XM’s average contract rate is 99.98%. High contract power.

XM’s average execution rate is 99.98%

XM provides a stable trading environment by combining two execution methods: “forex market trading,” which matches buy and sell orders between customers for each currency pair, and matching orders with the best rates from multiple affiliated liquidity providers (LPs). As one of the largest companies in the industry, XM instantly executes orders from a vast number of traders, offering execution speed and reliability that surpasses other brokers.

At XM, all orders are executed automatically using a No Dealing Desk (NDD) system, with no human intervention. This ensures a fair trading environment, free from execution practices that could work against the interests of our customers.

![]()

XM has a large customer base, enabling it to efficiently match buy and sell orders and maintain high execution capacity.

The ability of FX brokers to execute buy and sell orders—often referred to as “execution rate” and “execution power”—has been gaining attention. Today, many traders using overseas FX brokers choose their broker based on execution quality rather than just narrow spreads or low fees. But what exactly do execution rate and execution power mean, and why do traders place such importance on them? We will explain using specific examples.

The Relationship Between Execution Rate and Execution Power

When placing an order for a currency pair in FX trading, there is a slight time lag before the order is actually executed and a confirmation is received. The execution rate generally represents the percentage of orders successfully executed within a given time frame (measured in seconds).

Execution Rate = Percentage of orders executed within the specified time lag (XX seconds).

If the execution rate is high—close to 100% within a given time frame—the execution power is considered strong (excellent). Conversely, if the execution rate is low, the execution power is regarded as weak (inferior).

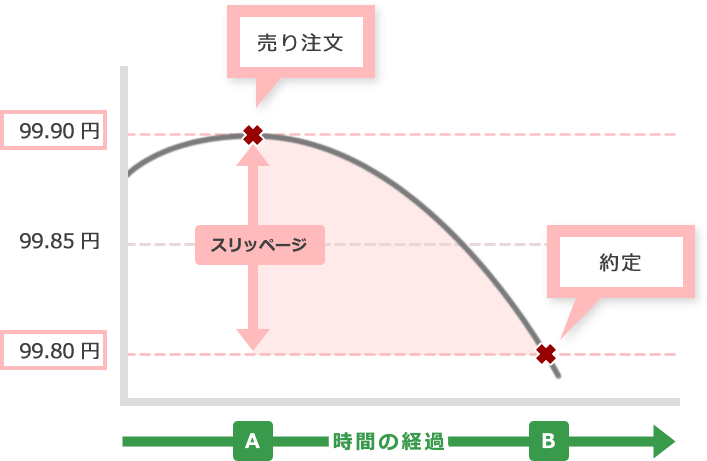

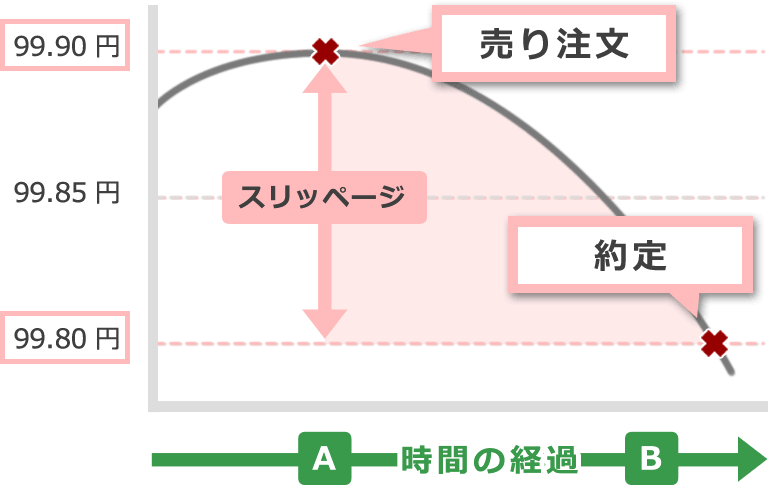

For example, suppose a trader places a sell order at ¥99.90 in the market shown in the diagram below. If the order is executed at Point A, it will be filled at ¥99.90. However, if it is executed at Point B, it will be filled at ¥99.80, resulting in a loss.

The Relationship Between Execution and Slippage

This phenomenon is especially noticeable during sudden market changes or periods of high price volatility. With an FX broker that has low execution power, the price at the time of the order can differ from the actual execution price, making it difficult to trade as intended. This price difference is called slippage.

