XM Bitcoin High Leverage Trading

XM Bitcoin Leverage Trading

XMTrading allows you to trade Bitcoin with high leverage of up to 500x, commission-free . In addition, the industry’s narrowest spreads keep trading costs down, so you can start trading with a small amount of capital, taking advantage of the high volatility unique to Bitcoin, without having to prepare a large amount of capital.

XM has created an optimal trading environment for Bitcoin trading so that customers can enjoy comfortable Bitcoin trading. Specifically, we use a ” tiered margin rate ” for Bitcoin leverage to avoid unnecessary risk. In addition, even if large losses occur due to market fluctuations, XM will cover any losses that exceed the margin through our ” zero cut system .” Even if you think Bitcoin trading is expensive, XM allows you to enjoy efficient Bitcoin trading from small amounts, commission-free, with appropriate risk management. The main benefits of trading Bitcoin with leverage at XM are as follows:

-

Increased capital efficiency

You can trade up to 500 times your available funds

XM allows you to trade Bitcoin dynamically with a small amount of capital by leveraging up to 500x.

-

Zero Cut System

Losses exceeding the margin will not occur

Bitcoin trading is characterized by high volatility, but you can minimize risk and maximize profits.

-

Beginners are also welcome

You can start trading with the bonus

Limited time offer! Take advantage of the 15,000 yen account opening bonus and try out leveraged Bitcoin trading with no deposit and no risk.

-

Ample trading opportunities

You can trade both buying and selling

It also supports hedging, so you can hold a Bitcoin position while watching the market and enter at the optimal time.

-

Available 24 hours a day, 365 days a year

You can trade on weekends and other times.

Even if you can’t find time to trade Bitcoin during the week due to work or other commitments, XM allows you to trade Bitcoin with leverage on the weekends.

-

Same margin as FX trading

Anyone can easily start trading

There is no need to open a new account just for Bitcoin. You can easily trade Bitcoin with leverage using the same account and margin as for FX trading.

XM Bitcoin Leverage Trading

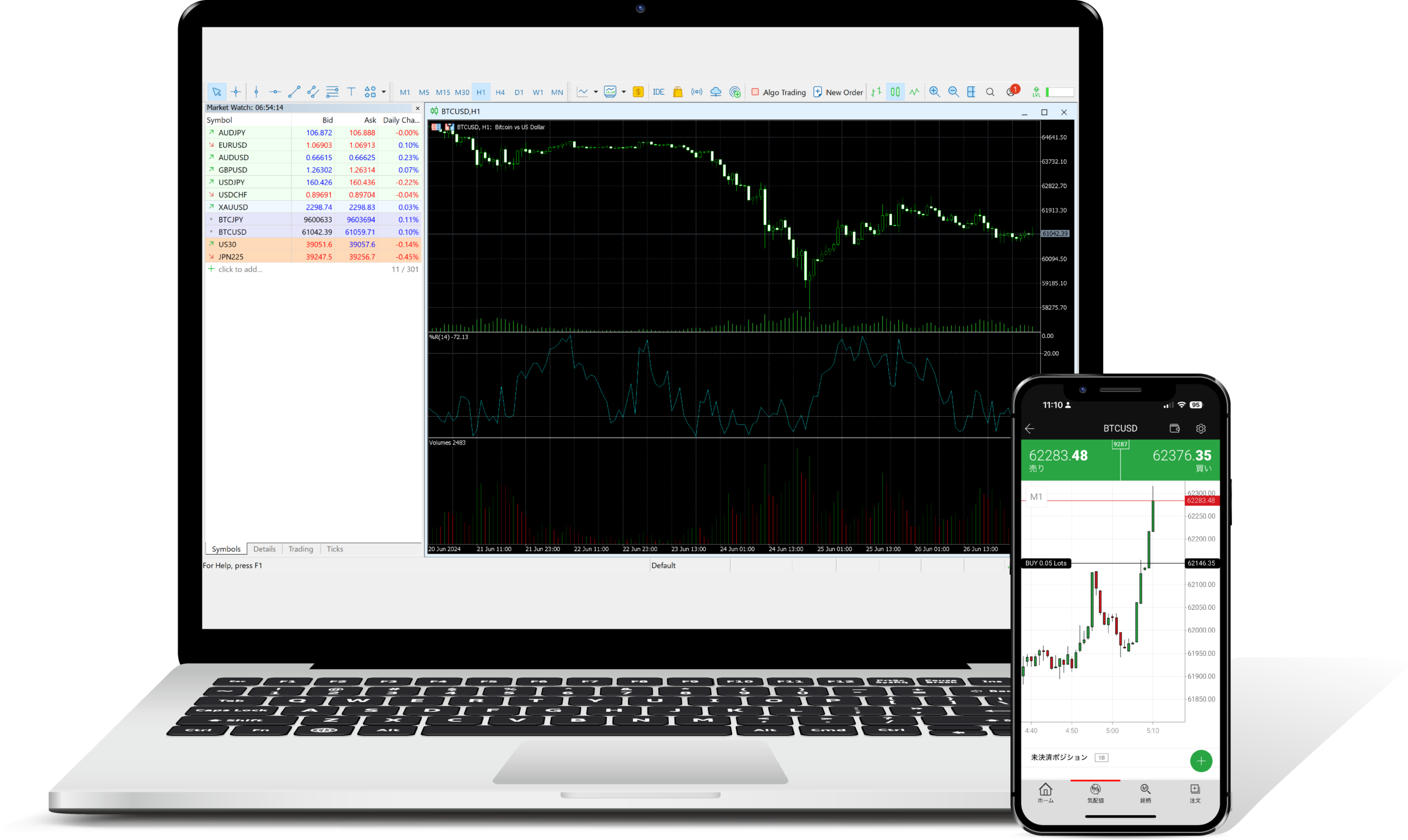

XM Trading supports leveraged trading using Bitcoin. You can trade Bitcoin with high leverage of up to 500x , and there are no transaction fees, so you don’t need to prepare a large amount of capital to start trading Bitcoin. XM also allows you to trade Bitcoin in the same trading environment as FX, so you can use the same trading strategies as FX trading. If you want to use your FX trading experience to try leveraged trading in Bitcoin, we recommend opening a new account with XM.

