direction on the daily chart, if the rate reaches below the horizontal line, consider going short, and if it reaches above, consider going long. While trend following that does not go against the daily trend is ideal, the aim of scalping using horizontal lines is to target a temporary rebound through scalping. To avoid losses when the market reverses, we recommend setting a settlement standard, such as taking profits before the 1-hour chart is confirmed. Once you become more familiar with the technique, a good tip is to carry over positions that look like they could increase profits using trailing stops, regardless of scalping.

Fundamentals of “money management” that you should not forget when scalping

No matter how good your scalping method is, poor capital management can result in a sudden loss of your account funds. Especially with overseas FX, where large trades can be made with a small margin, losses can occur quickly, making careful risk management essential.

A typical method is the “2% rule.” This is a simple idea that limits the amount you can afford to lose in a single trade to 2% of your account capital. By determining the lot size and stop loss range in advance, you can trade without straining yourself. For more detailed information on capital management methods, please see the link below.

Because scalping is a trading method that requires a short trading time, trading costs such as spreads and trading fees have a greater impact on trading profits and losses than other trading methods such as day trading and swing trading. By understanding the points to be careful of when scalping in advance, you can take measures to avoid unexpected losses and missing profit opportunities.

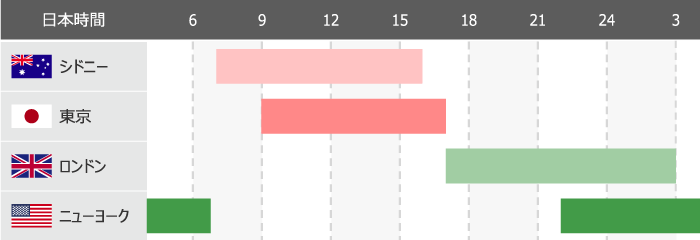

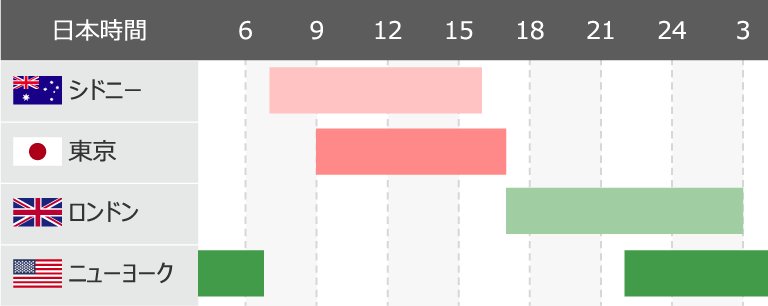

Timings when spreads tend to widen

Scalping is a trading method that is more susceptible to the influence of spreads than other trading methods. Spreads fluctuate according to market conditions, so when scalping, be aware of times when spreads tend to widen. Spreads generally tend to widen as trading activity increases between the Tokyo and New York markets.

Additionally, during the above time period from 9:00 PM to around 1:00 AM the following morning, the London and New York markets, which are larger in size, overlap, and spreads tend to be the widest.

XM spreads can be improved through the loyalty program

Some people say that scalping with XM is difficult because the spreads on some major currency pairs can be slightly wider than those of other brokers depending on the time of day. However, by using XM’s loyalty program, you can significantly reduce the spread difference that can be a concern when scalping. XM’s loyalty program allows you to receive credits equivalent to up to 0.6 pips of spread per lot trade. Since the spread difference between XM and other brokers is often less than 0.6 pips, utilizing the loyalty program can effectively reduce the spread. Therefore, scalping with XM is unlikely to be difficult due to the spread. Furthermore, while spreads are constantly fluctuating, the bonuses earned through the loyalty program and XM Points (XMP), which can be converted into cash, are always guaranteed to be a fixed amount and are not dependent on the success or failure of the trade.

There are some transactions where XM Points (XMP) cannot be received

XM Trading’s loyalty program rewards you with XM Points (XMP), which can be exchanged for credits or cash, with each trade. However, XM Points are not awarded for cryptocurrency CFD trades or trades with a position holding period of 10 minutes or less . Please note that XM Points may not be awarded for some trades when scalping with short holding periods. If you want to ensure you receive XMP, choose products other than cryptocurrency CFDs and trade with a position holding period of more than 10 minutes. Please also note that XM’s KIWAMI and Zero accounts are not eligible for the loyalty program.

Sudden fluctuations in the market due to economic indicators and statements by important figures

