XM tax return method and taxes

XM tax return method and taxes

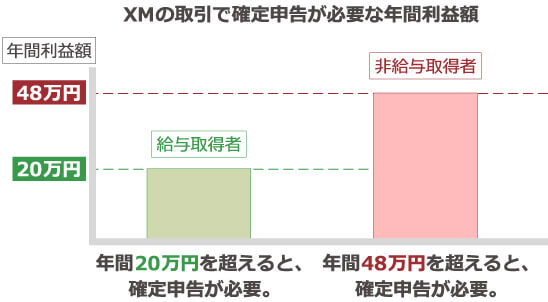

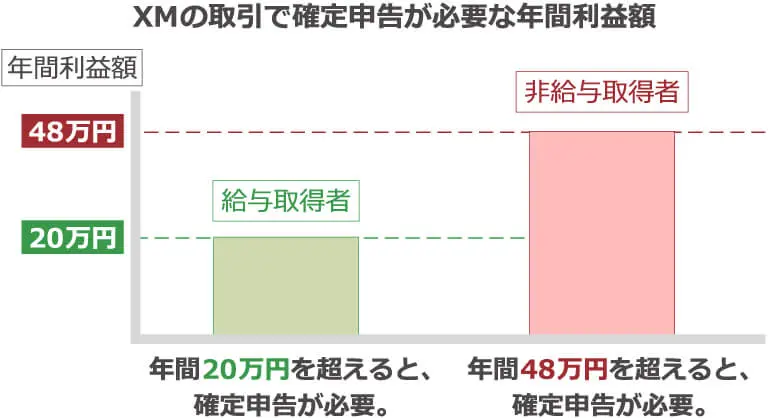

With XM, salaried individuals and non-salaried individuals are required to file a tax return if they earn more than 200,000 yen per year, and if they earn more than 480,000 yen per year. However, profits and losses from XM trading must be considered together with other income that is classified as “miscellaneous income subject to comprehensive taxation.” Therefore, even if the profit or loss generated by XM is small, please note that you may be required to file a tax return if you have income from overseas FX trading other than XM, resale income from auctions and flea market sites, manuscript fees, speaking fees, royalties, etc.

Please note that you must submit your tax return to the tax office in your jurisdiction and pay your taxes within the specified period. To ensure a smooth tax return process, we recommend that you familiarize yourself with the tax return system, procedures, and required documents.

XM tax return method and taxes

Filing a tax return is a series of procedures that are carried out to determine the amount of tax owed from income earned during the year from January 1st to December 31st each year. Those who are required to file a tax return must prepare and submit the tax return to the tax office in their jurisdiction within the designated period (usually February 16th to March 15th). Please note that if you fail to file or are late in filing, you may be subject to additional tax as a penalty.

Please note that there are various cases for filing tax returns depending on the individual’s income, deductions, etc. If you are unsure whether you can deduct an expense as a necessary expense or what type of income it falls into, please consult your local tax office or a tax accountant.

-

The taxable income for tax returns is the profits and losses realized by settling positions between January 1st and December 31st. Open positions with unrealized losses or profits do not need to be included in the calculation.

If you make a profit from trading with XMTrading, the income threshold for when you need to file a tax return differs between salaried and non-salaried individuals. Salaried individuals who are employed by a company and receive a salary, such as company employees, part-timers, and part-timers, are required to file a tax return if they make more than 200,000 yen per year , while non-salaried individuals who do not receive a salary, such as full-time traders, sole proprietors, and full-time housewives , are required to file a tax return if they make more than 480,000 yen per year .

If you are a “salaried worker” and need to file a tax return

Salaried workers are required to file a tax return if they make a profit of over 200,000 yen per year from trading with XM . Even if the profit made with XM is less than 200,000 yen or even if it is a loss, if the combined profits from overseas FX trading other than XM and miscellaneous income from side jobs (resale income from auctions and flea market sites, manuscript fees, lecture fees, royalties, etc.) exceed 200,000 yen, they are required to file a tax return .

If you are a “non-salaried worker” and need to file a tax return

Non-salaried individuals are required to file a tax return if they make a profit of over 480,000 yen per year from trading with XM . Even if the profit made with XM is less than 480,000 yen or even if there is a loss, if the combined profit from overseas FX trading other than XM, business income, manuscript fees, speaking fees, etc., exceeds 480,000 yen, they are required to file a tax return.

-

Please note that if your salary income exceeds 20 million yen or you receive your salary from two or more places, you will be required to file a tax return regardless of the amount of profit you make from overseas FX trading, including with XM.

-

If you are a student, a full-time housewife, or a full-time househusband and are dependent on your parents or spouse, you may no longer be considered a dependent if your trading profits or other income increase, and you may no longer be eligible for various deductions.

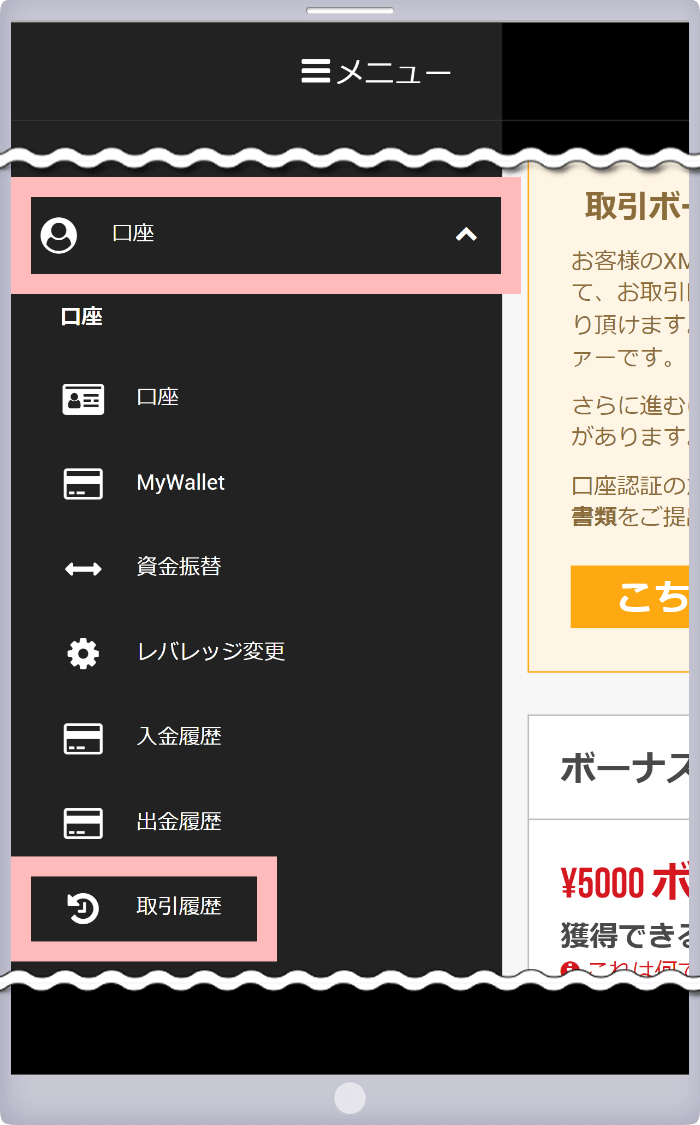

XM’s annual profit amount can be checked on the member page or XM app.

You can easily check your annual profits at any time on your member page or the XM app. We recommend that you regularly check your profits and prepare for a smooth tax return filing process.

To check your XM annual profit amount on the XM member page, log in to the member page, click “Account” from the menu, and select “Trading History.”

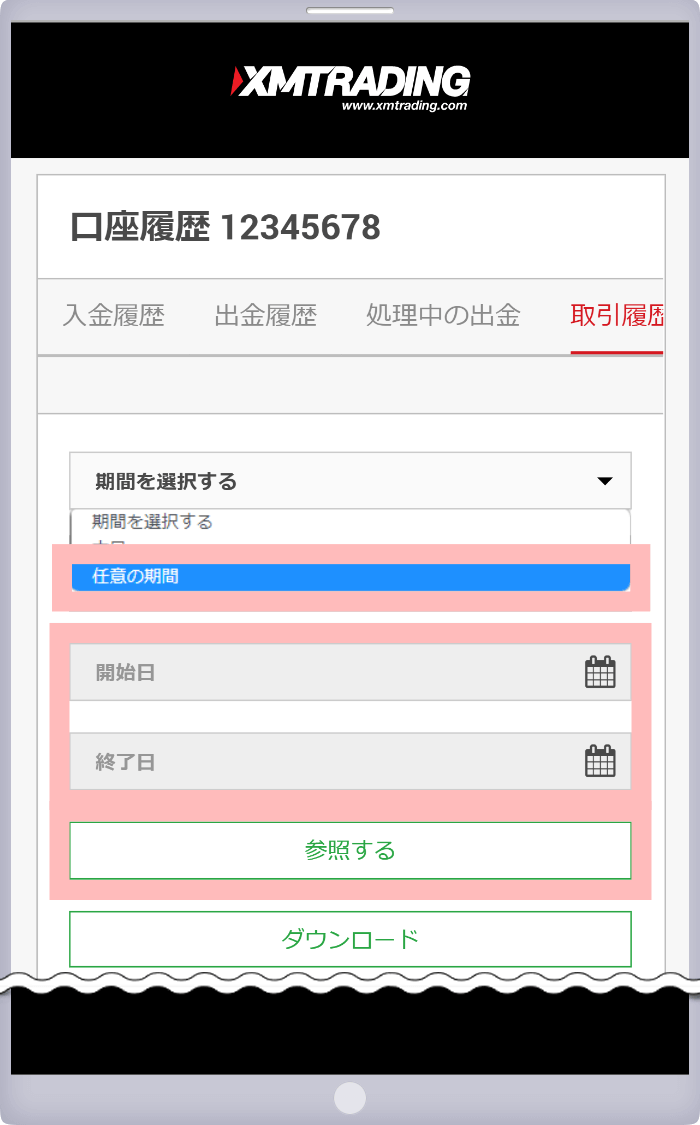

XMの年間利益額をXM会員ページで確認するには、会員ページへログインし、メニューより「口座」をタップし「取引履歴」を選択します。

The account history screen will be displayed. Select “Any period” from “Specify period”, specify the period, and click “View”.

