XM™/XMTrading™ (XM) | Japanese FX Account Opening Guide

Just turn on push notifications

circle

present !

先着100名様にプレゼント!

First come, first

served!

Get the news first!

-

Market price surges and falls

-

VIP remarks and major economic indicators

-

Limited-time campaign

-

XM Latest Updates

Limited time offer

Open a new accountin

Yen

Bonus Gift

The world is currently paying close attention

commission

free

Maximum Leverage

500

double

Trading possible from low cost

-

USDJPY

149.739149.765 -

EURUSD

1.171381.17157 -

GBPJPY

201.216201.257 -

GOLD

3903.173903.61 -

JP225Cash

4763147638 -

BTCUSD

123693.95123753.95 -

ETHUSD

4512.894517.79

-

2025.10.06NEW

The first 100 people to turn on push notifications will receive a 1,000 yen QUO card!

XMTrading will be holding the “XMTrading QUO Card Giveaway Campaign” from October 6, 2025. This campaign is open to all customers who have their push notifications enabled on this site! The first 100 customers will receive a QUO card worth 1,000 yen.

-

2025.10.02NEW

XMTrading Fall Affiliate League 2025

XM will be holding the “Autumn Affiliate League 2025” with a total prize of $150,000 for all existing and new affiliates from October 2nd to November 30th, 2025. 50 people will receive prizes based on the number of points they earn during the period.

-

2025.09.30NEW

Important Notice – October Holidays ’25

Please be advised that due to several public holidays in October, trading hours for various financial products will be affected from October 1st to October 31st, 2025.

Those who want to open a new XM real account

You can participate in the W-up campaign

Campaign end date: Friday, October 31, 2025

-

特典 0115,000 円分のボーナス

-

特典 02ロイヤルティプログラムGOLD ステイタス

ボーナス

キャンペーン終了日:2025年10月31日(金)

all new XM real account holders who open a new account from this page will receive Two major membership benefits

-

Limited time offer Benefit 1 特典 01期間限定 新規口座開設ボーナス

通常3,000円のところNew account opening bonus is usually 3,000 yen15,000Yen bonus present -

Bonus 2 特典 02ロイヤリティプログラム

通常EXECUTIVEのところLoyalty Program Usually EXECUTIVEGoldStatus (1 rank up) ステイタス (1ランクアップ) present

To ensure that you can use XM/XMTrading’s FX services without any risk, for a limited time we will be offering a generous bonus of 15,000 yen to be used for real trading to anyone who opens a new XM (XMTrading) real account through this website .

In addition, XM (XMTrading) offers three types of generous bonuses and incentives that can significantly increase your trading capital. XM (XMTrading) bonus incentives include the “XM New Account Opening Bonus (Trading Bonus)” worth 15,000 yen, which is available to all new XM (XMTrading) real account holders; the “XM Deposit Bonus” of 100% + 20% up to a maximum of $10,500 (equivalent) depending on the amount deposited into your trading account; and “Gold Status Privilege” in the “XM Point Program,” which allows you to accumulate points according to your trading volume .

Why XM/XMTrading is

chosen by Japanese people

XM/XMTrading aims to provide a stress-free FX trading environment for traders around the world who use overseas FX. To that end, XM (XMTrading) offers dynamic high-leverage trading with a maximum leverage of 1,000x, a high-quality trading environment with no requotes or rejections, and tight spreads starting from 0 pips . In the unlikely event that a sudden market fluctuation causes a loss in your trading account, XM (XMTrading) protects you from margin calls with its reassuring “Zero Cut Guarantee.”

Furthermore, in order to realize speedy and stable FX trading, XM (XMTrading) is constantly working to “speed up deposits and withdrawals” and “improve the quality of customer support.” By providing a variety of services that prioritize convenience, XM (XMTrading) has grown into an FX broker that is favored by traders around the world who use overseas FX.

-

Leverage up to 1,000x

With XM/XMTrading, you can freely choose your leverage from 1x to 1,000x immediately after opening your account (Note: 1) , and your margin maintenance rate will not change during nighttime or weekend rollovers.

High leverage allows you to trade with high leverage even with a small deposit.(Note:1)Only Zero accounts can win up to 500x.

