XM Prohibitions

XM Prohibitions

XM (XM) has prohibited transactions and actions that violate its terms of use. At XM, you can enjoy trading using a variety of methods, including scalping and hedging. However, please note that if you violate any of the prohibited activities set out by XM or the terms of use, you may be subject to penalties such as refusal to withdraw profits or account freezing.

At XM, if any prohibited actions or violations of the terms of use are discovered, penalties such as confiscation of profits or account freezing will be imposed. We will introduce specific examples of prohibited actions and violations of the terms of use as stipulated by XM, so please check in advance and enjoy FX trading in the high-spec trading environment provided by XM.

Examples of XM’s prohibited activities and violations of the Terms of Use

-

Hedging between multiple XM accounts

-

Hedging between accounts of other companies and XM accounts

-

Organized hedging transactions by multiple people

-

Transactions aimed solely at filling gaps

-

High leverage trading targeted only around the time of economic indicator releases and important person remarks

-

Arbitrage

-

Trading targeting connection delays and rate errors

-

Fraudulent acquisition and use of bonuses and XM points (XMP)

-

Third-party account management

-

Trading that places an excessive burden on XM’s servers

-

Fraudulent acquisition of rewards through self-affiliation

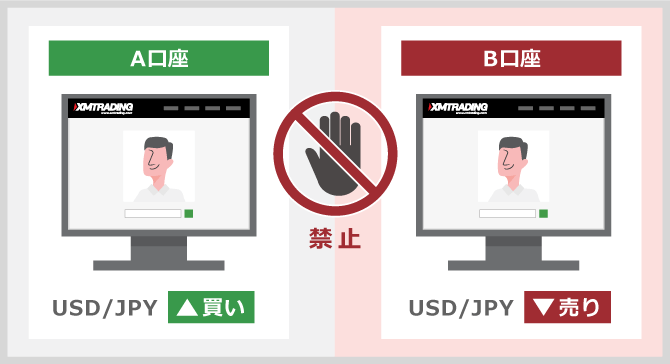

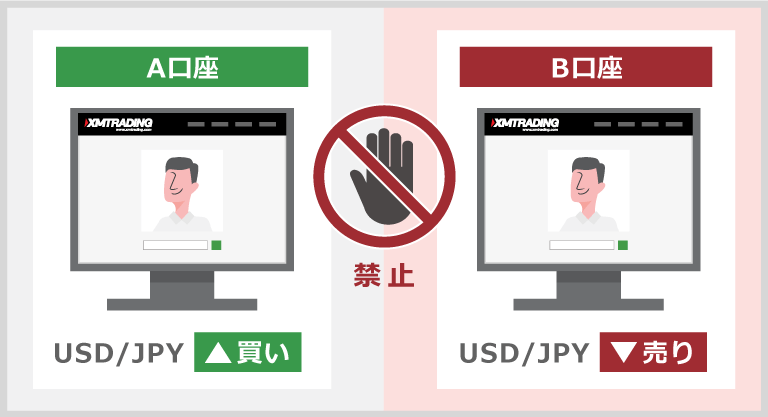

Hedging between multiple XM accounts

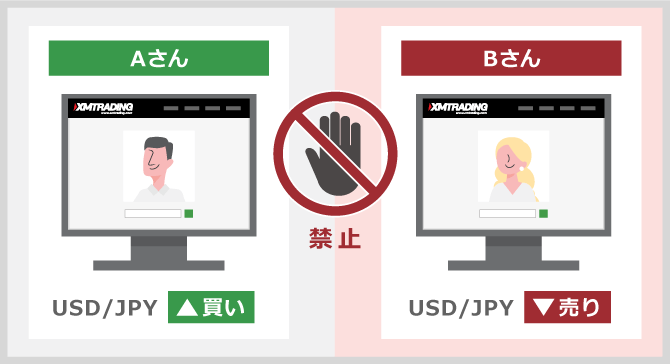

“Multiple-account hedging” at XM is a prohibited activity and a violation of the Terms of Use . Multi-account hedging refers to hedging performed using multiple XM trading accounts. XM allows you to open up to eight accounts per account, allowing you to trade comfortably by using multiple accounts depending on the trading instrument, trading strategy, risk diversification, and more. However, cross-account hedging is prohibited, so caution is required when simultaneously holding positions in multiple accounts . For example, if you hold a long position in USDJPY (US Dollar/Japanese Yen) in your Standard account and then open a short position in the same currency pair in your KIWAMI account, this will result in a prohibited multi-account hedging. Therefore, please be aware that unintended hedging may occur when using multiple XM accounts.