口座履歴画面が表示されますので、「期間を指定する」より「任意の期間」を選択して期間を指定し「参照する」をタップしてください。

Please refer to the link below to find out how to check your XM annual profits using the XM Trading app (XM smartphone app) . By using the XM app, you can easily check your trading history even when you are on the go.

Currently, the iOS version of the XMTrading app cannot be installed.

Profits generated from trading with overseas FX brokers such as XMTrading and domestic FX brokers are classified as the same “miscellaneous income.” However, because the taxation methods for overseas FX and domestic FX are different , the amount of tax paid will differ even if the profit amount is the same, and there are also differences in the offset of profits and losses and loss carryforward.

Differences in tax systems between XM (overseas FX) and domestic FX

| item | XMTrading (overseas FX) | Domestic FX |

| income classification | Miscellaneous income | |

| Tax classification | Comprehensive taxation | Separate self-assessment taxation |

| tax rate | progressive taxation | Flat rate 20.315% (*) |

| Profit and loss offset | Possible between “miscellaneous income subject to comprehensive taxation” | Possible between “miscellaneous income related to futures trading” |

| Loss carryforward | Not possible | Can be carried forward for three years |

| 所得区分 | |

| XMTrading (海外FX) |

雑所得 |

| 国内FX | |

Until December 31, 2037, a flat rate of 20.315% will be applied, with a 0.315% reconstruction tax added to the 20% rate.

income classification

The income category applied to profits from XMTrading is ” miscellaneous income ,” the same as domestic FX. However, even if it is the same miscellaneous income, the tax classification is different between “comprehensive taxation” and “separate declaration taxation,” so the taxation method differs.

Tax classification

The tax category applied to profits from XMTrading is ” comprehensive taxation .” Profits made with XM are calculated by combining them with income that is subject to comprehensive taxation, such as salary income, business income, and real estate income. On the other hand, profits made from domestic FX trading are subject to “separate taxation,” and taxes are calculated separately from other income.

Income subject to comprehensive taxation

-

business income

-

Real estate income

-

Salary income

-

Interest income

-

dividend income

-

capital gains

-

temporary income

-

Miscellaneous income

-

Depending on the type of income, you may be able to choose between comprehensive taxation or separate declaration taxation, or some income may be classified as separate declaration taxation.

tax rate

The tax rate applied to profits from XM is a ” progressive tax .” The tax rate increases as profits increase, and a flat 10% local tax is levied in addition to income tax. The total amount of income subject to comprehensive taxation is the taxable amount, so you must also take into account income other than profits generated from XM trading.

On the other hand, domestic FX is taxed at a flat rate of 20.315% including local tax, and the same tax rate applies regardless of whether the profit is small or large.

Progressive tax rates applied to annual income (including XM profits)

| Annual income amount | Income tax (*) | Deduction amount | Resident tax |

| Under 1.95 million yen | 5% | 0 yen | 10% |

| Over 1.95 million yen to 3.3 million yen | 10% | 97,500 yen | 10% |

| Over 3.3 million yen to 6.95 million yen | 20% | 427,500 yen | 10% |

| Over 6.95 million yen to under 9 million yen | twenty three% | 636,000 yen | 10% |

| Over 9 million yen to 18 million yen | 33% | 1,536,000 yen | 10% |

| Over 18 million yen to 40 million yen | 40% | 2,796,000 yen | 10% |

| Over 40 million yen | 45% | 4,796,000 yen | 10% |

| 195万円以下 | |

| 所得税(*) | 5% |

| 控除額 | 0円 |

| 住民税 | 10% |

Until December 31, 2037, a 2.1% special reconstruction income tax will be added to your income tax.

As mentioned above, if your total annual income, including profits from XM trading and other income, exceeds 3.3 million yen, you will be required to pay 30% tax on your income (20% income tax + 10% local tax), meaning that domestic FX trading will result in a lower tax rate.

While domestic FX trading offers advantages in tax terms alone, overseas FX trading offers attractive trading environments not found in domestic FX trading. For example, XM offers a Standard Account, which allows you to take full advantage of bonus campaigns that can be used as trading capital, as well as the Zero Account and KIWAMI Account, which feature tight spreads, allowing you to choose the account that best suits your trading style. The KIWAMI Account offers ultra -low spreads, no transaction fees, and no swaps, minimizing trading costs while allowing you to enjoy dynamic, capital-efficient trading with high leverage of up to 1,000x. When you open a new KIWAMI Account through this website, you will receive a ¥ 15,000 account opening bonus (trading bonus) that can be used toward trading. The usual ¥3,000 bonus is being specially increased for a limited time, allowing you to start trading without depositing funds. Take advantage of this opportunity to experience the high-spec trading of overseas FX trading that is not possible with domestic FX trading.

Profit and loss offset

Profits (losses) made on XMTrading cannot be offset against losses (profits) made on domestic FX . Because overseas FX is subject to “comprehensive taxation” and domestic FX is subject to “separate taxation,” the profits and losses made on each transaction cannot be offset, and all profits are subject to tax.

However, it is possible to offset losses incurred from overseas FX other than XM, or from cryptocurrencies, which are classified as “miscellaneous income” under the same “comprehensive taxation” as XM. By offsetting losses, you can reduce the amount of tax you pay, so please be sure to remember to declare your losses.

Loss carryforward

If you incur a loss during the year trading with XMTrading, you cannot carry that loss forward to the following year or later . With domestic FX, if you file a tax return, you can carry forward losses incurred in the same year for up to three years. For example, even if you incur a loss of 1 million yen in the first year, if you make a profit of 1 million yen in the second and third years, the loss will be offset against the profit and loss and will not be taxed at ±0 yen.

Loss carryover is a system that allows you to offset profits and losses over a three-year period and reduce the profits you declare, but please note that it does not apply to overseas FX, including XM.

Tax returns for overseas FX may be at a disadvantage compared to domestic FX in terms of tax rates, but overseas FX offers favorable trading environments such as high leverage and zero-cut systems. XMTrading is popular with many Japanese users for its attractive services, including generous bonus campaigns that can be used as trading funds, so you can enjoy trading with peace of mind.

When filing your tax return for profits earned from trading with XMTrading, you will need to prepare a tax return and submit it to the tax office in your area. Tax returns are created by transcribing documents that show your income, deductions, etc., so preparing these in advance will help you complete your tax return smoothly.

When submitting your tax return, you may be required to attach documents that verify the contents of your return. This will vary depending on the contents of your return and the method of filing, but if you use e-Tax (National Tax Electronic Filing and Payment System), which can be completed entirely online, you will be able to omit the need to attach documents in many cases.

Documents required for filing tax returns

-

tax return

-

Withholding tax slip

-

Deduction certificate

-

Expense receipts

-

Annual Transaction Report

-

My Number Card (individual number) or identification document

tax return

When filing your tax return, you must submit a tax return form as specified by the National Tax Agency. Tax return forms are available at your local tax office or municipal office, and can also be printed and used from the National Tax Agency’s website. There are two types of tax return forms: “Tax Return Form A” and “Tax Return Form B.” However, starting in 2023, “Tax Return Form A” will be abolished and replaced with “Tax Return Form B,” so please be sure to obtain the latest tax return form.

To file your tax return, you can follow the instructions on the National Tax Agency’s website’s “Tax Return Creation Corner” to create your tax return by entering amounts and other information, then print and submit it. Alternatively, if you have a My Number card and a device that can read My Number cards, or if you have registered the ID and password method, you can submit your tax return via e-Tax from the “Tax Return Creation Corner.” Regardless of the submission method, using the “Tax Return Creation Corner” will automatically calculate the tax amount by subtracting deductions from your income and multiplying it by the specified tax rate, preventing calculation errors.

What is e-Tax?

e-Tax (National Tax Electronic Filing and Payment System) is a system that allows you to file and report income tax and other taxes online. By visiting the “Tax Return Preparation Corner” on the National Tax Agency’s website, you can complete the entire process from preparing your tax return to submitting it to the tax office and paying your tax using your PC or smartphone.