We are currently running the ” XM Double Up Campaign ” where you can receive an account opening bonus of 15,000 yen instead of the usual 3,000 yen when you open a new account through this website . Get this limited-time bonus and start trading Bitcoin with leverage with no risk.

What is Leverage?

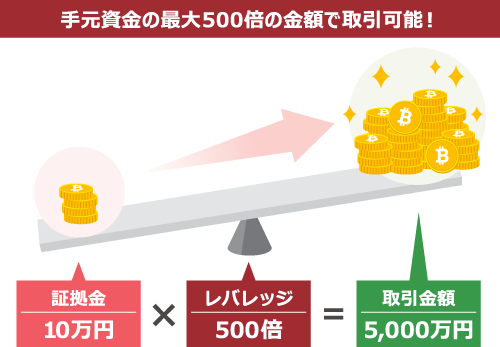

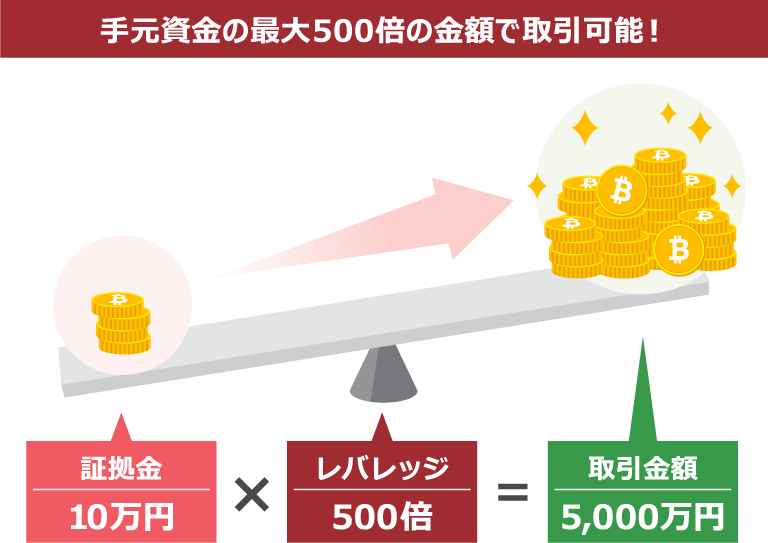

Leverage refers to a mechanism for trading using an amount larger than the funds you have on hand . Specifically, the trading amount is the amount of margin multiplied by the leverage, so if you deposit 100,000 yen in margin into an account with a 500x leverage, the amount you can trade will be 50 million yen. If you increase the leverage ratio, the amount you can trade will increase even with the same margin, so you can trade larger amounts with a smaller margin .

XM allows you to trade with leverage using CFD products such as foreign exchange (FX currency pairs), precious metals, and stocks, but you can also trade with leverage on Bitcoin. If you are interested in Bitcoin trading but find it difficult to prepare a large amount of capital, you can enjoy Bitcoin trading with leverage on XM and start trading with a small amount of capital.

XM’s Bitcoin trading leverage is up to 500x

XMTrading is an FX broker that is known for its high leverage trading, and you can trade not only FX currency pairs but also Bitcoin with high leverage. Specifically, XM allows you to trade Bitcoin with up to 500x leverage .