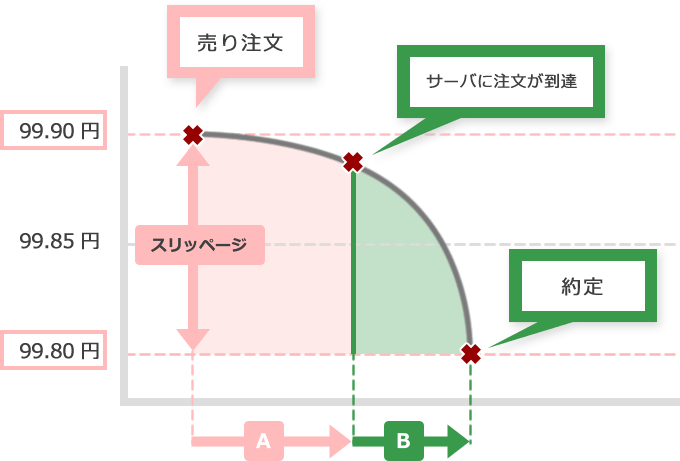

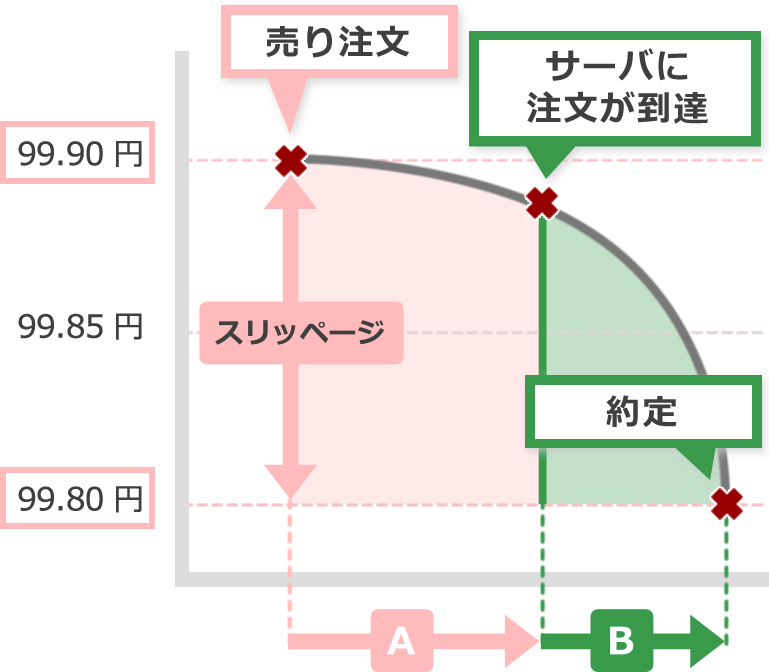

Slippage is the difference between the order price and the actual execution price, and it is primarily caused by two main factors.

The first factor is related to the internet connection and infrastructure of both the user and the FX broker. Key contributors include the speed of the user’s home internet and physical issues at the FX broker’s data center (shown as part [A] in the diagram).

The second factor relates to how FX brokers handle orders and access liquidity. Since the foreign exchange market operates 24 hours a day with constantly fluctuating bid and ask rates, brokers must manage individual traders’ orders in some way. Brokers with numerous counterparties (liquidity providers) can often execute orders quickly and at favorable prices, whereas brokers with fewer counterparties have limited options, which can result in slower execution or even unfilled orders (see part [B] in the diagram).

We will now explain in detail the two main factors that cause slippage.

The Two Main Causes of Slippage

A

Because FX trading is conducted over the internet, it is naturally influenced by the connection environment at the time an order is placed. However, for typical traders in Japan using a home or workplace internet connection, this impact on slippage is generally minimal. In particular, with smartphone usage rates exceeding 85% in Japan, accessing the market via 3G or 4G networks has virtually no effect on slippage.

When Using Automated Trading with an EA

When using automated trading with EAs, operations often run for extended periods, and the performance of the hardware running the EA can affect trading outcomes. As a result, more traders are turning to VPS (Virtual Private Server) services. This is especially true for ultra-high-frequency trading—automated trading that executes rapid, program-driven strategies—where the physical location of the trading server and VPS plays a crucial role, making the use of a VPS essential.

Using a VPS allows you to run MetaTrader in a stable internet environment within a data center on a managed Windows server, effectively reducing slippage caused by connection issues.

XM VPS Service

XM provides a VPS environment connected via fiber optic lines just 1.5 km from its data center in London. This XM VPS enables uninterrupted trading in a stable environment, removing the need to monitor EAs on individual PCs. The service offers a Windows 2012 server with 1.5 GB of RAM, 20 GB of hard drive space, and a reliable 600 MHz CPU.