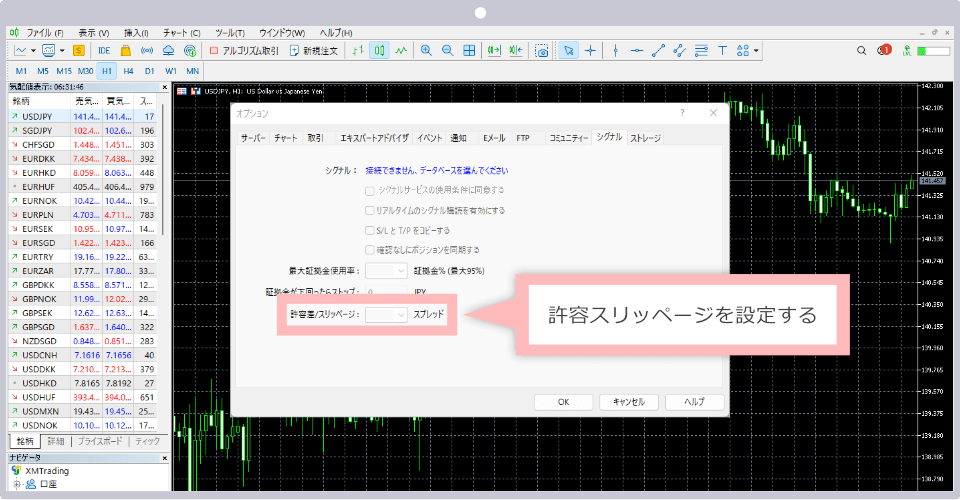

Spreads tend to widen when important economic indicators or important statements are released. When market surprises occur due to the release of highly anticipated economic indicators or important statements, be aware of the widening of spreads as well as the occurrence of slippage. Slippage refers to the difference between the order rate and the execution rate. Slippage can occur in a favorable direction for your position. However, slippage can also occur in an unfavorable direction for your position, so you can take measures by setting an “acceptable slippage.” You can set the acceptable slippage in XMTrading’s MT4/MT5 by going to “Tools” → “Options” → “Signals” in the top menu.

The maximum leverage for Zero accounts is 500x

If you are looking for tighter spreads with XMTrading, we recommend using the “KIWAMI Account” or “Zero Account.” However, the Zero Account has a maximum leverage limit of 500x , so those who want to trade with high leverage or trade with small amounts of capital should be careful.

Comparison of required margin per lot

| Currency Pair/Margin Required | KIWAMI polar account | Zero Account |

| USD/JPY (US dollar/Japanese yen) |

14,820 yen | 29,639 yen |

| EUR/GBP (Euro/Pound) |

17,271 yen | 34,543 yen |

| EUR/USD (Euro/US Dollar) |

17,271 yen | 34,543 yen |

| GBP/USD (Pound Sterling/US Dollar) |

19,904 yen | 39,808 yen |

| AUD/USD (Australian Dollar/US Dollar) |

9,669 yen | 19,337 yen |

| USD/CAD (US Dollar/Canadian Dollar) |

14,820 yen | 29,639 yen |

| USD/JPY | |

| KIWAMI極口座 | 14,820円 |

| ゼロ口座 | 29,639円 |

| EUR/GBP | |

| KIWAMI極口座 | 17,271円 |

| ゼロ口座 | 34,543円 |

| EUR/USD | |

| KIWAMI極口座 | 17,271円 |

| ゼロ口座 | 34,543円 |

| GBP/USD | |

| KIWAMI極口座 | 19,904円 |

| ゼロ口座 | 39,808円 |

| AUD/USD | |

| KIWAMI極口座 | 9,669円 |

| ゼロ口座 | 19,337円 |

| USD/CAD | |

| KIWAMI極口座 | 14,820円 |

| ゼロ口座 | 29,639円 |

The required margin fluctuates depending on the exchange rate, so please check the latest figures when trading.

Due to the difference in maximum leverage, the margin required for a Zero Account is twice that of a Standard Account or a KIWAMI Account. In terms of spreads, a Zero Account allows trading under tighter conditions than a KIWAMI Account, but because external trading fees are incurred, the total cost of trading is also lower with a KIWAMI Account. Additionally, a Zero Account is not eligible for bonus campaigns other than the “New Account Opening Bonus (Trading Bonus).” Like a Standard Account, trading funds cannot be increased with “Deposit Bonuses” or “Loyalty Programs,” so a Zero Account requires a large amount of trading funds, taking into account the leverage limit.

-

What kind of scalping trading method is permitted by XM?

Scalping trading, officially recognized by XM, is a trading method that aims to make a profit by repeatedly entering and closing positions in a short period of time. While many FX brokers prohibit scalping trading, XM allows you to trade without restrictions on trading instruments or lot sizes. Please note that there are some prohibited items, so please check in advance.

read more

2022.11.22

-

What XM account type is recommended for scalping trading?

XM recommends the Standard Account for scalping beginners and the KIWAMI Kiwami Account for professional scalping traders. The Standard Account allows you to trade with a small amount of capital with a maximum leverage of 1,000 times, and you can receive all bonuses, so you can try scalping trading with confidence.

read more

2022.11.22

-

Does XM allow scalping trading for all currency pairs?

Yes, you can perform scalping trades on all currency pairs offered by XM. In addition to currency pairs, scalping is also possible on a wide range of CFDs, including stocks, stock indexes, precious metals, commodities, energy, thematic indices, and cryptocurrencies. However, please note that XMP (XM Points) are not awarded for cryptocurrencies.

read more

2022.11.22

-

Is scalping trading with XM difficult for beginners?

No, XM scalping trading is also recommended for beginners. Rather than using difficult scalping techniques, you can avoid unexpected losses and earn profits by using easy techniques and XM beginner-friendly account types, and by understanding points to watch out for, such as when spreads tend to widen.

read more

2022.11.22

-

Does XM prohibit scalping trading?

No, scalping trading is not prohibited. XM officially permits scalping trading and allows trading without restrictions on trading instruments or lot sizes. However, please note that transactions that violate the terms of use, such as scalping involving hedging between multiple accounts, are prohibited.

read more

2022.11.22