XM Nikkei 225 trading

XM Nikkei 225 trading

XMTrading offers Nikkei 225 (JP225) spot and futures CFDs . XM allows you to trade the large and highly volatile Nikkei 225 with up to 500x leverage, reducing the required margin. You can also receive dividends when trading the Nikkei 225 spot at XM.

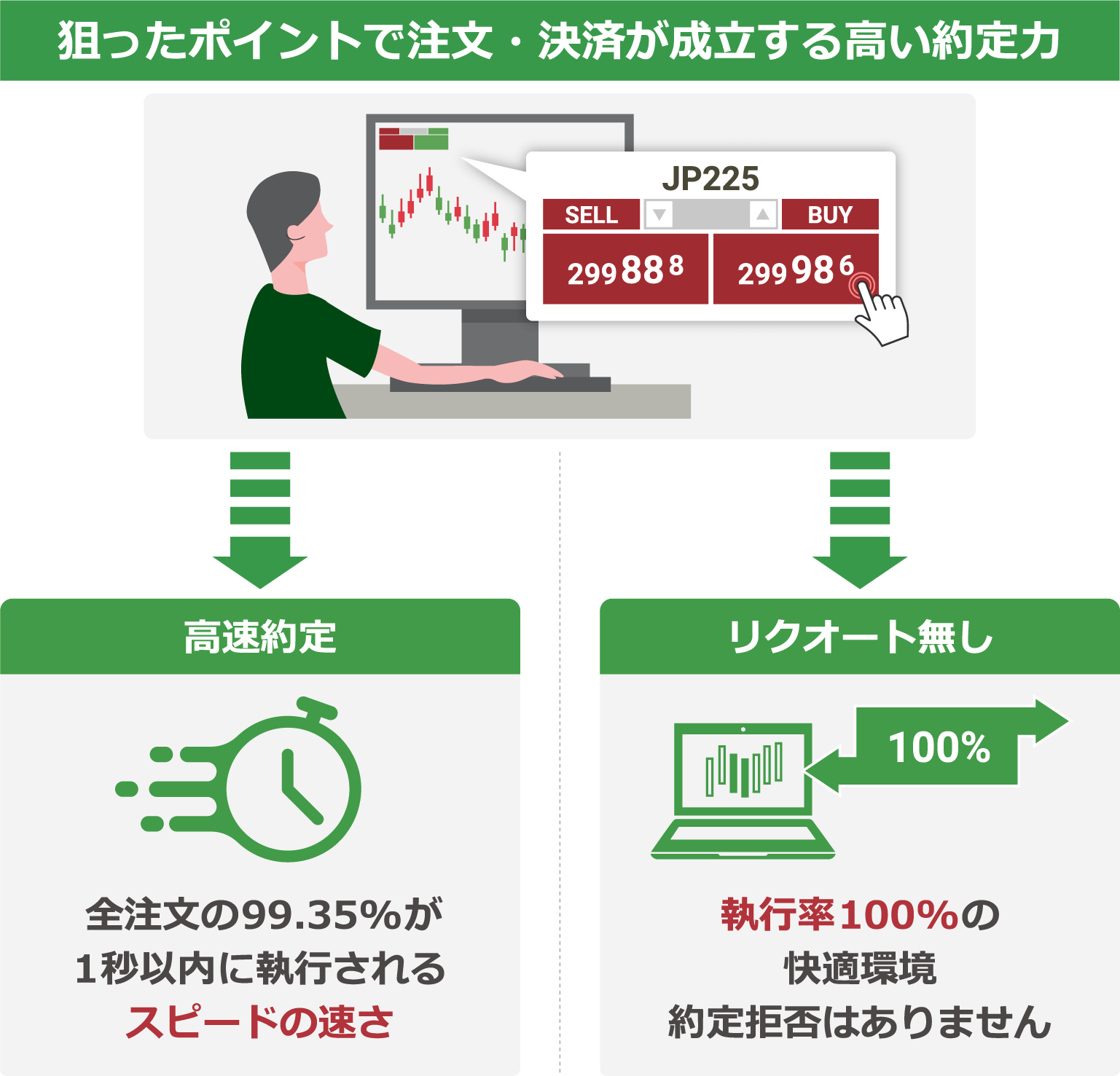

With a 100% execution rate with no requotes and a high average contract rate of 99.35%, XM offers one of the best trading environments in the industry, allowing beginners and advanced traders alike to trade comfortably. For a limited time, we are offering a 15,000 yen account opening bonus (trading bonus) (normally 3,000 yen) when you open a new XM account through this website. The bonus you earn can also be used as account funds, so please take advantage of this great opportunity.

XM Nikkei 225 trading

At XMTrading, you can trade Nikkei 225 (JP225) spot and futures CFDs. The trading conditions for spot and futures are different, so please check the basic knowledge and characteristics of Nikkei 225 in advance.

