XM’s Ultra-Low Spreads

XM’s Ultra-Low Spreads

XM employs a variable spread system, providing tight spreads starting from as low as 0 pips. With access to the world’s most liquid market, XM delivers excellent execution speeds and rates with no requotes, enabling customers to trade at the best spreads without encountering unfavorable prices.

For traders looking to minimize costs with ultra-low spreads and no fees, we recommend the XM KIWAMI Account. The Zero Account offers incredibly tight spreads starting from 0 pips, although trading fees do apply. XM’s Standard and Micro Accounts have slightly wider spreads, but by utilizing bonuses and XM Points (XMP), you can effectively reduce your overall spreads. Please note that spreads may vary depending on the stock. Trading stocks with very wide spreads can increase costs and make it harder to turn a profit, so be sure to check the spreads of your chosen stocks beforehand.

![]()

XM offers tight spreads starting from just 0 pips, creating a favorable trading environment for its customers.

XM uses a variable spread system, with spreads that fluctuate based on market conditions. Additionally, fractional pip pricing enables XM to offer exceptionally tight spreads, starting from less than 1 pip, creating a favorable trading environment for customers. The KIWAMI account provides even narrower spreads, starting from just 0.6 pips, with no commission charges, while the Zero account offers the tightest spreads, beginning at 0 pips. In the following, we will explain each of these XM spread features in detail.

Implementation of a variable spread system

XM has implemented a variable spread system to offer a more favorable trading environment for all customers. There are two types of spreads: fixed and variable. Unlike the fixed spread system, which maintains a constant spread regardless of market conditions, XM’s variable spread system adjusts dynamically, expanding and contracting in response to market fluctuations, similar to how spreads behave in the interbank market.

XM’s variable spread system may widen during significant market fluctuations. However, under normal conditions, it typically offers narrower spreads than the fixed spread system, resulting in lower trading costs on average. This makes it an appealing option for those concerned about wide spreads, as they can still trade with confidence. While the fixed spread system reduces the risk of fluctuations, it does come with higher costs.

Additionally, unlike many FX brokers that impose restrictions on trading before and after the release of important economic indicators, XM does not enforce such limitations, allowing you to fully capitalize on potential profit opportunities.

Provides fractional pip pricing

XM offers “fractional pip pricing” to obtain precise prices from liquidity providers (LPs) and ensure fair spreads. Fractional pips represent decimal places smaller than 1 pip for each currency pair. By using fractional pip pricing, XM can offer extremely tight spreads, such as “0.1 pips,” which are smaller than 1 full pip.

XM uses fractional pip pricing, displaying transaction prices up to the third to fifth decimal place. This allows for tighter spreads, enabling traders to profit from even small price fluctuations. Wide spreads can make it challenging to profit from narrow price movements, but XM’s ultra-tight spreads are ideal for scalping traders who target small pip gains.

XM spreads differ based on the account type.

At XM, spreads vary depending on the account type (Standard, Micro, KIWAMI, Zero). The KIWAMI Account, which offers commission-free, ultra-low spreads, and the Zero Account—unique to XM and designed specifically for ultra-low spreads—provide significantly narrower spreads than the Standard and Micro Accounts, creating one of the most favorable trading environments in the industry. While the Standard and Micro Accounts have slightly wider spreads, you can reduce the effective spreads by utilizing XM’s Loyalty Program (XM Points). Wide spreads can increase costs and make it harder to profit, but XM offers tight spreads across different account types with varying specifications.

The XM KIWAMI Account offers ultra-low spreads with no transaction fees.

XM offers the “KIWAMI Kyoku Account,” designed for traders who prioritize ultra-low spreads and zero trading fees, such as those engaged in high-speed strategies like scalping. This account provides spreads as low as 0.6 pips, helping to minimize trading costs. Among its wide range of instruments, currency pairs with particularly tight spreads include USD/JPY and EUR/USD, both averaging around 0.7 pips.

The Zero Account is the only account type that lets you experience XM’s standout feature—“zero” spreads—but it comes with a trading fee of \$5 (or equivalent) per lot. When factoring in these fees, the KIWAMI Account offers lower overall trading costs than the Zero Account.

Average spreads for XM FX currency pairs (including commissions)

| Product (brand) | Standard/Micro | KIWAMI pole | zero |

| USDJPY (US Dollar/Japanese Yen) |

2.5 pips | 1.2 pips | 1.6 pips |

| EURUSD (European Euro/US Dollar) |

1.6 pips | 1.0 pips | 1.3 pips |

| EURJPY (European Euro/Japanese Yen) |

3.1 pips | 2.1 pips | 2.8 pips |

| USDJPY | |

| スタンダード マイクロ |

2.5 pips |

| KIWAMI極 | 1.2 pips |

| ゼロ | 1.6 pips |

| EURUSD | |

| スタンダード マイクロ |

1.6 pips |

| KIWAMI極 | 1.0 pips |

| ゼロ | 1.3 pips |

| EURJPY | |

| スタンダード マイクロ |

3.1 pips |

| KIWAMI極 | 2.1 pips |

| ゼロ | 2.8 pips |

Wide spreads are unsuitable for scalping, which relies on capturing small price movements. With XM’s KIWAMI Account, you can enjoy smooth and efficient scalping thanks to its exceptionally tight spreads.

-

XM’s KIWAMI Account offers an average spread of just 0.7 pips on major currency pairs like EUR/USD and USD/JPY, giving you trading conditions comparable to other brokers’ low-spread accounts.

What is a spread?

