XM Copy Trading

XM Copy Trading

XM allows you to trade using copy trading. XM’s copy trading allows you to automatically copy the strategies and techniques of experienced professional traders , so even those with little trading experience or who cannot devote much time to trading can enjoy trading efficiently and aim for profits. In addition to copy trading, the platform also features a social trading function that allows you to exchange ideas and strategies with traders from around the world and learn from them. Please check out the features and usage of copy trading before trying to efficiently earn profits through copy trading.

XM supports copy trading. By following experienced professional traders, you can automatically copy their trades and aim for profits. Please check out the features of XM’s copy trading and use it to your advantage in trading.

What is XM Copy Trading?

XM’s copy trading service automatically copies the trades of experienced, professional traders . Anyone with an XM account can open an “investor account” specifically for copy trading and begin copy trading. Copy trading involves copying the strategies of professional traders without the need for you to perform your own analysis or orders, so even those with little knowledge of FX or who don’t have much time to devote to trading can aim for profits.

If you have not yet opened an account with XM, we are currently offering a 15,000 yen account opening bonus (trading bonus) for a limited time, so please take this opportunity to consider opening a real account with XM.

The difference between XM copy trading and automated trading (EA)

Copy trading and automated trading (EA) are both ways to automate trading, but they work differently. With XMTrading, all you need to do is open a dedicated account and follow the professional trader of your choice, and the professional trader’s trades will automatically be reflected in your own account. Copy trading is easy to get started with, as there are no initial costs and only commissions are charged on a performance-based basis .

On the other hand, automated trading (EA) involves installing an EA (Expert Advisor) on MT4/MT5, which automatically executes trades based on programmed trading rules . Automated trading does not require a dedicated account, but a VPS is required to ensure stable operation of the EA . In addition, if you use a paid EA, you will have to pay to purchase the EA, which means there will be an initial cost compared to copy trading. Also, since the EA needs to be installed, initially set up, and backtested and forward tested, a minimum level of PC proficiency and knowledge of trading tools is required.

Both copy trading and automated trading have the advantage of allowing those who cannot devote time to trading or those who are new to FX to efficiently manage their account funds, but copy trading is easier to get started with. XM supports both copy trading and automated trading, so please choose the method that best suits your trading goals.

XM Strategy Managers and Investors

At XM, the person who creates a strategy and trades is called a “Strategy Manager,” and the person who follows the Strategy Manager and copies it is called an “Investor.” If a Strategy Manager makes a profit from trading, they can receive rewards from investors who follow the strategy they created. The amount of reward can be set by the investor as a commission up to 50% when creating a strategy. If an investor makes a profit from copy trading, a commission will be charged based on the trading fee rules. Trading fees vary depending on the strategy, so please check the fees of the strategy you want to copy before copying.

| Strategy Manager |

Trader (the one being copied)

|

|---|---|

| investor |

Followers (those who copy)

|

XM Copy Trading Fees

At XMTrading, if a copy trade generates a profit, a portion of that profit is deducted as a performance fee. Performance fees are often set at around 10% to 30% (up to a maximum of 50%) , but they vary depending on the strategy manager, so please check the fees before following up. Furthermore, if a copy trade does not generate a profit, you do not have to pay a fee . Furthermore, if a copy trade generates a loss, the fee will not be charged until the profit exceeds the loss.

For example, if you follow a Strategy Manager with a 10% commission and earn a profit of 100 USD on your first trade, the commission will be calculated as follows:

1st transaction: Profit (100 USD)

100 USD x 10% = 10 USD

In other words, the investor’s profit will be 90 USD after deducting the commission fee .

For example, if you incur a loss of 30 USD on the second trade, a profit of 20 USD on the third trade, and a profit of 50 USD on the fourth trade, the commission will be calculated as follows:

Second trade: Loss (30 USD)

No commission for losses

3rd trade: Profit (20 USD)

30USD (loss) − 20USD (profit) = 10USD (loss)

No commission as cumulative profit and loss is negative

4th trade: Profit (50 USD)

50USD (profit) – 10USD (loss) = 40USD (profit)

40 USD x 10% = 4 USD

If a loss occurs during copy trading, it will be compensated for from the profits earned on the next trade, and fees will only be charged on the remaining profit. In other words, on the fourth trade, the investor’s profit will be “36 USD” after deducting the loss compensation and fees .

As such, XM’s copy trading is structured so that no fees are charged unless your assets increase, so you can trade with peace of mind.

XM copy trading is compatible with smartphone apps

XM’s copy trading can be performed both through a browser and through XM’s official mobile app, the XM app . The XM app is linked to the XM member page, allowing you to use a wide range of services, from account opening and deposits and withdrawals to copy trading, all on your smartphone . If you don’t have a PC or want to operate the service on the go, you can enjoy copy trading anytime by using the XM app.

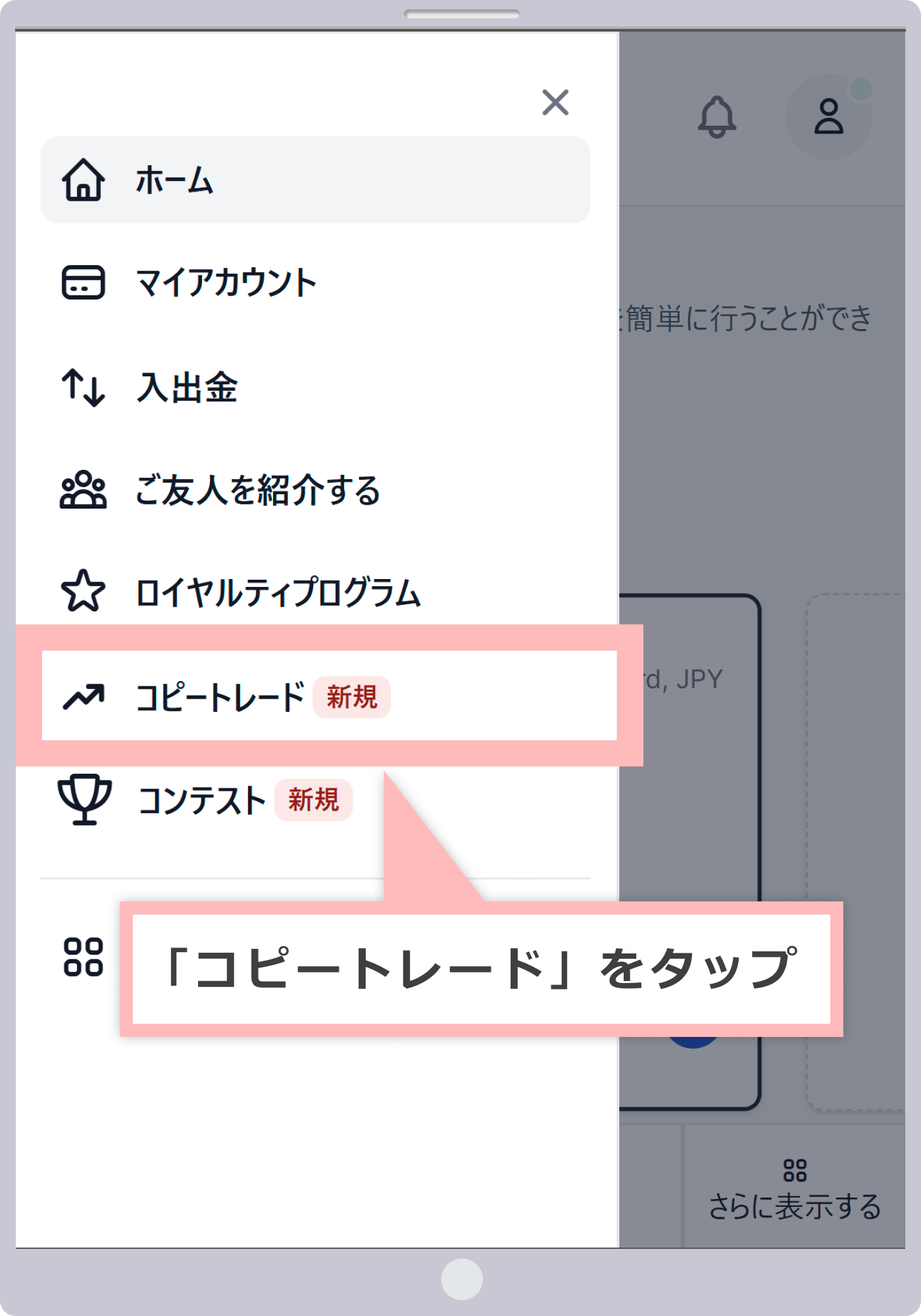

If you wish to copy trade from the XM app, after logging in to the XM app, tap “≡” in the upper left corner of the screen and select “Copy Trading” to open the copy trading screen. From the copy trading screen, you can not only follow strategies and start copy trading, but also use the social trading function to interact with other traders.

-

Currently, the iOS version of the XMTrading app cannot be installed. If you have already installed it, you can continue to use it.

XM’s copy trading has the advantage of allowing even beginners to efficiently aim for profits by automatically copying the trades of experienced traders. In addition, by copying the strategies of professional traders, you can aim to earn stable profits across a wide range of stocks while learning trading skills. The benefits of XM’s copy trading are as follows:

You can copy the strategies of successful traders as they are.

XM’s copy trading service allows you to copy a wide variety of strategies and techniques created by professional traders around the world directly into your own account . This service allows you to watch and learn from professional traders’ strategies in real time, making it ideal for those looking to improve their trading success rate. Even those who are hesitant to try new or difficult techniques can broaden their trading horizons and aim for profits by copying strategies created by professional traders. If your own strategy or technique isn’t producing good results, copy trading can help you compare it with traders with high success rates and identify areas for improvement in your own trading. Furthermore, XM has no limit on the number of strategy managers you can follow, so you can follow any strategy that interests you . Use copy trading to improve your own skills.

