XM Gold Trading

XM Gold Trading

In addition to FX (foreign exchange margin trading), XMTrading provides CFD trading on a range of popular instruments, including commodities, stocks, stock indices, precious metals, and energy. Among these, gold—a precious metal—is particularly favored by many traders due to its high volatility.

XM Gold trading can be conducted using the same account and trading platforms (MT4/MT5 or Web Trader) as your regular FX trades. Additionally, with a maximum leverage of up to 1,000:1, even beginners in gold trading can start easily, just as they would with FX—making this a key feature of XM Gold trading.

Click here for a description of XM’s trading stocks

XM provides seven precious metals CFD products for trading. Among them, gold (GOLD) is especially popular. The leverage and trading conditions depend on the account type. Make sure to understand the unique characteristics of gold (GOLD) and take advantage of its high volatility while trading with XM.

XM Gold Trading – Conditions and Features

| Supported account types |

Standard account, Micro account

, KIWAMI account, Zero account |

|---|---|

| Trading Platform |

MetaTrader 4 (MT4) and

MetaTrader 5 (MT5) |

| Trading Hours |

[Summer time]:

Monday 7:05 to Friday 5:55 (Saturday 5:50) [Winter time]: Monday 8:05 to Friday 6:55 (Saturday 6:50) |

| Transaction fees |

[Standard Account, Micro Account, KIWAMI Goku Account]

Free [Zero Account] One-way $5/1 lot |

| Maximum Leverage |

[Standard Account, Micro Account, KIWAMI Goku Account]

1,000 times [Zero Account] 500 times |

| Minimum Spread |

2.7 pips

|

| Minimum Order Quantity |

0.01 lot

|

| Maximum order quantity |

10,000 lots

|

Click here for details on XM Gold (GOLD) trading conditions

Gold as an investment

Gold traded on XMTrading is a precious metal with limited supply and high scarcity. It is widely sought after as an investment and is known for its correlation with the foreign exchange (FX) market. As a finite physical asset, gold maintains its value even during economic downturns, attracting the attention of many investors. Often referred to as “emergency gold,” it serves as a safe-haven asset in risk-off market conditions.