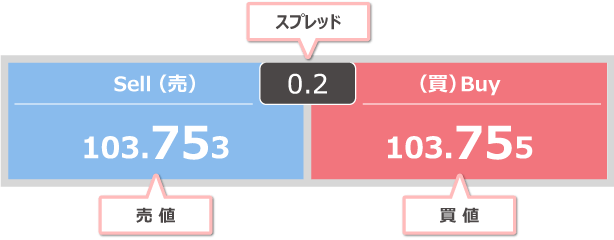

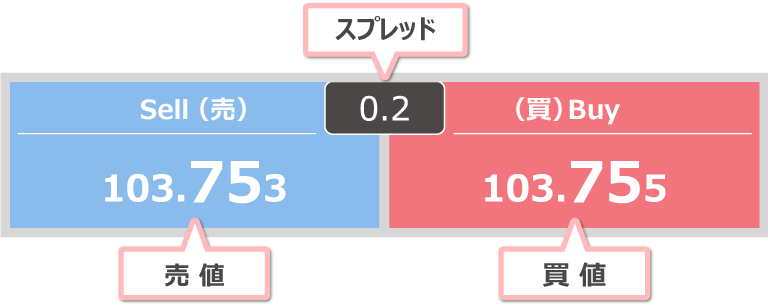

The spread is the difference between the buy price (Ask) and the sell price (Bid) of a currency pair. A narrower spread means lower trading costs, providing a more favorable environment for traders. Conversely, a wider spread increases trading costs, so caution is necessary. Since the cost from spreads grows with the number and size of trades, spreads are an important factor to consider when selecting an FX broker.

What is the spread unit, pips?

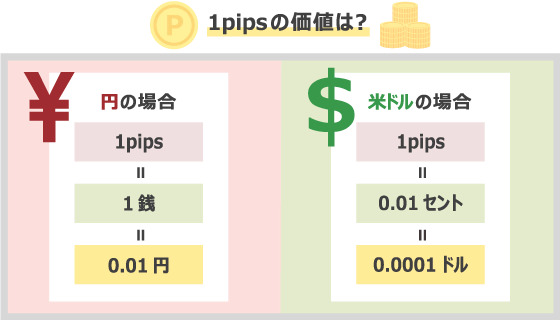

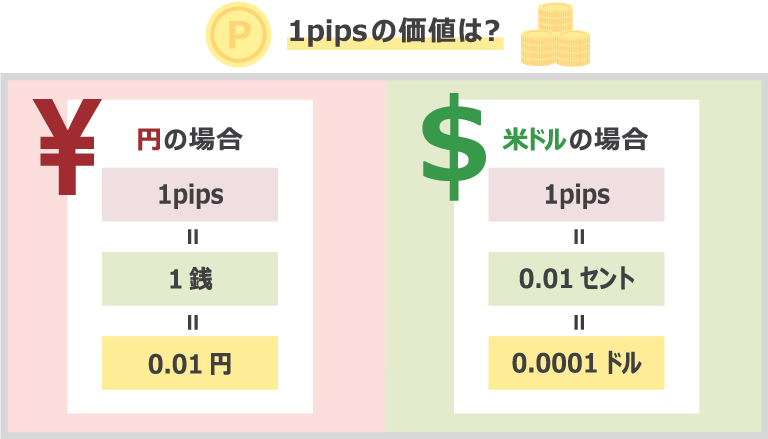

Spreads are typically measured in units called “pips.” A pip represents the smallest price movement in the market. Using pips makes it possible to express trading conditions in a standardized way, even for currency pairs with different quotation units.

For instance, the unit of measurement varies by currency pair—yen, sen, dollars, or cents—so you might see quotes like “the USD/JPY spread is 1 sen” or “the EUR/USD spread is 0.02 cents.” However, by using pips, these can be expressed in a standardized way, such as “the USD/JPY spread is 1 pip” or “the EUR/USD spread is 2 pips.”

How to Interpret and Calculate Spreads (in Pips)

The value of one pip differs depending on the currency pair. For pairs where the settlement currency is the yen—such as USD/JPY or EUR/JPY—1 pip equals 0.01 yen. In contrast, for pairs where the settlement currency is the US dollar—such as EUR/USD—1 pip equals 0.01 cents.

How to calculate spreads (transaction costs)

The above values represent the worth of 1 pip for each currency pair. For example, if you trade 1 lot of USD/JPY with a spread of 1 pip, the calculation is: 1 pip (0.01 yen) × 100,000 units = 1,000 yen.

To calculate trading costs, you first need to determine the value of the spread in pips. Doing this manually for every trade can be time-consuming, but with XM’s pip calculator, you can instantly find out the value without any complex calculations. Since costs expressed in pips can be difficult to grasp, converting them into the base currency makes it easier to visualize the spread as an actual trading cost. That’s why XM’s pip calculator is a useful tool to take advantage of.

The spreads offered on XM’s Standard and Micro accounts are generally in line with industry averages. However, some traders may feel that these spreads are wider compared to other account types. When XM’s generous bonuses are factored in, though, the effective spreads on Standard and Micro accounts become highly competitive with those of other brokers. Since wider spreads increase trading costs and make it harder to generate efficient profits, we’ll explain how you can reduce effective spreads by making the most of XM’s bonus programs.

Maximize Your Effective Spreads with XM’s Loyalty Program

XM Trading runs the “XM Loyalty Program,” which allows you to earn XM Points (XMP) with every trade. These points can be exchanged for bonuses, and by utilizing them effectively, you can reduce the effective spreads on your trades with XM.

What is XM’s Loyalty Program?