XM Nikkei 225 Trading Conditions (Features)

| Product (brand) |

[Spot]: JP225Cash

[Futures]: JP225 |

|---|---|

| Supported account types |

Standard account, Micro account ,

KIWAMI account, Zero account |

| Trading Platform |

MetaTrader 4 (MT4) and

MetaTrader 5 (MT5) |

| Trading Hours |

[Summer time]:

7:05 to 5:55 the next day (closes at 5:50 the next day on Fridays only) [Winter time]: 8:05 to 6:55 the next day (closes at 6:50 the next day on Fridays only) |

| Transaction fees |

free

|

| Maximum Leverage |

500 times

|

| Minimum Spread |

[Spot]: 7.00

[Futures]: 14.00 |

| Minimum Order Quantity |

[Spot] MT4: 0.1 lot / MT5: 0.1 lot

[Futures] MT4: 1 lot / MT5: 0.1 lot |

| Maximum order quantity |

[Spot]

MT4: 12,500 lots / MT5: 10,000 lots [Futures] MT4: 12,500 lots / MT5: 10,700 lots |

| Dividends |

[Spot]: Yes

[Futures]: No |

| Contract month (settlement date) |

[Spot]: No

[Futures]: Yes |

| Swap Points |

[Spot]: Yes

[Futures]: No |

For details on XM Nikkei 225 (JP225) trading conditions, click here

What is the Nikkei 225 (JP225)?

The Nikkei 225 (JP225) is a major stock price index traded on the Japanese stock market. It is calculated and published by Nikkei Inc. as an index showing the average stock prices of 225 representative Japanese companies listed on the Tokyo Stock Exchange. Because the Nikkei 225 is calculated based on Japan’s leading companies in each industry, it is attracting attention in the financial industry as an important benchmark indicating the health of the Japanese economy and trends in the Japanese stock market.

XM has spot and futures for the Nikkei 225 (JP225)

XMTrading offers both spot and futures products for the Nikkei 225 (JP225). Spot Nikkei 225 products are traded based on current stock prices on the Japanese stock market. Spot trading involves trading the stock prices of companies included in the Nikkei 225 index as they are. In addition, spot Nikkei 225 products offer dividends , so you can receive dividends as profits by holding them for the long term.

On the other hand, Nikkei 225 futures is a trading method that predicts future price movements of the Nikkei 225 index and invests in that future. In futures trading, future prices are traded through a system in which auction participants enter into contracts with each other regarding future price fluctuations. Predictions are made as to whether the Nikkei 225 value will rise or fall in the future, and trades (contracts) are made based on those predictions. Futures trading has a set settlement date (contract month) , and positions are settled at the price at that date when the settlement date arrives.

Click here for the difference between XM Nikkei 225 spot and futures

XMTrading’s Nikkei 225 (JP225) can be traded as both spot and futures CFDs (contract for difference). There are no differences in trading conditions depending on the account type, and trading is possible with all account types offered by XM.

XM Nikkei 225 (JP225) compatible trading account types

XMTrading’s Nikkei 225 (JP225) can be traded with all four account types: Standard Account , Micro Account , KIWAMI Account , and Zero Account . In addition, both MT4 (MetaTrader 4) and MT5 (MetaTrader 5) are supported, so you can trade with the platform that best suits your trading style. However, please note that the minimum and maximum lot sizes that can be placed per order differ between MT4 and MT5.

Click here for details on XM’s minimum and maximum lot size (lot calculation method)

XM Nikkei 225 (JP225) Trading Hours

At XM, you can generally trade the Nikkei 225 (JP225) from early Monday morning to early Saturday morning. There is a one-hour trading halt every morning, and the closing time is five minutes earlier on Fridays only. Also, please note that XM observes Daylight Saving Time (DST), so trading starts and closes one hour earlier during summer time than during winter time. XM Nikkei 225 trading hours are as follows:

XM Nikkei 225 (JP225) trading hours (Japan time)

| Daylight Saving Time |

7:05 to 5:55 the next day (closes at 5:50 the next day on Fridays only)

|

|---|---|

| Winter time |

8:05 to 6:55 the next day (closes at 6:50 the next day on Fridays only)

|

When trading the Nikkei 255 with XM, please be aware of changes in trading hours when the market switches between summer time and winter time, or when the market is closed during the New Year holidays, public holidays, etc. Changes in trading hours will be announced in advance on the ” XM Latest News (Notices from the Site) “. In addition, we will send an email with instructions to the email address registered with XM, so please check for details.

XM Nikkei 225 (JP225) Leverage

At XM, you can trade the popular Nikkei 225 (JP225) with high leverage of up to 500x across all account types . When trading the Nikkei 225 with a domestic FX broker, the maximum leverage is 25x. In comparison, XM allows for leverage of up to 500x, allowing you to trade larger amounts with less capital. The maximum leverage for XM Nikkei 225 spot and futures is as follows:

XM Nikkei 225 (JP225) Spot and Futures Maximum Leverage

| Brand | Maximum Leverage |

| Nikkei 225 Spot JP225Cash |

500x (required margin rate 0.2%) |

| Nikkei 225 Futures JP225 |

XM allows you to use high leverage with peace of mind without margin calls

XM employs a zero-cut system with no margin calls (additional margin deposits) for all trades, including the Nikkei 225 (JP225) . The zero-cut system prevents losses greater than the account’s funds by having XM compensate for losses that exceed the account balance due to sudden market fluctuations. While high-leverage trading allows you to trade large amounts with a small amount of capital, it also means that small market fluctuations can result in large losses. However, with XM’s zero-cut system, losses greater than the account’s funds will not occur, allowing you to trade with peace of mind.