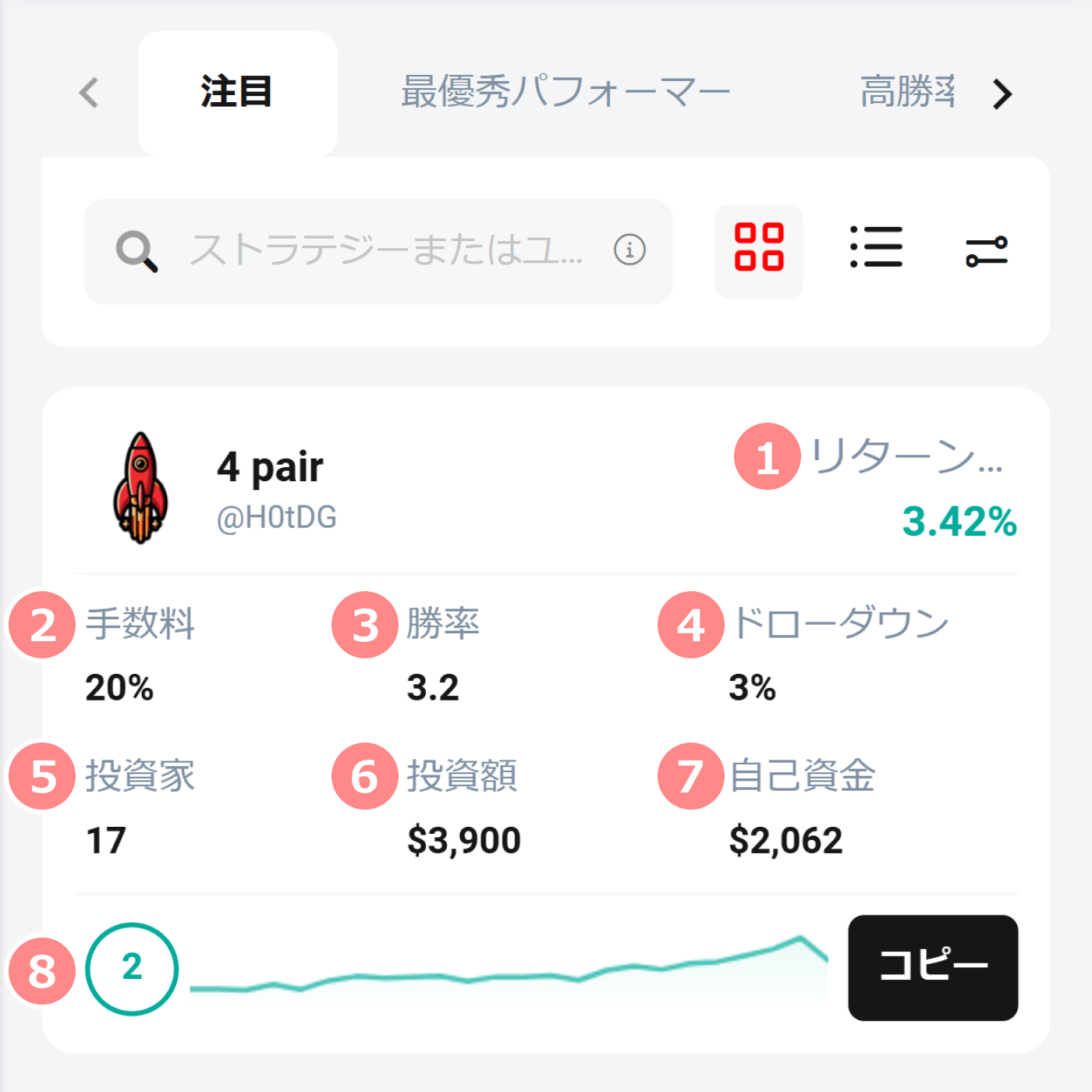

You can select the best strategy based on your trading performance.

At XM, professional traders from around the world are registered as strategy managers, and you can freely view the backgrounds and trading results of each strategy manager. Even those who are new to FX or have little knowledge of FX can check out these strategies and copy high-win strategies to earn profits. Furthermore, XM does not place a limit on the number of strategies you can follow, so you can copy as many strategies as you like. Before following a strategy, check details such as trading results, select the most suitable strategy, and enjoy copy trading.

Strategy details that can be viewed from the strategy list

| 1return | Current trade return rate |

|---|---|

| 2commission | A fee paid by investors when profits are made |

| 3Win Rate | Trade win rate to date |

| 4Drone Down | maximum loss rate |

| 5investor | Number of followers |

| 6Investment amount | Total amount of funds managed by followers (investors) |

| 7own funds | Strategy Manager’s managed capital |

| 8Risk Level | Strategy risk level (the higher the number, the greater the risk) |

To view the manager’s profile, a description of the trading methodology, and details on performance, risk, and portfolio, please click on the desired strategy.

マネージャーの経歴および取引手法の説明、「パフォーマンス」「リスク」「ポートフォリオ」の詳細は、希望するストラテジーをタップして頂くことでご確認頂けます。

Supports a wide range of brands

XMTrading’s copy trading allows you to trade a wide range of instruments, including FX currency pairs, precious metals, stock indices, energy, commodities, and cryptocurrencies . By automatically copying the strategies and techniques of professional traders, you can aim for profits even in instruments that are difficult to trade alone. You can check which instruments the Strategy Manager is trading on the Strategy screen, allowing you to select a strategy that is generating profits for the instrument you want to try. Copy trading allows you to watch and learn from the strategies of professional traders in real time, allowing you to apply that knowledge to future solo trades.

Can be used in conjunction with discretionary trading

XM allows you to simultaneously engage in copy trading and discretionary trading . By automatically copying the trades of professional traders while simultaneously conducting discretionary trading in your XM account, you can diversify your risk and achieve stable asset management . Furthermore, because copy trading is performed automatically based on a set strategy, there is no need to check the trading status every time. This allows you to focus on the market conditions of the stocks you have selected and increase your assets more efficiently. If you are aiming for efficient asset building, we recommend combining copy trading and discretionary trading.

Strategy Manager can earn two types of profits

At XMTrading, you can not only use copy trading as an investor, but also create strategies and act as a strategy manager. If the strategy you create generates profits, you can receive performance fees (rewards) from investors who follow you. Performance fees can be set up to 50% of the profit from successful trades, allowing you to maximize your rewards. If a trade is successful with a strategy manager account, you will receive a performance fee as reward in addition to the profit from the trade, allowing you to earn two types of profits with a single trade .

There are no special requirements to become a Strategy Manager, and there are no registration fees. As long as you have a minimum balance of $100 across all your XM accounts, you can register as a Strategy Manager for up to 10 accounts. If you’re confident in your trading skills, take this opportunity to register as a Strategy Manager and increase your assets efficiently.

Interaction between traders possible

In addition to copy trading, XMTrading also offers a social trading feature that allows traders from around the world to interact with each other . You can share information with traders from around the world via the “social feed” on the copy trading screen. By utilizing the social feed, you can learn more about the strategies of professional traders and check trend tags to get a sense of market direction.

To start copy trading with XM, you need to open an investor account, a dedicated copy trading account . Investor accounts are free to open, so if you’re interested in copy trading, be sure to open one. Furthermore, XM not only allows you to copy trade, but also allows you to create strategies and act as a strategy manager . If you wish to work as a strategy manager, open a strategy manager account.

If you have not yet opened an account with XM, please open a real account with XM first. After opening a real account, you can open an “Investor Account” from My Page.

XM investor account opening procedure

Here’s how to open an XM trading account:

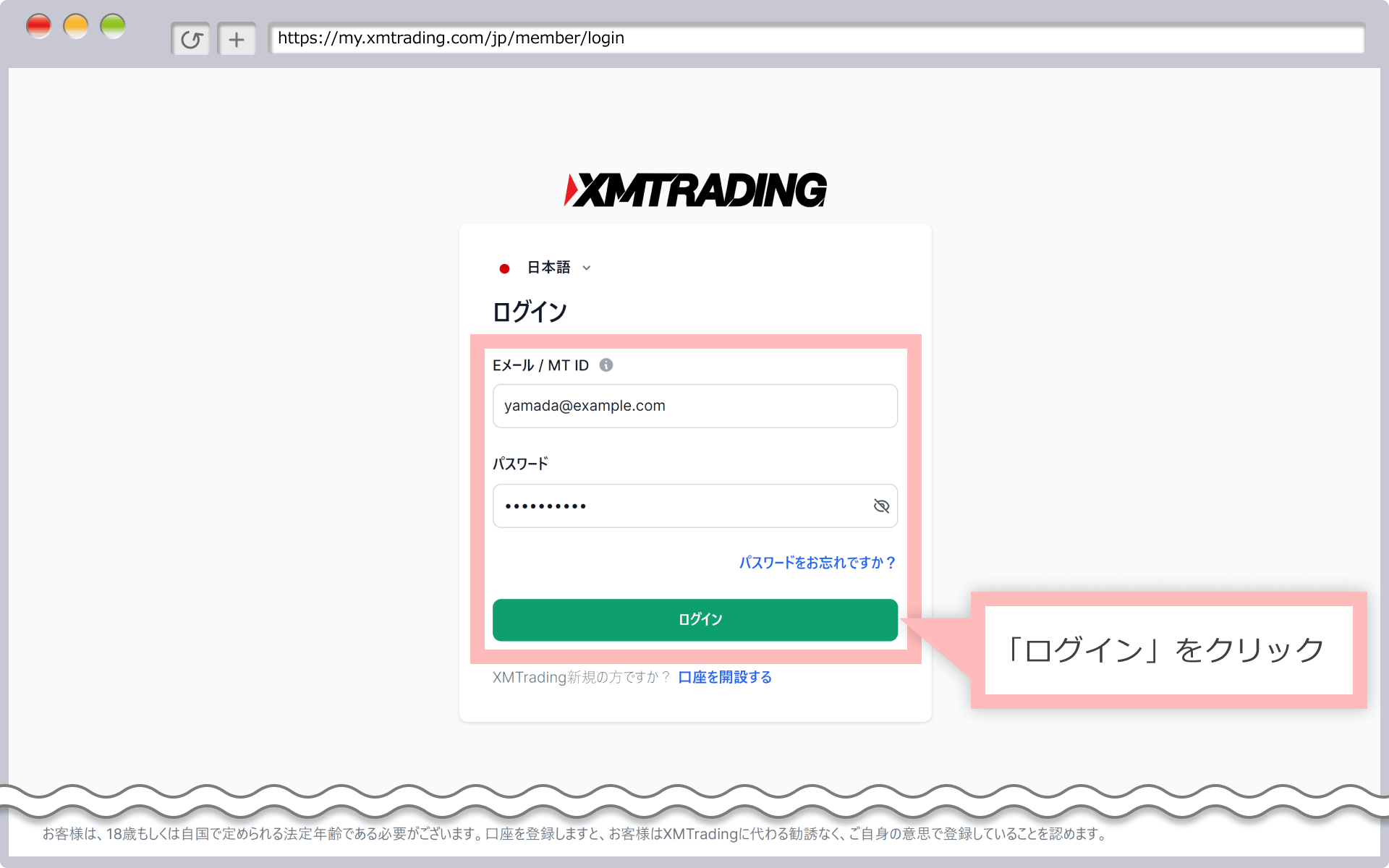

Log in to the XM member login page

Please log in to your XMTrading “Member Page” using your registered email address and password.

