XM margin list and calculation method

XM margin list and calculation method

XM offers a diverse range of products, including FX currency pairs and CFDs. When trading these instruments, it’s essential to understand the actual margin requirements and how the margin is calculated for each product. Additionally, by consulting XM’s “Required Margin List,” you can quickly see the minimum amount needed to start trading each product.

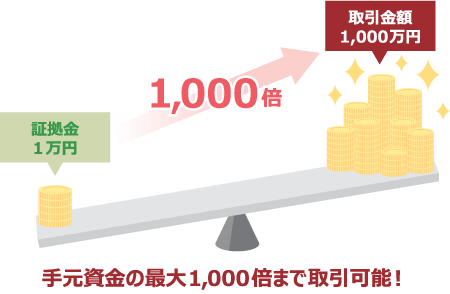

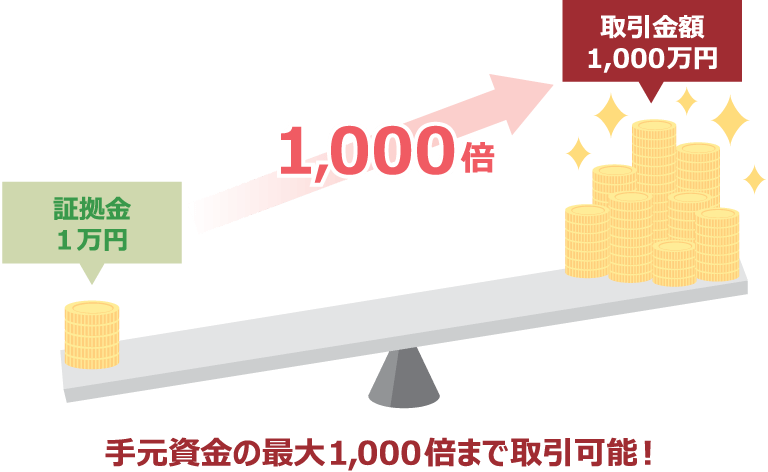

For traders looking to make large trades without a substantial amount of capital, one of XM’s key advantages is high-leverage trading—up to 1,000×. By utilizing XM’s maximum leverage, you can trade with a relatively low margin.

![]()

By using leverage of up to 1,000×, you can trade with a relatively small margin.

XM Margin

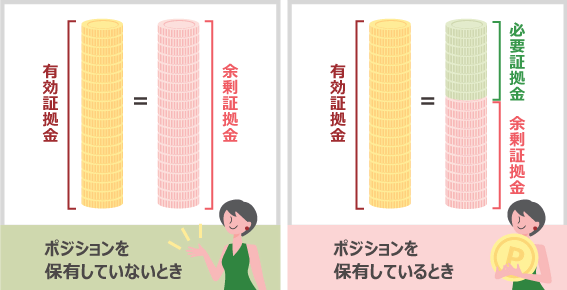

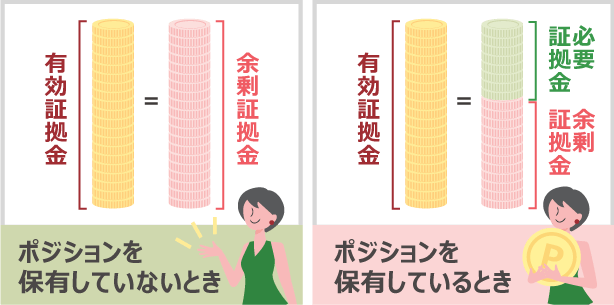

Margin is the minimum amount of funds required to trade a given position, and it serves as collateral for your trades. If your available margin is insufficient, you will not be able to open new positions. Moreover, if your margin is depleted due to sudden market movements, you may be required to close (settle) your positions. To prevent this, it is recommended to always maintain adequate margin in your account and manage your funds carefully.

At XMTrading, you can only open a new position if the required margin is less than your available margin for all offered products. For FX currency pairs, gold, and silver, the required margin for hedged positions of the same lot size is zero, allowing you to open positions even if your margin maintenance rate is below 100%. For other products, hedged positions do not reduce the required margin to zero; in these cases, only one side of the buy or sell order counts toward the margin requirement. In any case, even when using hedges, you can only open a new position if your required margin does not exceed your available margin.