XM Nikkei 225 (JP225) Swap Points

With XMTrading’s Nikkei 225 (JP225), swap points are only charged for spot trading. Spot trading swap points are negative for both long and short positions, so you need to be aware of the cost of swap points when carrying over a position to the next day. On the other hand, futures trading does not incur swap points, so you do not need to worry about paying negative swaps even if you hold a position for the long term. However, please note that futures trading has an expiration date (settlement date).

At XM, we have triple swap point days, where you can earn three times the usual swap points by carrying over a position from Wednesday to Thursday. This is because swap points for three days, including swap points for Saturday and Sunday when the market is closed, are awarded all at once on Wednesday. On triple swap point days, profits from positive swaps are tripled, but losses from negative swaps are also tripled, so please be careful when managing your positions.

XM’s swap points for Nikkei 225 (spot) are as follows.

XM Nikkei 225 (JP225) Spot Swap Points

| Nikkei 225 Spot JP225Cash |

-2.32 | -1.55 |

| Nikkei 225 Spot | |

| Long (Buy) | -2.32 |

| Short (sell) | -1.55 |

Swap points fluctuate daily, so please check the latest figures when trading.

XM Nikkei 225 (JP225) Spreads and Trading Fees

XMTrading uses variable spreads for both spot and futures Nikkei 225 (JP225) and offers trading with no trading fees . Spot Nikkei 225 spreads tend to be narrow due to high trading volume and volatility. In contrast, Nikkei 225 futures tend to have wider spreads because future price predictions are made and positions are held for the long term. However, since both are traded commission-free, your actual trading costs are limited to the spread. The minimum spreads for the Nikkei 225 offered by XM are as follows:

XM Nikkei 225 (JP225) Spot and Futures Minimum Spreads and Trading Fees

| Brand | Minimum Spread | Transaction fees |

| Nikkei 225 Spot JP225Cash |

7.00 | free |

| Nikkei 225 Futures JP225 |

14.00 |

| Nikkei 225 Spot | |

| Minimum Spread | 7.00 |

| Transaction fees | free |

| Nikkei 225 Futures | |

| Minimum Spread | 14.00 |

| Transaction fees | free |

With variable spreads, the optimal spread is always offered, taking into account market liquidity, etc., so please check the latest figures when trading. However, please note that the spread may widen from the offered spread if there is a decrease in market liquidity or the timing of the release of economic indicators related to the Nikkei 225.

XM Nikkei 225 (JP225) margin requirement per lot

The formula for calculating the required margin per lot when trading the Nikkei 225 (JP225) on XMTrading is as follows:

XM Nikkei 225 (JP225) Margin Calculation Formula

Market price x contract size x number of lots

÷ leverage = required margin

For example, when the market price of the Nikkei 225 is 30,000 yen, the required margin for an order with a contract size of 1, 10 trading lots, and 500x leverage can be calculated using the following formula:

30,000 × 1 × 10 ÷ 500 = 600 yen

XM’s Nikkei 225 offers a maximum leverage of 500x (required margin rate of 0.2%) for all account types, both for spot and futures. Depending on the trading platform, positions can be held with a minimum of 0.1 lots, so if you hold a position with the minimum trading number (0.1 lots) at the same rate, you can start trading the Nikkei 225 with a very low margin of just 6 yen.

XM Nikkei 225 (JP225) Minimum/Maximum Order Quantity and Contract Size

XMTrading’s Nikkei 225 (JP225) spot and futures contract sizes are the same, but the minimum and maximum order quantities (trading sizes) are different. There are also differences depending on the MT4/MT5 trading platform, so please be aware of this before starting trading. The minimum and maximum order quantities and contract sizes for XM Nikkei 225 spot and futures are as follows:

XM Nikkei 225 (JP225) Spot and Futures Min/Max Order Quantity and Contract Size

| Brand | Contract Size | Minimum Order Quantity | Maximum order quantity |

| Nikkei 225 Spot JP225Cash |

1 Japan 225 index | MT4: 0.1 lot MT5: 0.1 lot |

MT4: 12,500 lots MT5: 10,000 lots |

| Nikkei 225 Futures JP225 |

1 Japan 225 index | MT4: 1 lot MT5: 0.1 lot |

MT4: 12,500 lots MT5: 10,700 lots |

| Nikkei 225 Spot | |

| Contract Size | 1 Japan 225 index |

| Minimum Order Quantity | MT4: 0.1 lot MT5: 0.1 lot |

| Maximum order quantity | MT4: 12,500 lots MT5: 10,000 lots |

| Nikkei 225 Futures | |

| Contract Size | 1 Japan 225 index |

| Minimum Order Quantity | MT4: 1 lot MT5: 0.1 lot |

| Maximum order quantity | MT4: 12,500 lots MT5: 10,700 lots |

Click here for details on XM’s minimum and maximum lot size (lot calculation method)

