XM’s Safety – 5 Reasons Why XM is Trustworthy

XM’s Safety – 5 Reasons Why XM is Trustworthy

At XM, the safety of our services is our top priority. We are committed to providing a secure trading environment that gives our customers peace of mind. Even if you have concerns about the risks or legality of using an overseas FX broker, you can trade confidently with XM, which holds a highly reliable financial license and safeguards customer funds through segregated management.

Operating in 196 countries and offering services in 20 languages, the XM Group is one of the most highly regarded FX brokers worldwide, earning strong support from customers around the globe. Explore XM’s safety initiatives to trade with confidence and peace of mind.

![]()

At XM, we place the highest priority on the safety of our services and consistently offer a trading environment where our customers can feel secure.

XM’s Safety – 5 Reasons Why XM is Trustworthy

A key indicator of an overseas FX broker’s safety and reliability is its financial license. XM is regulated by both the Seychelles Financial Services Authority (FSA) and the Mauritius Financial Services Commission (FSC), and is officially authorized to provide financial services. With multiple financial licenses, XM allows you to trade with confidence, free from unnecessary risk.

What is a financial license?

A financial license is a permit required to operate a financial business, such as FX trading, and is issued by the financial authority of each country (in Japan, this is the Financial Services Agency). To obtain a financial license, a company must meet the regulatory criteria set by the authority, including capital requirements, management of customer assets, risk management systems, and more. The standards and difficulty of obtaining a license vary depending on the issuing authority, making it a key indicator of an FX broker’s safety and reliability. XM, in particular, has obtained a license from a highly rigorous regulator, making it a safe and fully legitimate overseas FX broker.

The XM Group holds multiple financial licenses across its operations.

The XM Group is an overseas FX broker officially licensed by financial authorities worldwide. XMTrading is operated by the group’s Tradexfin Limited and Fintrade Limited. Tradexfin Limited holds a securities dealer license (registration number SD010) issued by the Seychelles Financial Services Authority (FSA), while Fintrade Limited holds a securities dealer license (registration number GB20025835) issued by the Mauritius Financial Services Commission (FSC).

The companies within the XM Group, including Tradexfin Limited and Fintrade Limited, hold multiple financial licenses in addition to those from the Seychelles Financial Services Authority (FSA) and the Mauritius Financial Services Commission (FSC). Notably, the group has also obtained licenses from highly stringent regulators, such as the UK Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC), demonstrating that XM is a highly secure and reliable overseas FX broker.

XM Group’s main licenses

| XM Group Company | Acquired License |

| Trading Point of Financial Instruments Ltd | Cyprus Securities and Exchange Commission (CySEC) UK Financial Conduct Authority (FCA) |

| Trading Point of Financial Instruments UK Limited | UK Financial Conduct Authority (FCA) |

| XM Global Limited | Belize Financial Services Commission (FSC) |

| Trading Point of Financial Instruments Pty Ltd | Australian Securities and Investments Commission (ASIC) |

| Trading Point MENA Limited | Dubai Financial Services Authority (DFSA) |

| Tradexfin Limited | Seychelles Financial Services Authority (FSA) |

| Fintrade Limited | Mauritius Financial Services Commission (FSC) |

| Trading Point of Financial Instruments Ltd |

|

キプロス証券取引委員会(CySEC)

英国金融行動監視機構(FCA) |

| Trading Point of Financial Instruments UK Limited |

|

英国金融行動監視機構(FCA)

|

| XM Global Limited |

|

ベリーズ金融サービス委員会(FSC)

|

| Trading Point of Financial Instruments Pty Ltd |

|

オーストラリア証券投資委員会(ASIC)

|

| Trading Point MENA Limited |

|

ドバイ金融サービス局(DFSA)

|

| Tradexfin Limited |

|

セーシェル金融庁(FSA)

|

| Fintrade Limited |

|

モーリシャス金融サービス委員会(FSC)

|

XM has structured its group into separate operating companies, each holding a financial license in its respective country and operating under the regulations of that license. This structure allows each XM company to provide tailored services to residents of different countries. By obtaining reliable financial licenses, XM can offer attractive features—such as high-leverage trading—that are not permitted under the regulations of the Japanese Financial Services Agency.

High-Leverage Trading at XM

XM offers high leverage of up to 1,000x (500x for Zero accounts). In contrast to domestic FX brokers, which typically limit leverage to 25x per account, XM allows for significantly higher leverage. Naturally, some traders may be concerned about the risks associated with high-leverage trading. While high leverage can amplify potential returns, it also increases the risk of losing your margin if the market moves against your position. However, high leverage also allows you to trade with smaller amounts of capital, which can sometimes be less risky than trading large amounts with low leverage. Therefore, it is not accurate to assume that ‘low leverage = low risk.’ Additionally, XM uses a zero-cut system, ensuring you cannot lose more than your deposited margin. Traders should understand the risks of high leverage and select a leverage level that aligns with their capital and trading style. XM provides flexibility, allowing you to choose from a wide range of leverage settings, from 1x up to 1,000x.