-

XM permits hedging within the same account but prohibits hedging across multiple accounts or with other brokers. Please note that accounts engaging in fraudulent trading may be subject to closure.

Margin and leverage are closely connected, and using high leverage allows you to start trading with a smaller margin. For example, if you trade USD/JPY (US dollar/yen) at 10,000 units (0.1 lots) when the rate is 1 USD = 100 JPY, the required margin would normally be 1 million JPY. However, with 100× leverage, the required margin drops to 10,000 JPY, and with 1,000× leverage, it is reduced to approximately 1,000 JPY.

XM offers a wide range of flexible leverage, from 1:1 to 1:1,000, meaning the margin required for the same 0.1-lot trade can vary significantly depending on your chosen leverage. By taking advantage of XM’s high leverage, you can trade large positions even with a small amount of capital.

Margin requirements for each leverage

| Leverage | Margin Requirements |

| 1,000 times | 1,000 yen |

| 888 times | 1,130 yen |

| 500 times | 2,000 yen |

| 100 times | 10,000 yen |

| 50 times | 20,000 yen |

-

This is the margin required to trade 0.1 lots when the USD/JPY exchange rate is 1 USD = 100 JPY.

You can adjust your leverage from the XM Members page. Detailed, step-by-step instructions—with clear illustrations—are provided in the XM Members Page User Guide.

On the XM Members Page, you can open an account, deposit and withdraw funds, adjust your leverage, and access the copy trading page. For detailed instructions on using the XM Members Page, please refer to the “XM Members Page User Guide.”

XMTrading also applies leverage limits based on your margin balance. Specifically, for major FX currency pairs and gold/silver, leverage is reduced once the account’s equity exceeds certain thresholds, as follows:

Leverage Limits by Equity

| Equity | Maximum Leverage |

| $5 to $40,000 |

1,000 times |

| $40,001 to $80,000 |

500 times |

| $80,001 to $200,000 |

200 times |

Over $200,001 |

100 times |

If you have multiple XM trading accounts, please note that leverage limits apply based on the total equity across all accounts, not on each account individually. However, if your combined equity falls below $40,000, the leverage restriction is lifted, and you can once again use up to 1,000× leverage.

Additionally, some XM stocks have fixed leverage. Please refer to this page for details on the available margin and leverage limits for each stock.

For details on equity margin and leverage limits by product, click here

One of XMTrading’s key attractions is high-leverage trading, but sudden exchange rate fluctuations can delay stop-loss execution, potentially causing your margin to fall below zero and resulting in a large negative balance.

However, XM uses a zero-cut system, which means margin calls are not required and customers are not responsible for negative balances. Any negative balance will be reset to zero with your next deposit, and the full deposit amount will be reflected in your account. Since customers do not have to cover losses beyond their account balance, you can trade with peace of mind.

The indicator for a forced stop loss is the margin maintenance rate, which can be calculated using the following formula:

Margin Maintenance Rate (%)

= Equity ÷ Required Margin × 100

At XM, a forced stop loss is triggered when the margin maintenance rate falls below 20%. Before reaching this point, a margin call occurs if the rate drops below 50%. To avoid a forced stop loss, it is recommended to take early action, such as depositing additional funds to increase your margin or closing part of your position.

What is a margin call?

A margin call, short for “additional margin,” refers to the extra funds that must be deposited when your account balance falls below the required margin. However, XM uses a zero-cut system, so you are not required to cover margin calls even if your balance becomes negative.