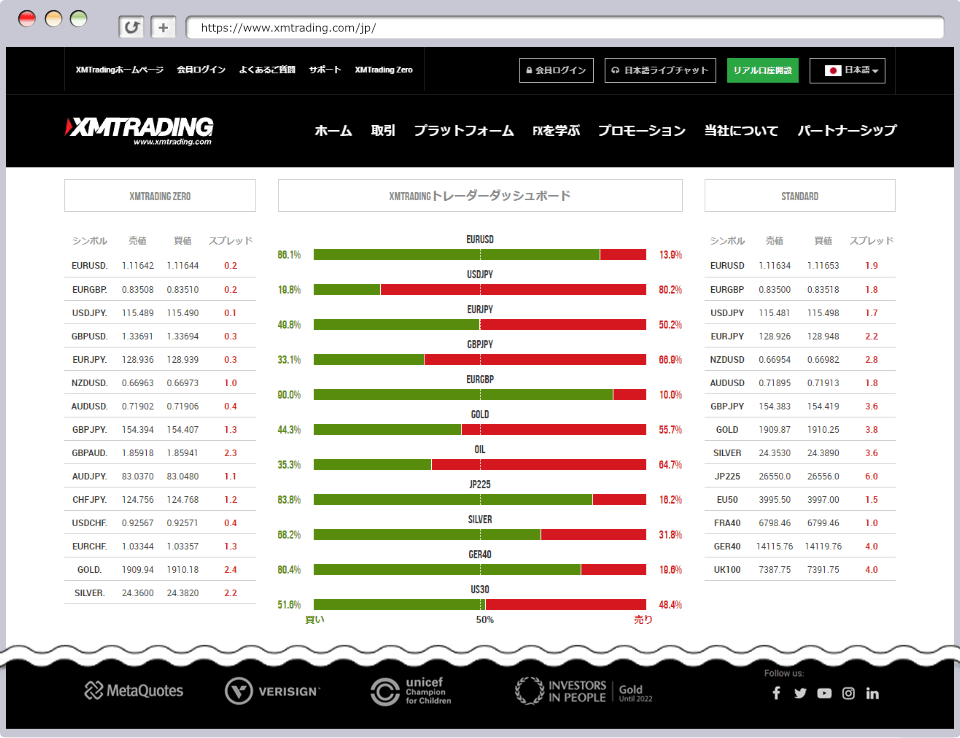

Gold, being highly sensitive to risk-off trends, is often used as an indicator of market participants’ risk sentiment. For instance, if long (buy) positions in gold dominate, it may suggest a strong risk-on mindset among traders. XM provides the position ratios for many instruments, including gold, on its “XMTrading Trader Dashboard (Note: 1).”

-

The dashboard can only be viewed on a PC.

High Liquidity and Significant Price Fluctuations

Gold (GOLD) is highly liquid, with an average daily range—the difference between its highest and lowest prices—of about $20. On calmer days, price movements may remain within roughly $10, while on more volatile days, fluctuations can exceed $50. Even during rapid market movements, XM does not issue requotes (rejected orders).

As illustrated in the table below, gold’s volatility is notable even when compared to GBP/JPY, a currency pair well-known for its high volatility. This characteristic makes gold especially popular among traders who focus on short-term trading.

Comparison of Average Price Ranges: Gold vs. FX Currency Pairs

| Gold GOLDUSD | 20.0 USD (200 pips) | 1.10% |

| US Dollar/Yen USDJPY | 0.7 yen (70 pips) | 0.60% |

| Euro/Yen EURJPY | 0.8 yen (80 pips) | 0.60% |

| Pound/Yen GBPJPY | 1.3 yen (130 pips) | 0.80% |

| GOLDUSD | |

| Average value range (Note: 1) | 20.0 USD (200 pips) |

| Volatility | 1.10% |

| USDJPY | |

| Average value range (Note: 1) | 0.7 yen (70 pips) |

| Volatility | 0.60% |

| EURJPY | |

| Average value range (Note: 1) | 0.8 yen (80 pips) |

| Volatility | 0.60% |

| GBPJPY | |

| Average value range (Note: 1) | 1.3 yen (130 pips) |

| Volatility | 0.80% |

-

Average range = Highest price – Lowest price

Gold trading pips

In FX trading, price movements are measured in “pips” (plural: “pips”). For the USD/JPY exchange rate, 0.01 yen (1 sen) equals 1 pip. In gold trading, 1 pip equals 0.1 USD. Gold prices are typically quoted in dollars to two decimal places (e.g., 1,792.67 USD), with the first decimal place—often highlighted—representing 1 pip. Gold typically fluctuates by around 20.0 USD per day, which equals 200 pips. Such daily movements are rare for major FX currency pairs, highlighting the high volatility of gold.

XM Gold Margin Requirements

Gold on XMTrading can be traded with the same leverage as FX, up to 1,000:1. Since gold trading is primarily conducted in US dollars, the required margin is calculated based on both the gold price and the USD/JPY exchange rate.

For example, if 1 oz of gold is priced at $1,800 and the USD/JPY exchange rate is 110 yen, the margin required to trade 1 oz of gold with 1,000:1 leverage would be calculated as follows:

For a yen-denominated account:

198,000 JPY ÷ 1,000 = approximately 198 JPY

For a dollar account:

1,800 USD ÷ 1,000 = approximately $1.80

In the XM Standard Account, 1 lot equals 100 oz, so the margin required to trade 1 lot of gold is calculated as follows:

Margin required for 1 lot (100 oz) of a yen-denominated account: 19,800 yen

Margin required for USD accounts 1 lot (100 oz) : $180

The table below shows a comparison of the margin required to hold a 1-lot position on a Standard Account with 1,000:1 leverage.