However, XM does not prohibit hedging within the same account. Hedging is possible only within the same XM account, so please use it as an effective trading method.

For details on hedging within the same account at XM, click here

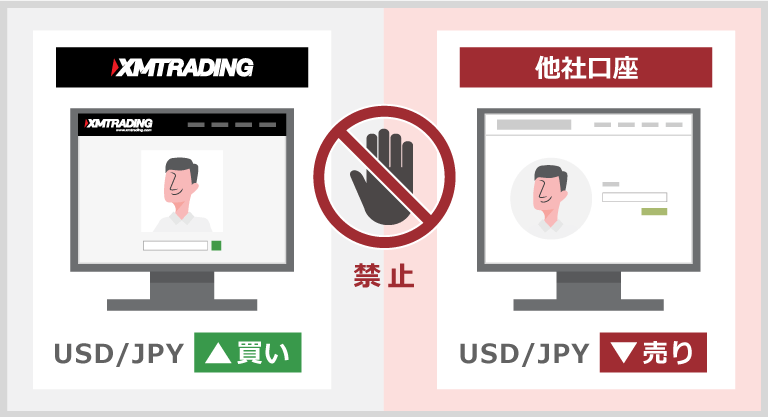

Hedging between accounts of other companies and XM accounts

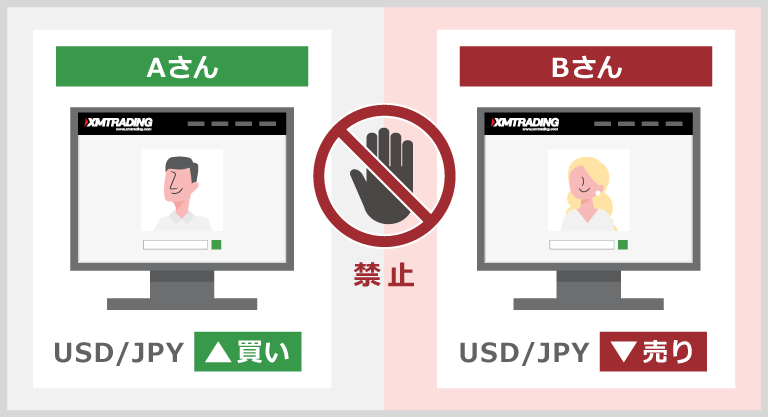

“Hedging between an account with another company and an XM account” at XMTrading (XM) is a prohibited act and a violation of the terms of use. Hedging between an account with another company and an XM account is a hedging transaction that spans an account with another company and an XM account. For example, if you hold a long position in USDJPY (US Dollar/Japanese Yen) with XM and then open a short position in the same currency pair with an account with another company, a hedging transaction will be established at this point.

Such hedging transactions, which involve trading between XM and other companies’ accounts, are prohibited by many FX brokers as they are considered an “abuse of the zero-cut system,” in which losses are limited to the margin amount on one side by the zero-cut system, while large profits are made on the other. If you trade with multiple FX brokers, please be careful not to engage in unintentional hedging transactions.

You can check hedged transactions between FX brokers

FX brokers are able to check and share cross-broker hedging transactions through trading platforms (MT4/MT5) and intermediaries known as LPs (liquidity providers). While hedging transactions with other companies’ accounts will not be detected, penalties will be imposed if you engage in prohibited transactions. Please also note that if your account with another company also prohibits hedging transactions between brokers, you may be subject to penalties stipulated by that company’s account.

Organized hedging transactions by multiple people

“Organized hedging by multiple people” on XMTrading is a prohibited act and a violation of the Terms of Use. Organized hedging by multiple people is colluding with a third party to conduct hedging. For example, one person (or group) holds a long position in USDJPY (US Dollar/Japanese Yen) and another person (or group) holds a short position, and they conduct hedging, sharing profits and losses.