XM FX Currency Pair Margin Calculation Method

The method for calculating margin for FX currency pairs offered by XMTrading is as follows:

Trading volume ÷ Leverage

× Current rate (*) = Required margin

For example, on a standard account, if you trade 0.01 lots (1,000 units) of USD/JPY at an exchange rate of 110.37, the required margin can be calculated using the following formula:

1,000 units of currency ÷ 1,000 times

× 110.37 yen = 110.37 yen

Please note that the maximum leverage is 1,000× for XM Standard Accounts, XM Micro Accounts, and XM KIWAMI Goku Accounts, while it is 500× for XM Zero Accounts. Some products also have leverage restrictions depending on the currency pair. Additionally, the lot size for Standard Accounts, KIWAMI Goku Accounts, and Zero Accounts is 100,000 units per lot, whereas for Micro Accounts it is 1,000 units per lot.

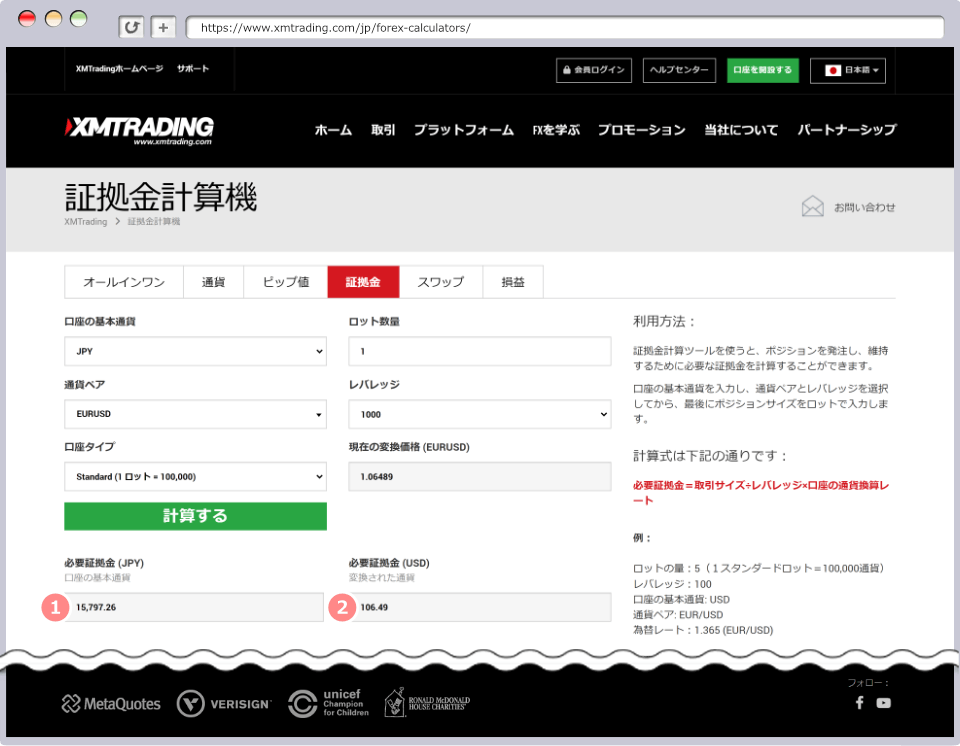

XMTrading offers the “XM Margin Calculator” for FX currency pairs, so you don’t have to calculate margins manually each time you trade. With this tool, anyone can easily determine the required margin. For detailed instructions on how to use the XM Margin Calculator, please see below.

Exchange rates fluctuate constantly.

XM FX currency pair margin requirements list

The following table shows the FX currency pairs offered by XMTrading and the required margin per lot. For XM Micro accounts, divide each of the required margins below by 100. Please note that required margins fluctuate with exchange rates, so be sure to check the latest figures before trading.