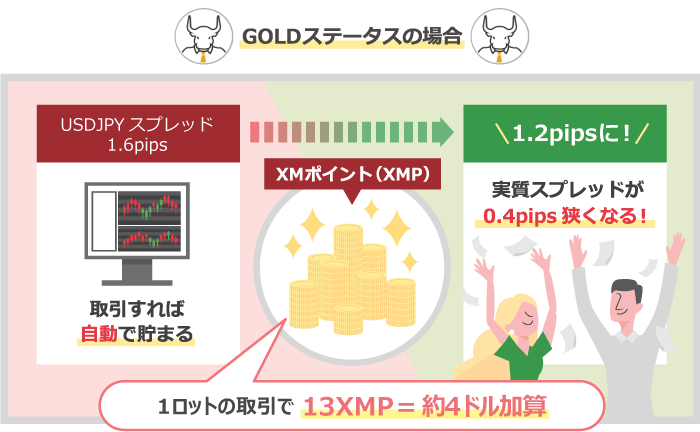

XM’s Loyalty Program (XM Point Program) ranks your “Loyalty Status” based on the number of trading days, which in turn increases the number of XM Points (XMP) you can earn. Currently, the “Double Up Campaign” is available exclusively to customers who open a new XM real account through this website. Normally, loyalty status starts at EXECUTIVE, but under this campaign, your status is immediately upgraded to GOLD upon opening an account. With the standard EXECUTIVE status, you earn 10 XMP per lot, while GOLD status allows you to earn 13 XMP per lot traded.

How much can you reduce the spread using XM Points (XMP)?

For example, if you trade 1 lot with a GOLD status account, you will earn 13 XMP (XM Points). By exchanging these 13 XMP for a trading bonus, roughly $4 is added to your margin balance per lot. Using XM’s Loyalty Program in this way can reduce your effective spread by approximately 0.4 pips.

Average spreads including XM points (Standard account/Micro account)

| Product (brand) | Regular Spread | Spreads taking XMP into account |

| USDJPY (US Dollar/Japanese Yen) |

2.5 pips | 2.1 pips |

| EURUSD (European Euro/US Dollar) |

1.6 pips | 1.2 pips |

| GBPUSD (British Pound / US Dollar) |

2.4 pips | 2.0 pips |

| USDCHF (US Dollar/Swiss Franc) |

2.6 pips | 2.2 pips |

| USDCAD (US Dollar/Canadian Dollar) |

3.0 pips | 2.6 pips |

| USDJPY | |

| 通常スプレッド | 2.5 pips |

| XMP加味スプレッド | 2.1 pips |

| EURUSD | |

| 通常スプレッド | 1.6 pips |

| XMP加味スプレッド | 1.2 pips |

| GBPUSD | |

| 通常スプレッド | 2.4 pips |

| XMP加味スプレッド | 2.0 pips |

| USDCHF | |

| 通常スプレッド | 2.6 pips |

| XMP加味スプレッド | 2.2 pips |

| USDCAD | |

| 通常スプレッド | 3.0 pips |

| XMP加味スプレッド | 2.6 pips |

Spreads fluctuate daily, so be sure to check the latest rates before trading.

Additionally, XM’s loyalty status rises based on the number of trading days, and the higher your status, the more XM Points (XMP) you earn per 1-lot trade. This means that the longer you trade with XM, the narrower your effective spreads become. Below is a summary showing how much you can reduce spreads using the XM Points earned per 1-lot trade at each loyalty status.

How Much You Can Reduce Spreads Using XM Points

| Loyalty Status |

Number of trading days required to rank up |

XM points earned/lot | Pips conversion (yen conversion) |

| EXECUTIVE |

– | 10XMP (XM points) |

Approximately 0.3 pips (approximately $3) |

| GOLD |

30 days | 13XMP (XM Points) |

Approximately 0.4 pips (approximately $4) |

| DIAMOND |

60 days | 16XMP (XM Points) |

Approximately 0.5 pips (approximately $5) |

| ELITE |

100 days | 20XMP (XM points) |

Approximately 0.6 pips (approximately $6) |

| EXECUTIVE(エグゼクティブ) | |

| ランクアップに 必要なトレード日数 |

– |

| 獲得XMポイント/ ロット |

10XMP (XMポイント) |

| pips換算 (円換算) |

約0.3pips (約3ドル) |

| GOLD(ゴールド) | |

| ランクアップに 必要なトレード日数 |

30日間 |

| 獲得XMポイント/ ロット |

13XMP (XMポイント) |

| pips換算 (円換算) |

約0.4pips (約4ドル) |

| DIAMOND(ダイアモンド) | |

| ランクアップに 必要なトレード日数 |

60日間 |

| 獲得XMポイント/ ロット |

16XMP (XMポイント) |

| pips換算 (円換算) |

約0.5pips (約5ドル) |

| ELITE(エリート) | |

| ランクアップに 必要なトレード日数 |

100日間 |

| 獲得XMポイント/ ロット |

20XMP (XMポイント) |

| pips換算 (円換算) |

約0.6pips (約6ドル) |

The “XM Loyalty Program,” a key tool for improving effective spreads, is available exclusively for XM’s Standard and Micro accounts and does not apply to KIWAMI or Zero accounts. If you trade using a Standard or Micro account, we encourage you to take full advantage of the XM Loyalty Program bonuses to trade with the narrowest possible spreads.

Detailed instructions for checking your XM Points (XMP) and loyalty status are provided in the XM Member Page Usage Guide, complete with easy-to-follow illustrations.

On the XM Members Page, you can open an account, deposit and withdraw funds, adjust your leverage, and access the copy trading page. For step-by-step instructions on using the XM Members Page, please refer to the “XM Members Page User Guide.”

Reduce Your Trading Costs with New Account Opening and Deposit Bonuses

You can also use XM’s generous bonuses to help narrow your spreads. All new customers who open a real account receive a ¥15,000 account opening bonus (trading bonus) that can be used as margin, as well as a two-tiered deposit bonus of up to $10,500 ($500 + $10,000), depending on your deposit amount. By leveraging these bonuses, you can effectively reduce trading costs and trade more efficiently. Since wide spreads can increase trading expenses, taking full advantage of XM’s bonuses is highly recommended.