| Gold/Dollar GOLDUSD | 1,800.00USD | 19,800 yen |

| US Dollar/Yen USDJPY | 113,000 yen | 11,300 yen |

| Euro/Yen EURJPY | 132,000 yen | 13,200 yen |

| Pound/Yen GBPJPY | 157,000 yen | 15,700 yen |

| GOLDUSD | |

| Price (example) | 1,800.00USD |

| Required margin (Note: 1) | 19,800 yen |

| USDJPY | |

| Price (example) | 113,000 yen |

| Required margin (Note: 1) | 11,300 yen |

| EURJPY | |

| Price (example) | 132,000 yen |

| Required margin (Note: 1) | 13,200 yen |

| GBPJPY | |

| Price (example) | 157,000 yen |

| Required margin (Note: 1) | 15,700 yen |

-

Standard Account Margin requirement per lot

With 1,000:1 leverage, you can start trading 1 lot of gold with a margin of approximately 20,000 yen. Additionally, using a Micro Account allows you to engage in dynamic gold trading with an even smaller margin.

XM Gold Trading Swap Points

When trading gold (GOLD) on XMTrading, holding a position overnight will incur swap points based on the trade size. At the time of writing, both GOLD (gold/USD) and XAUEUR (gold/EUR) have negative swaps for long (buy) positions and positive swaps for short (sell) positions. Swap points fluctuate depending on the policy interest rates of the relevant currencies (USD, EUR), so when carrying positions overnight, be aware that trading costs may increase or decrease due to swap points.

-

With XMTrading’s KIWAMI Account, you can trade Gold/USD (GOLD) and Gold/EUR (XAUEUR) without swap charges, meaning zero swaps for both long and short positions.

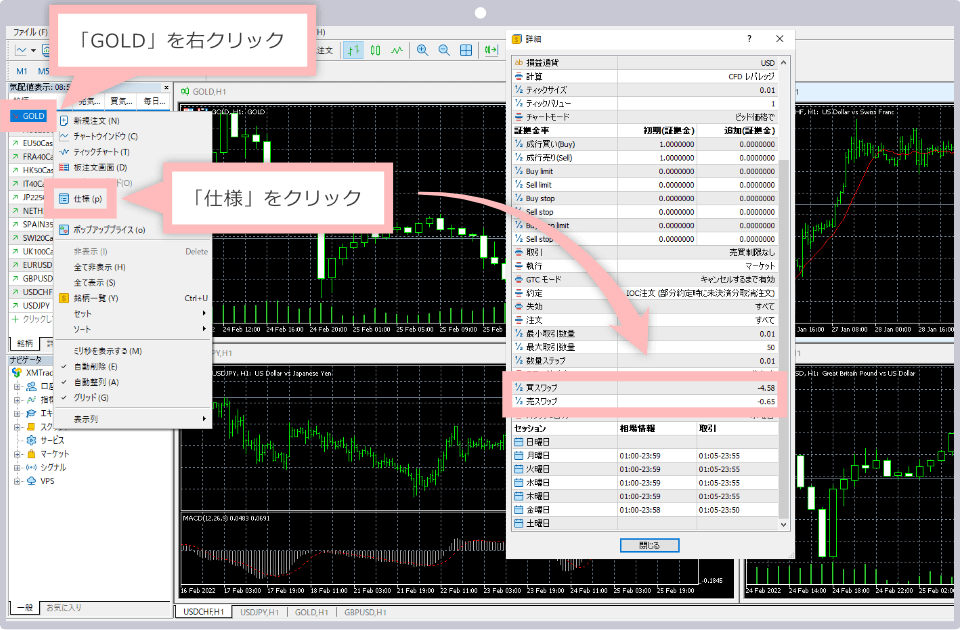

How to check swap points

There are two ways to check swap points for gold trading: by using the “Swap Calculation Tool” in the FX Calculation Tool or by viewing them directly on MT4/MT5.