XM Standard Account

| Currency Pairs | Leverage | Margin Requirements |

| EURUSD (European Euro/US Dollar) |

1,000 times | 17,095 yen |

| GBPUSD (British Pound / US Dollar) |

1,000 times | 19,616 yen |

| USDJPY (US Dollar/Japanese Yen) |

1,000 times | 14,767 yen |

XM Micro Account

| Currency Pairs | Leverage | Margin Requirements |

| EURUSD (European Euro/US Dollar) |

1,000 times | 171 yen |

| GBPUSD (British Pound / US Dollar) |

1,000 times | 196 yen |

| USDJPY (US Dollar/Japanese Yen) |

1,000 times | 148 yen |

XMKIWAMI polar account

| Currency Pairs | Leverage | Margin Requirements |

| EURUSD (European Euro/US Dollar) |

1,000 times | 17,095 yen |

| GBPUSD (British Pound / US Dollar) |

1,000 times | 19,616 yen |

| USDJPY (US Dollar/Japanese Yen) |

1,000 times | 14,767 yen |

XM Zero Account

| Currency Pairs | Leverage | Margin Requirements |

| EURUSD (European Euro/US Dollar) |

500 times | 34,189 yen |

| GBPUSD (British Pound / US Dollar) |

500 times | 39,232 yen |

| USDJPY (US Dollar/Japanese Yen) |

500 times | 29,534 yen |

XM Share CFD Margin Calculation

The method for calculating margin for stock CFDs offered by XMTrading is as follows:

Number of lots x contract size

x opening price (*) ÷ leverage

Leverage (required margin rate) for stock CFDs is fixed for each stock and does not vary by account type or margin balance. Popular stocks such as Apple, Amazon, Google, and Microsoft have a maximum leverage of 20× (required margin rate of 5%), while many others have a maximum leverage of 10× (required margin rate of 10%) or 6.67× (required margin rate of 15%). Additionally, the standard contract size is 10, though some UK stocks have a contract size of 100. Please check the leverage (required margin rate) and contract size for each stock before trading. Note that stock CFDs are available only with MT5 accounts.

Prices fluctuate constantly.

XM Stock CFD Margin Requirements

At the time of writing, the required margin per lot for some of the most popular stocks among the 1,313 stock CFDs on XMTrading is as follows. Please note that required margins fluctuate with the opening price, so be sure to check the latest figures before trading.

XM Stock CFD Margin Requirements for Major Stocks

| Brand | Contract Size | Leverage | Margin Requirements |

| Alibaba | 10 | 20 times | 8,159 yen |

| Amazon | 10 | 20 times | 14,681 yen |

| Apple | 10 | 20 times | 14,403 yen |

| Alibaba | |

| 契約サイズ | 10 |

| レバレッジ | 20倍 |

| 必要証拠金 | 8,159円 |

| Amazon | |

| 契約サイズ | 10 |

| レバレッジ | 20倍 |

| 必要証拠金 | 14,681円 |

| Apple | |

| 契約サイズ | 10 |

| レバレッジ | 20倍 |

| 必要証拠金 | 14,403円 |

XM Index CFD Margin Calculation

The method for calculating margin for stock index CFDs offered by XMTrading is as follows:

Number of lots x contract size

x opening price (*) ÷ leverage

Leverage for stock index CFDs is fixed for each index and does not vary by account type or margin balance. Generally, leverage is 100×, except for HK50CASH (HSI) at 66.7×; CA60CASH, ChinaHCASH, and US2000CASH at 250×; and SA40CASH at 400×. For GER40 (DAX), JP225 (Nikkei), UK100 (FTSE 100), US100 (NASDAQ), US30 (Dow Jones), and US500 (S&P 500), leverage is 500× for both futures and spot contracts.

Prices fluctuate constantly.

XM Stock Index CFD Margin Requirements

The required margin per lot for stock index CFDs offered by XMTrading is as follows. Please note that required margins fluctuate with the opening price, so be sure to check the latest figures before trading.

| index | Leverage | Margin Requirements |

| AUS200 (Australian stock price index) |

100 times | 8,333 yen |

| CA60CASH (Canadian stock index) |

250 times | 697 yen |

| ChinaHCASH (China Hong Kong H stock) |

250 times | 679 yen |

XM Precious Metals CFD Margin Calculations

The method for calculating margin for precious metals CFDs offered by XMTrading is as follows:

Number of lots x contract size

x market price (*) ÷ leverage

Margin for GOLD, SILVER, XAUEUR (Gold/Euro), XPDUSD (Palladium/US Dollar), and XPTUSD (Platinum/US Dollar) can be easily calculated using XM’s margin calculator. Please note that while leverage for GOLD, SILVER, and XAUEUR may fluctuate depending on margin balance, leverage for XPDUSD (Palladium) and XPTUSD (Platinum) is fixed at 22.2×.