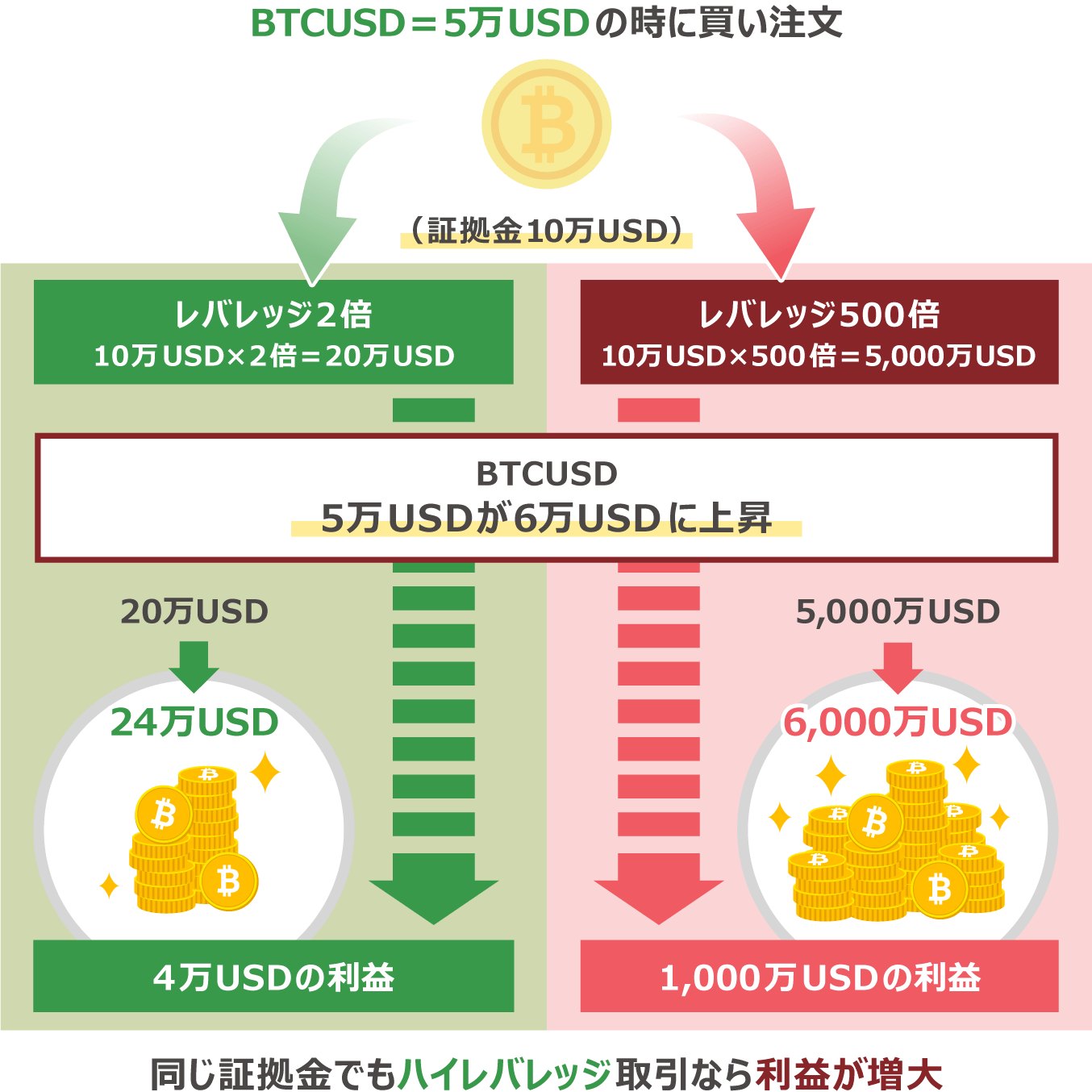

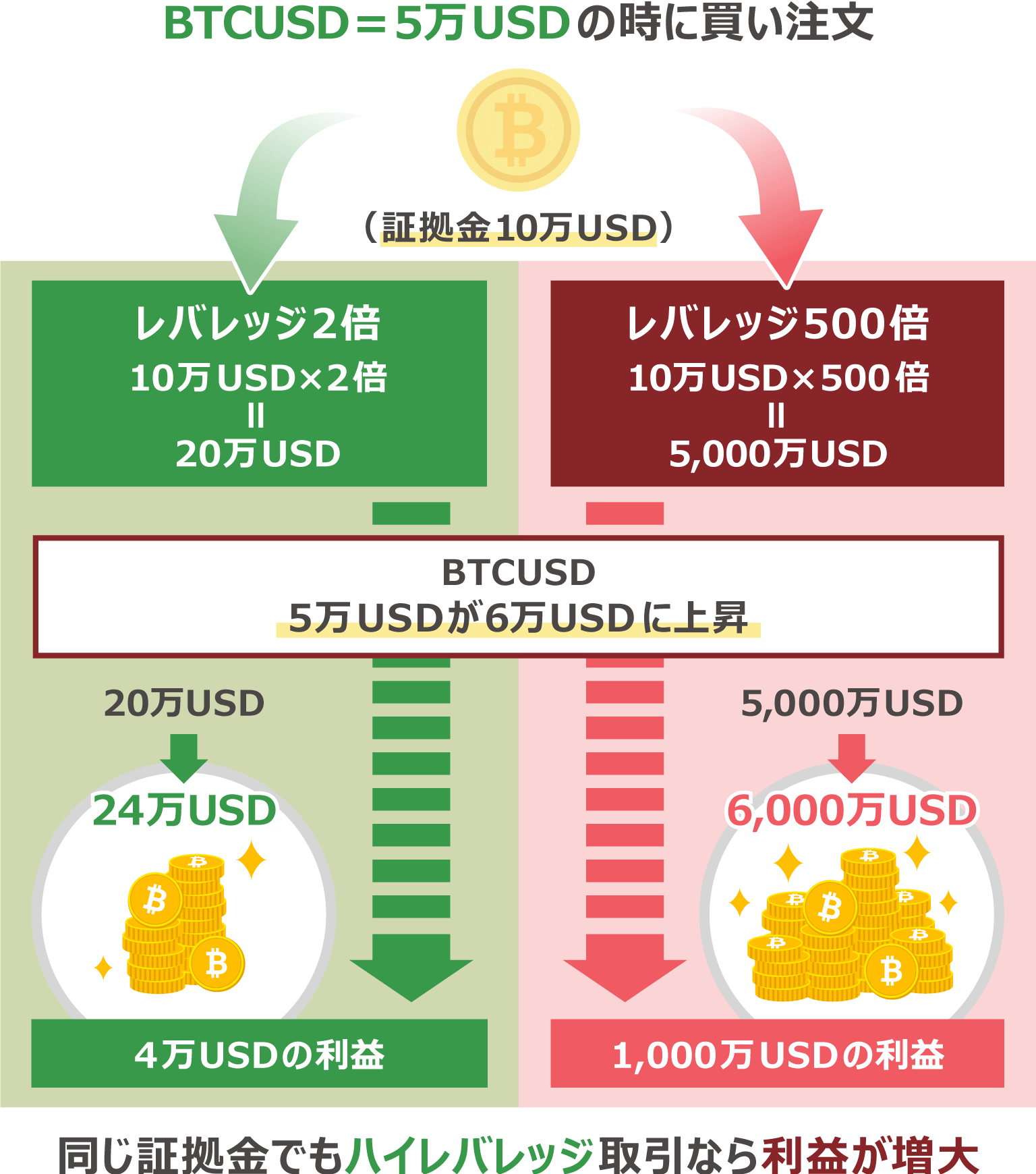

Increasing leverage increases the amount that can be traded with the same margin. For example, if you trade Bitcoin with a margin of 100,000 yen, the amount that can be traded is 200,000 yen if the leverage is 2x. However, if you increase the leverage to 500x, the amount that can be traded becomes 50 million yen.

By trading with high leverage, the amount that can be traded increases, which increases the “profit rate .” For example, if you prepare a margin of 100,000 USD, hold a long position when BTCUSD = 50,000 USD, and close the position when it reaches 60,000 USD, you will have earned a profit margin of 1 USD (100 pips). The difference in profit between 2x leverage and 500x leverage is as follows:

As leverage increases the trading amount, the profits you can earn from the same price range will also increase. Furthermore, XM employs a zero-cut system, so even if you incur losses greater than your margin due to a sudden market rise or fall, XM will compensate for the negative amount and reset your balance to zero, so you can rest assured. XM’s Bitcoin trading offers up to 500x leverage, a zero-cut system, and some of the tightest spreads in the industry. By taking advantage of tight spreads, you can efficiently aim for profits with small amounts while keeping trading costs down.