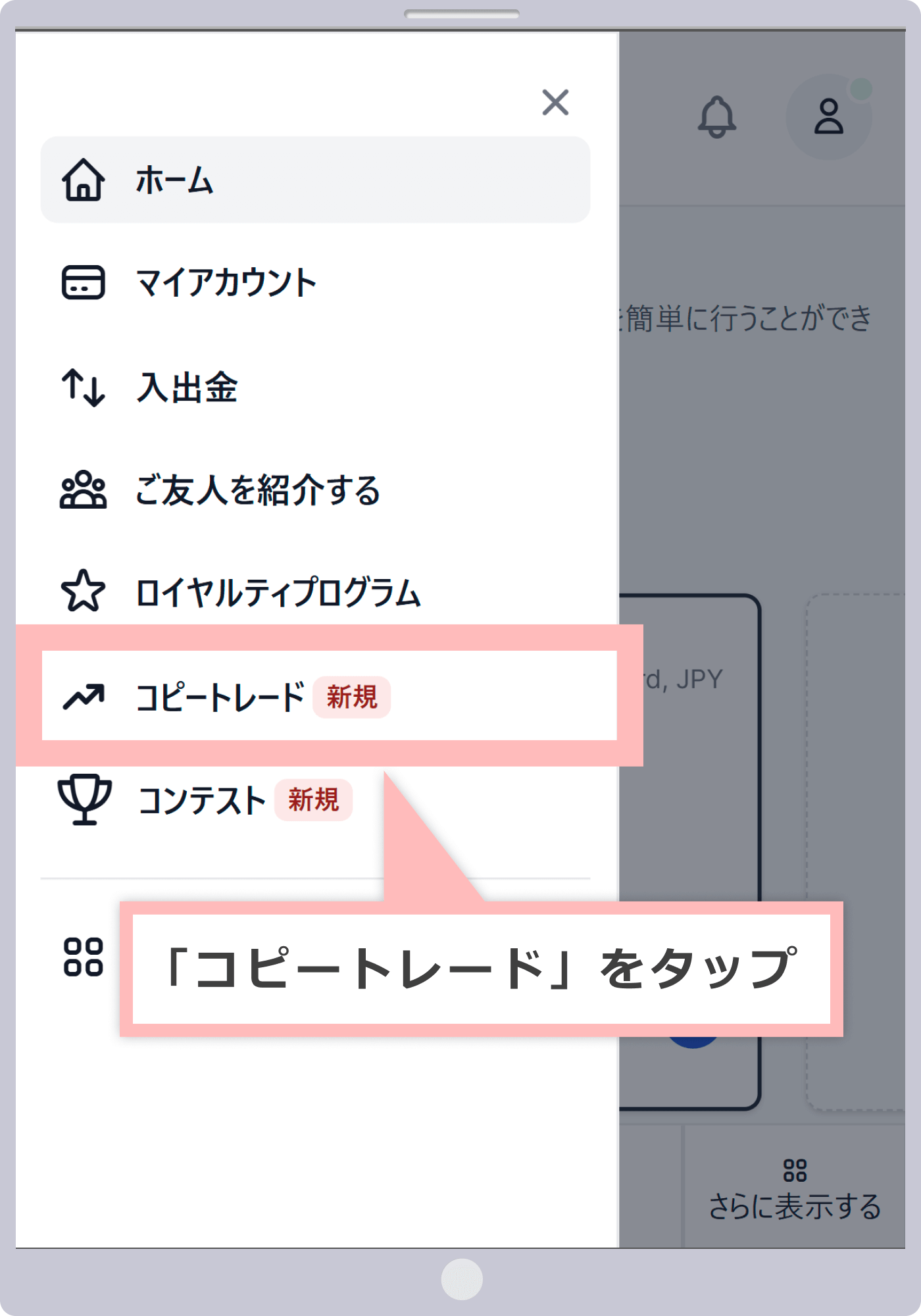

Copy Trade Menu Selection

After logging in to the XM “Member Page”, click ” Copy Trade “.

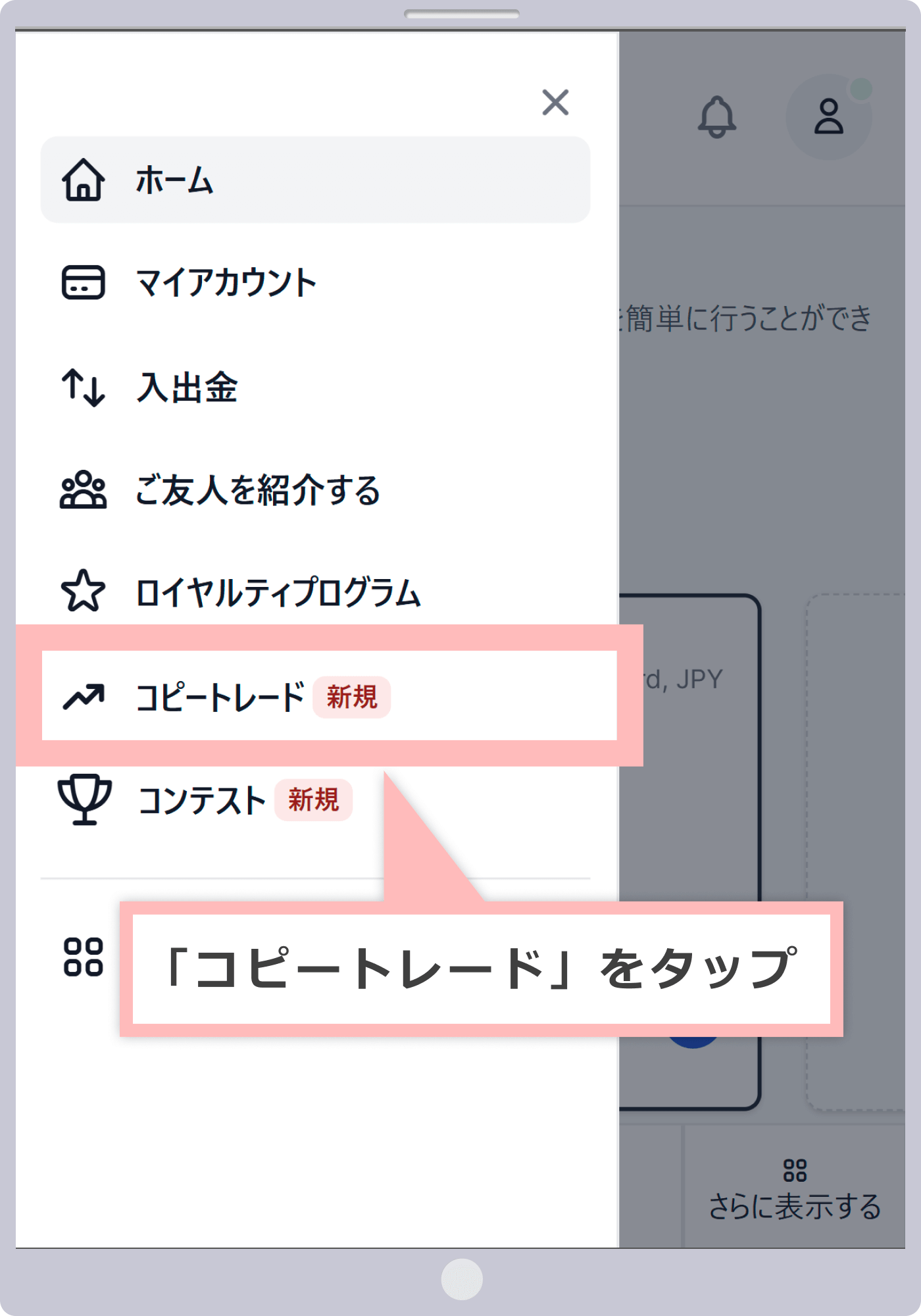

XMの『会員ページ』にログイン後、「コピートレード」をタップします。

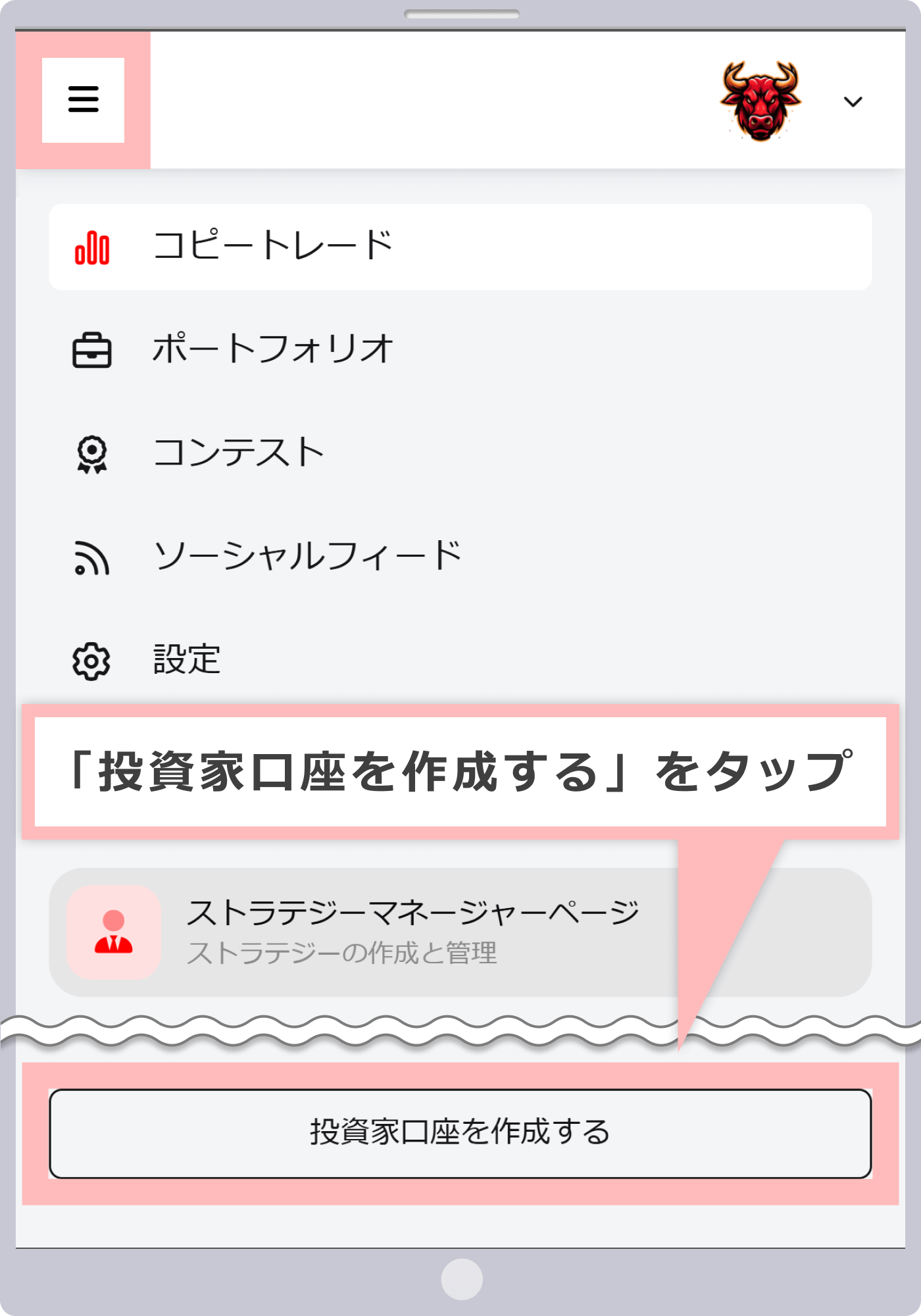

Creating an investor account

Click on ” Create an Investor Account ” in the top right corner .