To submit your tax return via e-Tax, you will need your My Number card and a smartphone that can read My Number cards or an ID card reader/writer. If you do not have a My Number card or a device that can read My Number cards, you can submit your tax return via e-Tax by entering the ID and password issued after applying in person or by mail to the tax office.

The “ID/password method” is a temporary measure until My Number cards and devices capable of reading My Number cards become widespread.

Withholding tax slip

Salaried workers will need a “Withholding Tax Certificate” when filing their tax return. The Withholding Tax Certificate is a document that lists the amount of income, deductions, income tax, etc. for the year from January 1st to December 31st, and is issued by your employer around mid- to late December. Please note that the Withholding Tax Certificate is used when preparing your tax return, and there is no need to submit the original or a copy to the tax office.

Deduction certificate

If you are eligible for various deductions, you will need the appropriate deduction certificate. Deductions are amounts that can be deducted from your taxable amount and are broadly categorized into “income deductions” and “tax credits.” Income deductions reduce your taxable income and come in a variety of forms, including social insurance premiums, life insurance premiums, iDeCo premiums, small business mutual aid premiums, and hometown tax donations. Tax credits reduce your tax amount and include mortgage deductions and dividend deductions.

In addition, if you have not been issued a document certifying your deductions, such as spouse deductions or single parent deductions, you are permitted to fill in or input your family structure, dependent status, etc. in your declaration. In many cases, you can omit attaching a deduction certificate.

Main types of income deductions

-

Spouse deduction

-

medical expense deduction

-

Miscellaneous loss deduction

-

Special spouse deduction

-

Dependent deduction

-

Social insurance premium deduction

-

Small business mutual aid premium deduction

-

Life insurance premium deduction

-

Earthquake insurance premium deduction

-

Donation deduction

-

Disability deduction

-

Single parent deduction

-

Widow/widower deduction

-

Working student deduction

Expense receipts

If you are declaring expenses related to XM trading as an expense, you will need a receipt for the expense. Please make sure that the receipt includes the date, recipient’s name, amount, content, and payee. Receipts are acceptable as long as they show that the expense was necessary for XM FX trading and was paid during the reporting period.

Please note that you do not need to submit receipts for expenses when filing your tax return, but you are required to keep them for seven years (five years for white tax returns) after filing your tax return, so please be careful not to discard them. The main necessary expenses for XM’s tax return are as follows.

General expenses for FX trading

-

For information on books and seminar participation fees related to FX, click here

-

For information on travel and accommodation costs for attending FX seminars, click here.

-

For information on entertainment expenses with FX-related people and companies, click here

FX-related books and seminar participation fees

The cost of books purchased to learn about FX, as well as participation fees for paid seminars and online salons, can be recorded as expenses. Paid market information and paid app purchases for recording trades can also be recorded as expenses. Stationery such as notebooks and pens purchased to study FX can also be recorded as expenses.

Travel and accommodation costs for attending seminars on FX

Travel and accommodation costs incurred when attending a seminar on FX can be recorded as necessary expenses. This includes train, bus, and taxi fares used to travel to the seminar venue, as well as hotel costs if you attend a seminar in a distant location that is difficult to return to in a day.

Entertainment expenses with FX-related people or companies

Entertainment expenses, including food and drink costs incurred at dinners with FX-related people or companies, or at seminar social gatherings, can be recorded as necessary expenses. However, in cases where you meet with an acquaintance who is knowledgeable about FX at a restaurant to obtain information, it is difficult to prove that the expense is necessary. Please note that even if the expense was actually necessary, it will not be recognized as a necessary expense unless you can prove that it was “expenses incurred to obtain information about FX.”

Internet communication costs

Internet communication costs can be recorded as necessary expenses related to FX trading. Since FX trading is conducted via the Internet, they are considered one of the necessary expenses for FX trading. If you rent an office exclusively for FX trading and use the Internet connection only for FX-related purposes, all or part of the costs may be recognized as necessary expenses.

However, if you are using your home internet connection to trade FX, it is unlikely that it will be recognized as a necessary expense. Since you may use your internet connection for purposes other than FX, if you want to deduct it as an expense, please declare it by dividing the amount used between FX and other purposes.

Purchase costs and monthly usage fees for devices used for FX trading, such as PCs and smartphones

Purchase costs and monthly fees for computers, smartphones, etc. used for FX trading can also be recorded as expenses. However, if you use equipment for both work and personal use, you must only record the portion used for FX trading as an expense.

Also, please note that expensive items that are used over a long period of time, such as computers, smartphones, and PC monitors, are subject to “depreciation .” If the purchase price of the equipment is less than 100,000 yen, it can be recorded as a consumable item and expensed in one lump sum on that year’s tax return, but if the purchase price of the equipment is 100,000 yen or more, it must be depreciated over three years, and if it is 200,000 yen or more, it must be depreciated over four years.

Depreciation of equipment used in FX trading

| Less than 100,000 yen |

Expense the entire amount as consumables for that year

|

|---|---|

| 100,000 yen or more but less than 200,000 yen |

Purchase price is expensed over a useful life of 3 years

|

| Over 200,000 yen |

Purchase price is expensed over a useful life of four years

|

Depreciation is calculated by dividing the purchase price by the useful life and the number of months used.

Example 1) Depreciation expenses for a PC purchased in July for 250,000 yen (for FX trading only)

250,000 yen ÷ 4 years × (6 months ÷ 12 months)

= 31,250 yen

Example: Depreciation expenses for a PC purchased in April for 250,000 yen (40% used for FX trading)

250,000 yen ÷ 4 years × (9 months ÷ 12 months)

× 40% = 18,750 yen

Rent and utility bills

If you rent an office exclusively for FX trading, you can deduct the rent and utility costs as business expenses. Also, if you are registered as a sole proprietor and use a room in your home as a trading room, you can deduct a portion of the rent and utility costs pro rata for the portion used for FX trading as business expenses.

VPS rental fees and EA (automated trading) software purchase costs

Rental fees for the VPS (Virtual Private Server) required for FX EA (automated trading) trading and the cost of purchasing EA software can be recorded as business expenses. If you are using the “XMTrading VPS” for a fee, a monthly usage fee of $28 (or equivalent) will be automatically deducted from your MT4/MT5 account on the 1st of each month. Please note that since this is deducted from your trading account’s MT4/MT5 balance, it is automatically added to the profits and losses generated by your XM trading and deducted as a necessary expense, and cannot be recorded as a separate necessary expense.

-

The final decision on whether an expense is deductible as a necessary expense is made by the tax office.

-

If the expenses you recorded are not recognized as necessary expenses, you will need to amend your tax return.

About XM’s free VPS service

XM will provide the “XMTrading VPS” which normally has a monthly usage fee of $28 (equivalent) free of charge to anyone who meets the following conditions.

-

Have a minimum balance of $1,000 (or equivalent) in your trading account

-

Completed a trade of 5 standard lots (500 micro lots) or more in a round-trip in FX currency pairs, gold or silver in the past 30 days

You can easily apply for “XMTrading VPS” from the XM member page. This service is only available to those who have an XM account, so please make use of it.

Even if you do not meet the above conditions, you can still use “XMTrading VPS” for $28 (equivalent) per month.

Annual Transaction Report

When filing your tax return for profits and losses incurred from trading with XMTrading, you will need to submit an annual trading report (trading history report). The annual trading report is a report that checks your trading history and total profits and losses for the year, and can be easily obtained using the MT4 or MT5 you used for trading. This is a report per account, so if you trade with multiple accounts, be sure to obtain it properly.

Click here for instructions on how to obtain your MT4/MT5 annual trading report.

My Number (individual number) or identification document

When filing your tax return, you will need to write or enter your My Number (individual number). Your My Number (individual number) can be found on your My Number Card, or if you have not been issued one, on your Individual Number Notification or Resident Record.

Please note that if you do not have a My Number card and you submit your tax return at a tax office counter or by mail, you will need to provide your Individual Number Notification or resident registration card, which contains your My Number, as well as identification such as a driver’s license or passport that can verify your identity as the owner of the My Number.

XMTrading’s annual trading report (trading history report) can be easily obtained from MT4/MT5’s “Account History”.

How to obtain your MT4/MT5 annual trading report

-

Steps: 1

View MT4/MT5 account history

Log in to XMTrading’s MT4/MT5 with the trading account ID for which you wish to file your tax return, and display “Account History” in the “Toolbox.”