XM Nikkei 225 (JP225) Major Constituent Stocks List

The constituent stocks of the Nikkei 225 (JP225), which can be traded on XMTrading, are selected from major companies listed on the First Section of the Tokyo Stock Exchange that have high liquidity and market capitalization. Since they are selected based on criteria that take into account trading volume, market capitalization, and industry balance, the composition of the index is characterized by its indicative composition of the Japanese economy as a whole. The constituent stocks are reviewed regularly and may be changed in line with corporate performance and market trends. At the time of writing, the main constituent stocks of the Nikkei 225 are as follows:

XM Nikkei 225 (JP225) Major Constituent Stocks List

| Industry | Brand name | Securities code |

| Retail | Fast Retailing | 9983 |

| Electrical Equipment | Tokyo Electron | 8035 |

| Electrical Equipment | Advantest | 6857 |

| Retail | |

| Fast Retailing | 9983 |

| Electrical Equipment | |

| Tokyo Electron | 8035 |

| Advantest | 6857 |

| FANUC | 6954 |

| TDK | 6762 |

| communication | |

| SBG | 9984 |

| KDDI | 9433 |

This is an excerpt of some of the major companies that make up the Nikkei 225.

The Nikkei 225 (JP225) spot and futures offered by XMTrading are both CFDs (contracts for difference) , but the trading conditions are different between spot and futures, so please check the characteristics of each before starting trading.

Differences in trading conditions between spot and futures for XM Nikkei 225 (JP225)

| Dividends | can be | none |

| Spread | 7.00 | 14.00 |

| Contract month (settlement date) | none | Yes (3 months) |

| Swap Points | can be | none |

| Dividends | |

| Actual item | can be |

| futures | none |

| Spread | |

| Actual item | 7.00 pips |

| futures | 14.00 pips |

| Contract month (settlement date) | |

| Actual item | none |

| futures | Yes (3 months) |

| Swap Points | |

| Actual item | can be |

| futures | none |

Spread figures fluctuate, so please check the latest figures when trading.

By understanding the differences between spot and futures trading conditions, you can trade comfortably in a way that suits your trading style and trading market conditions.

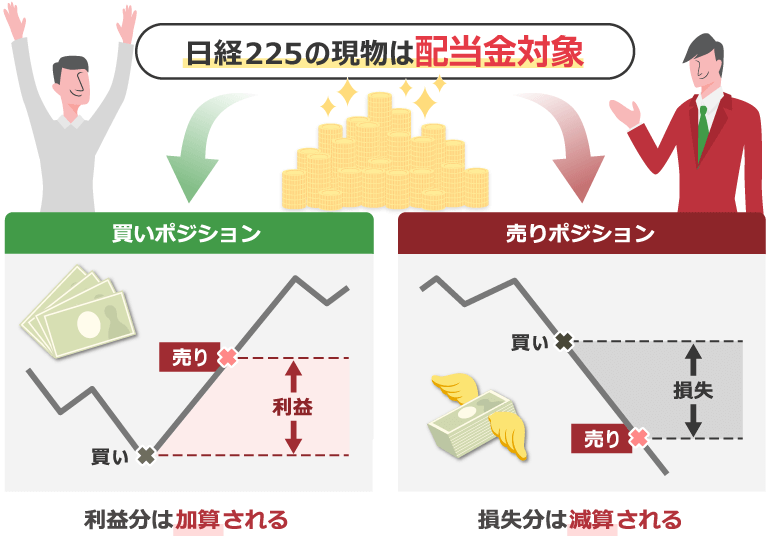

XM Nikkei 225 (JP225) spot stocks can receive dividends

With XMTrading, you can receive dividends (dividend adjustments) for the Nikkei 225 (JP225) spot . Dividend adjustments are reflected in your trading account based on the index dividends listed in the dividend schedule. If you hold a long position, it will be added as a profit, but if you hold a short position, it will be deducted as a loss, so please be careful when managing your positions during dividend adjustments. Please note that Nikkei 225 futures are not eligible for dividends.

XM Nikkei 225 (JP225) has narrower spot spreads

XMTrading’s Nikkei 225 (JP225) offers different spreads for spot and futures. The Nikkei 225 is Japan’s major stock index and is traded by many investors and Nikkei 225 traders. Due to its high trading volume and volatility, spot spreads tend to be tighter. If you are looking to make short-term profits through day trading or scalping, we recommend spot trading of the Nikkei 225, which has a narrower spread.