How to use the XM Swap Calculator

To check gold swap points on MT4/MT5, right-click on “GOLD” in the “Market Watch” window, then select “Specifications” from the menu to open the “Details” screen. The swap points for gold displayed in MT4/MT5 are shown in US dollars.

XM Gold Trading Spreads

XMTrading’s gold trading spreads average 2.7 pips on Standard Accounts. This is roughly twice the spread of popular currency pairs like USD/JPY and EUR/JPY, but similar to the spread of GBP/JPY, reflecting gold’s high volatility (Note 1) .

-

Exchange rates fluctuate continuously.

| Product (brand) | price | Standard Account | Zero Account |

| Gold/Dollar (GOLD) | 1,800USD | 2.7 pips | 1.4 pips |

| US Dollar/Yen (USDJPY) | 113 yen | 2.5 pips | 0.2 pips |

| Euro/Yen (EURJPY) | 132 yen | 3.1 pips | 1.2 pips |

| Pound/Yen (GBPJPY) | 157 yen | 3.8 pips | 1.2 pips |

| GOLD | |

| price | 1,800USD |

| Standard Account | 2.7 pips |

| Zero Account | 1.4 pips |

| USDJPY | |

| price | 113 yen |

| Standard Account | 2.5 pips |

| Zero Account | 0.2 pips |

| EURJPY | |

| price | 132 yen |

| Standard Account | 3.1 pips |

| Zero Account | 1.2 pips |

| GBPJPY | |

| price | 157 yen |

| Standard Account | 3.8 pips |

| Zero Account | 1.2 pips |

Gold and GBP/JPY, with their high volatility, are suitable for short-term strategies such as scalping. However, considering the spreads, medium- to long-term trading is recommended. Keep in mind that prices and spreads fluctuate, so always check the latest figures before trading.

XM Gold Trading Hours

XMTrading’s gold trading hours differ from regular FX trading hours. There is a 1-hour and 10-minute downtime at the daily rollover, during which trading is unavailable. Additionally, on Fridays, the market closes 5 minutes earlier than usual.

Gold trading hours (Japan time)

| Daylight Saving Time |

(Monday) 7:05 AM – (Friday) 5:55 AM

(Friday) 7:05 AM – (Saturday) 5:50 AM |

|---|---|

| Winter time |

(Monday) 8:05 AM – (Friday) 6:55 AM

(Friday) 8:05 AM – (Saturday) 6:50 AM |

Please note that the times shown on MT4/MT5 are not in Japan time; they follow summer time (GMT+3) and winter time (GMT+2).

XM Gold Trading has gained popularity among many customers thanks to benefits not offered by other brokers. With XM, anyone can start trading gold immediately by opening an account and depositing funds, enjoying a maximum leverage of up to 1,000:1.

Maximize Your Capital with Leverage of Up to 1,000:1

At XMTrading, you can trade gold with leverage of up to 1,000:1, just like with FX. This allows you to trade gold’s high-volatility market even with a small amount of capital and potentially profit from short-term scalping. Even without using high leverage, the low margin requirements enable a variety of trading strategies, including pyramiding with split entries.

Tips for Successful Gold Trading Using Pyramiding

Pyramiding is a strategy where positions are gradually increased in the direction of a trend, offering the potential for significant profits. However, it is generally suited for advanced traders, as it requires precise timing, effective capital management, and the ability to identify trend reversals. By learning a few key tips, you can improve your chances of success with pyramiding. Master these techniques to trade gold effectively using a variety of strategies.

XM Gold trading margin requirements

Exceptional Execution Power with Zero Rejections

XM offers industry-leading execution speeds for gold trading. Even in markets with large price fluctuations, 99% of all orders are executed within one second, with no rejections. This allows you to trade confidently, even in fast-moving markets. Additionally, any stress from executing large transactions is minimized, enabling a smooth and focused gold trading experience.