In this way, organized hedging, where one party limits losses to the margin while the other party aims for large profits, is a prohibited act that abuses the zero-cut system. Please note that even if you are trading with friends or family, hedging, where you adjust the trading name, position type, timing, etc. in order to share profits and losses, is prohibited.

What is the Zero Cut System?

The zero-cut system is a system in which XM compensates for losses and resets the account’s negative balance to zero when a sudden market fluctuation causes a loss cut to be delayed and the account balance goes into the negative. High leverage trading with up to 1,000x allows you to aim for large profits with small amounts, but also carries the risk of incurring large losses in a short period of time. XM employs a zero-cut system that does not require margin calls (additional margin) so that customers can trade in a safe environment. Risk is limited to the amount deposited, while unlimited profits are possible.

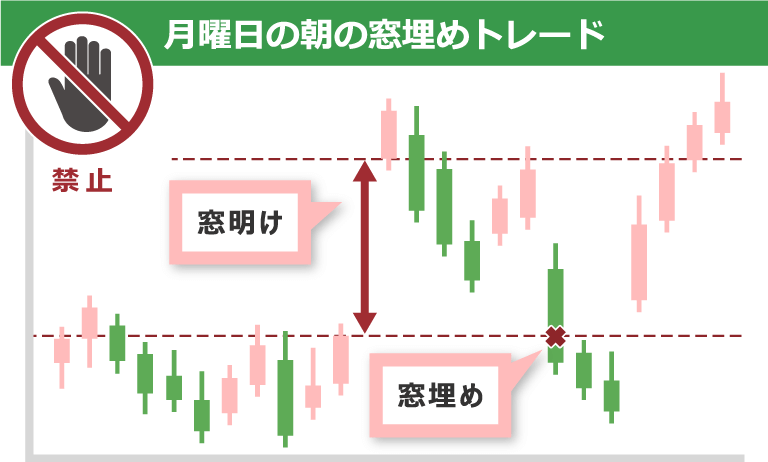

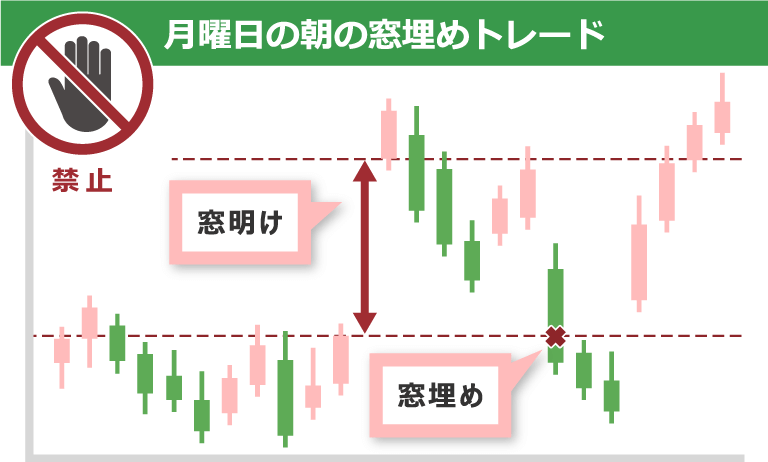

Transactions aimed solely at filling gaps

“Gap-filling only trading” on XMTrading is a prohibited activity and a violation of the Terms of Use. Trading that only aims to fill gaps means concentrated trading aimed solely at “gap-filling” which tends to occur after the “gap-opening” on Monday, the start of the week. When the closing price at the end of the week diverges significantly from the opening price at the start of the week, a gap (a “gap-opening”) appears between the candlesticks at the end of the week and the candlesticks at the start of the week. When the rate moves to fill this open gap, it is called “gap-filling,” and it is said that gap-filling occurs with a high probability after a gap-opening.

Gap filling is recognized by many traders as an effective trading technique, and it is possible to trade at XM when gaps are filled. However, please note that trades that focus solely on gap filling will be subject to penalties.