Prices fluctuate constantly.

XM Precious Metals CFD Margin Requirements

The required margin per lot for precious metals CFDs offered by XMTrading is as follows. Please note that required margins fluctuate with market prices, so be sure to check the latest figures before trading.

XM Standard Account

| Brand | Contract Size | Leverage | Margin Requirements |

| GOLD | 100 ounces | 1,000 times | 49,577 yen |

| SILVER | 5,000 ounces | 400 times | 7,037 yen |

| XAUEUR (Gold/Euro) |

100 ounces | 1,000 times | 50,637 yen |

| XPDUSD (Palladium/US Dollar) |

10 troy ounces | 100 times | 1,446 yen |

| XPTUSD (Platinum/US Dollar) |

10 troy ounces | 200 times | 1,562 yen |

| PALL (Palladium) |

10 troy ounces | 22.2 times | 84,201 yen |

| PLAT (Platinum) |

10 troy ounces | 22.2 times | 95,070 yen |

| GOLD | |

| 契約サイズ | 100オンス |

| レバレッジ | 1,000倍 |

| 必要証拠金 | 49,577円 |

XM Micro Account

| Brand | Contract Size | Leverage | Margin Requirements |

| GOLD | 1 ounce | 1,000 times | 496 yen |

| SILVER | 50 ounces | 400 times | 70 yen |

| XAUEUR (Gold/Euro) |

1 ounce | 1,000 times | 506 yen |

| XPDUSD (Palladium/US Dollar) |

1 troy ounce | 100 times | 145 yen |

| XPTUSD (Platinum/US Dollar) |

1 troy ounce | 200 times | 156 yen |

| PALL | 10 troy ounces | 22.2 times | 84,201 yen |

| PLAT | 10 troy ounces | 22.2 times | 95,070 yen |

| GOLD | |

| 契約サイズ | 1オンス |

| レバレッジ | 1,000倍 |

| 必要証拠金 | 496円 |

XMKIWAMI polar account

| Brand | Contract Size | Leverage | Margin Requirements |

| GOLD | 100 ounces | 1,000 times | 49,577 yen |

| SILVER | 5,000 ounces | 400 times | 7,037 yen |

| XAUEUR (Gold/Euro) |

100 ounces | 1,000 times | 50,637 yen |

| XPDUSD (Palladium/US Dollar) |

10 troy ounces | 100 times | 1,446 yen |

| XPTUSD (Platinum/US Dollar) |

10 troy ounces | 200 times | 1,562 yen |

| PALL | 10 troy ounces | 22.2 times | 84,201 yen |

| PLAT | 10 troy ounces | 22.2 times | 95,070 yen |

| GOLD | |

| 契約サイズ | 100オンス |

| レバレッジ | 1,000倍 |

| 必要証拠金 | 49,577円 |

XM Zero Account

| Brand | Contract Size | Leverage | Margin Requirements |

| GOLD | 100 ounces | 500 times | 99,154 yen |

| SILVER | 5,000 ounces | 400 times | 7,037 yen |

| XAUEUR (Gold/Euro) |

100 ounces | 500 times | 101,274 yen |

| XPDUSD (Palladium/US Dollar) |

10 troy ounces | 100 times | 1,446 yen |

| XPTUSD (Platinum/US Dollar) |

10 troy ounces | 200 times | 1,562 yen |

| PALL | 10 troy ounces | 22.2 times | 84,201 yen |

| PLAT | 10 troy ounces | 22.2 times | 95,070 yen |

| GOLD | |

| 契約サイズ | 100オンス |

| レバレッジ | 500倍 |

| 必要証拠金 | 99,154円 |

XM Energy CFD Margin Calculations

The method for calculating margin for energy CFDs offered by XMTrading is as follows:

Number of lots x contract size

x opening price (*) ÷ leverage

Leverage for energy CFDs varies by product. Specifically, leverage is fixed at 200× for BRENTCASH, NGASCASH, and OILCASH; 66.7× for BRENT, OIL, and OILMn; and 33.3× for GSOIL and NGAS.