-

Steps: 2

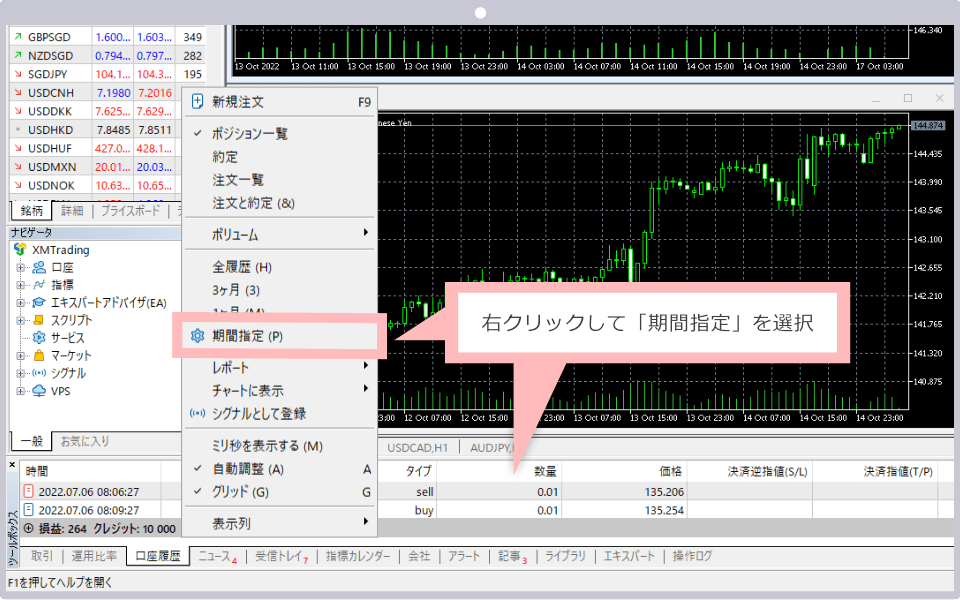

Select a time period

When “Account History” is displayed, right-click and select “Specify Period.”

-

Steps: 3

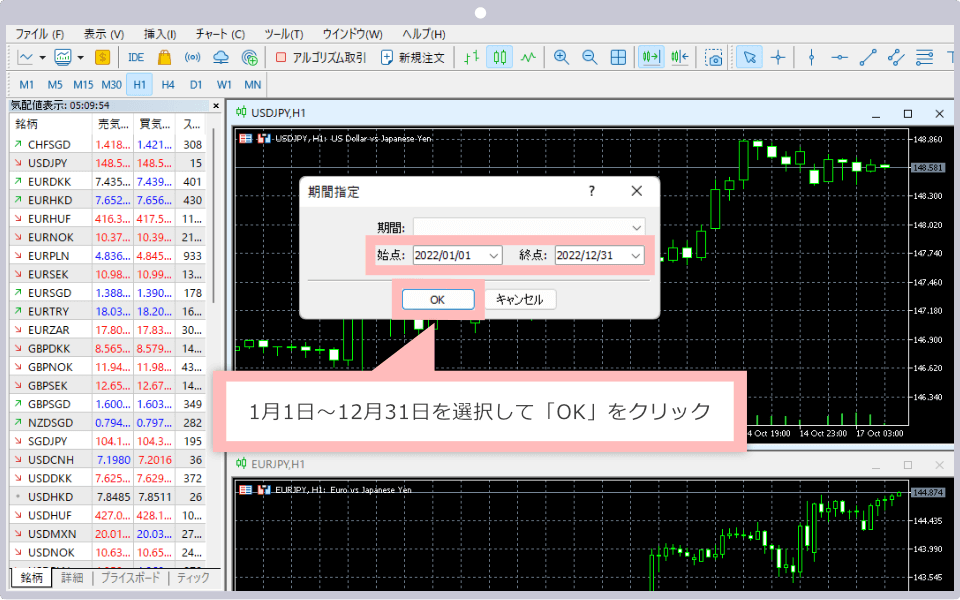

Specifying a period

On the “Specify Period” screen, select “January 1st” as the start date and “December 31st” as the end date, then click “OK.”

-

Steps: 4

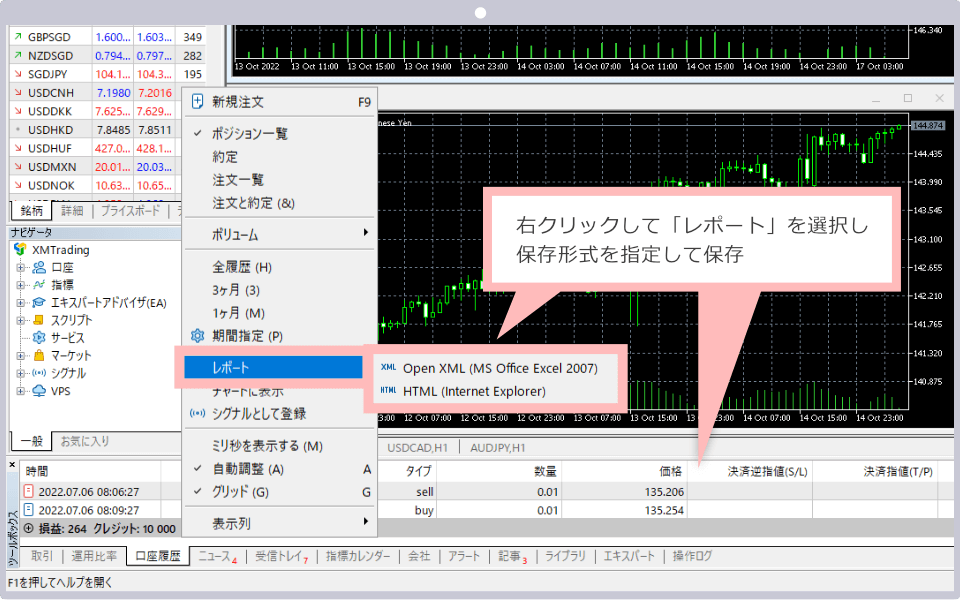

Saving a Report

The transaction history from January 1st to December 31st specified in “Account History” will be displayed. Right-click and select “Report” , then specify the save format as “XML” or “HTML” and save it to any location on your PC.

XML will be saved in Excel format and the annual trading report will be displayed in Excel. HTML will be saved in HTML format and the annual trading report will be displayed in a browser.

You can also view your annual trading report from the account history on your smartphone’s MT4/MT5 app, but please note that it cannot be saved on your device.

How to read the annual transaction report (transaction history report)

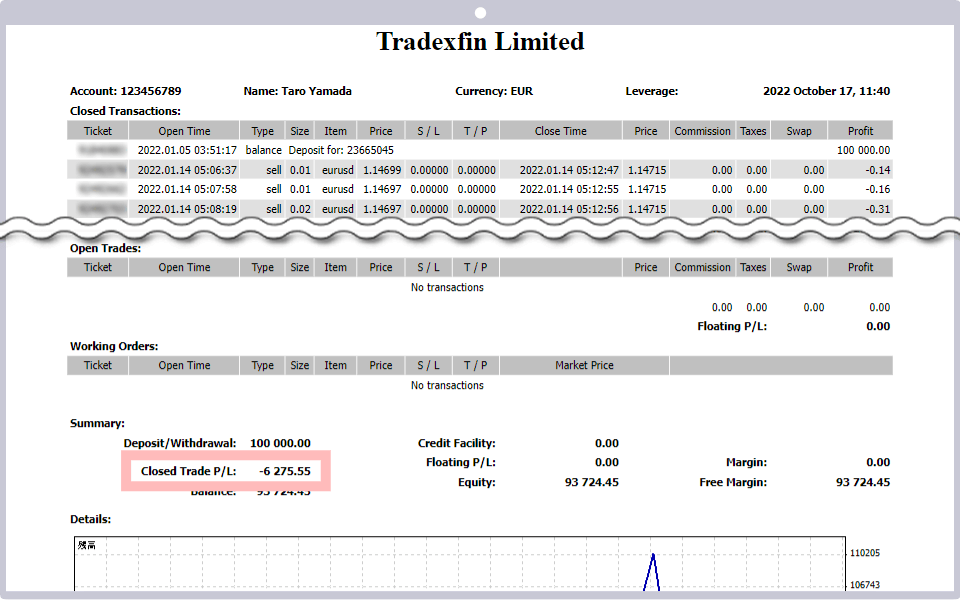

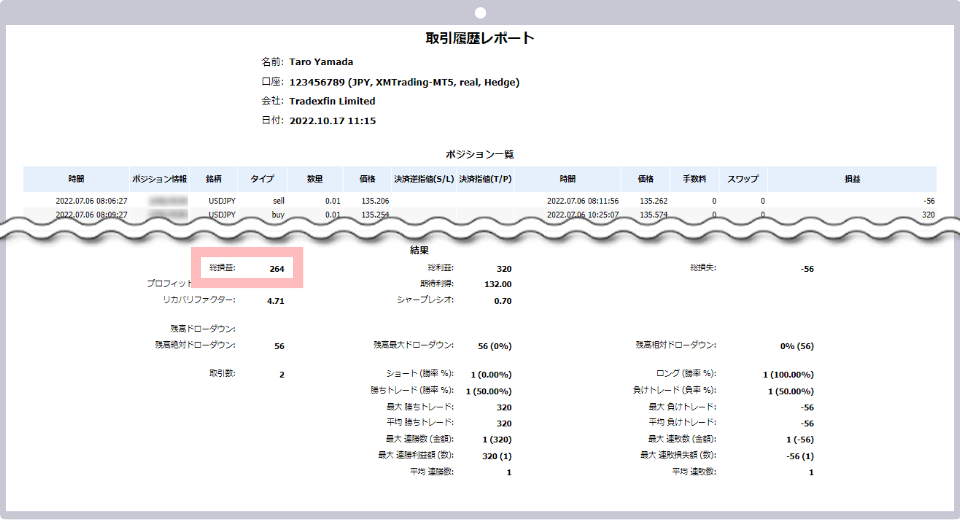

XMTrading’s annual trading report (trading history report) allows you to check a variety of information, including your trading history for the past year, win/loss ratio, and profit factor. The report is also viewed differently between MT4 and MT5. While the annual trading report (trading history report) contains a wealth of information, the only items you need to check when filing your tax return are “Closed Trade P/L” for MT4 and “Total P/L” for MT5.