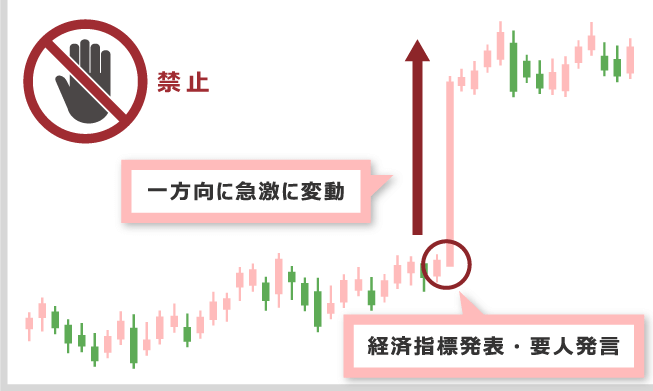

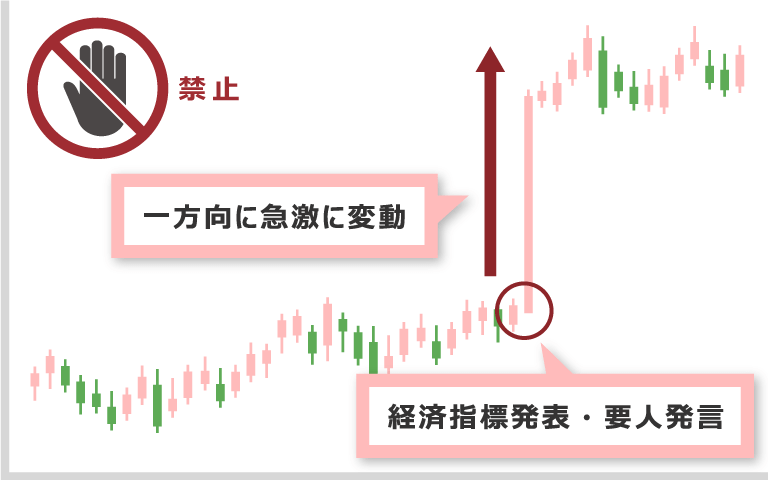

High leverage trading targeted only around the time of economic indicator releases and important person remarks

“High-leverage trading exclusively around the release of economic indicators and key figures’ statements” on XM is prohibited and a violation of the Terms of Use. High-leverage trading exclusively around the release of important economic indicators and key figures’ statements is a type of high-leverage trading that is limited to the release of important economic indicators and key figures’ statements, which are prone to large and sudden market fluctuations. Liquidity tends to be low before the release of important economic indicators such as key figures’ statements, employment statistics, and policy interest rate announcements, and after the announcement, funds inflow rapidly, resulting in volatile price fluctuations. While XM’s leverage of up to 1,000x allows for the potential for large profits, it also carries a high risk of being hit with a stop-loss order in a short period of time if the rate moves in a direction different from expectations.

XM does not prohibit trading around the time of economic indicator releases or important statements. However, please note that trading that focuses on specific timings will be subject to penalties.

Arbitrage

“Arbitrage” on XMTrading is a prohibited activity and a violation of the Terms of Use . Arbitrage is a trading technique that targets price differences, such as rates and swap points, that arise when trading the same stock across multiple accounts, including accounts with other companies and XM. Arbitrage that targets rate differences uses accounts with other companies and XM to profit from slight rate discrepancies that occur between different brokers. For example, if you buy USDJPY (US Dollar/Japanese Yen) when the quoted rate is 130,000 yen at another company and open a short position when the quoted rate is 130,005 yen at XM, you can minimize losses and ensure profits. Swap point arbitrage involves trading a stock with a guaranteed positive swap between your account with another company and your XM account. Please note that in both cases, penalties will be imposed if you intentionally trade to take advantage of differences in rates or swap points, including the fact that these are hedged transactions that span accounts with other companies and XM.

What are swap points?

Swap points are adjustments made to adjust for the interest rate differential between two countries when exchanging currencies with different policy interest rates. If you buy the currency of a country with a high interest rate and sell the currency of a country with a low interest rate, you will receive swap points, but if you do the opposite, you will have to pay swap points. Swap points are accrued every day while you hold a position. In the case of a negative swap, the swap points are recorded as a loss each day from the position’s profit and loss, so it is important to check your swap points when trading long-term. XM only allows hedging within the same XM account, but please note that the swap points accrued on both positions will result in a negative total.