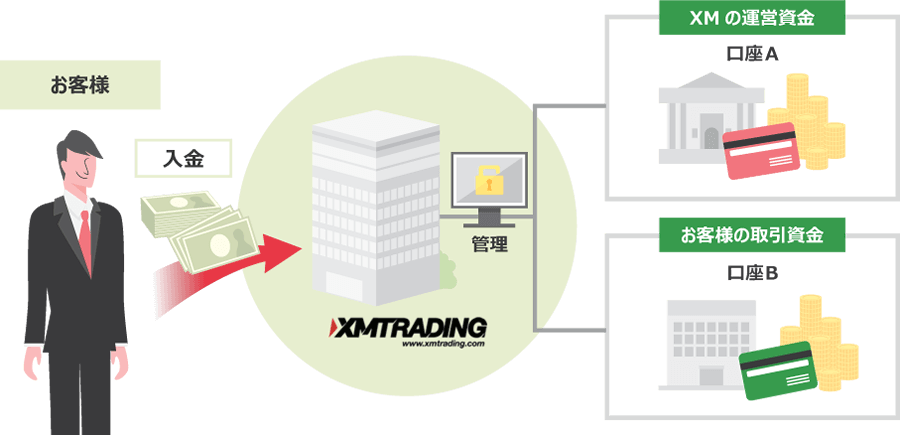

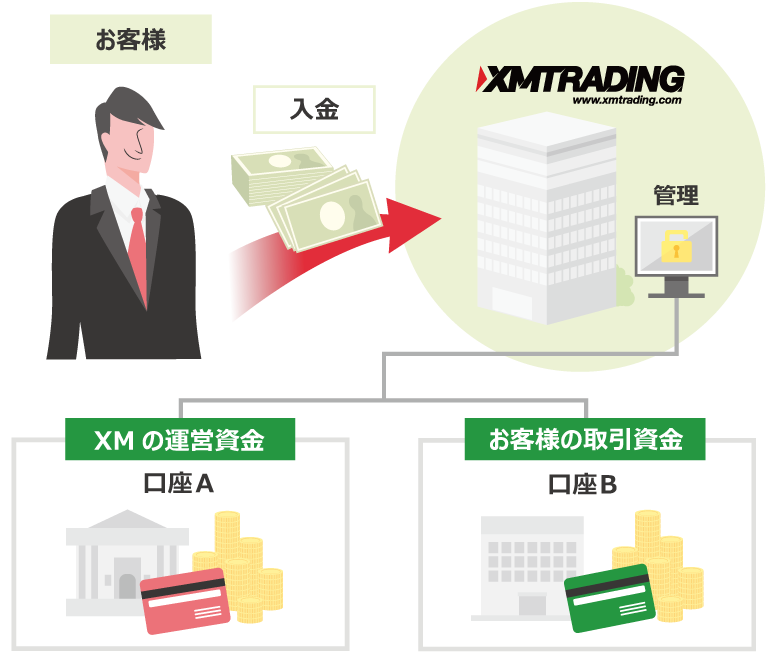

At XMTrading, customer funds are managed on a ‘segregated’ basis, completely separate from the company’s operating funds. Even among overseas FX brokers, XM takes strict measures to protect client funds, ensuring there is no risk of losing your deposits. Both your initial deposits and any profits are fully secure, allowing you to trade with complete peace of mind.

Segregated Funds Management System

Segregated management means that customer assets and the funds required for XM’s operations are held in separate bank accounts. This ensures that your funds are never used for company operations. XM is regulated by the Seychelles Financial Services Authority (FSA) and the Mauritius Financial Services Commission (FSC), and manages client assets safely in compliance with these licensing regulations.

Segregated Funds Management System

Comprehensive safety measures ensure that all deposits and profits remain secure.

XM uses a ‘segregated management’ system to safeguard customer assets. Client funds are held in reputable financial institutions within the EU and are completely separate from XM’s operating funds. To further ensure safety, XM conducts due diligence on these banks not only before deposits are made but also on a regular basis thereafter. Additionally, customer funds are not recorded on XM’s balance sheet, eliminating any risk that they could be used to pay creditors, even in the unlikely event of XM’s bankruptcy.

As a licensed entity with the Seychelles Financial Services Authority (FSA) and the Mauritius Financial Services Commission (FSC), XM is required to adhere to strict financial regulations. If an annual audit identifies any non-compliance in operations or fund management, XM’s internal audit firm reports all findings directly to the relevant licensing authorities.

The XM Group safeguards customer assets through segregated management and rigorous safety measures at reputable banks. All client funds, including deposits and profits, are securely managed, allowing you to use XM’s services with complete peace of mind, knowing your funds will never be used without your consent.

In recent years, traders have increasingly considered ‘execution speed’ alongside costs like spreads and trading fees when choosing an FX broker. XM is committed to providing a fair and transparent trading environment, grounded in the belief that execution power is paramount in FX trading. With industry-leading execution performance, XM enables you to trade with confidence and minimal risk of slippage.