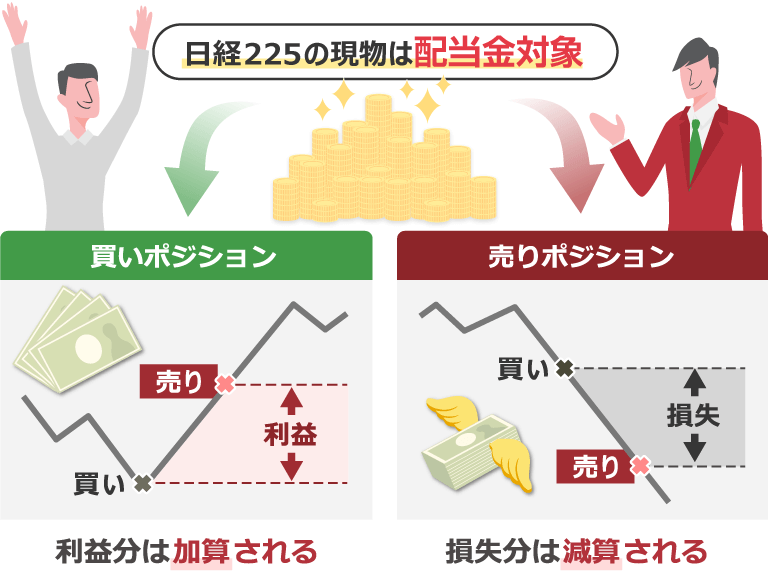

XM Nikkei 225 (JP225) futures have expiration months

The Nikkei 225 (JP225) futures offered by XMTrading have an expiration date , while the Nikkei 225 spot does not have an expiration date. The Nikkei 225 futures expiration date is three months, and when the settlement date three months later arrives, positions at that time will be forcibly settled.

You can check the Nikkei 225 contract month by launching XM’s MT4/MT5 and looking at the symbol name displayed on the “Market Watch” screen. The last part of the symbol name indicates the contract month; for example, “JP225-DEC23” indicates that the contract month is December 2023.

What is the expiration month for futures trading?

Futures trading is a trading method in which you contract to buy or sell an asset (commodity or financial product) at a certain price on a specific date in the future. In futures trading, the specific date in the future on which you buy or sell at the contracted price is called the “expiration month.” The expiration month refers to the month from the day the futures contract is concluded on which the actual commodity trade will take place. For example, if you enter into a futures contract in August 2023 and the expiration month is November 2023, the settlement date on which the commodity trade will take place will be November 2023.

XM Nikkei 225 (JP225) futures have no swap points

With XMTrading’s Nikkei 225 (JP225), swap points are not charged for futures trading only. Swap points charged for spot trading of the Nikkei 225 are negative for both long and short positions. Therefore, if you hold spot Nikkei 225 for the long term, you will need to pay swap points every business day. On the other hand, with Nikkei 225 futures trading, swap points are not charged, so you do not have to worry about the cost of carrying over positions, allowing you to comfortably trade for the medium to long term, even in swing trading and position trading.

The key points to keep in mind when trading the Nikkei 225 (JP225) on XMTrading are as follows. By understanding the basics of Nikkei 225 trading on XM and the characteristics of the Nikkei 225, you will be able to trade under more favorable conditions.

Identifying market trends

When trading the Nikkei 225 (JP225) on XMTrading, it is essential to understand market trends . The Nikkei 225 represents Japan’s economic situation. For this reason, it is easy for Japanese people to obtain news and trend information in real time, making it a stock that is relatively easy to predict price movements. When day trading or scalping, it is also effective to develop a trading strategy after understanding the market conditions of the day.

Get the latest news and trend information with the XM app

XM offers its own mobile app, the ” XM Smartphone App, ” which allows you to check the latest market news and advanced analytical data from Trading Central for free. By using the XM app, you can easily access the latest high-quality market information anytime, anywhere, and react quickly to market movements and trends. The XM app allows you to manage everything from account opening to deposits and withdrawals, and trading using a wide range of indicators all in one place.

-

Currently, the iOS version of the XMTrading app cannot be installed. If you have already installed it, you can continue to use it.

Analyzing trends in stocks correlated with the Nikkei 225 (JP225)

XMTrading’s Nikkei 225 (JP225) is composed of 225 stocks representing Japanese companies and plays an important role as a benchmark for the Japanese economy. Because the Japanese economy is closely related to trade with other countries and the global economic situation, correlations are often seen with different stock markets. By comparing the trends of highly correlated stocks with the Nikkei 225, you can analyze trend momentum and market flows. Representative markets that are highly correlated with the Nikkei 225 are as follows:

XM Nikkei 225 (JP225) and highly correlated markets

| US stock market (US30/US500) | The Nikkei 225 and major US stock indexes are influenced by global economic conditions, and so a correlation can be seen. In the past, the two indexes have tended to move in similar directions due to factors such as economic booms and busts and financial crises. However, the correlation can also fluctuate inversely or completely randomly due to factors within Japan or fundamentals related to the US economy. |

|---|---|

| Foreign exchange market (US dollar/Japanese yen) | There is a certain correlation between the Nikkei 225 and the US dollar/Japanese yen in the foreign exchange market, as these exchange rates affect Japan’s export industry and foreign investment. However, because the foreign exchange market is traded in currency pairs, the value of each currency fluctuates based on relative comparisons, and each country’s central bank can intervene in the value of its currency. Therefore, a correlation between the US dollar/Japanese yen and the Nikkei 225 is not always observed. |

| bond market | Trends in the bond market can also be correlated with the Nikkei 225. Monetary policy, interest rate hike/cut decisions, and interest rate fluctuations affect overall economic trends and are highly correlated with price trends in the Nikkei 225. |

Check out the Nikkei 225 (JP225) and related fundamentals

When trading the Nikkei 225 (JP225) on XMTrading, it is also important to understand the related fundamentals. Understanding the fundamentals that affect stock prices leads to an understanding of market trends and the factors behind market movements. By understanding information such as economic indicators and monetary policy, it is possible to confirm the impact on the market in the medium to long term. Representative examples of fundamentals that are highly related to the Nikkei 225 are as follows:

XM Nikkei 225 (JP225) and highly related economic indicators

| Domestic Economic Indicators | Economic indicators such as GDP growth, unemployment rate, consumer price index (CPI), and business activity indexes indicate the health and growth of the Japanese economy. Changes in these indicators can affect the Nikkei 225. |

|---|---|

| Corporate performance | The performance of the constituent companies, such as sales, profits, and dividend yields, influences the investment decisions of market participants. Good performance contributes to an increase in the index, while poor performance can lead to a decline in the market price. |

| monetary policy | Monetary policies such as the Bank of Japan’s policy interest rate and monetary easing policies affect financial markets and the economy as a whole. Interest rate movements affect corporate borrowing costs and consumer spending, which in turn impact the Nikkei 225. |

Using Nikkei 225 spot and futures

XMTrading’s Nikkei 225 (JP225) allows you to trade meaningfully by switching between spot and futures depending on your objectives and trading style . Spot trading of the Nikkei 225 is ideal for short-term trading, such as receiving dividends or taking advantage of tight spreads for day trading and scalping. Nikkei 225 futures trading, on the other hand, does not incur swap points, eliminating the need to worry about carrying over positions, making it ideal for medium- to long-term trading, such as swing trading and position trading. However, with futures trading, positions are forcibly liquidated upon the expiration date (settlement date), so please be careful when conducting medium- to long-term trades. By taking advantage of the characteristics of both spot and futures and adopting a flexible trading strategy, you can increase your trading opportunities on the Nikkei 225 while hedging your risks.

Click here for the difference between XM Nikkei 225 spot and futures

Learn the basics of FX trading with XM webinars

The skills and knowledge required to trade the Nikkei 225 (JP225) on XM Trading are similar to those required to trade XM currency pairs and other CFDs. Risk management methods, fundamentals, and technical analysis often originate in the stock market and are useful for trading the Nikkei 225. XM regularly hosts “XM Free Webinars,” where professional investors teach not only the basics of FX trading but also practical skills . Please take advantage of these to master the basics of FX. XM webinars also allow you to ask questions directly to experienced, professional Japanese instructors. You can ask questions about the Nikkei 225 and receive real-time information on the latest trading trends and strategies.

XMTrading offers the perfect trading environment for those looking to start trading the Nikkei 225 (JP225). We offer industry-leading leverage and execution power, making it stress-free for both beginners and professional traders. Furthermore, by taking advantage of generous bonus campaigns, including a new account opening bonus (trading bonus), you can trade the Nikkei 225 under even more favorable conditions.

Small trades are possible with up to 500x leverage

XM allows you to trade the Nikkei 225 (JP225) with industry-leading leverage of up to 500x. When trading the Nikkei 225 with other brokers, the high volatility of the index often limits trading due to low leverage limits. However, XM offers high leverage of up to 500x, giving you the advantage of being able to start trading with a small amount of capital. By making good use of XM’s high leverage, you can start trading the Nikkei 225 at low costs.