-

Average execution rate 99.35%

XM/XMTrading is the only overseas FX broker that uses a fair order system known as the next-generation NDD (No Dealing Desk), and does not engage in any execution manipulation that goes against the interests of customers. There is no

human intervention by dealers in customer orders, and orders are executed mechanically.(Note:1)Based on XM measurements.

-

Zero-cut guarantee for peace of mind

XM/XMTrading (XM) uses a “zero cut system” that does not require customers to make margin calls even if losses exceed the account’s available margin due to sudden price fluctuations, etc.

This prevents losses from exceeding the amount deposited, making it possible to control the risk of FX trading. This is a feature unique to overseas FX brokers that is not available with domestic FX brokers. -

Deposits and withdrawals within 24 hours

XM/XMTrading (XM) will reflect funds in your trading account instantly for credit/debit cards and online wallets, within one hour for cryptocurrencies, and within one hour for bank transfers if made during the payment processing company’s business hours. In addition, to reduce the burden on customers, there are no deposit fees.

We also strive for prompt withdrawals, and XM/XMTrading (XM) will complete withdrawal processing within 24 business hours. -

Japanese language support

XM/XMTrading (XM) provides support in Japanese for all customer FX trading-related inquiries via email, LINE, live chat, etc., with Japanese operators in Japanese. Email inquiries are accepted 24 hours a day, five days a week, and Japanese live chat and LINE are both available from 8:00 AM to 10:00 PM on weekdays (mornings on Saturdays and Sundays), striving to provide prompt support. XM (XMTrading) back office and IT staff monitor customers’ trading environments 24 hours a day, 365 days a year, and have a thorough backup system in place.

-

100% separate storage

XM/XMTrading (XM) segregates customer funds in bank accounts prepared by XM. These funds are not included in XM’s balance sheet and will not be used to pay creditors even in the unlikely event that XM goes bankrupt.

Customer funds held with XM (XMTrading) are fully safe, including deposit amounts and profits, so please use with confidence.

The reason why XM/XMTrading is so popular among overseas FX brokers is not just because of the bonuses they offer, but also because of their high-quality FX trading environment and customer-oriented service. If you are not satisfied with FX in Japan, we recommend opening an account with XM (XMTrading), which boasts the best service in overseas FX.

XM/XMTrading is the official FX partner of the Visa Cash Up RBF1 team.

For those using overseas FX for the first time

The greatest appeal of FX is that it can generate large profits in a short period of time by trading with a small amount of capital (margin) and high leverage. However, in developed countries, leverage regulations restrict this leveraged trading, which is the greatest attraction of FX.

As a result, many traders in countries where high leverage is restricted, including Japan, are shifting to using overseas FX brokers.

XM/XMTrading offers high leverage FX trading of up to 1,000 times and generous bonuses, making it popular with over one million FX traders worldwide.

Even if you are new to overseas FX, XM (XMTrading) offers a safe and secure trading environment with a deposit and withdrawal system that fully supports Japanese yen and 24-hour Japanese support.

Four

account types to choose from

XM/XMTrading offers four account types to suit your trading style: “XM Standard Account,” “XM Micro Account,” “KIWAMI Extreme Account,” and “XM Zero Account.”

The standard account, which allows you to make the most of 1,000x leverage and bonuses, is a popular account type for a wide range of traders, from beginners to advanced traders.

The micro account, which allows you to trade with a minimum of 10 currencies, is a recommended account type for beginners as it allows you to start trading with a small amount of money.

The KIWAMI Kiwami Account, which offers “ultra-small spreads,” ” no fees,” and “swap-free,” is a recommended account type for traders who want to keep trading costs to an absolute minimum.

The Zero Account, which offers narrow spreads starting from a minimum of “0” pips , is a recommended account type for professional traders and scalping traders.

-

(Note:1)

The FX currency pairs for which leverage is limited at XM (XMTrading) are as follows:

-

Swiss Franc (CHF) FX related currency pairs: 400x

-

Turkish Lira (TRY) FX related currency pairs: 100x

-

Hong Kong Dollar (HKD), Offshore Renminbi (CNH), Danish Krone (DKK), Russian Ruble (RUB) FX related currency pairs: 50x

Additionally, for all account types at XM (XMTrading), if the account balance exceeds $40,000 (equivalent), the maximum leverage will be reduced to 500x. If the account balance exceeds $80,000 (equivalent), it will be reduced to 200x, and if it exceeds $200,000 (equivalent), it will be reduced to 100x.