“Closed Trade P/L” or “Total Profit/Loss” is the total of losses and profits incurred in trading with XM over the course of a year, so if you have multiple XM accounts or overseas FX accounts other than XM, please add up the “Closed Trade P/L” / “Total Profit/Loss” of all your accounts and declare them.

How to read the MT4 annual trading report

MT5 Annual Trading Report

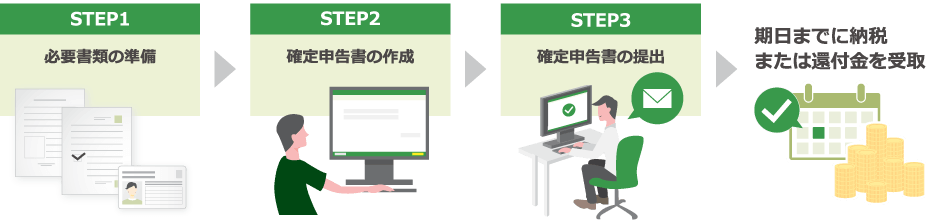

Here’s how to file a tax return for profits earned from trading with XMTrading. Please prepare the necessary documents for filing your tax return, fill out or input the appropriate information on the tax return form to calculate your income tax amount. Once you have completed your tax return, your tax return will be complete. Please pay your taxes by the due date using the specified method.

Preparation of tax return

Please prepare the necessary documents and fill out your tax return. The procedure for filling out your tax return is as follows:

Click here for documents required for filing tax return

-

If you are completingyour tax return by hand

-

When usingthe tax return preparation corner

-

-

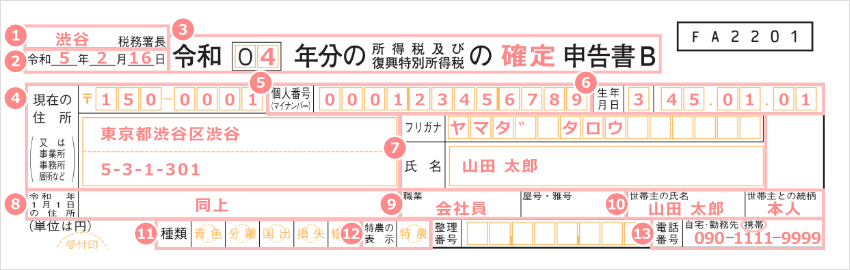

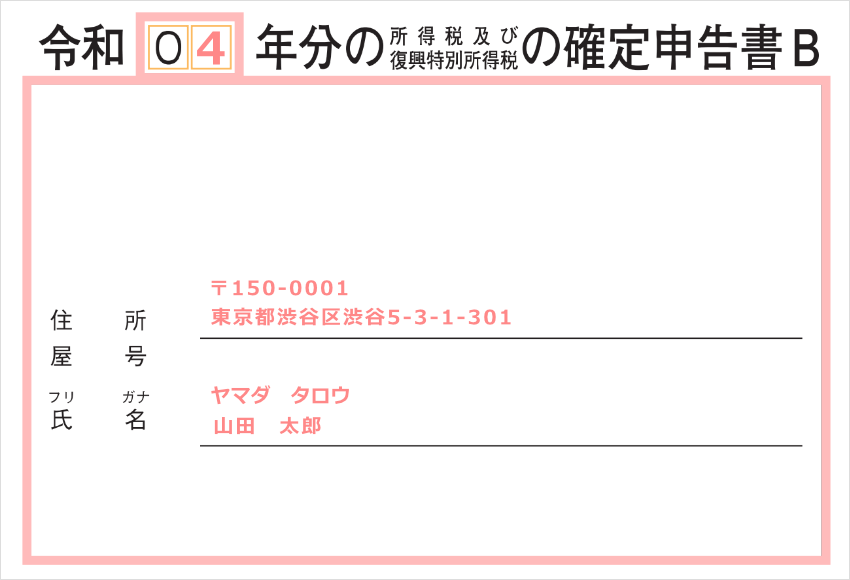

Steps: 1

Fill in your personal information

At the top of the first page of the tax return, fill in the following information, including your personal information such as your address, name, date of birth, My Number (personal identification number), and the name of your local tax office.

1The local tax office Example: Shibuya 2Date of filing of tax return Example ) February 16 , 2020 3title Example: 04 Confirmed 4Current address Example) 5-3-1-301 Shibuya, Shibuya-ku, Tokyo 150-0001 5Individual Number (My Number) Example: 000123456789 6date of birth Example: 3.45.01.01 7Name and furigana Example: Yamada

Taro8Address as of January 1st of the year you are filing Example: Same as above 9Occupation/trade name/pen name (B only) Example: Company employee/No entry 10Name and relationship of head of household Example: Taro Yamada / himself 11Type (B only) No entry 12Extra thick display (B only) No entry 13telephone number Example) Mobile number: 090-1111-9999 ①For the local tax office , please fill in the name of the tax office nearest you.

②Please enter the date of submission of the tax return in numbers only.

③In the title , write the year of the tax return period, and write “Final” in the blank immediately before Return Form B.

④ For current address , please fill in your current address from postal code to house number and room number. If you are self-employed and paying taxes at the address of your office or business, circle either business, office, or residence, and fill in the address of your office in the top row and your residential address in the bottom row.

⑤Please enter your personal identification number (My Number) correctly.

⑥Please enter your date of birth starting with the era name. The numbers corresponding to the era names are as follows:

Meiji 1 Taisho 2 Showa 3 Heisei 4 Reiwa 5 ⑦For Name and Furigana , please enter your full name in kana and kanji.

⑧ If your address as of January 1st of the year you are filing is the same as the address in ④, please write “Same as above.” If it is different from the address in ④, please write your address.

⑨ If you have an occupation/trade name or pen name, you must fill it in. If you are a sole proprietor, fill in the occupation section with detailed information about your occupation, such as “XX retail business” or “XX sales business,” and then fill in your trade name or pen name.

⑩ For the name and relationship of the head of household , please enter the name of the head of household and your relationship to the head of household. If you are the head of household, please write “myself.”

⑪For type , please circle all that apply to you: “Blue return filer,” “Those who use Form 3 of the tax return,” “Those subject to the overseas emigration tax system,” or “Those who use Form 4 of the tax return.” If you do not fall into any of these categories, you do not need to fill in the form.

⑫ For the “Extra-rich” label , please circle only if you are a special farmer. If you are not, there is no need to fill it in.

On the second page of your tax return, please also fill in the year of the declaration period in the title, as well as your address, name (in katakana), and business name.

-

Steps: 2

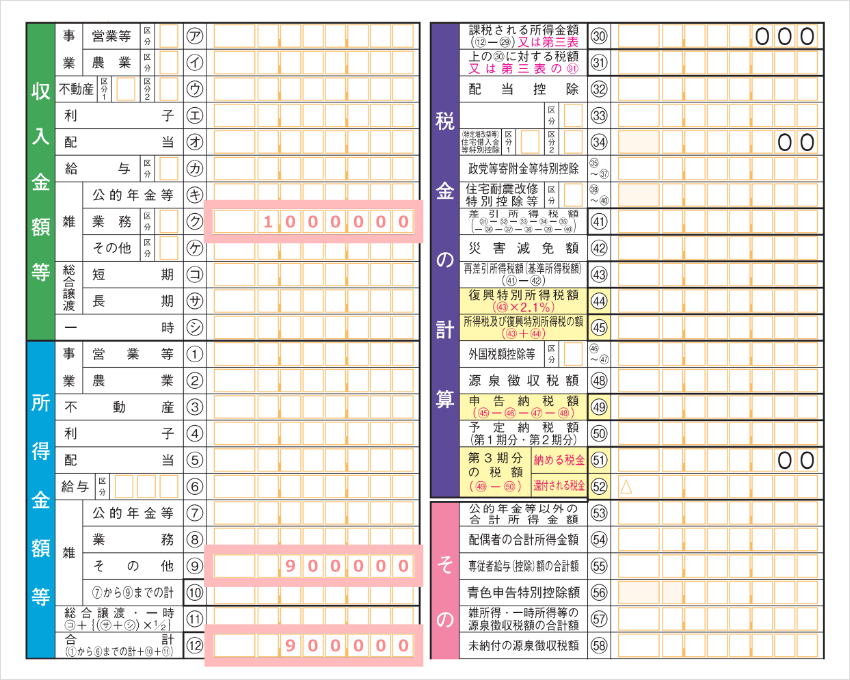

Enter XM profits (miscellaneous income)

Profits generated from trading with XM should be entered in the “Income Amount, etc.” section of Form 1 of your tax return. In addition, enter your final income amount after deducting necessary expenses in the “Income Amount, etc.” section. Enter the amount listed in “Closed Trade P/L” or “Total Profit/Loss” on your XM annual trading report. However, if you also trade with overseas FX or virtual currencies other than XM, enter the total amount of all of these.