Exceptional Execution Power with No Requotes or Order Rejections

At XM, all orders are executed automatically using a next-generation NDD (No Dealing Desk) system, without any human intervention. This ensures that order execution never works against the interests of customers, allowing you to trade with confidence in a fair and transparent environment.

XM also offers one of the industry’s most advanced order infrastructures, with no requotes or order rejections—even during peak trading periods. Impressively, 99.35% of all orders are executed within one second. As an industry leader with a large client base, XM can instantly match orders, delivering execution speed and reliability that surpasses other brokers.

XM employs a ‘zero-cut system,’ which means customers are never required to make additional margin calls if their available margin turns negative due to losses. XM covers the entire negative balance, allowing you to trade with confidence, knowing you cannot lose more than your deposited funds.

What is the Zero Cut System?

The zero-cut system is a mechanism where, if a loss cut (forced settlement) cannot be executed in time due to sudden price fluctuations and the resulting loss exceeds the account’s available margin, XM covers the loss and resets the negative balance to zero.

At domestic FX brokers, where balance compensation is not legally permitted, a negative effective margin can trigger a margin call, potentially leading to unexpectedly large debts. In contrast, many overseas FX brokers, including XM, use a zero-cut system that fully covers losses, ensuring you never fall into debt. Because losses cannot exceed your deposited funds, you can safely take advantage of XM’s signature high-leverage trading.

Conditions and Timing for the Zero-Cut System

XMTrading’s zero-cut system will immediately reset your account balance to zero if you make an additional deposit exceeding the minimum deposit to an account with negative equity, exchange XMP (XM Points) for USD, or transfer funds between accounts.

| Zero cut execution conditions | timing |

| Adding more money to your account | Immediate reflection |

| Exchange XM Points (XMP) for USD cash | |

| Transferring funds from other accounts |

| 執行条件 | タイミング |

| 口座への追加入金 | 即時反映 |

| XMポイントを USD現金へ交換 |

|

| 他口座からの資金移動 |

In principle, XM’s zero-cut system is triggered when you make an additional deposit. However, if you do not have any open positions, XM’s system may automatically reset a negative balance to zero even without a deposit. In such cases, the timing of the zero-cut execution may be irregular.

The stop-loss level is set at a 20% margin maintenance rate.

A stop-loss is a system in which an FX broker forcibly closes a position to prevent further losses when the unrealized loss reaches a certain level. It serves as a safety mechanism to protect customers’ assets by limiting potential losses. At XMTrading, the stop-loss is triggered when the margin maintenance ratio falls below 20%. This is one of the lowest thresholds among FX brokers, allowing you to continue trading resiliently even when the market moves against you more than expected.

Please note that, due to sudden price fluctuations, a stop-loss may not always be executed in time, and your effective margin could become negative. However, even if your account balance turns negative, the zero-cut system ensures that you are not required to make additional margin calls, allowing you to trade with peace of mind.

XM offers full Japanese-language support for all trading-related matters, including email and live chat, handled by Japanese-speaking operators. Our high-quality support eliminates common concerns with overseas FX brokers, such as communication difficulties or slow responses.

Support Options and Response Times

XMTrading is committed to providing prompt support, offering email and live chat assistance 24 hours a day, five days a week. Additionally, inquiries can be submitted through the inquiry form on the member page 24 hours a day on weekdays.

Our back-office and IT teams monitor your trading environment 24 hours a day, 365 days a year, with a comprehensive backup system in place to prevent system failures. In the event of a failure that causes a loss, we promptly correct the trade history, ensuring that our customers are never at risk.

Contact the XMTrading Japanese Support Desk

-

Response time:Weekdays (Monday to Friday) 24 hours (Japan time)

email address:support@xmtrading.com

-

For inquiries via Japanese live chat, please click here

Response time:Weekdays (Monday to Friday) 24 hours (Japan time)

-

For inquiries via the inquiry form, click here

Response time:Weekdays (Monday to Friday) 24 hours (Japan time)