「投資家口座を作成する」をタップします。

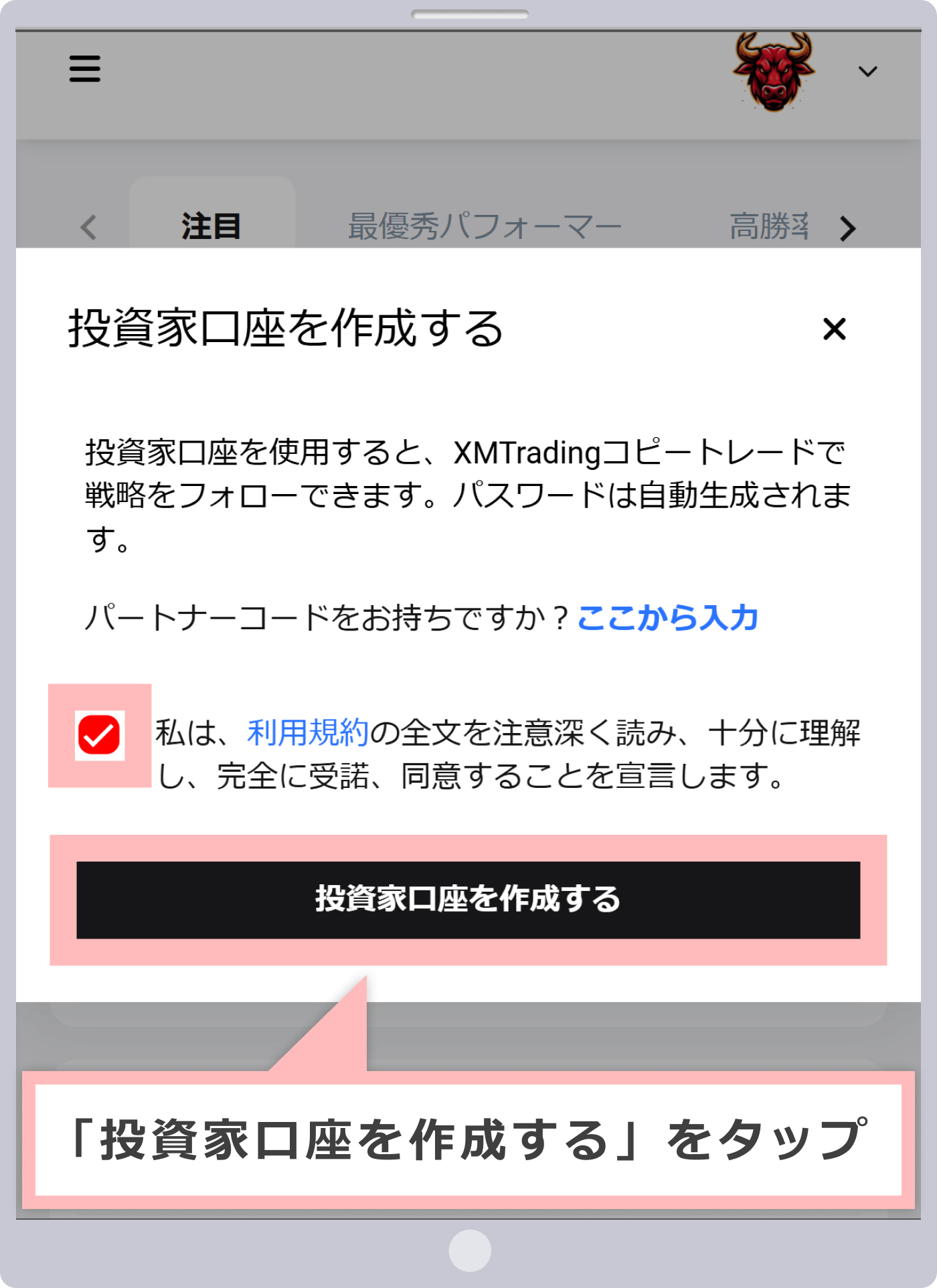

I agree to the terms of use

Once you have checked the box to accept the terms and conditions, click ” Create an investor account .”

利用規約の同意にチェックを入れましたら、「投資家口座を作成する」をタップします。

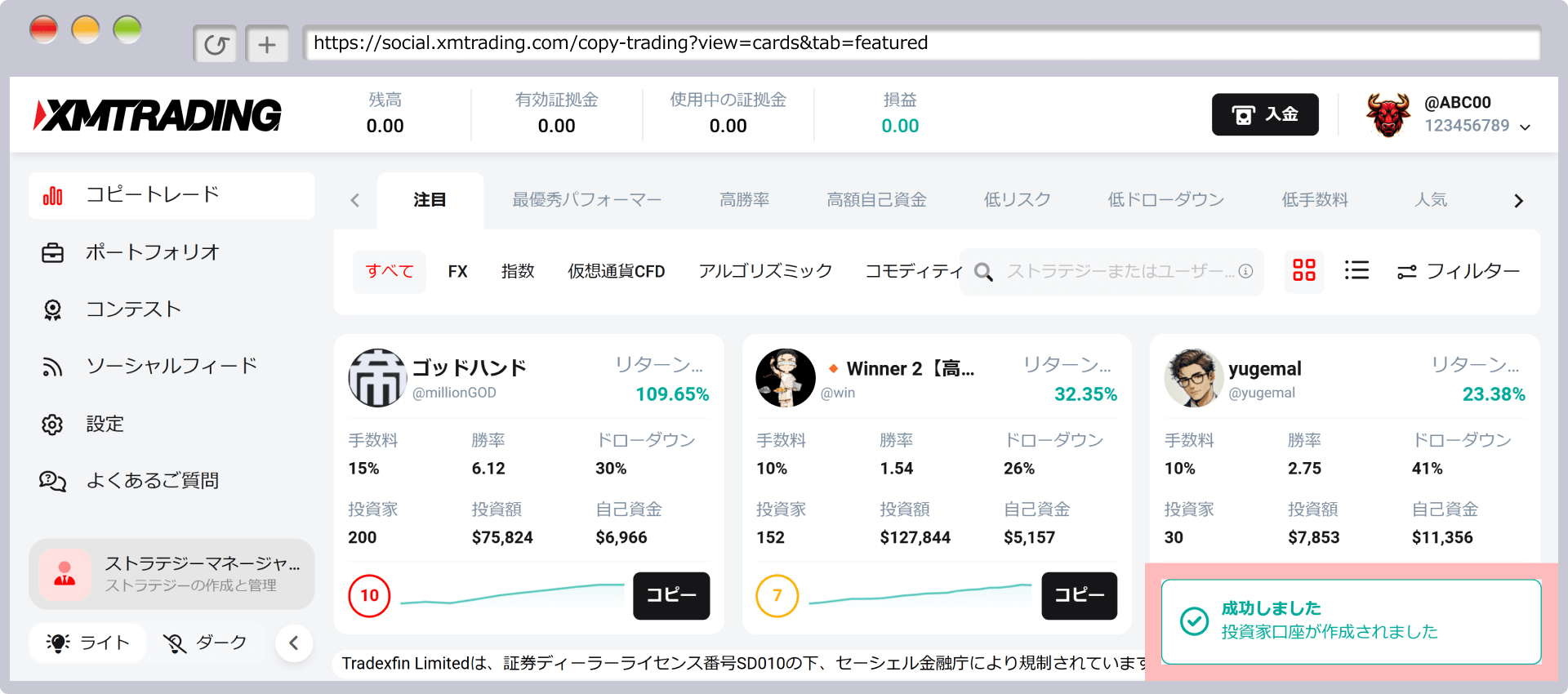

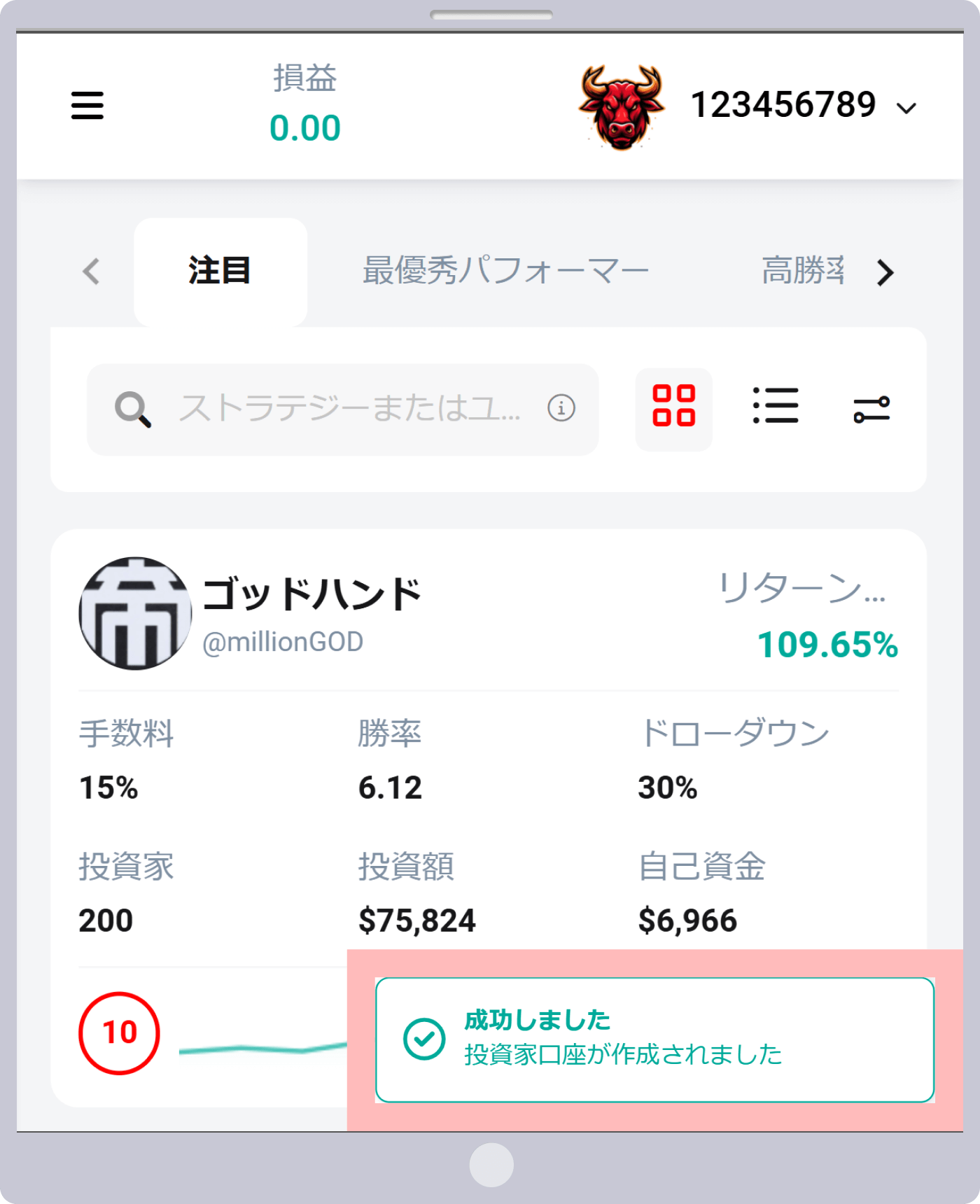

Investor account opening completed

If you see the message “Successful,” your investor account has been opened.