-

While XM does not reject orders, spreads may widen and slippage can occur during periods of low liquidity, such as US holidays or sudden economic news releases.

Trading volume can be adjusted in increments of 0.01 lots

At XM, you can trade gold starting from 0.01 lots with any account type—Standard, Micro, KIWAMI, or Zero. Many first-time gold traders are surprised by its high volatility. Gold prices can fluctuate significantly even over short periods, demanding quick and precise trading strategies, which can make sustaining long-term profits through short-term trading challenging. However, XM’s minimum trade size of 0.01 lots allows you to experience dynamic gold trading while limiting your risk.

Please note that maximum leverage and trading volume units differ depending on the account type.

XM Gold Trading Volume Across the Four Account Types

| Maximum Leverage | 1,000 times | 500 times | ||

Trading volume per lot |

1 lot = 100 oz | 1 lot = 1 oz | 1 lot = 100 oz | |

| Minimum Order Quantity | 0.01 lot = 1 oz | MT4: 0.01 lot = 0.01 oz MT5: 0.1 lot = 0.1 oz |

0.01 lot = 1 oz | |

| Fee (one way) | none | $5/lot | ||

| Stock Symbol | GOLD | GOLDmicro | GOLD# | GOLD. |

| XM points awarded | can be | none | ||

| Standard Account | |

| Maximum Leverage | 1,000 times |

Trading volume per lot |

1 lot = 100 oz |

| Minimum Order Quantity | 0.01 lot = 1 oz |

| Fee (one way) | none |

| Stock Symbol | GOLD |

| XM points awarded | can be |

| Micro Account | |

| Maximum Leverage | 1,000 times |

Trading volume per lot |

1ロット=1 oz |

| 最小注文数 | MT4: 0.01ロット =0.01 oz MT5: 0.1ロット=0.1 oz |

| 手数料(片道) | なし |

| 銘柄シンボル | GOLDmicro |

| XMポイントの付与 | あり |

| KIWAMI極口座 | |

| 最大レバレッジ | 1,000倍 |

| 1ロット当たりの 取引量 |

1ロット=100 oz |

| 最小注文数 | 0.01ロット=1 oz |

| 手数料(片道) | なし |

| 銘柄シンボル | GOLD# |

| XMポイントの付与 | なし |

| ゼロ口座 | |

| 最大レバレッジ | 500倍 |

| 1ロット当たりの 取引量 |

1ロット=100 oz |

| 最小注文数 | 0.01ロット=1 oz |

| 手数料(片道) | 5ドル/1ロット |

| 銘柄シンボル | GOLD. |

| XMポイントの付与 | なし |

Gold Trading Units

Gold trading is based on the troy ounce (symbol: oz), a unit of weight commonly used for precious metals and gemstones. One troy ounce is approximately 31.1 grams. Gold prices are quoted in US dollars per ounce.

-

example)

-

If the gold price is $1,800, 1 oz = $1,800

-

If the US dollar/yen exchange rate is 100 yen, 1 oz = 1,800 USD = 198,000 JPY

-

1 gram of gold = approximately 6,367 yen

-

Earn XM Points While Trading Gold

XM Points (XMP), available for XMTrading’s Standard and Micro accounts, can be earned based on trading volume, including when trading gold.

Similar to FX currency pairs, trading 1 lot (100 oz) of gold on a Standard Account (round trip) earns up to 20 XM Points (XMP) per lot. Additionally, 3 XMP can be converted into credits equivalent to 1 USD, meaning you can receive a trading bonus of approximately 6 USD simply by trading 1 lot of gold.

With the KIWAMI Goku Account, you can trade gold completely swap-free.

At XMTrading, gold can be traded swap-free with the “KIWAMI Kiwami Account,” minimizing trading costs. With no swap points applied to either long or short positions in GOLD (gold/USD) or XAUEUR (gold/EUR), you can engage in multi-day swing trading without worrying about margin decreasing due to negative swaps.