-

-

(Note:2)

Please note that XM (XMTrading) KIWAMI Goku Account and Zero Account are not eligible for deposit bonuses and do not receive loyalty program points. However, XM (XMTrading)’s new account opening bonus (trading bonus) of 15,000 yen can also be received with XM KIWAMI Goku Account and Zero Account.

-

(Note:3)

[CFD/Stocks] are only available for MT5 accounts. [FX/Currency Pairs] USD/RMB and [CFD/Cryptocurrency] are not available for Zero Accounts. [CFD/Thematic Indexes] are only available for MT5 Standard Accounts and KIWAMI Goku Accounts.

-

(Note:4)

XM (XMTrading) trading hours vary depending on the stock. Please click here for details.

-

(Note:5)

This is a one-way fee amount based on a USD/JPY transaction. With the XM Zero Account, fees are charged only for FX currency pairs and gold/silver transactions. Other CFDs (platinum, palladium, stocks, stock indexes, commodities, energy) can be traded commission-free. Click here to see the trading fees for each XM (XMTrading) product .

-

(Note:6)

Click here to learn how to open an additional XM (XMTrading) account .

-

(Note:7)

XM (XMTrading) allows hedging only within the same account. Please be aware of negative swaps if you hold for the long term. Please see here for the rules for hedging established by XM (XMTrading) .

The XM/XMTrading Standard Account is a standard account type that can be used with a minimum of 1,000 units and is an FX trading account that allows you to make the most of XM’s (XMTrading) generous bonuses. The XM Micro Account has almost the same trading conditions as the Standard Account, but requires a minimum of 10 units, making it an FX trading account that allows you to start trading with a small margin . The XM Zero Account offers narrow spreads starting from 0 pips and is also suitable for scalping . On the other hand, the XM KIWAMI Account has almost the same conditions as the Standard Account, but is an FX trading account that allows you to trade with narrower spreads starting from 0.6 pips.