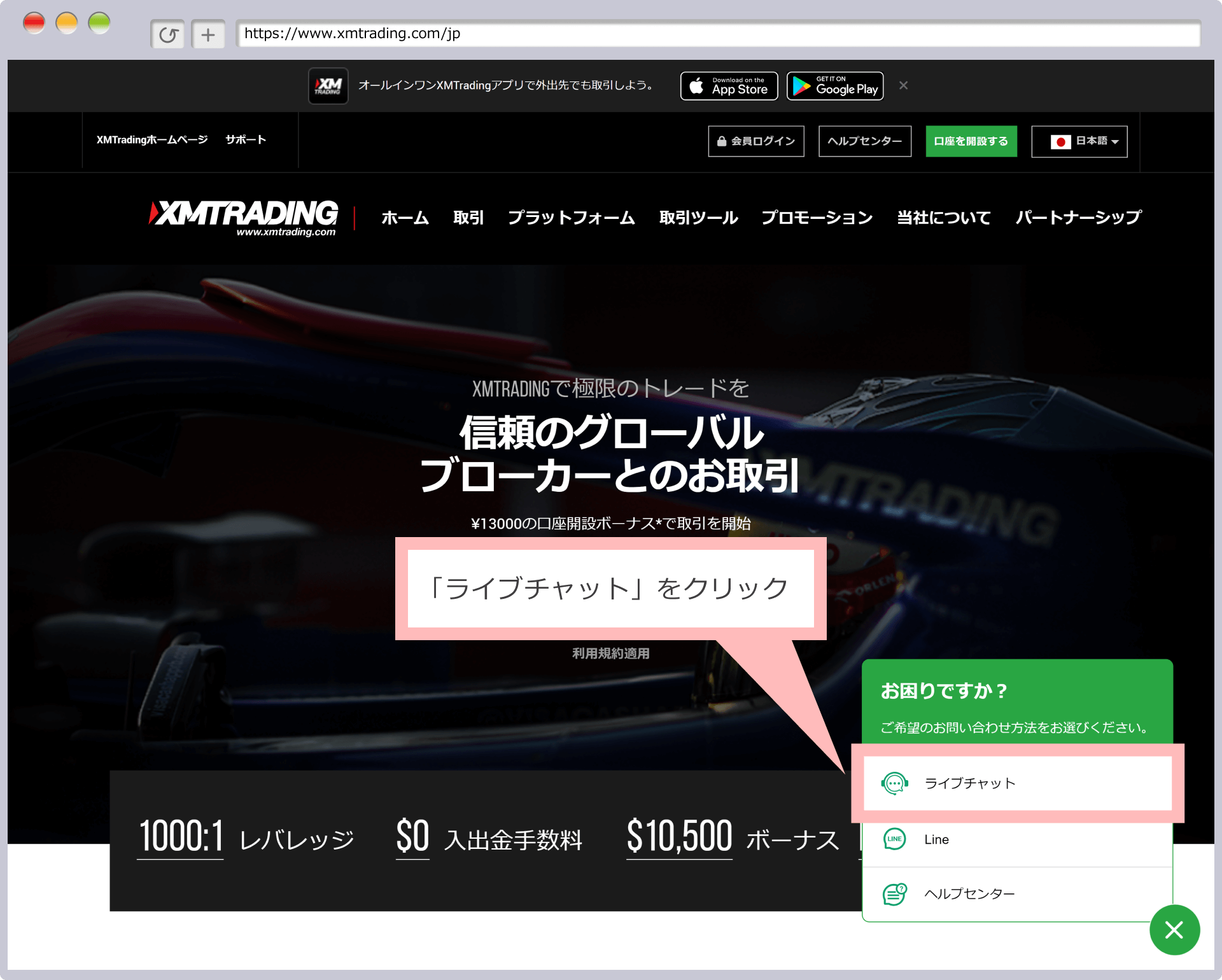

How to contact us (live chat, inquiry form)

How to contact us via Japanese live chat

-

Steps: 1

Access the XM Membership Page

Click ‘Support’ at the bottom right of the XMTrading homepage, then select ‘Live Chat.’