In “K” of the income amount, etc., enter the total profit or loss incurred from overseas FX trading, including XM. Next, enter the amount obtained by subtracting necessary expenses from the income amount entered in “K” in ⑨ of the income amount, etc. Enter the “total amount of ⑦ to ⑨” in ⑩ , and calculate “total of ① to ⑥ + ⑩ + ⑪” and enter this in ⑫ .

Example) If XM profit is 1,000,000 yen, necessary expenses are 100,000 yen, and there is no income other than XM

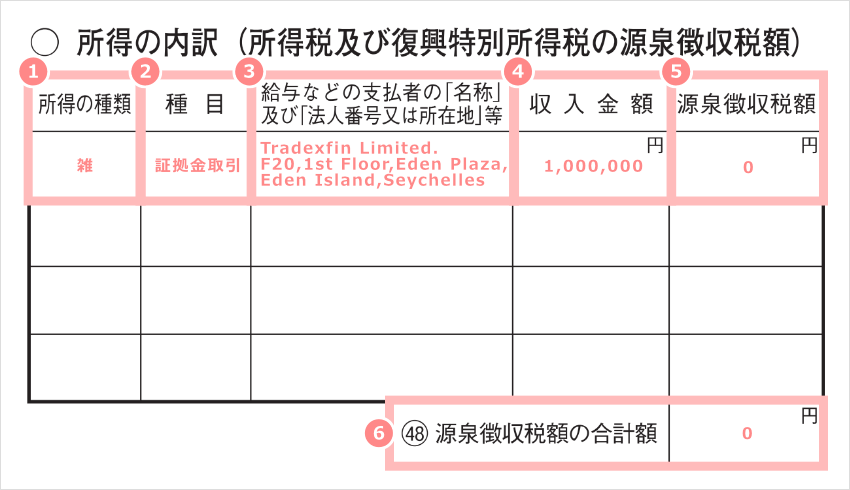

Next, enter the amount of income and detailed information about the amount of income you entered in ① in the “Income Breakdown (Amount of Income Tax and Special Reconstruction Income Tax Withheld)” section on the second page of your tax return.

If the income amount entered in “Q” includes profits earned from overseas FX other than XM, enter all of it in the “Income Breakdown” section.

1Type of income Example: Miscellaneous 2Event Example: Margin trading 3Name and

corporate number or address of payer of salary etc.Example) Tradexfin Limited.

F20,1st Floor,Eden Plaza,Eden Island,Seychelles4Income amount Example: 1,000,000 yen 5Withholding tax amount Example: 0 yen 6Total amount of withholding tax Example: 0 yen ① Enter “Miscellaneous” or “Miscellaneous Income” as the type of income .

② Enter “Margin Trading” as the type of transaction to indicate that it is an overseas FX transaction.

③For the “Name” and “Corporate Number or Address” of the payer of salary, etc. , enter XM’s company name “Tradexfin Limited.” and address “F20, 1st Floor, Eden Plaza, Eden Island, Seychelles.”

④ Enter the amount of income before deducting necessary expenses.

⑤ Enter “0” yen for the amount of withholding tax . *There is no withholding tax for overseas FX.

-

If you have income other than overseas FX including XMTrading, such as salary income, public pension, investment products such as stock trading and investment trusts, real estate investment, etc., please enter the amount of income etc. in the appropriate section.

-

-

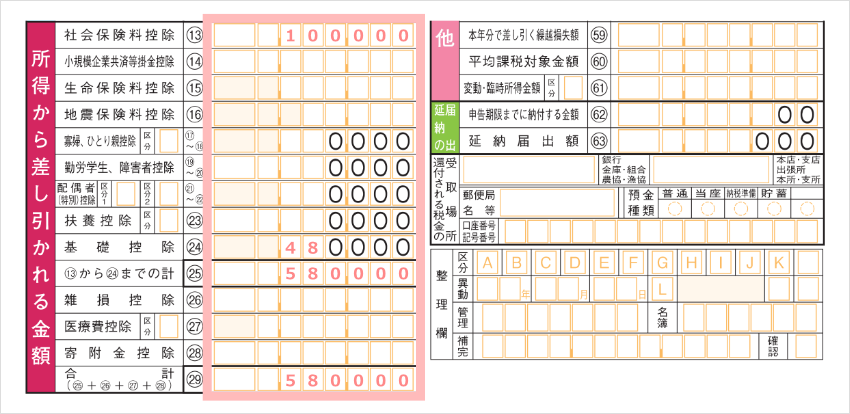

Steps: 3

Enter the deduction amount

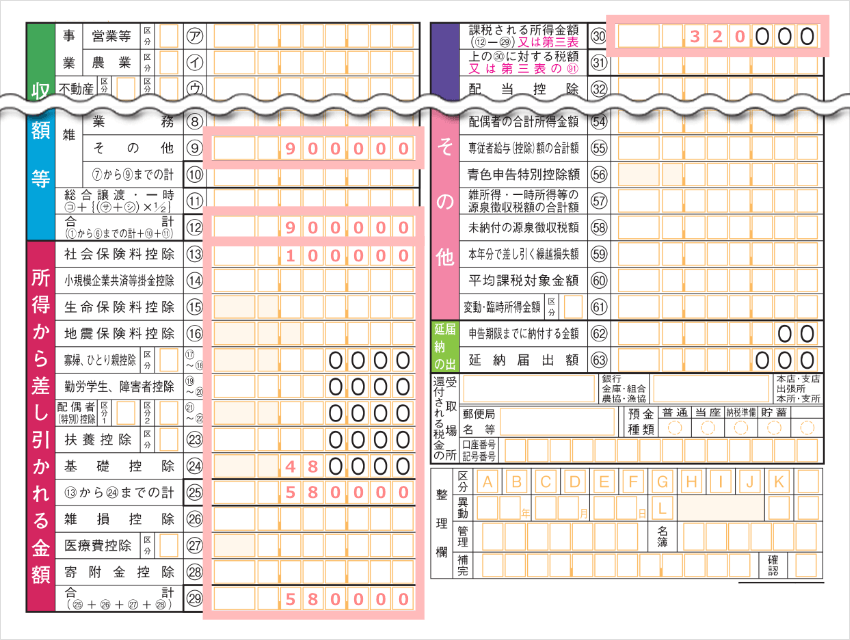

Once you have completed entering all your income amounts, enter the applicable deduction amounts in ⑬ to ㉔ and enter the total amount in ㉕ . If you are eligible for the deductions in ㉖ to ㉘, enter the deduction amount and enter the total amount in ㉙ .

Example) If a basic deduction of 480,000 yen and a social insurance deduction of 100,000 yen are applied

-

Please fill in the details of all deductions other than the basic deduction and the details of dependent deductions on the second page of the final tax return.

-

-

Steps: 4

Income tax calculation

Once you have completed entering all your income and deductions, including profits from XMTrading transactions, you can calculate your tax liability. Subtract your deductions from your income to calculate your taxable amount, which is then multiplied by the tax rate to calculate your income tax.

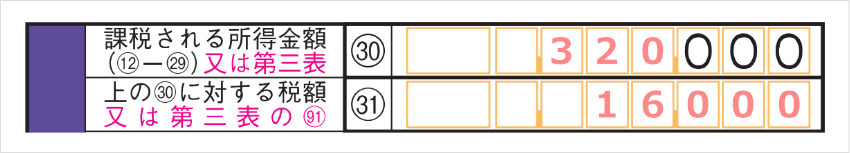

Subtract the amount in ㉙ of “Amount to be deducted from income” from the amount in ⑫ of “Income amount, etc.” on Form 1 of the final tax return. Enter the calculated amount in ㉚ of “Tax calculation.”

Any fraction less than 1,000 yen will be rounded down.

Example) ⑫ 900,000 yen – ㉙ 580,000 yen = 320,000 (enter in ㉚)

Refer to the “Calculation method for tax amount on taxable income amount” below to calculate the tax amount by multiplying the determined amount (2) by the tax rate corresponding to the amount and subtracting the deduction amount. Enter the determined tax amount in (2) of “Tax calculation”.

Calculation method for tax amount based on taxable income

Taxable income amount (㉚) Calculation method for tax amount based on taxable income 0 yen 0 yen 1,000 yen to 1,949,000 yen ㉚×5% 1,950,000 yen to 3,299,000 yen ㉚×10%-97,500 yen 3,300,000 yen to 6,949,000 yen ㉚×20%-427,500 yen 6,950,000 yen to 8,999,000 yen ㉚×23%-636,000 yen 9,000,000 yen to 17,999,000 yen ㉚×33% 536,000 yen 18,000,000 yen to 39,999,000 yen ㉚×40%-2,796,000 yen From 40,000,000 yen ㉚×45%-4,796,000 yen 0円 0円 1,000円~1,949,000円 ㉚×5% 1,950,000円~3,299,000円 ㉚×10%-97,500円 3,300,000円~6,949,000円 ㉚×20%-427,500円 6,950,000円~8,999,000円 ㉚×23%-636,000円 9,000,000円~17,999,000円 ㉚×33%536,000円 18,000,000円~39,999,000円 ㉚×40%-2,796,000円 40,000,000円~ ㉚×45%-4,796,000円 Example) 2) If your taxable income is 320,000 yen, applying the above table will result in a tax rate of 5% with no deductions, so the total will be 320,000 yen x 5% = 16,000 yen.