In particular, the ¥15,000 account opening bonus is provided free of charge to all customers who have never opened a real account with XM, allowing you to experience trading without any risk. Additionally, XM regularly offers limited-time bonus campaigns, so be sure to stay updated on the latest offers and use them to help narrow your effective spreads.

Please check the list of spreads for all products offered by XM. Note that spreads for XM’s FX currency pairs, cryptocurrency CFDs, and precious metal CFDs vary by account type. The spreads shown here represent average or minimum values. To view XM’s real-time spreads, please log in to XM’s MT4/MT5 platforms.

Average spreads for XM FX currency pairs ( as of August 2025 )

Below is a list of average spreads for major, minor, and exotic currency pairs offered by XMTrading for each account type. Depending on market conditions and liquidity, you may be able to trade with spreads narrower than those listed. While spreads vary by product, the tightest spreads are typically found on USD/JPY, EUR/USD, and GBP/USD, with an average of 0.7 pips. Currency pairs with wider spreads can make it harder to generate profits. Please note that spreads fluctuate daily, so always check the latest rates before trading. .

Average spreads for XM FX currency pairs (major currencies)

| Product (brand) | Standard/Micro | KIWAMI pole | zero |

| USDJPY (US Dollar/Japanese Yen) |

2.5 pips | 1.2 pips | 0.2 pips |

| EURUSD (European Euro/US Dollar) |

1.6 pips | 1.0 pips | 0.2 pips |

| GBPUSD (British Pound / US Dollar) |

2.4 pips | 1.2 pips | 0.9 pips |

| USDJPY | |

| スタンダード マイクロ |

2.5 pips |

| KIWAMI極 | 1.2 pips |

| ゼロ | 0.2 pips |

| EURUSD | |

| スタンダード マイクロ |

1.6 pips |

| KIWAMI極 | 1.0 pips |

| ゼロ | 0.2 pips |

| GBPUSD | |

| スタンダード マイクロ |

2.4 pips |

| KIWAMI極 | 1.2 pips |

| ゼロ | 0.9 pips |

Average spreads for XM FX currency pairs (minor and exotic currencies)

| Product (brand) | Standard/Micro | KIWAMI pole | zero |

| AUDCAD (Australian dollar/Canadian dollar) |

3.9 pips | 3.1 pips | 1.8 pips |

| AUDCHF (Australian dollar/Swiss franc) |

3.6 pips | 2.0 pips | 1.3 pips |

| AUDJPY (Australian dollar/Japanese yen) |

3.6 pips | 2.5 pips | 1.5 pips |

| AUDCAD | |

| スタンダード マイクロ |

3.9 pips |

| KIWAMI極 | 3.1 pips |

| ゼロ | 1.8 pips |

| AUDCHF | |

| スタンダード マイクロ |

3.6 pips |

| KIWAMI極 | 2.0 pips |

| ゼロ | 1.3 pips |

| AUDJPY | |

| スタンダード マイクロ |

3.6 pips |

| KIWAMI極 | 2.5 pips |

| ゼロ | 1.5 pips |

Spread Differences Between Major, Minor, and Exotic Currency Pairs

XMTrading offers trading in a total of 55 currency pairs, including major, minor, and exotic currencies. The major currency pairs consist of six widely traded FX pairs: EUR/USD, USD/JPY, GBP/USD, USD/CHF, USD/CAD, and AUD/USD. These pairs account for over 80% of global forex trading and generally have high trading volumes, resulting in tighter spreads. Exotic currencies, such as the Turkish lira, South African rand, Mexican peso, Hungarian forint, Polish zloty, and Hong Kong dollar, are less commonly traded currencies from emerging and Eastern European markets. Their lower trading volumes typically lead to wider spreads, although these pairs often exhibit larger price movements and higher swap rates. The remaining pairs are considered minor (or cross) currencies, such as cross-yen pairs, which usually have moderately wider spreads than major pairs.

XM Cryptocurrency CFD Lowest Spreads ( as of August 2025 )

Below is a list of the minimum cryptocurrency CFD spreads for each account type offered by XM. Spreads vary depending on the specific product and your account type, and the number of available products may also differ based on your account type and trading platform (MT4/MT5). Market conditions and liquidity can cause spreads to widen beyond the values listed, so please check the latest spreads before trading. Note that cryptocurrency CFD spreads are displayed in the settlement currency of each product.

XM Cryptocurrency CFD Minimum Spreads

| Product/Brand | Standard/Micro | KIWAMI pole |

| 1INCHUSD | 0.005 | 0.004 |

| AAVEUSD | 5.29 | 3.68 |

| ADAUSD | 0.00553 | 0.00391 |

| 1INCHUSD | |

| スタンダード マイクロ |

0.005 |

| KIWAMI極 | 0.004 |

| AAVEUSD | |

| スタンダード マイクロ |

5.29 |

| KIWAMI極 | 3.68 |

| ADAUSD | |

| スタンダード マイクロ |

0.00553 |

| KIWAMI極 | 0.00391 |

XM Average Precious Metals CFD Spreads ( as of August 2025 )

XM Precious Metals CFD Average Spreads

| Product/Brand | Standard/Micro | KIWAMI pole | zero |

| GOLD |

2.7 pips | 1.6 pips | 1.4 pips |

| SILVER |

3.0 pips | 2.0 pips | 2.6 pips |

| XAUEUR (Gold/Euro) |

3.5 pips | 2.5 pips | 3.2 pips |

| GOLD | |

| スタンダード マイクロ |

2.7 pips |

| KIWAMI極 | 1.6 pips |

| ゼロ | 1.4 pips |

| SILVER | |

| スタンダード マイクロ |

3.0 pips |

| KIWAMI極 | 2.0 pips |

| ゼロ | 2.6 pips |

| XAUEUR | |

| スタンダード マイクロ |

3.5 pips |

| KIWAMI極 | 2.5 pips |

| ゼロ | 3.2 pips |

XM Energy CFD Lowest Spreads ( as of August 2025 )

Below is a list of the minimum spreads for energy CFDs offered by XMTrading. Spreads for XM energy CFDs are the same across all account types. Depending on market conditions and liquidity, actual spreads may be wider than those listed. Energy CFD spreads are displayed in the settlement currency of each product, so please check the latest figures before trading. .