XM Bitcoin supports five types of leverage trading

XMTrading’s Bitcoin trading offers a total of five products, combining Bitcoin with four currencies (USD, EUR, GBP, JPY) and one cryptocurrency (ETH) . The trading conditions for each Bitcoin product offered by XM are as follows. Spreads are subject to change, so please check the latest figures when trading.

XM Trading Conditions for 4 Bitcoin Stocks

| Brand | Maximum Leverage | Min/Max Lot |

Spread (KIWAMI Account) |

|

BTCEUR (Bitcoin/European Euro) |

250 times | 0.01/30 lots | 115.00 pips |

|

BTCGBP (Bitcoin/British Pound) |

250 times | 0.01/30 lots | 170.00 pips |

|

BTCJPY (Bitcoin/Japanese Yen) |

250 times | 0.01/20 lots | 9,000 pips |

|

BTCUSD (Bitcoin/US Dollar) |

500 times | 0.01/20 lots | 30.00 pips |

|

ETHBTC (Ethereum/Bitcoin) |

500 times | 0.01/43 lots | 0.00009 pips |

| BTCEUR | |

| Maximum Leverage | 250 times |

| Min/Max Lot | 0.01/30 lots |

| Spread (KIWAMI Account) | 115.00 pips |

| BTCGBP | |

| Maximum Leverage | 250 times |

| Min/Max Lot | 0.01/30 lots |

| Spread (KIWAMI Account) | 170.00 pips |

| BTCJPY | |

| Maximum Leverage | 250 times |

| Min/Max Lot | 0.01/20 lots |

| Spread (KIWAMI Account) | 170.00 pips |

| BTCUSD | |

| Maximum Leverage | 500 times |

| Min/Max Lot | 0.01/80 lots |

| Spread (KIWAMI Account) | 30.00 pips |

| ETHBTC | |

| Maximum Leverage | 500 times |

| Min/Max Lot | 0.01/43 lots |

| Spread (KIWAMI Account) | 0.00009 pips |

XM’s Bitcoin trading allows up to 500x leverage for two products: BTCUSD (Bitcoin/US Dollar) and ETHBTC (Ethereum/Bitcoin) . The maximum leverage for BTCEUR (Bitcoin/European Euro), BTCGBP (Bitcoin/British Pound), and BTCJPY (Bitcoin/Japanese Yen) is 250x.

Additionally, these five products differ in the currencies (products) they are paired with when trading Bitcoin, resulting in different price movements. ETHBTC (Ethereum/Bitcoin) in particular is a combination of virtual currencies, so its price movements differ significantly from those of currency combinations. Trading conditions such as minimum/maximum lots and spreads, as well as price trends, vary depending on the Bitcoin product, so please check the details of each product before starting leveraged Bitcoin trading with XM.

About XM Cryptocurrency Tiered Margin Rates

XMTrading uses “tiered margin rates” for Bitcoin trading . Tiered margin rates are a system in which leverage fluctuates depending on the trading volume (lot) held . The higher the trading volume, the lower the leverage, allowing you to trade Bitcoin with a risk that matches the trading volume.

Generally, when trading with leverage, the risk of failure increases in proportion to the trading volume. Bitcoin, in particular, is highly volatile, so sudden price spikes and drops are not uncommon. However, XM employs a tiered margin maintenance rate, allowing you to automatically adjust to an appropriate trading risk (leverage). As the leverage is automatically limited as the trading volume increases, the trading amount is restricted, allowing you to trade Bitcoin with peace of mind. The leverage limits by trading volume for BTCUSD (Bitcoin/US Dollar), the most popular cryptocurrency with the highest trading volume offered by XM, are as follows:

XM BTCUSD (Bitcoin/US Dollar) Tiered Margin Rates

| Trading volume (lots) | Maximum Leverage |

| 0 to 14 lots | 500 times |

| Lots 14 to 43 | 250 times |

| Lots 43 to 70 | 50 times |

| 70 lots or more | 1x |

For BTCUSD, leverage is gradually restricted when the trading lot size exceeds 14 lots . Tiered margin rates are also applied to Bitcoin products other than BTCUSD, and maximum leverage is limited according to trading volume. Please refer to the following page for details.

XMTrading does not support spot trading of Bitcoin. Even though both trading with Bitcoin are done with leverage, there is a big difference between “leverage trading” and “spot trading.”

Bitcoin spot trading eliminates the risk of assets going negative due to Bitcoin price fluctuations, and it is possible to earn profits through lending, staking, and other methods in addition to buying and selling. On the other hand, purchasing Bitcoin through spot trading requires a large capital investment , and even if you start trading Bitcoin with a small amount, you cannot expect to make a large profit. On the other hand, Bitcoin leveraged trading allows you to start trading Bitcoin with a small amount but with a large amount by using your assets as margin . XM allows you to trade Bitcoin with leverage up to 500x, making it recommended for those who find it difficult to prepare a large amount of capital.

The main differences between leveraged and spot trading of Bitcoin

| Leveraged Bitcoin Trading | Bitcoin spot trading |

|

|

| Leveraged Bitcoin Trading |

|

| Bitcoin spot trading |

|

XM supports leveraged trading of not only Bitcoin, but also FX currency pairs and stock indices. You can trade Bitcoin with leverage in the same trading environment and trading platform (MT4/MT5) as you do FX trading, so if you want to expand your trading options, be sure to open an account with XM and try your hand at Bitcoin trading.

XM offers one of the best trading environments in the industry for Bitcoin trading. If you’re interested in Bitcoin trading, open an account with XM and try out leveraged Bitcoin trading in a favorable trading environment. The main benefits of leveraged Bitcoin trading with XM are as follows:

You can trade up to 500 times your available funds

XM allows you to leverage Bitcoin and trade up to 500 times your available funds . Because you can trade Bitcoin with high leverage and no fees, even if you only have a small amount of trading capital or are unsure about trading with a large amount of margin from the start, you can trade with small amounts with the aim of making large profits. While there are several overseas FX and CFD brokers that offer leveraged Bitcoin trading, the maximum leverage varies by broker. In particular , brokers based in Japan are limited to a maximum of 2x leverage on Bitcoin trading due to regulations by the Financial Services Agency.