-

Steps: 5

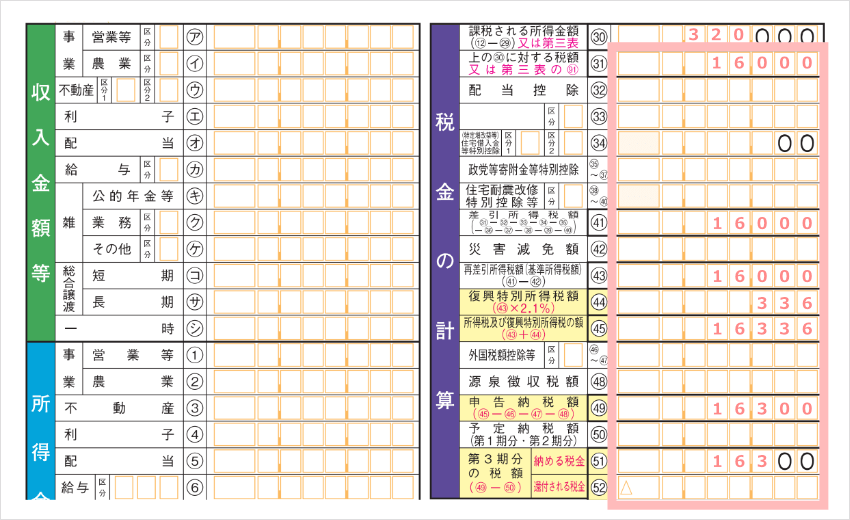

Enter and confirm the amount of tax to be paid

For income earned up to December 31, 2037, a 2.1% special income tax for reconstruction will be added to the income tax. Add the 2.1% special income tax for reconstruction to the tax amount determined in (27) to determine the final tax amount, and enter this in “Tax to be paid” 51. If a refund is due based on the calculations made so far, please enter this in “Tax to be refunded” 52 .

Subtract the amounts listed in (22) through (23) in order and enter the result in (24) . Enter the result of (24) – (25) in ( 26) . Enter the amount obtained by multiplying (26) by the Special Reconstruction Income Tax of 2.1% in (27) and enter the total amount of (28) + (29) in (28) .

Subtract the amounts in (2) through (2) from the amount in (2) and enter the result in (2) . If the number in (2) is in the black, round down any amount less than 100 yen, but if it is in the red, enter the amount as is.

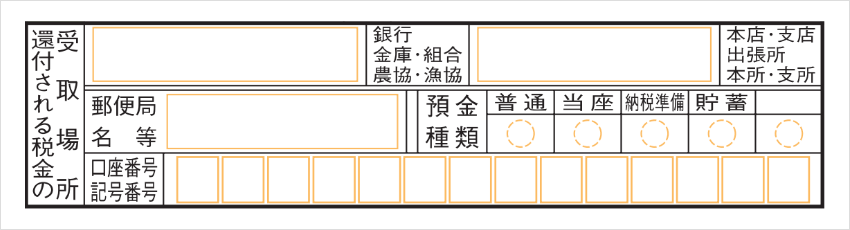

If there is a refund

If you are due a tax refund after calculating your taxes, please enter your bank account information in the “Place to receive the tax refund” section at the bottom right of Page 1 of your tax return. If you submit your tax return in person or by mail, the tax refund will be delivered to your designated account in approximately one to one and a half months.

-

Steps: 6

Other entries

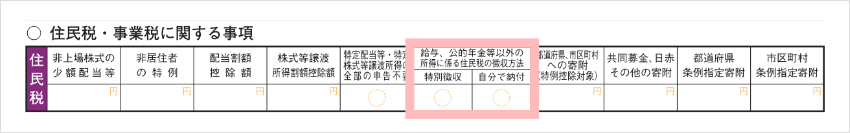

Fill in the required information in the appropriate sections of Form 2 of the final tax return. Salaried employees can choose how to collect resident tax on income earned through XM trading. If you want resident tax to be deducted from your salary, check “Special Collection.” If you pay it yourself, check “Pay by yourself.” If you select “Pay by yourself,” a payment slip will be sent to your current address, so please pay your resident tax by the due date.

-

Filing tax returns

Submit the completed tax return to the tax office by mail, at the counter, or via e-Tax. If you have completed your tax return using the tax return creation corner and have a My Number card and My Number reader, you can choose from all submission methods.

Submitting via e-Tax

The smoothest way to submit your tax return is via e-Tax, where you can simply submit the tax return you created in the tax return creation corner. However, to submit your tax return via e-Tax, you will need your My Number card and a smartphone that can read My Number cards, or an ID card reader/writer. If you do not have a My Number card or a device that can read My Number cards, you can submit your tax return via e-Tax by entering the ID and password issued after applying in person or by mail to the tax office.

Submission by mail

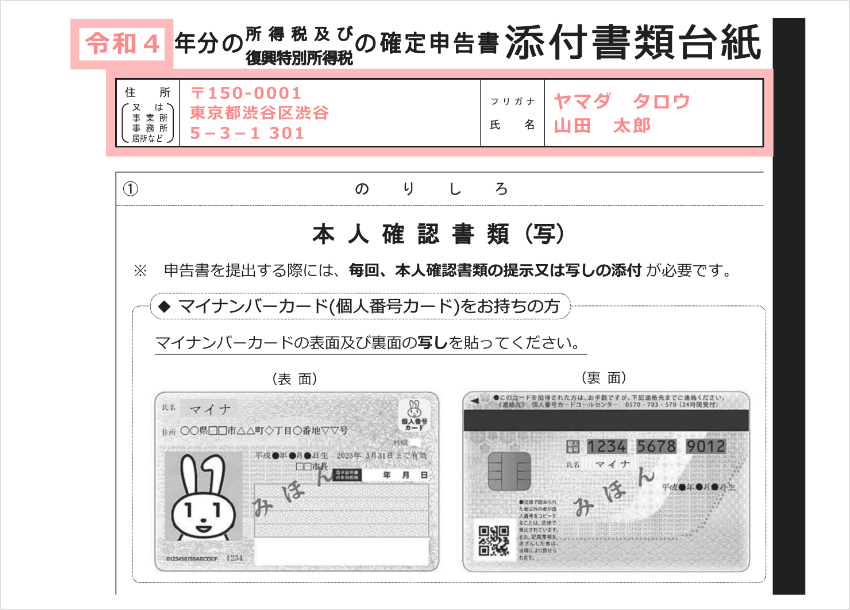

If you are submitting by mail, you will need to attach a copy of your identification document to the tax return attachment sheet and submit it together with your tax return. As with Forms 1 and 2 of the tax return, please be sure to fill in the “Year of tax return filing” and “Address and name (in furigana)” at the top.

The attachment sheets for the documents to be attached to your tax return can be obtained at the tax office counter, just like the tax return itself, or can be printed out and obtained from the National Tax Agency’s website.

When mailing your tax return to your local tax office, please use “Letter Pack,” “Regular Mail,” “Standard Mail,” etc. Please note that tax returns are considered “confidential documents” and cannot be sent by courier.

When submitting by mail, pay attention to the submission date.

If you submit your tax return by mail or letter, the postmark (communication date stamp) will be considered the submission date. If you send it by any other method, the submission date will be the day the tax return arrives at the tax office. If the deadline for submitting your tax return is approaching, we recommend that you take it to a post office counter rather than dropping it in the post, so that you have proof that you submitted it by the deadline.

Submit at the tax office

If you submit the application in person at the tax office in your area, bring the original of your identification document and present it at the reception desk.

Identification documents required for filing tax returns

The identification documents required to submit your tax return differ depending on whether or not you have a My Number card, as follows:

If you have a My Number card

If you have a My Number card, you can verify your My Number (individual number), address, name, and date of birth on your My Number card, so you do not need to submit any other identification documents. If you are submitting by mail, attach a copy of the front and back of your My Number card to the backing of the documents attached to your tax return.

If you do not have a My Number Card

If you do not have a My Number card, you will need a My Number notification card or a resident registration card with your My Number printed on it, along with one of the following identification documents. If you are submitting by mail, attach a copy of each document to the backing sheet for the documents attached to your tax return.

-

driver’s license

-

Public health insurance card

-

passport

-

Physical disability certificate

-

Residence card

etc.

How to pay taxes

If you owe taxes as a result of filing your tax return, you must pay them within the tax return filing period. There are five payment methods as listed below, so please pay using the method you prefer.