Trading targeting connection delays and rate errors

Trading targeting connection delays and rate errors on XM is prohibited and a violation of the Terms of Use. Trading targeting connection delays and rate errors involves trading during important events, such as the release of economic indicators or statements by important figures, when a large number of orders are received, resulting in connection delays and rate errors. For example, trading when rates are stagnant or slow due to a server error is prohibited. XM boasts an excellent average execution rate of 99.35% and works with multiple liquidity providers (LPs) to prevent connection delays and rate errors, even in volatile market conditions. However, please be aware that server errors may occur due to irregular market conditions, and therefore trading targeting connection delays and rate errors is prohibited.

Fraudulent acquisition and use of bonuses and XM points (XMP)

The fraudulent acquisition and use of bonuses and XM Points (XMP) at XMTrading is a prohibited act and a violation of the Terms of Use . The fraudulent acquisition and use of bonuses and XM Points (XMP) includes acts such as using a third party’s name to obtain a duplicate new account opening bonus (trading bonus) or engaging in hedging trades solely to accumulate XMP. The various bonuses and XM Points provided by XM are services designed to allow you to enjoy XM’s dynamic and comfortable trading more advantageously. Please note that exploiting blind spots in bonus campaigns and XM Points (loyalty program) to fraudulently acquire or use bonuses and XM Points is prohibited.

Please note that if you have already received an account opening bonus (trading bonus) from XM, or if another family member has claimed an account opening bonus from the same IP address, you will not be able to receive the account opening bonus.To make effective use of XM’s account opening bonus, deposit bonus, and XM points, we recommend that you check in advance how to use each campaign and loyalty program.

Third-party account management

“Third-party account management” at XMTrading is a prohibited activity and a violation of the Terms of Use . Third-party account management means that account opening, deposits and withdrawals, trading, and other operations are carried out by a third party other than the account holder. FX trading is conducted by the account holder himself/herself, based on his/her investment intentions and with an understanding of the risks. Please note that it is prohibited for a third party other than the account holder to manage an account, even if the third party is a family member or close friend living with you.

Trading that places an excessive burden on XM’s servers

“Trading that places an excessive burden on XM’s servers” at XM (XM) is a prohibited activity and a violation of the Terms of Use. Trading that places an excessive burden on XM’s servers refers to repeated high-frequency buying and selling in a short period of time, or trading that places a heavy load on the server using EA (automated trading software) or AI (artificial intelligence) that incorporates such logic. XM boasts industry-leading execution power and a stable server environment, but excessive load on the server may result in connection delays or errors. Please note that any activity that poses a risk of significantly impacting the trading of other users is prohibited.

-

XM officially approves scalping trades, but please note that if excessive trading is deemed to place a heavy burden on the server, penalties will be applied.

Fraudulent acquisition of rewards through self-affiliation

“Fraudulent acquisition of commissions through self-affiliation” at XM is a prohibited act and a violation of the Terms of Use . Fraudulent acquisition of commissions through self-affiliation means opening an account via an IB link (referral link) issued by yourself, trading, and earning commissions. XM affiliates are a program designed to have you introduce XM to third parties as an XM partner. When the person you refer opens an XM account and trades, you will receive commissions. Earning commissions through your own trading using your own IB link is contrary to the purpose of affiliates and is prohibited by XM. Please be careful when introducing and using the IB link you issued to third parties.

If XMTrading discovers any prohibited conduct or conduct that violates the terms of use, the following penalties may be imposed.

Confiscation of Bonus XM Points (XMP)

XM (XM) reserves the right to confiscate any bonuses and XM Points (XMP) received if any prohibited activities or violations of the Terms of Use are discovered. New account opening bonuses and deposit bonuses are valuable sources of funds that can be used for real trading as part of margin. XM Points are awarded according to trading volume and are one of XM’s distinctive services, allowing them to be exchanged for bonuses or cash.

Please note that if XM discovers any prohibited conduct that is deemed to be subject to penalties, all bonuses and XM points may be confiscated. In order to make effective use of the bonuses and XM points that are one of the attractions of XM, we recommend that you carefully read the prohibited conduct and terms of use before starting trading.