XMTrading(エックスエム)のトップページ右下に表示される「サポート」をタップして、「ライブチャット」をタップします。

-

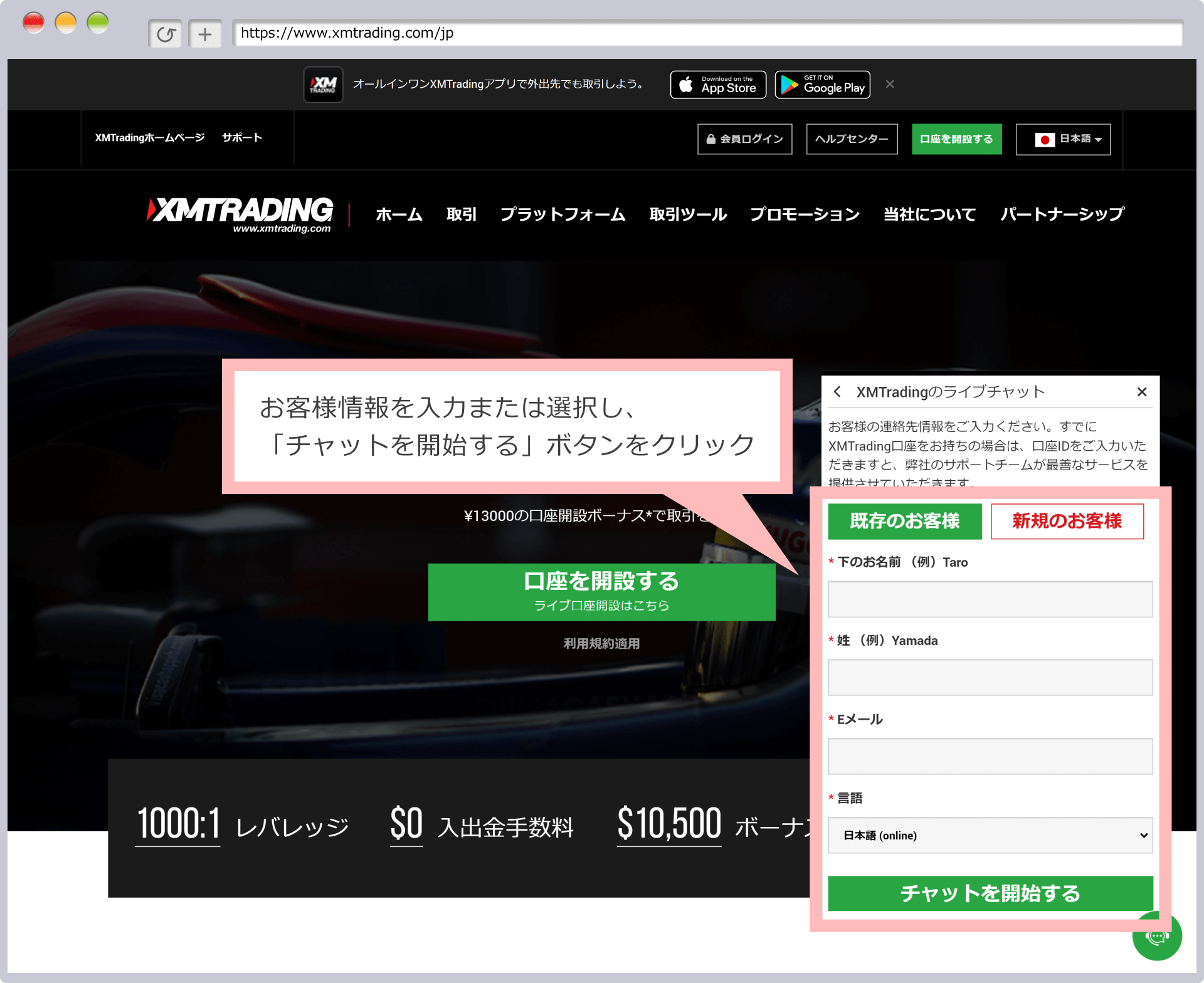

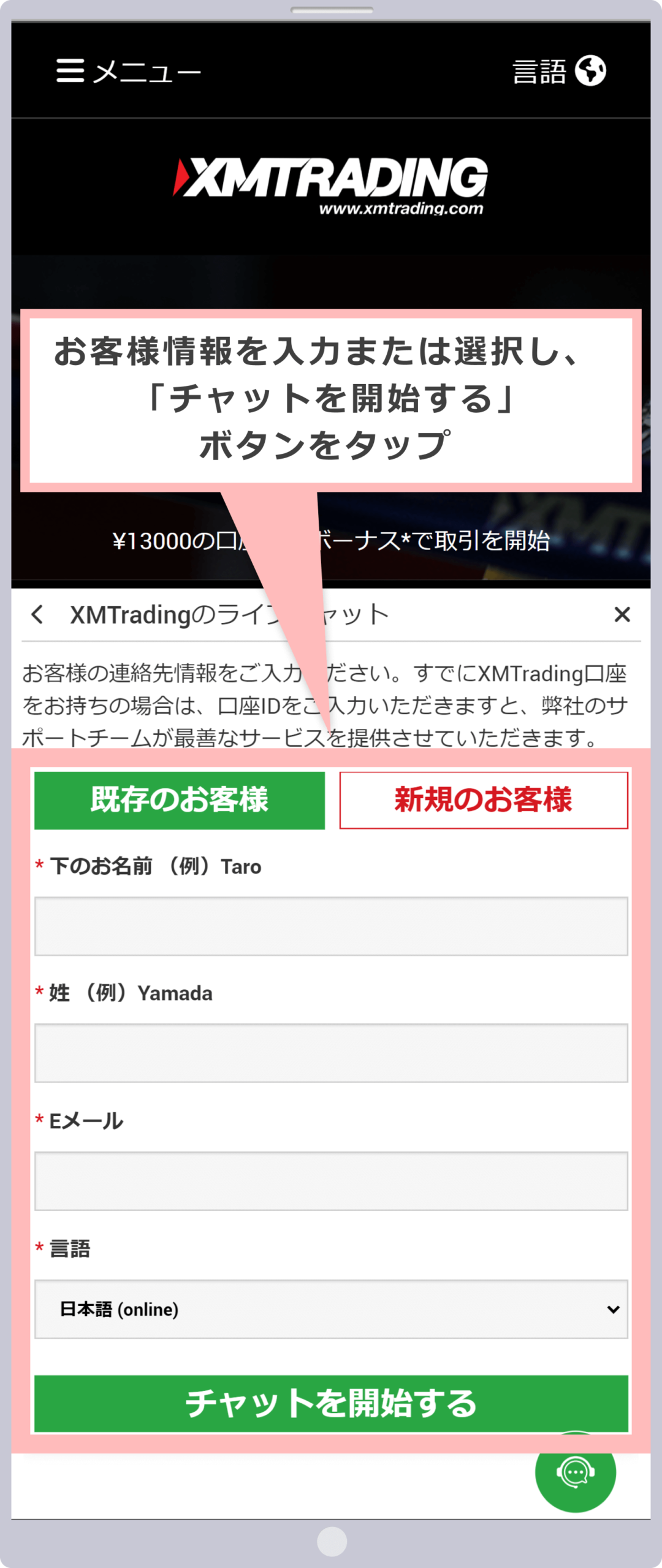

Steps: 2

Enter Your Customer Information

A screen for entering customer information will appear. If you already have a real account with XM, click ‘Existing Customer.’ If you do not have a real account, click ‘New Customer’ and fill in the required fields.