XM Energy CFD Minimum Spreads

| Product/Brand | Minimum spread (settlement currency) |

| BRENTCash (Brent Crude Oil Cash) | 0.03 |

| NGASCash (Natural Gas Cash) | 0.012 |

| OILCash (WTI Oil Cash) | 0.03 |

XM Commodity CFD Minimum Spreads ( as of August 2025 )

Below is a list of the minimum spreads for commodity CFDs offered by XMTrading. Spreads for XM’s commodity CFDs are the same across all account types. Depending on market conditions and liquidity, actual spreads may be wider than those listed. Commodity CFD spreads are displayed in the settlement currency of each product, so please check the latest figures before trading. .

XM Commodity CFD Minimum Spreads

| Product/Brand | Minimum spread (settlement currency) |

| COCOA (US Cocoa) | 15 |

| COFFE (US Coffee) | 0.0055 |

| CORN (US Corn) | 0.01 |

XM Stock CFD Minimum Spreads ( as of August 2025 )

Below is a list of the minimum spreads for the most popular stocks among the 1,313 stock CFDs offered by XMTrading. Spreads for XM stock CFDs are the same across all account types. Depending on market conditions and liquidity, actual spreads may be wider than those listed, so please check the latest figures before trading. Stock CFD spreads are shown in the settlement currency of each stock. Please note that stock CFDs are only available on MT5 accounts..

XM Stock CFD Minimum Spreads

| Product/Item (MT5 Symbol) | Minimum spread (settlement currency) |

| Alibaba | 0.9 |

| Amazon | 1.58 |

| Apple | 1.77 |

XM Stock Index CFD Minimum Spreads ( as of August 2025 )

Below is a list of the minimum spreads for stock index CFDs offered by XMTrading. Spreads for XM stock index CFDs are the same across all account types. Depending on market conditions and liquidity, actual spreads may be wider than those listed, so please check the latest figures before trading. Stock index CFD spreads are shown in the settlement currency of each index.

XM Stock Index CFD Minimum Spreads

| Product/Brand | Minimum spread (settlement currency) |

| AUS200Cash | 1.90 |

| CA60Cash | 0.85 |

| ChinaHCash | 3.90 |

-

Please note that spreads can be significantly wider than the average values listed above during exceptional circumstances, such as periods of low liquidity, sudden market fluctuations, early morning trading hours, or other unexpected events.

XM Thematic Indices Minimum Spreads ( as of August 2025 )

Below is a list of the minimum spreads for thematic index CFDs offered by XMTrading. Spreads for XM’s thematic index CFDs are the same across all account types. Depending on market conditions and liquidity, actual spreads may be wider than those listed, so please check the latest figures before trading. Thematic index CFD spreads are shown in the settlement currency of each product.

XM Thematic Index CFD Minimum Spreads

| Product/Brand | Minimum spread (settlement currency) |

| AI_INDX | 11.60 |

| ChinaInternet | 14.20 |

| Crypto_10 | 200.80 |

XM offers stable spreads thanks to its industry-leading execution capabilities. However, spreads tend to narrow when market trading volume is high and widen when trading volume is low. Please be aware of times when spreads are likely to increase. Specific periods when XM spreads may widen are as follows:

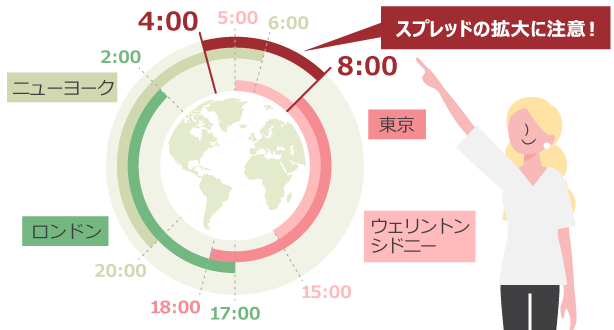

Spreads are more likely to widen in the early morning

XM uses a variable spread system linked to the interbank market, so spreads tend to widen during periods of low liquidity, such as early morning and late at night. Spreads are particularly prone to widening between 4:00 AM and 8:00 AM Japan time, which coincides with the New York market closing, and especially between 6:00 AM and 7:00 AM, when trading volumes are at their lowest. When trading with XM, please be mindful of potentially wider spreads in the early morning.

-

Spreads also tend to widen around the Christmas and New Year holidays, when fewer market participants are active due to the extended holiday period.

Spreads tend to widen during major economic indicator announcements.

Spreads may widen during sudden market fluctuations caused by the release of important economic indicators, periods of political instability, or unexpected external events. Excessively wide spreads can be disadvantageous for trading. The degree to which spreads widen depends on market conditions and liquidity, so it is wise to manage risk in advance by avoiding new orders during indicator releases. For reference, please note that spreads may temporarily widen when the following economic indicators are announced.