Prices fluctuate constantly.

XM Energy CFD Margin Requirements

The required margin per lot for energy CFDs offered by XMTrading is as follows. Please note that required margins fluctuate with the opening price, so be sure to check the latest figures before trading.

| Brand | Contract Size | Leverage | Margin Requirements |

| BRENTCASH (Brent Oil Spot) |

100 Barrels | 200 times | 5,184 yen |

| NGASCASH (spot natural gas) |

1,000 MMBtu | 200 times | 2,594 yen |

| OILCASH (WTI crude oil spot) |

100 Barrels | 200 times | 4,851 yen |

| OIL (WTI crude oil) |

100 Barrels | 66.7 times | 14,941 yen |

| OILMn (WTI Crude Oil Mini) |

10 Barrels | 66.7 times | 1,494 yen |

| NGAS (natural gas) |

1,000 MMBtu | 33.3 times | 15,855 yen |

| BRENT (Brent Oil) |

100 Barrels | 66.7 times | 15,413 yen |

| GSOIL (London Gas Oil) |

4 Tonnes | 33.3 times | 12,569 yen |

| BRENTCASH | |

| 契約サイズ | 100 Barrels |

| レバレッジ | 200倍 |

| 必要証拠金 | 5,184円 |

XM Commodity CFD Margin Calculations

The method used to calculate margin for commodity CFDs offered by XMTrading is as follows:

Number of lots x contract size

x opening price (*) ÷ leverage

The leverage for all commodity CFDs is fixed at 50x.

Prices fluctuate continuously.

XM Commodity CFD Margin Requirements

The required margin per lot for commodity CFDs offered by XMTrading is as follows. Please note that the margin amount varies depending on the opening price, so be sure to check the latest figures before trading.

| Brand | Contract Size | Leverage | Margin Requirements |

| COTTO (US cotton) |

10,000 LBS | 50 times | 20,365 yen |

| CORN (US corn) |

400 Bushels | 50 times | 4,794 yen |

| HGCOP (copper) |

2,000 LBS | 50 times | 32,884 yen |

| SBEAN (US soybean) |

400 Bushels | 50 times | 11,889 yen |

| SUGAR (US sugar) |

10,000 LBS | 50 times | 4,920 yen |

| WHEAT |

400 Bushels | 50 times | 6,411 yen |

| COCOA (US Cocoa) |

1 Metric Ton | 50 times | 23,157 yen |

| COFFE (US coffee) |

10,000 LBS | 50 times | 88,537 yen |

| COTTO | |

| 契約サイズ | 10,000 LBS |

| レバレッジ | 50倍 |

| 必要証拠金 | 20,365円 |

XM Thematic Index CFD Margin Calculations

The method for calculating margin on thematic index CFDs offered by XMTrading is as follows:

Number of lots x contract size

x opening price (*) ÷ leverage

The leverage for all thematic index CFDs is fixed at 50x.

Prices are constantly fluctuating.

XM Thematic Index CFD Margin Requirements

The required margin per lot for thematic index CFDs offered by XMTrading is as follows. Please note that the margin amount varies depending on the opening price, so be sure to check the latest figures when trading. Thematic index CFDs are available only on MT5 Standard and KIWAMI accounts.

| Brand | Leverage | Margin Requirements |

| AI_INDX | 50 times | 7,998 yen |

| ChinaInternet | 50 times | 4,769 yen |

| Crypto_10 | 50 times | 68,750 yen |

| Electric Vehicles | 50 times | 1,862 yen |

| FAANGs_10 | 50 times | 14,894 yen |

| LATAM_INDX | 50 times | 4,081 yen |

| Blockchain & NFT | 50 times | 3,292 yen |

| Altocoins_INDX | 50 times | 1,452 yen |

| AI_INDX | |

| レバレッジ | 50倍 |

| 必要証拠金 | 7,998円 |

XM Cryptocurrency CFD Margin Calculation

The method for calculating margin on cryptocurrency CFDs offered by XMTrading is as follows:

Number of lots x contract size

x opening price (*) ÷ leverage

The leverage for cryptocurrency CFDs varies by product. BTCUSD and ETHUSD can be traded with a maximum leverage of 500x, other Bitcoin and Ethereum pairs, as well as Ripple and Litecoin, have a maximum leverage of 250x, and all other altcoins can be traded with a maximum leverage of 50x.

