XM offers a variety of products such as forex, CFD products and more. When trading these products, it is very important to know how much margin you actually need to set aside or how to calculate the margin requirements for each product. You can see at a glance the minimum margin threshold to start trading by referring to XM's List of Required Margins for All Instruments.

One of the attractions of XM is that traders who want to trade big even if they do not have enough funds can use high leverage of up to 1000 times. With XM's maximum 1:1,000 leverage, you can trade with minimal margin.

You can trade with minimal margin by using leverage up to 1:1,000.

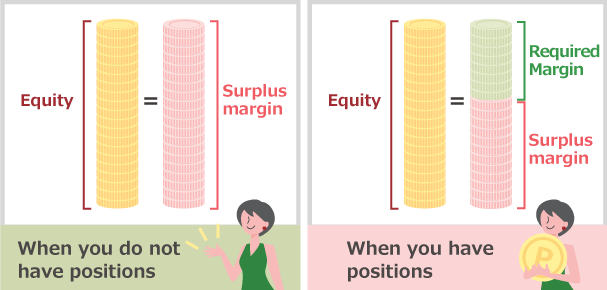

Margin is the minimum required funds to prepare the minimum trading amount, and you can trade based on this margin. Therefore, you cannot open a new position without sufficient margin. Also, if you fall into a margin shortage due to sudden market movements, you may have to close (settle) your position. To avoid this, we recommend keeping sufficient margin on your account and managing your funds.

For all products offered by XM, new positions can only be opened when there is "more margin than required" in any case. Also, if you hold the same lot position on both sides of the cross trade, the margin required for trading on both sides of FX, GOLD, and SILVER will be zero, so you can hold a position even if the margin level is 100 or less. can. % never mind. For other financial instruments, the cross-trading margin requirement is never zero, and one-sided margin must be maintained. By the way, even in cross trade, you can have a new position only if you have "surplus funds more than the required margin".

XM allows cross-trading within the same account, but cross-trading between multiple accounts or with other securities companies is prohibited. If fraudulent activity is discovered, penalties such as account closure may be imposed. so please understand.

Click here for more information on musical instruments.

XM Instruments|XM™

57 Forex and 1,322 CFD instruments (Precious Metals, Stock Indices, Energies, Commodities, Stock CFDs, Cryptocurrencies) available 24 hours a day on global markets can be traded with high leverage on XM.

Here's how the margin requirements for Forex XM offers are calculated:

Transaction Amount / Leverage * Current Rate (*) = Margin Requirement

For reference, there are also FX with leverage restrictions. 100,000 units of currency per lot for Standard and XM Ultra Low accounts Standard, whereas 1,000 units for Micro and XM Ultra Low accounts Micro. so please understand.

XM offers the "XM Margin Calculator" for Forex to save you the trouble of manually calculating the margin rate. With this "XM Margin Calculator", anyone can easily calculate the required margin. For more information on how to use the XM Margin Calculator, please see below.

Conversion rates are always fluctuating.

Below is a list of all forex margin requirements and the per-lot margin requirements offered by XM. Please read the margin below in 1/100 for XM Micro account margin requirements.

Currency Pair | Leverage | Required Margin |

|---|---|---|

EURUSD | 1:1,000 | 97.23USD |

GBPUSD | 1:1,000 | 110.62USD |

USDJPY | 1:1,000 | 100.00USD |

Unfold this accordion and see the table below.

Currency Pair | Leverage | Required Margin |

|---|---|---|

EURUSD | 1:1,000 | 97.23USD |

GBPUSD | 1:1,000 | 110.62USD |

USDJPY | 1:1,000 | 100.00USD |