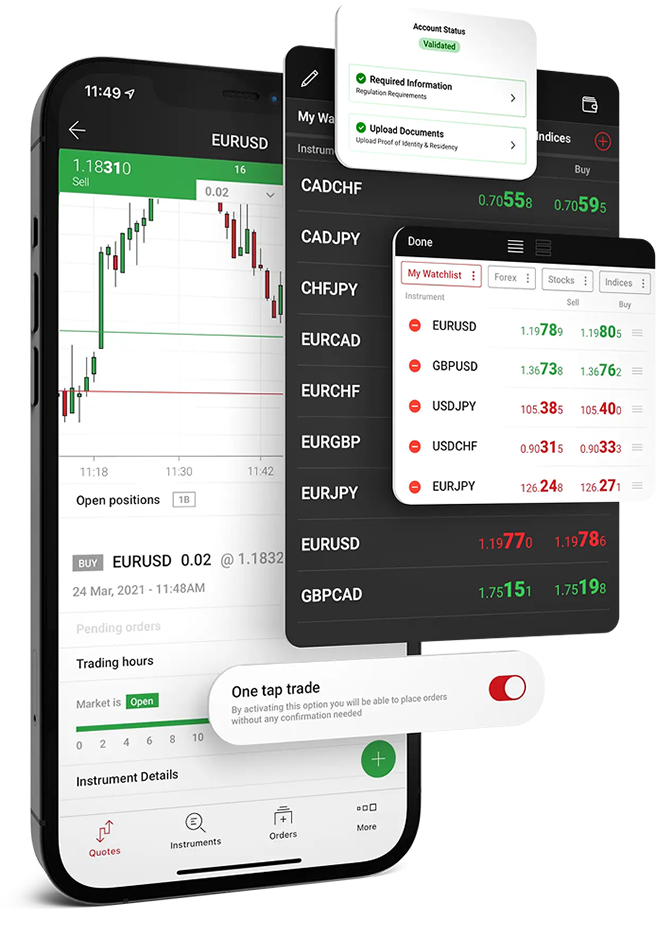

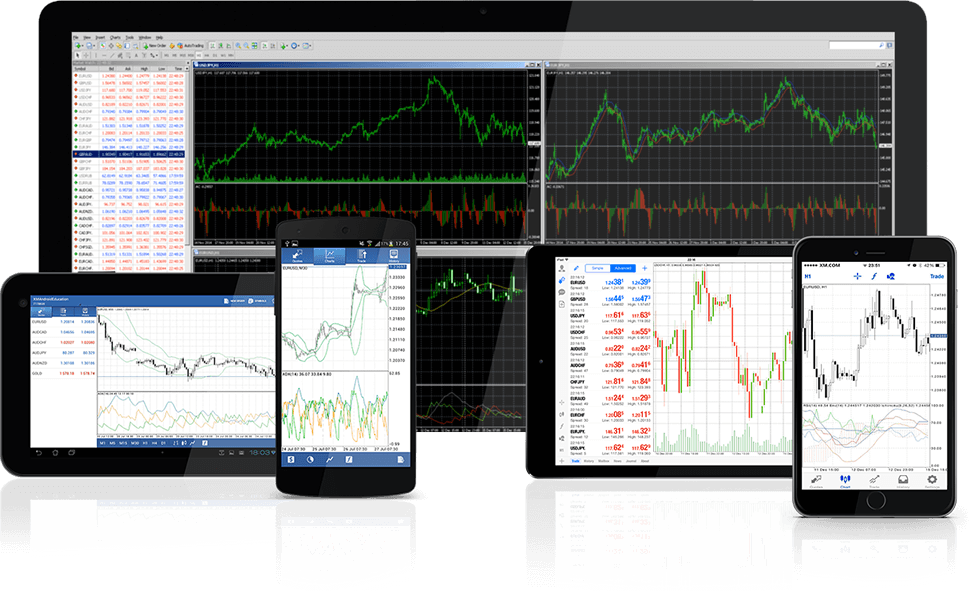

The world’s most popular

trading tool

Fulfilling traders’ advanced needs

High-performance platform compatible with various devices

XM/XMTrading offers MetaTrader 4 (MT4) and MetaTrader 5 (MT5) for Windows OS, Mac OS , and mobile (iOS/Android) versions to accommodate customers with various access methods. Additionally, you can use the universal browser-compatible “WebTrader,” which allows you to trade online without installing the MT4/MT5 application. Additionally, you can access MT4/MT5 on smartphones and tablets via XM’s proprietary “XMTrading app (XM smartphone app) .”

Learn about the features of MT4 and MT5 , and choose the application that best suits your trading style from the wide range of trading tools offered by XM.

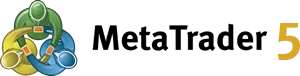

XM Copy Trade

Automatically copy the strategies of professional traders

to optimize your asset management and

earn profits efficiently.

XM/XMTrading allows you to efficiently earn profits by utilizing “copy trading,” which automatically copies the strategies and techniques of experienced professional traders. XM’s copy trading also features a social trading function that allows traders from around the world to interact with each other, allowing you to understand market trends in real time while learning more about the strategies of professional traders. In addition to using copy trading, you can also act as a strategy manager and receive compensation based on trading results. If you are looking to build assets efficiently, we recommend taking advantage of XM’s copy trading.

How to deposit and withdraw funds from your account

XM/XMTrading emphasizes three key points: security, speed, and convenience. We offer seven deposit and withdrawal methods: bank transfers, credit cards, three online wallets, online payment services, and cryptocurrencies (crypto assets). Credit

cards and online wallets like bitwallet are instantly deposited into your trading account, while cryptocurrency deposits are reflected within minutes to an hour. You can also deposit funds via domestic bank transfers in your country of residence. During bank hours, deposits are reflected within an hour.

XM (XMTrading) boasts industry-leading speeds, with withdrawals completed within 24 business hours. XM (XMTrading) has eliminated all deposit and withdrawal fees, striving to reduce customer burden. To protect your valuable personal data, all payments are processed using SSL technology.

We are currently not accepting payments via STICPAY.

You can use the online wallet STICPAY. All fees for deposits and withdrawals using STIPAY are borne by XM. Instant deposits and withdrawals are possible.

You can use the online payment service Apple Pay. Deposits using Apple Pay are free of charge and can be made 24 hours a day. For withdrawals, please use domestic bank transfers.