Economic Indicators That Often Cause Spreads to Widen

-

US FOMC Policy Interest Rate Announcement / USA

-

GDP growth rate / USA

-

Consumer Price Index (CPI) / United States

-

Unemployment Rate & Non-Farm Employment Statistics / United States

-

ADP Employment Statistics / United States

-

ISM Business Conditions Index / United States

-

New Home Sales and Used Home Sales / United States

-

Financial results reports of major US companies / USA

-

European Central Bank (ECB) Policy Interest Rate Announcement / Europe

-

Bank of Japan Monetary Policy Meeting / Japan

もっと見る閉じる

Exercise caution with stop-loss orders during periods of widening spreads.

Please note that during periods of wide spreads, your stop-loss orders are more likely to be triggered. Since spreads represent a cost for each transaction, wider spreads increase the trading costs borne by the customer. If losses rise due to a widening spread and your margin maintenance ratio falls below a certain threshold, stop-losses may be executed. Therefore, it is recommended to avoid trading during periods of wide spreads. XM’s stop-loss level is set at 20%. In the unlikely event that a stop-loss is not triggered in time and your account balance becomes negative, XM employs a zero-cut system, ensuring that you will not lose more than the amount you deposited.

The spreads listed in the “XM Spread List” represent average and minimum values over a certain period. To view XM’s real-time spreads, log in to XM’s MT4/MT5 platforms or the official XM smartphone app. If you do not have a real account, you can also check spreads under real trading conditions using a demo account. Please refer to instructions on how to check and view spreads for each trading tool.

-

Click here to see spreads on XM MT4/MT5 (smartphone version)

-

Click here to see the spreads on the official XM smartphone app (XM app)

How to view spreads on XM MT4/MT5 (PC version)

Here’s how to check the real-time spreads offered by XMTrading on MT4 (MetaTrader 4)/MT5 (MetaTrader 5).

-

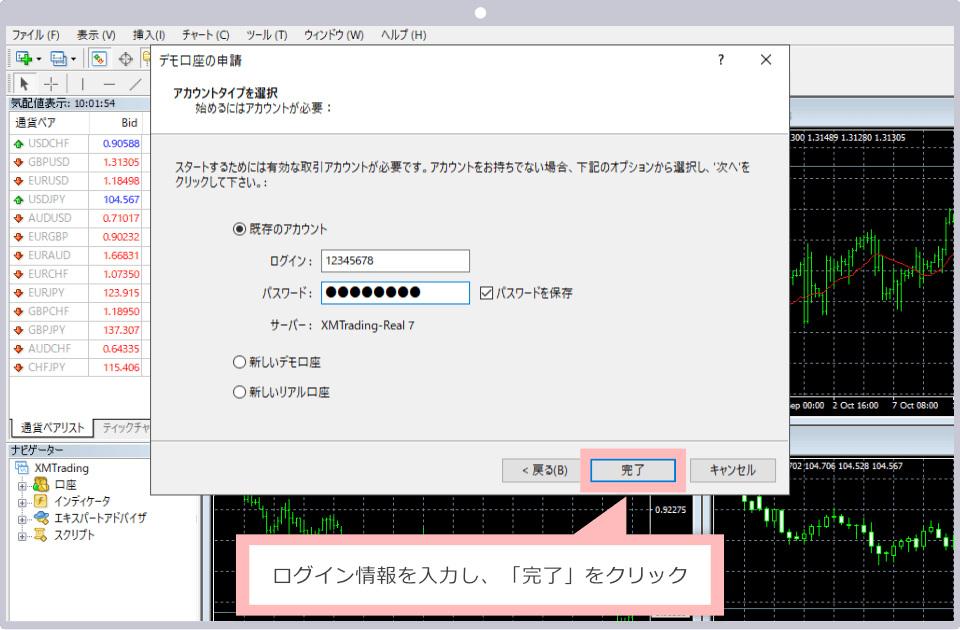

Steps: 1

Log in to XM MT4/MT5

To check real-time spreads, launch XMTrading’s MT4/MT5 platform, enter your account number and password, and log in.

-

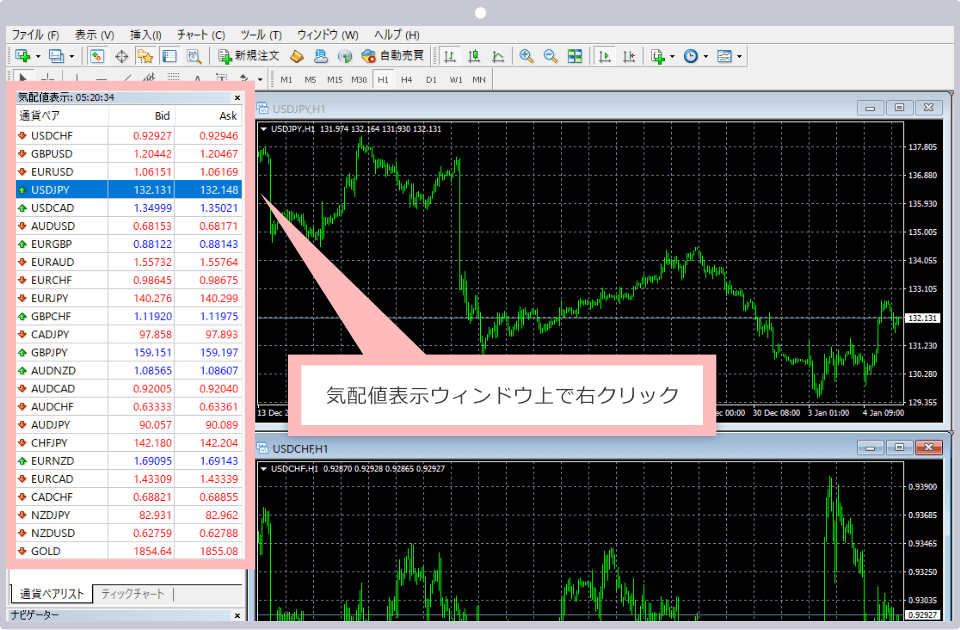

Steps: 2

Right click on the Market Watch window

Right-click on the Market Watch window.