B

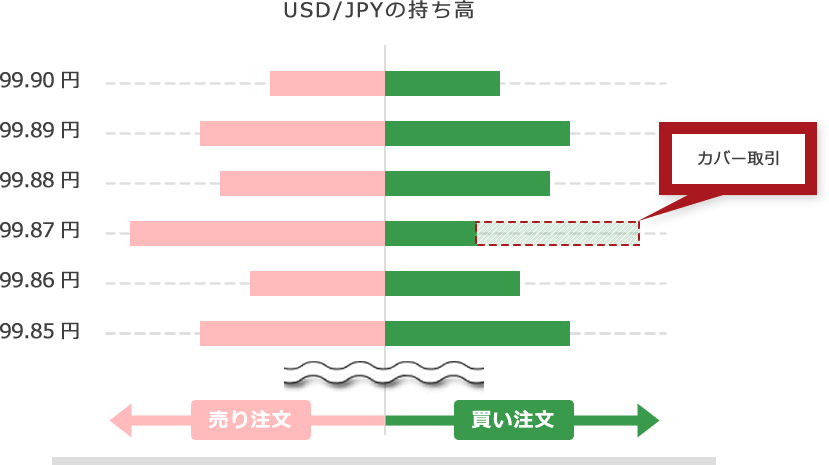

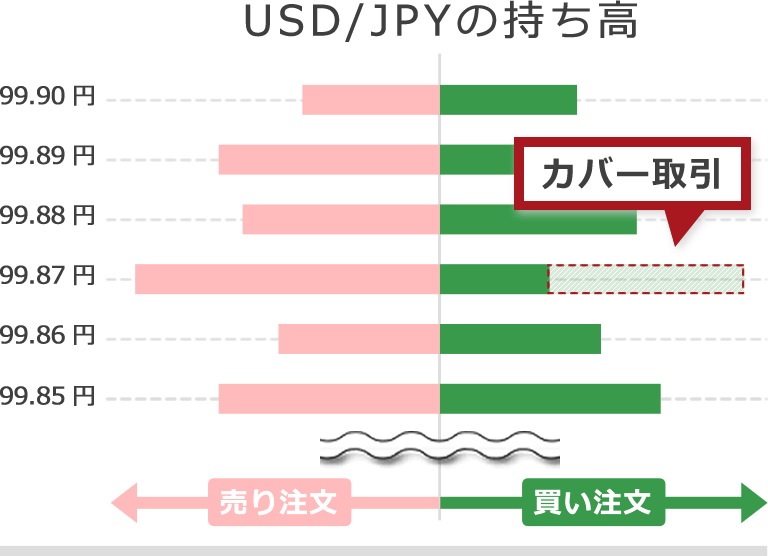

When an FX broker receives an order from a client, they typically decide whether to offset the order internally or place a counter-order with a liquidity provider. Internal offsetting occurs, for example, when ‘Customer A’ buys USD/JPY at 109 yen while ‘Customer B’ sells USD/JPY at the same rate. In this case, the broker can avoid exposure to exchange rate fluctuations as long as the market remains stable. This practice of matching buy and sell orders internally to offset positions is called a foreign exchange ‘market transaction.’

While foreign exchange market trading is an effective method of risk management when the market is stable and fluctuations are small, the FX market is constantly changing, and clients place orders for a wide variety of instruments. When a broker cannot fully offset internal orders for the same currency, they execute a counter trade with the broader market or a liquidity provider to balance their positions and mitigate exchange rate risk. This type of trade is known as a cover transaction.

Margin Trading and Cover Transactions in Forex

FX brokers that primarily use internal market trading to handle orders are generally referred to as B-Book brokers, while those that engage in cover trading are called A-Book brokers. The STP (Straight Through Processing) method, often highlighted as a feature of these brokers, is one approach to cover trading.

No Slippage in Forex Trading

Slippage generally does not occur in foreign exchange market transactions. This is because such transactions are processed in-house, with the broker placing offsetting orders with a counterparty only when positions cannot be fully balanced, eliminating the risk of order rejection or slippage at the time the customer places an order. However, even B-Book brokers can experience order rejections and slippage, which are influenced by the volume of orders received and the liquidity available from counterparties.

In theory, FX brokers accept all orders when a customer places them. However, if the risk of exchange rate fluctuations is too high, brokers may not be able to assume that risk. Even brokers using the FX brokerage method may refuse to execute an order—known as a requote—if it would clearly disrupt their own balance or involves a minor currency with limited counterparties.

In Cover Trading, Liquidity Directly Affects Slippage

When executing cover trades, the liquidity of the counterparty has a significant impact. Typically, the FX broker places cover trades with a prime broker or financial institution that handles larger volumes than the broker itself. As a result, whether an order is accepted depends largely on the counterparty’s liquidity. For example, if ‘Customer A’ trades through FX broker ‘Brand A,’ an A-Book broker, the execution capability of Brand A will depend heavily on the liquidity of its counterparties, which can significantly influence slippage.

From the counterparty’s perspective, ‘Brand A’ is also a client. Like ‘Customer A,’ Brand A deposits collateral and conducts market transactions with the counterparty. Therefore, not only the counterparty’s liquidity but also whether Brand A is in a position to place orders becomes an important factor.

Which Is More Advantageous: A-Book Brokers or B-Book Brokers?