How to get started with XM copy trading

Here’s how to get started with XMTrading copy trading:

Access the XM copy trade screen

After logging in to the XM “Member Page”, click ” Copy Trade “.

XMの『会員ページ』にログイン後、「コピートレード」をタップします。

Deposit into investor account

If you have not yet deposited funds into your investor account, please proceed by clicking ” Deposit ” in the upper right corner.

投資家口座に資金を入金していない方は、「入金」よりお手続きください。

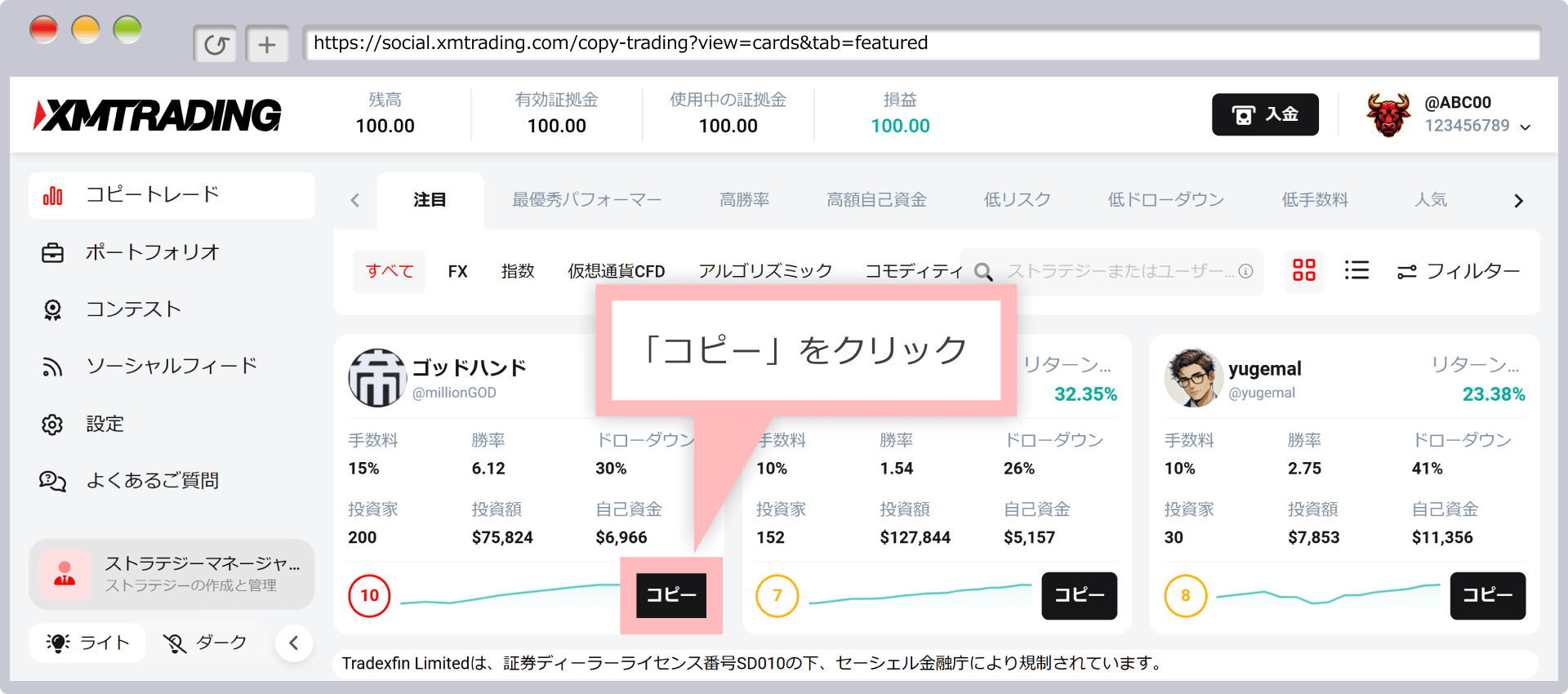

Select Strategy Manager

Select the Strategy Manager you wish to copy trade and click ” Copy “.