XM is based overseas and operates under licenses from the Seychelles Financial Services Authority (FSA) and the Mauritius Financial Services Commission, meaning there’s no need to limit the maximum leverage to 2x. This allows for exciting Bitcoin trading with greater leverage than domestic brokers . While XM does not hold a Japanese financial license, it is not against the law for Japanese people to use XM’s services. You can trade Bitcoin with peace of mind, knowing that you won’t have your funds confiscated or your account frozen by using XM. XM’s leverage allows for low margin requirements, so you can enjoy Bitcoin trading with ease.

Zero cut system prevents negative balance

XMTrading employs a “zero cut system” to handle sudden losses caused by market fluctuations . The zero cut system is a mechanism whereby if a sudden rise or fall in the market prevents a stop loss from being triggered in time and a loss that exceeds the margin is incurred, XM will cover the excess. The zero cut system resets negative balances to zero, so you can resume trading immediately by re-depositing margin without having to pay additional margin when starting a new trade.

Bitcoin is one of the most volatile stocks handled by XM, so while trading with leverage can bring about large profits, it also carries the risk of incurring losses greater than the margin.However, XM’s zero-cut system means you will not incur debt due to market fluctuations , allowing you to enjoy aggressive leveraged Bitcoin trading.

You can start trading with the bonus

XM regularly holds various campaigns where you can earn generous bonuses. Bonuses earned can be used as margin when trading with XM, and of course, can also be used for Bitcoin trading. Currently, XM offers two types of bonuses: an ” account opening bonus ” and a ” deposit bonus .” Anyone can earn these bonuses as long as they meet the conditions, and by utilizing the bonuses, you can reduce the amount of capital required for Bitcoin trading. Of course, profits made from trading using bonuses can be withdrawn, making it possible to increase your assets with virtually no personal capital.

In particular, XM’s new account opening bonus is being increased from the usual 3,000 yen to 15,000 yen for a limited time as part of the ” Double Up Campaign ” for those who open a new account through this website . Since the account opening bonus is available without any deposit, you can start trading Bitcoin immediately after activating your account. Make effective use of XM’s generous bonuses and enjoy advantageous leveraged Bitcoin trading with XM.

Limited-time promotions are also held irregularly.

In addition to the bonus campaigns mentioned above, XMTrading also holds limited-time promotions from time to time. Some limited-time promotions are automatically available, while others require customer entry. Limited-time promotions are posted regularly on the ” Current Bonus Campaigns ” page, so please check regularly.

You can trade both “buy” and “sell”

Bitcoin trading on XMTrading is leveraged CFD trading, so you can enter not only by buying but also by selling . Being able to enter by selling simply doubles your trading opportunities , allowing for more aggressive trading.

XM also allows you to incorporate “hedge trading” into your trading strategy. Hedge trading is a method of temporarily freezing unrealized losses (unrealized gains) by holding both a “buy” and a “sell” position at the same time . The Bitcoin market tends to be highly volatile and prone to violent price movements, but by utilizing hedge trading, you can hold your position while watching the market stabilize.

XM allows you to trade by choosing to either “buy” or “sell” depending on the market environment, allowing you to trade Bitcoin with a more aggressive trading strategy. Another attraction of Bitcoin trading with XM is that there are many trading opportunities, so you can make aggressive trades without any fees.

Trading available 24 hours a day, 365 days a year

Since the cryptocurrency market is open 24 hours a day, 365 days a year, XM allows you to trade Bitcoin CFDs on weekends and holidays . Even if you are busy during the week and don’t have time to look at charts, you can make effective use of your weekend time and enjoy leveraged Bitcoin trading.

As markets in all countries are closed on weekends, most of the stocks handled by XM are unavailable for trading on those days. However, with XM’s Bitcoin CFDs, charts operate on weekends just like they do on weekdays, so you can trade whenever you like. If you only have time to trade on weekends, why not start leveraged Bitcoin trading with XM?

-

XM’s cryptocurrency CFDs, including Bitcoin, will not be available for trading for 30 minutes on Saturdays only, from 16:05 to 16:35 (17:05 to 17:35 in winter) due to system maintenance.

-

Please note that when trading Bitcoin with XM, trading volume may decrease and spreads may widen depending on the time of day you trade.

For details on XM’s weekend trading and deposit/withdrawal rules, click here

You can trade with the same margin as FX trading

With XMTrading, you do not need to open a new real account when trading Bitcoin . You can trade all products, including Bitcoin, foreign exchange (FX), and other CFDs, using the same account you use for FX trading.

Typically, to start trading Bitcoin, you need to open an account with a cryptocurrency exchange. Therefore, if you want to trade both FX and Bitcoin, you have to go through the hassle of splitting your assets and switching accounts. At XM, you can complete both FX and Bitcoin trading in the same account , eliminating the need to open multiple accounts or use different accounts for different trading instruments. Furthermore, since you can trade Bitcoin using the same margin as for FX trading , fund management is extremely easy. If you’re considering starting Bitcoin trading alongside FX trading, we encourage you to try XM’s excellent trading environment, which is suitable for both FX and Bitcoin trading.

XM offers four account types with different trading conditions, but only three accounts allow you to trade Bitcoin: Standard Account , Micro Account , and KIWAMI Kyoku Account (XM’s Zero Account does not allow you to trade Bitcoin). All account types allow you to trade Bitcoin commission-free, but we recommend the KIWAMI Kyoku Account, which offers the tightest spreads and no trading fees . Here are the reasons why XM’s KIWAMI Kyoku Account is recommended for Bitcoin trading:

Why XM KIWAMI Account is recommended for Bitcoin trading

-

No transaction fees

-

Bitcoin trading is possible with the industry’s narrowest spreads

-

You can start trading Bitcoin without making a deposit using the bonus.