Payment method

| Transfer tax payment |

Payment by debit from a designated savings account

|

|---|---|

| Electronic payment | Pay directly using e-Tax or via internet banking |

| Credit card payment | Pay by credit card on the “National Tax Credit Card Payment Site” |

| Convenience store QR payment | Print out the QR code for payment along with your tax return and pay at a convenience store |

| Payment at a financial institution or tax office | Pay in cash at a financial institution or at the tax office in your jurisdiction with a payment slip attached |

If you choose to pay your taxes by bank transfer, you will need to submit a separate “Deposit Account Transfer Request Form and Payment Slip Delivery Request Form.” You can submit this to the tax office together with your tax return, to the bank you designated as your tax withdrawal account, or by sending it via e-Tax.

Pay your taxes by the due date

Once you have completed submitting your tax return, please pay your taxes promptly. The deadline for paying taxes is usually March 15th, the same as the deadline for submitting your tax return. If you use the “tax transfer system” where the tax is deducted from your savings account, you must deposit the tax amount by the transfer date set by the National Tax Agency (usually mid-April). Please note that if you forget to pay your tax or if the payment is not deducted due to insufficient funds, you will be subject to late payment penalties (the tax rate changes annually).

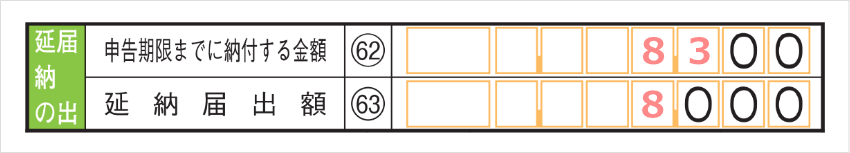

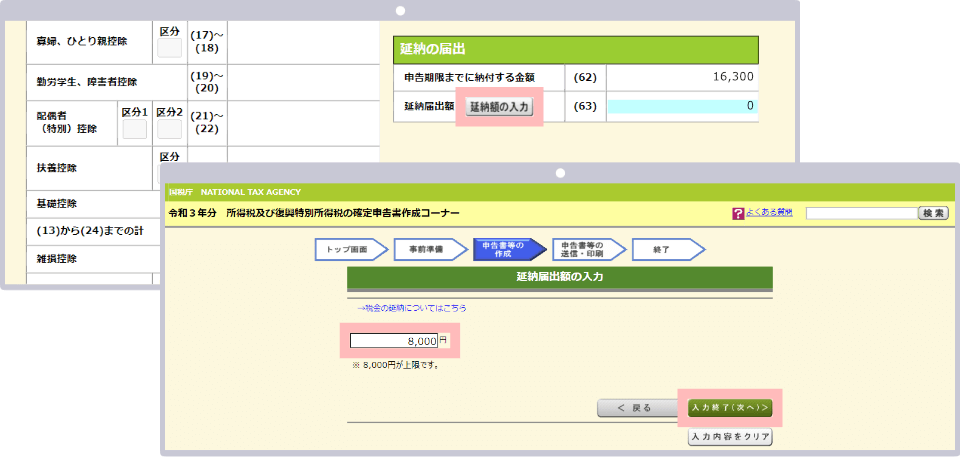

If you know in advance that you will not be able to pay the full amount of your tax by the due date, you can use the “deferral system.” The deferral system is a system that allows you to postpone payment of the remaining amount if you pay more than half of the tax amount by the due date. If you want to use the deferral system, you should write the following in the “Notification of deferral” section of your tax return:

If you are using the tax return preparation corner, the “Notification of Deferral” button will appear on the tax “Calculation Result Confirmation Screen.” Please fill in or input the “Deferral Amount” and “Amount to be paid by the filing deadline.”

Please note the following points when filing your tax return for XMTrading.

If you are trading in multiple accounts, you should combine them and file your tax return.

If you trade with multiple accounts, you can offset your profits and losses between them. If you have a loss in one account, you can deduct the loss from your profits, so be sure to offset your profits and losses across all your accounts when filing your tax return.

If you only want to view the trading history of each account, you can easily check it from the XMTrading member page. After logging in to the member page, click on “Select an option” for each account displayed in the My Account overview and then click on “Trading History”.

If there is a profit or loss in an account with another company, the total amount is subject to taxation

If you have accounts with multiple overseas FX brokers and are incurring profits and losses with your accounts with other companies, the total amount of your profits and losses will be subject to tax. For example, if your annual profit and loss with XMTrading is 1 million yen, and your annual profit and loss with your accounts with other companies is minus 500,000 yen, then 500,000 yen will be subject to tax. Also, if you have income that is classified as the same miscellaneous income, the combined profit and loss will be subject to tax in the same way.

-

When preparing your tax return using the Tax Return Preparation Corner, please declare profits and losses for each company (payer) that incurred the profit or loss.

XM bonuses are not included in profits

XMTrading offers a variety of bonus programs and campaigns, including a 15,000 yen new account opening bonus (trading bonus) upon new registration, deposit bonuses, and XM Points (XM Points) earned with each trade. Bonuses received through these programs and bonus campaigns are reflected as credit balances in MT4/MT5 accounts and are not included in profits. They are not included in “Closed Trade P/L” or “Total Profit/Loss” in the annual trading report, and are not subject to taxation.

Furthermore, the bonuses offered by XM are managed separately from the funds you deposit, but can be used as margin for trading. By receiving tax-exempt bonuses, you can increase your margin and enjoy more dynamic trading, so please make use of them.

-

Please note that profits generated from trading using bonuses (credit balances) are subject to tax.

Cashback is taxable

Unlike bonuses, which are reflected in the credits of your MT4/MT5 account, cashback is a cash prize that can be withdrawn and is added to your account balance, so it is subject to taxation. XM Points offered by XM can be used as trading margin, and customers with “DIAMOND” or “ELITE” status can also exchange points for cash. If you convert XM Points to cash, it will be subject to taxation, so be sure to declare it together with profits earned from trading.

Transaction fees for Zero Accounts cannot be expensed separately.

Trading fees incurred when trading with an XMTrading Zero Account cannot be recorded as an expense. The trading fees required for an XM Zero Account are deducted from the account balance for a round trip when opening a position for MT4, and for one way when opening and closing a position for MT5.

In other words, please note that the deducted trading fees are offset against trading profits and reflected in the “Closed Trade P/L” or “Total P/L” in your annual trading report, so you cannot record the trading fees as a separate expense.

If the account currency is other than Japanese yen, profits and losses will be converted into yen and reported.

If the base currency of your XMTrading trading account is not Japanese Yen, you will need to convert the amount to yen at the mid-rate (TTM) on the day of the trade and declare it. The mid-rate is the standard rate used by financial institutions when conducting foreign exchange transactions with their customers, and is announced around 9:55 every weekday. You can check past mid-rates on each financial institution’s website, so extract the mid-rate for the day of the trade and convert it to yen.

-

If you trade on a Japanese public holiday when financial institutions are closed, or on the weekend when trading cryptocurrency CFDs, please use the mid-price of the previous day to convert to yen.

If you want to change the base currency of your trading account to Japanese Yen

The base currency of your trading account cannot be changed, so please open an additional account and select “JPY” when selecting “Account Base Currency.” XM allows one person to open up to eight accounts, so you can use different account base currencies, or use different accounts for different trading methods or trading instruments. You can also diversify your risk by diversifying your assets across multiple accounts. To open an additional account, log in to the XM member page and apply by clicking “Open an additional account.” If you already have an activated real account, you can open an additional account in just a few minutes.

-

Can I carry forward losses when filing my XM tax return?

No, when trading with XM, even if you incur a loss during the year, you cannot carry the loss forward to the following year. For domestic FX trading, loss carryforward applies, allowing you to offset profits and losses over a three-year period and reduce the profit you declare, but please note that this does not apply to overseas FX trading, including XM.

read more

2022.10.14

-

Can I combine the profits and losses from multiple XM accounts or accounts with other companies and file my tax return?

Yes, if you are trading in multiple XM accounts or accounts with multiple overseas FX brokers and incurring profits and losses, you can combine your profits and losses. If you have an account that incurs a loss, you can deduct the loss from your profits, and the difference will be subject to tax. In addition, if you have income that is classified as miscellaneous income, you can combine your profits and losses in the same way.

read more

2022.10.14

-

Are XM bonuses subject to tax on tax returns?

No, the bonuses you receive from XM are reflected as credits in your MT4/MT5 account and are not included in your profits, so they are not subject to tax. However, please note that profits generated from trading using the bonus and cashback that is credited to your account balance and can be withdrawn are subject to tax.

read more

2022.10.14

-

Do I need to declare unrealized gains on my tax return at XM?

No, XM’s tax return only covers profits and losses settled by settling positions between January 1st and December 31st. Unsettled positions are not subject to tax, but please note that if the combined profits from overseas FX trading with other companies and other miscellaneous income exceed the annual standard income amount, you will be required to file a tax return.

read more

2022.10.14

-

Please tell me the amount of income that requires filing a tax return for XM.

The amount of income that requires filing a tax return for XM differs between salaried and non-salaried individuals. Salaried individuals who are employed by a company and receive a salary are required to file a tax return if they make more than 200,000 yen per year, and non-salaried individuals who do not receive a salary are required to file a tax return if they make more than 480,000 yen per year.

read more

2022.10.14