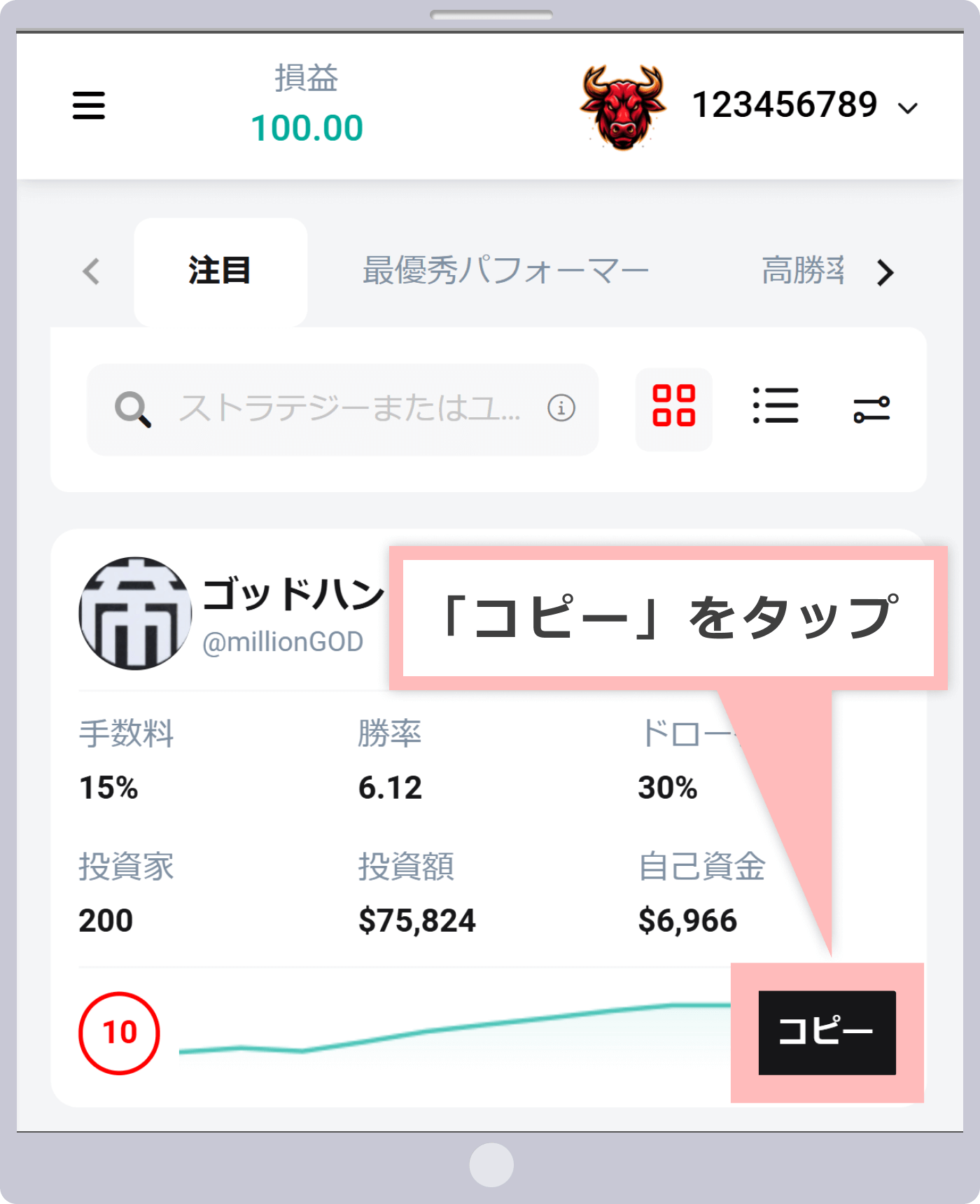

コピートレードを希望するストラテジーマネージャーを選択し、「コピー」をタップします。

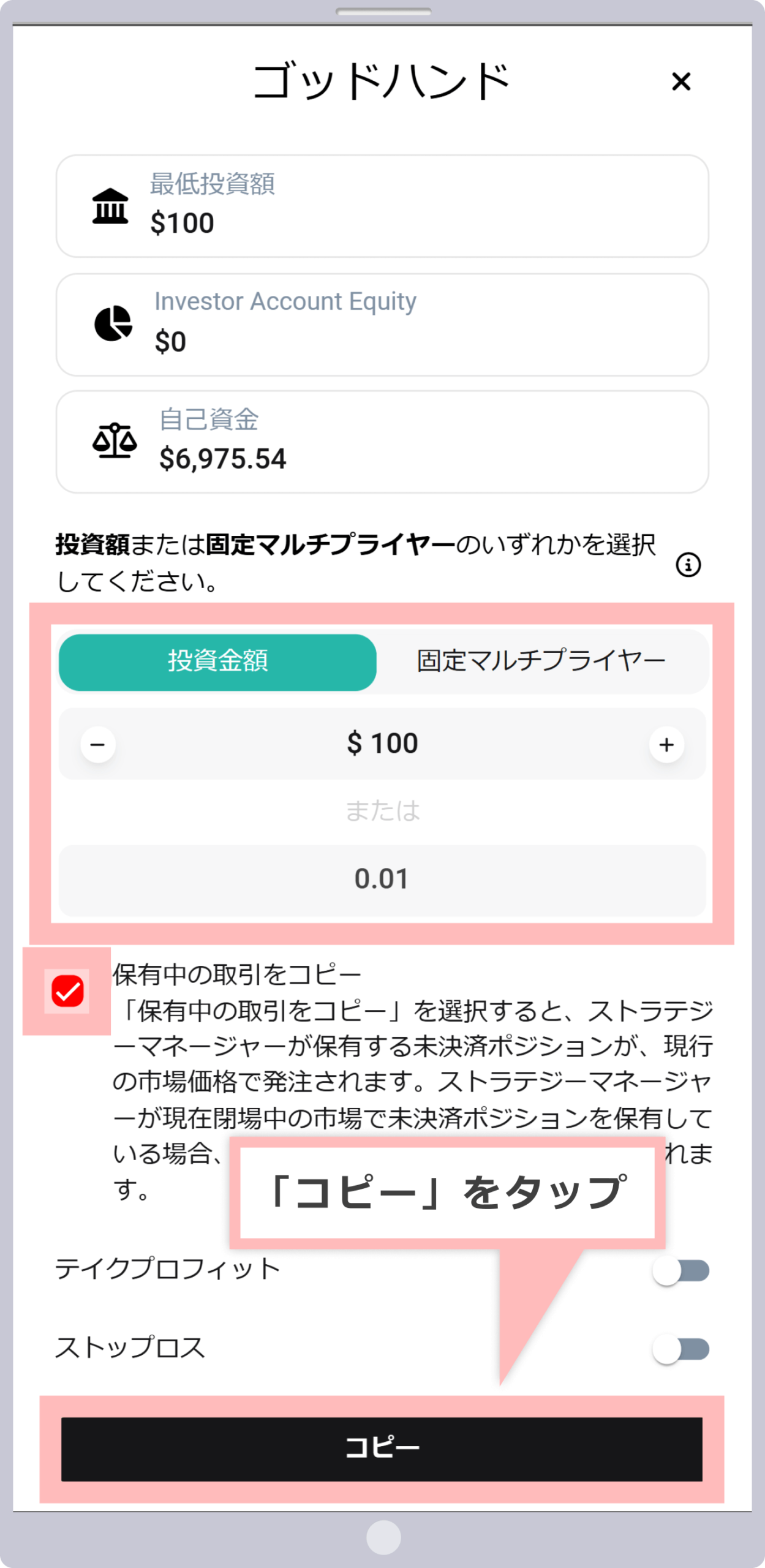

Copy trading settings

After setting the “Investment Amount” or “Fixed Multiplier”, click ” Copy “. If you want to copy the trades of the open positions held by the Strategy Manager, check the checkbox.

「投資金額」または「固定マルチプライヤー」を設定した後、「コピー」をタップします。ストラテジーマネージャーが保有中の未決済ポジションの取引のコピーを希望する場合は、チェックボックスにチェックを入れてください。

| Investment amount |

If you select “Investment Amount”, the multiplier will automatically adjust according to the Strategy Manager’s investment amount.

|

|---|---|

| Fixed Multiplier |

If you select “Fixed Multiplier”, the trading volume will be determined by the percentage set by the investor relative to the Strategy Manager’s trading volume.

|

| Take Profit |

Once profits exceed a certain level, the position is automatically closed and profits are secured.

|

| Stop Loss |

Once the loss falls below a certain level, the position will be automatically closed, limiting the loss.

|

For example, if you set the “Investment Amount” to $1,000, the Strategy Manager’s investment amount is $2,000, and the leverage is 500x, you can calculate the multiplier using the following formula.

Multiplier (percentage)

= (1,000 ÷ 2,000) × (500 ÷ 500) = 0.5 (*)

Multiplier (percentage) = (Investor’s investment amount ÷ Strategy Manager’s equity) × (Investor’s leverage ÷ Strategy Manager’s leverage). Leverage for investor accounts is fixed at 500x.

In other words, if the Strategy Manager trades 1 lot, the Investor will open a position with 0.5 trading lots. When the Strategy Manager’s investment amount is changed, the Investor’s multiplier will be automatically adjusted using the above formula.

If you set the “Fixed Multiplier” to 0.1, the investor will always open a position with a trading lot of 0.1 regardless of the investment amount of the strategy manager. If the strategy manager trades 2 lots, the number of trading lots for the investor can be calculated using the following formula:

Investor’s trading lot = 2 lots x 0.1 = 0.2 (*)

The investor’s trading lot is calculated as “Strategy Manager’s trading lot x multiplier”.

In other words, if the strategy manager trades 2 lots, the investor will hold a 0.2 lot position.

-

Please note that the Strategy Manager’s profile or description may state that they do not recommend “investment amounts” or “fixed multipliers.”

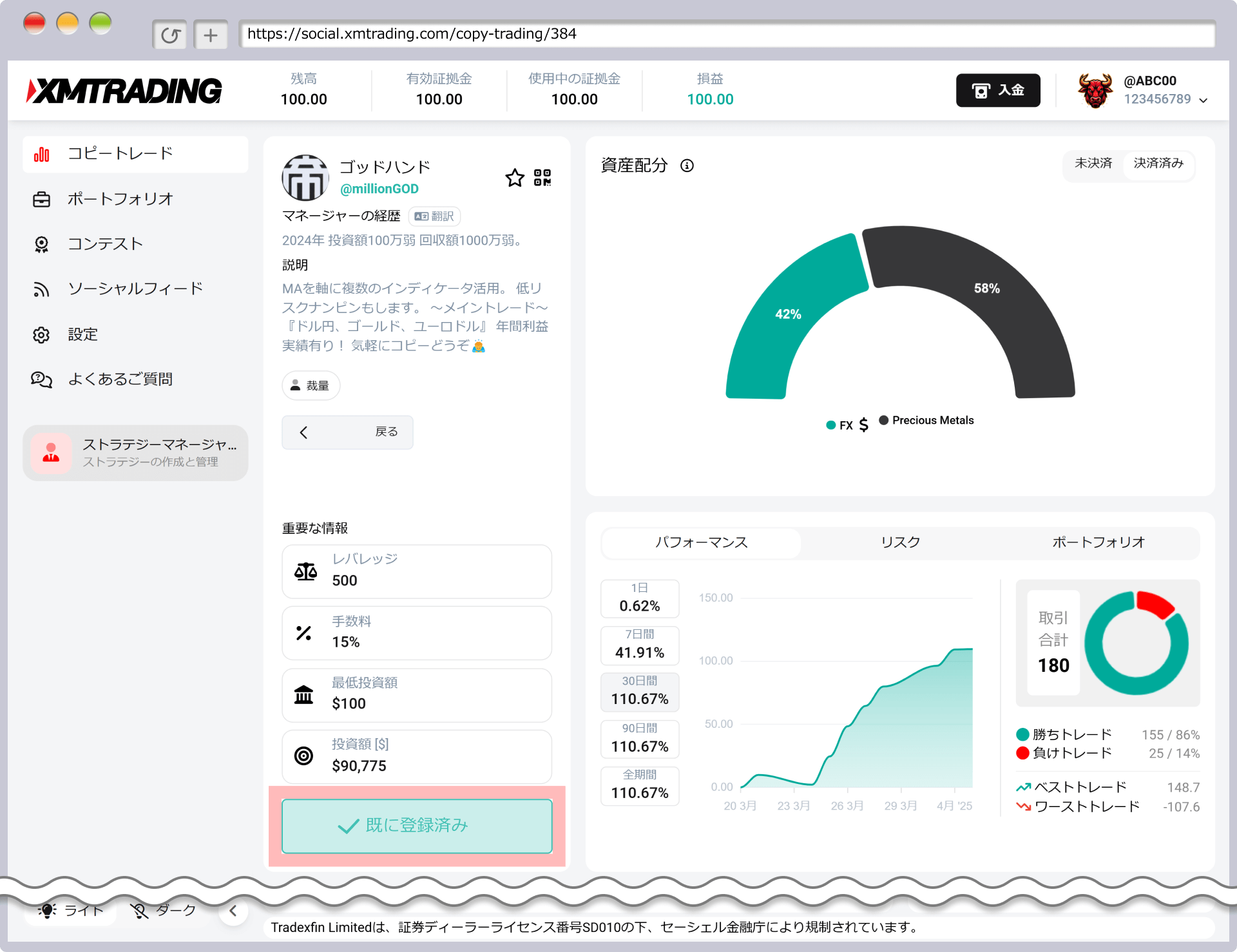

Strategy Follow-up Completed

When you see the message “Already registered,” your strategy follow-up is complete.

When a trade is made using the strategy you followed, the trade will be automatically copied to your investor account. You can view your trading history in the “Portfolio” tab.

XM Strategy Manager Account Opening Procedure

Here’s how to open an XM Strategy Manager account:

Access the XM copy trade screen

After logging in to the XM “Member Page”, click ” Copy Trade “.

XMの『会員ページ』にログイン後、「コピートレード」をタップします。

Access the Strategy Manager screen

Click ” Strategy Manager ” on the copy trading screen .

コピートレード画面より「ストラテジーマネージャー」をタップします。

Select “Create a Strategy”

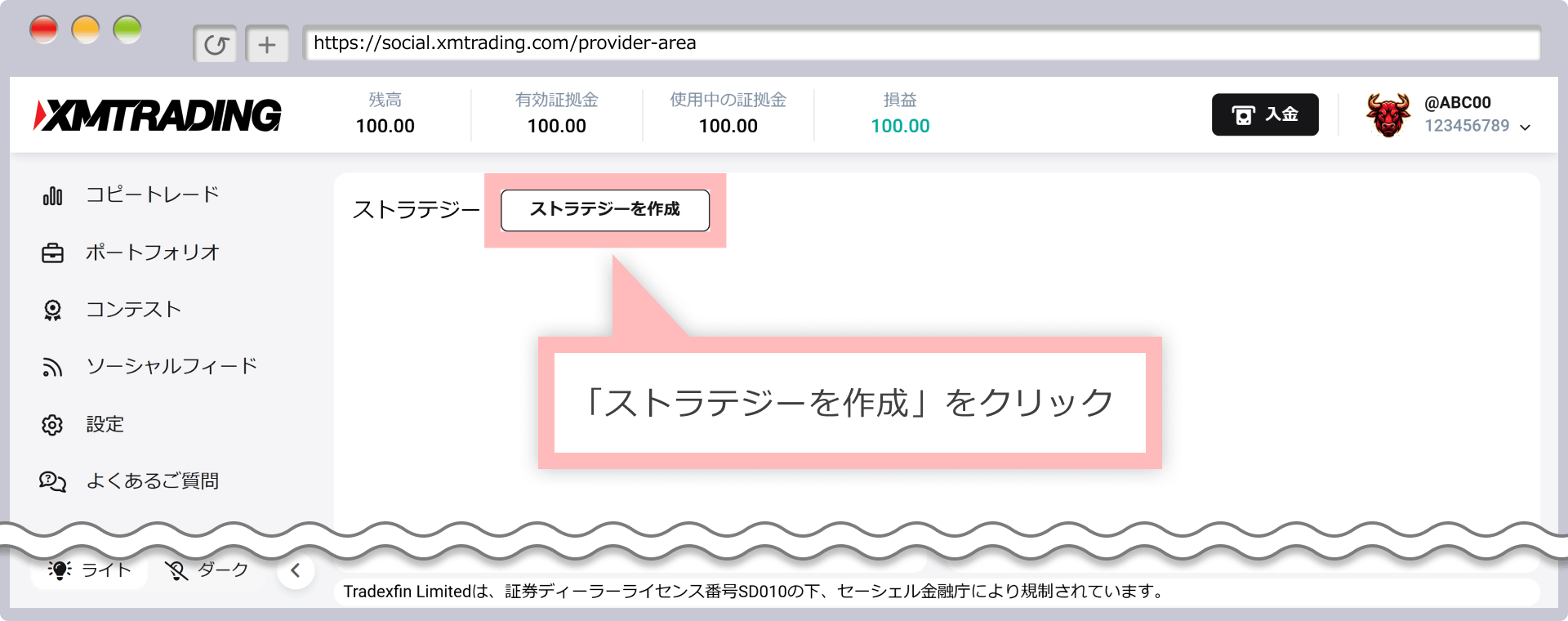

Click Create Strategy .