-

Enjoy trading in a trading environment withan average contract rate of 99.35%

-

Supports a wide range of brands in addition to Bitcoin

XM’s KIWAMI Kyoku Account is characterized by its “ultra-small spreads” and “no trading fees ,” allowing you to trade Bitcoin with the narrowest spreads and lowest costs of any account type offered by XM. Trading costs, including spreads, have a significant impact on profits and losses, so XM’s KIWAMI Kyoku Account, which offers the industry’s narrowest spreads, allows you to pursue profits in Bitcoin trading more advantageously than other account types. However, spreads tend to widen depending on the timing of your trade, so please check ” XM’s Minimum Spreads for Cryptocurrency CFDs ” at any time to see a rough guide to XM’s Bitcoin spreads.

Additionally, while the KIWAMI Goku account is a very small spread account, it is eligible for XM’s account opening bonus campaign . XM’s account opening bonus, normally 3,000 yen, has been increased to 15,000 yen for a limited time for customers who open a new account through this website . By taking advantage of XM’s account opening bonus, you can start trading Bitcoin without depositing any funds. Even if a trade fails and your margin is depleted, your funds will not be lost at all because they were earned through the bonus. Open an XM KIWAMI Goku account and enjoy the exciting world of Bitcoin trading with no risk.

XM Trading not only allows you to trade with leverage up to 500x, but also offers a zero-cut system that reduces the risk of sudden losses, allowing you to trade Bitcoin in a comfortable trading environment. Another attraction of XM is that you can trade Bitcoin commission-free using the same trading account and margin as for FX. However, there are some points to be aware of when trading leveraged Bitcoin with XM, so please check them before actually starting trading.