-

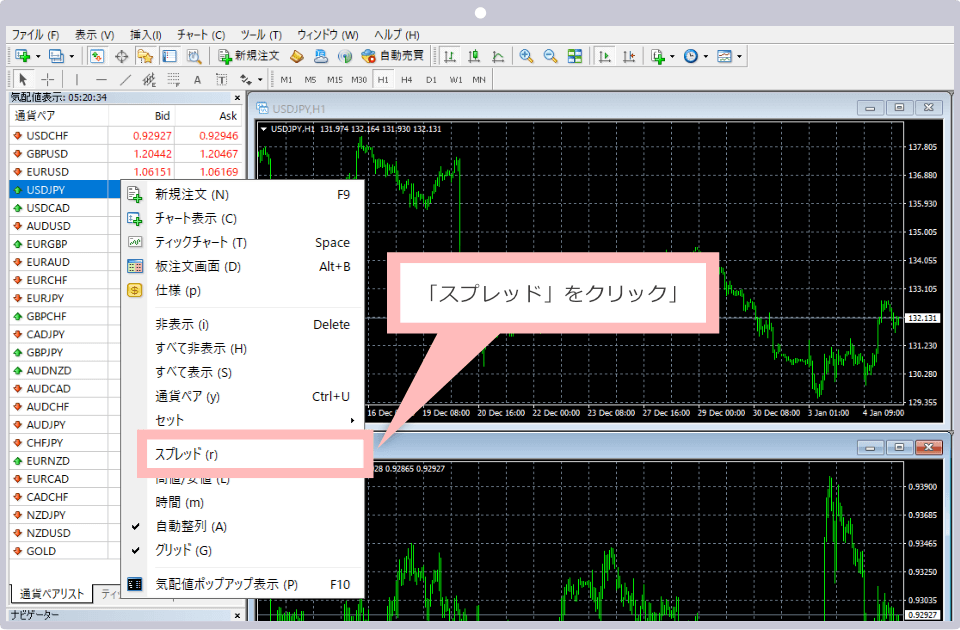

Steps: 3

Click “Spread”

From the menu list that appears, select “Spread.

-

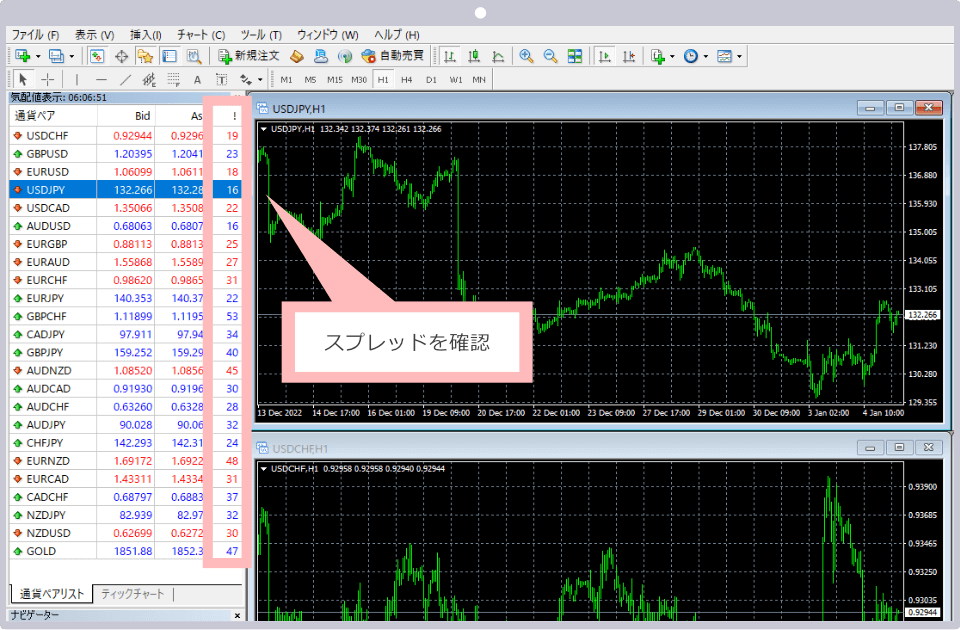

Steps: 4

Check Spreads

Please note that the spread is shown to the left of the “Bid” and “Ask” prices in the Market Watch window.