お客様情報の入力画面が表示されますので、XMにてリアル口座を開設済みのお客様は「既存のお客様」を、リアル口座を保有されていないお客様は「新規のお客様」をタップし、各項目を入力してください。

Whether you select ‘Existing Customer’ or ‘New Customer,’ please enter your first name, last name, and contact email address below.

After entering your customer information, select ‘Japanese (online)’ in the language field and click the ‘Start Chat’ button to begin Japanese live chat. If you access the site outside of live chat hours, the language field will display ‘Japanese (offline).’ Please try again on a weekday (Monday to Friday, 24 hours a day) Japan time.

お客様情報の入力が完了しましたら、言語欄から「日本語(online)」を選択の上、「チャットを開始する」ボタンをタップすると、日本語ライブチャットを開始頂けます。尚、日本語ライブチャットの対応時間外にアクセス頂いた場合、言語欄に「日本語(offline)」と表示されますので、再度、日本時間の平日(月曜~金曜、24時間対応)にお試しください。

You can also reach us via live chat using the XM smartphone app!

The XM smartphone app is an exclusive mobile app available to anyone with an XM account. It allows you to trade, deposit and withdraw funds, manage your account, and access the member page—all within a single app. You can also contact the XM support desk via Japanese live chat directly from the app.

Currently, the XMTrading app is not available for installation on iOS devices.