Prices fluctuate constantly.

Learn more about XM Bitcoin Leverage Trading

XM Cryptocurrency CFD Margin Requirements

The required margin per lot for cryptocurrency CFDs offered by XMTrading is as follows. Please note that the margin amount varies depending on the opening price, so be sure to check the latest figures before trading.

| Brand | Contract Size | Leverage (*) | Margin Requirements |

| 1INCHUSD (1INCH Network/USD) |

10,000 | 50 times | 5,600 yen |

| AAVEUSD (Aave/USD) |

10 | 50 times | 6,943 yen |

| ADAUSD (Cardano/USD) |

1,000 | 50 times | 1,921 yen |

| 1INCHUSD | |

| 契約サイズ | 10,000 |

| レバレッジ | 50倍 |

| 必要証拠金 | 5,600円 |

| AAVEUSD | |

| 契約サイズ | 10 |

| レバレッジ | 50倍 |

| 必要証拠金 | 6,943円 |

| ADAUSD | |

| 契約サイズ | 1,000 |

| レバレッジ | 50倍 |

| 必要証拠金 | 1,921円 |

Cryptocurrency CFDs have tiered margin rates, meaning leverage varies depending on the trade size.

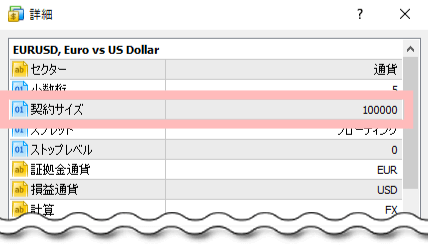

The contract size can be viewed on MT4/MT5.

The contract size for each XMTrading product can be viewed on MT4 (MetaTrader 4) or MT5 (MetaTrader 5). Simply right-click the desired currency pair in the “Quotes” window, select “Specifications,” and you can see the contract size along with other trading conditions.