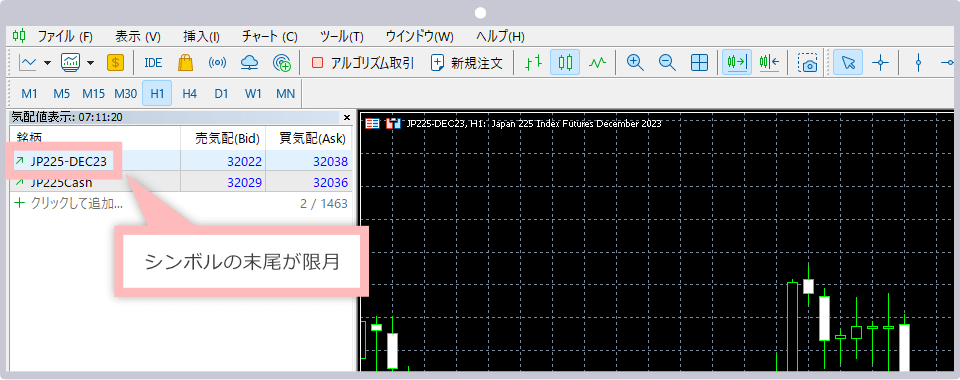

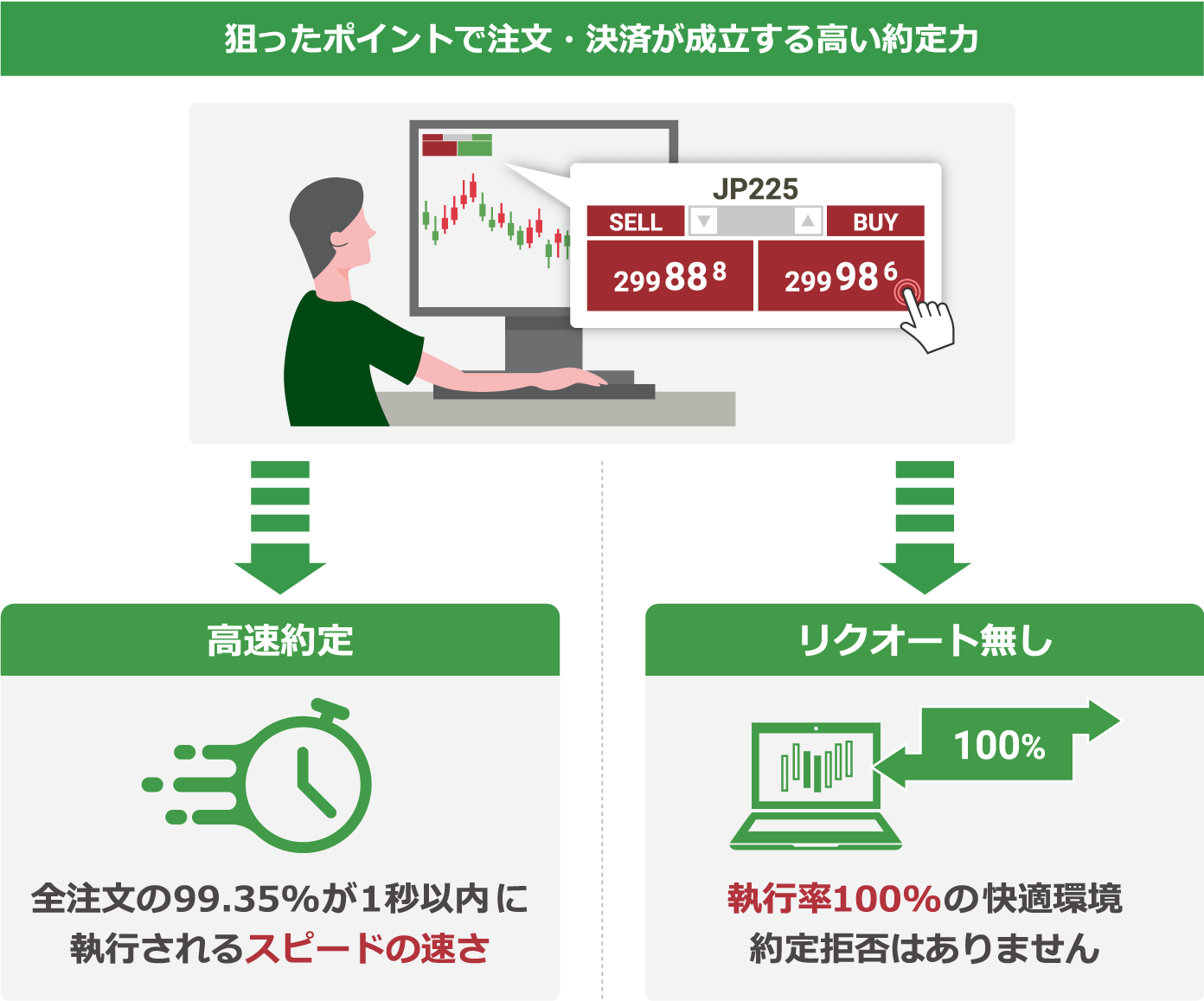

Excellent execution power and execution speed

XM offers the advantage of trading the Nikkei 225 (JP225) with excellent execution power and speed without requotes . Typically, trading the highly liquid Nikkei 225 tends to experience slippage, a difference between the desired price at the time of order/settlement and the executed price when the trade is completed. However, XM achieves an execution speed of 99.35% for all orders, including the Nikkei 225, executed within one second. Furthermore, by providing a comfortable trading environment with no requotes (rejected orders), you can trade the Nikkei 225 smoothly.

Trade the Nikkei 225 with generous bonuses

With XM’s Nikkei 225 (JP225), you can use the bonus credits and cashback earned through various bonuses as trading capital of the same amount. For example, with the ” New Account Opening Bonus (Trading Bonus) ,” you can earn up to 15,000 yen in account opening bonus credits simply by opening a new account and completing the account activation process. Other benefits include the ” Deposit Bonus ,” which allows you to receive a bonus of up to $10,500 just by depositing funds into your trading account, and the ” XM Loyalty Program ,” which allows you to accumulate XM Points (XMP) that can be exchanged for bonuses or cash with each trade . Be sure to take advantage of these great bonus campaigns that are unique to XM.