With XM, you can start trading immediately after opening an account and completing identity verification, regardless of whether you choose a Standard, Micro, KIWAMI, or Zero Account. If you already have an XM trading account, simply select ‘GOLD’ from the quotes list on MT4 or MT5. Trading gold follows the same procedure as trading FX currency pairs.

If you don’t have an XM trading account yet, you can open one here. The application takes just five minutes, and you could start trading gold in as little as 30 minutes.

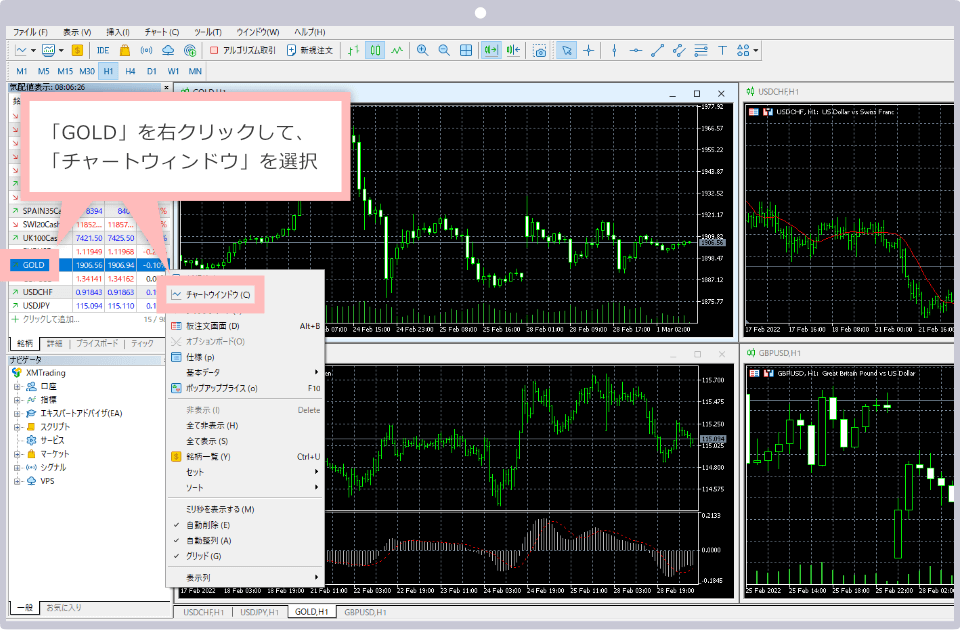

How to view gold charts in MT4/MT5

To open a Gold (GOLD) chart in MT4/MT5, right-click on the ‘GOLD’ symbol in the Market Watch window and select ‘Chart Window.’ (See Note 1).

-

In MT4, click “Show Chart”.

In addition to the method above, you can open a gold chart in MT4/MT5 by selecting ‘New Chart’ from the ‘File’ menu, or by dragging and dropping the ‘GOLD’ symbol from the Market Watch window onto an existing chart.