There has long been debate over which is more advantageous for customers: A-Book brokers, which primarily use cover trading, or B-Book brokers, which rely mainly on internal (marriage) trading. In reality, both approaches have their own advantages and disadvantages.

A-Book brokers are often described as highly transparent, free of conflicts of interest, and immune to fraudulent manipulation. However, even A-Book brokers are frequently owned by investment companies or financial institutions. If the counterparty in a cover transaction is a related company, can the transaction truly be considered fully transparent? Additionally, with STP or instant execution, slippage and order rejections are common, which can make trading less stable. Moreover, brokers that exclusively offer A-Book trading are unable to participate in today’s high-leverage markets (200–500x, or even 1,000x), as the maximum leverage provided by cover brokers is typically around 100x.

On the other hand, B-Book brokers are often criticized for having conflicts of interest and being prone to fraudulent practices. However, to conduct internal (marriage) trading, a broker must receive orders for many instruments from a large number of customers. This means that only major FX brokers with a substantial client base can engage in B-Book trading. Additionally, because execution does not depend on an external counterparty, the broker’s execution capacity is not affected by market conditions, providing a more stable trading environment.

The real problem arises with B-Book brokers that do not even attempt internal (marriage) trading. As noted earlier, internal offsetting requires a large number of orders, making it impossible for new or small FX brokers to balance positions and maintain a flat market. As a result, their unhedged positions grow, leaving them reliant on customers’ losses to profit. Brokers in this situation face a direct conflict of interest with their clients, and many engage in unethical practices, such as failing to execute individual orders or intentionally causing slippage to achieve prices favorable to the broker.

XM is a B-Book broker that emphasizes internal (marriage) trading. Its greatest advantage is the exceptionally high volume of customer orders compared to other brokers. As a result, most trades are balanced internally, and the need for cover trades is extremely low.

In addition, XM has removed human intervention from its dealing desk to eliminate any potential conflicts of interest with its customers. This ensures that no actions can be taken that might manipulate positions or interfere with transactions involving individual clients or specific trades.

These innovations have allowed XM to offer its unique hybrid order system, combining the fairness and transparency of A-Book methods with the advantages of B-Book trading. Thanks to these improvements, XM achieved an average execution rate of 99.98% per second in 2017 and continues to set new records as one of the leading FX brokers.

A Broker with a Standard Dealing Desk

At FX brokers that operate a dealing desk system, dealers handle customer orders. They typically place a corresponding order with a counterparty, such as a bank (a cover transaction), earning a profit from the price difference (spread) with the customer’s order. If a dealer cannot find a counterparty that allows for a profitable trade, they may requote the order, offering the customer a less favorable price.

Additionally, dealers may choose not to place part of a customer’s order with a bank or other counterparty. In this case, the FX broker profits if the customer loses, and incurs a loss if the customer profits. Under such circumstances, traders cannot trade with confidence.

XM’s Next-Generation NDD (Non-Dealing Desk) System

XM’s next-generation NDD system is a cutting-edge order method that completely eliminates human intervention. All orders are executed automatically within the XM system, with no dealer involvement in execution decisions.

XM’s transparent pricing and fast order execution have earned it worldwide acclaim. Customers can trade with confidence in an environment free from order rejections or requotes.

-

Do XM’s order execution methods vary by account type?

No, XM uses the same order execution method across all account types. Every account—including Micro, Standard, KIWAMI, and Zero—employs the NDD (Non-Dealing Desk) A/B hybrid system, which executes orders automatically without any human intervention.

read more

2020.06.30

-

Which order execution methods does XM use?

XM uses an A/B hybrid system that combines internal (marriage) trading, which matches buy and sell orders between customers, with cover trading through multiple affiliated liquidity providers. In addition, it employs a NDD (Non-Dealing Desk) system that executes all orders automatically, without human intervention.

read more

2020.06.30

-

How fast and reliable is XM’s order execution?

XM achieves an average order execution rate of 99.98%, delivering industry-leading execution performance. The execution rate, or contract power, represents the likelihood that an order will be executed as intended. The closer the rate is to 100%, the higher the execution reliability; conversely, lower rates indicate reduced execution effectiveness.

read more

2020.06.30

-

What gives XM its high order execution performance?

Thanks to an exceptionally large number of customers and orders, XM primarily processes trades through internal (marriage) trading rather than relying on cover trading. This approach avoids the typical drawbacks of cover trading, such as execution delays and limited liquidity, creating an environment with exceptionally high execution performance.

read more

2020.06.30

-

What is the NDD (Non-Dealing Desk) order method used by XM?

XM uses the NDD (Non-Dealing Desk) method, which executes orders automatically without any human intervention. All trades are processed mechanically, without dealer involvement. As a result, XM offers a fair trading environment with no manipulation of executions that could work against the interests of customers.

read more

2020.06.30