Refusal to withdraw illegally obtained profits

XM may refuse to withdraw fraudulently obtained profits if it discovers any violations of its prohibited activities or terms of use. Illegally obtained profits are profits obtained through activities prohibited by XM, such as hedging using multiple accounts or under multiple names, arbitrage, or account management by a third party. If XM determines that the profits were obtained fraudulently through trading that violates its prohibited activities or terms of use, it may refuse to withdraw the fraudulently obtained profits and confiscate them. Before starting trading, please carefully review the prohibited activities and terms of use and enjoy dynamic trading with XM, with up to 1,000x your profits.

Account freeze

XM may freeze your account if it discovers any prohibited conduct or violations of the terms of use. If your account is frozen, you will be unable to log in to your XM member page or MT4/MT5 account. In addition, all bonuses and XM points (XMP) you have received will be lost. A frozen account cannot be restored, so if you wish to trade with XM, you will need to open a new account. Furthermore, if XM determines that you have engaged in serious prohibited conduct or violations of the terms of use, you will not be able to open an XM account after your account has been frozen. To enjoy trading in XM’s high-spec trading environment, we recommend that you review XM’s prohibited conduct and terms of use in advance.

-

The handling of positions and margin (own funds) held at the time of account freezing will differ depending on the reason for the account freezing.

-

If you reopen an account after your account has been frozen, you will not be able to receive the new account opening bonus.

-

If you reopen your account after it has been frozen, you will not be able to retain your loyalty program status from before the account was frozen.

-

For inquiries regarding account freezing, please contact the support center below:support@xmtrading.com(Business hours: 24 hours a day, Monday to Friday)

XM prohibits malicious trading that exploits blind spots in the services and systems provided by XM. However, by checking the prohibited items and terms of use in advance, you can avoid transactions that will result in penalties and experience XM’s dynamic trading. In order to broaden your trading style, XM allows you to use trading methods that are prohibited or restricted by other FX brokers without any restrictions. We will introduce you to transactions that do not violate XM’s prohibited items and terms of use, so you can enjoy trading in XM’s high-spec trading environment, including leverage of up to 1,000x, extremely small spreads, and excellent execution power.

Scalping trade

XM officially recognizes scalping trading . Scalping trading is a trading technique that involves repeatedly buying and selling over short periods of time, from a few seconds to a few minutes, to accumulate small profits. While the price swings you can earn per trade are smaller than those of day trading, XM’s high leverage of up to 1,000x makes it possible to make large profits even from a few pips. XM offers high leverage, ultra-small spreads, and excellent execution power, creating an ideal trading environment for scalping trading. The “KIWAMI Account,” which offers ultra-small spreads starting from 0.6 pips and no transaction fees, is a recommended account type for scalping trading.

-

If you use multiple accounts with XM and other companies, please be careful not to engage in hedging transactions, which are prohibited acts and a violation of the terms of use.

-

XM officially permits scalping trading, but please note that excessive buying and selling that places a heavy load on the server is prohibited.