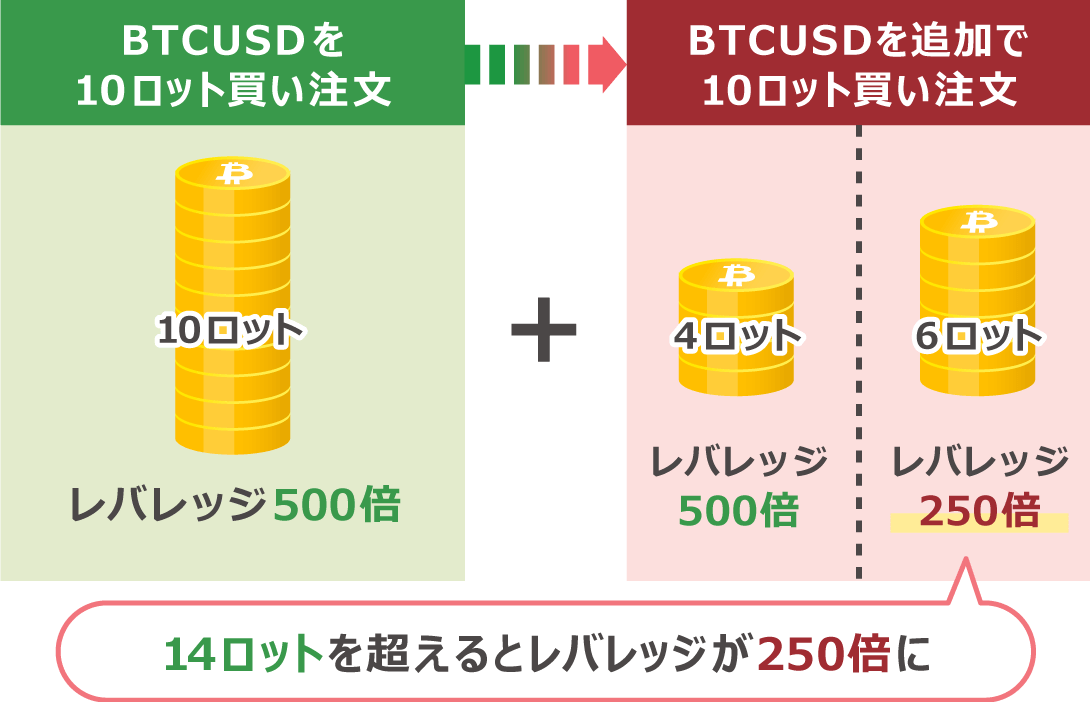

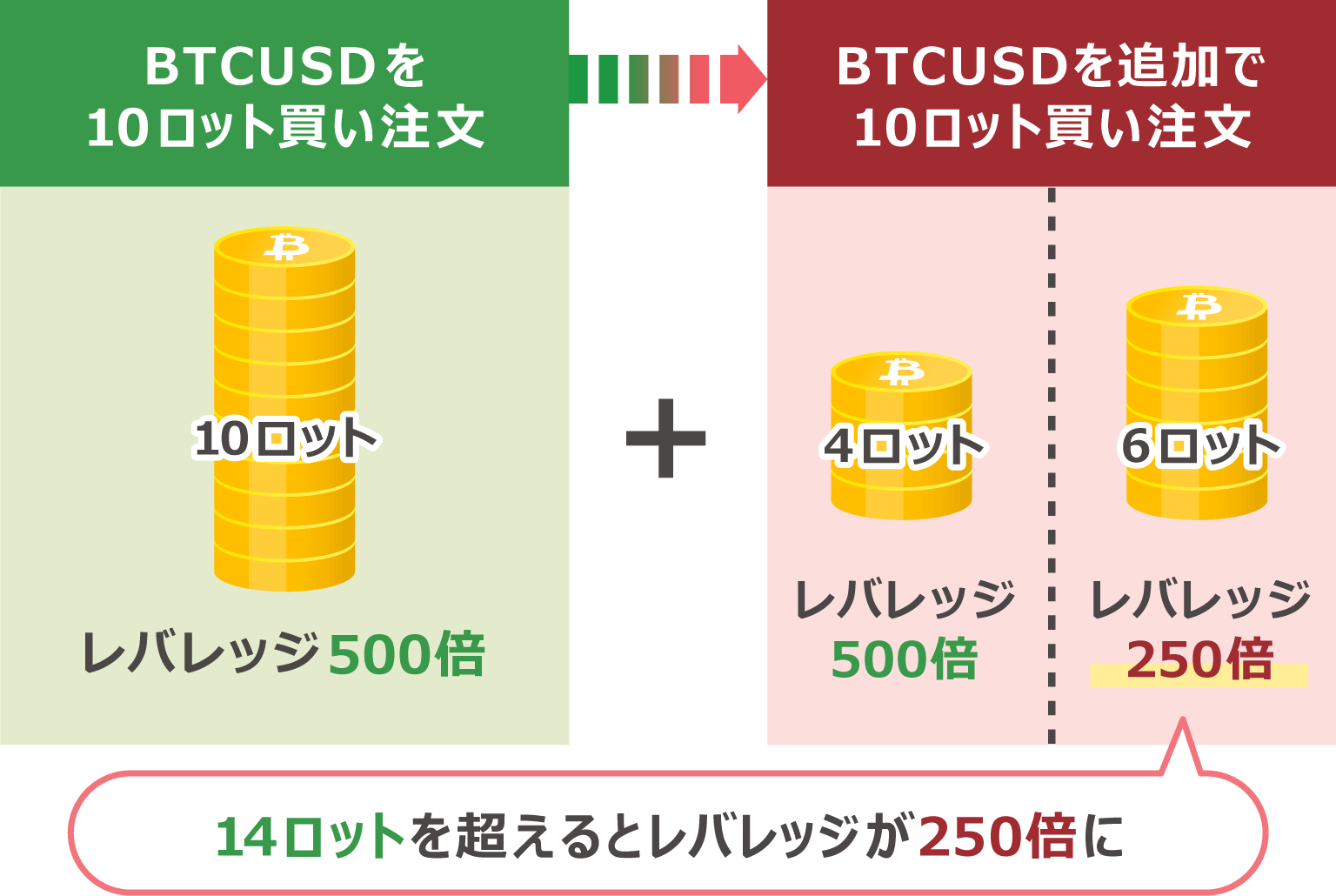

Be careful of leverage fluctuations due to additional orders

XMTrading’s Bitcoin trading uses tiered margin rates , limiting maximum leverage according to trading volume. Since trading volume is not per trade but per account, if additional orders cause trading volume to exceed 14 lots, leverage will be gradually restricted . Below is an example of leverage restrictions due to additional orders.

With tiered margin rates, leverage limits are applied as the trading volume increases, so it’s important to note that the calculation of the tradable amount is more complicated than with fixed leverage, making capital management a little more difficult. If you want to trade Bitcoin with simple capital management without having to worry about margin fluctuations due to leverage limits, consider your trading strategy, such as not making the trading volume too large, and enjoy Bitcoin trading with XM.

For details on XM Bitcoin trading volume leverage limits, click here

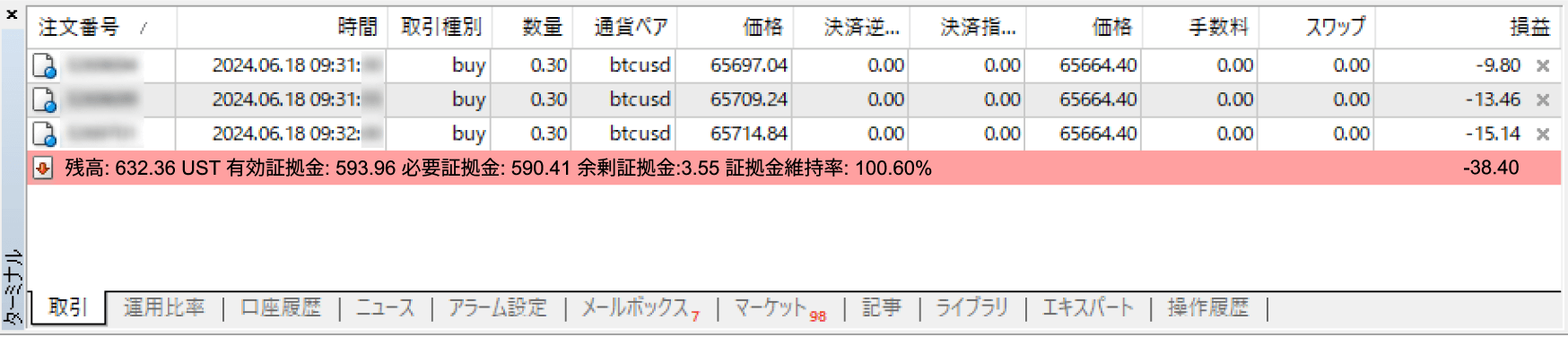

Beware of declining margin maintenance rates

XM allows you to trade Bitcoin with small amounts by using high leverage, but please note that the margin maintenance rate is prone to fluctuations. The margin maintenance rate can be calculated using the formula ” Available Margin ÷ Required Margin × 100 ” and is a number that represents the margin available in your account. The higher the margin maintenance rate, the more margin you have available for trading. At XM, if your margin maintenance rate falls below 20%, your position will be forcibly closed (stop loss).

Bitcoin is a highly volatile asset, and it is not uncommon for its price to fluctuate dramatically over a short period of time. When trading with high leverage, the margin maintenance rate is also prone to fluctuation, so it is important to be aware that there is a higher risk of forced liquidation compared to FX trading. When trading Bitcoin with high leverage at XM, please enjoy trading while keeping an eye on the margin maintenance rate.

How to check margin maintenance rate

The margin maintenance rate is displayed in the “Trading” tab in the terminal window of XM’s trading platform, “MetaTrader4 (MT4) / MetaTrader5 (MT5).” If the margin maintenance rate falls below a certain level, a stop loss will be executed and your held positions will be forcibly liquidated (stop loss). Please check your margin maintenance rate frequently to avoid unexpected losses.

XM points cannot be earned through Bitcoin trading

XMTrading has a ” Loyalty Program ” where you can earn XM points with every trade , but XM points are not awarded unconditionally. Specifically, XM points are not awarded for trading with the “KIWAMI Account,” which offers extremely small spreads. Also, XM points are not awarded for Bitcoin trading with Standard Accounts or Micro Accounts. If you want to earn XM points, trade with products such as FX currency pairs and stock indexes.

At XM, you cannot earn XM points through Bitcoin trading, but you can trade Bitcoin using bonuses from XM points as margin . However, XM points cannot be transferred to KIWAMI accounts. When using XM points to start trading Bitcoin, please be careful about the account type you open.