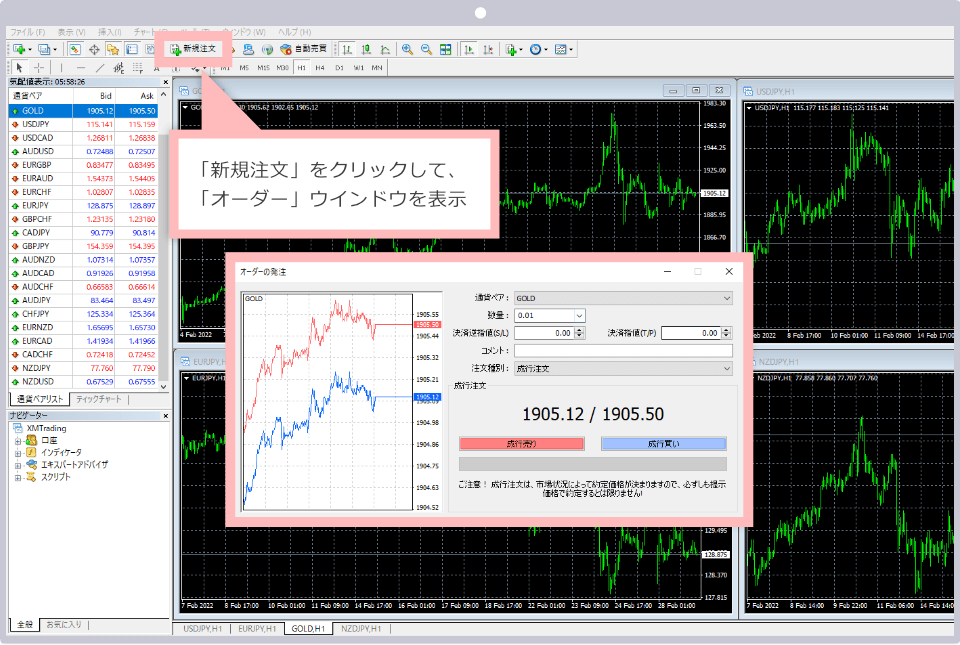

Placing a new order in MT4/MT5

To place a new order for Gold (GOLD) in MT4/MT5, click ‘New Order’ on the toolbar, then enter your trade details in the Order window.

In addition to the methods above, you can place a new order in MT4/MT5 by selecting ‘New Order’ from the ‘Tools’ menu, using the one-click Trading Panel in the upper-left corner of the chart, or by double-clicking the ‘GOLD’ symbol in the Market Watch window.

MT4/MT5 symbol

The way symbols are displayed in MT4/MT5 varies depending on whether you are using an XMTrading Standard Account, Micro Account, KIWAMI Goku Account, or Zero Account.

-

Standard Account

-

Micro Account

-

KIWAMI polar account

-

Zero Account

In Standard Accounts, gold is displayed simply as ‘GOLD’; in Micro Accounts, it appears as ‘GOLDmicro’; in KIWAMI Accounts, it is shown as ‘GOLD#’; and in Zero Accounts, it is displayed as ‘GOLD.’

-

What are the swap points for XM Gold trading?

Currently, when rolling over, XM Gold swap points generate a positive swap for short positions and a negative swap for long positions. You can check swap points in the ‘Specifications’ section of MT4/MT5 or using the ‘XM FX Calculator.’

read more

2022.02.28

-

Is XM Gold trading eligible for the XM Points program?

Yes, you can earn XM Points (XMP) based on your trading volume when trading XM’s gold CFD (GOLD). The number of points earned depends on your loyalty status, with a maximum of 20 XMP per lot. Please note that KIWAMI and Zero accounts are not eligible for XM Points.

read more

2022.02.28

-

What are the advantages of trading gold with XM?

XM Gold trading offers a maximum leverage of 1,000x and a minimum trade size of 0.01 lots, enabling flexible trading with controlled risk. Additionally, you can use the same accounts and trading tools as for FX, making it easy for beginners to get started.

read more

2022.02.28

-

What are the trading hours for XM Gold?

XM Gold trading hours are from 7:05 AM to 5:55 AM Japan time during summer (closing at 5:50 AM the following Friday) and from 8:05 AM to 6:55 AM Japan time during winter (closing at 6:50 AM the following Friday). Please note that on Fridays, the market closes 5 minutes earlier than usual.

read more

2022.02.28

-

Are there any leverage restrictions when trading gold with XM?

No, XM Gold (GOLD) can be traded with a maximum leverage of 1,000×, just like FX, allowing even beginners to trade the highly volatile Gold (GOLD) with a small amount of capital. For Zero Accounts, the maximum leverage is 500×.

read more

2022.02.28