![]()

You can deposit and withdraw funds using virtual currency (crypto assets). There are no fees for deposits or withdrawals using virtual currency. Deposited virtual currency will be automatically converted to the base currency of your account and reflected in your account within one hour.

You can use the online wallet BXONE. All fees for deposits and withdrawals using BXONE are borne by XM. Instant deposits and withdrawals are possible.

![]()

We accept two types of credit/debit cards: VISA and JCB. Simply enter your card information and the deposit amount will be reflected immediately, allowing you to start trading immediately.

![]()

You can transfer funds from a bank in Japan using an ATM or online bank. On normal business days, the funds will be reflected in your account balance within one hour of arrival.

![]()

You can use the online wallet bitwallet. All fees for deposits and withdrawals using bitwallet are borne by XM. Instant deposits and withdrawals are possible.

You can use the online wallet STICPAY. All fees for deposits and withdrawals using STIPAY are borne by XM. Instant deposits and withdrawals are possible.

You can use the online payment service Apple Pay. Deposits using Apple Pay are free of charge and can be made 24 hours a day. For withdrawals, please use domestic bank transfers.

![]()

You can deposit and withdraw funds using virtual currency (crypto assets). There are no fees for deposits or withdrawals using virtual currency. Deposited virtual currency will be automatically converted to the base currency of your account and reflected in your account within one hour.

You can use the online wallet BXONE. All fees for deposits and withdrawals using BXONE are borne by XM. Instant deposits and withdrawals are possible.

![]()

We accept two types of credit/debit cards: VISA and JCB. Simply enter your card information and the deposit amount will be reflected immediately, allowing you to start trading immediately.

![]()

You can transfer funds from a bank in Japan using an ATM or online bank. On normal business days, the funds will be reflected in your account balance within one hour of arrival.

![]()

You can use the online wallet bitwallet. All fees for deposits and withdrawals using bitwallet are borne by XM. Instant deposits and withdrawals are possible.

You can use the online wallet STICPAY. All fees for deposits and withdrawals using STIPAY are borne by XM. Instant deposits and withdrawals are possible.