Swap points will incur expenses

When trading Bitcoin with XMTrading, swap points are incurred. Swap points are adjustment losses due to the interest rate differential between the combined currencies, and are incurred by holding a position for more than one day. Swap points can be positive depending on the currency pair and the direction of the position (buy or sell), so by making good use of interest rate differentials, it is possible to increase your assets simply by holding a position.

These swap points occur not only in FX but also in Bitcoin trading, and all swap points for XM’s Bitcoin products are negative swaps for both buying and selling . Therefore, it is important to note that if you hold a Bitcoin product with XM for more than one day, swap points will be deducted from your assets. The swap points for the four Bitcoin products that can be traded with XM are as follows:

XM Bitcoin Swap Points

| Brand | Swap points (buy) | Swap points (selling) |

|

BTCGBP (Bitcoin/British Pound) |

-6,707.03 | -6,707.03 |

|

BTCEUR (Bitcoin/European Euro) |

-7,751.48 | -7,751.48 |

|

BTCJPY (Bitcoin/Japanese Yen) |

-11,106.3 | -11,106.30 |

|

BTCUSD (Bitcoin/US Dollar) |

-7,552.71 | -7,552.71 |

|

ETHBTC (Ethereum/Bitcoin) |

-3.34 | -3.34 |

| BTCGBP | |

| Swap points (buy) | -6,707.03 |

| Swap points (selling) | -6,707.03 |

| BTCEUR | |

| Swap points (buy) | -7,751.48 |

| Swap points (selling) | -7,751.48 |

| BTCJPY | |

| Swap points (buy) | -11,106.3 |

| Swap points (selling) | -11,106.30 |

| BTCUSD | |

| Swap points (buy) | -7,552.71 |

| Swap points (selling) | -7,552.71 |

| ETHBTC | |

| Swap points (buy) | -3.34 |

| Swap points (selling) | -3.34 |

Swap points occur at the rollover time from Monday to Friday (6:00 a.m. Japan time), so when trading Bitcoin, please be careful about the length of time you hold your position.

-

What is XM’s “tiered margin” for Bitcoin?

Tiered margin is a system in which the margin rate (leverage) varies depending on the trading amount. For BTCUSD (Bitcoin/US Dollar), the maximum leverage is 500x, but if the trading amount per order exceeds $1 million, it is limited to 250x. The leverage gradually decreases to 50x for orders over $3 million and 1x for orders over $5 million.

read more

2024.06.05

-

Can I use my XM bonus as margin to trade Bitcoin?

Yes, XM bonuses can be used as margin for Bitcoin trading. XM offers a wide range of bonuses, and by utilizing these bonuses you can increase your capital efficiency and enjoy Bitcoin trading. You can also try Bitcoin trading risk-free by using only the account opening bonus, which you can receive without making a deposit.

read more

2024.06.05

-

Do I need to open a new account to trade Bitcoin with XM?

No, at XM, you can trade all cryptocurrency CFDs, including Bitcoin, using the same account as your FX trading. There is no need to switch accounts depending on the product you are trading, and you can trade Bitcoin using the same margin as your FX trading. Fund management is very easy, so even beginners can easily start trading Bitcoin.

read more

2024.06.05

-

Can I trade Bitcoin on weekends at XM?

Yes, XM allows you to trade all cryptocurrency CFDs, including Bitcoin, on weekends (including holidays). XM’s Bitcoin CFDs are available for trading 24 hours a day, 365 days a year, but are closed for 30 minutes on Saturdays from 16:05 to 16:35 (17:05 to 17:35 during winter hours) due to maintenance. Please be aware of this when trading Bitcoin CFDs with XM.

read more

2024.06.05

-

Does XM offer spot trading of Bitcoin?

No, XM does not offer spot trading of Bitcoin. XM only offers CFD trading (contract for difference) of Bitcoin, which can be traded in both “buying” and “selling” directions. Since you can trade Bitcoin even when it is falling, one of the features of XM’s Bitcoin CFD trading is that it offers more trading opportunities compared to spot trading.

read more

2024.06.05

-

What are the spreads for XM’s Bitcoin trading products?

XM’s Bitcoin spreads vary depending on the account type. With the KIWAMI account, you can trade BTCUSD (Bitcoin/US Dollar) at a minimum of 190 pips, BTCEUR (Bitcoin/European Euro) at 350 pips, and BTCGBP (Bitcoin/British Pound) at 200 pips.

read more

2023.05.17

-

What are the benefits of trading Bitcoin with XM?

XM Bitcoin can be traded 24 hours a day, 365 days a year with a maximum leverage of 500x. This has the advantage of making it easy to hold positions for the long term with a small amount of capital. In addition, XM employs a zero-cut system, allowing you to trade while minimizing risk.

read more

2023.05.17

-

Bitcoin is not showing up on XM’s MT4/MT5.

To display Bitcoin on XM’s MetaTrader4 (MT4) / MetaTrader5 (MT5), log in to MT4/MT5, right-click on the market price display screen, and click “Show all.” Note that Bitcoin is not displayed on Zero accounts, as it is not handled in these accounts.

read more

2023.05.17

-

Are there any leverage limits when trading Bitcoin with XM?

Yes, XM’s Bitcoin trading has leverage limits based on the number of lots held. BTCUSD (Bitcoin/US Dollar) has a maximum leverage of 500x, while BTCEUR (Bitcoin/European Euro), BTCGBP (Bitcoin/British Pound), and BTCJPY (Bitcoin/Japanese Yen) have a maximum leverage limit of 250x, with leverage limits gradually increasing depending on the number of lots held.

read more

2023.05.17

-

What Bitcoin trading instruments does XM support?

XM’s Bitcoin products are BTCUSD (Bitcoin/US Dollar), BTCEUR (Bitcoin/Euro), BTCGBP (Bitcoin/British Pound), BTCJPY (Bitcoin/Japanese Yen), and ETHBTC (Ethereum/Bitcoin). By combining major fiat currencies with popular cryptocurrencies, you can trade with high market liquidity.

read more

2023.05.17