How to use the inquiry form

-

Steps: 1

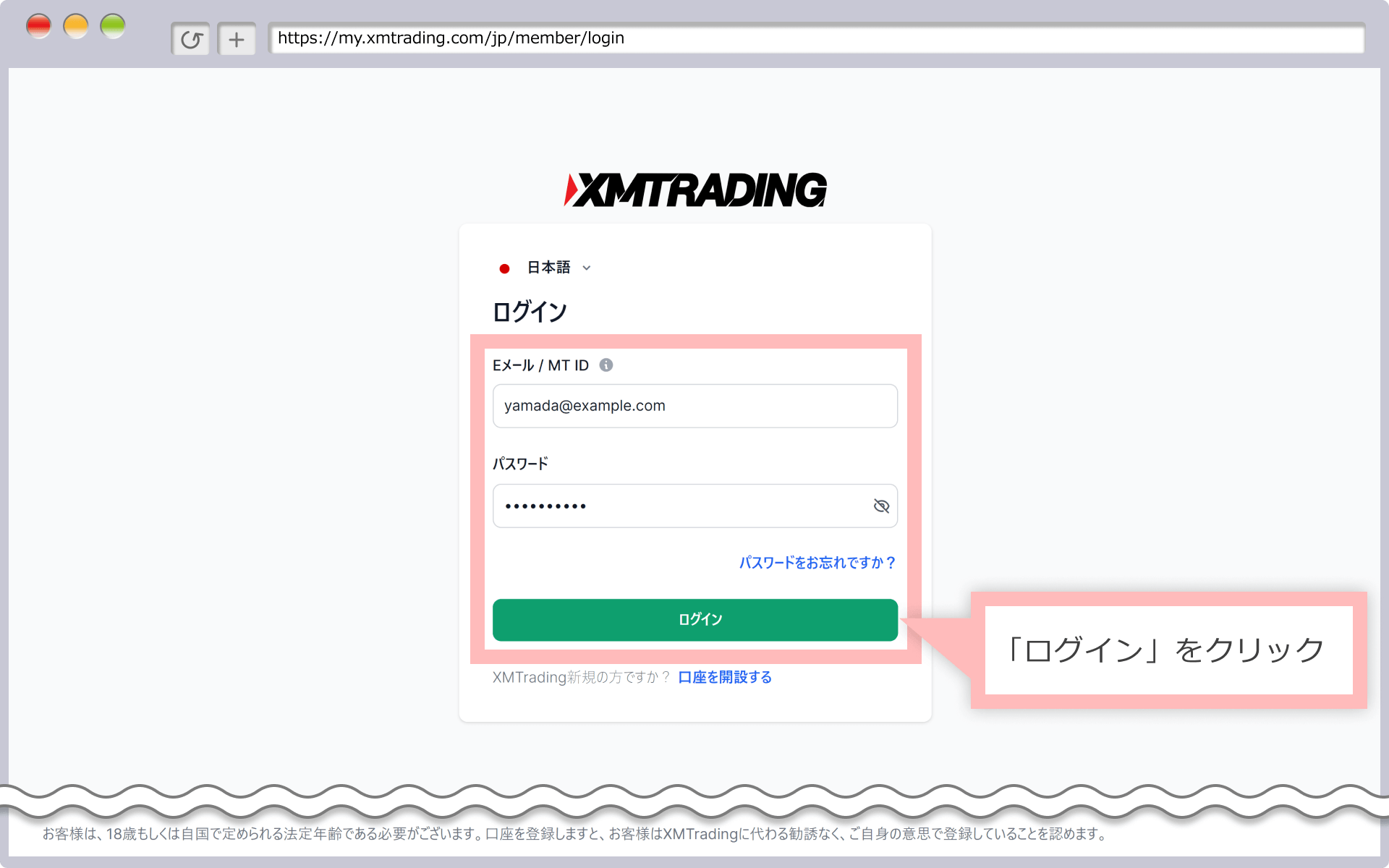

Login to XM Member Page

Please log in to your XMTrading ‘Member Page’ using your registered email address and password.

-

With the introduction of the new account management feature, XMTrading Profile, XM has changed the login ID for the member page from your MT4/MT5 ID to your email address. If you have converted to a profile or registered a profile, you will no longer be able to log in using your MT4/MT5 ID. Please be sure to use your registered email address to access the member page.