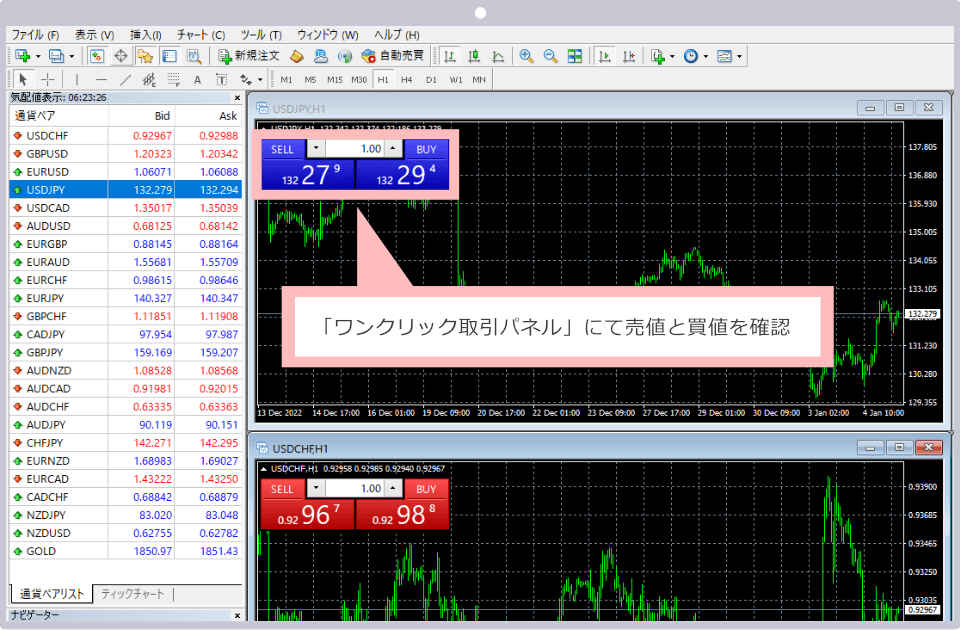

You can also check spreads using the One-Click Trading panel.

You can also view XM’s buy and sell prices from the One-Click Trading Panel. The first time you use the MT4/MT5 One-Click Trading Panel, a disclaimer will appear, and you can use the panel after agreeing to it. If the panel is hidden, you can enable it by going to Tools > Options > Trading.

How to view spreads on XM MT4/MT5 (smartphone version)

Here’s how to check the real-time spreads provided by XMTrading on MT4/MT5 (smartphone version).

-

Steps: 1

Log in to the smartphone version of MT4/MT5

To check real-time spreads, open the XMTrading mobile version of MT4/MT5, enter your account number and password, and log in.

-

Steps: 2

Tap “Quotes”

Tap “Quotes” to display a list of quotes.

-

Steps: 3

Tap “Advanced mode”

If you switch to “Detailed Mode,” the spread will be displayed below each symbol, so be sure to check it.

How to view spreads on the official XM smartphone app (XM app)

Please refer to the link below for instructions on how to check XM’s real-time spreads using the official XM app (XM smartphone app).

Spreads on the official XM smartphone app are displayed in points.

On the official XM smartphone app, spreads are shown in “points” rather than “pips.” Ten points equal 1 pip, so to convert the spread from points to pips, divide the displayed value by 10. For example, if the USD/JPY spread is shown as “20,” it corresponds to 2.0 pips.

How to see spreads on an XM demo account

XMTrading’s demo account lets you trade all of XM’s products in an environment nearly identical to a real account. By logging in to MT4/MT5 or the official XM smartphone app with your demo account credentials, you can view the same spreads as in the real trading environment. If you do not yet have a real XM account, you can use a demo account to check real-time spreads.

XM offers three types of demo accounts: Standard, KIWAMI, and Zero. To open a demo account, please apply using the link below. Note that Micro Accounts are not available as demo accounts.

-

Is there a way to reduce spreads on XM?

At XM, you can reduce your effective spreads through the loyalty program. This program rewards you with points for every trade, meaning the more you trade, the lower your effective spreads become. However, KIWAMI and Zero accounts are not eligible for this program.

read more

2023.01.03

-

In what units are XM spreads measured?

At XM, spreads are measured in pips. The value of a pip depends on the quote currency of the pair: for yen-based pairs, 1 pip equals 0.01 yen, while for pairs quoted in U.S. dollars, 1 pip equals 0.01 cents. You can use XM’s pip calculator to automatically determine the pip value.

read more

2023.01.03

-

How do I calculate XM spreads?

You can automatically calculate XM’s spreads using the XM pip calculator. Simply select the currency pair, your account’s base currency, account type, and lot size, then click ‘Calculate’ to see the spread value.

read more

2023.01.03

-

Please tell me about the spreads for XM’s Zero Account.

The XM Zero Account is designed for traders who want ultra-tight spreads, starting from 0 pips. If you’re looking to trade with minimal spreads, we recommend this account type. However, please note that a commission of $5 (or equivalent) per lot, per side, applies.

read more

2023.01.03

-

Which currency pairs offer the tightest spreads at XM?

The currency pairs with the tightest spreads at XM are USD/JPY, EUR/USD, and GBP/USD, with an average spread of 0.7 pips. Please note that spreads may vary depending on the account type and trading hours.

read more

2023.01.03

-

Is there a difference in spreads for CFD futures versus CFD spot at XM?

Yes, XM’s spot CFDs generally have narrower spreads than futures CFDs. You can view the spreads for both spot and futures CFDs by selecting the desired product in the quotes section on MetaTrader 4 (MT4) / MetaTrader 5 (MT5) or via the trading tab on the XM website.

read more

2021.09.10

-

Where can I check XM spreads?

At XM, you can view real-time spreads in MetaTrader 4 (MT4) or MetaTrader 5 (MT5). After logging in, right-click in the Market Watch window and select ‘Spread’—the spreads for all currency pairs will then appear on the right.

read more

2021.09.10

-

Are there periods when spreads at XM tend to widen?

Yes, spreads at XM—as with all FX brokers—tend to widen during periods of low trading volume, such as just before market close or on weekends. In particular, the market can be especially volatile when the New York session ends, between 6:00 AM and 7:00 AM Japan time (7:00 AM to 8:00 AM during winter), causing spreads to widen significantly.

read more

2021.09.10

-

Do spreads at XM vary by account type?

Yes, at XM, spreads vary depending on the account type—Standard, Micro, KIWAMI, or Zero. While the Zero Account charges a trading commission, it uses an ECN model that does not add markup to the spread, allowing trades with ultra-tight spreads starting from 0 pips.

read more

2021.09.10

-

Can you explain how spreads work at XM?

XM uses a variable spread system for all account types. In this system, spreads fluctuate based on the price and can widen or narrow depending on the time of day and market conditions. The XM Zero Account offers the tightest spreads, starting from as low as 0 pips.

read more

2021.09.10