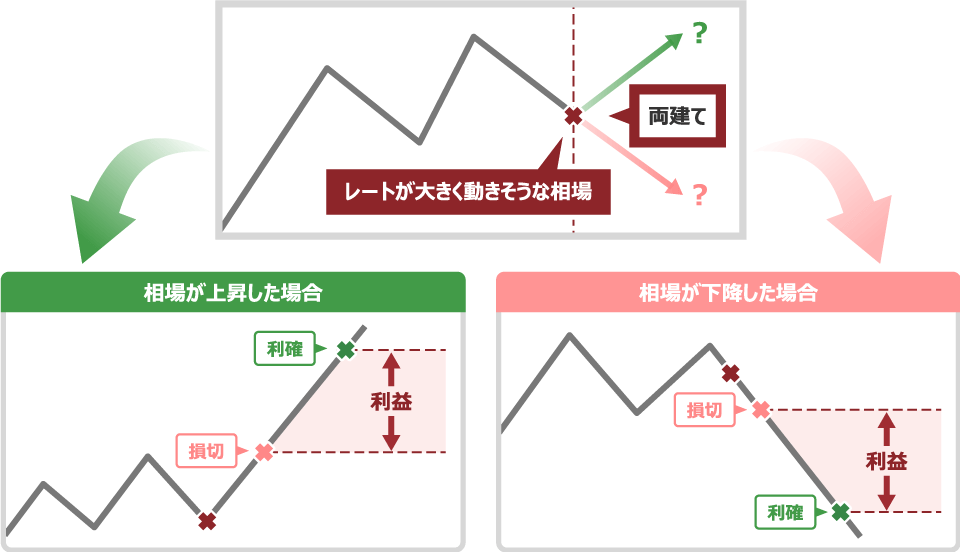

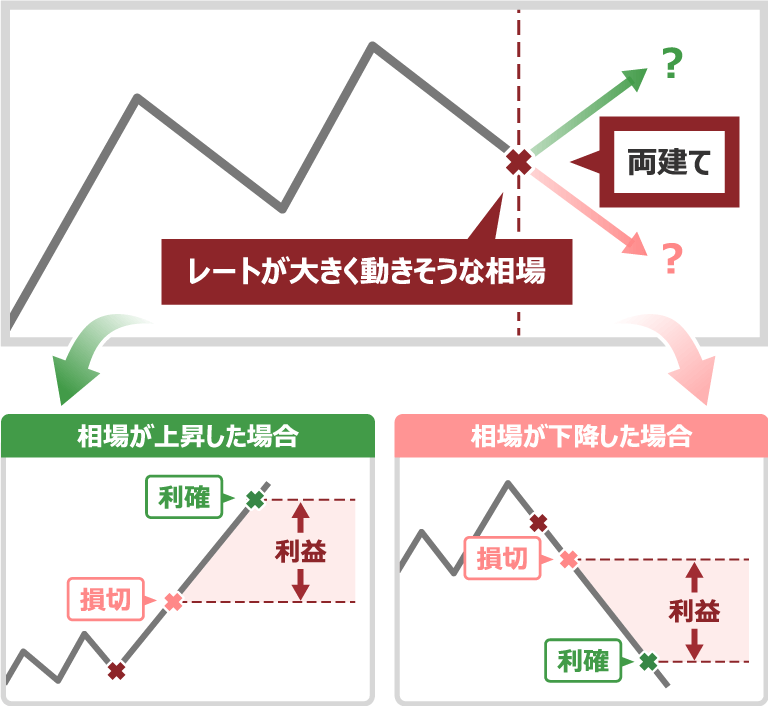

XM allows for hedging within the same account . Hedging is an effective trading method for hedging risk when sudden price fluctuations occur, avoiding forced stop losses, and aiming for large profits in certain markets.

XM prohibits hedging across multiple accounts, including accounts with other companies, and organized hedging between multiple names. However, there are no restrictions on hedging within a single XM account.

XM’s Margin Requirements for Hedging

At XM, when opening an opposite position of the same lot size for FX currency pairs, gold, or silver within the same account, the required margin is zero. You can execute hedging trades with the margin of one position, meaning you can open an opposite position without reducing your margin. This allows you to temporarily avoid forced stop losses by opening an opposite position without reducing your margin, even when your margin maintenance ratio drops due to sudden market fluctuations. Hedging within the same XM account is an effective way to reduce trading costs, protect against currency fluctuations, and avoid large losses. Please be aware of prohibited activities and violations of the Terms of Use when using hedging within the same XM account.

Automated trading using EA

XM allows you to perform automated trading using EAs (Expert Advisors) . Automated trading is trading that automatically buys and sells based on the logic built into the EA. If you install an EA on the MT4/MT5 trading platform used by XM, the EA will monitor charts and perform automated trading 24 hours a day. Automated trading using EAs has the advantage that you don’t have to keep an eye on the charts yourself and you won’t miss the timing to enter or close a position.

XM offers a “Free VPS Service” that allows you to use the VPS (Virtual Private Server), which is essential for automated trading, free of charge. Normally, the “XMTrading VPS” costs $28 (equivalent) per month, but those who meet certain conditions can use it for free. Please take advantage of the free “XMTrading VPS” service, as it allows you to carry out automated trading using EAs in the optimal environment without being affected by connection speeds or PC malfunctions.

Click here for details on XM’s VPS service

-

When using EA, please be sure to check in advance whether the EA logic violates any prohibited items or terms of use of XM.

-

Please note that if you use multiple accounts to conduct automated trading using various EAs, there is a possibility that you may end up with a hedging transaction across multiple accounts.