-

-

Steps: 2

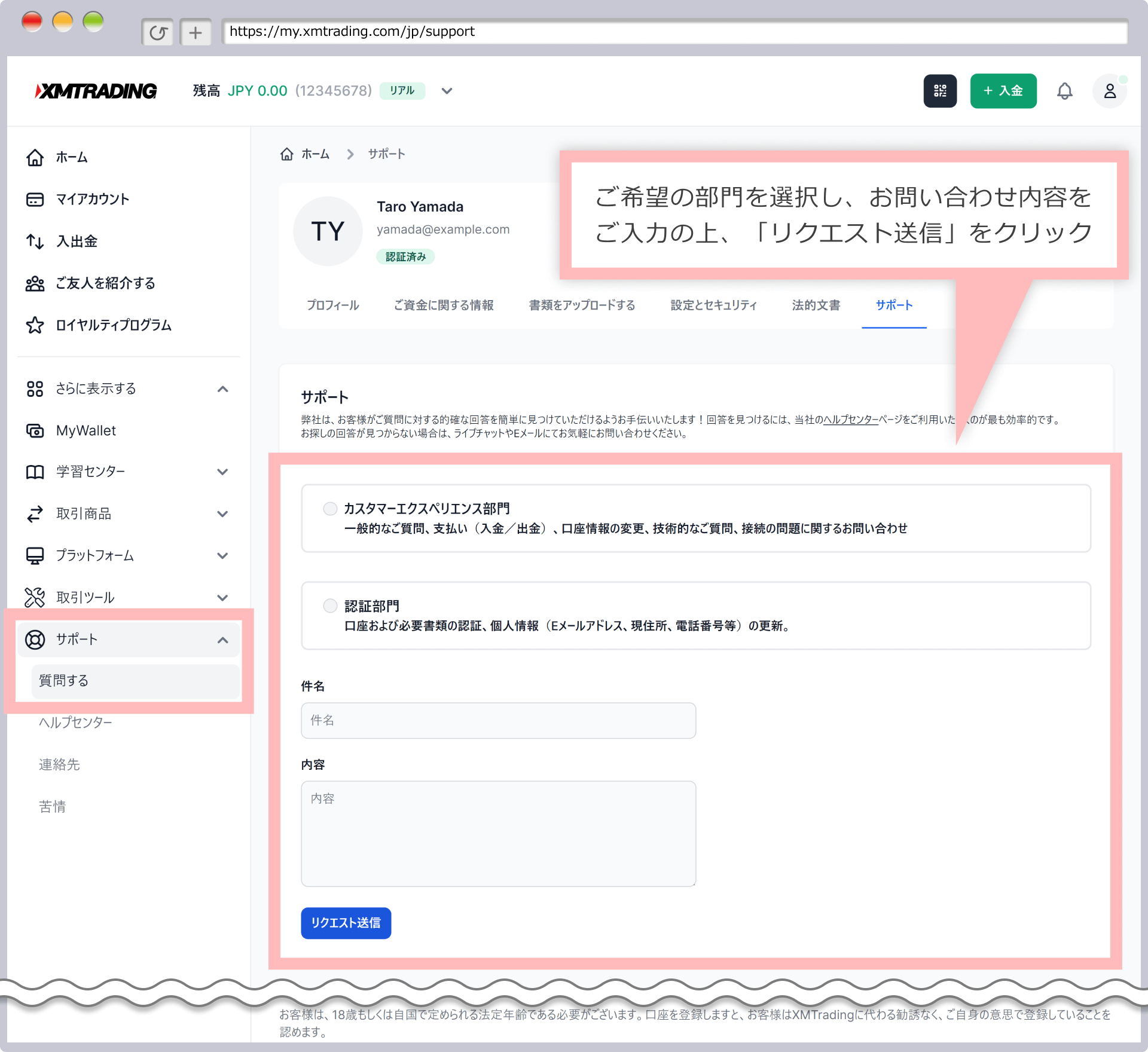

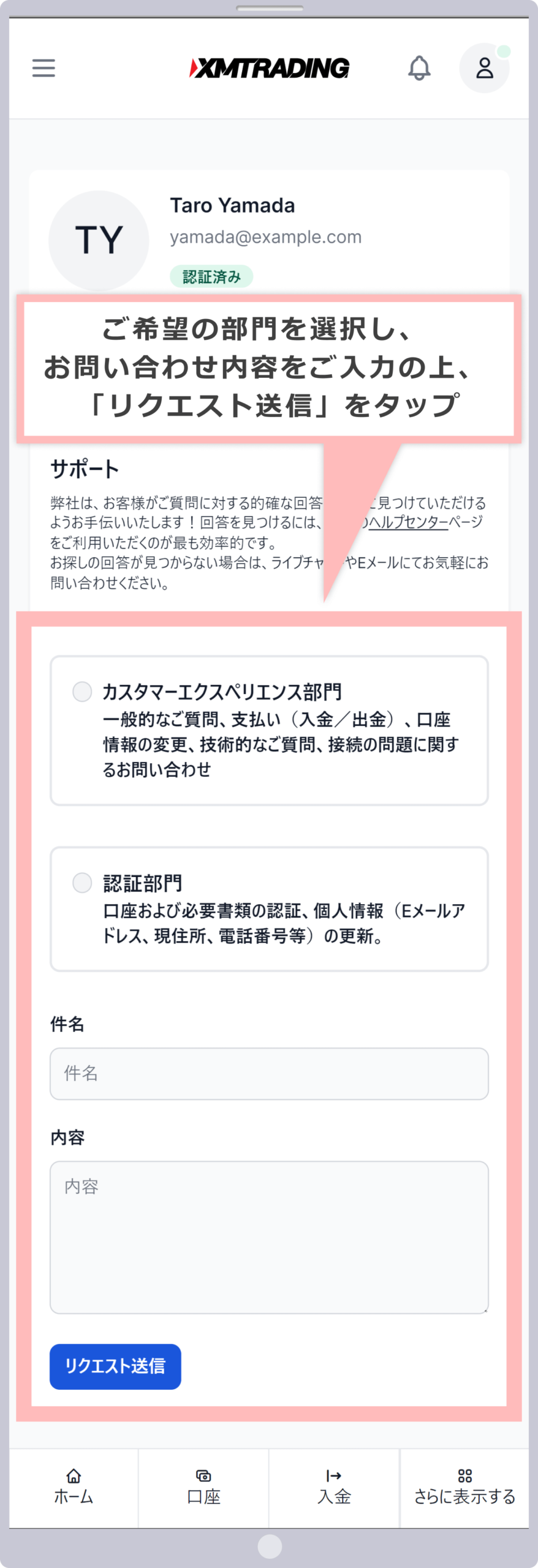

Displaying the inquiry form

Click ‘Ask a Question’ under ‘Support’ in the left menu to open the inquiry form. Select the appropriate department (Customer Support or Activation), enter your inquiry details, and click ‘Submit Request.’

左上のメニューより「サポート」内の「質問する」をタップすると、問い合わせフォームが表示されます。ご希望の部門(カスタマーサポート部門、有効化部門)を選択し、お問い合わせ内容をご入力の上、「リクエストの送信」をタップしてください。

Detailed instructions for contacting the support desk are provided in the XM Member Page User Guide, which includes clear, easy-to-understand illustrations.

On the XM Members Page, you can open an account, deposit and withdraw funds, change your leverage, and access the copy trading page. For detailed instructions on how to use the Members Page, please refer to the ‘XM Members Page User Guide.’

-

Is there any risk of trade or order manipulation at XM?

No, XM uses a fair order system called the next-generation No Dealing Desk (NDD), ensuring there is no risk of trade manipulation. Customer orders are executed automatically without any human intervention that could work against their interests, providing a fair and transparent trading environment.

read more

2020.12.17

-

Is there a risk of my order being rejected at XM?

No, there is no risk of requotes or order rejections at XM. In fact, 99.35% of all orders are executed within one second, achieving one of the highest execution rates and speeds in the industry. A higher execution rate reduces slippage, allowing you to trade with confidence and peace of mind.

read more

2020.12.17

-

Is it possible to contact XM in Japanese?

Yes, XM has Japanese-speaking staff, and both email support and live chat are available 24 hours a day, five days a week. Even if you are not confident in English, you can contact us with confidence, as our Japanese staff will respond promptly.

read more

2020.12.17

-

Can my account balance become negative at XM?

XM uses a ‘zero-cut system,’ which automatically resets your account balance to zero if it becomes negative due to sudden market fluctuations. XM fully covers any negative balance, ensuring that you cannot lose more than your deposited funds. You can therefore trade with complete peace of mind.

read more

2020.12.17

-

Is my deposit safe with XM?

Yes, XM manages customer funds under a ‘segregated management’ system. Even in the unlikely event of company bankruptcy, customer funds are kept completely separate from the company’s own funds. This ensures that deposits and profits are fully protected, allowing you to use XM’s services with peace of mind.

read more

2020.12.17