-

The “Deposit Bonus” and “XM Loyalty Program” are not available for XM KIWAMI Goku Accounts and Zero Accounts.

Can be operated using automated trading (EA)

XMTrading’s Nikkei 225 (JP225) allows for automated trading using EAs (Expert Advisors) . EAs automatically execute trades using a program, making them ideal for those who find it difficult to devote time to trading, those who want to run automated trading on the Nikkei 225 in parallel with discretionary trading, and even short-term traders who scalp on the Nikkei 225.

When scalping, it is important to maintain a high win rate while increasing the number of trades, and to trade in highly volatile markets where it is easy to secure a price range in a single trade. By using automated trading, the program executes trades quickly and at the best possible timing, which is a great advantage for traders aiming for short-term speculative profits. XM also provides a free VPS (Virtual Dedicated Server) that is ideal for running automated trading (EA) at all times.

Please note the following points when trading Nikkei 225 (JP225) spot and futures on XMTrading.

The stock symbols are different between spot and futures

XMTrading’s Nikkei 225 (JP225) has different symbol names for spot and futures in MT4/MT5. Spot has “Cash” at the end of the symbol name (JP225Cash), while futures has “- expiry month” at the end of the symbol name (JP225- expiry month). Futures expiry months can be confirmed by the MT4/MT5 symbol name, or you can find details under ” Available Trades ” on the XM stock index page . When starting to trade the Nikkei 225 with XM, please check the symbol name in advance to avoid confusing spot and futures.

-

Actual item

-

futures

It is a CFD (contract for difference).

XMTrading’s Nikkei 225 (JP225) is a contract for difference (CFD) for both spot and futures. CFDs are a method of settlement based solely on the difference between the opening and closing price of a trade without actually owning the financial product. Therefore, even when trading the Nikkei 225 spot, you do not actually own the stocks. Therefore, please note that unlike regular stock trading, you cannot receive dividends directly from the company like a shareholder who owns actual stocks.

Minimum/maximum order quantities differ between MT4 and MT5

XMTrading’s Nikkei 225 (JP225) trading conditions are the same for all account types, but please note that the minimum and maximum order quantities vary depending on the trading platform (MT4/MT5). By choosing the platform that best suits your trading style and funds, you can trade the Nikkei 225 more comfortably.

Click here for details on minimum/maximum order quantities for XM Nikkei 225 (JP225)

Hedging between multiple accounts is prohibited

XMTrading’s Nikkei 225 (JP225) prohibits hedging between multiple accounts. Hedging between additional accounts or accounts with other companies is prohibited and is subject to penalties such as profit cancellation (withdrawal refusal) and account freezing. Please be especially careful when running automated trading software (EA) targeting the Nikkei 225, as there is a risk of unintentionally hedging between multiple accounts.

For details on hedging transactions prohibited by XM, click here

-

Are swap points generated with XM’s Nikkei 225 (JP225)?

Yes, swap points are only charged for spot trading of the Nikkei 225 (JP225) at XM. Swap points for spot trading of the Nikkei 225 are negative for both long and short positions. In addition, if you carry over a position from Wednesday to Thursday, you will receive three times the normal swap points.

read more

2023.10.02

-

What is the maximum leverage for XM’s Nikkei 225 (JP225)?

XM’s Nikkei 225 (JP225) can be traded with a maximum leverage of 500x for both spot and futures. With XM’s stock index CFD trading, there are no leverage restrictions based on the trading account balance (account funds/equity), so you can always trade the Nikkei 225 (JP225) with a constant margin rate.

read more

2023.10.02

-

Can I receive dividends when trading the Nikkei 225 (JP225) with XM?

Yes, you can receive dividends (dividend adjustments) only through spot trading of XM’s Nikkei 225 (JP225). Dividends will be reflected in your trading account based on the index dividends listed in the dividend schedule. Please note that Nikkei 225 futures are not eligible for dividends.

read more

2023.10.02

-

What are XM’s trading hours for the Nikkei 225 (JP225)?

At XM, you can trade the Nikkei 225 (JP225) from early Monday morning until early Saturday morning. However, there is a one-hour trading suspension every morning, and closing times are five minutes earlier on Fridays only. Please note that XM observes Daylight Saving Time (DST), so opening and closing times during summer time are one hour earlier than winter time.

read more

2023.10.02

-

What is the difference between spot trading and futures trading of the Nikkei 225 (JP225) offered by XM?

XM’s Nikkei 225 (JP225) spot and futures are both CFDs (contracts for difference), but there are differences in trading conditions. Spot CFDs incur swap points and allow you to receive dividends. On the other hand, futures CFDs do not incur swap points, have slightly larger spreads, and have a fixed settlement date (contract month).

read more

2023.10.02