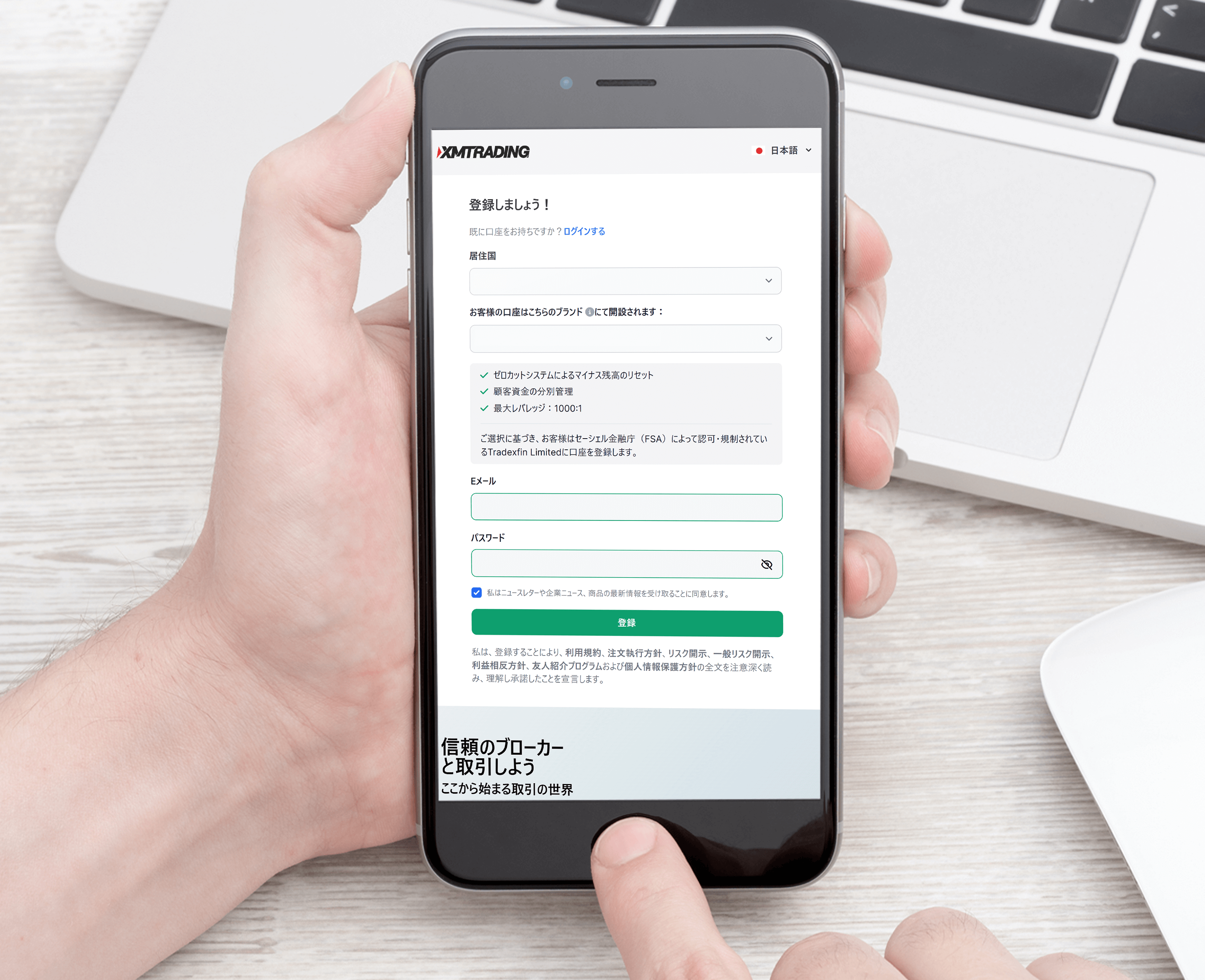

How to open a real XM/XMTrading account

The application to open a new XM/XMTrading account can be completed in just over 5 minutes, and you can start trading in as little as 30 minutes. The submission of the various certificates required to activate your XM (XMTrading) account is completed entirely online, eliminating the need for any cumbersome procedures such as mailing or faxing.

To register for an XM (XMTrading) account, simply enter your email address and click the link in the email you receive. After that, register your customer information on the XM (XMTrading) member page and upload your supporting documents (ID and address proof). We will then check your application details and the details on your certificates within 30 minutes to one business day and activate your real account. Once activated, you will be able to use all of XM (XMTrading)’s services.

-

STEP 1

Account Registration

Simply verify your identity with your email address to complete your account registration and open a real account.

Simply enter your email address into the registration form on your computer, smartphone, or the XM/XMTrading app, and verify your email address to complete your account registration and open a real account.

-

STEP 2

Profile Verification

Fill out your customer information and investor profile to complete profile verification

Please log in to your XM/XMTrading member page with your registered email address and password, register your customer information, and complete profile authentication.

-

STEP 3

RealAccount Activation

We will ask you to submit your ID and proof of current address to verify your identity.

We will ask you to submit various documents and confirm your application details. Once this process is complete, your XM/XMTrading account will be activated.

-

STEP 4

MarginDeposit

Please deposit margin by domestic bank transfer or credit card.

Please deposit margin into your XM/XMTrading trading account using one of seven deposit methods (domestic bank transfer, credit card, online wallet, or virtual currency).

If you do not have an account with XM/XMTrading, please apply to open an FX account. XM (XMTrading) does not charge any account opening or management fees. To open an account, you only need to fill out the account opening form, which is entirely in Japanese, and the application process (entering the necessary information) can be completed in just 5 minutes.

Opening a real account with XM (XMTrading) can be completed entirely online, from application to account issuance.

-

The name, date of birth, and current address on your application must be the same as those on your various certificates.

-

Please note that if there are any deficiencies in your application or the various verification documents, it may take several days to open your account.

-

For details on the various certificates available at XM (XMTrading),please clickhere .

-

XM (XMTrading) is currently suspending the use of STICPAY for deposits.

XM/XMTrading (XM) has set high standards for all aspects of service quality, including bonuses and spreads, because we recognize that high service quality is extremely important to both our customers and XM.

XM (XMTrading)’s mission is to meet the demands of the global market and approach the investment goals of high-level clients. By maintaining a high level of service and excellent customer communication, XM (XMTrading) attracts traders and investors from around the world.

All our staff look forward to welcoming everyone in Japan to try out the XM/XMTrading trading platform and account types, which provide comfortable and fair trading to all traders around the world.