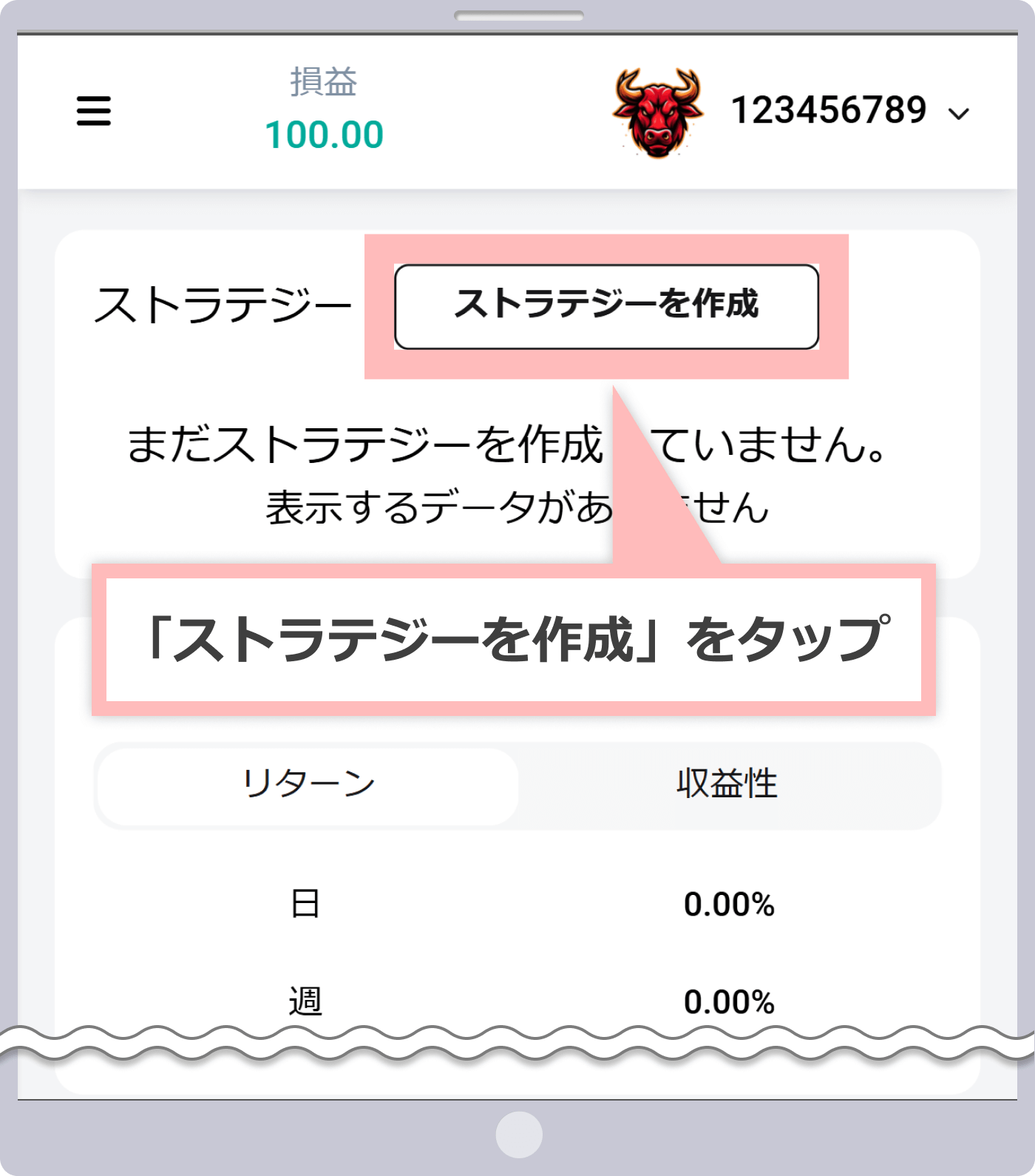

「ストラテジーを作成」をタップします。

Creating a Strategy Manager Account

When the Strategy Manager account creation screen appears, select your trading account details, check the box to confirm your agreement to each of the terms and conditions, and click ” Next .”

ストラテジーマネージャー口座の作成画面が表示されましたら、取引口座の詳細情報を選択し、各規約の同意に確認のチェックマークを入れて、「次へ」をタップします。

| 1Trading Platform | Example) MT5 |

|---|---|

| 2Leverage | Example: 500:1 |

| 3password | Example: #Abcd12345 |

① Select either “MT5” or “MT4” as the trading platform type.

② Choose the desired leverage from three options: 1:300, 1:400, or 1:500.

3) Your password must be 10 to 15 characters long and must include at least one uppercase letter, one lowercase letter, one number, and one special character. Special characters that can be used include “#[]()@$&*!?|,.^/+_-“.

-

XMTrading’s Strategy Manager account has a “Standard Account” account type and a fixed base currency of “USD.”