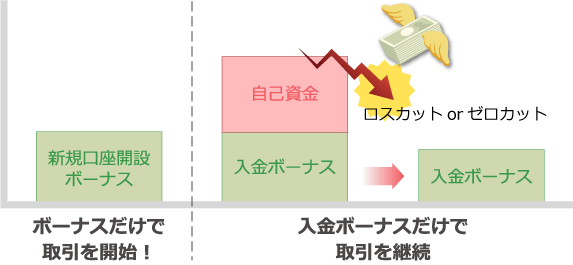

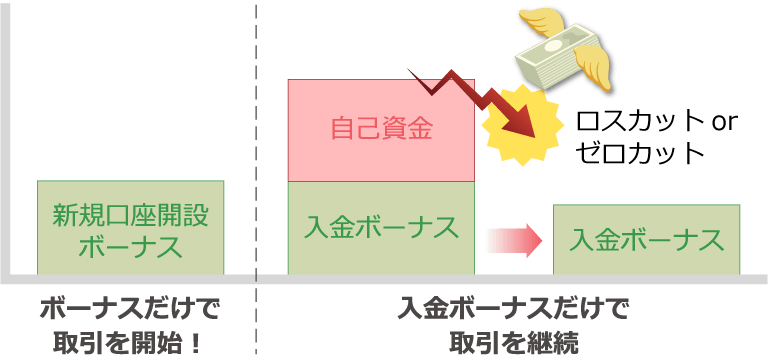

Trading using bonuses only

At XM , you can trade using only the bonus . If you receive a new account opening bonus, you can experience real trading with XM without making a deposit. Also, if you trade using a deposit bonus and are left with only the bonus (credit) balance due to a zero cut, you can continue trading using only the bonus, even if your account balance is zero. You cannot withdraw the bonus itself, but you can withdraw profits earned from trading using the bonus.

XM offers a variety of bonuses, including a ” New Account Opening Bonus ” of up to 15,000 yen for new account holders , a ” Deposit Bonus ” that allows you to receive a bonus of up to $10,500 depending on the amount you deposit , and a ” Loyalty Program ” that allows you to accumulate XM Points (XMP) that can be exchanged for bonuses or cash the more you trade . Take full advantage of these generous bonuses and enjoy trading with XM with a small amount of money.

We are currently running a ” Double Up Campaign ” for those who open a new XM account through this website . The Double Up Campaign offers two major benefits: an increased new account opening bonus and an upgrade to your loyalty program status. If you don’t yet have an account with XM, be sure to take advantage of the Double Up Campaign.

-

Is automated trading using EA prohibited or a violation of the terms of use at XM?

No, XM does not prohibit automated trading using EAs. You can trade automatically by installing an EA on the MT4/MT5 trading platform used by XM. However, if you wish to trade automatically using an EA, please check in advance whether the EA logic violates any of XM’s prohibited items or terms of use.

read more

2023.02.09

-

Please tell me about XM’s prohibited activities and penalties for violating the terms of use.

If XM discovers any prohibited conduct or violations of the terms of use, penalties will be imposed. Penalties may include the confiscation of bonuses and XM points, refusal of withdrawals, confiscation of profits, and account freezing. Furthermore, if XM determines that the violation is serious, you will not be able to reopen your XM account.

read more

2023.02.09

-

Please tell me about XM’s prohibited activities and actions that violate the terms of use.

XM prohibits hedging between multiple accounts. Please note that hedging between accounts with other companies and XM accounts, as well as organized hedging by multiple people, are prohibited acts and violations of the Terms of Use. There are also other prohibited acts such as arbitrage, so please check in advance.

read more

2023.02.09

-

Is arbitrage prohibited or a violation of the terms of use at XM?

Yes, arbitrage trading at XM is prohibited and a violation of the Terms of Use. Arbitrage is a method of taking advantage of price differences in rates and swap points that arise when trading the same stock across accounts with other companies and XM accounts. Please note that penalties will be imposed if you engage in arbitrage.

read more

2023.02.09

-

Is hedging between multiple accounts prohibited or a violation of the terms of use at XM?

Yes, at XM, hedging between multiple accounts is prohibited and a violation of the terms of use. Please note that if you hold positions simultaneously in multiple accounts, you cannot hold both a long and a short position for the same stock. However, hedging within the same account is possible and is not prohibited.

read more

2023.02.09