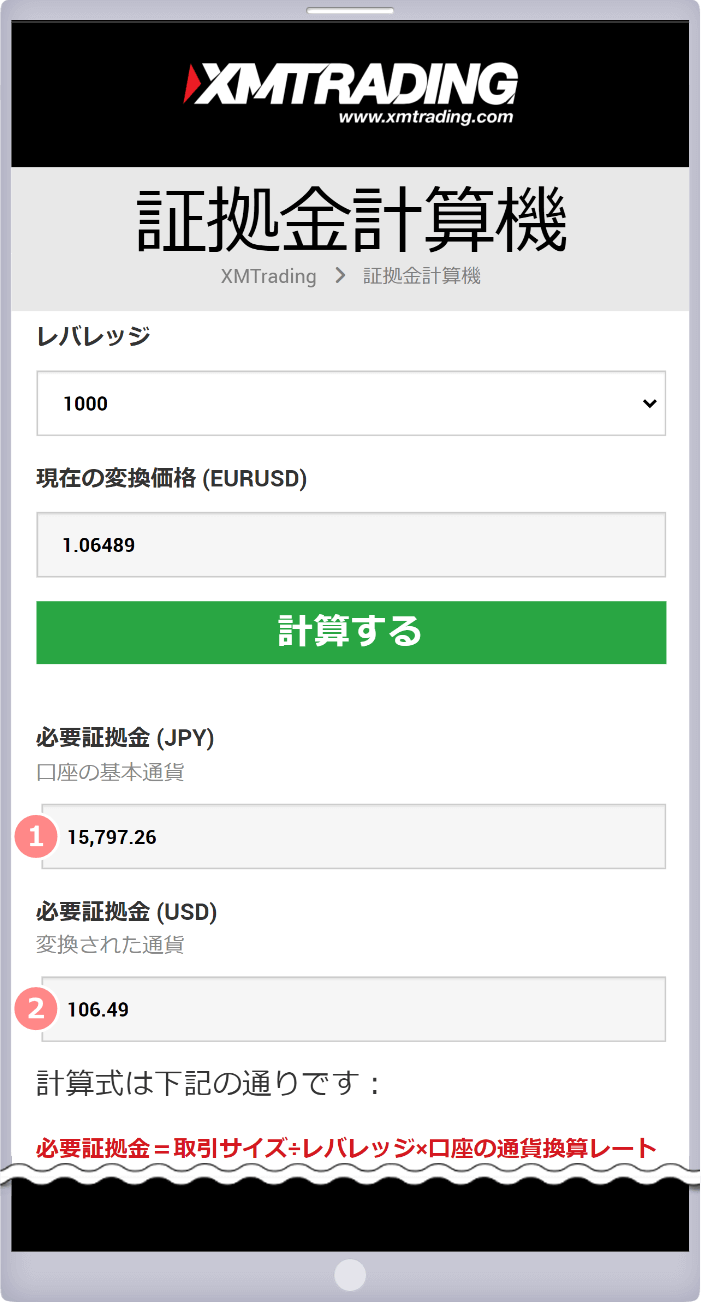

XMTrading offers the “XMTrading Margin Calculator,” which makes it easy to calculate the required margin for FX currency pairs, gold, and silver. Simply enter the necessary values to compute the margin. Here’s how to use the XM Margin Calculator:

Enter the required information

① Select your account’s base currency and ② the currency pair for which you want to calculate the margin. Next, choose ③ your account type, ④ the lot size, and ⑤ the leverage you wish to use, then click “Calculate.”

①口座の基本通貨と、証拠金を計算したい②通貨ペアを選択します。次に、お取引を行う③口座タイプと④ロット数量、⑤レバレッジを選択し、「計算する」をタップします。

| 1Account base currency | Example: JPY |

|---|---|

| 2Currency Pairs | Example: EURUSD |

| 3Account Type | Example: Standard (1 lot = 100,000) |

| 4Lot Quantity | Example: 1 |

| 5Leverage | Example: 1000 |

Displaying calculation results

Once the margin calculation is complete, ① “Required Margin (JPY)” will display the margin converted to your account’s base currency, and ② “Required Margin (USD)” will show the margin in the settlement currency (the currency listed to the right of the currency pair).

-

The calculated required margin is constantly fluctuating based on the currency pair rate and other factors. Please note that the results from the XM Margin Calculator may differ from the actual margin required for trading.

-

Please provide information on the margin required for hedging with XM.

For XM’s FX currency pairs, gold (GOLD), and silver (SILVER), if you hold long and short positions of the same lot size, the required margin is zero. This means you can maintain these positions even if your margin level falls below 100%. For other products, margin is required for only one of the buy or sell orders.

read more

2021.10.25

-

How is the margin calculated for CFDs on XM?

The margin for XM CFDs can be calculated using the formula: Margin = Number of lots × Contract size × Opening price ÷ Leverage. To check the contract size, right-click the desired currency pair in the “Quotes” window on MetaTrader 4 (MT4) or MetaTrader 5 (MT5), then select “Specifications.”

read more

2021.10.25

-

What does “Free Margin” mean on XM?

XM’s Free Margin is the difference between your equity and the required margin, representing the amount available to open new positions or maintain existing ones. The higher your Free Margin, the greater your available margin for trading.

read more

2021.10.25

-

What margin maintenance ratio does XM recommend?

At XM, a margin call is triggered when the margin level falls below 50%, and a stop-out (forced close) occurs if it falls below 20%. To avoid forced liquidation, it is recommended to maintain your margin level above 20% by making additional deposits or partially closing positions when a margin call occurs.

read more

2021.10.25

-

What happens if my account does not have enough margin on XM?

At XM, you must have sufficient margin to open new positions and maintain existing ones. If your margin runs low, you may be unable to open new trades, and your existing positions could be liquidated. To avoid this, it is recommended to maintain adequate margin by either depositing additional funds or partially closing positions.

read more

2021.10.25