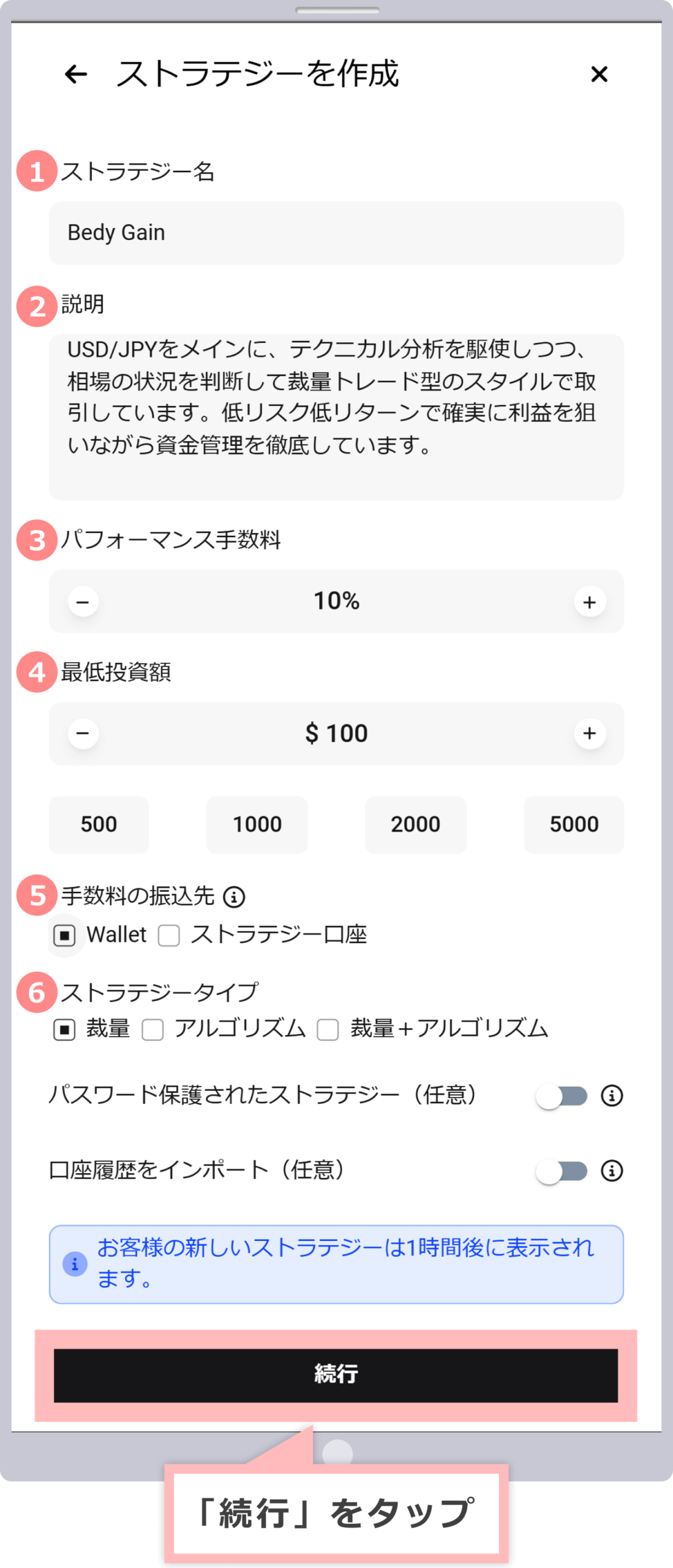

Create a strategy

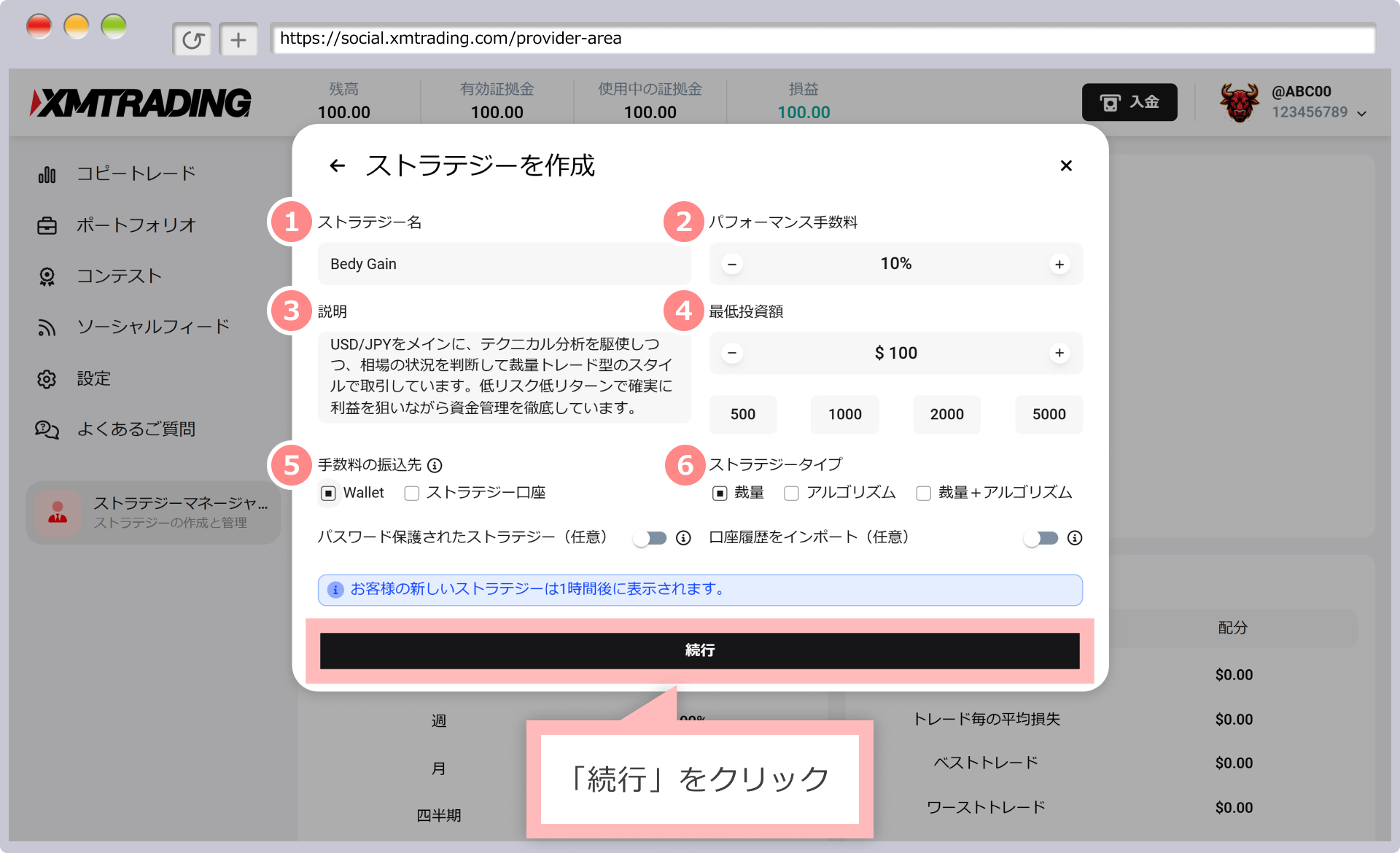

Complete the strategy details and click Continue .

ストラテジーの詳細を設定し、「続行」をタップします。

① Set the strategy name. The strategy name will be displayed in the strategy list.

② Set the performance fee between 0% and 50%. The performance fee will be calculated based on the fee rules and can be received as a reward.

3) In the description , you can enter your trading history, trading style, and the strategy and methods of your strategy. Investors will pay attention to these points, so please clearly explain the strategy and methods of your strategy.

④ Set the minimum investment amount. The minimum investment amount can be set from 50 USD.

⑤Select the transfer destination for the fee from “Wallet” or “Strategy Account.” Set the transfer destination for the performance fee.

⑥Select the strategy type from “Discretionary,” “Algorithmic,” or “Discretionary + Algorithmic.”

-

If you don’t want to share your strategy with everyone, turn on “Password Protected Strategy (Optional)”. Only investors who share the password you set will be able to copy your strategy.

-

If you would like to import the trading history of an existing XM account into your Strategy Manager account, please turn on “Import account history (optional)” and select your XM account number.

Strategy creation complete

Once the created strategy is displayed, the creation of your Strategy Manager account is complete.

The created strategy will appear in the strategy list after one hour.

When starting copy trading with XMTrading, please note the following points:

You need to open an XM investor account.

To copy trade with XM, you must have an investor account. Copy trading cannot be done using a real account , so if you wish to copy trade, please open an investor account from your XM My Page. If you have already registered an XM account, you can open an investor account immediately. If you do not have a real XM account, please first register for an XM account.

Please note that you are limited to one investor account and cannot open multiple investor accounts, but there is no limit to the number of strategies you can follow. Also, investor accounts are not included in XM’s maximum number of accounts (8 accounts), so even if you already have multiple real accounts, you can open an investor account.

How to open an XM investor account

Trading fees vary depending on the strategy

At XM, trading fees vary depending on the strategy you follow. Strategy managers can freely set trading fees up to 50%, so depending on the strategy, half of the profit may be deducted as a fee. Investors’ profits are the profits earned from copy trading minus trading fees , so be sure to check the trading fees before following a strategy. Furthermore, if a loss occurs from copy trading, no trading fees will be charged, and investors will not be put at a disadvantage.

Click here for details on XM’s copy trading fees rules

There is a minimum investment amount

The minimum investment amount for copy trading at XMTrading varies depending on the strategy. If the strategy manager sets the minimum investment amount at 1,000 USD, please note that you will not be able to perform copy trading unless your investor account has a balance of at least 1,000 USD. You can deposit funds into your investor account via domestic bank transfer (Japan), credit card/debit card (VISA/JCB), Apple Pay, or virtual currency (crypto assets) . Alternatively, you can transfer funds from your real account to your investor account. Please check the minimum investment amount for the strategy you wish to copy, then deposit funds into your investor account and begin copy trading.

Your funds are safe and self-managed

With XM copy trading, investors directly manage their own funds and the trades of the copied strategy manager are reflected in their own account. Unlike MAM and PAMM, where professional traders manage and manage investors’ funds on their behalf, the assets used in copy trading are always under the investor’s control. Investors can also pause or terminate and unfollow strategies they are following at any time from the “Portfolio” section of the copy trading screen. Unfollowing a strategy manager will immediately halt trading, allowing you to adjust your funds yourself. XM does not manage your funds on your behalf, so you can enjoy trading with peace of mind.

Risk management is necessary according to the funds

XMTrading’s copy trading allows you to copy the trades of professional traders exactly, making it an easy way for even those with little experience in FX to make profits. However, since you cannot always make a profit, we recommend that you select the strategy you want to follow after considering the risk of incurring losses.

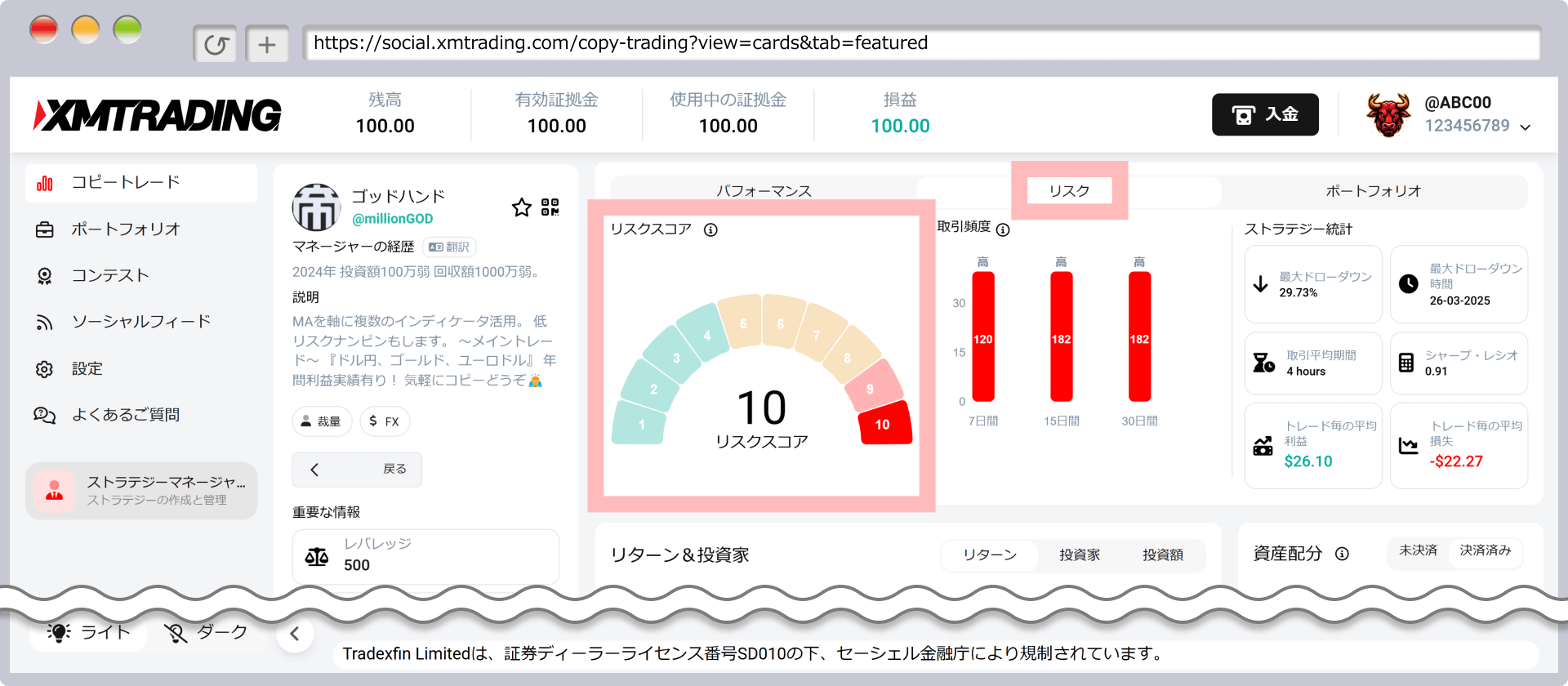

On the XM Copy Trading screen, select a strategy manager to view details such as the manager’s background, description, and minimum investment amount. The background and description often include the strategy manager’s trading style and past performance, so be sure to check what trading method they use and how successful they are. It’s also important to ensure that the minimum investment amount set by the strategy manager fits your budget when it comes to risk management. Furthermore, the “Risk” tab displays the strategy’s risk score on a scale of 1 to 10. The higher the number, the greater the risk . Therefore, please consider whether the strategy is within your risk tolerance before selecting it.

-

Can I stop copy trading with XM midway?

Yes, you can stop copy trading with XM at any time. Investors can pause or terminate the strategies they are following and unfollow them freely from the “Portfolio” section of the copy trading screen. If you unfollow a strategy manager, trading will be stopped immediately.

read more

2025.04.01

-

Does XM charge a fee for copy trading?

Yes, when you make a profit with XM copy trading, a portion of the profit will be deducted as a performance fee. The performance fee is set at approximately 10% to 30% of the profit (up to a maximum of 50%). Since it differs depending on the Strategy Manager, please check the fees before following.

read more

2025.04.01

-

What is the minimum amount required to copy trade with XM?

The capital required for copy trading at XM varies depending on the strategy. If your investor account does not have the minimum investment amount set by the strategy manager, you will not be able to copy trade. Please check the minimum investment amount for the strategy you wish to copy and then deposit or transfer funds to your investor account.

read more

2025.04.01

-

Do I need a dedicated account to copy trade with XM?

Yes, a dedicated account is required for copy trading with XM. If you wish to copy trade, please open an investor account from your XM My Page. Investor accounts are free to open. In addition to copy trading, XM also allows you to create strategies and act as a strategy manager.

read more

2025.04.01

-

Does XM offer copy trading?

Yes, anyone with an XM account can use copy trading. XM’s copy trading automatically copies the strategies and techniques of experienced professional traders, making it a groundbreaking service that allows even those with little trading experience or who cannot devote much time to trading to efficiently aiming for profits.

read more

2025.04.01